Global Helicobacter Pylori Non-Invasive Testing Market By Product Type (Serology Test, Urea Breath Test, and Stool Antigen Test), By Test Type (Laboratory-based, and Point-of-Care), By End-user (Diagnostic Labs, Hospitals, and Clinics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162209

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

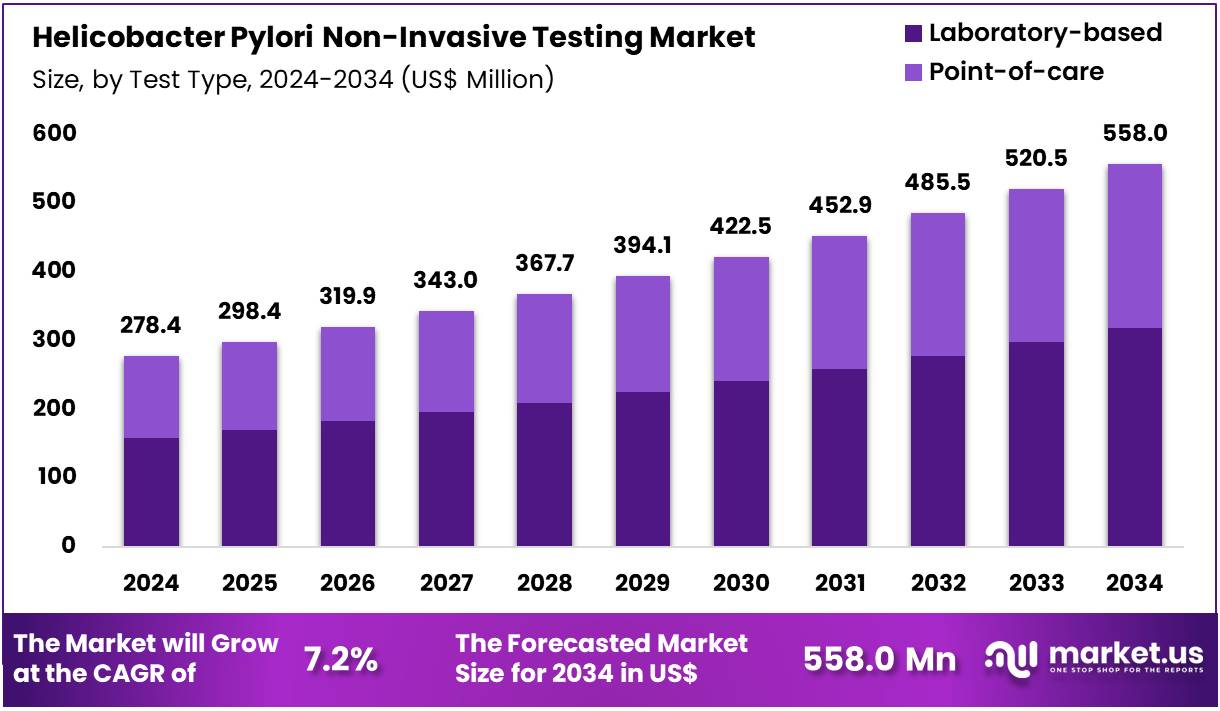

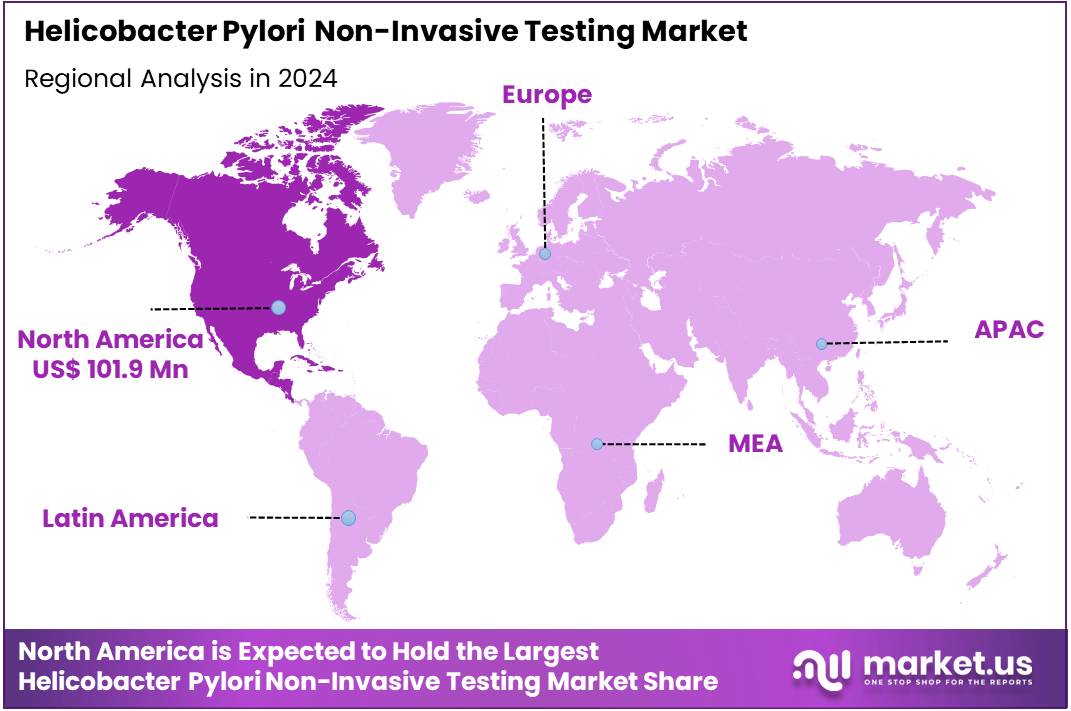

Global Helicobacter Pylori Non-Invasive Testing Market size is expected to be worth around US$ 558.0 Million by 2034 from US$ 278.4 Million in 2024, growing at a CAGR of 7.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 36.9% share with a revenue of US$ 101.9 Million.

Rising prevalence of gastrointestinal disorders propels the Helicobacter Pylori Non-Invasive Testing Market, as clinicians prioritize early detection to mitigate risks of ulcers and gastric malignancies. Healthcare providers increasingly adopt urea breath tests for initial diagnosis in dyspeptic patients, offering high sensitivity without procedural discomfort.

Stool antigen assays support post-eradication verification, enabling efficient follow-up in outpatient settings to confirm treatment success. Emerging point-of-care innovations accelerate results, streamlining workflows in busy practices.

In July 2023, Meridian Bioscience obtained FDA clearance for its Premier HpSA FLEX enzyme immunoassay, which detects H. pylori antigens in fresh, frozen, and preserved stool samples to enhance diagnostic flexibility. This advancement expands testing applications in diverse clinical scenarios, fostering market growth through versatile, patient-centered solutions.

Growing emphasis on patient comfort drives the Helicobacter Pylori Non-Invasive Testing Market, with non-invasive methods gaining traction over endoscopy for routine screening. Serological tests identify at-risk individuals in primary care, guiding preventive strategies against chronic gastritis. These approaches integrate seamlessly into population health initiatives, promoting widespread adoption for carrier detection. Technological refinements boost accuracy, reducing diagnostic delays and improving outcomes.

In December 2023, Biomerica, Inc. received FDA 510(k) clearance for its Hp Detect Stool Antigen ELISA test, which targets H. pylori linked to gastric cancers and aids both initial diagnosis and post-treatment confirmation. Such developments enhance monitoring capabilities, creating opportunities for expanded use in longitudinal care protocols.

Increasing integration of advanced diagnostics fuels the Helicobacter Pylori Non-Invasive Testing Market, as innovations address gaps in pediatric and adult applications. Urea breath tests now extend to younger populations, facilitating timely interventions in family medicine. Stool-based assays complement these by providing cost-effective options for confirming eradication in resource-limited environments.

Trends toward rapid, on-site testing empower providers to act decisively, optimizing resource allocation. On January 11, 2024, ARJ Medical Inc. received PMA supplement approval for its PyloPlus UBT System, extending indications to both adults and pediatric patients aged 3–17 for initial diagnosis and post-treatment monitoring. This approval broadens accessibility across age groups, positioning the market for sustained expansion through inclusive, evidence-based practices.

Key Takeaways

- In 2024, the market generated a revenue of US$ 278.4 Million, with a CAGR of 7.2%, and is expected to reach US$ 558.0 Million by the year 2034.

- The product type segment is divided into serology test, urea breath test, and stool antigen test, with serology test taking the lead in 2023 with a market share of 41.7%.

- Considering test type, the market is divided into laboratory-based and point-of-care. Among these, laboratory-based held a significant share of 57.2%.

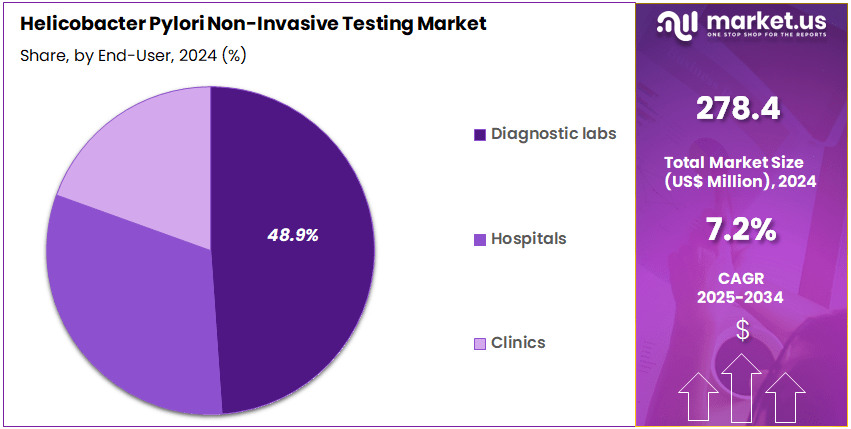

- Furthermore, concerning the end-user segment, the market is segregated into diagnostic labs, hospitals, and clinics. The diagnostic labs sector stands out as the dominant player, holding the largest revenue share of 48.9% in the market.

- North America led the market by securing a market share of 36.6% in 2023.

Product Type Analysis

Serology tests hold 41.7% of the market and are expected to continue growing due to their widespread use for non-invasive detection of Helicobacter pylori infections. These tests detect specific antibodies in the blood, providing a convenient and reliable diagnostic option. Increasing prevalence of gastrointestinal disorders, including gastritis and peptic ulcer disease, is likely to drive demand for serology-based testing.

Healthcare providers prefer serology tests for their rapid turnaround time, ease of sample collection, and suitability for mass screening programs. Advancements in assay sensitivity and specificity are anticipated to improve diagnostic accuracy, further promoting adoption. The growing awareness of H. pylori’s role in gastric cancer is expected to encourage regular testing, particularly in high-risk populations.

Additionally, cost-effectiveness and minimal invasiveness make serology tests attractive for outpatient settings and routine screenings. Increasing integration with laboratory information systems ensures faster reporting and improved workflow, supporting the segment’s growth.

Manufacturers continue to invest in developing multiplex serology tests for concurrent detection of multiple gastrointestinal pathogens, further strengthening adoption. The combination of convenience, accuracy, and scalability ensures serology tests maintain dominance in the market.

Test Type Analysis

Laboratory-based tests represent 57.2% of the test type segment and are projected to grow due to their high accuracy and capacity for handling large volumes of samples. Laboratory-based diagnostics provide precise quantitative measurements of H. pylori infection, making them suitable for clinical research, epidemiological studies, and hospital-based testing.

Advances in automated platforms, high-throughput analyzers, and improved assay reagents are expected to enhance the speed and reliability of laboratory-based testing. Hospitals and diagnostic centers increasingly adopt these systems to standardize results and ensure reproducibility. Regulatory support for validated laboratory methods also strengthens adoption, providing healthcare providers with confidence in clinical decision-making.

The integration of laboratory-based testing with electronic health records and reporting systems enhances data management and patient monitoring. Additionally, laboratory-based tests support comprehensive surveillance programs and clinical trials, contributing to market expansion.

The ability to combine multiple tests in a single platform further improves operational efficiency and cost-effectiveness. Growing awareness of H. pylori’s long-term health impact and the need for accurate diagnostics ensures laboratory-based testing remains the backbone of the market. Continuous innovation and increasing laboratory infrastructure investment are likely to drive sustained growth.

End-User Analysis

Diagnostic laboratories account for 48.9% of the end-user segment and are expected to remain the primary driver of the Helicobacter pylori non-invasive testing market due to their expertise, infrastructure, and ability to handle high testing volumes. Diagnostic labs offer reliable serology, urea breath, and stool antigen tests, catering to both routine clinical and research-based testing requirements. The rising prevalence of H. pylori infection, especially in regions with high gastrointestinal disease burden, is likely to increase sample inflow to diagnostic labs.

Labs benefit from advancements in automated testing platforms and high-throughput systems, which enhance operational efficiency and reduce turnaround times. Collaboration with hospitals, clinics, and public health agencies strengthens the role of diagnostic laboratories as the central testing hub. Increasing patient awareness and physician recommendations for regular H. pylori screening further support demand.

Diagnostic laboratories also provide quality assurance, standardized protocols, and data reporting, which are critical for accurate diagnosis and treatment monitoring. Government-supported screening programs and initiatives in high-risk populations are expected to further enhance utilization of diagnostic lab services. The combination of technical expertise, reliability, and scalability ensures diagnostic laboratories remain the leading end-users for non-invasive H. pylori testing.

Key Market Segments

By Product Type

- Serology Test

- Urea Breath Test

- Stool Antigen Test

By Test Type

- Laboratory-based

- Point-of-Care

By End-user

- Diagnostic Labs

- Hospitals

- Clinics

Drivers

Rising Burden of Gastric Cancer Associated with Helicobacter Pylori is Driving the Market

The escalating association between Helicobacter pylori infection and gastric cancer has intensified the imperative for non-invasive testing to support early eradication efforts and reduce oncogenic progression. This pathogen’s induction of chronic inflammation facilitates metaplasia and dysplasia, positioning it as a modifiable risk factor amenable to diagnostic intervention.

Non-invasive tests, such as urea breath and stool antigen assays, enable population-wide screening without procedural discomfort, aligning with guidelines from gastroenterological societies. The clinical rationale extends to high-risk cohorts, including those with family histories or ethnic predispositions, where timely detection averts advanced-stage diagnoses.

Healthcare policymakers are embedding these diagnostics into dyspepsia evaluation pathways, correlating with decreased malignancy incidences through proactive management. This driver is amplified by epidemiological surveillance, which informs resource allocation toward scalable testing infrastructures.

The American Cancer Society, in collaboration with the National Cancer Institute, estimated 26,500 new cases of stomach cancer in the United States for 2023, with Helicobacter pylori attributable to a substantial proportion of non-cardia subtypes. This projection underscores the diagnostic demand, as eradication post-detection can mitigate up to 70% of attributable cases.

Innovations in assay multiplexing further enhance utility, allowing concurrent evaluation of virulence factors. Economically, widespread adoption curtails oncology treatment outlays, justifying expanded reimbursement frameworks. International consortia promote harmonized protocols, fostering global equity in testing access. This causal linkage not only propels market dynamics but also reinforces preventive paradigms in oncology.

Restraints

Limited Reimbursement Coverage for Non-Invasive Tests is Restraining the Market

Constrained reimbursement landscapes for non-invasive Helicobacter pylori diagnostics continue to obstruct equitable deployment, favoring resource-intensive alternatives despite superior patient-centered attributes. Insurers frequently impose utilization thresholds, such as symptom severity mandates, relegating breath and antigen tests to confirmatory rather than primary roles. This fiscal conservatism exacerbates disparities, as self-pay burdens deter screening in underserved demographics, perpetuating undetected chronic infections.

Jurisdictional inconsistencies in billing codes compound challenges, with some payers requiring endoscopic correlation for coverage validation. Developers encounter protracted negotiations for tiered pricing, hindering innovation dissemination amid rising procedural costs. The resultant underutilization inflates indirect expenses through unmanaged complications like refractory ulcers.

The Centers for Medicare & Medicaid Services reported total U.S. healthcare spending reached $4.5 trillion in 2022, within which diagnostic reimbursements for gastrointestinal assays, including those for Helicobacter pylori, encountered persistent coding and coverage restrictions. Such allocations highlight systemic priorities that marginalize preventive non-invasive modalities.

Provider hesitancy stems from revenue models incentivizing invasive evaluations, further entrenching market fragmentation. Advocacy for bundled payments remains nascent, with demonstration projects yielding variable outcomes. These barriers not only impede scalability but also undermine public health objectives for infection control.

Opportunities

Expansion of National Screening Programs in Endemic Regions is Creating Growth Opportunities

The proliferation of state-sponsored screening endeavors in Helicobacter pylori-endemic locales has engendered substantial prospects for non-invasive testing, facilitating broad-based detection to attenuate disease sequelae. These initiatives, often integrated into primary health networks, leverage breath and fecal assays for their logistical simplicity, enabling outreach in remote or densely populated areas.

Opportunities manifest in supply chain fortification, as bulk procurement contracts emerge for standardized kits tailored to regional infrastructures. Public-private synergies accelerate validation studies, ensuring cultural adaptations that boost participation rates among stigmatized groups. Value-driven metrics, such as averted disability-adjusted life years, underpin funding escalations, positioning diagnostics as cost-effective prophylactics.

In high-incidence zones, these programs catalyze infrastructure upgrades, including training modules for community health workers. The World Health Organization highlighted Bhutan’s completion of a national gastric cancer prevention program in 2023, incorporating Helicobacter pylori screening that screened over 100,000 individuals and achieved eradication rates exceeding 80% in positive cases. This benchmark illustrates replicable models for Southeast Asian counterparts, where analogous efforts could amplify test volumes.

Digital tracking integrations promise enhanced follow-up, mitigating loss-to-care issues. As patent landscapes evolve, biosimilar reagents lower entry thresholds for local manufacturers. These expansions not only diversify commercial pathways but also embed the market within sustainable health architectures.

Impact of Macroeconomic / Geopolitical Factors

Rising energy costs and a cautious investment climate are prompting developers in the gastric pathogen detection market to pause enhancements on breath analyzers, focusing instead on improving basic antigen strip tests amid limited R&D resources. Increasing U.S.-China regulatory tensions and disruptions in Arctic shipping routes are delaying imports of isotopic tracers from Eurasia, extending stability trials and raising logistics costs for large-scale validation networks.

To address these challenges, some developers are partnering with tracer suppliers in Montana, incorporating eco-certifications that streamline payer approvals and attract specialized health-focused investors. Growing awareness of peptic ulcers is driving CMS demonstration funding toward rapid urease breath kits, encouraging their use in outpatient endoscopy clinics.

At the same time, U.S. investigations into medical devices and diagnostic equipment are raising concerns about potential tariffs on Asian-sourced sampling swabs and reagent buffers, increasing lab costs and limiting adoption in value-conscious primary care programs while slowing prototype exchanges. These uncertainties are creating hesitancy in resource allocation, occasionally disrupting multi-cohort efficacy studies.

Forward-thinking developers are leveraging ARPA-H funding to build assay production capabilities in Dakota, introducing fluorescence-quenched probes and enhancing expertise in aerosol containment and safe lab practices.

Latest Trends

FDA Clearance of PyloPlus UBT System Supplement is a Recent Trend

The endorsement of supplemental validations for urea breath test platforms has epitomized a key evolution in Helicobacter pylori non-invasive diagnostics during 2025, emphasizing enhanced procedural robustness for diverse clinical contexts.

The PyloPlus UBT System’s updated iteration incorporates refined isotopic protocols, optimizing sensitivity in post-antimicrobial scenarios where residual suppression might confound results. This chemiluminescence-based enhancement streamlines laboratory workflows, accommodating higher caseloads without sacrificing diagnostic fidelity. The trend signifies a maturation toward resilient assays, resilient to pharmacological interferences prevalent in polypharmacy patients.

Automated result interfaces facilitate guideline-concordant reporting, bridging gaps in multidisciplinary care coordination. Such advancements align with escalating demands for verifiable eradication confirmation, curtailing relapse incidences. The Food and Drug Administration issued clearance for the PyloPlus UBT System supplement (P170022/S003) on January 8, 2025, affirming its efficacy for detecting active Helicobacter pylori infections via exhaled carbon-13 labeled urea metabolism. This approval extends indications to pediatric and immunocompromised populations, broadening applicability.

Real-world implementations demonstrate concordance rates above 95% with invasive benchmarks, influencing therapeutic algorithms. The trajectory anticipates multiplex expansions, incorporating resistance genotyping. This isotopic refinement not only augments precision but also reinforces the sector’s integration with antimicrobial stewardship initiatives.

Regional Analysis

North America is leading the Helicobacter Pylori Non-Invasive Testing Market

In 2024, North America represented 36.6% of the global Helicobacter pylori non-invasive testing market, influenced by updated clinical protocols that prioritize urea breath and stool antigen tests for initial dyspepsia evaluations, reducing reliance on endoscopy in low-prevalence settings. Gastroenterologists adopted these methods more frequently following endorsements from professional societies, enabling cost-effective eradication confirmation without procedural risks, particularly in primary care where antibiotic resistance complicates therapy selection.

The emphasis on testing high-risk individuals, such as those with family histories of gastric malignancy or autoimmune gastritis, expanded utilization in outpatient networks, supported by streamlined insurance approvals for at-home kits. Demographic shifts, including immigration from endemic regions, heightened screening in diverse urban populations, correlating with proactive public health efforts to mitigate gastric adenocarcinoma risks.

Technological improvements in assay sensitivity enhanced detection thresholds, facilitating broader implementation in community laboratories amid rising awareness of asymptomatic carriers. These factors demonstrated the region’s strategic emphasis on accessible, patient-centered diagnostic strategies. The American College of Gastroenterology’s 2024 guideline recommends non-invasive testing for all patients with dyspepsia and those at elevated gastric cancer risk, marking a pivotal shift from prior endoscopy-first approaches.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Health authorities in Asia Pacific project the Helicobacter pylori non-invasive testing sector to accelerate during the forecast period, as endemic prevalence in Southeast Asian nations drives expanded screening to curb gastric malignancy burdens in resource-constrained environments.

Governments in Indonesia and the Philippines invest in urea breath test distribution, equipping district clinics with portable devices to identify carriers among agricultural workers exposed to contaminated water sources. Diagnostic providers collaborate with national institutes to validate stool antigen kits for pediatric cohorts, anticipating higher eradication rates through early intervention in school-based programs.

Oversight agencies in Malaysia and Vietnam pioneer subsidy schemes for serology panels, positioning rural health posts to conduct mass surveys without invasive procedures. Authorities anticipate integrating these tests into digital health platforms, streamlining follow-up for iron deficiency anemia linked to chronic gastritis in coastal communities.

Regional experts advance multiplex formats, coordinating with surveillance networks to track clarithromycin resistance patterns in urban migrants. These developments foster a comprehensive approach to infection control.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Dominant firms in the gastric pathogen detection arena advance their portfolios by rolling out rapid antigen assays and urea breath kits that yield results within minutes, streamlining outpatient workflows for early intervention. They execute product approvals and launches, such as Meridian Bioscience’s 2023 FDA-cleared FLEX immunoassay, to fortify regulatory credibility and capture untapped demand in primary care.

Organizations nurture collaborations with regional health authorities to embed tests into national eradication campaigns, amplifying volume in high-burden territories. Executives funnel capital into multiplex platforms that pair H. pylori screening with resistance profiling, addressing antibiotic challenges head-on.

They intensify distribution networks across Africa and the Middle East, customizing kits for low-infrastructure environments to seize subsidized procurement opportunities. Moreover, they devise integrated service bundles with teleconsultation links, enhancing clinician uptake and generating ancillary revenue from follow-up analytics.

Meridian Bioscience, Inc., founded in 1978 and headquartered in Cincinnati, Ohio, specializes in molecular and immunoassay diagnostics for infectious diseases, emphasizing rapid, point-of-care solutions for global providers. The company engineers platforms like its illumigene line for PCR-based detection and the Premier HpSA series for antigen identification, supporting efficient H. pylori management in clinical and home settings.

Meridian allocates dedicated funds to assay refinements, prioritizing sensitivity in diverse populations to align with evolving guidelines. CEO Jack L. Bowman directs a streamlined operation across North America and Europe, underscoring compliance and innovation in gastrointestinal testing.

The firm engages with laboratory consortia to validate performance, ensuring seamless adoption in routine screenings. Meridian cements its competitive edge by merging technical precision with accessible formats to combat prevalent infections effectively.

Top Key Players

- Tri-Med

- Quidel Corporation

- Meridian Bioscience Inc.

- Gulf Coast Scientific

- Fisher Scientific

- certest Biotech srl

- Cardinal Health

- Bio-Rad Laboratories, Inc.

- Biohit Oyj

- Abbott

Recent Developments

- In March 2025, Alpha Laboratories introduced the PRIMA Professional H. pylori Antigen Test, a rapid, simple, stool-based sandwich EIA providing results within 10 minutes. This launch strengthens the non-invasive H. pylori testing market by offering laboratories a fast, reliable diagnostic solution that enhances gastrointestinal patient care pathways.

- In April 2025, SSI Diagnostica Group acquired Gulf Coast Scientific to expand its footprint in the US diagnostics market. The acquisition enhances SSI Diagnostica’s gastrointestinal testing portfolio by incorporating Gulf Coast Scientific’s expertise in Urea Breath Testing (UBT). By combining rapid antigen screening solutions with UBT, the group can now offer a broader, integrated range of H. pylori diagnostics, driving the market.

Report Scope

Report Features Description Market Value (2024) US$ 278.4 Million Forecast Revenue (2034) US$ 558.0 Million CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Serology Test, Urea Breath Test, and Stool Antigen Test), By Test Type (Laboratory-based, and Point-of-Care), By End-user (Diagnostic Labs, Hospitals, and Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tri-Med, Quidel Corporation, Meridian Bioscience Inc., Gulf Coast Scientific, Fisher Scientific, certest Biotech srl, Cardinal Health, Bio-Rad Laboratories, Inc., Biohit Oyj, Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Helicobacter Pylori Non-Invasive Testing MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Helicobacter Pylori Non-Invasive Testing MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tri-Med

- Quidel Corporation

- Meridian Bioscience Inc.

- Gulf Coast Scientific

- Fisher Scientific

- certest Biotech srl

- Cardinal Health

- Bio-Rad Laboratories, Inc.

- Biohit Oyj

- Abbott