Global Artificial Organ And Bionics Market By Product(Artificial Organs, Heart, Pancreas, Kidney, Others)Artificial Bionics (Brain bionics, Bionic limbs, Exoskeleton, Others) By Technology(Mechanical Bionics, Electronic Bionics);By Method of Fixation(Implantable, Externally Worn) By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: July 2024

- Report ID: 13741

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

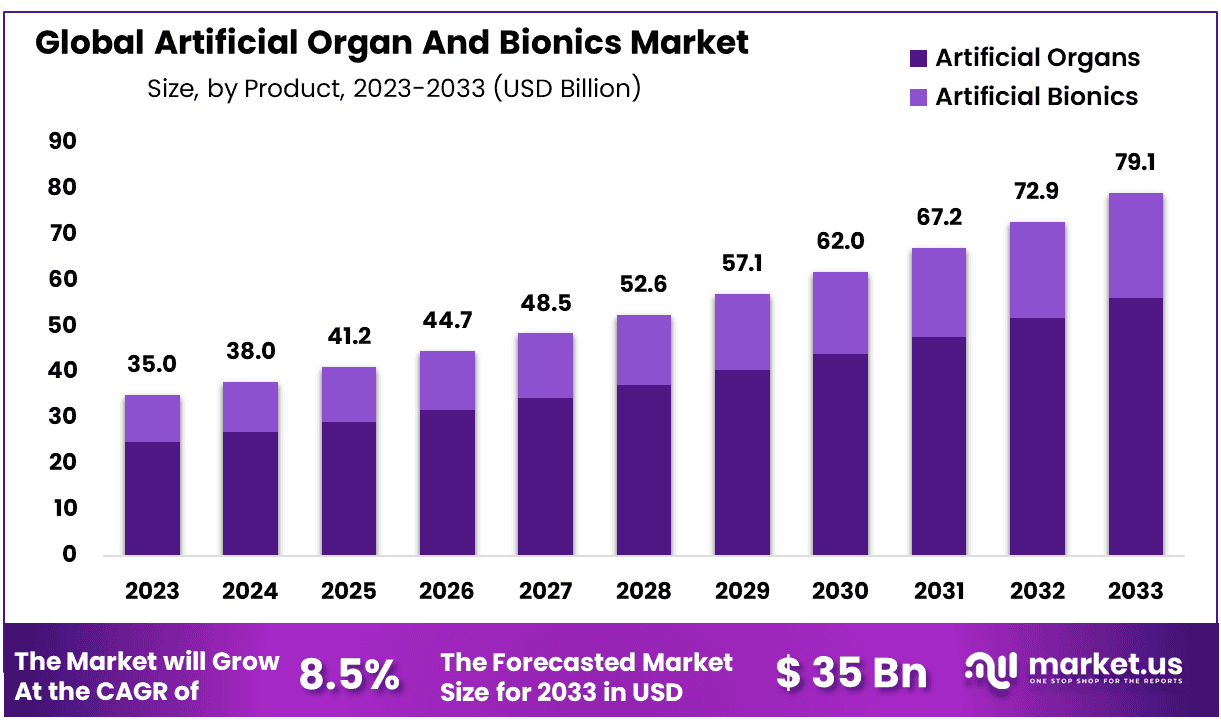

The Global Artificial Organ And Bionics Market size is expected to be worth around USD 79.1 Billion by 2033 from USD 35.0 Billion in 2023, growing at a CAGR of 8.5% during the forecast period from 2024 to 2033.

The escalating incidence of organ failure has led to a substantial surge in the utilization of artificial organs and bionic devices within the healthcare landscape. The burgeoning requirement for organ donors to facilitate transplants of vital organs such as kidneys, hearts, lungs, livers, and pancreas stands as a pivotal catalyst propelling market expansion.

Furthermore, numerous biotechnology and medical device enterprises have devoted their efforts to the advancement of 3D-printed bionics. These cutting-edge devices harness the capabilities of myoelectric and sensory electric technologies, empowering the mobility of synthetic human anatomical components.

An increasing global geriatric population is driving demand for organ implants. There is a rising number of older people seeking transplants. As they are more prone to developing post-transplant malignancies, older patients have the greatest demand for artificial equipment. According to HRSA, there were 8,615 transplants performed on Americans aged over 65 in 2019. According to the HRSA, 8,615 organ transplant procedures were performed in the U.S. in 2019. This is due to an increasing life expectancy as well as a rising demand for donors.

Key Takeaways

- Market Size: Artificial Organ And Bionics Market size is expected to be worth around USD 79.1 Billion by 2033 from USD 35.0 Billion in 2023.

- Market Growth: The market growing at a CAGR of 8.5% during the forecast period from 2024 to 2033.

- Product Analysis: Artificial organs dominated this market, with a more than 71% share in 2023.

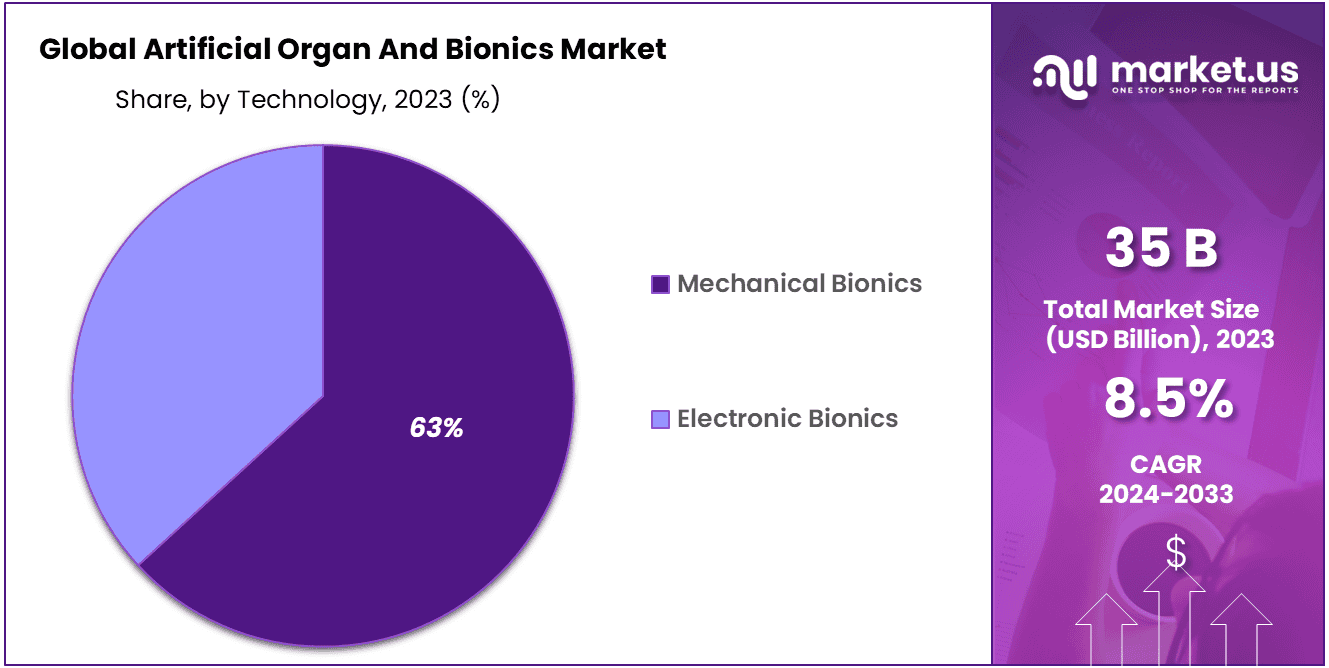

- Technology Analysis: The market was dominated by mechanical bionics in 2023, with a share of 63%.

- EMethod of Fixation Analysis: The externally Worn segment dominate 57% market share in 2023.

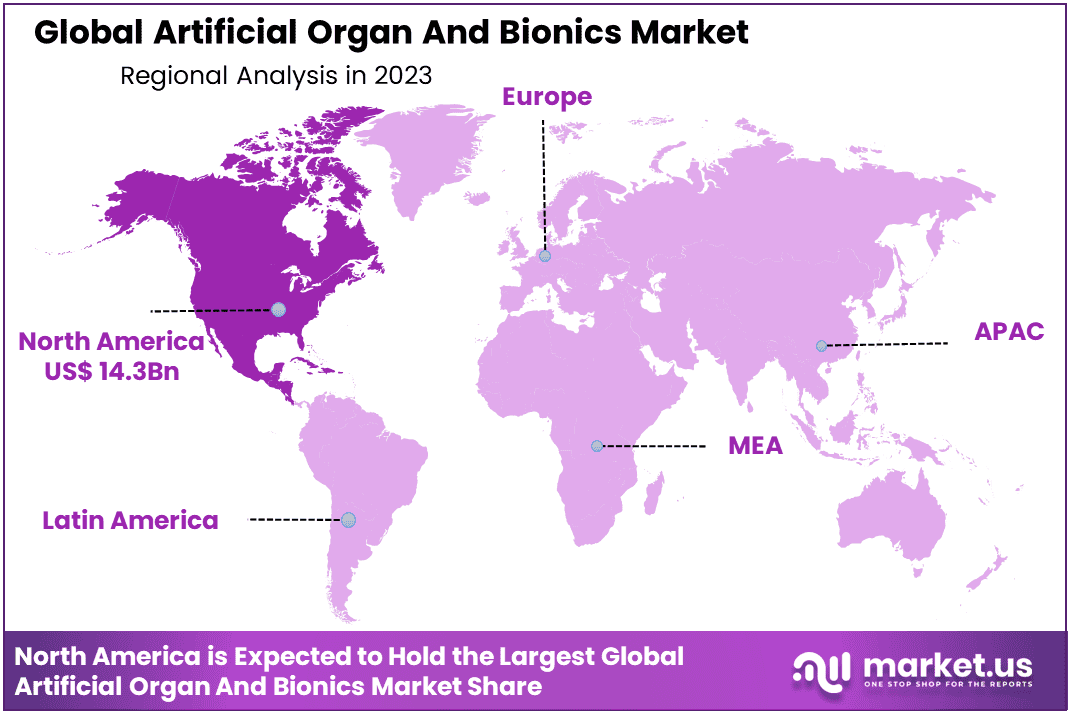

- Regional Analysis: North America led the market in 2023 with 41% and hold USD 14.3 billion market revenue.

- Ethical and Regulatory Challenges: Complex regulatory frameworks and ethical considerations can slow down product development and market entry.

- Emerging Markets: Opportunities for growth exist in emerging markets, particularly in Asia-Pacific and Latin America.

- Collaborations and Partnerships: Strategic partnerships can accelerate research and development efforts, helping bring innovative products to market faster.

Product Analysis

Artificial organs dominated this market, with a more than 71% share in 2023. The growth of this segment is due to the demand for liver, kidney, heart, and lung transplants. In the U.S., the average waiting time for transplanting a kidney is 5 years. While waiting lists are created, many factors are taken into consideration, including body size, blood type as well as the distance from donors and severity of illness. Unmet demand forced manufacturers to create bio-lungs, artificial livers, and wearable artificial kidneys.

The segment of artificial bionics is expected to see the highest CAGR over the forecast. Major drivers of this growth include the growing demand for Cochlear Implants, vision and exoskeletons. Market growth for artificial organs, bionics, and implants is further aided by favourable reimbursement policies and FDA approval speedy for implants. Orion, a bionic eye, was brought to the FDA’s expedited access pathway in November 2017. This allowed for faster commercialization. The device uses a cortical prosthesis to replace the visual nerves in visually impaired persons. It is equipped with a camera, brain implant, and a computer.

Technology Analysis

The market was dominated by mechanical bionics in 2023, with a share of 63%. This is mainly due to the growing incidence of organ damage and the low price of mechanical bionics. Strong demand has resulted from the fact that mechanical artificial heart valves last much longer than any other options. Additional factors driving the growth include quick FDA approvals as well as reimbursement policies. For example, the FDA approved Abbott’s world’s smallest mechanical cardiac valve in March 2018. This device is for children and toddlers with a need to have a mitral, aortic or heart valve.

The market for artificial organs, bionics and electronic bionics will see the fastest growth during the forecast period. Bionics Queensland says that around 1.0 Billion people are affected by a physical disability. Another 190.0 M adults have severe functional disabilities. Most countries in the developing world face high logistical or financial barriers.

The only option for many who are disabled is to obtain prosthetics such as artificial hands, arms, and legs These prosthetics are battery and electronic systems that are myoelectric-controlled and can create nerve movement through sensors. These technologies enable mobility within artificial organs. These devices are based on a personalized computational neuromuscular skeletal model that uses machine learning, smart wearables, and element mapping to achieve mobility. There will be an increase in road accidents and amputees as well as people born without limbs.

Method of Fixation Analysis

In the realm of the Artificial Organ and Bionics Market, fixation methods play a crucial role in shaping the industry landscape. Among these methods, external wearables currently hold sway, commanding a dominant 57% share of the market. These externally worn devices have gained prominence due to their non-invasive nature and user-friendly characteristics. They offer patients the advantage of mobility and ease of use while still providing essential life-sustaining functions.

However, the market is not limited to external wearables alone. Implantable technologies are also making significant strides. These innovations, while a smaller segment presently, are rapidly advancing. Implantable artificial organs and bionics promise long-term solutions with fewer external constraints, marking a promising avenue for future growth and technological development in this dynamic industry.

Key Market Segments

Product

Artificial Organs

- Heart

- Pancreas

- Kidney

- Others

Artificial Bionics

- Brain bionics

- Bionic limbs

- Exoskeleton

- Others

Technology

- Mechanical Bionics

- Electronic Bionics

Method of Fixation

- Implantable

- Externally Worn

Driver

Aging Population and Chronic Diseases

The main drivers of the market in artificial organs and biologics are an increasing number of transplants and a growing number of people looking for donors. According to the human resource and services administration in the U.S., more than 112,000 people are on the nation’s waiting list for 2020. According to HRSA reports, every 10 min a new person is added to the U.S. transplant list, increasing demand for these artificial medical devices.

Technological Advancements

Rapid advancements in medical technology, particularly in the fields of bioengineering and materials science, have played a pivotal role in the expansion of this market. Innovations such as 3D printing, nanotechnology, and biocompatible materials have enabled the development of more sophisticated and effective artificial organs and bionic devices, boosting patient outcomes and acceptance.

3D Bio-printing has proven to be a crucial tool in organ transplantation. This technology is used to make artificial organs. 3D Bio-printing is highly sought after as it helps to reduce the chances of organ rejection. Artificial intelligence is expected to change the global trends in artificial devices. Many countries are working on a tool to assess organ and donor compatibility. This tool would help in making efficient decisions about organ retrieval. Patients will also be able to decide whether they wish to wait for better organs.

Trend

Miniaturization and Wearable Devices

A notable trend in the Artificial Organ and Bionics Market is the shift towards miniaturization and the development of wearable bionic devices. These advancements are allowing patients to regain mobility and functionality in a more discreet and user-friendly manner. Wearable bionics, such as exoskeletons and prosthetic limbs, are becoming increasingly integrated into daily life.

Personalized Medicine

The trend towards personalized medicine is also influencing the market. Customized artificial organs and bionic devices are being developed to match the specific needs and anatomical characteristics of individual patients. This approach not only enhances the effectiveness of these devices but also reduces the risk of rejection and complications.

Restraint

High Cost of Development and Adoption

One of the significant restraints in this market is the high cost associated with the development and adoption of artificial organs and bionics. Research, clinical trials, and regulatory approvals are resource-intensive processes, leading to elevated product prices. This can limit access to these life-changing technologies for some patients and healthcare systems.

Ethical and Regulatory Challenges

Ethical considerations, as well as complex regulatory frameworks, can pose substantial challenges to market growth. Ensuring patient safety, privacy, and ethical standards while advancing cutting-edge technologies can slow down the introduction of new products and therapies.

Opportunity

Emerging Markets

The Artificial Organ and Bionics Market presents significant growth opportunities in emerging markets. Rising healthcare infrastructure, increasing awareness, and a growing middle-class population with greater disposable income are creating a conducive environment for market expansion in regions like Asia-Pacific and Latin America.

Collaborations and Partnerships

Strategic collaborations between healthcare institutions, research organizations, and technology companies present a promising opportunity. These partnerships can accelerate research and development efforts, streamline regulatory processes, and facilitate the market entry of innovative artificial organs and bionics.

Regional Analysis

North America led the market in 2023 with 41% and hold USD 14.3 billion market revenue. It will likely continue its dominance over the forecast period. This is due in part to an increasing number and demand for transplantation, as well as the increased incidence of organ failures. This dominance is also due in part to the well-developed healthcare infrastructure and local presence of large biotechnology/medical device companies, such as Zimmer, Arthrex, Inc., Medtronic, Novartis AG, and Stryker.

The U.S. has witnessed a dramatic increase in donor numbers over the last 5 years. According to the U.S. Department of Health and Human Services (2015 to 2019), there has been a 27.7% growth in the number of organ donors from 2015. A major driver for the market for artificial organs and bionics is the growing demand for kidney donation. Kidney transplantation saw an explosion from 16,186 transplants in 2011 to 23,401 transplants by 2019.

The Asia Pacific is expected to experience the fastest market growth during the forecast period. This is due to emerging economies like India and China. These countries are home to a large and varied population with high levels of chronic disease. An increase in the prevalence of chronic diseases that cause organ failure will likely boost artificial organ and other bionics device production. Myval, India’s initial artificial heart valve technology, was launched by Meril Life Sciences in December 2018. Merril Life Sciences launched it under the “Make in India campaign.”

The countries boast advanced technology and many advanced procedures. They also have a growing medical tourism sector. Patients can travel to the region because of the low cost of surgical procedures. The region’s market has grown significantly due to an increase in chronic diseases leading up to organ failure and medical tourism.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The market for artificial organs and Bionics is fragmented due to the presence of large, small, medium and small-scale vendors. Syncardia is the dominant player in the industry, along with Berlin Heart Gmbh (Ekso Bionics), Edwards Lifesciences Corporation and Ekso Bionics. These players are active in the development and expansion of regional markets to maximize their industry share.

The acquisitions and mergers of prominent leaders allow them to expand their product lines and expand their geographical reach. Edwards Lifesciences Corporation announced in 2019 that they would launch KONECT RESILA in 2020, a ready-to-launch tissue valve conduit.

The High demand for transplant products is due to increasing regulatory approvals for artificial kidneys and other materials. This 3D printing can be used in the regeneration of organs and tissues. Open Bionics 3D printing prosthetic arm from the U.S. was demonstrated in April 2019. The company designs 3D technologies and produces custom 3D-printed devices. There are several prominent players in this artificial organ and bionics industry.

Market Key Players

- Medtronic Plc.

- Boston Scientific Corporation

- Zimmer Biomet

- Edwards Lifesciences Corporation

- Jarvik Heart, Inc

- Cochlear Ltd.

- SynCardia Systems, LLC

- Berlin Heart

- Ekso Bionics

- ABIOMED

- Other Key Players

Recent Developments

- Medtronic Plc. – In May 2024, Medtronic Plc. acquired Aortix, a company specializing in advanced circulatory support technologies, to expand its portfolio in artificial organ systems. This acquisition is expected to enhance Medtronic’s capabilities in providing innovative solutions for patients with severe cardiac conditions.

- Boston Scientific Corporation – In March 2024, Boston Scientific Corporation launched the Alaris bionic limb, an advanced prosthetic arm with integrated sensors and AI-driven movement capabilities. The new product aims to provide enhanced mobility and functionality for amputees, reflecting Boston Scientific’s commitment to innovation in bionics.

- Zimmer Biomet – In April 2024, Zimmer Biomet announced a merger with Bio-Mechanical Solutions, a leader in orthopedic bionics. This strategic merger aims to integrate Zimmer Biomet’s expertise in orthopedic solutions with advanced bionic technologies, thereby expanding their product offerings and market reach.

- Edwards Lifesciences Corporation – In February 2024, Edwards Lifesciences Corporation acquired BioValve Innovations, a company known for its innovative heart valve technologies. This acquisition is expected to strengthen Edwards Lifesciences’ position in the artificial heart valves market, enhancing their product portfolio and technological capabilities.

- Jarvik Heart, Inc – In January 2024, Jarvik Heart, Inc. introduced the Jarvik 2200, a next-generation artificial heart designed for long-term use in patients with end-stage heart failure. This new product features improved biocompatibility and durability, aiming to provide better patient outcomes and quality of life.

- Cochlear Ltd. – In June 2024, Cochlear Ltd. merged with Auditory Solutions, Inc., a company specializing in auditory brainstem implants. The merger aims to combine Cochlear’s cochlear implant technology with Auditory Solutions’ expertise, offering comprehensive solutions for patients with severe hearing loss.

Report Scope

Report Features Description Market Value (2023) USD 35.0 Billion Forecast Revenue (2033) USD 79.1 Billion CAGR (2024-2033) 8.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product-(Artificial Organs, Heart, Pancreas, Kidney, Others)Artificial Bionics-(Brain bionics, Bionic limbs, Exoskeleton, Others);By Technology-(Mechanical Bionics, Electronic Bionics);By Method of Fixation-(Implantable, Externally Worn) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Medtronic Plc., Boston Scientific Corporation, Zimmer Biomet, Edwards Lifesciences Corporation, Jarvik Heart, Inc, Cochlear Ltd., SynCardia Systems, LLC, Berlin Heart, Ekso Bionics, ABIOMED, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Artificial Organ and Bionics Market?The Artificial Organ and Bionics Market refers to the industry involved in the development and manufacturing of artificial organs and bionic devices, which aim to replace or enhance the functionality of natural organs and body parts.

How big is the Artificial Organ and Bionics Market?The global Artificial Organ and Bionics Market size was estimated at USD 35.0 Billion in 2023 and is expected to reach USD 79.1 Billion in 2033.

What is the Artificial Organ and Bionics Market growth?The global Artificial Organ and Bionics Market is expected to grow at a compound annual growth rate of 8.5%. From 2024 To 2033

Who are the key companies/players in the Artificial Organ and Bionics Market?Some of the key players in the Artificial Organ and Bionics Markets are Medtronic Plc., Boston Scientific Corporation, Zimmer Biomet, Edwards Lifesciences Corporation, Jarvik Heart, Inc, Cochlear Ltd., SynCardia Systems, LLC, Berlin Heart, Ekso Bionics, ABIOMED, Other Key Players.

Why is the market growing?The market is growing due to factors such as an aging population, technological advancements, and the increasing prevalence of chronic diseases, which drive the demand for artificial organs and bionics.

What are some examples of artificial organs and bionics?Examples include artificial hearts, cochlear implants, prosthetic limbs, bionic eyes, and wearable exoskeletons designed to enhance mobility and functionality.

How do personalized medicine and customization impact the market?Personalized medicine and customization are trends that involve tailoring artificial organs and bionic devices to individual patients, improving their effectiveness and reducing the risk of complications.

What are the key challenges in the market?High development costs, ethical considerations, and complex regulatory frameworks are some of the challenges faced by the Artificial Organ and Bionics Market.

Artificial Organ And Bionics MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Artificial Organ And Bionics MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Medtronic Plc.

- Boston Scientific Corporation

- Zimmer Biomet

- Edwards Lifesciences Corporation

- Jarvik Heart, Inc

- Cochlear Ltd.

- SynCardia Systems, LLC

- Berlin Heart

- Ekso Bionics

- ABIOMED

- Other Key Players