Global Home Shopping Services Market Size, Share, Statistics Analysis Report By Type (Teleshopping, E-commerce and Mobile Shopping, Others), By Product Type (Apparels & Accessories, Footwear, Personal & Beautycare, Groceries, Electronic Goods, Other Product Types), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Mar 25

- Report ID: 142620

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Scope

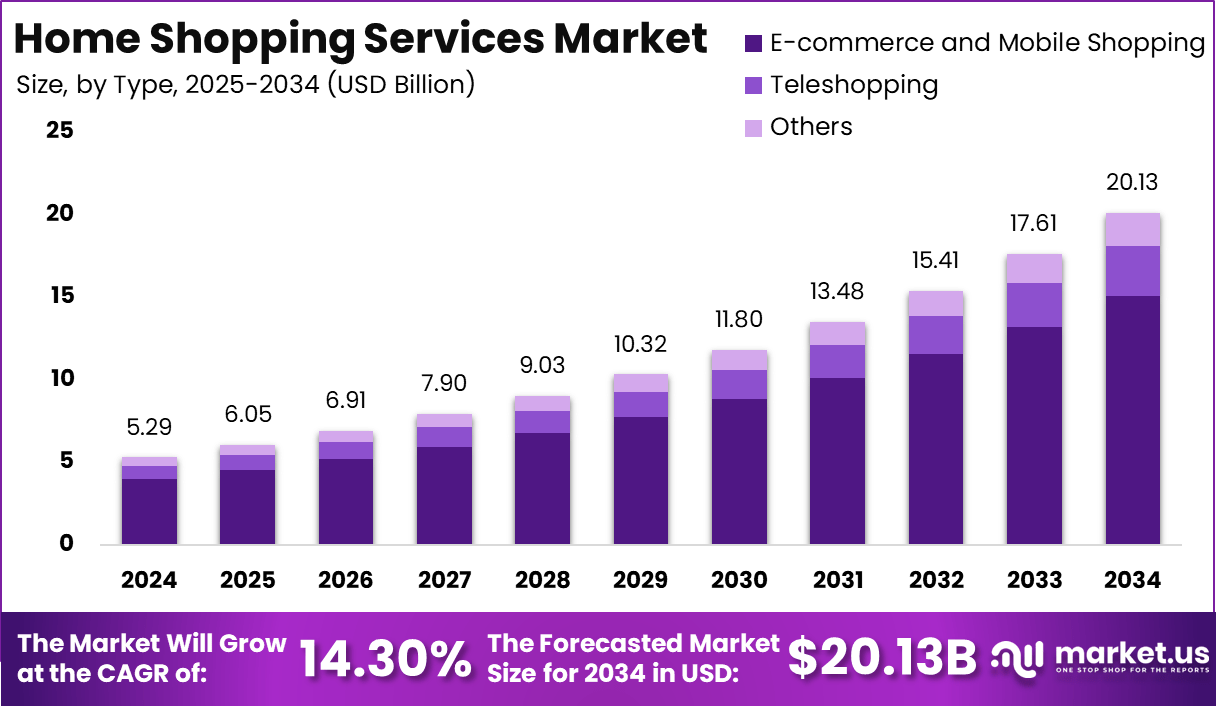

The Global Home Shopping Services Market is expected to be worth around USD 20.13 Billion by 2034, up from USD 5.29 Billion in 2024. It is expected to grow at a CAGR of 14.30% from 2025 to 2034.

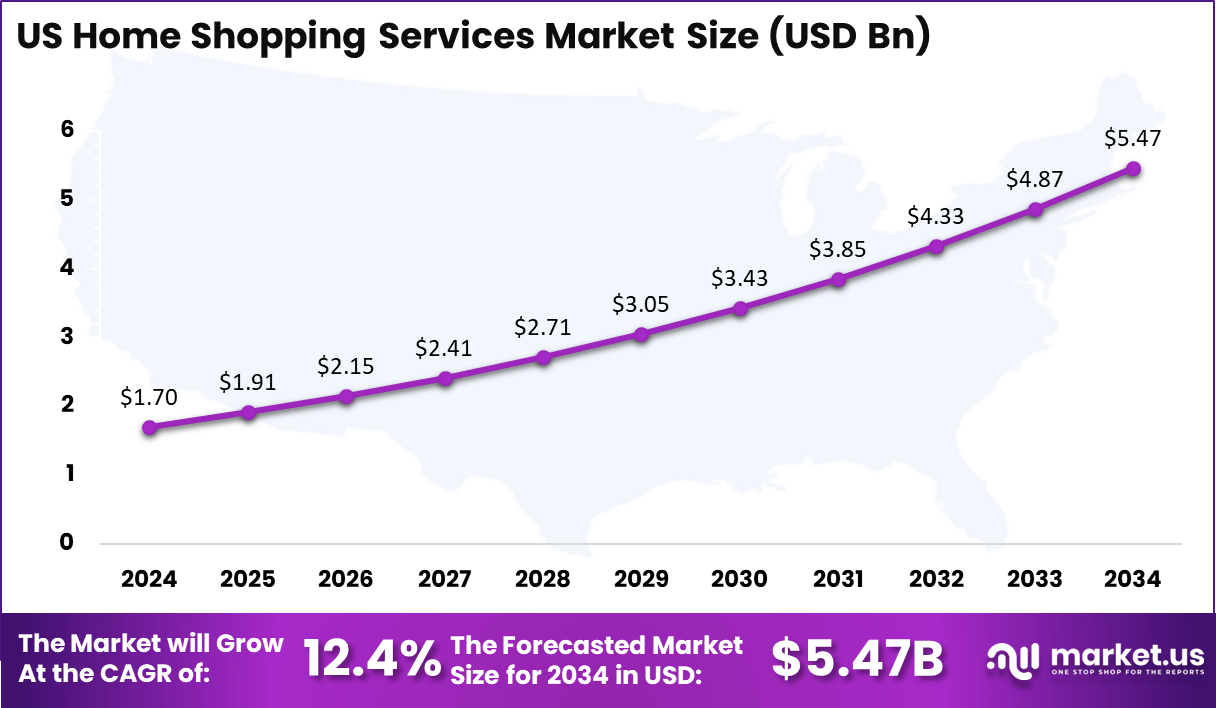

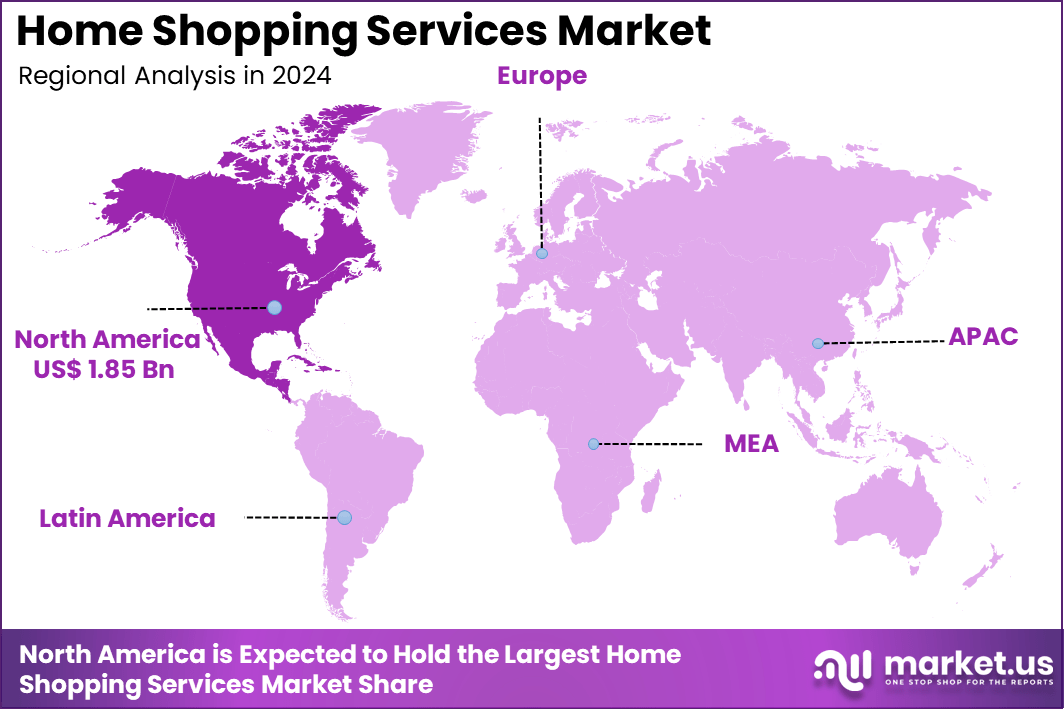

In 2024, North America held a dominant market position, capturing over a 35% share and earning USD 1.85 Billion in revenue. Further, the United States dominates the market by USD 1.7 Billion, steadily holding a strong position with a CAGR of 12.4%.

The home shopping services market is a sector that allows consumers to purchase goods from the comfort of their homes through various platforms, including television shopping channels, online websites, and mobile applications.

This market has grown considerably due to a combination of technological advancements, shifting consumer behavior, and increased access to the internet. The growing preference for convenience has been a driving force behind this market’s expansion, as people seek the ease of shopping at any time without leaving their homes.

Additionally, technological improvements such as enhanced e-commerce platforms, secure payment methods, and mobile applications have made online shopping more efficient and user-friendly, further fueling the market’s growth.

The demand for home shopping services has been bolstered by several key factors. One of the major contributors is the increasingly busy lifestyles of consumers, who value the ability to shop from home without the need to visit physical stores.

Furthermore, global events like the COVID-19 pandemic accelerated the shift to online shopping as people opted to stay home to avoid crowded places. Alongside this, the growing penetration of smartphones has made it easier for consumers to shop on the go, increasing the demand for home shopping services and further driving market growth.

Key Takeaways

- Market Value Growth: The market value is projected to grow from USD 5.29 billion in 2024 to USD 20.13 billion by 2034.

- CAGR: The compound annual growth rate (CAGR) of the market is 14.30%, indicating strong expansion over the next decade.

- Market Type Distribution: E-commerce and mobile shopping account for 75% of the market share, highlighting the dominance of digital shopping platforms.

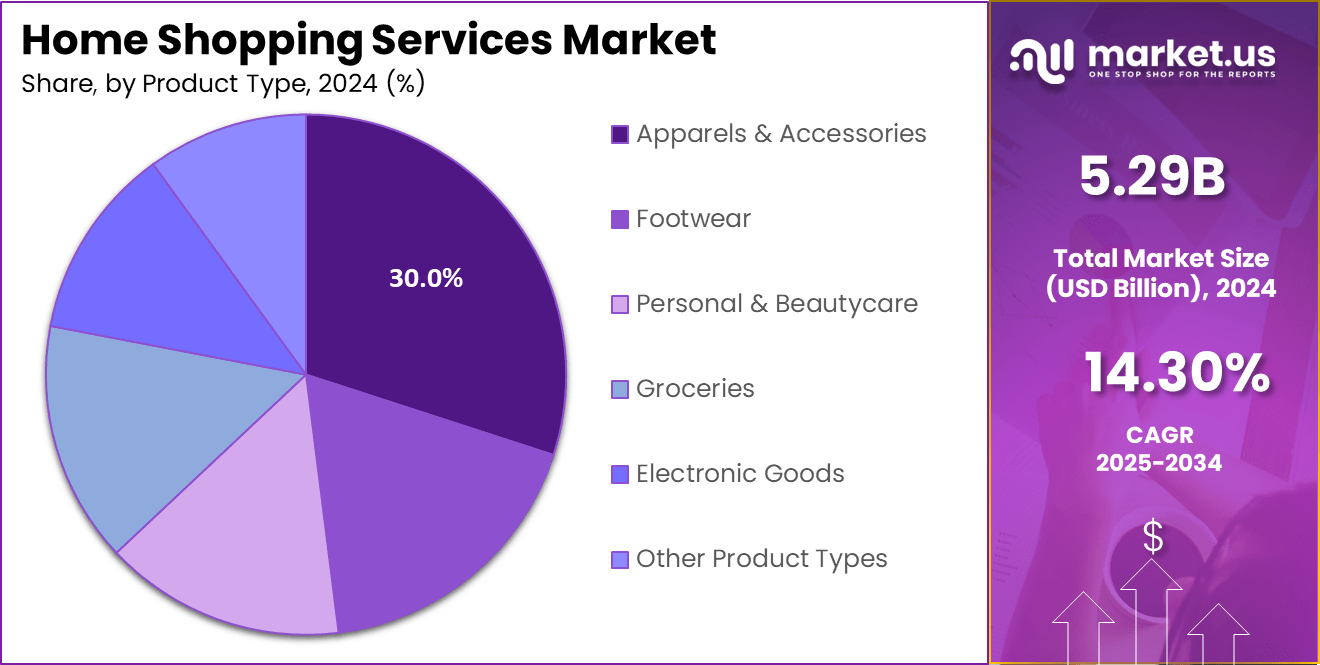

- Product Type: Apparels & Accessories represent 30% of the total product types purchased in the home shopping services market.

- Regional Insights: North America holds a significant market share, contributing 35% to the global market.

- US Market: The US market alone is valued at USD 1.7 billion, underlining its importance in the global landscape.

- US CAGR: The US home shopping services market is expected to grow at a CAGR of 12.4%, reflecting steady growth within the region.

Analyst’s Review

The home shopping services market also presents numerous opportunities for businesses to capitalize on. For example, incorporating emerging technologies such as augmented reality (AR) and virtual reality (VR) into the shopping experience can offer consumers the ability to visualize products in their own space before making a purchase, enhancing the overall shopping experience.

Additionally, expanding into emerging markets with increasing internet penetration presents untapped growth opportunities. Another potential area for growth is the rise of subscription-based models, where consumers receive regular deliveries of products, creating a steady revenue stream and fostering customer loyalty.

Technological advancements continue to play a vital role in shaping the future of the home shopping services market. Artificial intelligence (AI) is increasingly being used to personalize the shopping experience by recommending products based on individual preferences and browsing behaviors.

Furthermore, innovations such as drone delivery systems are being explored to speed up delivery times, especially in remote or hard-to-reach areas. With continued improvements in technology, such as AI-powered chatbots and personalized recommendations, businesses can create more efficient and engaging shopping experiences that cater to the specific needs of their customers.

In summary, the home shopping services market is rapidly evolving, and businesses that harness the power of technology while addressing changing consumer demands are well-positioned to thrive in this growing and dynamic industry.

Key Statistics

Usage Trends

- Home goods account for a significant portion of online purchases.

- 47% of shoppers focus on home upgrades.

- 38% engage in DIY projects, and 13% shop for moving-related needs.

- Tools like AR (Augmented Reality) are used by only 13% of buyers, while virtual design tools are used by 12%.

User Demographics and Behavior

- 79% of Americans shop online, with 20% making purchases weekly, 24% bi-weekly, and 31% monthly.

- Millennials dominate online shopping.

- 67% prefer online shopping over physical stores.

- 60% of their purchases are made online, with 60% using mobile devices to compare prices.

- Men spend on average $220 per transaction, compared to women at $151 per transaction.

Logistics and Delivery

- 28% of shoppers use Buy Online, Pick Up In Store (BOPIS), while 21% prefer curbside pickup.

- Same-day delivery is utilized by 20% of online shoppers, but late deliveries affect 16%, and order cancellations impact 14%.

Challenges

- Inventory issues: 31% of shoppers encounter out-of-stock products online.

- Customer service delays affect 13% of users, while shipping costs deter about 40% of buyers.

Regional Analysis

United States Market Size

In North America, the United States dominates the home shopping services market size by USD 1.7 billion, holding a strong position steadily with a strong CAGR of 12.4%. The US continues to lead due to its advanced digital infrastructure, high internet penetration, and increasing consumer preference for convenience in shopping.

The market in the region is primarily driven by e-commerce and mobile shopping, which together account for a substantial share of the home shopping services market. As more consumers adopt online shopping, the demand for home shopping services is growing rapidly.

The market’s growth is also fueled by the increasing adoption of mobile devices, which allow consumers to shop on the go, and the continuous improvement of mobile shopping apps that enhance user experience. Retailers are capitalizing on these trends by offering a wide range of products and services that cater to evolving consumer needs. Apparels and accessories make up a significant portion of the purchases, driven by the convenience of browsing and buying clothing and accessories online.

As a result, businesses in the US are positioning themselves to capture this growing demand, investing in digital technologies and innovative strategies to enhance their offerings. The future outlook for home shopping services in the US remains strong with continued market expansion.

North America Market Size

In 2024, North America held a dominant market position, capturing more than a 35% share, with USD 1.85 billion in revenue, and remains the leading region in the home shopping services market. This is largely due to the high adoption of e-commerce and mobile shopping in the region, with consumers favoring the convenience of shopping from home.

North America benefits from advanced digital infrastructure, widespread internet access, and a tech-savvy population, making it an ideal environment for the growth of home shopping services. The region’s strong consumer purchasing power and preference for online shopping further contribute to its leadership in the market.

The United States plays a key role within North America, with significant contributions to the overall market size. The US alone accounted for USD 1.7 billion, driven by continuous technological advancements and innovations in mobile apps and e-commerce platforms.

Furthermore, consumer behavior in the US shows an increasing shift toward mobile and online shopping, boosting market growth. The market is also supported by efficient delivery systems, secure payment gateways, and personalized shopping experiences, which appeal to US consumers’ demand for convenience and time-saving solutions.

In Europe, the market shows steady growth, driven by a large consumer base in countries such as the UK, Germany, and France. However, it lags behind North America due to factors such as varying levels of internet penetration and slower adoption rates of new shopping technologies in some regions. Despite this, the European market is experiencing a positive trend, with the rise of e-commerce and mobile shopping helping to increase market share.

In APAC, the home shopping services market is witnessing rapid growth, particularly in countries like China, Japan, and India. While e-commerce is expanding rapidly in this region, challenges like limited digital infrastructure in rural areas and a preference for traditional shopping in some regions might slow down its overall growth rate compared to North America. However, the growth potential in emerging markets within APAC is substantial due to rising disposable incomes, increased smartphone penetration, and a growing trend of online shopping.

Latin America, Middle East, and Africa represent emerging markets in the home shopping services space. The market in these regions is gradually gaining momentum as internet access improves and digital shopping habits begin to take hold. However, they still face challenges related to infrastructure, payment security, and economic instability, which can hinder faster growth. Despite this, the increasing use of smartphones and growing interest in e-commerce presents promising growth opportunities in the future.

By Type

In 2024, the E-commerce and Mobile Shopping segment held a dominant market position, capturing more than 75% of the share in the home shopping services market. This dominance is primarily due to the growing trend of online shopping, facilitated by the widespread adoption of smartphones and easy access to internet platforms.

Consumers today are increasingly turning to e-commerce and mobile shopping for the convenience, variety, and accessibility they offer. These platforms allow users to shop anytime, anywhere, and browse through an extensive range of products, which is a significant advantage over traditional retail.

E-commerce platforms and mobile shopping apps are continuously evolving, offering personalized shopping experiences through artificial intelligence, data analytics, and tailored recommendations, which further enhance user satisfaction.

Additionally, advancements in payment technologies, such as secure online payment systems and digital wallets, have increased consumer confidence in shopping online. The ease of mobile accessibility and the ability to compare prices across different platforms have made e-commerce and mobile shopping the preferred choice for consumers. As a result, this segment is expected to continue leading the market in the coming years.

By Product Type

In 2024, the Apparels & Accessories segment held a dominant market position, capturing more than 30% of the share in the home shopping services market.

This segment’s leadership is driven by the growing trend of online shopping for fashion-related products, as consumers increasingly prefer the convenience of browsing and purchasing clothing and accessories from the comfort of their homes. E-commerce platforms and mobile shopping apps have revolutionized the fashion industry, offering a vast variety of styles, sizes, and brands to suit every preference.

The rise of fast fashion, along with the increasing popularity of online fashion retailers, has further boosted the growth of this segment. Consumers are also drawn to the ease of comparing prices, reading customer reviews, and benefiting from frequent discounts and promotions that are often offered by online retailers.

Personalized recommendations powered by artificial intelligence have further enhanced the shopping experience, helping consumers discover new items tailored to their preferences. As a result, the Apparels & Accessories segment continues to dominate the home shopping services market and is expected to maintain its strong position in the years to come.

Key Market Segments

By Type

- Teleshopping

- E-commerce and Mobile Shopping

- Others

By Product Type

- Apparels & Accessories

- Footwear

- Personal & Beautycare

- Groceries

- Electronic Goods

- Other Product Types

Driving Factor

Increasing Internet and Smartphone Penetration

The proliferation of internet access and the widespread adoption of smartphones have significantly propelled the growth of the home shopping services market. As of 2019, global internet users numbered approximately 4 billion, reflecting a substantial increase from previous years.

This surge in connectivity has enabled consumers worldwide to engage in online shopping, enjoying the convenience of purchasing products from their homes. In emerging markets like India, internet penetration grew from 18% in 2014 to over 50% by 2019, opening new avenues for e-commerce platforms to reach a broader audience. Similarly, the widespread adoption of smartphones has empowered consumers to shop on-the-go, further expanding the market’s reach.

Restraining Factor

Limited Infrastructure in Developing Countries

Despite the rapid growth of home shopping services, certain regions face challenges due to inadequate infrastructure. In many developing countries, unstable power supplies, limited internet connectivity, and insufficient technological expertise hinder the seamless operation of e-commerce platforms. These infrastructural shortcomings can lead to unreliable service delivery, affecting customer satisfaction and limiting market growth.

For instance, regions with poor internet connectivity may experience difficulties in accessing online shopping platforms, while inconsistent power supplies can disrupt order processing and delivery schedules. Addressing these challenges requires significant investments in infrastructure development to ensure reliable and efficient home shopping services across diverse markets.

Growth Opportunity

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence (AI), virtual reality (VR), and augmented reality (AR) presents significant growth opportunities for the home shopping services market. These technologies can enhance the online shopping experience by offering personalized recommendations, virtual product try-ons, and immersive browsing experiences.

For example, AI can analyze consumer behavior to suggest products tailored to individual preferences, while VR and AR can allow customers to visualize products in their environment before making a purchase. Companies like IKEA have implemented VR experiences to provide customers with virtual shopping options, enhancing engagement and satisfaction. The adoption of these technologies is expected to attract more consumers to online shopping platforms, thereby expanding the market.

Challenging Factor

Cybersecurity Concerns

As the home shopping services market expands, so do cybersecurity concerns. The increase in online transactions has made platforms attractive targets for cyber threats, including data breaches and fraud. Consumers are becoming more cautious about sharing personal and financial information, fearing misuse or theft. This apprehension can lead to decreased trust in online shopping platforms, potentially hindering market growth.

E-commerce companies must invest in robust security measures, such as encryption and secure payment gateways, to protect consumer data and maintain trust. Failure to address these cybersecurity challenges could result in legal repercussions, financial losses, and a tarnished reputation, posing significant threats to the sustainability of home shopping services.

Growth Factors

The home shopping services market is witnessing impressive growth, driven by multiple factors. The increasing global penetration of the internet and smartphones plays a significant role. By 2024, it’s estimated that 5.3 billion people will be connected to the internet, a large portion of which are mobile users, making online shopping more accessible than ever.

In developing regions, internet penetration has surged by over 20% in the past five years, which expands the consumer base for home shopping services. Another key growth factor is the rising demand for convenience, with busy consumers opting to shop from the comfort of their homes.

This shift is bolstered by technological advancements like AI, which personalizes shopping experiences, and augmented reality (AR), which allows consumers to visualize products in real-time before purchasing.

Emerging Trends

Several emerging trends are reshaping the home shopping services market. One of the most notable trends is the rise of live commerce, where brands use live streaming to interact with consumers and enhance shopping experiences in real-time.

This model, originating in Asia, is now gaining traction in Western markets, providing a more engaging and personalized shopping experience. Another trend is the integration of artificial intelligence (AI) and automation in retail, which allows businesses to provide personalized recommendations, streamline inventory management, and enhance customer service with virtual assistants and chatbots.

Additionally, omnichannel retail strategies are growing, where businesses blend online and offline experiences to offer consumers flexibility. For example, shoppers can browse products online and pick them up in-store or have them delivered, enhancing convenience.

Business Benefits

The shift toward home shopping services offers numerous advantages for businesses. First and foremost, it extends market reach beyond geographical limitations, allowing companies to access a global customer base.

This is especially beneficial for small and medium-sized enterprises that traditionally struggled to expand due to the constraints of physical retail space. Additionally, the vast amount of customer data generated through online transactions provides valuable insights into consumer behavior, allowing businesses to tailor marketing strategies and product offerings.

The cost efficiency of operating online is another significant benefit, as businesses save on rent, utilities, and in-store staff. By automating inventory management and customer service, businesses can reduce operational costs further. Furthermore, online businesses have the agility to quickly adapt to changes in market demand or consumer preferences.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Amazon.com Inc., a global leader in e-commerce, has significantly expanded its market presence through strategic acquisitions and partnerships. In 2017, Amazon acquired Whole Foods Market for $13.7 billion, marking its largest acquisition to date. This move allowed Amazon to enter the physical retail space and enhance its grocery delivery services.

JD.com Inc., one of China’s largest e-commerce platforms, has actively pursued growth through numerous acquisitions and strategic initiatives. The company has completed 12 acquisitions with an average deal size of $612 million, focusing on sectors such as horizontal e-commerce and logistics technology. In July 2022, JD.com acquired China Logistics Asset Holdings, enhancing its logistics capabilities to better serve its vast customer base.

VGL Group of Companies is a prominent player in the home shopping market, known for its diverse retail offerings. While specific details regarding recent acquisitions, mergers, or product launches by VGL Group are limited, the company continues to be recognized among the major contributors to the home shopping industry.

Top Key Players in the Market

- Amazon.com Inc.

- VGL Group of Companies

- JD.com Inc

- Ebay Inc.

- Sears Brand LLC

- Walmart Inc

- Alibaba Group

- Naaptol Company

- Majid Al Futtaim (Carrefour)

- Ubuy

- QVC

- HSN (Home Shopping Network)

- Flipkart

- Rakuten

- Hointer

- Other Key Players

Recent Developments

- In 2024, Amazon launched its official flagship store on JD.com, expanding its reach to Chinese consumers and offering access to over 400,000 international products.

- In 2024, JD.com initiated a $5 billion share buyback program, signaling strong market confidence and reinforcing its position in the global e-commerce landscape.

Report Scope

Report Features Description Market Value (2024) USD 5.29 Billion Forecast Revenue (2034) USD 20.13 Billion CAGR (2025-2034) 14.30% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Teleshopping, E-commerce and Mobile Shopping, Others), By Product Type (Apparels & Accessories, Footwear, Personal & Beautycare, Groceries, Electronic Goods, Other Product Types) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Amazon.com Inc., VGL Group of Companies, JD.com Inc, Ebay Inc., Sears Brand LLC, Walmart Inc, Alibaba Group, Naaptol Company, Majid Al Futtaim (Carrefour), Ubuy, QVC, HSN (Home Shopping Network), Flipkart, Rakuten, Hointer, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Home Shopping Services MarketPublished date: Mar 25add_shopping_cartBuy Now get_appDownload Sample

Home Shopping Services MarketPublished date: Mar 25add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon.com Inc.

- VGL Group of Companies

- JD.com Inc

- Ebay Inc.

- Sears Brand LLC

- Walmart Inc

- Alibaba Group

- Naaptol Company

- Majid Al Futtaim (Carrefour)

- Ubuy

- QVC

- HSN (Home Shopping Network)

- Flipkart

- Rakuten

- Hointer

- Other Key Players