Global Liver Transplantation Market Analysis By Treatment Type (Liver Transplantation Surgery, Post-Surgery Anti-Rejection Treatment, Cyclosporine, Tacrolimus, Sirolimus, Prednisone, Others), By End User (Hospitals, Transplant Centres, Ambulatory Surgical Centres, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 136740

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

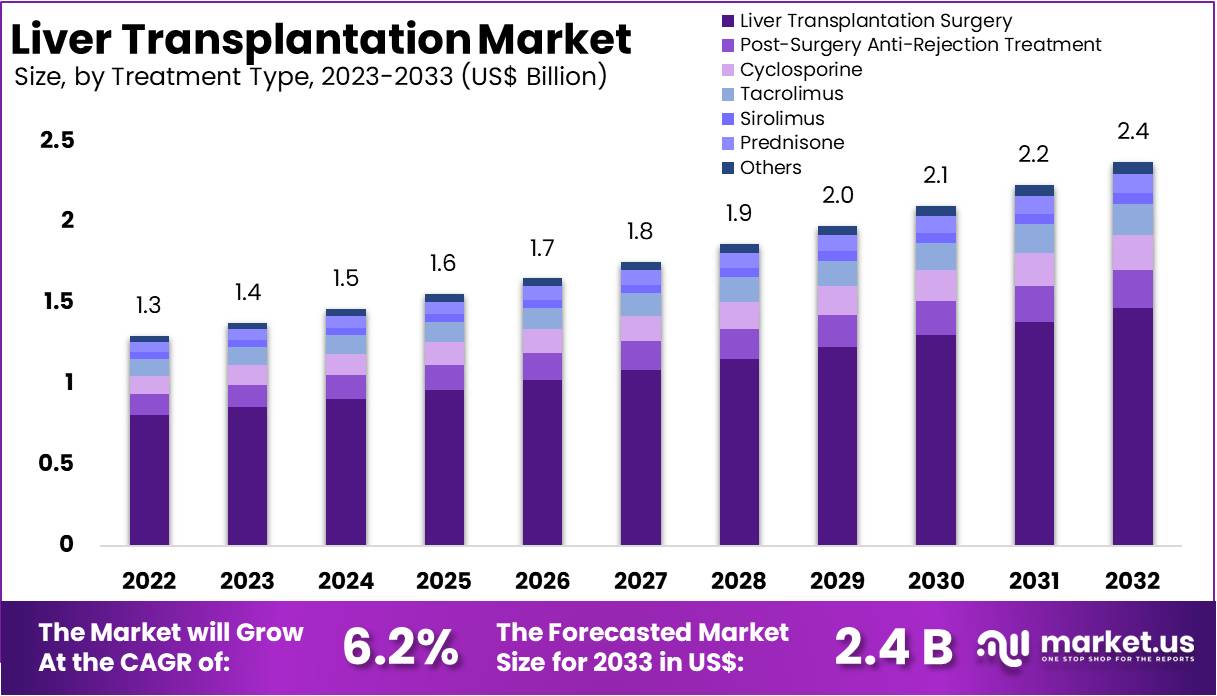

The Global Liver Transplantation Market Size is expected to be worth around US$ 2.4 Billion by 2033, from US$ 1.3 Billion in 2023, growing at a CAGR of 6.2% during the forecast period from 2024 to 2033.

Liver transplantation is a surgical procedure to replace a diseased liver with a healthy liver from another person. This treatment is typically reserved for individuals who have significant complications due to end-stage chronic liver disease or acute liver failure, where other treatments have failed. The most common reasons for this procedure include chronic hepatitis with cirrhosis, alcoholic liver disease, nonalcoholic fatty liver disease, and liver cancer.

The liver transplantation market includes services and products related to liver transplants, such as surgical procedures, post-operative care, and pharmaceuticals. It also encompasses immunosuppressive drugs, diagnostic tests, and monitoring technologies essential for preventing organ rejection and ensuring patient recovery. This market is driven by the rising prevalence of liver diseases and advancements in healthcare infrastructure, particularly in developed countries.

According to the Organ Procurement and Transplantation Network, liver transplants in the United States reached a record 10,660 in 2023. This represents an 11.9% increase over 2022, which saw 9,528 transplants. According to Living Liver Foundation, 93.7% of 2022’s procedures involved deceased donors, while 603 living donor transplants marked a new record. Enhanced surgical techniques and rising organ donation rates have fueled this upward trend. Additionally, 2022 marked the twelfth consecutive year of growth in deceased organ donations, which totaled 14,903.

Despite progress, a gap remains between supply and demand. For example, the Scientific Registry of Transplant Recipients reported 24,186 adult candidates on the liver transplant waiting list in 2022. This reflects a 10.7% decline compared to 2012. During 2022, 11,324 adults were initially waitlisted, 12,862 were added, and 13,638 were removed. By year-end, 10,548 individuals were still awaiting transplantation, highlighting the continuing demand.

Key growth drivers include technological advancements in transplantation techniques and immunosuppression. Improved donor registration processes have also increased the availability of organs. However, challenges such as high costs, infection risks, and organ rejection persist. These factors significantly influence market dynamics and strategies for growth and innovation.

Studies have emphasized the role of healthcare investments in driving the market. For example, rising healthcare expenditure and improved infrastructure in developed nations support better access to transplantation services. While the market shows promise, addressing the organ donor shortage remains crucial for sustaining growth and meeting patient needs effectively.

Key Takeaways

- The Global Liver Transplantation Market is projected to grow from US$ 1.3 billion in 2023 to US$ 2.4 billion by 2033, with a 6.2% CAGR.

- In 2023, Liver Transplantation Surgery was the leading treatment type, accounting for over 62% of the market share.

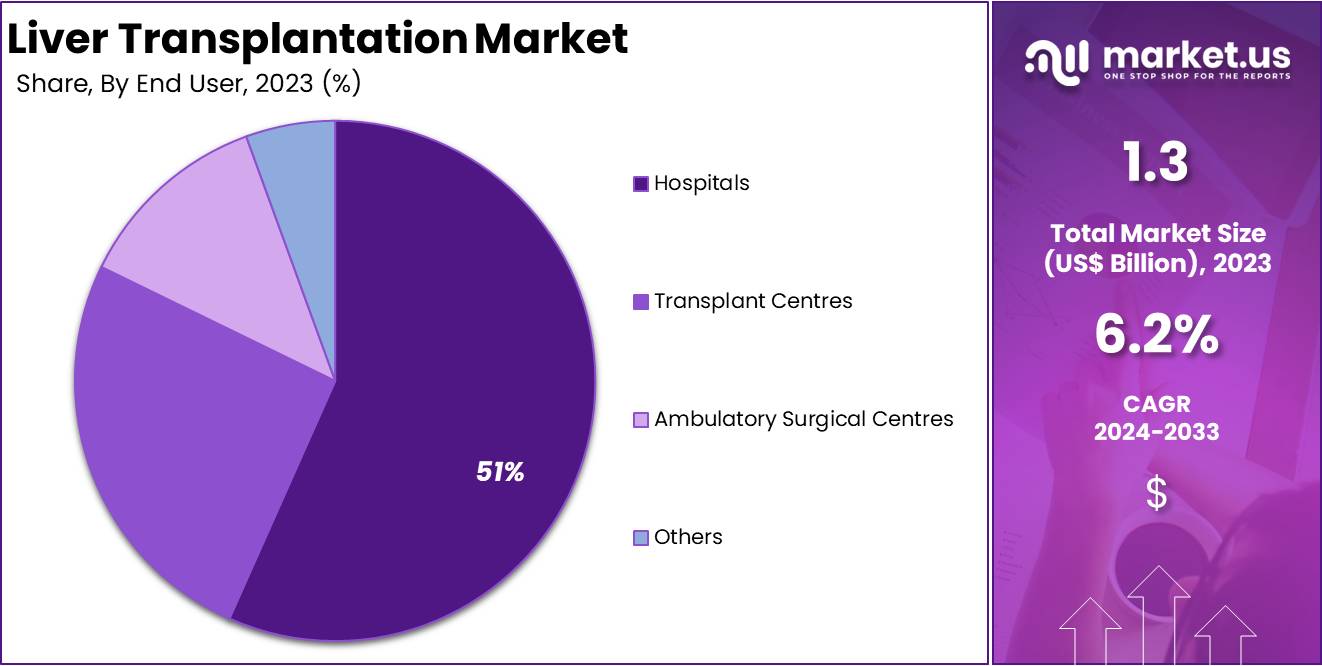

- Hospitals were the main end-users in the liver transplantation market in 2023, securing more than 51% of the market.

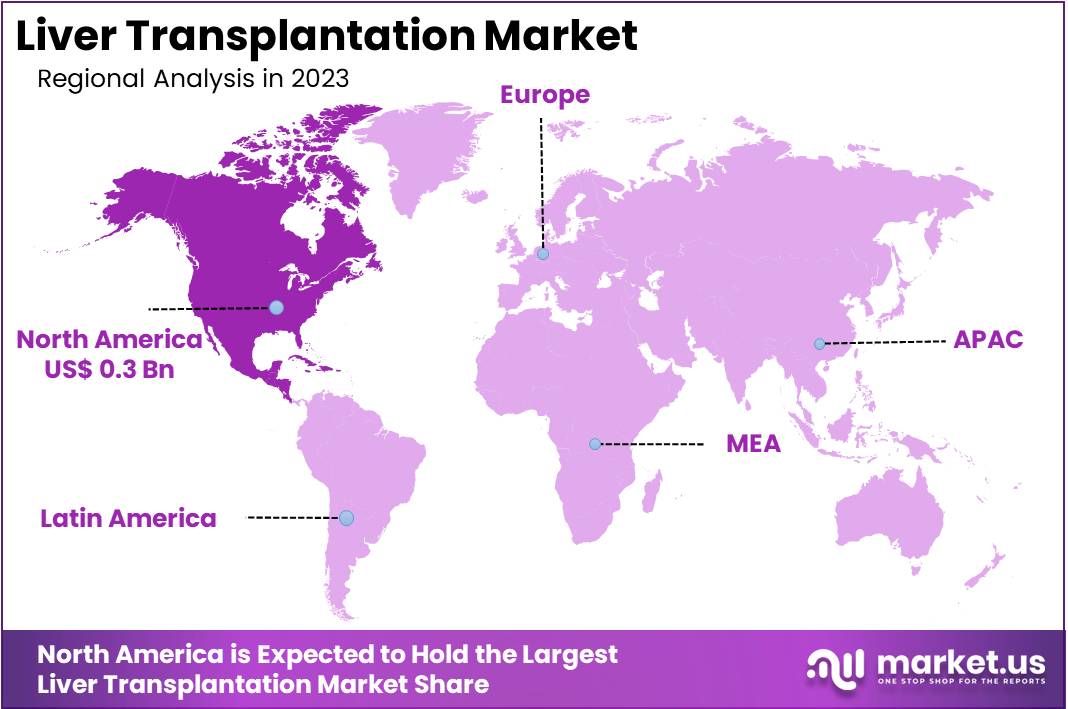

- North America dominated the liver transplantation market in 2023, holding over 30% share and valued at US$ 0.3 billion.

Treatment Type Analysis

In 2023, Liver Transplantation Surgery held a dominant market position in the treatment type segment of the Liver Transplantation Market, capturing more than a 62% share. This success is largely due to advancements in surgical techniques and better post-operative outcomes. The growing number of patients requiring transplants also plays a key role. Enhanced survival rates and improved healthcare infrastructure have further strengthened the demand for surgical procedures in this segment.

Post-Surgery Anti-Rejection Treatment is an essential part of the liver transplantation process. These therapies help prevent organ rejection and ensure long-term success. The increasing adoption of targeted therapies has significantly boosted this segment’s growth. Patients rely on these treatments for improved graft survival and fewer complications. Their critical role in maintaining transplant health has made them a vital component of the market.

Among immunosuppressive drugs, Cyclosporine and Tacrolimus are the most frequently prescribed options. Tacrolimus, known for its higher effectiveness, is preferred by many healthcare providers. These drugs prevent the immune system from attacking the transplanted organ. Sirolimus is also gaining traction as an alternative for patients who cannot tolerate other medications. Its reduced toxicity and unique benefits make it a valuable choice for certain cases.

Other treatments include innovative solutions and emerging therapies that address specific needs. Prednisone remains a standard option in combination therapies to enhance outcomes. Additionally, personalized medicine and novel drug formulations are advancing steadily. These innovations aim to improve patient care and treatment success rates. With continued research, the market is expected to experience significant growth in this category.

End User Analysis

In 2023, hospitals held a dominant position in the liver transplantation market’s end-user segment, capturing more than a 51% share. This dominance is due to their advanced infrastructure and availability of skilled surgeons. Hospitals provide multidisciplinary care, making them the preferred choice for complex liver transplant procedures. Patients benefit from better outcomes and comprehensive medical services, reinforcing hospitals as the leading end-user in this market segment.

Transplant centers secured the second-largest market share, showcasing their importance in liver transplantation. These centers specialize in offering focused and personalized care. Their streamlined pre- and post-operative processes attract patients seeking dedicated transplant services. Transplant centers are well-equipped with advanced technology, ensuring precision in liver transplant procedures. Their role continues to grow as they cater to a large number of patients requiring specialized care.

Ambulatory surgical centers (ASCs) are emerging as an option for specific liver-related procedures. These centers are known for cost-effective treatments and reduced hospital stays. ASCs mainly handle less complex cases, providing efficient services in a convenient setting. However, their market share remains smaller compared to hospitals and transplant centers. Their growth reflects the increasing demand for accessible healthcare in non-hospital settings.

The Others category includes clinics and standalone medical units that cater to patients in underserved regions. These facilities are gaining recognition due to the rising awareness of liver transplantation and better access to healthcare. While this segment holds a smaller share, its contribution is essential in expanding the reach of liver transplant services. Their growth aligns with improving healthcare infrastructure in remote areas.

Key Market Segments

By Treatment Type

- Liver Transplantation Surgery

- Post-Surgery Anti-Rejection Treatment

- Cyclosporine

- Tacrolimus

- Sirolimus

- Prednisone

- Others

By End User

- Hospitals

- Transplant Centres

- Ambulatory Surgical Centres

- Others

Drivers

Growing Prevalence of Liver Diseases

The growing prevalence of liver diseases serves as a primary driver for the liver transplantation market. According to the Journal of Hepatology, chronic conditions like hepatitis, fatty liver, and cirrhosis are increasingly common due to unhealthy lifestyle choices, including excessive alcohol intake and obesity. These diseases significantly raise the demand for effective transplantation solutions as they lead to severe complications or necessitate organ transplants.

Annually, liver disease leads to roughly 2 million deaths globally, highlighting its impact on public health. For example, complications from cirrhosis account for about half of these deaths, with the remaining fatalities linked to viral hepatitis and hepatocellular carcinoma. This high mortality rate underscores the critical need for advanced liver transplantation techniques and improved healthcare interventions.

In India, liver diseases represent a substantial health challenge, affecting a large portion of the population. A study by The Liver Foundation India notes that the country accounts for 18.3% of global liver disease-related deaths. Hepatitis B virus (HBV) infection is a significant contributor to this statistic, with India harboring over 40 million HBV-infected individuals.

This alarming prevalence highlights the urgency for enhanced liver transplantation services. With India representing approximately 15% of the global HBV burden, there is a pronounced demand for both preventive healthcare measures and effective treatment modalities, including liver transplants. Such data drive the liver transplantation market, stressing the need for ongoing research and development in this medical field.

Restraints

High Cost and Limited Availability of Donor Organs

The liver transplantation market faces significant challenges due to the high costs associated with the procedure and the limited availability of donor organs. According to Medical News Today, in 2020, the average cost of a liver transplant was approximately $878,400. This includes pre-transplant evaluations, the surgery itself, extended hospital stays, post-transplant care, and necessary medications. Such steep expenses place a heavy financial burden on patients and healthcare systems, making it difficult for many who need transplants to afford them.

Moreover, the scarcity of donor organs serves as another major constraint in the liver transplantation market. The limited availability restricts the number of transplants that can be performed, directly impacting patient outcomes and market growth. This shortage means that even if patients can afford the procedure, they may not receive a transplant in time due to the lack of suitable donors.

For instance, the combination of high costs and donor organ scarcity leads to a constrained liver transplant market, where demand substantially outstrips supply. These factors collectively act as a restraint, limiting access to liver transplantation for many patients across the globe. As a result, potential market expansion is hindered, affecting both the healthcare sector and patients desperately in need of life-saving transplants.

Ultimately, addressing these issues requires multifaceted strategies, including enhancing donor registration programs and exploring cost-reduction measures in healthcare. Developing innovative medical practices and government interventions could also play a crucial role in alleviating these restraints, potentially boosting market growth by making liver transplantation more accessible to a broader population.

Opportunities

Advancements in Transplantation Technology

Advancements in transplantation technology are providing significant opportunities within the liver transplantation market. Innovations in surgical techniques have refined the precision and efficiency of liver transplants, leading to enhanced patient outcomes. Such improvements not only increase the success rates of surgeries but also reduce the time patients spend in recovery. This progress supports a growing demand for liver transplants, potentially expanding the market.

Further, the introduction of bioartificial liver devices represents a transformative leap in treatment options. These devices can temporarily replace liver function for patients awaiting a transplant or aid in recovery, thereby increasing the pool of viable recipients. The market potential for these devices is expanding as they promise to bridge the gap between liver failure and transplantation.

Improved immunosuppressive medications are also pivotal to advancing the liver transplantation market. By better managing the immune response post-transplant, these medications diminish the risk of organ rejection and complications. Enhanced immunosuppressants align with the growing trend towards personalized medicine, offering tailored treatment plans that improve long-term transplant success rates.

Overall, the integration of these technologies fosters a more robust liver transplantation framework, ensuring better patient care and expanding treatment horizons. As these advancements continue to evolve, they promise not only to improve patient outcomes but also to drive growth within the liver transplantation market by addressing previously unmet medical needs.

Trends

Increasing Adoption of Living Donor Liver Transplantation (LDLT)

The liver transplantation market is witnessing a significant shift with the increasing adoption of Living Donor Liver Transplantation (LDLT). This trend is primarily driven by the acute shortage of available organs from deceased donors. LDLT involves transplanting a segment of the liver from a living donor to a recipient, offering a viable alternative to overcome the limitations of donor organ availability. As healthcare systems continue to face challenges in organ donation rates, LDLT presents a practical solution, ensuring more patients receive timely life-saving procedures.

LDLT not only alleviates the strain on organ waiting lists but also showcases comparable, if not superior, post-transplant outcomes. This method has been particularly beneficial in regions with lower deceased donor rates, providing an essential lifeline for patients with end-stage liver disease. The procedure’s success hinges on the liver’s unique ability to regenerate, both in the donor and recipient, which facilitates a quicker recovery and reduces long-term complications associated with transplantation.

From a market perspective, the rise in LDLT is fostering developments in surgical techniques and post-operative care. Healthcare providers are investing in training programs to enhance surgeon expertise in LDLT procedures, which is further supported by advancements in medical imaging and biotechnology. These improvements are making LDLT more accessible and safer, thus encouraging its adoption across more transplantation centers globally.

Looking forward, the growing preference for LDLT is likely to influence market dynamics by stimulating the demand for specialized medical services and products related to liver regeneration and transplant care. This trend is expected to drive innovation in both pharmaceutical and medical device sectors, as companies seek to meet the specific needs of LDLT patients and healthcare providers. As awareness and successful outcomes of LDLT increase, so does its potential to become a standard practice in liver transplantation strategies worldwide.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 30% share and reaching a market value of US$ 0.3 billion. This leadership is primarily attributed to advanced healthcare infrastructure, high awareness levels, and favorable reimbursement policies. The region’s increasing prevalence of liver diseases like cirrhosis and hepatitis C further boosted demand for transplantation services.

The United States remains a key contributor, driven by its robust organ donation programs. Data from the Organ Procurement and Transplantation Network highlights over 9,000 liver transplants performed annually in the country. Additionally, growing investments in transplant centers have improved access to services, supporting regional growth.

Canada also plays a significant role, with government support for liver disease treatments enhancing patient access to transplants. Awareness campaigns, such as those led by the Canadian Liver Foundation, promote the importance of liver health and organ donation.

North America’s strong market position is the result of advanced medical systems, supportive policies, and efforts to increase liver transplantation accessibility. This trend is expected to continue, maintaining the region’s leadership in the global market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The liver transplantation market is driven by innovations from key players like AlloSource, Conatus Pharmaceuticals, and Digna Biotech. AlloSource focuses on advanced tissue preservation and regenerative solutions to improve graft longevity. Conatus Pharmaceuticals develops non-surgical therapeutic interventions, such as emricasan, to delay the need for transplantation.

Similarly, Digna Biotech pioneers gene therapy and hepatocyte regeneration for enhanced post-transplant recovery. These companies invest heavily in R&D, forming collaborations to improve treatment outcomes and address challenges related to organ shortages and transplantation success rates.

Dompé Farmaceutici and Isogenis Inc. also play vital roles in this market. Dompé develops biologics and drug formulations that support pre- and post-transplant care, focusing on rare liver conditions. Isogenis specializes in regenerative therapies like bioengineered liver constructs to mitigate donor shortages.

Both companies collaborate with academic institutions and research organizations to advance innovative solutions. Their efforts are crucial for addressing growing liver disease prevalence and improving transplant accessibility globally.

Other companies, such as Organogenesis, Astellas Pharma, and Pfizer, significantly contribute to this market. Organogenesis advances graft materials, while Astellas focuses on immunosuppressive therapies to prevent transplant rejection. Pfizer develops adjunct therapies that enhance post-transplant outcomes.

Together, these players drive the market through strategic partnerships, cutting-edge R&D, and product innovation. As a result, the liver transplantation market is evolving rapidly, with increasing adoption of advanced treatments and technologies to meet the rising demand for effective liver disease management solutions.

Market Key Players

- Allosource

- Conatus Pharmaceuticals Inc.

- Digna Biotech S.L.

- Dompe Farmaceutici S.p.A.

- Isogenis Inc.

- RedHill Biopharma Ltd.

- Thompson Surgical

- Integra Life Sciences

- Baxter International Inc.

- VirTech Bio

Recent Developments

- In November 2024: Aligos Therapeutics announced significant outcomes from its study at the American Association for the Study of Liver Disease’s The Liver Meeting 2024. The company showcased robust results from its ALG-055009 molecule, which after a 12-week treatment demonstrated a median reduction in liver fat by up to 46.2%. This therapy is being evaluated for its efficacy in reducing liver fat in Metabolic Dysfunction-Associated Steatohepatitis (MASH) patients, highlighting its potential as a first-line therapy for chronic suppression of hepatitis B virus.

- In February 2024: UT Southwestern Medical Center has progressed to phase three trials with an experimental drug targeting fatty liver disease, a condition leading to liver failure and necessitating transplantation. The drug, inhibiting diacylglycerol acyltransferase 2 (DGAT2), has shown promise in reducing liver fat and improving function in phase two trials, signaling potential new treatment paths before liver transplants become necessary.

- In January 2022: Dompé Farmaceutici announced a strategic investment in Engitix Ltd as part of a $54 million Series A financing round. This collaboration focuses on the use of Dompé’s Exscalate drug discovery platform to support research into new treatments for fibrosis and liver-associated solid tumors. The partnership aims to leverage Engitix’s human extracellular matrix (ECM) drug target discovery platform, marking a significant move towards advancing liver health solutions.

Report Scope

Report Features Description Market Value (2023) US$ 1.3 Billion Forecast Revenue (2033) US$ 2.4 Billion CAGR (2024-2033) 6.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Treatment Type (Liver Transplantation Surgery, Post-Surgery Anti-Rejection Treatment, Cyclosporine, Tacrolimus, Sirolimus, Prednisone, Others), By End User (Hospitals, Transplant Centres, Ambulatory Surgical Centres, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Allosource, Conatus Pharmaceuticals Inc., Digna Biotech S.L., Dompe Farmaceutici S.p.A., Isogenis Inc., RedHill Biopharma Ltd., Thompson Surgical, Integra Life Sciences, Baxter International Inc., VirTech Bio Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Liver Transplantation MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Liver Transplantation MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Allosource

- Conatus Pharmaceuticals Inc.

- Digna Biotech S.L.

- Dompe Farmaceutici S.p.A.

- Isogenis Inc.

- RedHill Biopharma Ltd.

- Thompson Surgical

- Integra Life Sciences

- Baxter International Inc.

- VirTech Bio