Global LGBTQ Tourism Market Size, Share, Growth Analysis By Traveler Type (Solo Travelers, Couples, Families, Group Travelers), By Purpose of Travel, By Accommodation Type, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136473

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Environment Analysis

- Traveler Type Analysis

- Purpose of Travel Analysis

- Accommodation Type Analysis

- Destination Type Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Emerging Trends

- Regional Analysis

- Competitive Landscape

- Recent Developments

- Report Scope

Report Overview

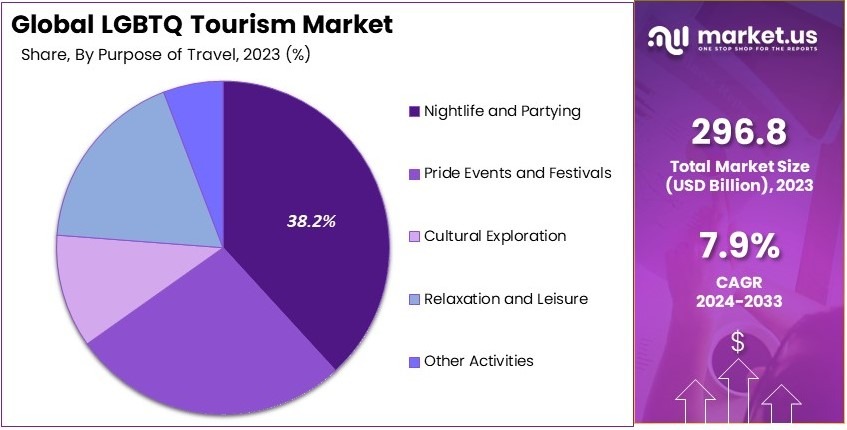

The Global LGBTQ Tourism Market size is expected to be worth around USD 634.9 Billion by 2033, from USD 296.8 Billion in 2023, growing at a CAGR of 7.9% during the forecast period from 2024 to 2033.

LGBTQ tourism refers to travel experiences designed specifically for lesbian, gay, bisexual, transgender, and queer individuals. It includes destinations, accommodations, events, and activities that are welcoming and inclusive. The goal is to provide safe and enjoyable environments where travelers can express their identities freely.

The LGBTQ tourism market consists of businesses and services that cater to LGBTQ travelers. This includes specialized travel agencies, LGBTQ-friendly hotels and resorts, event organizers, and media platforms. The market focuses on creating and promoting destinations and experiences that meet the unique needs and preferences of the LGBTQ community.

LGBTQ tourism is expanding as acceptance and visibility grow worldwide. 7.6% of U.S. adults identify as LGBTQ+, forming a substantial traveler group. According to Gallup, 37 countries now legalize same-sex marriages, offering more destinations. Additionally, 84% of non-LGBTQ Americans support equal rights, fostering a welcoming environment for LGBTQ travelers.

The LGBTQ tourism market presents strong growth opportunities driven by increasing demand and inclusive marketing. Microsoft Advertising reports that 70% of Gen Z trust diverse brands, while Facebook found 59% prefer inclusive ads. Market saturation remains low, allowing new businesses to enter. Competitive strategies focused on diversity can capture this expanding market, positively impacting both global and local economies.

Growth factors include rising societal acceptance and targeted advertising. Demand is fueled by 13.9 million LGBTQ individuals in the U.S. and supportive global regulations. Opportunities arise from brands leveraging diversity, as inclusive campaigns boost purchase intent by 23 points. Technological advancements also enhance personalized travel experiences for LGBTQ tourists.

Government investment and regulations support LGBTQ tourism growth. Policies that protect LGBTQ rights and promote inclusive tourism attract more visitors. Regulations like anti-discrimination laws ensure a safe environment for LGBTQ travelers. According to GLAAD, government backing boosts market confidence and encourages sustainable industry practices.

Key Takeaways

- The LGBTQ Tourism Market was valued at USD 296.8 Billion in 2023, and is expected to reach USD 634.9 Billion by 2033, with a CAGR of 7.9%.

- In 2023, Couples dominate the traveler type segment with 40.6% due to the popularity of joint travel experiences.

- In 2023, Nightlife and Partying lead the purpose of travel segment with 38.2%, reflecting the community’s preference for vibrant social activities.

- In 2023, Hotels and Resorts account for 39.2% of the accommodation type segment, offering comfortable and inclusive lodging options.

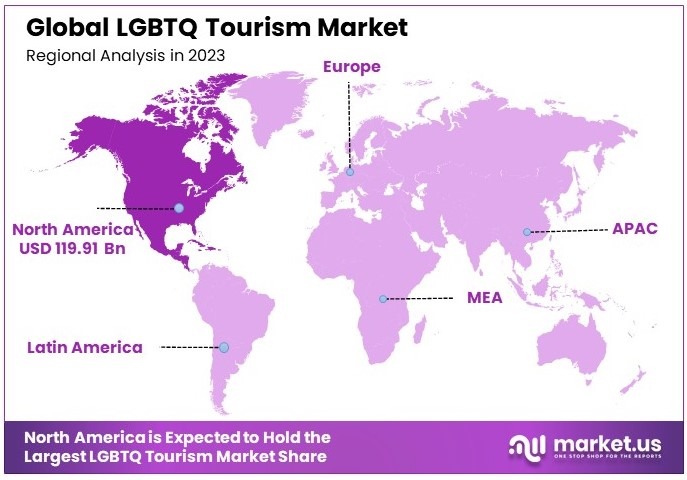

- In 2023, North America dominates the region segment with 40.4% and USD 119.91 Billion, driven by its large and active LGBTQ community.

Business Environment Analysis

LGBTQ tourism market remains moderately saturated, with top destinations like Canada, Malta, New Zealand, Portugal, and Spain leading according to the Gay Travel Index 2024. However, emerging destinations such as Nepal and Thailand are expanding their offerings, providing new opportunities for growth without overwhelming competition.

The target demographic primarily includes LGBTQ+ individuals under 45 years old, particularly gay and bisexual men. According to GLAAD’s 2023 study, 84% of non-LGBTQ Americans support equal rights, broadening the appeal. Additionally, 70% of Gen Z trust brands that represent diversity, enhancing market reach.

Product differentiation is achieved through inclusive environments and unique experiences. For example, Nepal’s April 2024 International Rainbow Tourism Conference highlighted its commitment to LGBTQ+ rights. Similarly, Thailand’s June 2024 “Pink Plus Economy” initiative offers tailored services, setting these destinations apart from competitors.

Value chain analysis underscores the importance of strategic partnerships and support systems. The International Gay & Lesbian Travel Association (IGLTA), with members from over 80 countries, provides essential marketing technology and tools and networking events. Collaborations like Nepal Tourism Board’s efforts ensure a robust support network for LGBTQ+ tourism businesses.

Investment opportunities are substantial, driven by government initiatives and private sector support. Thailand’s Pink Plus Economy and Connecticut’s September 2024 tourism campaign demonstrate significant investment in infrastructure and marketing. These efforts attract investors seeking to capitalize on the growing demand for inclusive travel experiences.

Adjacent markets, including hospitality, retail, and events, benefit from LGBTQ tourism growth. The March 2024 Rainbow Book Bus initiative and December 2024 FITUR LGBT+ event in Madrid highlight opportunities in literature and cultural events. These activities boost local businesses and create a comprehensive ecosystem supporting LGBTQ+ travelers.

Traveler Type Analysis

Couples dominate with 40.6% due to diverse, couple-friendly offerings.

In the LGBTQ tourism market, Couples emerge as the dominant sub-segment, accounting for 40.6% of the market share. This prevalence is driven by the vast array of tourism offerings that cater specifically to couples, including romantic getaways, anniversary celebrations, and destination weddings, all within LGBTQ-friendly environments.

This segment appreciates destinations that provide both security and welcoming atmospheres, enhancing their overall travel experience.

Solo Travelers explore the world on their terms, valuing safety and social opportunities to connect with like-minded individuals.

Families within the LGBTQ community seek destinations that are not only accepting but also enriching for both parents and children, offering educational and leisure activities that embrace diversity.

Group Travelers often organize around shared interests or social causes, traveling together to events that cater to or support LGBTQ rights, which bolsters communal bonds and fosters a sense of belonging.

Purpose of Travel Analysis

Nightlife and Partying dominates with 38.2% due to vibrant, inclusive events.

Nightlife and Partying hold the largest share in the Purpose of Travel category at 38.2%, reflecting the LGBTQ community’s preference for vibrant, inclusive social environments. This segment is particularly drawn to destinations known for their lively bar scenes, clubs, and annual events that celebrate diversity and freedom of expression, which are pivotal in shaping the social experiences of LGBTQ travelers.

Pride Events and Festivals attract a significant number of visitors, drawn by the chance to celebrate their identity and solidarity in a supportive environment.

Cultural Exploration is important for those interested in the history and current cultural dynamics of LGBTQ communities across the globe, often blending travel with education and personal growth.

Relaxation and Leisure are sought by travelers looking for a respite from the daily grind, in locations that are not only scenic but affirming of their lifestyle.

Other Activities include adventure sports, culinary tours, and art exhibitions, which are increasingly including LGBTQ-focused options to cater to this diverse market.

Accommodation Type Analysis

Hotels and Resorts dominate with 39.2% due to tailored experiences and luxury amenities.

Hotels and Resorts lead the Accommodation Type segment with a 39.2% market share. This dominance stems from their ability to offer tailored experiences that cater to the nuances of LGBTQ preferences, including respect for privacy, luxurious amenities, and culturally competent service, which are highly valued by this demographic.

Private Rentals are preferred for their privacy and the comfort of a ‘home away from home,’ providing a discreet and relaxed environment.

Boutique Accommodations attract those seeking unique and intimate settings, often in culturally significant or particularly progressive locales.

Others include hostels and guest houses, which are options for budget-conscious travelers or those seeking a more communal lodging experience.

Destination Type Analysis

LGBTQ-friendly Destinations dominate due to a prioritization of safety and inclusivity.

LGBTQ-friendly Destinations take the forefront in the Destination Type segment, valued for their proactive stance on safety, inclusivity, and support for the LGBTQ community. These destinations are not only popular for their cultural acceptance but also for their legal protections, making them attractive travel choices.

Non-specific Destinations are also frequented, often by those seeking new experiences or business opportunities, though they may not specifically cater to LGBTQ travelers.

Key Market Segments

By Traveler Type

- Solo Travelers

- Couples

- Families

- Group Travelers

By Purpose of Travel

- Nightlife and Partying

- Pride Events and Festivals

- Cultural Exploration

- Relaxation and Leisure

- Other Activities

By Accommodation Type

- Hotels and Resorts

- Private Rentals

- Boutique Accommodations

- Others

By Destination Type

- LGBTQ-friendly Destinations

- Non-specific Destinations

Driving Factors

Inclusive Marketing Strategies Drive Market Growth

The LGBTQ Tourism Market is experiencing robust growth driven by several key factors. Inclusive marketing strategies play a pivotal role by specifically targeting LGBTQ travelers through tailored advertising and representation. For example, campaigns featuring same-sex couples or Pride events resonate deeply with the community, fostering a sense of belonging and trust.

Additionally, the increasing acceptance and legalization of same-sex relationships in many regions have expanded travel opportunities for LGBTQ individuals. Countries like Canada and Spain, which have legalized same-sex marriage, attract more LGBTQ tourists seeking welcoming environments. This social progress encourages more people to explore destinations that celebrate diversity.

Furthermore, the rise of LGBTQ-friendly accommodations and services enhances the overall travel experience, making destinations more appealing. Hotels like the Gaylord Hotels in the United States and the Axel Hotels in Europe offer specialized services and safe spaces for LGBTQ guests. These inclusive practices not only attract more tourists but also build long-term loyalty among travelers.

Restraining Factors

Societal Discrimination and Safety Concerns Restrain Market Growth

The LGBTQ tourism market, despite its growth, faces several challenges that hinder its potential. Societal discrimination remains a key obstacle, as LGBTQ travelers may encounter hostile environments in some destinations. For example, countries like Russia and Saudi Arabia enforce strict anti-LGBTQ laws, discouraging travelers due to fears of persecution.

Safety concerns also impact the market, with instances of violence and harassment influencing travel decisions. In parts of Southeast Asia, reports of harassment against LGBTQ tourists highlight the risks, making travelers hesitant to visit certain locations. This limits the potential of the market in these regions.

Economic instability further adds to the challenges, as fluctuating currencies and rising travel costs reduce accessibility for many LGBTQ tourists. For instance, economic downturns in popular destinations like Brazil can lower disposable income, affecting travel plans.

Additionally, limited legal protections in certain countries increase these risks, as LGBTQ individuals may feel unsafe expressing their identities openly. Without strong legal safeguards, many travelers choose to avoid destinations where their rights and safety are uncertain.

Growth Opportunities

Expanding Niche Travel Packages Provides Opportunities

The LGBTQ tourism market offers exciting opportunities for growth, driven by creative initiatives and new travel options. Developing niche travel packages designed specifically for LGBTQ travelers is a promising way to expand the market. These packages can include themed cruises, Pride festivals, and special events that reflect the interests of the community. For instance, the Sydney Gay and Lesbian Mardi Gras draws thousands of LGBTQ tourists every year.

Partnering with LGBTQ influencers and travel bloggers is another effective strategy for increasing visibility and trust. Influencers who share their positive experiences in LGBTQ-friendly destinations can encourage others to explore similar travel options.

The demand for personalized travel experiences also creates opportunities to design unique trips that match individual preferences. Travel agencies can offer custom itineraries that include visits to LGBTQ landmarks, exclusive events, and safe spaces for socializing.

Collaboration with local LGBTQ organizations further enhances the travel experience by ensuring destinations are welcoming and supportive. Partnerships with groups such as Out & Equal or local Pride organizations provide valuable insights for creating inclusive travel environments and events.

Emerging Trends

Virtual Reality and Social Media Are Latest Trending Factors

The LGBTQ Tourism Market is evolving with several trending factors shaping its current landscape. Virtual reality (VR) technology is becoming increasingly popular, offering immersive previews of destinations and experiences tailored for LGBTQ travelers. For instance, VR tours of LGBTQ-friendly resorts allow potential tourists to explore accommodations virtually before booking.

Social media platforms also play a crucial role, providing spaces for LGBTQ individuals to share experiences, reviews, and recommendations. Platforms like Instagram and TikTok enable travelers to post about their journeys, creating a wealth of peer-driven content that significantly influences travel decisions. Hashtags like #LGBTQTravel and #PrideTourism help build communities and inspire others to explore similar destinations.

Additionally, the rise of online booking platforms that specialize in LGBTQ-friendly accommodations and activities simplifies the planning process. Websites like Misterb&b offer tailored search options for LGBTQ travelers, making it easier to find suitable lodging and experiences.

Moreover, the integration of artificial intelligence (AI) in customer service enhances personalized recommendations and support, improving overall satisfaction. AI-driven chatbots can provide instant assistance and customized travel suggestions based on user preferences.

Regional Analysis

North America Dominates with 40.4% Market Share

North America leads the LGBTQ Tourism Market with a 40.4% share and valuation of USD 119.91 Billion. This dominance is attributed to its inclusive travel culture, progressive societal attitudes, and strong LGBTQ rights advocacy. The region offers numerous destinations with dedicated LGBTQ-friendly services, including major cities like San Francisco, New York, and Toronto, which attract global travelers with their vibrant LGBTQ events and festivals.

The region’s market performance is also bolstered by its extensive hospitality infrastructure, proactive marketing campaigns, and significant investments in tourism by businesses that actively promote inclusivity. The legal and social acceptance of LGBTQ travelers further enhances its appeal, allowing for seamless and enjoyable travel experiences.

Looking ahead, North America is expected to retain its leading position as awareness about LGBTQ travel grows and inclusivity in tourism services expands. Increasing collaborations between tourism boards and LGBTQ organizations will likely enhance the travel experience, further strengthening the region’s market share in the global LGBTQ tourism sector.

Regional Mentions:

- Europe: Europe is a prominent region for LGBTQ tourism, driven by its progressive attitudes and rich cultural offerings. Destinations like Amsterdam, Berlin, and Madrid attract travelers with LGBTQ-friendly environments and popular pride events.

- Asia Pacific: Asia Pacific is an emerging market in LGBTQ tourism, with destinations like Thailand and Japan actively promoting inclusivity. Growing awareness and improved LGBTQ rights in the region are driving market growth.

- Middle East & Africa: Middle East & Africa face challenges due to varying levels of societal acceptance, but destinations like South Africa are positioning themselves as safe and welcoming for LGBTQ travelers.

- Latin America: Latin America is growing steadily in LGBTQ tourism, with cities like São Paulo and Mexico City offering vibrant pride events and LGBTQ-focused hospitality, enhancing their appeal on the global stage.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The LGBTQ tourism market is supported by key players who focus on inclusivity and tailored travel experiences. The leading companies in this market include International LGBTQ+ Travel Association (IGLTA), Out Adventures, Olivia Travel, and Atlantis Events. These organizations drive growth through community engagement, curated services, and targeted marketing strategies.

The International LGBTQ+ Travel Association (IGLTA) serves as a global leader in advocacy and partnerships. It connects travelers with LGBTQ-friendly businesses worldwide and promotes inclusivity in the travel industry. IGLTA’s network of partners and extensive resources make it a central player in the market.

Out Adventures specializes in guided tours and small group travel, targeting LGBTQ travelers seeking unique experiences. The company combines adventure with cultural exploration, offering trips that focus on safety and authentic local interactions.

Olivia Travel focuses on serving women in the LGBTQ community. It offers exclusive cruises, resort vacations, and adventure trips. Olivia Travel’s customer loyalty is strengthened by its emphasis on community building and creating safe, inclusive environments.

Atlantis Events is a leader in LGBTQ cruises and large-scale resort events. The company organizes high-energy experiences with entertainment, social activities, and exclusive charters. Its focus on luxury and vibrant atmospheres appeals to LGBTQ individuals and groups seeking celebratory travel.

These players stand out due to their deep understanding of LGBTQ travelers’ needs. Their strong branding, inclusive policies, and curated travel experiences foster loyalty and trust. Partnerships with LGBTQ-friendly businesses and destinations enhance their market reach. Additionally, they emphasize safety and acceptance, which are key concerns for LGBTQ tourists.

Major Companies in the Market

- International LGBTQ+ Travel Association (IGLTA)

- Out Adventures

- Olivia Travel

- Atlantis Events

- R Family Vacations

- HE Travel

- VACAYA

- RSVP Vacations

- GayCities

- Misterb&b

- Purple Roofs

- Out & About Travel

- ManAboutWorld

Recent Developments

- Thailand: On July 2023, Thailand reported a substantial increase in LGBTQ+ tourism revenue, reaching approximately US$6.5 billion in 2019, which accounted for 1.23% of the country’s GDP. This growth has fueled advocacy for the legalization of same-sex marriage, aiming to further attract LGBTQ+ travelers and enhance the nation’s appeal as a diverse and inclusive destination.

- Travel Counsellors: On September 2024, Travel Counsellors, a personalized travel services provider, surpassed £1 billion in annual sales for the first time. This achievement was driven by a post-pandemic surge in tourism, with leisure sales contributing £735 million. The company offers tailored travel planning, including services for LGBTQ+ travelers seeking inclusive and customized experiences.

- Organizations in Thailand: On October 2024, organizations in Thailand, such as Borderless.lgbt, expanded the country’s health and wellness offerings for queer travelers by introducing a series of “pink plus” packages. These packages are designed to provide inclusive and tailored experiences, enhancing Thailand’s position as a leading destination for LGBTQ+ tourism in Asia.

Report Scope

Report Features Description Market Value (2023) USD 296.8 Billion Forecast Revenue (2033) USD 634.9 Billion CAGR (2024-2033) 7.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Traveler Type (Solo Travelers, Couples, Families, Group Travelers), By Purpose of Travel (Nightlife and Partying, Pride Events and Festivals, Cultural Exploration, Relaxation and Leisure, Other Activities), By Accommodation Type (Hotels and Resorts, Private Rentals, Boutique Accommodations, Others), By Destination Type (LGBTQ-friendly Destinations, Non-specific Destinations) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape International LGBTQ+ Travel Association (IGLTA), Out Adventures, Olivia Travel, Atlantis Events, R Family Vacations, HE Travel, VACAYA, RSVP Vacations, GayCities, Misterb&b, Purple Roofs, Out & About Travel, ManAboutWorld Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- International LGBTQ+ Travel Association (IGLTA)

- Out Adventures

- Olivia Travel

- Atlantis Events

- R Family Vacations

- HE Travel

- VACAYA

- RSVP Vacations

- GayCities

- Misterb&b

- Purple Roofs

- Out & About Travel

- ManAboutWorld