Scaffold Technology Market By Product Type (Hydrogels (Wound Healing, Immunomodulation, and 3D Bioprinting), Micropatterned Surface Microplates, Polymeric Scaffolds, and Nanofiber Based Scaffolds ), By Disease Type (Musculoskeletal, Orthopedics, & Spine, Cancer, Dental, Cardiology & Vascular, Neurology, and Others), By Application (Regenerative Medicine, Stem Cell Therapy, & Tissue Engineering, Drug Discovery, and Others), By End-use (Biotechnology & Pharmaceutical Organizations, Hospitals & Diagnostic Centers, Research Laboratories & Institutes, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135704

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Scaffold Technology Market size is expected to be worth around US$ 7 Billion by 2033, from US$ 1.9 Billion in 2023, growing at a CAGR of 13.9% during the forecast period from 2024 to 2033.

The expansion of the scaffold technology market is increasingly driven by its pivotal role in regenerative medicine and tissue engineering. Scaffold technology is essential for creating three-dimensional structures that facilitate cell growth and tissue regeneration. Its applications span drug discovery, personalized medicine, and wound healing.

These scaffolds act as supportive matrices that replicate the extracellular environment, allowing cells to proliferate, differentiate, and function akin to natural tissues. According to industry analysts, the rising demand for organ transplantation and breakthroughs in stem cell research are expected to significantly propel market growth.

For instance, the use of biodegradable materials in scaffold construction enhances the potential of scaffold technology for sustainable applications in regenerative therapies. As advancements in personalized therapies and tissue engineering continue, the market for scaffold technology is anticipated to witness rapid growth. This growth is expected to drive new developments in cell therapy, regenerative medicine, and disease modeling, presenting substantial opportunities for stakeholders in the healthcare sector.

Recent studies underscore the efficacy of combination therapies in treating blood cancers. At the American Society of Hematology meeting in December 2024, researchers presented data showing that a combination of Revumenib, Venclexta, and Inqovi achieved an 82% overall response rate in patients with advanced acute myeloid leukemia. Another trial involving Tibsovo, Venclexta, and Onureg reported a 94% overall response rate and a 70.5% three-year overall survival rate, highlighting the potential of these regimens to significantly impact treatment paradigms.

In the realm of breast cancer, a study published in December 2024 suggests a shift towards less invasive management for certain cases. The study found that regular monitoring and mammograms over two years were as effective as surgery for women with low-risk ductal carcinoma in situ (DCIS), potentially altering treatment approaches for early-stage breast cancer.

Moreover, advancements in imaging techniques are enhancing cancer treatment efficacy. A new MRI-based method, hyperpolarized carbon-13 imaging, allows for the distinction between tumor subtypes and provides rapid feedback on treatment effectiveness. This technique, aimed at customizing treatments, could enable adjustments to therapy regimes within days, improving outcomes for ovarian cancer patients.

Key Takeaways

- In 2023, the market for Scaffold Technology generated a revenue of US$ 1.9 billion, with a CAGR of 13.9%, and is expected to reach US$ 7 billion by the year 2033.

- The product type segment is divided into hydrogels, micropatterned surface microplates, polymeric scaffolds, and nanofiber based scaffolds , with hydrogels taking the lead in 2023 with a market share of 45%.

- Considering disease type, the market is divided into musculoskeletal, orthopedics, & spine, cancer, dental, cardiology & vascular, neurology, and others. Among these, musculoskeletal, orthopedics, & spine held a significant share of 40%.

- Furthermore, concerning the application segment, the market is segregated into regenerative medicine, stem cell therapy, & tissue engineering, drug discovery, and others. The regenerative medicine, stem cell therapy, & tissue engineering sector stands out as the dominant player, holding the largest revenue share of 50% in the Scaffold Technology market.

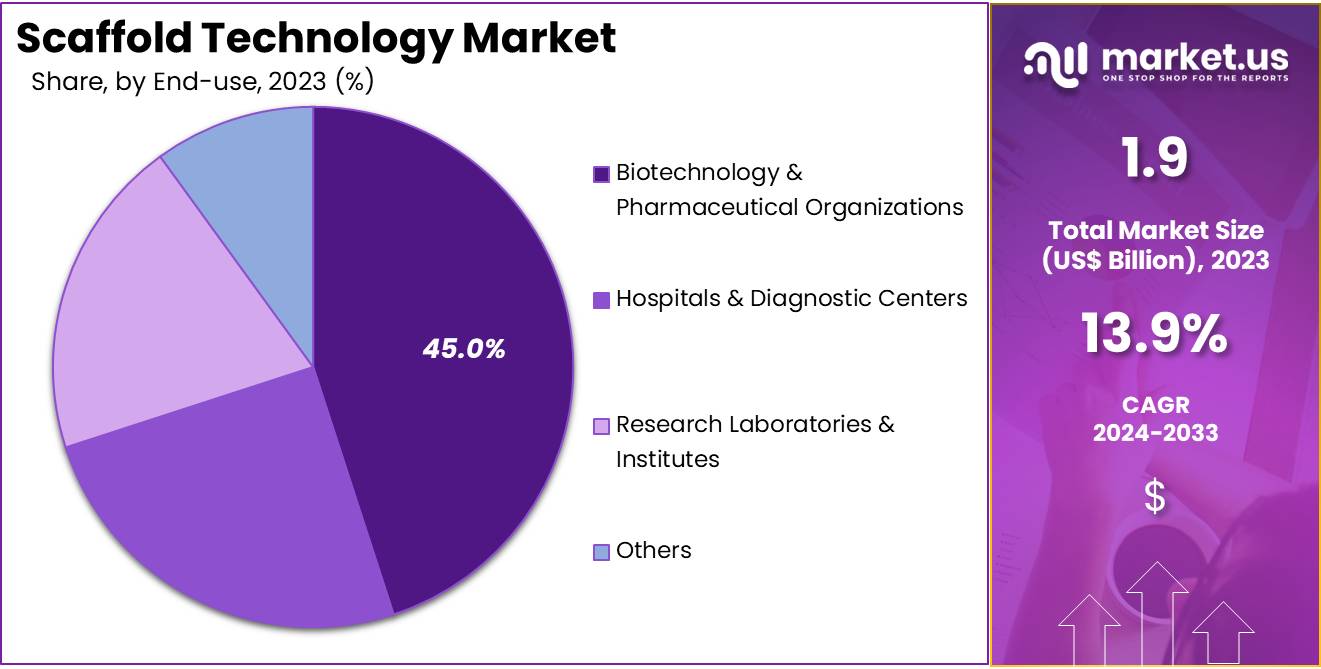

- The end-use segment is segregated into biotechnology & pharmaceutical organizations, hospitals & diagnostic centers, research laboratories & institutes, and others, with the biotechnology & pharmaceutical organizations segment leading the market, holding a revenue share of 45%.

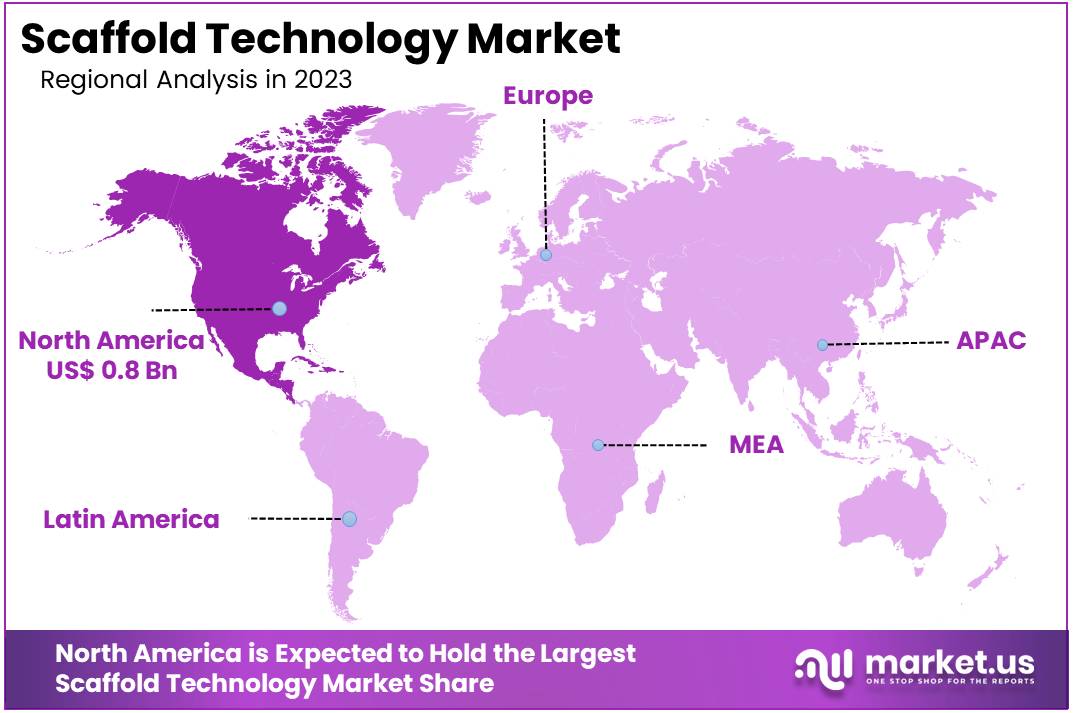

- North America led the market by securing a market share of 41.1% in 2023.

Product Type Analysis

The hydrogels segment led in 2023, claiming a market share of 45% owing to their versatile properties and applications in tissue engineering. Hydrogels, with their high water content and biocompatibility, provide a suitable environment for cell growth, making them ideal for regenerative medicine. This segment is projected to benefit from the increasing demand for advanced wound healing products, as hydrogels offer moisture retention, which accelerates the healing process.

The ability of hydrogels to mimic the extracellular matrix (ECM) and promote cell differentiation further drives their adoption in tissue repair and organ regeneration. Additionally, advancements in hydrogel formulations, such as stimuli-responsive hydrogels, are likely to enhance their functionality in controlled drug release systems, contributing to their growing market share.

Furthermore, the rising focus on personalized medicine and the increasing number of surgical procedures are expected to boost the demand for hydrogel-based scaffolds in various therapeutic applications, including cartilage, skin, and bone regeneration.

Disease Type Analysis

The musculoskeletal, orthopedics, & spine held a significant share of 40% due to the rising prevalence of musculoskeletal disorders and an aging global population. The increasing number of orthopedic surgeries, including spinal fusions and joint replacements, drives demand for scaffolds that support tissue regeneration and healing.

Scaffold technologies are expected to play a critical role in enhancing the success rates of these procedures by promoting the growth of bone, cartilage, and other tissues. The development of advanced materials that offer better integration with natural tissues is anticipated to accelerate market expansion.

Additionally, innovations in 3D printing and bio-printed scaffolds are likely to enable more precise treatments and personalized approaches for patients with complex musculoskeletal and spinal conditions. The growing emphasis on minimally invasive surgeries and the improvement of patient outcomes in orthopedics are expected to further drive the adoption of scaffold technologies in this segment.

Application Analysis

The regenerative medicine, stem cell therapy, & tissue engineering segment had a tremendous growth rate, with a revenue share of 50% owing to the increasing demand for advanced therapeutic approaches in tissue repair and organ regeneration. The use of scaffolds in regenerative medicine is expected to significantly enhance the outcomes of stem cell therapies by providing a structured environment that supports cell growth and differentiation.

As tissue engineering progresses, scaffolds are becoming essential for creating three-dimensional structures that mimic natural tissues, offering solutions for conditions that cannot be treated by traditional methods. The growing focus on personalized medicine is anticipated to drive innovation in scaffold materials, with the development of biocompatible, biodegradable, and functional scaffolds.

Additionally, the rise in chronic diseases and the aging population is likely to spur the demand for effective regenerative therapies, further fueling the adoption of scaffold technologies in regenerative medicine, stem cell therapies, and tissue engineering.

End-use Analysis

The biotechnology & pharmaceutical organizations segment grew at a substantial rate, generating a revenue portion of 45% as these industries continue to explore advanced therapeutic options and drug development methods. Scaffold technologies play a crucial role in drug discovery and testing by providing an in vitro environment that mimics human tissue, improving the accuracy and reliability of preclinical studies.

The demand for high-quality scaffolds in these sectors is likely to increase as pharmaceutical companies seek more effective models for drug screening, disease modeling, and toxicology studies. As biotechnology firms and pharmaceutical organizations increasingly invest in regenerative medicine and personalized therapies, they are anticipated to rely more on scaffolds for cell-based therapies and tissue engineering applications.

This segment’s growth will be driven by the need for more efficient drug discovery platforms and the rising prevalence of chronic diseases, which require innovative treatments. Additionally, advancements in biomaterials and manufacturing techniques are projected to make scaffolds more accessible and versatile for use in both research and therapeutic applications.

Key Market Segments

By Product Type

- Hydrogels

- Wound Healing

- Immunomodulation

- 3D Bioprinting

- Micropatterned Surface Microplates

- Polymeric Scaffolds

- Nanofiber Based Scaffolds

By Disease Type

- Musculoskeletal, Orthopedics, & Spine

- Cancer

- Dental

- Cardiology & Vascular

- Neurology

- Others

By Application

- Regenerative Medicine, Stem Cell Therapy, & Tissue Engineering

- Drug Discovery

- Others

By End-use

- Biotechnology & Pharmaceutical Organizations

- Hospitals & Diagnostic Centers

- Research Laboratories & Institutes

- Others

Drivers

Increasing Use in Vaccine Development Driving the Scaffold Technology Market

Increasing use of scaffold technology in vaccine development is driving significant growth in the market. Scaffold-based systems provide an effective method for delivering antigens and stimulating the immune system in the development of vaccines. In October 2021, research published in the Advanced Healthcare Materials Journal revealed the creation of a COVID-19 vaccine candidate that utilizes biomaterial scaffolds to attract immune cells, facilitating the development of adaptive immunity.

This innovative approach demonstrates the potential of scaffold technology in improving vaccine efficacy by enhancing immune responses. The growing interest in novel vaccine platforms and personalized immunotherapies is expected to boost demand for scaffold technology solutions in the coming years.

As biopharmaceutical companies explore new methods to optimize vaccine performance, the role of scaffolds in enhancing the delivery and effectiveness of vaccines is likely to become increasingly crucial. The market for scaffold technology is anticipated to grow as it continues to find applications in both infectious disease and cancer vaccine development.

Restraints

High Cost and Complex Manufacturing Processes

High cost and complex manufacturing processes are key restraints in the scaffold technology market. The production of scaffold materials, particularly those used in biomedical applications, often involves expensive biomaterials and sophisticated fabrication techniques, making the initial investment for manufacturers high.

The complex processes required for creating scaffolds with specific properties such as bio-compatibility, structural integrity, and drug-delivery capabilities require specialized equipment and expertise. These factors contribute to increased production costs, which can deter small and mid-sized companies from entering the market. Additionally, regulatory approvals for scaffold-based products can be time-consuming and costly, further hindering market expansion.

While the demand for scaffold technologies grows, these high upfront and operational costs are expected to impede widespread adoption, particularly in cost-sensitive regions or industries.

Opportunities

Rising Innovation as an Opportunity for the Scaffold Technology Market

Rising innovation in the field of regenerative medicine presents a significant opportunity for the scaffold technology market. As the demand for advanced treatments and personalized medicine grows, researchers continue to develop cutting-edge scaffold technologies to support tissue regeneration. In June 2022, 3D Systems partnered with United Therapeutics Corporation to present a human lung scaffold, along with two other major breakthroughs in the field of 3D-printed organs.

This advancement reflects the increasing potential of scaffold technology to revolutionize organ transplantation. In addition, in January 2021, researchers developed a bioactive scaffold made from polycaprolactone/chitosan (PCL/CS) nanofibers, which promoted nerve regeneration by improving cell attachment and supporting nerve cell growth. These innovations are expected to drive the demand for more sophisticated scaffolds in various medical applications, further enhancing the growth prospects for the scaffold technology market.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the scaffold technology market. Economic downturns may reduce the availability of research and development funding, which can slow innovation in this field. However, governments’ increasing focus on advancing healthcare and regenerative medicine often results in favorable policies and funding opportunities.

Geopolitical tensions, such as trade wars and tariffs, may disrupt global supply chains for raw materials used in the production of scaffolds. On the other hand, growing demand for personalized medicine and advancements in tissue engineering drive market growth, as healthcare systems strive for more effective and affordable treatments. Despite challenges, the market is expected to benefit from continuous advancements in biomaterials and tissue regeneration technologies, ensuring long-term opportunities for innovation.

Trends

Surge in Mergers and Acquisitions Driving the Scaffold Technology Market

Rising mergers and acquisitions (M&A) have become a key trend driving the scaffold technology market. These strategic moves are expected to consolidate expertise, improve product offerings, and expand global reach. In August 2022, Conmed revealed its acquisition of Biorez, a company specializing in bio-inductive scaffolds, as part of its strategy to enhance its portfolio of sports medicine solutions for soft tissue healing.

This acquisition reflects a broader trend where companies are increasingly looking to integrate innovative technologies to strengthen their competitive positions. As the demand for advanced tissue repair solutions grows, the market is likely to see more such collaborations, fueling rapid advancements and expanding the accessibility of cutting-edge scaffold technologies.

Regional Analysis

North America is leading the Scaffold Technology Market

North America dominated the market with the highest revenue share of 41.1% owing to advancements in regenerative medicine and the increasing adoption of tissue engineering applications. The market was further bolstered by government support, such as the USD 2 million grant awarded to RevBio, Inc. by the National Institutes of Health (NIH) in June 2023.

This funding aimed to support the development of innovative dental adhesive bone scaffold products, highlighting the growing interest in biomaterials for improving patient outcomes. Additionally, the rise in chronic conditions, an aging population, and the growing need for reconstructive surgeries have spurred demand for advanced scaffold solutions. The continuous innovations in scaffold technology, including the development of more biocompatible and functional materials, have significantly contributed to the market’s expansion in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rising healthcare demands, technological advancements, and increasing research and development activities in tissue engineering. Countries like Japan, China, and India are at the forefront of adopting regenerative medicine technologies.

In November 2022, Gelomics and Rousselot entered into a co-branding partnership to combine Rousselot Biomedical’s X-Pure GelMA with Gelomics’ Luna platform, aiming to advance extracellular matrix technologies in regenerative medicine.

The growing interest in personalized treatments, along with the need for more effective therapies in areas such as orthopedics, wound healing, and cancer, is likely to drive the demand for scaffold technologies in the region. With increasing investments in healthcare infrastructure and R&D, the scaffold technology market is projected to grow at a strong pace in Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the scaffold technology market focus on advancing product development, expanding applications, and forging strategic partnerships to foster growth. Companies invest in developing biocompatible, biodegradable scaffolds that support tissue regeneration, targeting applications in regenerative medicine, drug delivery, and implantable devices.

They also collaborate with academic institutions and research organizations to drive innovation and accelerate the clinical adoption of scaffold technologies. Expanding into emerging markets and exploring new verticals, such as personalized medicine and 3D bioprinting, further supports market expansion. Additionally, players emphasize improving scalability and cost-effectiveness to make advanced scaffold solutions more accessible.

One key player in the scaffold technology market is Stryker Corporation. Stryker is a leading player in medical technology, providing a range of implantable devices and tissue scaffolds for regenerative medicine. The company’s growth strategy centers on continuous innovation, including advancements in 3D-printed scaffolds and tissue engineering technologies.

Stryker also focuses on strengthening its market position through strategic acquisitions and collaborations with healthcare providers and research institutions. By expanding its product offerings and focusing on regenerative treatments, Stryker enhances its leadership in the scaffold technology market.

Top Key Players in the Scaffold Technology Market

- Tecan Trading AG

- Systemic Bio

- ReLive Biotechnologies, Ltd

- Nanofiber Solutions

- Merck KGaA

- Matricel GmbH

- Stryker Corporation

- 3D Biomatrix

Recent Developments

- In January 2023: ReLive Biotechnologies, Ltd. revealed that it had finalized the acquisition of Co.Don AG, a biotech company listed in Germany. This acquisition enables ReLive to pursue independent research and create affordable tissue-engineered products utilizing stem cell technology and 3D printing.

- In April 2023: Systemic Bio inaugurated a new laboratory in Texas, US, dedicated to the manufacturing of hydrogel scaffolds and conducting research and development on organ-on-a-chip technology to accelerate drug discovery and development.

Report Scope

Report Features Description Market Value (2023) US$ 1.9 billion Forecast Revenue (2033) US$ 7.0 billion CAGR (2024-2033) 13.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Hydrogels (Wound Healing, Immunomodulation, and 3D Bioprinting), Micropatterned Surface Microplates, Polymeric Scaffolds, and Nanofiber Based Scaffolds ), By Disease Type (Musculoskeletal, Orthopedics, & Spine, Cancer, Dental, Cardiology & Vascular, Neurology, and Others), By Application (Regenerative Medicine, Stem Cell Therapy, & Tissue Engineering, Drug Discovery, and Others), By End-use (Biotechnology & Pharmaceutical Organizations, Hospitals & Diagnostic Centers, Research Laboratories & Institutes, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tecan Trading AG, Systemic Bio, ReLive Biotechnologies, Ltd, Nanofiber Solutions, Merck KGaA, Matricel GmbH, Stryker Corporation, and 3D Biomatrix. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Tecan Trading AG

- Systemic Bio

- ReLive Biotechnologies, Ltd

- Nanofiber Solutions

- Merck KGaA

- Matricel GmbH

- Stryker Corporation

- 3D Biomatrix