Biopharma Market By Product Type (Immunomodulators (Cytokines and Monoclonal Antibodies), Enzymes (Hyrolyases and Lyases), Vaccines (Recombinant/Subunit/ Conjugate, Inactivated, and Live Attenuated), Hormones (Insulin, Human Growth Hormones, and Thyroid Stimulating Hormones)), By Application (Cardiology, Respiratory, Oncology, and Others), By End-user (Hospital Pharmacies, Online Pharmacies, and Drug Stores & Retail Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139944

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

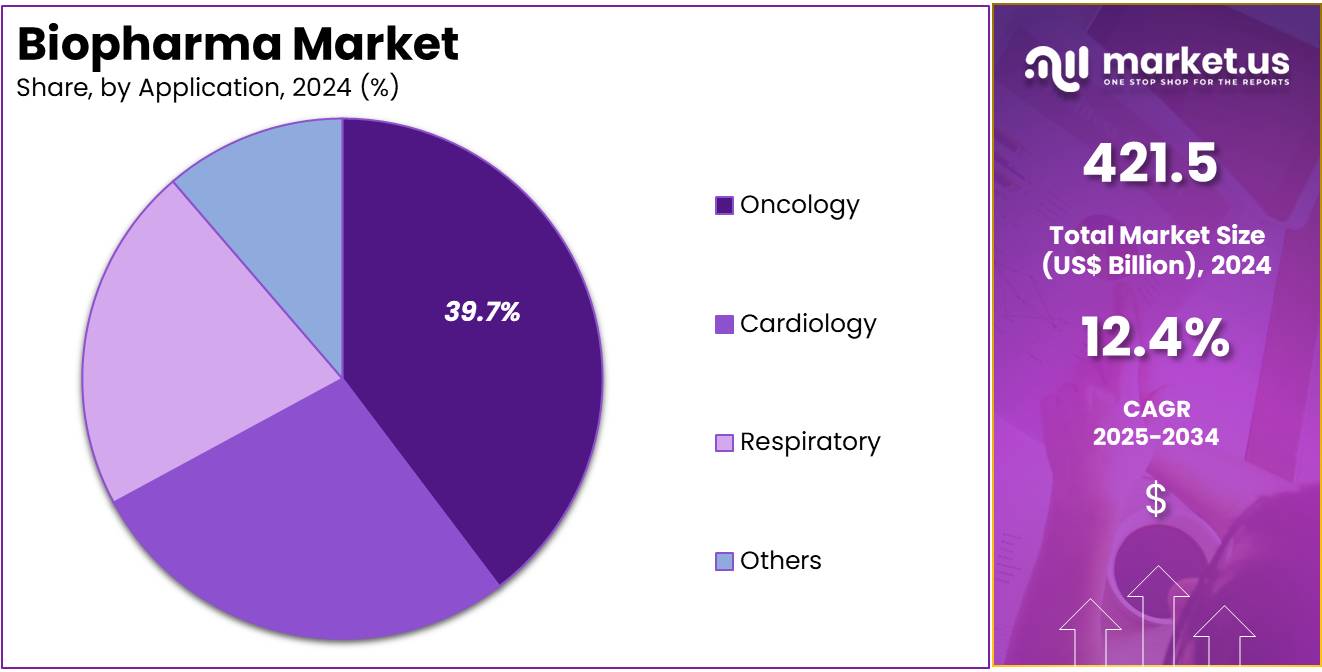

The Biopharma Market Size is expected to be worth around US$ 1356.6 billion by 2034 from US$ 421.5 billion in 2024, growing at a CAGR of 12.4% during the forecast period 2025 to 2034.

Increasing demand for innovative therapies and the rising prevalence of chronic and infectious diseases are driving the growth of the biopharma market. The biopharmaceutical industry, which focuses on developing drugs derived from biological sources, plays a pivotal role in providing treatments for a wide range of diseases, including cancer, autoimmune disorders, and infectious diseases.

The complexity of drug development and the need for targeted therapies create substantial opportunities for biopharma companies to invest in advanced technologies like gene therapy, monoclonal antibodies, and biologics. A 2022 World Health Organization (WHO) study estimated that the cost of developing a new pharmaceutical drug can range anywhere between USD 43.4 million and USD 4.2 billion, depending on research complexity and development stages.

This highlights the significant investments required but also the high potential returns in the biopharma sector. The WHO’s 2022 Global Vaccine Report indicated that, in 2021, the global vaccine industry distributed approximately 16 million doses of 47 different vaccines produced by 94 manufacturers worldwide, demonstrating the growing role of biopharma in addressing public health challenges. Recent trends show increased focus on biologics, particularly in oncology and immunology, due to their potential to offer more effective and personalized treatment options.

The rise in biologics and biosimilars is creating new opportunities for market growth, as these treatments provide cost-effective alternatives to traditional drugs. As biopharma companies continue to advance cutting-edge research and expand their product portfolios, the market is set to experience continued innovation and growth.

Key Takeaways

- In 2024, the market for Biopharma generated a revenue of US$ 421.5 billion, with a CAGR of 12.4%, and is expected to reach US$ 1356.6 billion by the year 2034.

- The product type segment is divided into immunomodulators, enzymes, vaccines, hormones, with immunomodulators taking the lead in 2024 with a market share of 42.5%.

- Considering application, the market is divided into cardiology, respiratory, oncology, and others. Among these, oncology held a significant share of 39.7%.

- Furthermore, concerning the end-user segment, the market is segregated into hospital pharmacies, online pharmacies, and drug stores & retail pharmacies. The hospital pharmacies sector stands out as the dominant player, holding the largest revenue share of 53.2% in the Biopharma market.

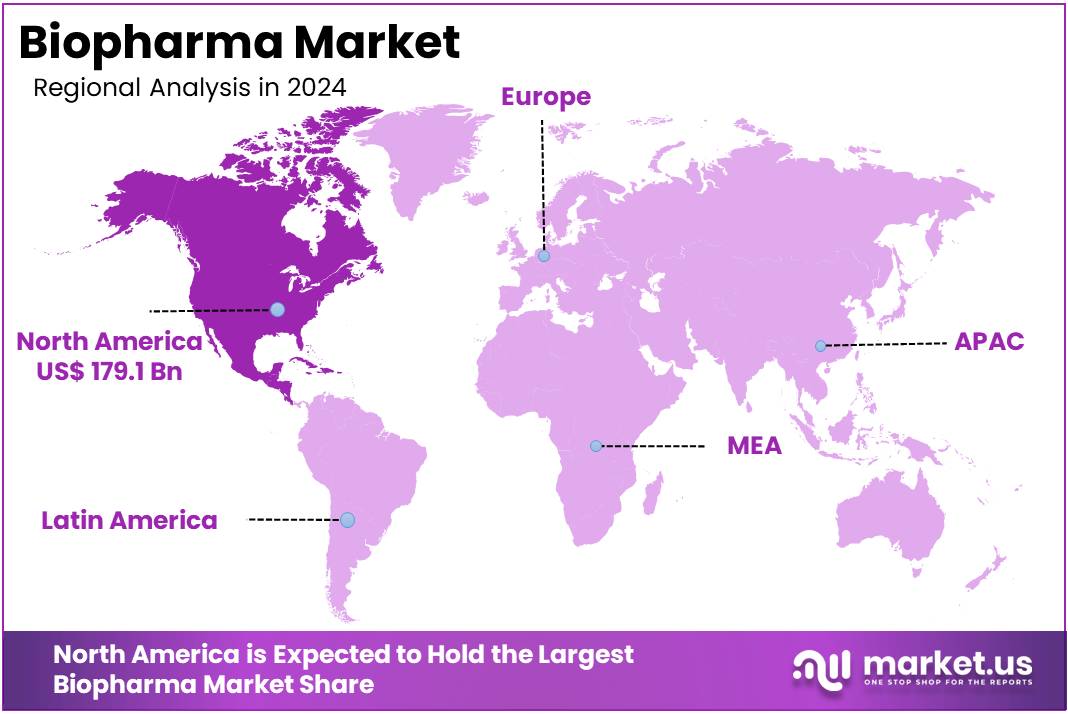

- North America led the market by securing a market share of 42.5% in 2024.

Product Type Analysis

The immunomodulators segment led in 2024, claiming a market share of 42.5% owing to increasing research into autoimmune diseases, inflammatory conditions, and cancer fuels demand for these therapies. Immunomodulators, which help regulate the immune system, are anticipated to become integral in treating diseases that involve immune dysfunction, such as rheumatoid arthritis, multiple sclerosis, and lupus. Their role in oncology, particularly in enhancing the body’s immune response against cancer, is projected to drive further adoption.

Additionally, the growing focus on personalized medicine and biologic therapies is likely to increase the use of immunomodulators in precision treatment, further contributing to the expansion of this segment. As the global burden of chronic diseases rises, the immunomodulators segment is projected to experience substantial growth.

Application Analysis

The oncology held a significant share of 39.7% as advancements in cancer treatments continue to evolve. The increasing prevalence of various cancer types, coupled with innovations in targeted therapies, immunotherapies, and personalized medicine, is expected to drive demand for oncology products.

Biopharmaceutical companies are focusing on developing more effective and less toxic treatments to improve patient outcomes, leading to significant investments in cancer research and drug development. As cancer continues to be one of the leading causes of death globally, the oncology segment is anticipated to grow as new therapies targeting specific cancer types emerge, offering greater hope for successful treatments.

End-user Analysis

The hospital pharmacies segment had a tremendous growth rate, with a revenue share of 53.2% as hospitals continue to play a central role in patient care and treatment delivery. Hospital pharmacies are critical in providing personalized medication regimens, managing complex drug therapies, and ensuring patient safety, all of which contribute to their growth.

The increasing demand for specialized treatments, such as biologics, immunotherapies, and advanced oncology drugs, is likely to further drive the growth of this segment. Additionally, the rising number of hospitals and medical institutions, especially in emerging markets, and the increasing prevalence of chronic diseases that require long-term drug management, will propel the hospital pharmacies segment’s expansion in the biopharma market.

Key Market Segments

By Product Type

- Immunomodulators

- Cytokines

- Monoclonal Antibodies

- Enzymes

- Hyrolyases

- Lyases

- Vaccines

- Recombinant/Subunit/ Conjugate

- Inactivated

- Live Attenuated

- Hormones

- Insulin

- Human Growth Hormones

- Thyroid Stimulating Hormones

By Application

- Cardiology

- Respiratory

- Oncology

- Others

By End-user

- Hospital Pharmacies

- Online Pharmacies

- Drug Stores & Retail Pharmacies

Drivers

Increasing Prevalence of Non-Communicable Diseases Driving the Biopharma Market

Rising cases of non-communicable diseases are expected to drive the biopharma market as demand for targeted and innovative therapies continues to grow. According to World Health Organization (WHO) data from 2023, non-communicable diseases (NCDs) account for approximately 41 million deaths annually, representing 74% of global mortality. The report highlights that these chronic conditions disproportionately affect older populations. The increasing burden of diseases such as cancer, diabetes, and cardiovascular disorders is accelerating the development of biologics and targeted treatments.

Monoclonal antibodies and gene therapies are gaining traction as effective solutions for managing complex health conditions. Biopharmaceutical companies are investing heavily in research to develop next-generation therapeutics that offer enhanced efficacy and safety. Government initiatives and funding programs are supporting advancements in biologic drug manufacturing. The expansion of biosimilars is improving treatment accessibility while reducing healthcare costs.

The rising adoption of cell and gene therapies is transforming the management of rare and inherited disorders. Biopharmaceutical innovations are improving patient outcomes by offering precision treatments tailored to genetic profiles. Strategic partnerships between biotech firms and pharmaceutical giants are driving the commercialization of novel biologics. The increasing shift toward biologics and immunotherapies is likely to support sustained market expansion.

Restraints

High Manufacturing Costs Are Restraining the Biopharma Market

Increasing production expenses are limiting the growth of the biopharma market by making advanced therapies costly to develop and commercialize. The complexity of biologic drug manufacturing requires sophisticated infrastructure, advanced technology, and strict regulatory compliance, leading to high operational costs.

Biopharmaceutical companies must invest in specialized facilities for cell culture, fermentation, and purification processes, further increasing expenses. The long development timeline for biologics, often spanning over a decade, adds financial risk for companies awaiting regulatory approvals. Stringent guidelines from agencies such as the FDA and EMA mandate extensive clinical trials and quality control measures, raising overall production costs.

The need for cold chain logistics and specialized storage conditions makes distribution expensive, particularly for biologics and gene therapies. High costs associated with research, patent protection, and workforce training create additional financial challenges. Addressing these cost concerns through process optimization, automation, and regulatory harmonization could improve affordability and market accessibility.

Opportunities

Growing Popularity of Personalized Cancer Treatments as an Opportunity for the Biopharma Market

Rising demand for personalized cancer therapies is anticipated to create new opportunities in the biopharma market by offering targeted treatment solutions. In February 2022, Johnson & Johnson Services, Inc. secured U.S. FDA approval for CARVYKTI, a CAR-T therapy developed for the treatment of refractory multiple myeloma in adult patients, marking a significant advancement in personalized cancer treatment.

Advances in biomarker research are improving the development of precision oncology drugs tailored to individual patient profiles. Immunotherapies and cell-based treatments are transforming the cancer care landscape by enhancing treatment efficacy. The integration of genomic sequencing is enabling the identification of cancer mutations, allowing for the customization of therapeutic strategies.

Biopharmaceutical companies are collaborating with diagnostic firms to expand companion diagnostics, improving treatment selection and monitoring. Increased funding for cancer research is accelerating the discovery of novel biologics and gene therapies. Regulatory agencies are streamlining approval pathways for personalized treatments to meet rising demand. The expansion of targeted cancer therapies is likely to drive long-term growth and innovation in the biopharma market.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the biopharma market. Increasing healthcare investments and the demand for advanced therapeutics and vaccines are major growth drivers. Governments worldwide are enhancing public health funding, benefiting drug development, especially in emerging markets. The fight against global health issues, like the COVID-19 pandemic, has spurred innovation and the adoption of new biopharma technologies.

However, economic downturns, trade restrictions, and political instability pose risks. Geopolitical tensions and diverse regulatory frameworks can hinder market entry for companies seeking international expansion. Despite these obstacles, the persistent need for novel treatments and biotechnological advancements promises sustained market growth.

Latest Trends

Rise in the Number of Clinical Trials Driving the Biopharma Market

Increasing the number of clinical trials is a recent trend driving the biopharma market. High demand for new, innovative therapies, particularly in oncology, immunology, and rare diseases, is expected to continue fueling this trend. Pharmaceutical companies, driven by the need to bring new drugs to market, are expanding their clinical trial activities to explore more effective treatment options. As the number of clinical trials grows, so does the need for regulatory compliance and efficient trial management, providing opportunities for innovation in the sector.

Rising collaboration between biopharma companies and research institutions is likely to accelerate the progress of clinical trials. A 2022 report from Trialtrove revealed that Phase I clinical trials accounted for nearly one-third of all clinical research activities that year. Among the leading locations for these trials in Asia, China led the way, contributing approximately 40% of total Phase I studies, followed by Australia, Japan, India, and South Korea. As clinical trials continue to rise, the market for biopharmaceuticals is anticipated to experience significant expansion, driven by advancements in drug development and increasing access to new therapies.

Regional Analysis

North America is leading the Biopharma Market

North America dominated the market with the highest revenue share of 42.5% owing to continued innovation in biologics, gene therapies, and monoclonal antibody treatments. A 2022 study published in Nature Biotechnology highlighted that regulatory bodies approved a diverse range of biologics, including 97 monoclonal antibodies and 16 gene therapy treatments, despite pandemic-related challenges. This strong pipeline of approvals reinforced confidence in research and development investments across the U.S. and Canada.

Expanding applications of precision medicine and advancements in mRNA technology further accelerated market expansion. Increased funding from government agencies and private investors supported clinical trials and the commercialization of next-generation therapies. Strategic partnerships between pharmaceutical giants and biotech startups fostered innovation, leading to accelerated drug discovery and development.

Additionally, improvements in regulatory processes streamlined market entry for novel biologics, ensuring faster access to groundbreaking treatments. The rising prevalence of chronic diseases, such as cancer and autoimmune disorders, also drove demand for targeted biologic therapies, solidifying North America’s leadership in biopharmaceutical advancements.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rising healthcare investments and an expanding pipeline of biologic treatments. Japan’s Ministry of Health, Labour and Welfare (MHLW) granted approval in June 2022 for Rituxan, an anti-CD20 monoclonal antibody developed by Zenyaku Kogyo Co., Ltd. and Chugai Pharmaceutical Co., Ltd., reinforcing the region’s focus on innovative biologics. Increasing demand for targeted therapies, particularly in oncology and immunology, is likely to boost market expansion.

Government initiatives promoting local manufacturing of biologic drugs are anticipated to reduce costs and improve accessibility. Collaborations between global pharmaceutical companies and regional firms are projected to enhance research capabilities and accelerate clinical trials. The rising prevalence of chronic and rare diseases is expected to fuel demand for next-generation treatments.

Expanding biomanufacturing infrastructure, particularly in China and India, is likely to strengthen supply chains and reduce reliance on imports. Advances in biosimilars and personalized medicine are anticipated to further drive market growth, positioning Asia Pacific as a key player in the global biopharmaceutical landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the biopharma market focus on advancing biologic drug development by investing in monoclonal antibodies, gene therapies, and mRNA-based treatments. Companies allocate significant resources to research and development, leveraging cutting-edge technologies to enhance drug efficacy and production efficiency. Strategic collaborations with biotechnology firms and academic institutions accelerate innovation and regulatory approvals.

Geographic expansion into emerging markets with increasing healthcare investments supports broader patient access to biologic therapies. Many players also emphasize sustainability by optimizing manufacturing processes and reducing environmental impact. Amgen is a leading company in this market, specializing in biologic medicines for oncology, cardiovascular diseases, and autoimmune disorders.

The company focuses on innovation through biosimilars and next-generation therapies while strengthening global partnerships. Amgen’s dedication to scientific advancements and patient-centric solutions establishes it as a key player in the biopharma industry.

Top Key Players in the Biopharma Market

- Novo Nordisk A/S

- Johnson & Johnson

- ImmunoGen

- Hoffmann-La Roche

- Eli Lilly and Company

- Amgen

- AbbVie

- Abbott Laboratories

Recent Developments

- In November 2022, ImmunoGen secured FDA approval for mirvetuximab soravtansine-gynx, branded as ELAHERE, a targeted therapy for adult women with platinum-resistant ovarian cancer.

- In February 2021, AbbVie entered a collaboration with Caribou Biosciences, Inc. through a licensing agreement aimed at advancing research and development in chimeric antigen receptor (CAR) T-cell therapies.

Report Scope

Report Features Description Market Value (2024) US$ 421.5 billion Forecast Revenue (2034) US$ 1356.6 billion CAGR (2025-2034) 12.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Immunomodulators (Cytokines and Monoclonal Antibodies), Enzymes (Hyrolyases and Lyases), Vaccines (Recombinant/Subunit/ Conjugate, Inactivated, and Live Attenuated), Hormones (Insulin, Human Growth Hormones, and Thyroid Stimulating Hormones)), By Application (Cardiology, Respiratory, Oncology, and Others), By End-user (Hospital Pharmacies, Online Pharmacies, and Drug Stores & Retail Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Novo Nordisk A/S, Johnson & Johnson, ImmunoGen, F. Hoffmann-La Roche, Eli Lilly and Company, Amgen, AbbVie, and Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Novo Nordisk A/S

- Johnson & Johnson

- ImmunoGen

- Hoffmann-La Roche

- Eli Lilly and Company

- Amgen

- AbbVie

- Abbott Laboratories