Global Healthcare Construction Market By Facility Type (Hospitals, Clinics, Ambulatory Surgical Centers, Diagnostic Laboratories, Rehabilitation Centers, Long-Term Care Facilities, Specialty Care Centers, Academic & Research Institutions, Others), By Construction Type (New Construction, Renovation & Refurbishment, Maintenance & Repair), By End-User (Public Sector, Private Sector), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152545

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

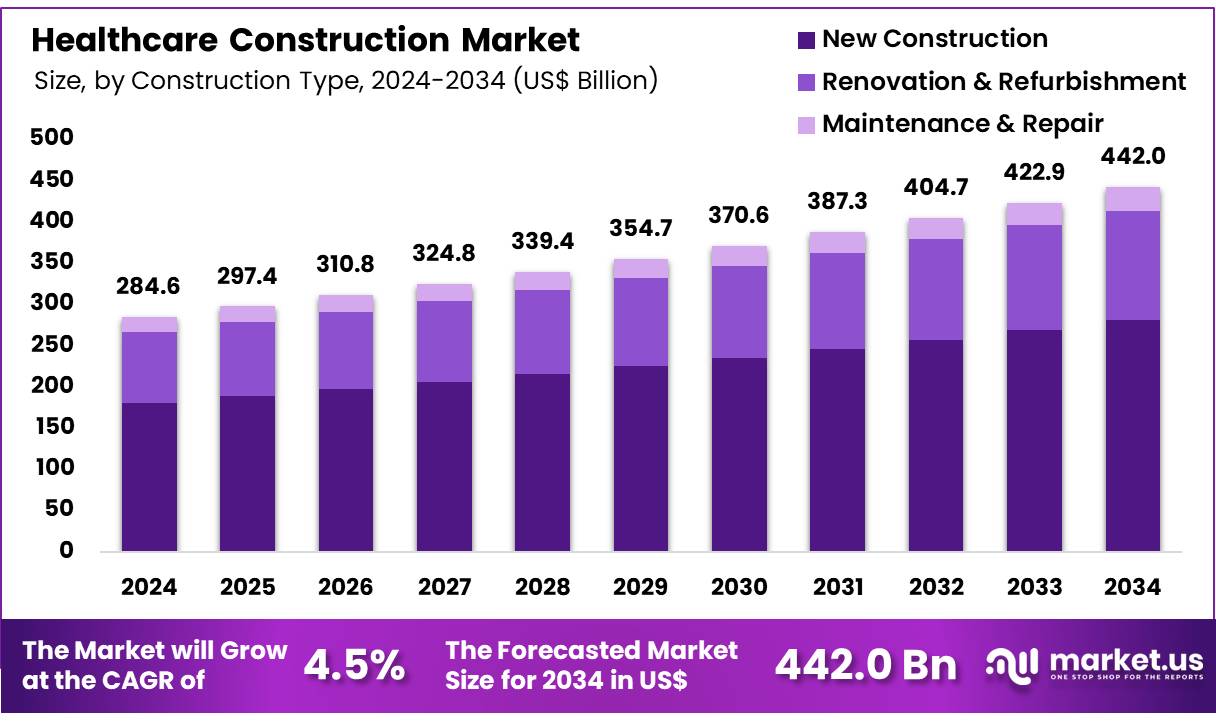

Global Healthcare Construction Market size is forecasted to be valued at US$ 442.0 Billion by 2034 from US$ 284.6 Billion in 2024, growing at a CAGR of 4.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 36.2% share with a revenue of US$ 103.0 Billion.

The healthcare construction market is experiencing significant growth, driven by various factors such as rising healthcare expenditure, an aging global population, increasing prevalence of chronic diseases, and advancements in medical technologies. This growth is evident in both developed and emerging economies, where there is a heightened demand for modern healthcare facilities that can accommodate advanced medical equipment and provide improved patient care.

In regions like the United States, healthcare construction is a major contributor to employment. For instance, in Houston, the healthcare sector is rapidly expanding, with over 100,000 jobs added in the past decade alone. Projections suggest that healthcare could surpass government as the region’s largest employer by 2062, underscoring the sector’s pivotal role in the economy.

Similarly, in Southeast Queensland, Australia, a report indicates the need for at least 55 new hospitals and 70 medical centers by 2046 to meet the demands of a growing population. This highlights the critical importance of strategic planning and investment in healthcare infrastructure to ensure accessibility and quality care for all.

The market is also witnessing a shift towards sustainable and innovative construction practices. The integration of green building standards and energy-efficient designs is becoming increasingly common, as stakeholders aim to reduce the environmental impact of healthcare facilities. Additionally, the adoption of modular and prefabricated construction methods is on the rise, offering benefits such as reduced construction time and cost, as well as flexibility in facility design.

These trends reflect a broader commitment within the industry to enhance operational efficiency and environmental stewardship. Technological advancements play a crucial role in shaping the future of healthcare construction. The implementation of Building Information Modeling (BIM) and digital twin technologies allows for more precise planning, design, and management of healthcare facilities.

These tools enable stakeholders to simulate and optimize building performance, leading to improved patient outcomes and operational efficiencies. Moreover, the increasing use of telemedicine and remote monitoring is influencing the design of healthcare spaces, necessitating infrastructure that supports digital health solutions.

Therefore, the healthcare construction market is poised for continued expansion, driven by demographic shifts, technological innovations, and a growing emphasis on sustainability. Stakeholders across the public and private sectors are investing in the development of state-of-the-art healthcare facilities to meet the evolving needs of populations worldwide. As the industry progresses, the focus will likely remain on creating environments that promote health, enhance patient experiences, and contribute to the overall well-being of communities.

Key Takeaways

- In 2024, the market for healthcare IT consulting generated a revenue of US$ 284.6 billion, with a CAGR of 4.5%, and is expected to reach US$ 442.0 billion by the year 2034.

- By Facility Type, Hospitals dominated the market with 52.0% share in 2024.

- New Construction segment held the largest market within the Construction Type category in 2024, with 63.5% share.

- By end-user, Private Sector led the market with 61.8% share in 2024.

- North America held the largest share of 36.2% in 2024 in the global market.

Facility Type Analysis

Hospitals continue to dominate the healthcare construction market, accounting for the largest share of 52.0% in the market in 2024. The demand for hospital infrastructure is being driven by several factors, including the aging population, advancements in medical technology, and the increasing prevalence of chronic diseases.

For instance, national inpatient volumes are projected to grow by 5.6% over the next decade, with lengths of stay increasing by 5.9%, primarily due to the aging demographic and the rising complexity of medical cases. This trend underscores the necessity for expanding and modernizing hospital facilities to accommodate the evolving healthcare needs. Moreover, hospitals are investing in infrastructure to enhance patient care and operational efficiency.

Internationally, hospital construction is also on the rise. In India, Apollo Hospitals plans to add 4,300 beds over the next three to four years, expanding its network to meet the increasing healthcare demands. Despite the robust growth, hospital construction faces challenges such as rising costs, labor shortages, and supply chain disruptions. A 2024 Hospital Construction Survey indicated that nearly half of healthcare respondents experienced cost increases and delays on 76% to 100% of their recent projects, highlighting the need for efficient project management and planning.

Construction Type Analysis

The New Construction segment remains the largest growing category in the global healthcare construction market holding 63.5% share in 2024, driven by the escalating demand for modern healthcare facilities that can accommodate advanced medical technologies and provide improved patient care. This trend is particularly evident in regions experiencing rapid population growth and urbanization, where existing healthcare infrastructure is often inadequate to meet the increasing needs.

For instance, the construction of the $530 million expansion of Townsville University Hospital in Queensland, Australia, aims to add 143 beds and new operating theatres to cater to the growing population in North Queensland. Construction was scheduled to commence in mid-2024, with the expected completion date set for late 2026. Similarly, the $1.2 billion Bundaberg Hospital project is expected to provide 121 additional beds and expanded emergency services, reflecting the region’s commitment to enhancing healthcare access through new infrastructure.

The preference for new construction over renovation is also influenced by the limitations of existing structures. Renovating outdated facilities can be cost-prohibitive and may not meet modern healthcare standards. For example, the cost of a “gut and rebuild” renovation is approximately 55% of the cost of new construction, while a moderate renovation is about 35% of the cost of new construction. Despite challenges such as rising construction costs and labor shortages, the new construction segment continues to dominate the healthcare construction market.

End-User Analysis

The private sector was the largest segment in the end-user category with 61.8% share in 2024, driven by increasing demand for high quality, accessible healthcare services. In the United States, private healthcare construction projects are substantial contributors to the market. For instance, the Children’s Hospital of Philadelphia is investing $3.4 billion into new construction, including a 22-story inpatient tower with 300 beds, addressing overcrowding and expanding capacity. Similarly, Ohio State University’s Wexner Medical Center is developing a $1.79 billion inpatient hospital with 820 beds, marking it as the largest single-facility project in the institution’s history.

In India, 46% of inpatients are managed in private sector. The preference for private sector healthcare construction is influenced by several factors. Private investors are often more agile, enabling quicker project initiation and completion compared to public sector projects, which may face bureaucratic delays.

Additionally, private facilities often offer advanced amenities and technologies, attracting patients seeking high-quality care. This trend is evident in the development of specialized centers, such as the Cleveland Clinic’s outpatient center opened in London, UK in December 2023, which provides a range of services including cardiology and dermatology. Therefore, the private sector’s dominance in healthcare construction is driven by its ability to meet the increasing demand for modern healthcare facilities, offer specialized services, and deliver projects efficiently.

Key Market Segments

By Facility Type

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Diagnostic Laboratories

- Rehabilitation Centers

- Long-Term Care Facilities

- Specialty Care Centers

- Academic & Research Institutions

- Others

By Construction Type

- New Construction

- Renovation & Refurbishment

- Maintenance & Repair

By End-User

- Public Sector

- Private Sector

Drivers

Growing Demand for Healthcare Infrastructure

The growing demand for healthcare infrastructure worldwide is being driven by multiple factors, including the demographic shifts, rising healthcare needs, and advancements in medical technology. As populations continue to age, the prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer increases, putting a strain on existing healthcare systems.

For example, according to the WHO, global life expectancy at birth is projected to reach 73.3 years by 2024, marking an increase of 8.4 years since 1995. The global population of individuals aged 60 and above is expected to grow from 1.1 billion in 2023 to 1.4 billion by 2030, with the most rapid growth occurring in developing regions. This demographic shift is creating an urgent need for more hospitals, clinics, and healthcare facilities that can handle the increasing demand for medical services.

Moreover, rapid urbanization is contributing to this demand, as more people move into cities where healthcare infrastructure is often insufficient to support the growing population. Cities around the world are facing an unprecedented need to expand or upgrade their healthcare facilities to ensure they can meet the needs of both the local and migrant populations. In regions like Sub-Saharan Africa, for example, the healthcare infrastructure gap is particularly stark, with a severe shortage of hospitals and healthcare professionals. This gap is prompting both government and private sector investments in the construction of new healthcare facilities, as well as the modernization of existing ones.

In addition to demographic and urbanization trends, advancements in medical technologies are also a key driver of the demand for healthcare infrastructure. The integration of cutting-edge technologies such as telemedicine, robotics, and artificial intelligence (AI) into healthcare delivery requires infrastructure capable of supporting these innovations. Hospitals and healthcare facilities are increasingly being designed to accommodate these technologies, leading to a shift towards more technologically advanced buildings with integrated digital systems.

Through the National Health Mission (NHM), Indian states receive financial assistance to strengthen the public health system, including the upgrading of existing infrastructure or the construction of new facilities. High-focus states can allocate up to 33% of their NHM funds to infrastructure, while other states are permitted to spend up to 25%.

Restraints

High Capital Expenditure and Long ROI Cycles

The global healthcare construction market faces significant challenges due to high capital expenditures and extended return on investment (ROI) cycles. These financial constraints often hinder the timely development and expansion of healthcare facilities, affecting their ability to meet growing patient demands. Hospital construction projects are inherently capital-intensive, with costs varying widely based on location, design complexity, and facility type. For instance, constructing a new hospital can range from $60 million to $190 million, with costs per square foot typically between $200 and $600. Specialized units like intensive care units or surgical suits can further escalate expenses due to their advanced infrastructure requirements.

These escalating costs are compounded by prolonged ROI cycles. The capital-intensive nature of healthcare construction means that facilities often take several years to become operational, with ROI periods extending beyond five years. This extended payback period can deter private investors and strain public budgets, especially in regions with limited financial resources. Additionally, the integration of advanced technologies and sustainable design features, while beneficial in the long term, can increase initial capital expenditures.

Implementing energy-efficient systems, state-of-the-art medical equipment, and environmentally friendly building materials requires substantial upfront investment. While these features can lead to operational savings and improved patient outcomes, the initial financial burden can be a significant barrier for many healthcare providers.

Furthermore, spending on hospital care totaled US$1.5 trillion in 2023, representing nearly one third (31%) of national health expenditures in that year. This substantial financial commitment places a strain on budgets, making it difficult for governments and private investors to allocate sufficient resources for new healthcare infrastructure projects, particularly given the high capital expenditures required for such developments.

Opportunities

Growth in Green and Sustainable Building Demand

The global healthcare construction market is experiencing a significant shift towards sustainability, driven by increasing demand for green and energy-efficient buildings. This movement is not only a response to environmental concerns but also a strategic approach to reduce operational costs and enhance patient well-being.

The growth of green hospitals is attributed to the adoption of energy-efficient lighting, renewable energy sources, and waste reduction programs. For instance, the Queen’s Medical Centre in Nottingham, UK’s one of the largest NHS hospitals, is undergoing a £15 million (US$ 20.4 million) energy efficiency upgrade, including the installation of 12,000 double-glazed windows and a new energy center utilizing high-efficiency heat pumps. These initiatives are expected to cut CO₂ emissions by 10,000 tonnes annually and improve patient comfort.

Certifications such as Leadership in Energy and Environmental Design (LEED) and Green Globes are becoming standard in healthcare construction. These certifications ensure that facilities meet rigorous environmental standards, leading to healthier, more productive spaces with reduced environmental impact. For example, Kaiser Permanente’s San Diego Medical Center, California’s first LEED Platinum certified hospital, exemplifies the integration of sustainable practices in healthcare infrastructure.

As of 2024, Kaiser Permanente’s portfolio includes 74 buildings certified under the LEED program. In addition, the emphasis on sustainability in healthcare construction is also evident in design trends. Modern healthcare facilities are incorporating biophilic design elements, such as natural lighting and green spaces, to enhance patient and staff well-being. Additionally, the adoption of modular and flexible designs allows for quicker construction and adaptability to future healthcare needs.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors such as inflation, interest rates, and labor costs have a direct impact on construction budgets and timelines. For example, during periods of high inflation, the cost of construction materials and labor can rise significantly, resulting in increased project expenses and potential delays. Labor market conditions have been improving, with U.S. construction employment growing by over 2% annually and the unemployment rate slightly decreasing to 4.6%, as reported by the Bureau of Labor Statistics in November.

This increase in employment, coupled with a tighter labor market, can drive up wages and labor costs, which in turn affects the overall budget and timeline of healthcare construction projects. As labor costs rise, construction projects may experience longer completion times and higher expenses, adding complexity to the economic challenges facing healthcare infrastructure development globally.

On the other hand, economic downturns may lead to reduced public spending on healthcare infrastructure, slowing the pace of new projects and renovations. Additionally, fluctuations in currency exchange rates can influence the cost of imported materials and equipment, further complicating the budgeting process for international projects.

Geopolitical factors also play a crucial role in shaping the healthcare construction landscape. Trade policies, political stability, and international relations can influence the availability and cost of construction materials and skilled labor. For example, trade restrictions or tariffs can disrupt supply chains, leading to shortages of essential materials and increased costs. Political instability in certain regions can deter investment in healthcare infrastructure, as investors seek more secure environments. Moreover, international sanctions or conflicts can impede the importation of necessary technologies and equipment, delaying project timelines and increasing expenses.

Latest Trends

Increasing Public-Private Partnerships (PPPs)

The global healthcare construction market is witnessing a significant shift towards Public-Private Partnerships (PPPs), as governments and private entities collaborate to address the growing demand for healthcare infrastructure. This trend is driven by the need to bridge financing gaps, enhance service delivery, and leverage private sector expertise in managing complex healthcare projects.

For instance, in January 2024, Peru’s Private Investment Promotion Agency (PROINVERSIÓN) initiated six PPP projects in the health sector, valued at approximately US$ 700 million. These projects aim to benefit over 2 million inhabitants by constructing and operating modern healthcare facilities, including hospitals and specialized medical centers. The initiative reflects a strategic move to mobilize private capital and expertise to improve healthcare access and quality in underserved regions.

Similarly, as per June 2025 news, in India, the state of Gujarat is exploring the PPP model to establish nine new medical colleges by repurposing existing healthcare facilities. This approach not only addresses the shortage of medical professionals but also optimizes the use of existing infrastructure, thereby reducing costs and accelerating project timelines.

These examples underscore the growing adoption of PPPs in healthcare construction, highlighting their potential to enhance infrastructure development, optimize resource utilization, and improve service delivery. As governments continue to face fiscal constraints, PPPs offer a viable solution to meet the increasing demand for quality healthcare services globally.

Regional Analysis

North America is leading the Healthcare Construction Market

North America led the market accounting for 36.2% share in 2024. In North America, the healthcare construction market is robust, driven by aging populations, technological advancements, and increasing demand for healthcare services. As per industry reports, New York state leads in healthcare construction activities, with 355 construction-related certificates of need (CONs) and requests for proposals (RFPs) reported in 2024. This surge is attributed to the state’s stringent CON requirements, large population, and the necessity to modernize aging healthcare infrastructure.

The US: Estimated Healthcare Expenditure, US$ Bn (2021-2024)

2021 2022 2023 2024 4,081.6 4,246.8 4,954.8 4,448.8 The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific region is experiencing rapid growth in healthcare construction, driven by urbanization, increasing healthcare needs, and government investments. The expansion of this region is particularly evident in countries like China and India, where substantial investments are being made in healthcare infrastructure.

For instance, following the construction of 76 regional medical centers, the average number of patients seeking treatment outside their local regions decreased by approximately 30%, according to NHC official Zhuang Ning. By the end of 2023, China had also established over 18,000 medical consortia in various forms to enhance community healthcare infrastructure and improve accessibility, as reported by NHC statistics. These developments underscore the region’s focus on enhancing healthcare infrastructure to meet the growing demands of their populations.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global healthcare construction market is highly competitive, with several major players dominating the sector. Companies like Turner Construction Company, Balfour Beatty plc, and McCarthy Building Companies, Inc. are at the forefront, contributing to the development of large-scale healthcare facilities across various regions. These firms have established strong reputations for delivering high-quality healthcare infrastructure projects, including hospitals, medical centers, and specialized health facilities.

The competition in the healthcare construction market is driven by the increasing demand for modern and sustainable healthcare facilities to meet the needs of growing populations and the rise in chronic diseases. Key players also focus on meeting the specific needs of healthcare providers, such as patient-centric designs, flexibility in facility use, and the incorporation of advanced medical technologies.

They are also increasingly adopting green building practices, with many projects aiming for sustainability certifications. Strategic partnerships and joint ventures are common in the market, as firms collaborate with healthcare organizations and governments to secure large contracts.

Top Key Players

- Turner Construction Company

- Balfour Beatty plc

- Gilbane Building Company

- McCarthy Building Companies, Inc.

- Clark Construction Group

- Kiewit Corporation

- Lendlease Group

- Bouygues Construction

- HDR, Inc.

- HKS, Inc.

- Stantec

- CannonDesign

- Perkins&Will

- NBBJ

- SmithGroup

- Vanguard Modular Building Systems

- Jacobs Engineering Group

Recent Developments

- In April 2025, McCarthy Building Companies, Inc. and HOK, a leading global architecture firm specializing in healthcare design, announced the groundbreaking of Kedren Children’s Village for Kedren Community Health Center in the Watts neighborhood of Los Angeles. Once completed, this $145 million facility will be one of the few pediatric-focused behavioral hospitals in the country and the first comprehensive behavioral health center in South Los Angeles, providing essential healthcare services to the community.

- In September 2024, HKS, in collaboration with its joint venture partner SmithGroup, is assisting the U.S. Department of Veterans Affairs (VA) and the U.S. Army Corps of Engineers (USACE) in improving project delivery through design-build best practices on a $600 million health facility at Fort Bliss in El Paso, Texas.

- In August 2024, Balfour Beatty received approval from the Sandwell and West Birmingham Hospitals NHS Trust to proceed with the Midland Metropolitan University Hospital project, which is set to open on October 6, 2024. This new nine-floor hospital, the largest acute care facility in the region, will offer approximately 700 inpatient beds. It is a key component of the New Hospital Programme.

Report Scope

Report Features Description Market Value (2024) US$ 284.6 Billion Forecast Revenue (2034) US$ 442.0 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Facility Type (Hospitals, Clinics, Ambulatory Surgical Centers, Diagnostic Laboratories, Rehabilitation Centers, Long-Term Care Facilities, Specialty Care Centers, Academic & Research Institutions, Others), By Construction Type (New Construction, Renovation & Refurbishment, Maintenance & Repair), By End-User (Public Sector, Private Sector) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Turner Construction Company, Balfour Beatty plc, Gilbane Building Company, McCarthy Building Companies, Inc., Clark Construction Group, Kiewit Corporation, Lendlease Group, Bouygues Construction, HDR, Inc., HKS, Inc., Stantec, CannonDesign, Perkins&Will, NBBJ, SmithGroup, Vanguard Modular Building Systems, Jacobs Engineering Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Healthcare Construction MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Healthcare Construction MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Turner Construction Company

- Balfour Beatty plc

- Gilbane Building Company

- McCarthy Building Companies, Inc.

- Clark Construction Group

- Kiewit Corporation

- Lendlease Group

- Bouygues Construction

- HDR, Inc.

- HKS, Inc.

- Stantec

- CannonDesign

- Perkins&Will

- NBBJ

- SmithGroup

- Vanguard Modular Building Systems

- Jacobs Engineering Group