Global Clinical Oncology Next Generation Sequencing Market By Workflow Type (NGS Sequencing, NGS Pre-Sequencing, and NGS Data Analysis), By Technology (Whole Genome Sequencing, Targeted Sequencing & Resequencing, and Whole Exome Sequencing), By Application (Screening (Sporadic Cancer and Inherited Cancer), Companion Diagnostics, and Others), By End-use (Hospitals & Clinics and Laboratories), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 141080

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

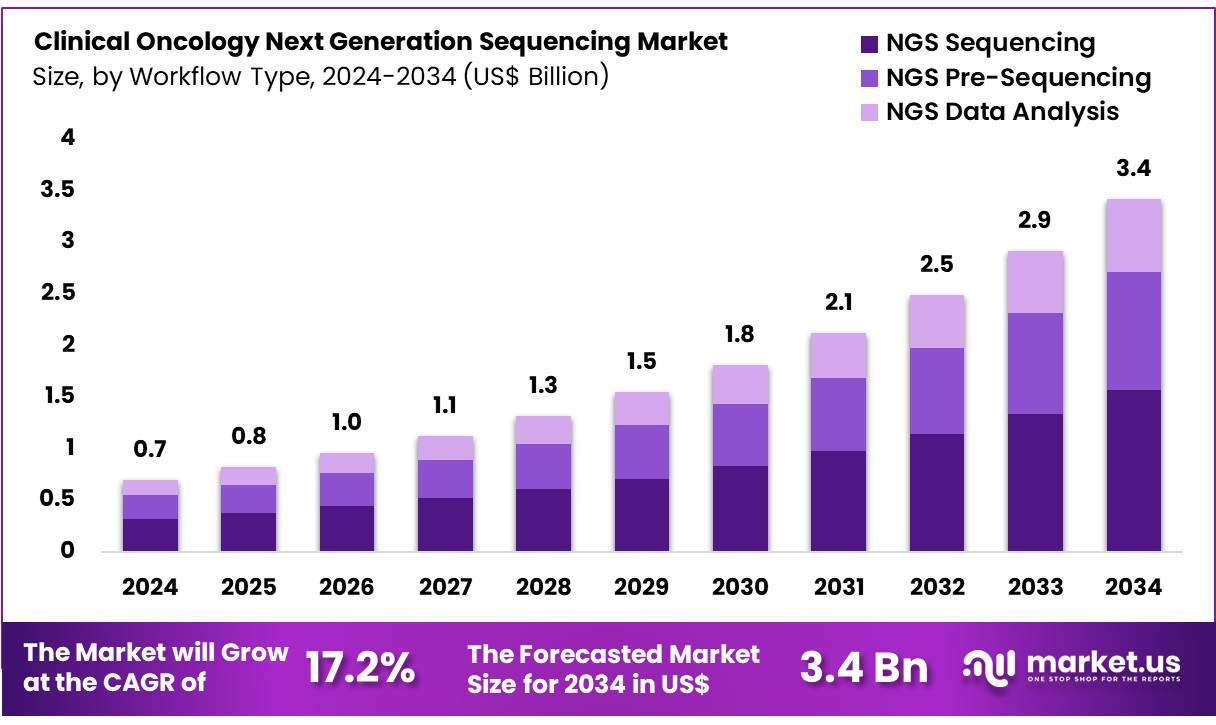

Global Clinical Oncology Next Generation Sequencing Market size is expected to be worth around US$ 3.4 Billion by 2034 from US$ 0.7 Billion in 2024, growing at a CAGR of 17.2% during the forecast period 2025 to 2034.

Increasing advancements in cancer research and the rising need for precision oncology treatments are driving the growth of the clinical oncology next-generation sequencing (NGS) market. NGS technologies enable comprehensive genetic analysis of tumors, helping clinicians identify mutations, genetic alterations, and biomarkers that influence cancer progression and response to treatment.

These insights support personalized treatment strategies, particularly in targeted therapies and immunotherapies, by providing more accurate and actionable information about a patient’s specific cancer type. In May 2023, researchers from UCLA and the Children’s Hospital of Philadelphia (CHOP) developed a cutting-edge computational tool named IRIS (Isoform Peptide from RNA Splicing for Immunotherapy Target Screening).

This tool identifies tumor antigens derived from alternative RNA splicing, broadening the scope of potential targets for cancer immunotherapy. Recent trends in the market show an increasing integration of NGS with liquid biopsy technologies, which offer non-invasive ways to track tumor DNA and monitor treatment response. The growing adoption of companion diagnostics and the expanding pipeline of cancer immunotherapies provide significant opportunities for NGS applications in clinical oncology.

As the cost of sequencing continues to decrease and the technology becomes more accessible, NGS will continue to transform cancer diagnostics, facilitating the development of more effective and tailored therapies. The clinical oncology NGS market is poised for substantial growth as these innovations reshape cancer care.

Key Takeaways

- In 2024, the market for clinical oncology next generation sequencing generated a revenue of US$ 0.7 billion, with a CAGR of 17.2%, and is expected to reach US$ 3.4 billion by the year 2033.

- The workflow type segment is divided into NGS sequencing, NGS pre-sequencing, and NGS data analysis, with NGS sequencing taking the lead in 2023 with a market share of 45.8%.

- Considering technology, the market is divided into whole genome sequencing, targeted sequencing & resequencing, and whole exome sequencing. Among these, targeted sequencing & resequencing held a significant share of 48.6%.

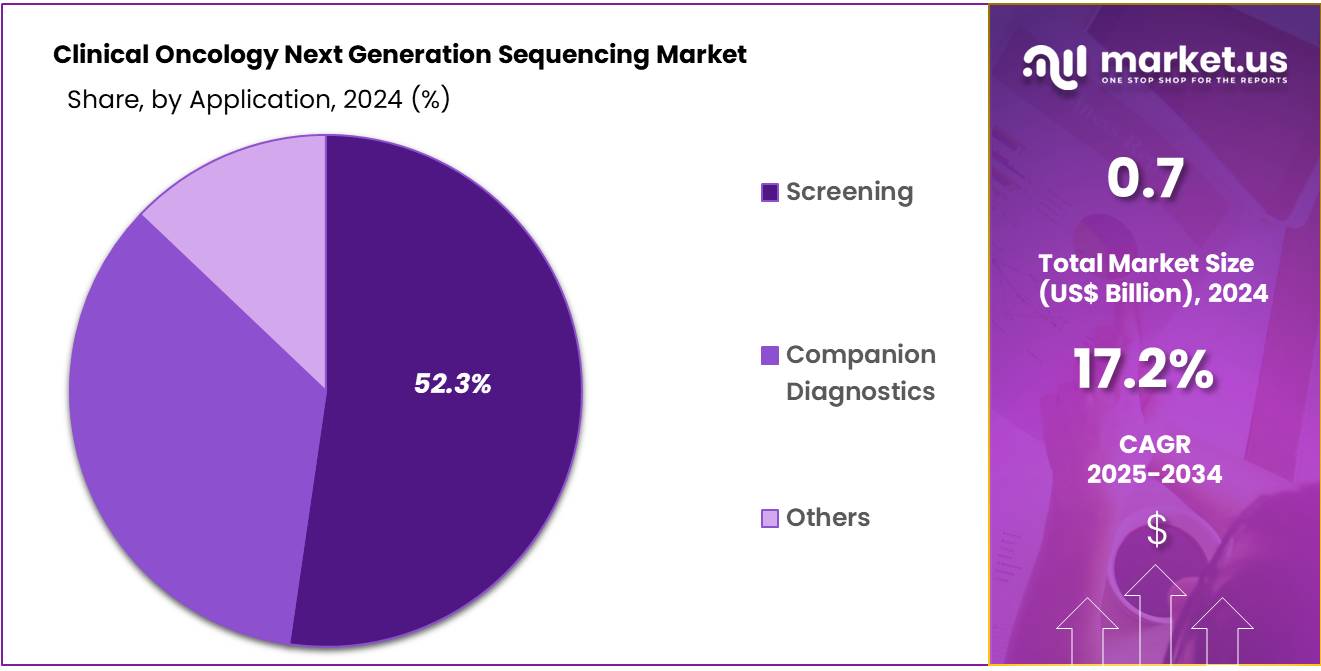

- Furthermore, concerning the application segment, the market is segregated into screening, companion diagnostics, and others. The screening sector stands out as the dominant player, holding the largest revenue share of 52.3% in the clinical oncology next generation sequencing market.

- The end-use segment is segregated into hospitals & clinics and laboratories, with the laboratories segment leading the market, holding a revenue share of 57.4%.

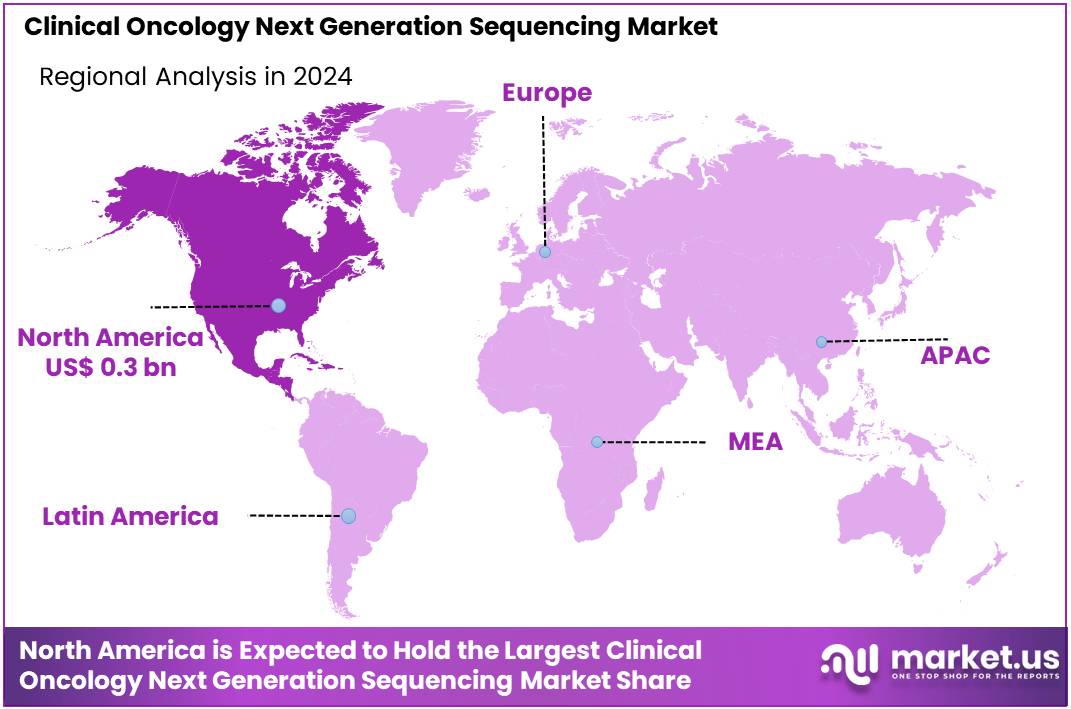

- North America led the market by securing a market share of 41.3% in 2024.

Workflow Type Analysis

The NGS sequencing segment led in 2023, claiming a market share of 45.8% owing to its increasing application in cancer research and diagnosis. NGS sequencing allows for high-throughput, comprehensive genomic analysis, which is crucial for understanding the genetic mutations and alterations that contribute to cancer.

As personalized medicine and precision oncology become more prevalent, the demand for accurate and detailed genomic data is anticipated to drive the growth of NGS sequencing. The ability to identify and target specific cancer-related genes using NGS technology will likely support the adoption of this segment, especially in oncology treatment planning.

Technology Analysis

The targeted sequencing & resequencing held a significant share of 48.6% due to its ability to focus on specific genes or regions of interest within the genome. This targeted approach enables more cost-effective and efficient sequencing, which is critical for cancer diagnosis and treatment.

As the focus shifts toward more tailored therapies, targeted sequencing and resequencing technologies will likely play a pivotal role in identifying genetic mutations that influence cancer development and progression. The increasing use of targeted therapies based on genetic markers is expected to fuel the demand for targeted sequencing technologies in oncology.

Application Analysis

The screening segment had a tremendous growth rate, with a revenue share of 52.3% owing to the increasing emphasis on early cancer detection. NGS-based screening allows for the identification of genetic mutations and biomarkers associated with cancer at early stages, which is critical for improving patient outcomes.

With advancements in liquid biopsy and non-invasive screening methods, this segment is expected to witness considerable adoption in routine cancer screenings. Additionally, the rise of personalized cancer treatments based on genetic findings further supports the growth of screening applications within the clinical oncology next-generation sequencing market.By End-Use Analysis

The laboratories segment grew at a substantial rate, generating a revenue portion of 57.4% due to the increasing use of advanced genomic testing in research and clinical settings. Laboratories, including those in hospitals and independent diagnostic centers, are expected to adopt NGS technologies to improve cancer diagnosis, prognosis, and treatment monitoring.

The need for more efficient and accurate genomic data to guide personalized oncology treatments is anticipated to drive the demand for NGS-based diagnostic services. As cancer care increasingly moves towards precision medicine, laboratories’ role in providing comprehensive genetic analysis will likely expand, fueling growth in this segment.

Key Market Segments

Workflow Type

- NGS Sequencing

- NGS Pre-Sequencing

- NGS Data Analysis

Technology

- Whole Genome Sequencing

- Targeted Sequencing & Resequencing

- Whole Exome Sequencing

Application

- Screening

- Sporadic Cancer

- Inherited Cancer

- Companion Diagnostics

- Others

End-use

- Hospitals & Clinics

- Laboratories

Drivers

Increasing Prevalence of Cancer Driving the Clinical Oncology Next Generation Sequencing Market

Increasing prevalence of cancer is anticipated to drive the clinical oncology next generation sequencing market significantly. The International Agency for Research on Cancer projected nearly 27.5 million new cancer cases globally by 2040, highlighting the growing burden of this disease. Next-generation sequencing (NGS) enables detailed analysis of cancer genomes, identifying rare and unique mutations that were previously undetectable.

This advanced technology helps detect hereditary cancer risks and provides molecular-level insights to guide personalized therapies. Oncologists increasingly rely on NGS to tailor treatment plans, ensuring higher efficacy and reduced side effects for patients. The growing demand for precision medicine further boosts the adoption of clinical oncology NGS, particularly in identifying actionable biomarkers.

Technological advancements, such as single-cell sequencing, enhance the resolution and accuracy of cancer diagnostics. Expanding collaborations between research institutions and pharmaceutical companies accelerate the development of NGS-driven cancer therapies. These trends underscore the critical role of NGS in transforming cancer care and addressing the rising global cancer incidence.

Restraints

High Costs Are Restraining the Clinical Oncology Next Generation Sequencing Market

High costs are restraining the clinical oncology next generation sequencing market. Implementing NGS technologies requires substantial investments in equipment, reagents, and computational tools for data analysis. Many healthcare facilities, especially in low-income regions, face challenges in adopting this technology due to financial constraints.

Additionally, the cost of training specialists to operate NGS platforms and interpret complex genomic data adds to the economic burden. Limited insurance reimbursement for NGS-based cancer diagnostics further discourages widespread adoption. The high cost of sequencing tests also makes it less accessible to patients in cost-sensitive markets.

Smaller labs struggle to scale operations and compete with established players due to the financial challenges associated with maintaining NGS infrastructure. Addressing these barriers requires government subsidies, expanded reimbursement policies, and cost-effective innovations to improve accessibility.

Opportunities

Growing Advancements in Biomarkers as an Opportunity for the Clinical Oncology Next Generation Sequencing Market

Growing advancements in biomarkers present a significant opportunity for the clinical oncology next generation sequencing market. In August 2022, Thermo Fisher Scientific introduced its CE-IVD (IVDD)-certified NGS Analysis and Test Software, aiming to expand precision oncology biomarker testing. This innovative tool enables healthcare providers to interpret genomic test results rapidly, enhancing cancer diagnostics and treatment planning. Biomarker discoveries play a critical role in identifying cancer subtypes, enabling personalized therapy approaches.

NGS platforms integrate advanced biomarker panels that guide treatment decisions and predict therapy responses more accurately. Partnerships between diagnostic companies and academic institutions accelerate biomarker validation and deployment. Expanding research into liquid biopsy biomarkers, such as circulating tumor DNA, further enhances the scope of NGS applications in oncology. These advancements highlight the transformative impact of biomarkers in advancing the adoption of clinical oncology NGS and improving patient outcomes globally.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the clinical oncology next generation sequencing (NGS) market. On the positive side, increasing healthcare investments, particularly in precision medicine and personalized treatments, fuel the demand for advanced NGS technologies. As cancer rates rise globally, the need for more precise diagnostic tools to guide treatment decisions accelerates the adoption of NGS.

Additionally, growing awareness of the benefits of genomic profiling and targeted therapies contributes to market growth. However, economic recessions or healthcare budget cuts may limit access to high-cost diagnostic technologies, especially in resource-constrained settings. Geopolitical issues, such as regulatory variations across countries, trade barriers, and political instability, can disrupt the supply chain and delay product availability.

Furthermore, shifting healthcare policies and reimbursement changes can impact the affordability of these advanced diagnostics. Despite these challenges, the ongoing advancements in cancer genomics and the global emphasis on early detection and personalized treatments ensure a promising future for the NGS market in oncology.

Latest Trends

Surge in Partnerships and Collaborations Driving the Market

Rising partnerships and collaborations are fueling significant growth in the clinical oncology next generation sequencing market. High demand for innovative, precision oncology solutions is expected to drive companies to collaborate and share expertise. These strategic alliances enable the integration of diverse technologies, such as tissue and blood biomarkers, digital pathology solutions, and sequencing technologies, which enhance the capabilities of NGS in oncology.

The increasing focus on developing companion diagnostics to support personalized cancer therapies is likely to further accelerate market expansion. In February 2023, F. Hoffmann-La Roche Ltd strengthened its collaboration with Janssen Biotech Inc. to advance the development of companion diagnostics for precision therapies.

The expanded partnership focuses on integrating a diverse range of diagnostics, improving the overall efficiency and accuracy of cancer treatment decisions. As partnerships continue to grow, the market is anticipated to benefit from enhanced technological capabilities, driving innovation and market growth in clinical oncology NGS.

Regional Analysis

North America is leading the Clinical Oncology Next Generation Sequencing Market

North America dominated the market with the highest revenue share of 41.3% owing to increasing cancer cases and advancements in precision medicine. A 2022 WebMD report highlighted that cancer causes over 600,000 deaths annually in the U.S. and approximately 80,000 in Canada, underscoring the urgent need for innovative diagnostic and therapeutic approaches.

The rising adoption of NGS technologies in clinical oncology enabled healthcare providers to identify genetic mutations with greater precision, supporting personalized treatment plans. Expanding research initiatives in genomics and collaborations between biotechnology companies and research institutions further accelerated the adoption of NGS. Favorable regulatory frameworks and government funding for cancer research also contributed to market growth.

The integration of artificial intelligence in genomic data analysis enhanced the efficiency and accuracy of NGS workflows, attracting widespread adoption. Additionally, increasing awareness among oncologists and patients about the benefits of molecular profiling boosted the demand for NGS-based diagnostics. Strong healthcare infrastructure and access to advanced technologies in the U.S. and Canada played a significant role in driving market expansion.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rising cancer prevalence and increasing investments in advanced diagnostic technologies. Expanding healthcare infrastructure in countries like China, India, and Japan is expected to improve access to NGS-based solutions. Government initiatives promoting precision medicine and cancer genomics research are likely to support market growth.

Collaborations between global NGS technology providers and regional healthcare institutions are projected to enhance the availability and affordability of advanced sequencing systems. The growing middle-class population and increasing healthcare expenditure in emerging economies are anticipated to boost demand for personalized cancer treatments. Rising awareness about the benefits of early detection and targeted therapies is expected to drive adoption of NGS-based diagnostics.

Medical tourism in the region, fueled by cost-effective cancer care solutions, is likely to attract patients seeking advanced diagnostics. Technological advancements in sequencing platforms and bioinformatics tools are anticipated to improve the efficiency of NGS, further strengthening market growth in Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the clinical oncology next-generation sequencing market focus on developing advanced sequencing platforms to improve the accuracy and speed of cancer genome analysis. Companies invest heavily in research and development to expand the range of actionable insights for personalized cancer therapies. Partnerships with pharmaceutical companies and research institutions help integrate sequencing solutions into clinical trials and precision medicine programs.

Geographic expansion into emerging markets with increasing investments in oncology care supports further market growth. Many players also emphasize regulatory compliance and cost-effective solutions to enhance accessibility and adoption among healthcare providers.

Illumina, Inc. is a leading company in this market, offering cutting-edge sequencing platforms such as the NovaSeq and NextSeq systems. The company focuses on innovation by providing robust tools for comprehensive tumor profiling and molecular diagnostics. Illumina’s strong global presence and commitment to advancing cancer genomics establish it as a key player in the field of next-generation sequencing for oncology.

Top Key Players

- Thermo Fisher Scientific

- Perkin Elmer

- Myriad Genetics

- Illumina, Inc.

- Foundation Medicine

- Hoffmann-La Roche Ltd

- Beijing Genomics Institute

- Agilent Technologies

Recent Developments

- In October 2024, 4baseCare, in collaboration with Innovate Life Sciences, expanded its operations to Dubai by setting up a state-of-the-art genomics lab. This growth was fueled by a recent US$ 6 million investment from Yali Capital. The lab will focus on providing personalized cancer treatment options through cutting-edge genetic testing solutions, including whole exome sequencing and specialized cancer gene panels.

- In June 2023, Illumina Inc, a leader in DNA sequencing and array-based technologies, launched PrimateAI-3D, an advanced artificial intelligence algorithm designed to predict hereditary disease-causing mutations with unmatched accuracy.

- In May 2022, Berry Oncology unveiled the HIFI System, an innovative liquid biopsy technology designed to revolutionize early cancer detection. This self-iterative approach enables precise tumor screening and facilitates timely treatment for patients, significantly improving cancer care.

Report Scope

Report Features Description Market Value (2024) US$ 0.7 billion Forecast Revenue (2033) US$ 3.4 billion CAGR (2025-2034) 17.2% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Workflow Type (NGS Sequencing, NGS Pre-Sequencing, and NGS Data Analysis), By Technology (Whole Genome Sequencing, Targeted Sequencing & Resequencing, and Whole Exome Sequencing), By Application (Screening (Sporadic Cancer and Inherited Cancer), Companion Diagnostics, and Others), By End-use (Hospitals & Clinics and Laboratories) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Perkin Elmer, Myriad Genetics, Illumina, Inc., Foundation Medicine, F. Hoffmann-La Roche Ltd, Beijing Genomics Institute, and Agilent Technologies. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Clinical Oncology Next Generation Sequencing MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Clinical Oncology Next Generation Sequencing MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific

- Perkin Elmer

- Myriad Genetics

- Illumina, Inc.

- Foundation Medicine

- Hoffmann-La Roche Ltd

- Beijing Genomics Institute

- Agilent Technologies