Global Transcriptomics Market By Product Type (Consumables, Instruments and Software & Services), By Technology (Next-Generation Sequencing (NGS), Microarray, Polymerase Chain Reaction (PCR) and Others), By Application (Drug Discovery & Development, Diagnostics & Disease Profiling and Others), By End-User (Academic & Research Institutes, Biotechnology Companies, Pharmaceutical Companies and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174993

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

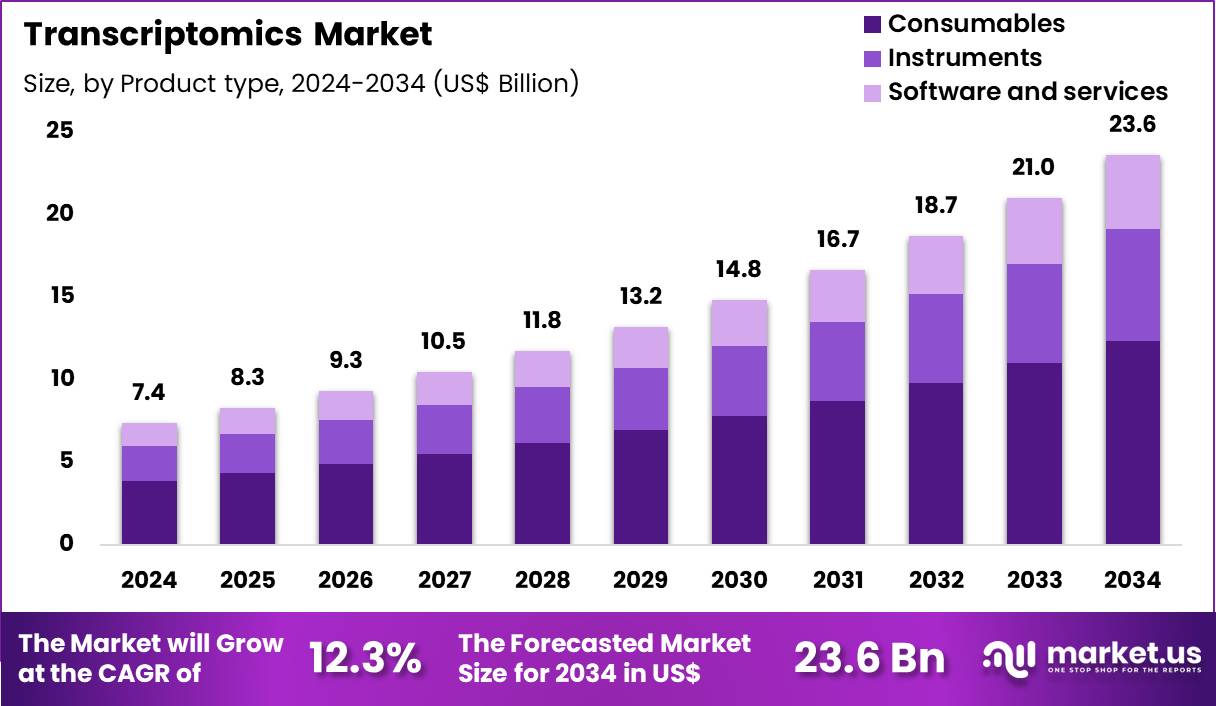

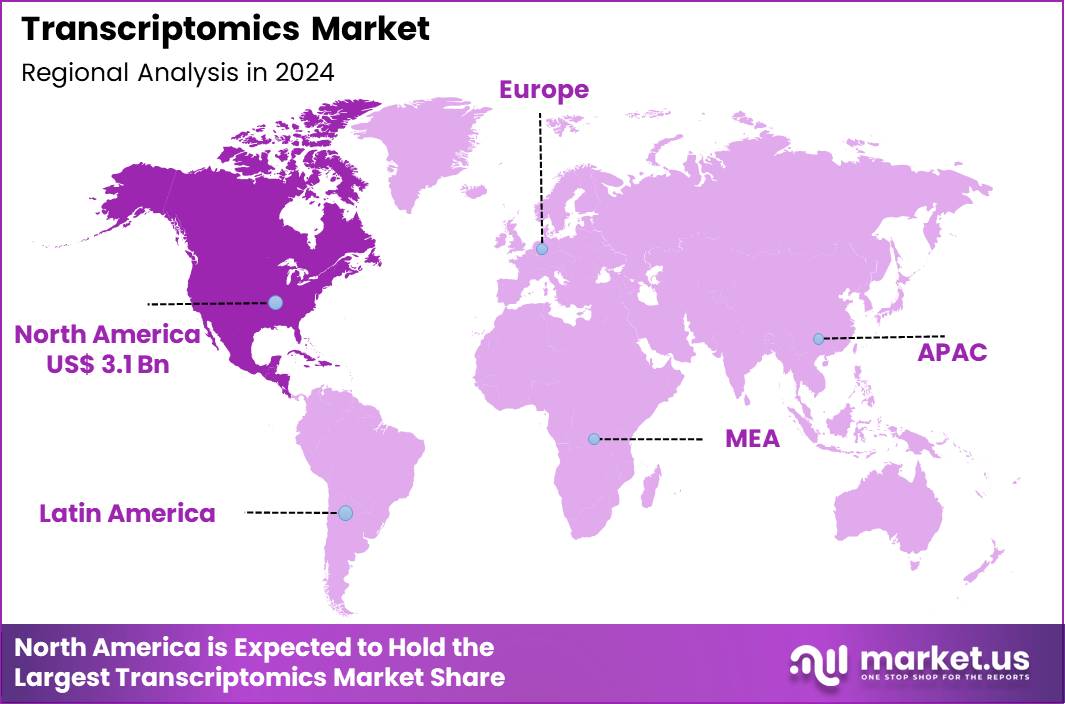

Global Transcriptomics Market size is expected to be worth around US$ 23.6 Billion by 2034 from US$ 7.4 Billion in 2024, growing at a CAGR of 12.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.1% share with a revenue of US$ 3.1 Billion.

Increasing demand for precision diagnostics and therapeutics propels the transcriptomics market as scientists leverage RNA sequencing to uncover dynamic gene expression profiles that inform disease mechanisms and treatment responses. Researchers apply bulk RNA sequencing to characterize transcriptomes in cancer biopsies, identifying oncogenic drivers and resistance pathways that guide immunotherapy selection.

Transcriptomics supports infectious disease research by quantifying viral RNA loads and host immune responses, facilitating antiviral drug screening and vaccine efficacy evaluations. Laboratories utilize microarray platforms to monitor gene expression changes in cardiovascular tissues, revealing molecular signatures of atherosclerosis progression for early intervention strategies.

These tools enable pharmacogenomic studies that assess drug-induced transcriptional alterations in hepatic cells, optimizing compound safety profiles during preclinical development. Clinicians integrate transcriptomic data into neurology workflows to profile neuronal gene activity in Alzheimer’s models, advancing biomarker discovery for cognitive decline prediction.

Manufacturers seize opportunities to innovate single-cell transcriptomics workflows that dissect cellular heterogeneity, broadening applications in immunology where analysts map lymphocyte activation states for autoimmune disorder therapies. Developers advance spatial transcriptomics platforms that preserve tissue architecture while capturing localized gene expression, opening avenues in developmental biology to study organogenesis at molecular resolution.

These advancements facilitate integration with multi-omics datasets, enhancing precision in regenerative medicine by identifying stem cell differentiation pathways. Opportunities emerge in automated library preparation systems that streamline high-throughput sequencing, supporting large-scale epidemiological studies of gene-environment interactions in metabolic diseases.

Companies invest in bioinformatics tools that analyze vast transcriptomic datasets, accelerating discovery of non-coding RNA functions in epigenetics. Recent trends emphasize CRISPR-based transcriptomic editing that validates gene targets in real time, positioning the market for breakthroughs in personalized oncology and rare genetic disorder treatments.

Key Takeaways

- In 2024, the market generated a revenue of US$ 7.4 billion, with a CAGR of 12.3%, and is expected to reach US$ 23.6 billion by the year 2034.

- The product type segment is divided into consumables, instruments and software & services, with consumables taking the lead with a market share of 52.4%.

- Considering technology, the market is divided into next-generation sequencing (NGS), microarray, polymerase chain reaction (PCR) and others. Among these, next-generation sequencing (NGS) held a significant share of 56.8%.

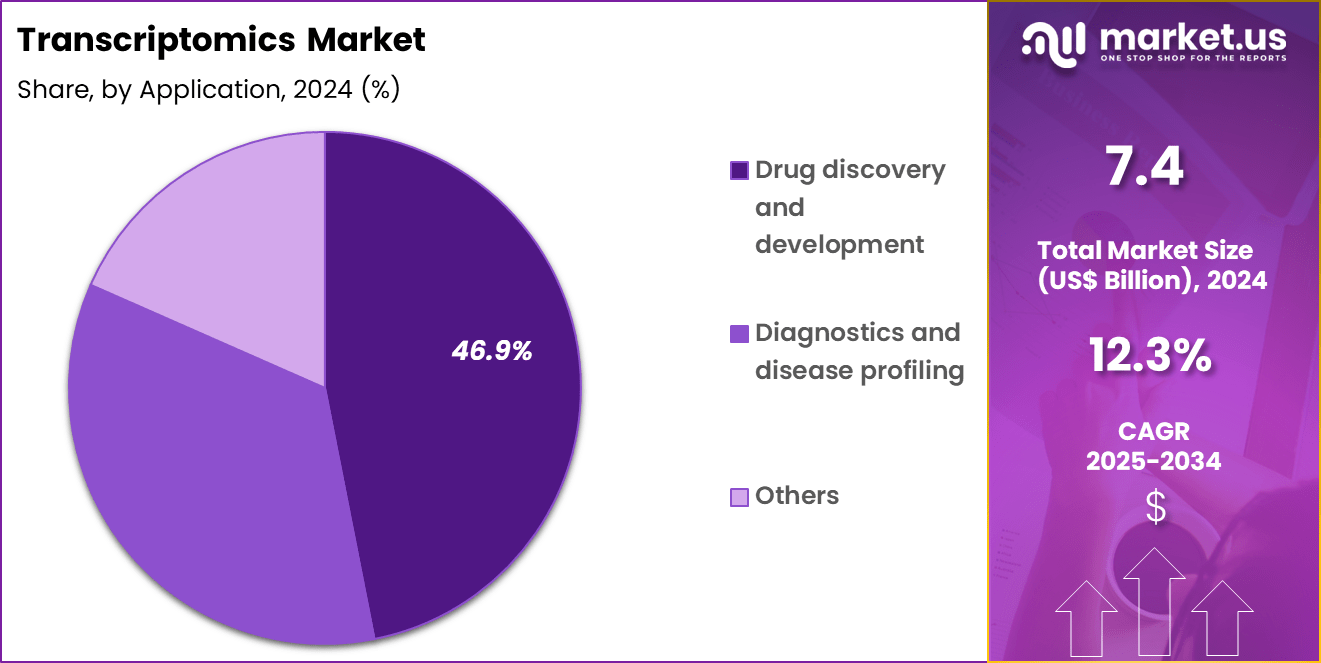

- Furthermore, concerning the application segment, the market is segregated into drug discovery & development, diagnostics & disease profiling and others. The drug discovery & development sector stands out as the dominant player, holding the largest revenue share of 46.9% in the market.

- The end-user segment is segregated into academic & research institutes, biotechnology companies, pharmaceutical companies and others, with the academic & research institutes segment leading the market, holding a revenue share of 41.6%.

- North America led the market by securing a market share of 42.1%.

Product Type Analysis

Consumables contributed 52.4% of growth within product type and remain the most recurring revenue driver in the transcriptomics market. Every sequencing workflow requires repeat purchase of library prep kits, reagents, enzymes, buffers, and lab plastics, which keeps consumption high across routine and high-throughput projects.

Large cohort studies increase per-project reagent burn rates, while QC checks, repeats, and optimization cycles further push reorder frequency. Single-cell and spatial workflows raise spend intensity because they use specialized chemistries and higher per-sample input. Many academic labs also keep more steps in-house to protect data continuity and shorten timelines, which increases direct procurement of kits and consumables.

Consumables align well with grant-funded budgets because labs often secure reagent funding more easily than new instrumentation. Falling sequencing costs expand total sample throughput, so reagent demand climbs even when per-run pricing trends downward. Automation in core labs increases run volume, and consumables scale directly with every additional batch processed.

Multi-site studies prefer standardized kits to reduce variability, which strengthens branded reagent adoption. Shelf-life limitations on enzymes and sensitive reagents also drive frequent replenishment. The segment is projected to stay dominant because consumables sit at the core of every transcriptomic experiment from extraction to library preparation.

Technology Analysis

Next-generation sequencing accounted for 56.8% of growth within technology and shapes the transcriptomics market through scalability and deep biological resolution. Researchers select NGS because RNA sequencing captures transcriptome-wide expression with strong sensitivity, enabling discovery of splice variants, novel transcripts, and low-abundance signals beyond microarray reach.

Declining sequencing costs support larger cohorts and repeated sampling across timepoints, which expands total run volume. Single-cell RNA sequencing also strengthens NGS demand because it depends on sequencing read depth to resolve cell-level heterogeneity and pathway shifts.

Core labs and shared facilities expand NGS pipelines to serve multiple departments, which improves utilization and supports consistent instrument throughput. Oncology, immunology, neuroscience, and infectious disease programs increasingly depend on RNA-seq outputs for biomarker discovery and mechanistic interpretation.

Faster alignment tools and cloud-based analysis reduce time-to-results, which makes NGS more practical for routine research. Multi-omics studies also reinforce NGS adoption because teams combine transcriptomics with genomics and epigenomics to build integrated disease models. The segment is expected to lead due to broad utility, high information yield, and strong fit with modern high-throughput study designs.

Application Analysis

Drug discovery and development represented 46.9% of growth within application and remain the most commercially impactful use area for transcriptomics. Pharma and biotech teams use expression profiling to identify targets, validate pathways, and confirm mechanisms of action early, which improves decision speed across preclinical stages.

Transcriptome data helps rank compounds by biological response rather than single markers, supporting smarter prioritization and fewer late-stage failures. Toxicology programs also use gene expression signatures to detect risk signals earlier, strengthening the value of transcriptomics in safety screening.

Precision medicine strategies further increase demand because sponsors use RNA-based biomarkers to stratify patients and predict response. Immuno-oncology and inflammation pipelines rely on pathway-level readouts, so transcriptomics supports both efficacy tracking and combination therapy design. Preclinical models generate expression data that links phenotypes to molecular drivers, improving translational confidence.

Outsourced CRO packages increasingly include transcriptomics to match accelerated timelines and multi-assay workflows. AI-led target discovery also raises dataset demand because model performance depends on large, well-annotated expression libraries. The segment is anticipated to remain strong due to pipeline expansion, higher molecule complexity, and the need for data-driven go or no-go decisions.

End-User Analysis

Academic and research institutes accounted for 41.6% of growth within end-users and serve as the largest base of transcriptomics experimentation. Universities and publicly funded centers run high volumes of discovery studies across disease biology, developmental research, and functional genomics, which sustains regular sequencing and profiling activity. Grant-funded initiatives and multi-year programs create steady purchasing cycles for reagents and access to shared sequencing platforms. Academic teams also prioritize broad exploratory designs, which aligns strongly with RNA-seq and multi-sample workflows.

Core facilities inside universities support many departments, increasing instrument utilization and consumable turnover at scale. Training programs continuously add new users with transcriptomics skill sets, expanding long-term market participation. Academic groups also pioneer single-cell and spatial protocols, which increases adoption of next-generation workflows and raises per-project consumable demand.

Collaboration networks promote multi-site dataset generation and cross-study validation, strengthening run volume and standardization needs. Data-sharing initiatives increase the utility of transcriptomic profiling by enabling comparative analysis across cohorts and regions. The segment is projected to remain dominant because academic research produces high diversity, high frequency demand that continuously refreshes method adoption.

Key Market Segments

By Product Type

- Consumables

- Instruments

- Software & Services

By Technology

- Next-Generation Sequencing (NGS)

- Microarray

- Polymerase Chain Reaction (PCR)

- Others

By Application

- Drug Discovery & Development

- Diagnostics & Disease Profiling

- Others

By End-user

- Academic & Research Institutes

- Biotechnology Companies

- Pharmaceutical Companies

- Others

Drivers

The shift toward precision oncology is driving the market

The transition from bulk tissue analysis to high-resolution molecular profiling in oncology is a primary driver for the transcriptomics market. In 2024, the National Cancer Institute (NCI) estimated that 2,001,140 new cancer cases were recorded in the US, many of which require advanced diagnostic tools to identify specific gene expression patterns. Transcriptomics provides essential insights into tumor heterogeneity, allowing clinicians to tailor therapies based on the unique RNA profile of a patient’s tumor.

Major technology providers have reported consistent demand for sequencing platforms; for instance, Illumina reported that its core revenue reached US$ 4.33 billion in fiscal year 2024. While overall revenue saw a slight decline from 2023, the underlying demand for high-throughput consumables remains robust as clinical labs integrate RNA-Seq into oncology workflows.

Furthermore, the National Institutes of Health (NIH) continues to fund large-scale genomic medicine initiatives that emphasize the clinical utility of the transcriptome. This regulatory and financial support encourages healthcare systems to adopt transcriptomic testing for biomarker discovery and patient stratification.

The ability to monitor dynamic changes in gene expression also makes transcriptomics invaluable for assessing therapeutic response in real-time. As a result, the integration of RNA-based diagnostics into personalized medicine protocols continues to expand the market’s reach.

Restraints

High data complexity and storage costs are restraining the market

The transcriptomics market is significantly restrained by the immense computational challenges and financial burdens associated with high-dimensional data management. A single-cell transcriptomics experiment can generate several terabytes of raw data, necessitating expensive high-performance computing (HPC) infrastructure and specialized bioinformaticians.

In 2024, government-funded studies highlighted that technical errors where gene expression is either missed or incorrectly merged remain major hurdles for data accuracy. These technical limitations require complex computational methods that can inadvertently introduce false correlations into the results.

Additionally, the high cost of instruments and specialized reagents continues to limit adoption in smaller research institutions. For example, 10x Genomics reported that its instrument revenue was US$ 92.7 million for the full year 2024, representing a decrease from US$ 123.5 million in 2023.

The lack of standardized protocols for data analysis also leads to variability between labs, complicating the process of large-scale data integration. Hospitals and research centers must also navigate strict data privacy regulations, such as the NIH Data Management and Sharing Policy, which adds administrative layers. These logistical and financial barriers prevent many facilities from transitioning from traditional methods to advanced transcriptomic workflows.

Opportunities

Advancements in spatial transcriptomics are creating growth opportunities

The emergence of spatial transcriptomics represents a major growth opportunity by enabling researchers to map gene expression within the original architecture of intact tissues. This technology overcomes the limitations of traditional single-cell sequencing, which requires tissue dissociation and loses critical spatial context.

In early 2024, 10x Genomics reported that its first-quarter revenue grew to US$ 141 million, a 5% increase year-over-year driven primarily by spatial revenue. This growth was bolstered by the launch of new products like Visium HD, which offers whole-transcriptome discovery at single-cell scale resolution.

Governments are also recognizing the potential of this field; for instance, the European Research Council (ERC) announced its 2025 Consolidator Grants totaling €728 million to support cutting-edge research. These spatial insights are particularly valuable for understanding the tumor microenvironment and neurodegenerative diseases where cell-to-cell interaction is key.

The opportunity also extends to the plant sciences, where the National Science Foundation (NSF) supports functional genomics research. As spatial technologies become more automated, they are expected to become a standard tool in both basic research and clinical pathology. Ultimately, the ability to visualize gene activity in situ opens new frontiers for drug discovery and diagnostic accuracy.

Impact of Macroeconomic / Geopolitical Factors

Global economic expansions direct substantial investments toward genomic research, invigorating the transcriptomics market as laboratories ramp up RNA sequencing projects to advance drug discovery in prosperous regions. Executives align strategies with rising R&D budgets in biotech hubs, which accelerates adoption of microarray technologies amid favorable monetary conditions.

Despite these drivers, persistent international inflation elevates reagent and instrument expenses, compelling firms to streamline operations in resource-limited settings. Geopolitical rivalries in supply-dominant territories fracture access to critical sequencing chips, urging multinational entities to confront logistical hurdles in fragmented global chains.

Leaders adapt by forging resilient sourcing ties in neutral zones, which refines adaptability and unveils novel efficiency pathways. Current US tariffs, levying duties from 20% to 100% on imported biotechnology equipment and pharmaceuticals from nations like China under Section 301 and 232 measures, amplify procurement burdens for overseas-dependent players.

American companies leverage this framework by bolstering native manufacturing setups, which catalyzes job growth and harmonizes with innovation mandates. Revolutionary strides in single-cell transcriptomics consistently empower the sector’s resilience, unlocking transformative insights and lucrative opportunities for stakeholders across borders.

Latest Trends

The integration of AI and machine learning for data interpretation is a recent trend

A dominant trend in late 2024 and early 2025 is the widespread integration of Artificial Intelligence (AI) and Machine Learning (ML) to interpret the massive datasets generated by transcriptomics. These AI-driven algorithms are now being used to automate cell segmentation and identify rare cell subtypes that were previously undetectable.

In November 2024, the FDA granted approval for the MI Cancer Seek test, which is the first and only simultaneous Whole Exome and Whole Transcriptome-based assay with companion diagnostic indications. This test leverages AI to analyze molecular blueprints and identify patients who may benefit from specific targeted therapies.

Furthermore, major players like Tempus AI launched their FDA-approved xT CDx test in January 2025 to advance precision medicine through the practical application of AI. These systems allow for the simultaneous analysis of thousands of genes while using machine learning to filter out noise and improve signal detection.

The trend toward multimodal data integration—combining transcriptomics with proteomics and imaging—is also accelerating. This technological convergence is reducing the time required for biomarker discovery from months to weeks. Consequently, the role of the computational “dry lab” is becoming as critical as the experimental “wet lab” in the modern transcriptomics ecosystem.

Regional Analysis

North America is leading the Transcriptomics Market

North America holds a 42.1% share of the global transcriptomics market, reflecting robust expansion in 2024 driven by advancements in next-generation sequencing technologies and their integration into clinical diagnostics. This growth stems from substantial investments in biotechnology infrastructure, particularly in the United States, where leading companies such as Illumina and Thermo Fisher Scientific have enhanced RNA sequencing capabilities to support precision medicine initiatives.

The region’s dominance arises from a well-established ecosystem of academic institutions and research centers collaborating on gene expression studies for oncology and infectious diseases. Increased adoption of single-cell transcriptomics has accelerated discoveries in cellular heterogeneity, enabling targeted therapies and boosting market demand.

Government support through agencies like the National Institutes of Health has fueled innovation by funding large-scale omics projects that incorporate transcriptomic data. Collaborative efforts between pharmaceutical firms and universities have streamlined drug development pipelines, reducing time-to-market for RNA-based therapeutics.

Furthermore, regulatory approvals from the FDA for transcriptomic biomarkers in companion diagnostics have encouraged commercial applications. In 2023, the NIH awarded $50.3 million for multi-omics research encompassing transcriptomics to study human health and disease, underscoring federal commitment to this field.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project substantial expansion in the Asia Pacific region’s market for gene expression analysis during the forecast period, propelled by escalating biotechnology investments across countries like China, India, and Japan. Emerging economies prioritize genomics research to address rising chronic disease burdens, fostering innovation in RNA profiling tools. Key players establish regional hubs to capitalize on lower operational costs and vast patient cohorts for clinical trials.

Governments implement strategic policies to enhance domestic capabilities in molecular biology, attracting international partnerships. Researchers leverage advanced sequencing platforms to explore disease mechanisms, driving demand for consumables and services. Pharmaceutical companies integrate these technologies into drug discovery, accelerating personalized treatment development.

Academic institutions collaborate with industry to translate findings into practical applications, strengthening the supply chain. In 2022, China’s National Natural Science Foundation allocated 33 billion yuan for basic science research, including projects in life sciences that advance transcriptomic studies.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Transcriptomics market drive growth by expanding sequencing and spatial gene expression solutions that reveal disease biology at higher resolution and accelerate biomarker discovery. Companies strengthen adoption by simplifying workflows through integrated sample prep, automation, and user-friendly analysis software that reduces time from RNA to insight.

Commercial strategies emphasize partnerships with biopharma and research institutes to support large-scale studies in oncology, immunology, and neuroscience. Innovation priorities include single-cell platforms, higher sensitivity chemistry, and scalable cloud analytics that enable broader translational research use.

Market expansion targets emerging genomics hubs where funding and infrastructure for omics research continue to rise. Illumina operates as a leading participant with a broad sequencing ecosystem, global installed base, and strong innovation engine that supports high-throughput transcriptomic research across academic and clinical environments.

Top Key Players

- Illumina, Inc.

- Thermo Fisher Scientific

- 10x Genomics

- Agilent Technologies, Inc.

- BGI

- Bio Rad Laboratories, Inc.

- NanoString Technologies

- Pacific Biosciences of California, Inc.

- QIAGEN N.V.

- Roche

Recent Developments

- In 2024, 10x Genomics reported revenue of roughly US$ 612 million, supported by its strong position in spatial transcriptomics. Platforms such as Visium and Xenium are increasingly adopted as researchers move beyond bulk RNA sequencing toward spatially resolved gene expression analysis. This capability allows precise localization of transcript activity within tissues, which is becoming critical for understanding disease biology, tumor heterogeneity, and drug response during discovery and development.

- During 2024, Thermo Fisher Scientific continued to strengthen its transcriptomics offering within the Life Sciences Solutions segment by expanding Applied Biosystems and Invitrogen product lines. Developments such as MagMAX nucleic acid isolation kits and next generation qPCR systems support highly sensitive detection of low abundance RNA targets. These tools underpin transcriptomic research by enabling reliable sample preparation and quantification across clinical research, infectious disease studies, and translational science workflows.

Report Scope

Report Features Description Market Value (2024) US$ 7.4 Billion Forecast Revenue (2034) US$ 23.6 Billion CAGR (2025-2034) 12.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Consumables, Instruments and Software & Services), By Technology (Next-Generation Sequencing (NGS), Microarray, Polymerase Chain Reaction (PCR) and Others), By Application (Drug Discovery & Development, Diagnostics & Disease Profiling and Others), By End-User (Academic & Research Institutes, Biotechnology Companies, Pharmaceutical Companies and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Illumina, Inc., Thermo Fisher Scientific, 10x Genomics, Agilent Technologies, Inc., BGI, Bio Rad Laboratories, Inc., NanoString Technologies, Pacific Biosciences of California, Inc., QIAGEN N.V., Roche Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Illumina, Inc.

- Thermo Fisher Scientific

- 10x Genomics

- Agilent Technologies, Inc.

- BGI

- Bio Rad Laboratories, Inc.

- NanoString Technologies

- Pacific Biosciences of California, Inc.

- QIAGEN N.V.

- Roche