Organoids Market By Type of Organoids (Liver, Pancreas, Intestine, Kidney, Heart, and Others), By Application (Drug Testing, Personalized Medicine, Developmental Biology, and Others), By End-users (Academic & Research Institutes, Contract Research Organizations (CROs), Pharmaceutical & Biotechnology Company, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135523

- Number of Pages: 248

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

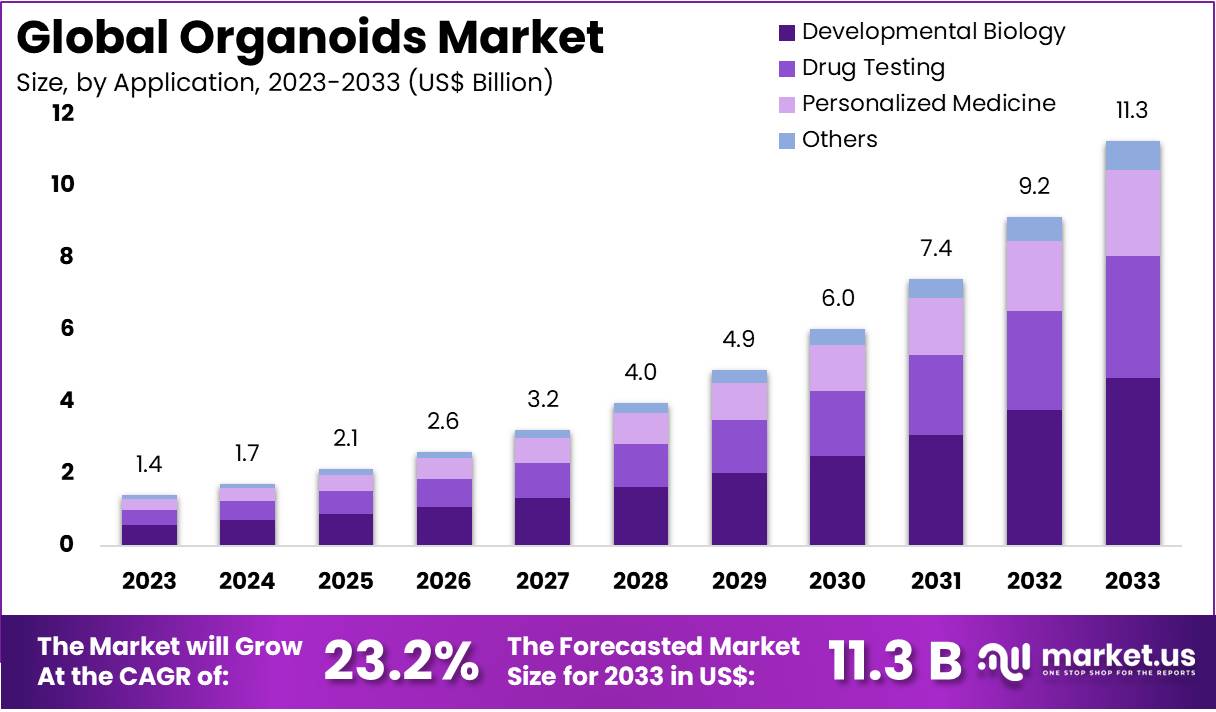

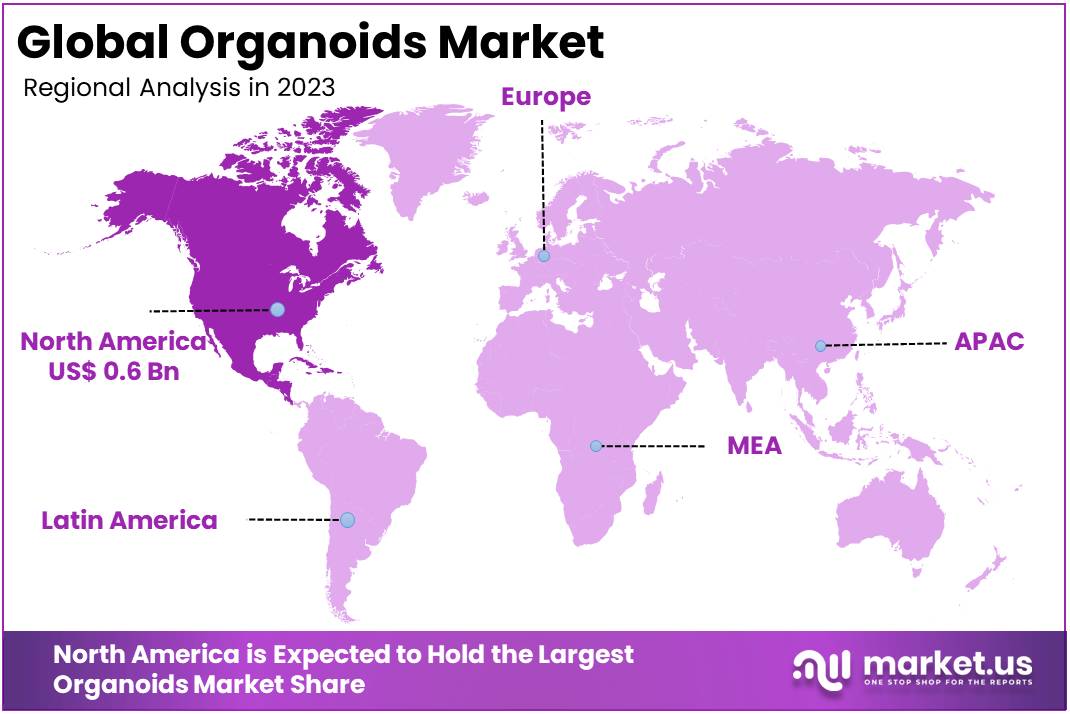

The Organoids Market size is expected to be worth around US$ 11.3 billion by 2033 from US$ 1.4 billion in 2023, growing at a CAGR of 23.2% during the forecast period 2024 to 2033. North America held a dominant market position, capturing more than a 41.2% share and holds US$ 0.6 Billion market value for the year.

Growing interest in personalized medicine and advanced drug development is driving the expansion of the organoids market. Organoids, three-dimensional structures grown from stem cells that mimic the function of human organs, have become vital tools for research in areas like drug discovery, disease modeling, and regenerative medicine.

These models enable researchers to study human-specific biological processes and test therapeutic compounds with greater accuracy, improving the efficiency of drug development while reducing reliance on animal models. Rising demand for more predictive preclinical models and the growing emphasis on targeted therapies present significant opportunities for organoid applications in oncology, neurology, and infectious disease research.

In July 2023, Molecular Devices introduced a service aimed at expanding custom organoid lines, integrating advanced bioprocess technology to support high-throughput applications. This innovation underscores the trend toward automation and scalability in organoid research. Additionally, in August 2021, STEMCELL Technologies partnered with Hubrecht Organoid Technology (HUB) to incorporate tissue-derived organoids, such as lung, liver, and intestinal models, into preclinical toxicology screening and drug development services.

This partnership further highlights the growing integration of organoids in drug development and toxicology assessments. As organoid technology continues to evolve, it offers promising applications in precision medicine, accelerating the discovery of novel therapeutic agents and enhancing the development of more effective treatments.

Key Takeaways

- In 2023, the market for organoids generated a revenue of US$ 1.4 billion, with a CAGR of 23.2%, and is expected to reach US$ 11.3 billion by the year 2033.

- The type of organoids segment is divided into liver, pancreas, intestine, kidney, heart, and others, with intestine taking the lead in 2023 with a market share of 32%.

- Considering application, the market is divided into drug testing, personalized medicine, developmental biology, and others. Among these, developmental biology held a significant share of 41.3%.

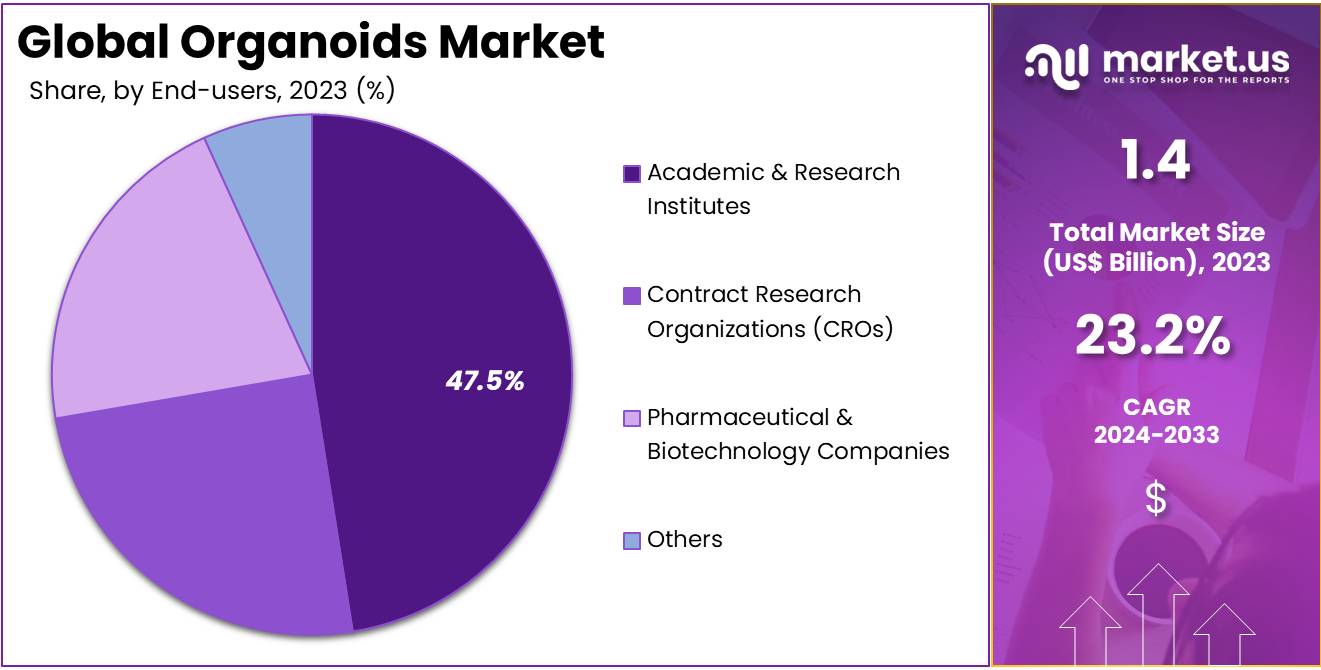

- Furthermore, concerning the end-users segment, the academic & research institutes sector stands out as the dominant player, holding the largest revenue share of 47.5% in the organoids market.

- North America led the market by securing a market share of 41.2% in 2023.

Type of Organoids Analysis

The intestine segment led in 2023, claiming a market share of 32% owing to increasing research in gastrointestinal diseases, regenerative medicine, and drug development. Intestinal organoids, which are 3D structures that mimic the human intestine, have gained significant attention for their potential to study intestinal disorders, including inflammatory bowel disease (IBD), colorectal cancer, and other digestive tract conditions.

Researchers are anticipated to rely more on these models to better understand gut microbiota interactions, disease pathogenesis, and treatment responses. The growth of the segment is also likely to be driven by advances in personalized medicine, where intestinal organoids are utilized for drug screening and testing to predict patient-specific responses to treatments.

As pharmaceutical companies increasingly turn to more relevant in vitro models for preclinical testing, the demand for intestine organoids in drug discovery is projected to increase. Moreover, the expanding use of organoids in food and nutrition studies will likely support the growth of this segment, as these models allow for testing the effects of various diets and nutrients on gut health.

Application Analysis

The developmental biology held a significant share of 41.3% due to the rising importance of organoid models in understanding human development and disease mechanisms. Researchers are expected to increasingly use organoids for studying complex processes such as tissue differentiation, organogenesis, and the molecular basis of diseases.

These models enable more accurate in vitro recapitulation of human developmental biology compared to traditional 2D cultures, making them essential tools in developmental biology research. The growing demand for personalized medicine will likely drive further adoption of organoids for drug testing and patient-specific treatment strategies.

Additionally, advances in gene editing technologies, such as CRISPR, are anticipated to enhance the precision of organoid models, contributing to their expanded use in developmental biology. With increased investment in stem cell research and regenerative medicine, the developmental biology application of organoids is expected to witness accelerated growth in the coming years.

End-users Analysis

The academic & research institutes segment had a tremendous growth rate, with a revenue share of 47.5% as these institutions continue to drive scientific discoveries using advanced 3D models. Academic and research institutes are expected to remain the primary users of organoids, as they enable cutting-edge research in areas such as cancer biology, disease modeling, and drug discovery.

The segment’s growth is anticipated to be fueled by the increasing availability of funding for stem cell research and tissue engineering, which supports the adoption of organoids in academic settings. Additionally, the collaboration between academia and industry in the development of organoid-based models for personalized medicine and drug testing is projected to accelerate market growth.

Research institutes are likely to continue to expand their use of organoids for educational purposes as well, providing students with hands-on experience in tissue engineering and regenerative medicine. As a result, the demand for organoids in academic and research institutes is expected to grow steadily in the coming years.

Key Market Segments

By Type of Organoids

- Liver

- Pancreas

- Intestine

- Kidney

- Heart

- Others

By Application

- Drug Testing

- Personalized Medicine

- Developmental Biology

- Others

By End-users

- Academic & Research Institutes

- Contract Research Organizations (CROs)

- Pharmaceutical & Biotechnology Company

- Others

Drivers

Growing Awareness Regarding Animal Cruelty Driving the Organoids Market

Growing awareness regarding animal cruelty is significantly driving the expansion of the organoids market. In December 2022, the FDA enacted the Modernization Act 2.0, allowing the use of alternative methods, such as organoids, in drug approval processes to replace animal testing. This move reflects a broader societal push to reduce animal suffering in scientific research and is likely to increase demand for organoid models as more ethical alternatives to traditional testing methods.

As regulatory bodies begin to recognize the potential of organoids in toxicology, disease modeling, and drug discovery, their use is expected to become more widespread in the pharmaceutical industry. The increased focus on ethical considerations in research is anticipated to encourage greater investment in organoid technologies, which offer a more humane and accurate approach to preclinical testing. With growing consumer awareness and industry support, the organoids market is projected to experience sustained growth as demand for alternatives to animal testing rises.

Restraints

Rising Ethical and Regulatory Concerns Restraining the Organoids Market

Rising ethical and regulatory concerns are expected to restrain the growth of the organoids market. Despite their promise, the use of organoid models raises complex ethical questions, especially regarding their creation and manipulation, which could impede their broader acceptance. Regulatory bodies, such as the FDA and EMA, have yet to establish clear guidelines for the validation and standardization of organoids in research, creating uncertainty in their widespread adoption.

High compliance costs and slow-moving regulatory processes may hamper the rapid integration of organoids into mainstream drug development. Furthermore, concerns about the potential for organoid models to evolve into forms with unexpected capabilities or ethical implications are likely to create barriers for their use. As regulatory frameworks develop, these concerns will need to be addressed to fully unlock the potential of organoid technologies in biomedical research.

Opportunities

Rising Innovation as an Opportunity for the Organoids Market

Rising innovation in cellular and tissue engineering is presenting significant opportunities for the organoids market. In June 2024, DefiniGEN and Atelerix successfully delivered in vitro liver models from the UK to a leading pharmaceutical client in the US. This achievement combined DefiniGEN’s iPSC hepatocytes with Atelerix’s hydrogel preservation technology to ensure sample stability and functionality during long-distance shipping.

Such innovations are likely to drive the adoption of organoid-based models across multiple industries, particularly in drug discovery and toxicology. As researchers develop more sophisticated techniques for creating and culturing organoids, the market is expected to expand. Increased advancements in organoid modeling will enhance their ability to replicate human organ functions more accurately, making them an attractive option for preclinical studies.

The growing potential for organoids to be used in personalized medicine and regenerative therapies is projected to further accelerate their market growth.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors strongly influence the organoids market. On the negative side, economic downturns can lead to reduced funding for scientific research, which may slow down the development and adoption of organoid technologies. Geopolitical instability, such as trade restrictions or international conflicts, could disrupt the supply of necessary materials or create barriers to cross-border collaboration, hindering the growth of the sector.

However, the global push toward advanced healthcare technologies and the increasing emphasis on personalized medicine present significant opportunities for the market. Rising investments in biotechnology and pharmaceuticals, coupled with favorable regulatory frameworks in key regions, have spurred growth in organoid applications for drug testing, disease modeling, and regenerative medicine. As the sector continues to innovate, these positive drivers are expected to overcome current challenges.

Trends

Surge in Partnerships and Collaborations Driving the Organoids Market

Increasing partnerships and collaborations are propelling the organoids market forward. High demand for personalized medicine and innovative drug testing models is fostering closer cooperation between research institutions, biotechnology companies, and pharmaceutical firms. In May 2024, Crown Bioscience and the Shanghai Model Organisms Center (SMOC) expanded their ongoing collaboration, focusing on immuno-oncology platforms and services.

This partnership is expected to strengthen global research capabilities and accelerate the use of organoid technology in cancer treatment development. Such collaborations are likely to enhance the accessibility of cutting-edge organoid-based platforms and facilitate further market expansion.

Regional Analysis

North America is leading the Organoids Market

North America dominated the market with the highest revenue share of 41.2% owing to significant advancements in biotechnology and increasing investments in drug discovery and regenerative medicine. One of the key developments in January 2024 was the global launch of HUB Organoids’ IntegriGut Screen services, which utilizes IBD PDO monolayers to help create innovative therapies for inflammatory bowel disease (IBD).

This service highlights the growing role of organoids in developing high-quality human data, particularly for therapeutic applications in gastrointestinal diseases. Furthermore, the increasing demand for personalized medicine has driven the adoption of organoids in drug testing and screening, as they offer more accurate models than traditional animal studies.

The presence of major biotechnology and pharmaceutical companies, alongside a robust research infrastructure, has also contributed to North America’s leadership in this field. The integration of organoids in precision medicine and their potential to model human diseases has positioned the region as a key player in the market’s expansion.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to advancements in stem cell research, biotechnology, and increasing healthcare investments. Countries such as China, Japan, and South Korea are anticipated to drive the adoption of organoid-based technologies in drug development and disease modeling.

Additionally, rising healthcare needs, particularly in the fields of cancer research and personalized medicine, are likely to further boost market growth. Regulatory support for stem cell research and innovations in bioengineering are expected to create a favorable environment for the growth of organoids. As Asia Pacific’s medical and scientific community increasingly embraces advanced research techniques, the market is projected to see substantial growth in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the organoids market focus on advancing technological capabilities, expanding applications in drug discovery, and strengthening partnerships to drive growth. Companies invest in developing more complex and accurate organoid models that replicate human tissue functionality, improving their utility in research and personalized medicine.

They also enhance scalability and standardization, ensuring that organoid models can be produced at a larger scale while maintaining consistency. Strategic collaborations with pharmaceutical companies, academic institutions, and healthcare providers help expand market applications and improve access to advanced organoid-based solutions. Furthermore, players aim to target emerging markets by offering cost-effective products that meet the growing demand for preclinical models.

One key player in the organoids market is Hubrecht Organoid Technology (HUB). HUB focuses on creating high-quality human organoid models that can be used for drug testing, disease modeling, and personalized medicine. The company’s growth strategy includes expanding its product offerings and strengthening partnerships with global pharmaceutical companies and academic research institutions.

HUB also focuses on advancing its technology to enhance the reproducibility and scalability of its organoid models, aiming to improve their clinical application. Through continued innovation and a strong commitment to advancing biomedical research, HUB remains a leader in the organoid space.

Recent Developments

- In June 2024: Molecular Devices, LLC opened a new high-tech facility in Cardiff, UK. This multimillion-pound investment houses the company’s advanced bioprocess workflow and state-of-the-art bioreactor technology. The facility is geared towards enhancing the large-scale production of PDOs under stringent quality controls.

- In March 2021: Bio-Techne introduced its Cultrex UltiMatrix Reduced Growth Factor Basement Membrane Extract (RGF BME). This product is designed to facilitate the cultivation of organoids and pluripotent stem cells, thereby improving their growth and development.

Top Key Players in the Organoids Market

- Molecular Devices, LLC

- Greiner Bio-One

- Corning Incorporated

- Cellesce Ltd.

- Bio-Techne

- Hubrecht Organoid Technology

- 3D Biotek LLC

- 3D Biomatrix

Report Scope

Report Features Description Market Value (2023) US$ 1.4 billion Forecast Revenue (2033) US$ 11.3 billion CAGR (2024-2033) 23.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type of Organoids (Liver, Pancreas, Intestine, Kidney, Heart, and Others), By Application (Drug Testing, Personalized Medicine, Developmental Biology, and Others), By End-users (Academic & Research Institutes, Contract Research Organizations (CROs), Pharmaceutical & Biotechnology Company, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Molecular Devices, LLC, Greiner Bio-One, Corning Incorporated, Cellesce Ltd., Bio-Techne, AMS Biotechnology Limited, 3D Biotek LLC, and 3D Biomatrix. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Molecular Devices, LLC

- Greiner Bio-One

- Corning Incorporated

- Cellesce Ltd.

- Bio-Techne

- Hubrecht Organoid Technology

- 3D Biotek LLC

- 3D Biomatrix