Global Green Electronics Manufacturing Market Share Analysis By Product Type (Green Computers, Green Smartphones, Green Smart Home Appliances, Green Wearable Electronics, Green Industrial Electronics), By Material Type (Bioplastics, Plant-Based Materials, Aluminum, Borosilicate Glass, Graphene, Iron Alloy, Sustainable Wood, Recycled Glass, Recycled Plastics), By End-Use Industry (Consumer Electronics, Automotive, Industrial, Government), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2024

- Published date: Feb. 2025

- Report ID: 140213

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- U.S. Market Size

- Analysts’ Viewpoint

- Product Type Analysis

- Material Type Analysis

- End-Use Industry Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Regions and Countries

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

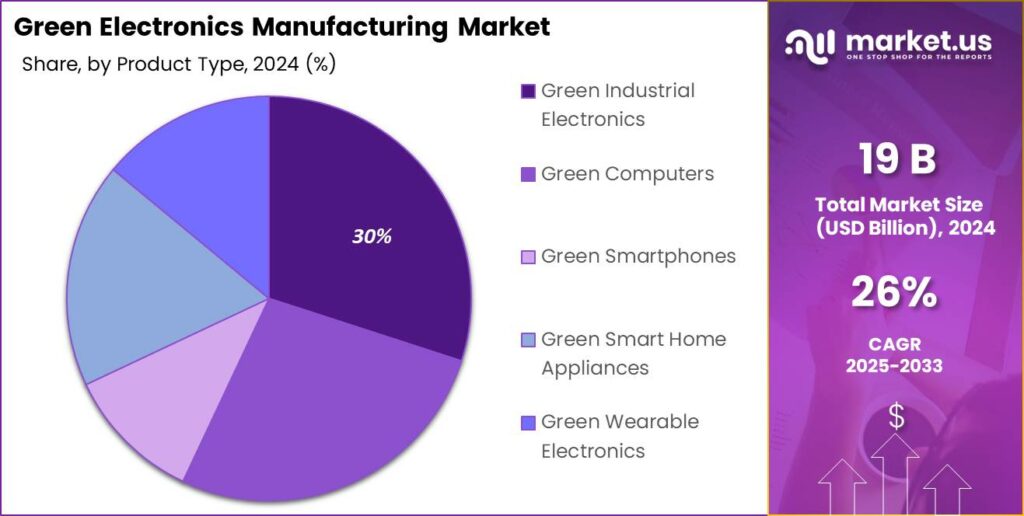

The Global Green Electronics Manufacturing Market size is expected to be worth around USD 187 billion by 2034, from USD 19 billion in 2024, growing at a CAGR of 26% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35% share, holding USD 6.6 Billion revenue.

Green electronics manufacturing refers to the practice of producing electronic devices in an environmentally responsible manner. This approach emphasizes reducing environmental harm throughout the lifecycle of electronic products, including design, manufacturing, usage, and disposal. The goal is to minimize the ecological footprint of electronics by using sustainable materials, reducing energy consumption, and implementing recycling processes.

The green electronics manufacturing market is expanding as consumers and regulators push for more sustainable electronic products. This market comprises companies that produce energy-efficient electronics, use recycled materials, or develop technologies to reduce environmental impact. The growth in this sector is driven by increasing awareness of environmental issues, governmental regulations on electronic waste, and consumer preference for eco-friendly products.

Key Takeaways

- The global market for green electronics manufacturing is on track to expand significantly, projected to reach approximately USD 187 billion by 2034, up from USD 19 billion in 2024. This represents a robust compound annual growth rate (CAGR) of 26% from 2025 to 2034. This growth underscores the increasing emphasis on sustainable manufacturing practices across the globe.

- In the United States alone, the green electronics manufacturing sector demonstrated a strong performance, with a market size of USD 6.02 billion in 2024, growing at a CAGR of 8%.

- In 2024, the Aluminum segment in the green electronics manufacturing market held a dominant position, capturing more than a 25% share.

- A standout performer in this burgeoning market is the Green Industrial Electronics segment, which dominated the industry in 2024. It captured more than a 30% share of the market, illustrating its critical role in the broader push towards sustainable electronic solutions.

U.S. Market Size

The US Green Electronics Manufacturing Market size was exhibited at USD 6.02 Billion in 2024 with CAGR of 24.8%. The United States is leading the green electronics manufacturing market for several reasons, highlighted by a combination of strong government support, technological innovations, and market dynamics.

Firstly, the US government has been instrumental in fostering the growth of green electronics through significant legislation and investments. The enactment of the IRA and CHIPS Act has spurred substantial investments in green energy and semiconductor manufacturing.

This support has not only boosted the sector’s growth through direct financial injections but has also encouraged technological advancements and increased employment within the industry. These actions demonstrate a strategic commitment to strengthening the domestic manufacturing base in environmentally friendly ways, contributing to economic resilience and sustainability.

In 2024, North America maintained a commanding presence in the green electronics manufacturing market, holding over 35% market share with revenues reaching approximately USD 6.5 billion. This region’s leadership is underpinned by a confluence of factors that uniquely position it at the forefront of the industry.

The dominance of North America can largely be attributed to the robust ecosystem of innovation and advanced manufacturing capabilities. Home to Silicon Valley and numerous other tech hubs, the region benefits from the concentration of technological expertise and cutting-edge research facilities. Companies in North America are often early adopters of new technologies, which enables them to lead in green manufacturing practices, such as reducing waste and energy consumption in electronics production.

Moreover, stringent environmental regulations and government policies play a critical role in shaping the market dynamics in North America. Initiatives like the Electronic Product Environmental Assessment Tool (EPEAT) and regulations such as the Restriction of Hazardous Substances (RoHS) push companies towards adopting sustainable practices.

Analysts’ Viewpoint

Demand analysis in the green electronics manufacturing market reveals a significant shift towards products that offer greater energy efficiency and reduced environmental impact. There is a growing demand for devices made with recycled materials and those that are easier to recycle at the end of their life cycle. This trend is encouraging companies to invest in new technologies and designs that align with these consumer preferences, thereby expanding the market.

Investment opportunities in the green electronics sector are robust, with significant potential for growth in areas like renewable energy use in manufacturing processes, advancements in sustainable materials, and development of new recycling technologies. However, these opportunities come with risks such as high initial costs, uncertain returns on investment due to evolving technologies, and potential supply chain disruptions due to the reliance on specific, sometimes scarce, sustainable materials.

Technological advancements are continuously shaping the green electronics manufacturing market. Innovations such as improved battery recycling processes, more efficient energy use in production, and breakthroughs in biodegradable electronics are paving the way for a more sustainable future. These advancements not only help reduce the environmental impact but also offer manufacturers competitive advantages in a market increasingly driven by eco-conscious consumers.

Product Type Analysis

In 2024, the Green Industrial Electronics segment held a dominant market position, capturing more than a 30% share of the green electronics manufacturing market. This leadership stems from several key factors that underscore the segment’s pivotal role in the broader electronics sector.

Green Industrial Electronics benefit significantly from the integration of advanced manufacturing technologies and sustainable practices. This segment has been at the forefront of adopting energy-efficient solutions and automating processes to reduce energy consumption and waste. The push towards industrial automation and the use of Internet of Things (IoT) technologies have also played a critical role in enhancing the operational efficiency and sustainability of industrial electronics.

Additionally, stringent regulatory frameworks across global markets have mandated the incorporation of eco-friendly practices in industrial settings. These regulations have driven the adoption of green technologies in the industrial electronics sector, as companies strive to comply with environmental standards and avoid penalties.

For instance, directives like RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) have compelled manufacturers to innovate and implement greener solutions within their operational and product development strategies.

Material Type Analysis

In 2024, the Aluminum segment in the green electronics manufacturing market held a dominant position, capturing more than a 25% share. This leadership can be attributed to several key factors that highlight aluminum’s essential role in sustainable manufacturing.

Aluminum is renowned for its lightweight, strength, and high recyclability, which makes it an attractive option for green electronics. It is one of the most used metals in the world, second only to steel, and plays a crucial role across various industries including electronics.

The push towards sustainability has led to the development of “green aluminum,” which refers to aluminum produced using processes that are less carbon-intensive. This includes the use of renewable energy sources such as hydro, solar, and wind power to reduce the carbon footprint associated with aluminum production.

The market’s growth is bolstered by increasing regulatory pressures and consumer demand for more sustainable products. Governments and international bodies are promoting the use of low-carbon materials, providing incentives that encourage manufacturers to adopt greener practices.

Additionally, technological advancements in the aluminum sector have led to more efficient recycling and refining processes, enhancing aluminum’s appeal as a sustainable material. Moreover, the significant investments required to shift to green aluminum production are supported by its broad application range and the potential for long-term cost savings in energy consumption and materials sourcing.

End-Use Industry Analysis

In 2024, the Consumer Electronics segment held a dominant market position, capturing more than a 40% share of the Green Electronics Manufacturing Market. This significant share is primarily attributed to the growing consumer demand for sustainable and eco-friendly electronic devices.

As environmental concerns continue to rise, manufacturers in the consumer electronics industry are under increasing pressure to reduce their carbon footprint and adopt environmentally conscious production practices. The rapid adoption of energy-efficient devices, such as smartphones, laptops, and smart home products, has been a key driver for the growth of this segment.

The integration of sustainable materials and green manufacturing processes in consumer electronics is increasingly being prioritized. Key players in the market are incorporating renewable energy sources and recycling programs in their production lines.

The shift toward energy-efficient and environmentally friendly products not only aligns with changing consumer preferences but also helps manufacturers comply with tightening environmental regulations across various regions. For instance, eco-label certifications and adherence to international standards like RoHS (Restriction of Hazardous Substances) are becoming essential for gaining market acceptance.

Additionally, the rapid pace of technological advancements and innovation in the consumer electronics sector has further propelled market growth. The increasing demand for products with longer lifespans and lower energy consumption is motivating companies to invest in green electronics. Consumer electronics companies are also focusing on reducing e-waste through take-back programs and improving product recyclability.

Key Market Segments

By Product Type

- Green Computers

- Green Smartphones

- Green Smart Home Appliances

- Green Wearable Electronics

- Green Industrial Electronics

By Material Type

- Bioplastics

- Plant-Based Materials

- Aluminum

- Borosilicate Glass

- Graphene

- Iron Alloy

- Sustainable Wood

- Recycled Glass

- Recycled Plastics

By End-Use Industry

- Consumer Electronics

- Automotive

- Industrial

- Government

Driver

Growing Environmental Concerns and Regulations

The surge in environmental awareness and stringent global regulations are major drivers for the green electronics manufacturing market. Over recent decades, the escalating impacts of electronic waste have prompted both consumers and governments to demand more sustainable electronic products. Electronics often contain harmful materials like lead, cadmium, and mercury, which pose serious environmental and health risks when improperly disposed of.

This has led to increased regulatory pressures such as the EU’s Restriction of Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE) directives, which mandate the reduction of hazardous substances and promote recycling efforts. Consequently, these factors drive electronics companies to innovate and adopt greener practices, helping to expand the market for sustainable electronic products.

Restraint

High Implementation Costs

The transition to green electronics manufacturing is significantly restrained by the high costs associated with implementing sustainable practices and technologies. Adopting green manufacturing requires substantial investments in new technologies, equipment, and training, which can be prohibitively expensive, especially for smaller firms. Sustainable materials, such as bioplastics, often come at a premium due to their limited availability and the complexities involved in their production.

Additionally, aligning existing manufacturing processes with stringent global environmental standards entails ongoing costs, including compliance testing and certification. These financial challenges can slow down the adoption of green practices across the electronics industry.

Opportunity

Circular Economy and Technological Advancements

The shift towards a circular economy presents significant opportunities within the green electronics manufacturing sector. This approach emphasizes the reuse and recycling of materials, reducing the reliance on raw resources and minimizing waste. Technological advancements are facilitating this shift, with innovations in recycling technologies and the development of more sustainable materials and components.

For example, the integration of AI and blockchain technology improves supply chain transparency and enhances resource efficiency, further promoting sustainable practices. As these technologies mature, they lower costs and barriers to entry, making sustainable practices more accessible and economically viable for manufacturers.

Challenge

Supply Chain Complexities

One of the critical challenges facing the green electronics manufacturing market is the complexity of ensuring sustainability throughout the supply chain. Manufacturers must ensure that all stages of their supply chain adhere to environmental standards, which can be difficult to monitor and control, especially across global networks.

The variability in regulations across different regions adds to the complexity, requiring companies to navigate a maze of compliance requirements that can differ markedly from one country to another. Additionally, competition from less expensive non-green alternatives continues to pressure the market, as these often offer lower upfront costs despite their higher environmental toll.

Growth Factors

The green electronics manufacturing market is experiencing robust growth, primarily driven by increasing environmental awareness among consumers and stringent regulatory standards aimed at reducing the ecological footprint of electronic products. The demand for sustainable and eco-friendly electronics is surging as consumers become more cognizant of the environmental impacts of their purchasing decisions.

This consumer shift is bolstered by the proliferation of regulations like the EU’s Restriction of Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE) directives, which mandate the reduction of hazardous materials and promote recycling initiatives.

Moreover, technological advancements are playing a pivotal role in this sector’s growth. Innovations in material science and manufacturing processes are enabling producers to enhance the energy efficiency of electronic devices and utilize recycled materials more extensively.

These technologies not only help in meeting regulatory compliance but also in achieving operational efficiencies and cost savings over time. The integration of artificial intelligence and blockchain technology further enhances supply chain transparency and resource management, making these processes more sustainable and efficient.

Emerging Trends

Emerging trends in the green electronics manufacturing market include the adoption of the circular economy principles, where the focus is on minimizing waste through the reuse, refurbishment, and recycling of components and materials. This approach is gaining traction as it offers significant environmental benefits and aligns with global sustainability goals.

Additionally, the use of advanced manufacturing technologies that support the development of energy-efficient and low-waste electronics is on the rise. There is also a notable shift towards using biodegradable or recyclable materials in electronics manufacturing, which further drives the sustainability agenda.

The market is also seeing a trend towards transparency in supply chains, with more companies investing in technologies that provide clear visibility of their sourcing and manufacturing processes. This transparency is crucial for ensuring compliance with environmental regulations and for building consumer trust in the sustainability claims of electronic products.

Business Benefits

Adopting green manufacturing practices offers a range of business benefits, including compliance with global regulatory standards and reducing the risk of penalties associated with non-compliance. Companies engaged in green electronics manufacturing can also gain a competitive edge by differentiating their products in a market that increasingly values sustainability.

This differentiation can lead to increased market share and customer loyalty as consumers are more inclined to purchase products from companies they perceive as environmentally responsible. Furthermore, green manufacturing practices can lead to cost savings in the long run. By using materials more efficiently and reducing waste, companies can decrease operational costs.

Energy-efficient processes and technologies also reduce energy consumption, which not only lowers expenses but also minimizes the carbon footprint of manufacturing activities. Additionally, engaging in sustainable practices enhances corporate image and brand reputation, which is invaluable in today’s market where corporate sustainability is a significant factor influencing consumer choices.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Apple has emerged as a leader in the green electronics manufacturing space, with its long-standing commitment to sustainability. The company’s aggressive push towards reducing its environmental footprint is evident through its efforts to make all of its products carbon neutral by 2030.

Samsung Electronics, a major player in the global electronics market, has placed a strong emphasis on incorporating green practices into its manufacturing processes. The company’s commitment to sustainable innovation is seen through its recent product launches such as the Galaxy Z Fold 5, which uses eco-friendly materials like recycled plastic.

Sony Corporation has also made significant strides in the green electronics manufacturing market. The company has developed an array of products with a focus on sustainability, including energy-efficient home entertainment systems and eco-friendly gaming consoles like the PlayStation 5.

Top Key Players in the Market

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Dell Technologies Inc.

- Sony Corporation

- LG Electronics Inc.

- HP Inc.

- Panasonic Corporation

- Siemens AG

- Toshiba Corporation

- General Electric Company

- Sharp Corporation

- Koninklijke Philips N.V.

- Acer Inc.

- Lenovo

- Other Key Players

Recent Development

- November 2024: Sony introduced biodegradable printed circuit boards (PCBs) for select consumer electronics, aiming to reduce e-waste significantly. This innovation aligns with their “Road to Zero” environmental plan

- March 2024: LG launched an initiative to recycle rare earth elements from discarded appliances and electronics, reducing dependency on virgin materials. The company also introduced solar-powered smart home devices.

Report Scope

Report Features Description Market Value (2024) USD 19 Bn Forecast Revenue (2034) USD 187 Bn CAGR (2025-2034) 26% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Green Computers, Green Smartphones, Green Smart Home Appliances, Green Wearable Electronics, Green Industrial Electronics), By Material Type (Bioplastics, Plant-Based Materials, Aluminum, Borosilicate Glass, Graphene, Iron Alloy, Sustainable Wood, Recycled Glass, Recycled Plastics), By End-Use Industry (Consumer Electronics, Automotive, Industrial, Government) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Apple Inc., Samsung Electronics Co. Ltd., Dell Technologies Inc., Sony Corporation, LG Electronics Inc., HP Inc., Panasonic Corporation, Siemens AG, Toshiba Corporation, General Electric Company, Sharp Corporation, Koninklijke Philips N.V., Acer Inc., Lenovo, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Green Electronics Manufacturing MarketPublished date: Feb. 2025add_shopping_cartBuy Now get_appDownload Sample

Green Electronics Manufacturing MarketPublished date: Feb. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Dell Technologies Inc.

- Sony Corporation

- LG Electronics Inc.

- HP Inc.

- Panasonic Corporation

- Siemens AG

- Toshiba Corporation

- General Electric Company

- Sharp Corporation

- Koninklijke Philips N.V.

- Acer Inc.

- Lenovo

- Other Key Players