Global Guava Market By Type (Fresh Fruit, Jam, Juice), By Product Type (Strawberry Guava, Lemon Guava, Tropical White, Pineapple Guava, Others), By Variety (Red Guavas, White Guavas, Yellow Guavas, Hybrid Varieties), By Nature (Organic, Conventional), By Form (Fresh, Frozen, Processed), By Application (Fresh Consumption, Juice and Nectar Production, Jelly and Preserves Production, Bakery and Confectionery Products, Cosmetics and Personal Care Products), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retailers, Farmers' Markets, Wholesale Suppliers) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133151

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

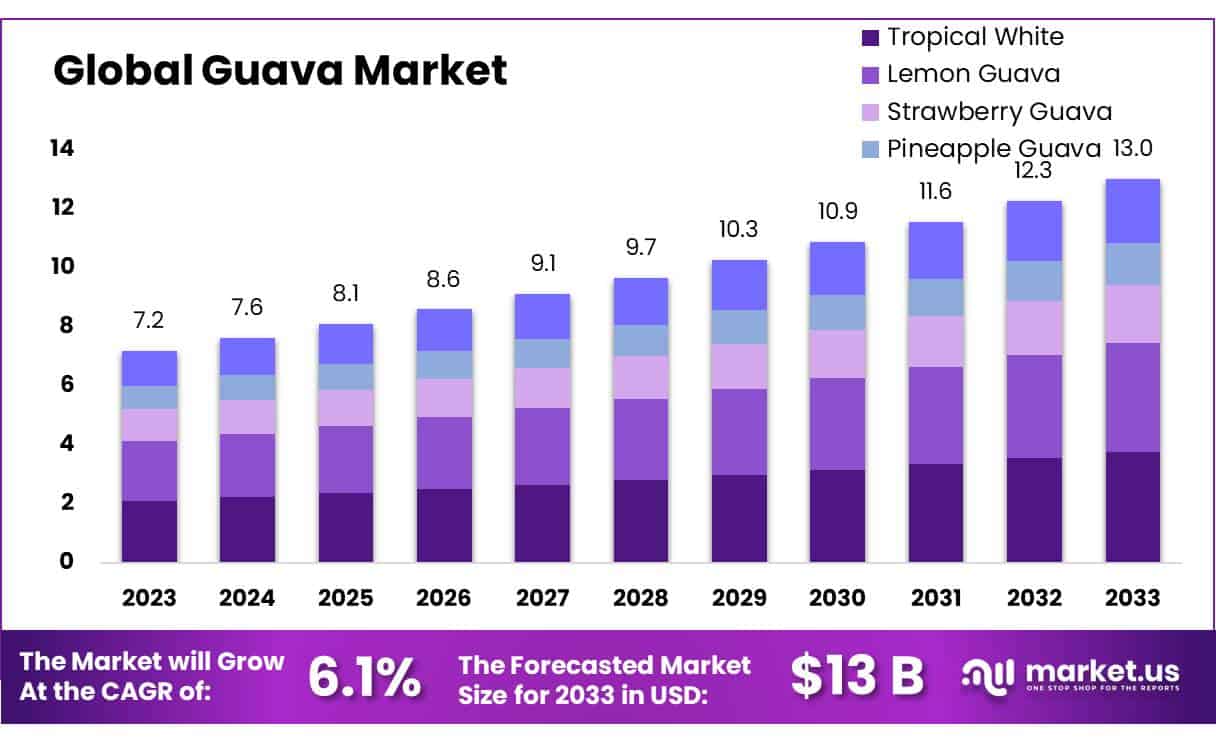

The Global Guava Market size is expected to be worth around USD 13.0 Bn by 2033, from USD 7.2 Bn in 2023, growing at a CAGR of 6.1% during the forecast period from 2024 to 2033.

Guavas are typically round or oval, with green, yellow, or maroon skin, and their flesh can range from white to pink or red, depending on the variety. The fruit is rich in nutrients, particularly vitamin C, dietary fiber, and antioxidants, making it highly valued for its health benefits.

Guava production and trade are influenced by various governmental regulations that ensure food safety, quality, and sustainability. India, the world’s largest producer of guava, cultivates the fruit across more than 3 million hectares, with an annual production exceeding 5 million metric tons, as reported by the National Horticulture Board (NHB).

The Indian government, through initiatives like the National Mission on Horticulture, has supported guava farming by providing subsidies for irrigation systems, cold storage, and processing facilities. These measures have significantly boosted production and supply chain efficiency.

Globally, guava trade is subject to strict import regulations. The European Union (EU), under its Common Agricultural Policy (CAP), imports approximately 20,000 metric tons of guava annually, primarily from India, Thailand, and Vietnam.

These imports must meet stringent quality and safety standards. Similarly, the U.S. Department of Agriculture (USDA) enforces rigorous rules on pesticide residues and requires phytosanitary certification for guava imports, which affects trade flows and compliance costs for exporters.

India is also a key player in guava exports, shipping 56,000 metric tons in 2022, valued at USD 40 million. Other major exporters include Mexico, which exported 25,000 metric tons in 2021, worth USD 20 million. The global guava export market was valued at approximately USD 150 million in 2021 and is growing at an annual rate of 4-5%.

Recent years have seen increased investment in guava processing and distribution. In 2023, an Indian agribusiness company announced a USD 50 million investment to expand guava pulp production for export. The Indian government also invested USD 10 million through its National Agricultural Market (eNAM) initiative to modernize logistics and digital platforms for guava and other horticultural products.

International partnerships and acquisitions are driving market growth. In 2022, a U.S.-based company partnered with a Mexican guava grower in a USD 30 million deal to develop new guava-based products for North American and European markets.

Key Takeaways

- Guava Market size is expected to be worth around USD 13.0 Bn by 2033, from USD 7.2 Bn in 2023, growing at a CAGR of 6.1%.

- Fresh Fruit held a dominant market position, capturing more than a 62.3% share of the guava market.

- Tropical White held a dominant market position, capturing more than a 28.7% share of the guava market.

- White Guavas held a dominant market position, capturing more than a 44.3% share of the guava market.

- Conventional guavas held a dominant market position, capturing more than an 83.2% share of the market.

- Fresh guavas held a dominant market position, capturing more than a 57.6% share of the market.

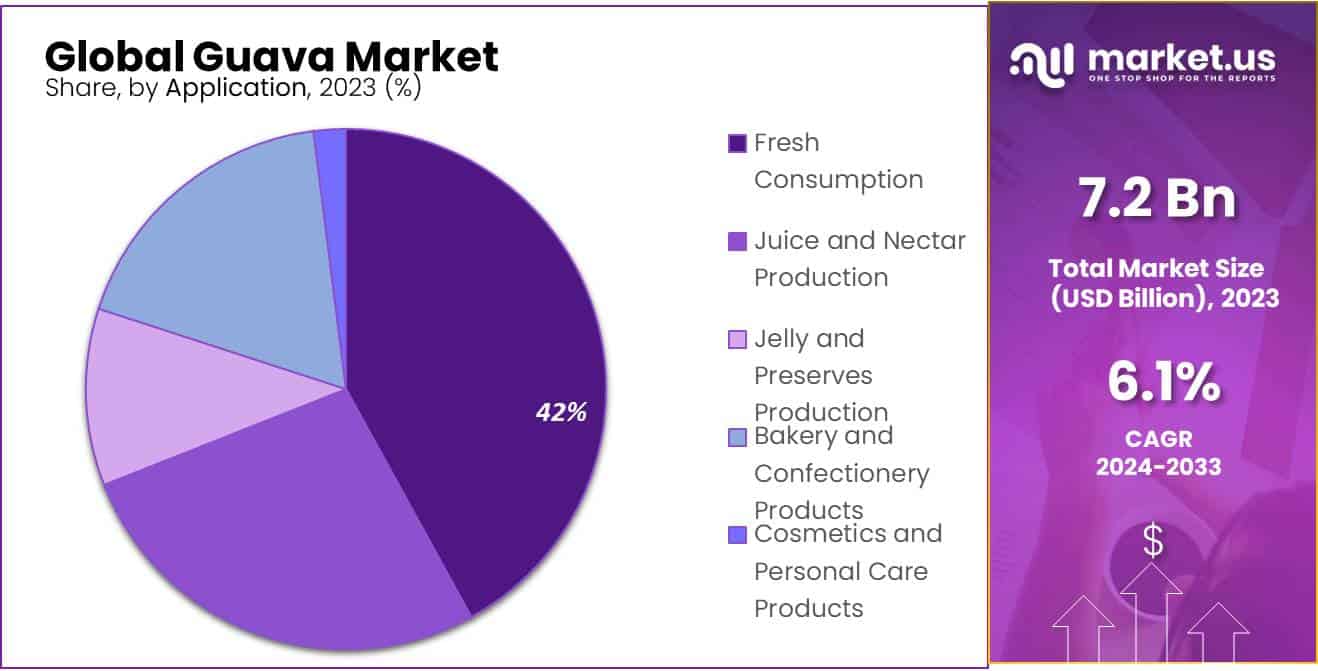

- Fresh Consumption held a dominant market position, capturing more than a 42.3% share of the guava market.

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 41.3% share of the guava market.

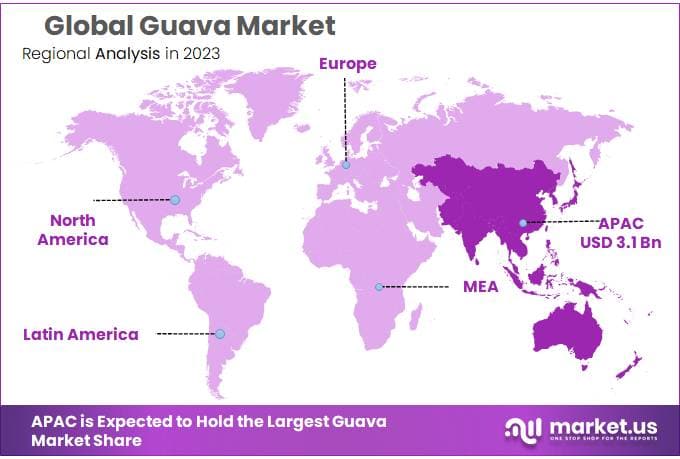

- Asia Pacific (APAC) region held a dominant position in the global guava market, capturing 38.5% of the market share, valued at approximately USD 3.1 billion

By Type

In 2023, Fresh Fruit held a dominant market position, capturing more than a 62.3% share of the guava market. Fresh guava remains the most widely consumed form due to its natural flavor, nutritional benefits, and versatile use in various culinary applications. It is primarily consumed as a whole fruit, and its popularity is driven by increasing consumer awareness of its health benefits, such as high vitamin C content and dietary fiber.

Guava Jam accounted for a smaller, but steadily growing share in the market. The segment is projected to expand as more consumers look for convenient ways to enjoy the fruit throughout the year. Guava jam is increasingly used as a spread, in baking, and as an ingredient in various desserts and snacks. This segment benefits from the rising demand for fruit-based spreads and the growing trend toward natural, preservative-free food options.

Guava Juice is also gaining traction in the market, driven by the rising preference for healthy, natural beverages. The segment is expected to grow as consumers shift away from sugary, artificial drinks in favor of more nutritious options. Guava juice is appreciated for its refreshing taste and rich nutrient profile. It is often marketed as a natural source of hydration, antioxidants, and vitamins, making it a popular choice among health-conscious consumers.

By Product Type

In 2023, Tropical White held a dominant market position, capturing more than a 28.7% share of the guava market. Tropical White guava is favored for its mild flavor, smooth texture, and high yield, making it a popular choice among consumers and growers alike. Its versatility in fresh consumption and processing into juices and jams has contributed to its market leadership.

Strawberry Guava accounted for a significant portion of the market, driven by its unique flavor and growing popularity in niche markets. Known for its sweet, aromatic taste, strawberry guava is used in premium fruit products, such as specialty jams, juices, and sauces. The segment is expanding as more consumers seek exotic, flavorful varieties of guava.

Lemon Guava represents a smaller but growing segment. Its tangy, citrus-like flavor makes it ideal for culinary applications that require a zesty fruit. Lemon guava is increasingly used in beverages, salad dressings, and gourmet sauces, appealing to consumers looking for distinctive, fresh flavors.

Pineapple Guava is also gaining attention due to its sweet, tropical flavor that is a cross between guava and pineapple. The segment has been growing, particularly in tropical regions, where it is used in both fresh and processed forms, including juices, jams, and fruit salads.

By Variety

In 2023, White Guavas held a dominant market position, capturing more than a 44.3% share of the guava market. White guavas are the most widely grown and consumed variety globally, particularly in regions like India, Mexico, and Southeast Asia. Their smooth texture, mild taste, and versatility in fresh consumption and processing have contributed to their market dominance.

Red Guavas represent a smaller but growing segment of the market. Known for their vibrant color and sweeter, more aromatic flavor, red guavas are becoming increasingly popular among consumers looking for fruit with higher antioxidant content. This variety is often preferred for making juices, jams, and desserts, where its rich color and flavor can stand out.

Yellow Guavas are also gaining traction, particularly in tropical markets. Their distinct golden color and sweeter, tangier taste appeal to both local and international consumers. Yellow guavas are increasingly used in both fresh and processed forms, including juices, fruit salads, and confectionery products. However, their market share remains smaller compared to white guavas.

Hybrid Varieties are an emerging segment, driven by innovations in fruit breeding. Hybrid guavas are being developed to combine the best traits of different varieties, such as improved disease resistance, higher yield, and better flavor. While this segment currently holds a smaller share, it is expected to expand as consumers seek more specialized and resilient fruit varieties.

By Nature

In 2023, Conventional guavas held a dominant market position, capturing more than an 83.2% share of the market. Conventional guavas are more widely available due to their lower production costs and established supply chains. These guavas are grown using traditional farming methods, which allows for large-scale production and greater affordability, making them the preferred choice for consumers in many regions.

Organic guavas, while representing a smaller portion of the market, are growing in popularity. This segment has benefitted from the increasing consumer demand for organic and sustainably produced food. Organic guavas are cultivated without the use of synthetic pesticides or fertilizers, making them appealing to health-conscious consumers and those looking for environmentally friendly products. The organic segment is expected to grow at a faster rate, driven by rising awareness about the benefits of organic farming and food consumption.

By Form

In 2023, Fresh guavas held a dominant market position, capturing more than a 57.6% share of the market. Fresh guavas are widely consumed due to their natural taste, nutritional benefits, and versatility. They are commonly eaten as whole fruit or used in fresh juices, salads, and desserts. The availability of fresh guava in both local and international markets drives its strong market presence.

Frozen guavas, while a smaller segment, are gaining traction as they offer convenience and extended shelf life. Frozen guavas are typically used in smoothies, juices, and processed food products. The segment is growing, particularly in regions where fresh guavas are out of season or less accessible. The convenience and cost-effectiveness of frozen guava make it a popular option for both households and food manufacturers.

Processed guavas, including those used in jams, juices, sauces, and canned products, also play an important role in the market. This segment benefits from the increasing demand for ready-to-consume and packaged fruit products. Processed guava is used in a wide range of food and beverage applications, catering to the growing trend of convenience foods and beverages. The processed segment is expanding as consumer preferences shift toward healthier snack options and fruit-based beverages.

By Application

In 2023, Fresh Consumption held a dominant market position, capturing more than a 42.3% share of the guava market. Fresh guava is widely consumed due to its natural flavor, high nutritional value, and versatility. It is commonly eaten as a whole fruit or used in smoothies, salads, and fruit bowls. This segment remains the largest, driven by consumer preference for fresh, healthy food options.

Juice and Nectar Production is another significant application, accounting for a growing share of the guava market. Guava juice is popular for its refreshing taste and health benefits, including high vitamin C content. The demand for guava-based beverages is increasing, driven by the broader trend toward natural, nutrient-rich drinks. This segment is expected to grow at a steady pace as consumers continue to shift toward healthier beverage choices.

Jelly and Preserves Production also represents an important application, fueled by the popularity of fruit-based spreads and preserves. Guava jelly is appreciated for its sweet, tangy flavor and is commonly used as a spread or in desserts. As demand for natural, preservative-free food products grows, the market for guava jelly and preserves continues to expand.

Bakery and Confectionery Products are an emerging segment in the guava market. Guava’s unique flavor is increasingly being incorporated into bakery products like cakes, pastries, and cookies, as well as in candies and other confections. This application is gaining traction, particularly in regions where fruit-flavored baked goods are popular. The segment is expected to see steady growth as more consumers seek innovative and natural ingredients in their snacks and desserts.

Cosmetics and Personal Care Products is a smaller but growing segment, with guava gaining recognition for its antioxidant-rich properties. Extracts from guava are increasingly used in skincare products, including lotions, creams, and face masks. As consumers become more interested in natural and plant-based ingredients, the demand for guava in the personal care market is expected to rise.

By Distribution Channel

In 2023, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 41.3% share of the guava market. Supermarkets and hypermarkets remain the primary distribution channels for fresh and packaged guava products. These large retail stores offer a wide variety of guava products, including fresh fruit, juices, jams, and processed goods, catering to a broad customer base. Their convenient locations and extensive product range make them the preferred shopping destination for consumers.

Convenience Stores represent a smaller but growing segment in the guava market. These stores are particularly popular for on-the-go purchases, and their appeal lies in the availability of ready-to-consume guava products, such as packaged juices and snacks. While the segment holds a smaller share, it is expanding due to the increasing demand for convenient, single-serve fruit products, especially in urban areas.

Online Retailers have seen significant growth, particularly driven by the increasing trend of e-commerce shopping. Consumers are now more inclined to purchase guava products like juices, jams, and fresh fruit through online platforms due to the convenience of home delivery. The online retail segment is projected to continue expanding as consumers increasingly prefer shopping from home and access a broader range of products.

Farmers’ Markets offer a niche but growing distribution channel for fresh guavas, especially in regions with strong local food movements. These markets provide consumers with direct access to fresh, locally grown guavas. The segment appeals to health-conscious consumers seeking organic or freshly harvested fruits. While it holds a smaller share of the overall market, it benefits from increasing consumer interest in supporting local agriculture and sustainable food sourcing.

Wholesale Suppliers play an important role in distributing guava to other businesses, such as food processors, restaurants, and smaller retailers. This segment focuses on bulk distribution and typically serves as the backbone for supply chains, especially for processed guava products like juices and preserves. While wholesale suppliers make up a significant portion of the market, their share is smaller compared to direct consumer-facing channels like supermarkets.

Key Market Segments

By Type

- Fresh Fruit

- Jam

- Juice

By Product Type

- Strawberry Guava

- Lemon Guava

- Tropical White

- Pineapple Guava

- Others

By Variety

- Red Guavas

- White Guavas

- Yellow Guavas

- Hybrid Varieties

By Nature

- Organic

- Conventional

By Form

- Fresh

- Frozen

- Processed

By Application

- Fresh Consumption

- Juice and Nectar Production

- Jelly and Preserves Production

- Bakery and Confectionery Products

- Cosmetics and Personal Care Products

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retailers

- Farmers’ Markets

- Wholesale Suppliers

Drivers

Increasing Consumer Demand for Healthy, Natural Products

One of the key driving factors behind the growth of the guava market is the rising global consumer demand for healthy, natural, and nutrient-dense food products. This demand is being driven by growing health consciousness, particularly among millennials and younger generations, who are more focused on improving their diet and lifestyle.

Rising Awareness of Health Benefits

Guava’s nutritional profile plays a significant role in its growing popularity. According to the U.S. Department of Agriculture (USDA), a single guava can provide up to 4 times the daily recommended intake of vitamin C. Guava is also rich in dietary fiber, which promotes digestive health, and is a good source of antioxidants that help combat oxidative stress and reduce inflammation. This health profile is driving the demand for guava, not only in its fresh form but also in processed products such as juices, jams, and dietary supplements.

Global Shift Toward Healthy Beverages

The global shift towards healthier beverage options has significantly benefited the guava juice segment. As consumers increasingly prefer beverages that offer functional health benefits, the market for fruit juices, including guava-based products, has expanded. Guava juice, with its rich vitamin C content and refreshing taste, is becoming a popular choice, particularly in regions like Asia, North America, and Europe.

The Food and Agriculture Organization (FAO) highlights that global fruit and vegetable consumption needs to increase by 70% by 2050 to meet the demands of a growing and aging global population. As part of this trend, guava is being marketed as a healthy alternative to sugary, processed beverages, further boosting its market appeal.

Government Support and Agricultural Initiatives

Government initiatives and agricultural programs also play a critical role in supporting the growth of the guava market. In countries like India, which is the world’s largest producer of guava, the government has introduced several programs aimed at boosting fruit cultivation and improving productivity.

The National Horticulture Mission (NHM) in India, for instance, has allocated substantial funds for the development of guava farming, including providing subsidies for irrigation systems, cold storage facilities, and post-harvest management.

India’s Ministry of Agriculture and Farmers’ Welfare reports that over 3 million hectares of land are dedicated to guava cultivation, producing approximately 5 million metric tons of guavas annually. The Indian government has also been focusing on improving the export of guava, aiming to increase the export value, which stood at USD 40 million in 2022, and encouraging the adoption of modern farming techniques.

Restraints

Limited Shelf Life and Post-Harvest Losses

One of the major restraining factors for the guava market is its limited shelf life, which leads to significant post-harvest losses. Guava is a highly perishable fruit, with a shelf life of just 2-3 days when stored at room temperature.

This short shelf life is a major challenge for growers, distributors, and retailers, as it requires rapid handling and processing to prevent spoilage. In developing countries, where infrastructure and cold storage facilities are limited, the problem of waste becomes even more pronounced, affecting the overall market dynamics.

Post-Harvest Losses and Economic Impact

The Food and Agriculture Organization (FAO) estimates that approximately 30-40% of fruits and vegetables, including guava, are lost after harvest due to improper handling, inadequate storage, and lack of efficient transportation networks.

In countries like India, which produces more than 5 million metric tons of guava annually, this results in an annual loss of over 2 million metric tons of guava. These losses not only affect the profitability of guava farmers but also contribute to food insecurity in regions where guava is an important part of the local diet.

The limited shelf life also increases the costs associated with distribution. Guava requires special care in transportation and storage, often involving refrigerated transport and controlled storage conditions. However, the lack of cold chain infrastructure in many developing countries adds to the financial burden.

For instance, in India, despite efforts by the National Horticulture Mission (NHM) to improve cold storage capacity, the country still faces challenges in managing post-harvest losses, with only 30% of total horticultural production being stored in cold storage.

Government Efforts and Solutions

Governments in key guava-producing countries are taking steps to reduce post-harvest losses and improve the overall supply chain for guava. In India, for instance, the National Agricultural Market (eNAM) initiative is working to improve supply chain efficiencies by digitalizing the agricultural marketplace and improving logistics. Additionally, cold storage infrastructure is being upgraded under various government schemes to minimize waste.

According to the Indian Ministry of Agriculture, over 1.2 million metric tons of horticultural produce are currently stored in cold storage facilities across the country, and the government is working to expand this capacity. However, despite these efforts, the challenge remains significant, with the cold cain infrastructure still inadequate in many rural areas.

Opportunity

Expanding Processed Guava Products

One of the key growth opportunities for the guava market lies in the increased production and consumption of processed guava products. As consumer demand for convenience foods and beverages continues to rise, the demand for guava-based processed products, such as juices, jams, dried guava, and snacks, is growing steadily. The ability to process guava into a variety of products that have a longer shelf life offers significant market potential, especially in countries where fresh guava faces logistical and storage challenges due to its perishability.

Government Support for Fruit Processing Industries

Several governments are investing in the development of the fruit processing sector to boost local economies and increase exports. In India, for instance, the National Horticulture Mission (NHM) has allocated funds to improve the infrastructure of the fruit processing industry, including the establishment of processing plants and cold storage facilities.

These initiatives aim to reduce post-harvest losses, enhance the value-added processing of fruits like guava, and expand export potential. In 2022, the Indian government announced a USD 1.5 billion investment to boost the horticulture sector, focusing on both fresh and processed fruit exports. These investments are expected to significantly increase the processing of guava, especially into juices, jams, and dried products, thereby driving market growth.

Furthermore, Mexico, one of the world’s largest guava exporters, has introduced initiatives to enhance guava processing facilities, with a focus on increasing the shelf life and quality of processed products. These efforts are expected to further strengthen Mexico’s position in the global market, where it exports processed guava products to regions such as North America and Europe.

Diversification into New Processed Products

In addition to juices and jams, guava can be processed into a range of value-added products such as guava paste, dried guava slices, and guava-flavored candies, which are gaining popularity in international markets.

For example, the FAO reports that dried fruit consumption in the global market has been increasing at a rate of 5-7% annually, with tropical fruits like guava seeing a rise in processed forms. These products are particularly popular in markets with large diasporas from tropical regions, such as in the Middle East and Southeast Asia, where guava-based snacks and sweets are highly favored.

Trends

Rising Demand for Organic and Sustainable Guava

One of the latest trends in the guava market is the growing consumer preference for organic and sustainably produced guava. As environmental concerns and health awareness increase, more consumers are shifting towards organic produce.

Organic guava, which is grown without synthetic pesticides or fertilizers, aligns with the broader global movement toward sustainable and eco-friendly food choices. This trend is particularly evident in developed markets such as North America, Europe, and Australia, where there is a rising demand for organic fruits and vegetables.

According to the United States Department of Agriculture (USDA), the demand for organic fruit in the U.S. has grown by 15% annually over the past five years. This shift is part of a larger trend where consumers are prioritizing food transparency, traceability, and sustainable farming practices. Organic guava is capitalizing on this trend as consumers become more informed about the benefits of organic farming, both for their health and for the environment.

Government Initiatives Supporting Organic Farming

Governments around the world are increasingly supporting organic farming through subsidies, certifications, and funding for research and development. For example, in India, which is the largest producer of guava, the National Program for Organic Production (NPOP) provides financial assistance and certification support to farmers adopting organic farming practices.

This initiative, backed by the Ministry of Agriculture, aims to increase the country’s organic farming area, which was approximately 3.6 million hectares in 2021. This government support is encouraging more farmers to transition to organic farming, boosting the supply of organic guava.

Similarly, in Mexico, the government is working to promote organic agriculture, including tropical fruits like guava, under its Organic Products Certification Program. Mexico’s organic farming area has increased by over 5% annually, with significant focus on fruit and vegetable cultivation.

This trend has paved the way for a more sustainable guava supply chain and has opened up export opportunities, particularly to markets that demand organic produce, such as North America and Europe.

Increasing Popularity of Organic Guava Products

The demand for organic guava products is also expanding. Processed organic guava products such as juices, jams, and dried fruit are gaining popularity as consumers look for natural, chemical-free alternatives to conventional processed foods.

According to the Food and Agriculture Organization (FAO), global consumption of organic food products is expected to grow by 10-12% annually through 2025, with organic fruit-based beverages seeing a particularly high growth rate. Organic guava juice, for instance, is now being marketed as a premium product in many countries, due to its health benefits and eco-friendly production methods.

In addition to beverages, organic guava is also being used in snacks, health supplements, and cosmetics, tapping into the natural beauty and wellness market. The increasing incorporation of guava extracts in skincare products, such as organic face creams and masks, is another trend fueled by the demand for organic ingredients.

Regional Analysis

In 2023, the Asia Pacific (APAC) region held a dominant position in the global guava market, capturing 38.5% of the market share, valued at approximately USD 3.1 billion. The region’s dominance is primarily driven by India, the world’s largest producer and consumer of guava, where the fruit is integral to both the local diet and the export market.

In addition, countries like China, Thailand, and Indonesia are emerging as significant contributors to guava production and consumption, with growing demand for both fresh and processed guava products such as juices and jams. The APAC region benefits from a large population base, increasing health consciousness, and a shift towards natural, nutritious food options.

In North America, the guava market is seeing moderate growth, driven by rising demand for tropical fruits, especially in the United States, where the market is expanding with the increasing consumption of guava juices and processed products.

In 2023, North America accounted for around 18.5% of the global market. The region’s demand is further supported by consumer interest in health-focused beverages, with guava’s high vitamin C content making it a popular choice for functional drinks.

The European market represents around 15.2% of the global share, with countries like Germany and the UK importing increasing quantities of guava-based products. Meanwhile, Latin America and the Middle East & Africa (MEA) contribute smaller shares but show potential for growth due to increasing demand for tropical fruits and emerging distribution channels in these regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The guava market is characterized by a diverse range of players, including both regional and international companies, each contributing to the growth and expansion of the industry. Leading companies like 12-Lucky Co., Ltd., Al Noorani Exports, and Bajaj Agro Foods India Ltd. play a critical role in the cultivation, export, and processing of guava products, catering to both domestic and international markets.

Brokaw Spain and Celsius Holdings Inc. are key players in the processed guava sector, producing a variety of value-added products such as guava juices and concentrates, which are gaining popularity in global markets due to the rising demand for healthy beverages. Companies like Döhler Group and Grünewald Fruchtsaft GmbH are involved in the global distribution of fruit juices, including guava, capitalizing on the health-conscious consumer shift towards natural, nutrient-rich drinks.

On the production side, companies such as Jain Irrigation Systems Limited, Shimla Hills Offerings Pvt. Ltd., and Jadli Foods (India) Pvt. Ltd. are key players in guava farming and processing, leveraging advanced agricultural practices and infrastructure to meet the growing demand for both fresh and processed guava products. In addition, Cobell Limited, Hari Agri, and Tricom Fruit Products Limited are contributing to the supply chain by processing guava into products like jams, purees, and canned goods.

Meanwhile, Kiril Mischeff, La Tulipe Company, and Sri Satya Nursery are expanding their portfolios to include guava-based offerings, focusing on premium organic and value-added products to cater to the evolving market preferences. As the global demand for guava continues to rise, these companies are well-positioned to leverage their processing capabilities and distribution networks to expand their market share across regions.

Top Key Players in the Market

- 12-Lucky Co., Ltd

- Al Noorani Exports

- Bajaj Agro Foods India Ltd,

- Bhakthavatsala Florist & Agro Welfare Society

- Brokaw Spain

- Celsius Holdings Inc.,

- Cobell Limited,

- Dairy Day,

- Döhler Group,

- Grünewald Fruchtsaft GmbH,

- H K Timbers Pvt Ltd

- Hari Agri

- Jadli Foods (India) Pvt. Ltd

- Jain Irrigation Systems Limited,

- Kiril Mischeff,

- La Tulipe Company

- Shimla Hills Offerings Pvt. Ltd

- Sri Satya Nursery

- Tricom Fruit Products Limited.

Recent Developments

In 2023, 12-Lucky has focused on leveraging the natural properties of guava, which are rich in polyphenols and antioxidants, to market their products not just as food items but also for their health benefits.

In 2023 Al Noorani Exports has been making significant strides in the guava market, particularly noted for their contribution to guava exports from India.

Report Scope

Report Features Description Market Value (2023) USD 7.2 Bn Forecast Revenue (2033) USD 13.0 Bn CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Fresh Fruit, Jam, Juice), By Product Type (Strawberry Guava, Lemon Guava, Tropical White, Pineapple Guava, Others), By Variety (Red Guavas, White Guavas, Yellow Guavas, Hybrid Varieties), By Nature (Organic, Conventional), By Form (Fresh, Frozen, Processed), By Application (Fresh Consumption, Juice and Nectar Production, Jelly and Preserves Production, Bakery and Confectionery Products, Cosmetics and Personal Care Products), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retailers, Farmers’ Markets, Wholesale Suppliers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 12-Lucky Co., Ltd, Al Noorani Exports, Bajaj Agro Foods India Ltd,, Bhakthavatsala Florist & Agro Welfare Society, Brokaw Spain, Celsius Holdings Inc.,, Cobell Limited,, Dairy Day,, Döhler Group,, Grünewald Fruchtsaft GmbH,, H K Timbers Pvt Ltd, Hari Agri, Jadli Foods (India) Pvt. Ltd, Jain Irrigation Systems Limited,, Kiril Mischeff,, La Tulipe Company, Shimla Hills Offerings Pvt. Ltd, Sri Satya Nursery, Tricom Fruit Products Limited. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 12-Lucky Co., Ltd

- Al Noorani Exports

- Bajaj Agro Foods India Ltd,

- Bhakthavatsala Florist & Agro Welfare Society

- Brokaw Spain

- Celsius Holdings Inc.,

- Cobell Limited,

- Dairy Day,

- Döhler Group,

- Grünewald Fruchtsaft GmbH,

- H K Timbers Pvt Ltd

- Hari Agri

- Jadli Foods (India) Pvt. Ltd

- Jain Irrigation Systems Limited,

- Kiril Mischeff,

- La Tulipe Company

- Shimla Hills Offerings Pvt. Ltd

- Sri Satya Nursery

- Tricom Fruit Products Limited.