Global High Nucleotide Yeast Extract Market Size, Share, And Business Benefits By Form (Powder, Paste, Liquid), By Nucleotide Content (Standard Nucleotide Yeast Extract, Enriched High-Nucleotide Extract), By Source Yeast (Saccharomyces Cerevisiae, Brewer’s Yeast, Torula Yeast), By Processing Method (Autolysis-Derived Extract, Enzymatic Hydrolysis Extracts), By Application (Food and Beverages, Animal Feed, Pharmaceuticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165883

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

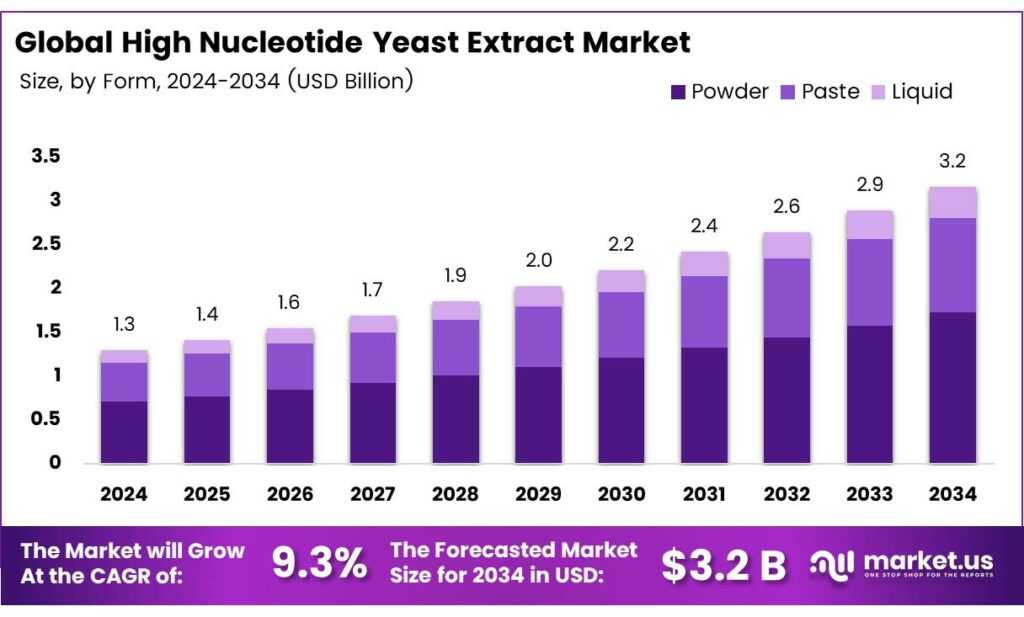

The Global High Nucleotide Yeast Extract Market size is expected to be worth around USD 3.2 billion by 2034, from USD 1.3 billion in 2024, growing at a CAGR of 9.3% during the forecast period from 2025 to 2034.

Yeast extract is a natural flavor enhancer derived from the water-soluble components of yeast cells. Rich in B vitamins, amino acids, peptides, minerals, glutamates, and nucleotides, it is produced via fermentation, autolysis, and enzymatic hydrolysis. Available in powder, paste, or liquid form, it delivers a robust umami taste and is widely used to intensify savory flavors and enhance depth in various foods.

The nutraceutical and functional food sectors have shown particular interest in bioactive peptides derived from yeast extract. These peptides, generated through gastrointestinal digestion of food proteins, consist of 3 to 20 amino acids and exert regulatory effects on the digestive, immune, cardiovascular, and nervous systems when consumed orally. Their bioactivity depends on specific amino acid composition and sequence, enabling targeted biological and metabolic functions.

- Elsa et al. demonstrated that yeast extract obtained via mechanical crushing can achieve a protein content of up to 64.1% (dry weight), with fat at just 1.32% (dry weight) and RNA at 4%. Essential amino acids comprised 40% of total amino acids, while flavor-enhancing ones, glutamic acid, aspartic acid, glycine, and alanine, accounted for 34%. Beyond its nutritional profile, yeast extract offers a wide array of physiologically beneficial compounds and exhibits strong antioxidant capacity, making it highly useful in food applications.

In food production, Biolaxi yeast extract enables sodium reduction without sacrificing taste, adds depth and authenticity to vegan and vegetarian products, and is extensively used in soups, sauces, snacks, and ready meals. Beyond the food sector, it supports robust microbial cultures in media formulations, enriches animal feed with essential nutrients, and is increasingly incorporated into skincare products for its antioxidant benefits and ability to support collagen synthesis.

Key Takeaways

- The Global High Nucleotide Yeast Extract Market is expected to grow from USD 1.3 billion in 2024 to USD 3.2 billion by 2034 at a CAGR of 9.3%.

- Standard Nucleotide Yeast Extract dominated the By Nucleotide Content segment in 2024 with 56.2% market share.

- Saccharomyces Cerevisiae led the By Source Yeast segment in 2024, holding 48.1% share.

- Autolysis-Derived Extract commanded the By Processing Method segment in 2024 with 56.4% share.

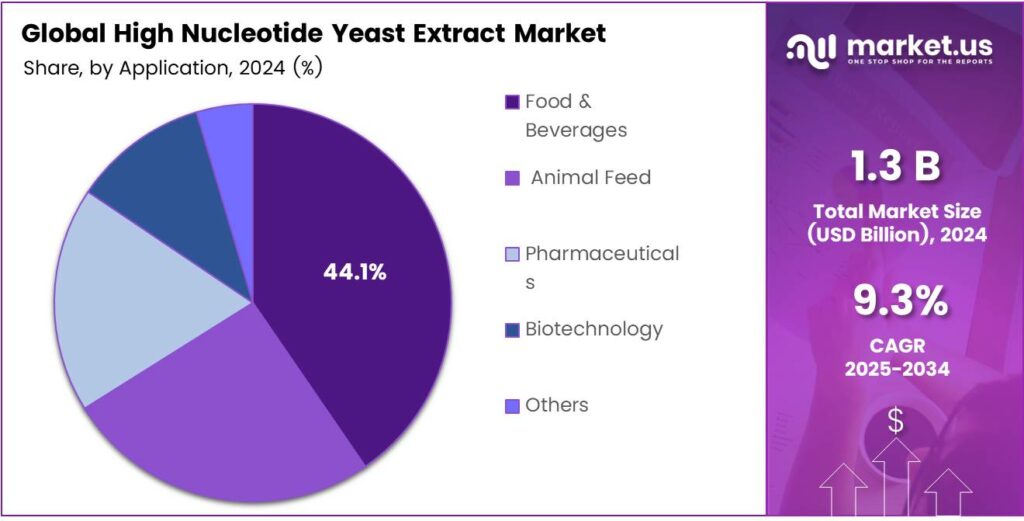

- Food and Beverages was the top application segment in 2024, capturing 44.1% market share.

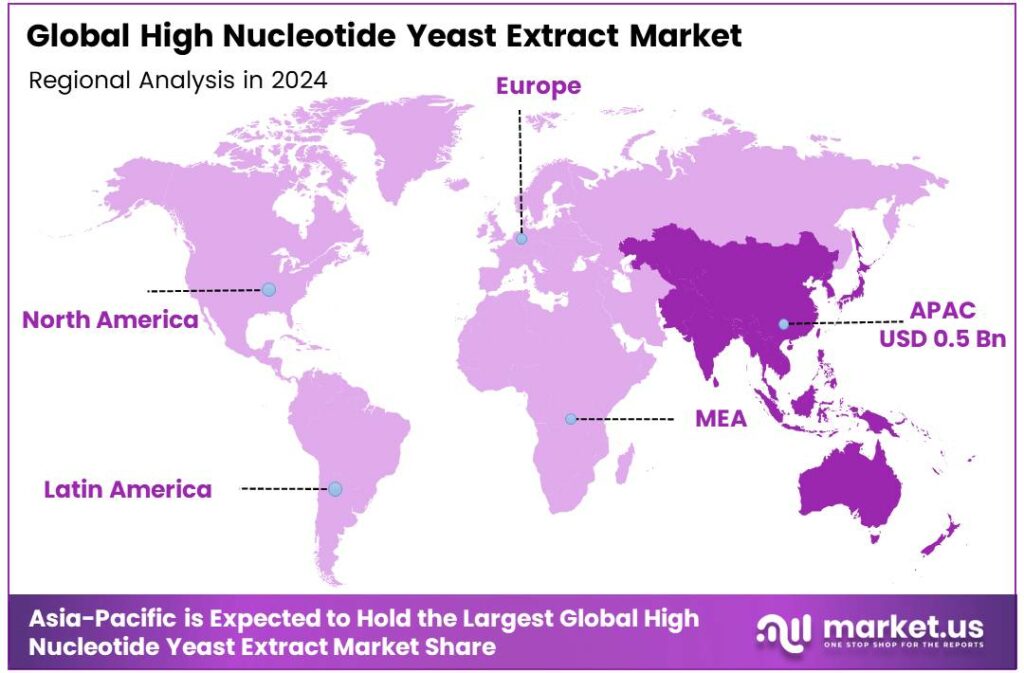

- Asia Pacific held the largest regional share at 43.8% in 2024, valued at USD 0.5 billion.

By Nucleotide Content Analysis

Standard Nucleotide Yeast Extract dominates with 56.2% due to its balanced profile and wide functional use.

In 2024, Standard Nucleotide Yeast Extract held a dominant market position in the By Nucleotide Content segment of the High Nucleotide Yeast Extract Market, with a 56.2% share. It supports consistent flavor enhancement for soups, snacks, and seasonings. Producers prefer its reliable composition, ensuring stable performance across multiple food formulation applications.

Enriched High-Nucleotide Extract continued expanding as industries sought stronger umami intensity. This sub-segment benefits from increasing adoption in premium food categories and efficiency-focused product formulations. Companies utilize it to reduce sodium without compromising taste. Furthermore, enriched extracts support clean-label needs, making them suitable for modern processing environments.

Customized Nucleotide Blends advanced steadily as manufacturers pursued tailored flavor modulation. These blends allow specific ratios of nucleotides, enabling product differentiation with precise taste outcomes. Customized profiles assist companies targeting regional flavor preferences. Their adaptability supports innovation across snacks, instant meals, and sauces.

Demand for customized solutions also reflects rising R&D investments, enabling manufacturers to build specialized formulations. These blends help enhance mouthfeel and improve palatability across diverse categories. As consumers explore new flavor experiences, custom nucleotide combinations strengthen branding opportunities for producers in competitive markets.

By Source Yeast Analysis

Saccharomyces Cerevisiae dominates with 48.1% due to its clean taste profile and global availability.

In 2024, Saccharomyces Cerevisiae held a dominant market position in the By Source Yeast segment of the High Nucleotide Yeast Extract Market, with a 48.1% share. It provides a consistent yield, mild flavor, and high nucleotide concentration. Manufacturers depend on this strain for stable performance and scalable industrial processing.

Brewer’s Yeast maintained solid growth due to its nutrient-rich composition. It offers natural B vitamins and supports stronger flavor notes, making it suitable for savory applications. Producers value its fermentation-derived complexity. Additionally, its availability as a byproduct enhances cost-efficiency for various processing needs.

Torula Yeast gained traction as a clean-label flavor enhancer with mild smoky undertones. Users apply it for seasoning blends, snack coatings, and plant-based products. Its distinct sensory attributes strengthen product appeal. As clean-label preferences rise, torula yeast continues expanding its role across multiple niches.

Others in this segment include diverse yeast strains used for specialized texture and flavor outcomes. These options enable manufacturers to experiment with novel profiles. Their use supports unique product positioning, especially in gourmet and regional foods. Flexible sourcing also encourages broader adoption within innovation-driven categories.

By Processing Method Analysis

Autolysis-Derived Extract dominates with 56.4% due to efficient cell breakdown and consistent output.

In 2024, Autolysis-Derived Extract held a dominant market position in the By Processing Method segment of the High Nucleotide Yeast Extract Market, with a 56.4% share. This method naturally breaks down yeast cells, delivering rich flavors and stable compositions. Its simplicity and cost-effectiveness support broad food and beverage adoption.

Enzymatic Hydrolysis Extracts expanded steadily due to growing demand for controlled processing. Enzymes allow precision in cell breakdown, enhancing nucleotide release. Manufacturers prefer this approach for premium formulations where higher functionality is required. The method also supports improved consistency, benefiting advanced flavor systems and nutrition-rich applications.

Thermal Hydrolysis Extracts advanced in niche applications as industries sought distinctive flavor intensities. Heat-based processing modifies sensory characteristics, supporting robust taste outcomes. This approach fits well with snacks, soups, and instant meal categories. Producers use it to create differentiated profiles for competitive product placement.

Thermal hydrolysis also offers scalability for large-volume manufacturing. Its straightforward mechanism reduces operational complexity, making it suitable for long-run production schedules. Companies leverage this method when cost control and unique flavor expressions are simultaneously required, strengthening overall market versatility in processing technologies.

By Application Analysis

Food and Beverages dominate with 44.1% due to strong demand for flavor enhancement and clean-label reformulation.

In 2024, Food and Beverages held a dominant market position in the By Application segment of the High Nucleotide Yeast Extract Market, with a 44.1% share. It supports flavor boosting in soups, snacks, sauces, and ready meals. Its efficiency improves taste without excessive salt, aligning with health-focused reformulations.

Animal Feed usage increased steadily as yeast-derived nucleotides supported gut health and improved feed palatability. Producers utilize these extracts to strengthen immune responses in young animals and enhance nutrient absorption. This sub-segment benefits from rising demand for natural feed supplements across poultry, aquaculture, and livestock industries.

Pharmaceuticals incorporated yeast extracts for fermentation processes and formulation support. Nucleotides assist in cell culture activities and provide essential growth components. Their biochemical consistency enables reliable outputs. As biologics grow, pharmaceutical reliance on yeast-based inputs strengthens, improving production productivity and research outcomes.

Biotechnology and other segments continued expanding through broader R&D usage. Biotechnology firms use nucleotide-rich extracts for microbial growth and enzyme production. Meanwhile, other industries apply them for specialized functions, including taste modulation and nutrient enrichment. Their adaptability encourages continued adoption across evolving application landscapes.

Key Market Segments

By Form

- Powder

- Paste

- Liquid

By Nucleotide Content

- Standard Nucleotide Yeast Extract

- Enriched High-Nucleotide Extract

- Customized Nucleotide Blends

By Source Yeast

- Saccharomyces Cerevisiae

- Brewer’s Yeast

- Torula Yeast

- Others

By Processing Method

- Autolysis-Derived Extract

- Enzymatic Hydrolysis Extracts

- Thermal Hydrolysis Extracts

By Application

- Food and Beverages

- Animal Feed

- Pharmaceuticals

- Biotechnology

- Others

Emerging Trends

Clean-Label Salt Reduction is Transforming Flavor Use

Across the food industry, one clear trend is shaping demand for high nucleotide yeast extract: the move toward clean-label recipes that also cut salt. The World Health Organization has asked all member states to reduce average salt intake by 30% by 2025 and recommends that adults consume no more than 5 g of salt per day. This pushes brands to reformulate soups, snacks, sauces, and ready meals without sacrificing taste.

Governments and health agencies are turning that target into concrete action. WHO’s global sodium benchmarks now set maximum sodium levels for 70 processed food sub-categories, giving regulators and manufacturers very specific reformulation goals. Regional bodies such as PAHO in the Americas are translating this into stepwise sodium-reduction targets for key categories like breads, processed meats, and instant noodles.

- Ingredion’s ATLAS study found that 44% of consumers check both ingredient and nutrition labels more than they did the year before, up from 35%. A consumer tracker from Food Standards Australia New Zealand reports that 73% of people actively put effort into maintaining a healthy diet, and 65% say they trust mandatory food labels. When you combine this label scrutiny with government pressure to cut sodium, the attraction of natural flavor from yeast becomes obvious.

Drivers

Rising plant-based applications fuel demand for high-nucleotide yeast extracts

One major driver for the high-nucleotide yeast extract market is the escalating adoption of plant-based foods and savoury applications that require rich flavour and clean-label credentials. As consumers shift towards flexitarian or vegan diets, food manufacturers face the challenge of delivering meat-like taste and texture without animal-derived ingredients.

High-nucleotide yeast extracts, rich in ribonucleotides and free amino acids, are ideally suited to enhance savoury depth in plant-based meats, snacks, soups, and sauces. Research reviews repeatedly highlight that yeast extracts are safe and nutritious… and now considered a natural, high-quality product capable of meeting diverse flavour requirements and essential nutrients.

The European natural additives market is growing at an expected average annual rate of around 5.3%, reflecting how food formulators are shifting to natural rather than synthetic additives. From a regulatory standpoint, clean-label and reduced-artificial-additive frameworks are nudging formulators to seek ingredient alternatives that meet consumer and regulatory demands.

Restraints

Regulatory and safety burdens

One of the major restraints on the High‑Nucleotide Yeast Extract (HNYE) ingredient market is stringent food-safety regulations and restricted allowable levels of added nucleotides. From a human side: while HN-YE is valued for its umami-enhancing nucleotides (such as IMP, GMP, AMP, etc.), regulatory bodies emphasise that excessive nucleotide or RNA intake may carry health risks.

- The European Food Safety Authority (EFSA) notes that when assessing nucleotides in infant formula, typical exogenous RNA intake ranged from 0.25–1.0 g/day for adults in certain claims. Although a firm upper safe limit for nucleotides in general adult foods is not established, EFSA highlights the need for cautious evaluation given potential metabolic and immunological implications.

Manufacturers of HN-YE must ensure that nucleotides are traceable, quantified, and that the raw yeast and extraction process meet food-grade specifications. For instance, a technical article states that HN-YE aims for high I+G content (inosine and guanosine monophosphates) compared with traditional yeast extracts.

Opportunity

Growing Need for Long-Distance Renewable Power Transfer Shapes Market Trends

The HVDC Converter Stations Market is seeing strong momentum as countries push more renewable energy into their power grids. Trends show a clear move toward systems that can transfer clean electricity across long distances with fewer losses. This shift is happening because solar and wind farms are often built far from cities, making efficient transmission essential.

Another major trend is the rising use of voltage source converter (VSC) technology. VSC systems are becoming more popular because they support grid stability, enable smooth integration of variable renewable power, and work well in offshore environments. Their flexibility is making them a preferred choice for new HVDC projects.

Global interconnection projects are also shaping market trends. Many regions are planning cross-border links to share electricity during peak demand or supply shortages. This cooperation helps countries maintain stable grids and manage renewable fluctuations more effectively.

Regional Analysis

Asia Pacific Leads the High Nucleotide Yeast Extract Market with a 43.8% Share Valued at USD 0.5 Billion

Asia Pacific holds the strongest position in the High Nucleotide Yeast Extract Market, capturing a 43.8% share and reaching USD 0.5 billion in value. Demand is driven by expanding food processing industries, rising adoption of natural flavor enhancers, and growing investments in fermentation technologies. Countries like China, Japan, and India continue to strengthen regional growth through advancements in clean-label formulations and nutrient-dense ingredients.

North America shows steady growth supported by its developed food, nutraceutical, and biotechnology sectors. The region benefits from strong consumer preference for natural ingredients and enhanced protein-based additives. Rising applications in savory foods and dietary supplements, alongside improved R&D in yeast-derived components, continue to boost demand across the U.S. and Canada.

Europe reflects consistent expansion due to stringent clean-label regulations and increasing reliance on yeast extract as a flavor-rich and healthier alternative to synthetic enhancers. Strong innovation within the food processing and bakery sectors contributes to rising utilization. Western European countries, particularly Germany, France, and the U.K., drive stable adoption across diverse product categories.

The Middle East & Africa market is growing gradually, supported by expanding food manufacturing capabilities and rising interest in fortified and nutritious ingredients. Urbanization and shifts toward packaged foods fuel steady usage of yeast-derived flavor bases. Regional food processors increasingly invest in natural solutions to meet evolving consumer expectations.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key High Nucleotide Yeast Extract Company Insights

The global High Nucleotide Yeast Extract Market in 2024 reflects rising demand for natural flavour enhancers, cleaner labels, and improved nutritional performance across food, beverage, nutraceutical, and animal-nutrition applications. Within this evolving environment, leading companies have adopted distinct strategies to strengthen their presence.

Angel Yeast Co., Ltd. continues to expand its role by focusing on biotechnology-driven fermentation and nutrient-enriched yeast extract solutions. Its emphasis on high-nucleotide formulations supports cleaner umami profiles and functional benefits, allowing the company to meet strong demand across Asia-Pacific food processing and health-oriented segments. Angel’s scale and technical expertise position it firmly as an innovation-oriented supplier.

Lesaffre Group strengthens its market position through its deep fermentation heritage and diversified yeast-based ingredient portfolio. By advancing its savoury and functional extract capabilities, Lesaffre addresses the need for high-nucleotide solutions used in soups, sauces, ready meals, and plant-based foods. Its strategic focus on global reach and enhanced production capacity enables consistent supply and customer-centric product development.

DSM-Firmenich has historically maintained a strong influence in yeast-derived ingredients through its advanced biotechnology, flavour development know-how, and formulation expertise. Even with portfolio realignments, the company remains valued for its technical contributions to high-nucleotide yeast extract applications, especially in clean-label seasonings and functional nutrition systems.

Kerry Group plc leverages its broad range of flavour technologies and application expertise to serve the growing demand for premium, high-function yeast extracts. Its capabilities in savoury systems, nutritional enhancement, and plant-based food solutions position the company to benefit from the increasing adoption of high-nucleotide extracts in global markets.

Top Key Players in the Market

- Angel Yeast Co., Ltd.

- Lesaffre Group

- DSM-Firmenich

- Kerry Group plc

- Lallemand Inc.

- Biorigin

- ABF Ingredients

- Sensient Technologies Corporation

- KOHJIN Life Sciences Co., Ltd.

- Thai Foods International PCL (TFI)

Recent Developments

- In 2024, Angel Yeast introduced FM888, a high-nucleotide yeast extract designed for exceptional umami flavor profiles in processed foods and beverages. This product leverages advanced filtration technology to concentrate nucleotides, targeting clean-label formulations.

- In 2024, DSM-Firmenich’s yeast extract operation (including high-nucleotide products for savory and health applications) will be transferred to Lesaffre, retaining a technology partnership for R&D. This realignment of resources will focus on high-growth areas, such as microbiome science.

Report Scope

Report Features Description Market Value (2024) USD 1.3 billion Forecast Revenue (2034) USD 3.2 billion CAGR (2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Paste, Liquid), By Nucleotide Content (Standard Nucleotide Yeast Extract, Enriched High-Nucleotide Extract, Customized Nucleotide Blends), By Source Yeast (Saccharomyces Cerevisiae, Brewer’s Yeast, Torula Yeast, Others), By Processing Method (Autolysis-Derived Extract, Enzymatic Hydrolysis Extracts, Thermal Hydrolysis Extracts), By Application (Food and Beverages, Animal Feed, Pharmaceuticals, Biotechnology, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Angel Yeast Co., Ltd., Lesaffre Group, DSM-Firmenich, Kerry Group plc, Lallemand Inc., Biorigin, ABF Ingredients, Sensient Technologies Corporation, KOHJIN Life Sciences Co., Ltd., Thai Foods International PCL (TFI) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  High Nucleotide Yeast Extract MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

High Nucleotide Yeast Extract MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-