Global Cell Cryopreservation Market By Product (Consumables (Cooler Boxes/Containers, Cryogenic Tubes, Cryogenic Vials, and Others), Cell Freezing Media (Dimethyl Sulfoxide, Ethylene Glycol, Glycerol, and Others), and Equipment (Freezers, Incubators, and Liquid Nitrogen Supply Tanks)), By Application (Hepatocytes, Oocytes & Embryotic Cells, Sperm Cells, Stem Cells, and Others), By End-use (Biobanks, Biopharmaceutical & Pharmaceutical Companies, IVF Clinics, Research Institutes, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2025

- Report ID: 139602

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

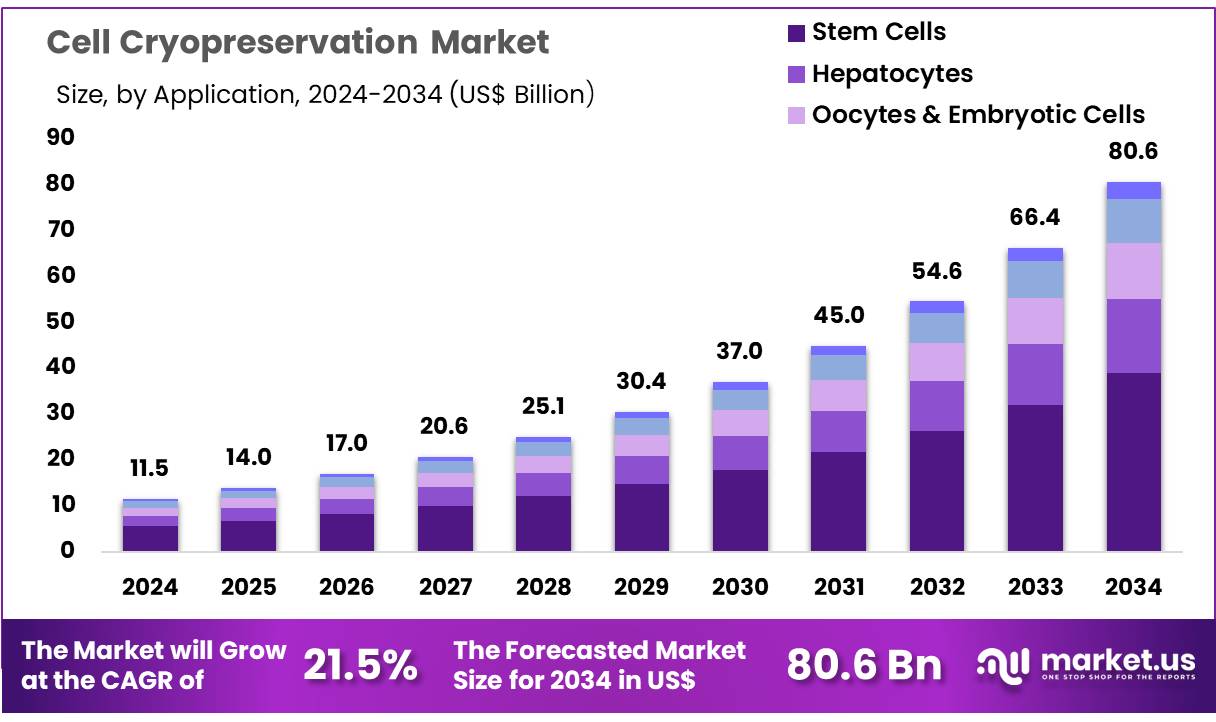

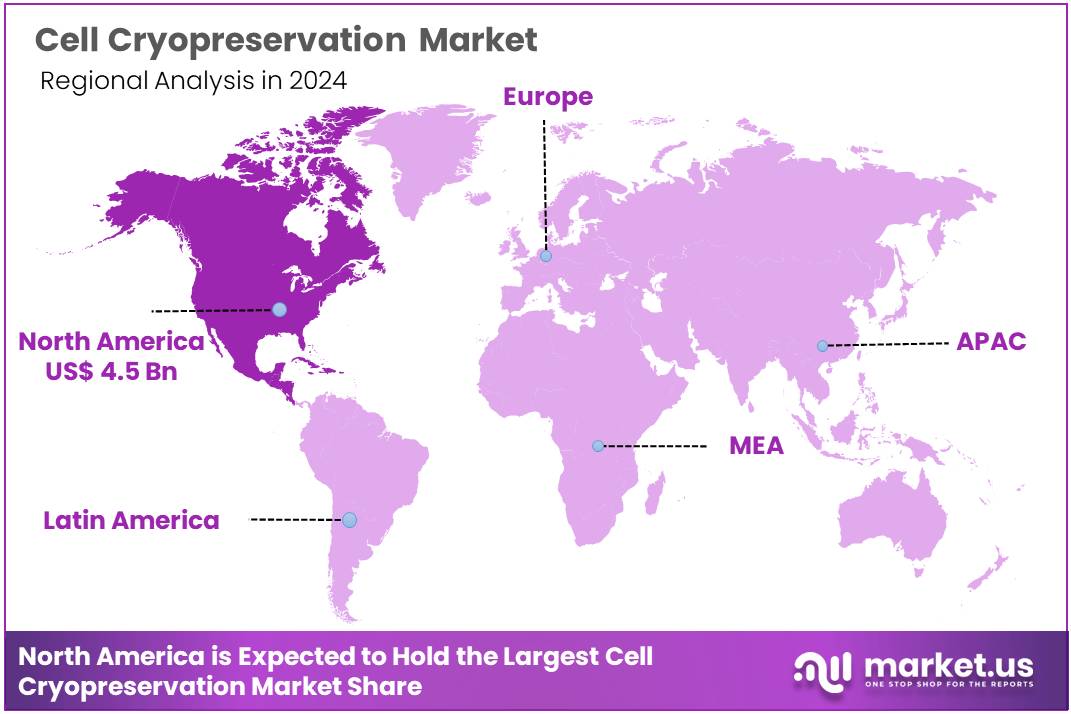

The Global Cell Cryopreservation Market size is expected to be worth around US$ 80.6 billion by 2034 from US$ 11.5 billion in 2024, growing at a CAGR of 21.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.5% share with a revenue of US$ 4.5 Billion.

Rising demand for advanced medical treatments and research applications is driving the growth of the cell cryopreservation market. Cell cryopreservation enables the long-term storage of cells, tissues, and organs at sub-zero temperatures, preserving their viability for future use in therapies, diagnostics, and research. This technology is crucial in fields such as stem cell therapy, regenerative medicine, reproductive medicine, and biobanking, where maintaining cell integrity is essential.

The increasing prevalence of diseases like cardiovascular conditions, which, according to the World Health Federation’s 2023 report, affect over half a billion people globally, further fuels the demand for cell-based therapies and regenerative medicine. As these treatments become more widespread, the need for efficient cryopreservation methods grows.

The growing interest in personalized medicine also presents opportunities for the development of cryopreservation techniques that can store patient-specific cells for future therapies. Recent trends show an increased focus on improving cryoprotectants, freezing techniques, and thawing processes to minimize cell damage and enhance the efficiency of storage.

Additionally, innovations in automation and cryopreservation equipment are expanding the market’s potential, offering solutions that improve scalability, reduce costs, and increase throughput. The continued advances in biotechnology and cell therapies ensure that the cell cryopreservation market will play a critical role in future medical breakthroughs.

Key Takeaways

- In 2024, the market for cell cryopreservation generated a revenue of US$ 5 billion, with a CAGR of 21.5%, and is expected to reach US$ 80.6 billion by the year 2034.

- The product segment is divided into consumables, cell freezing media, and equipment, with consumables taking the lead in 2024 with a market share of 58.7%.

- Considering application, the market is divided into hepatocytes, oocytes & embryotic cells, sperm cells, stem cells, and others. Among these, stem cells held a significant share of 48.3%.

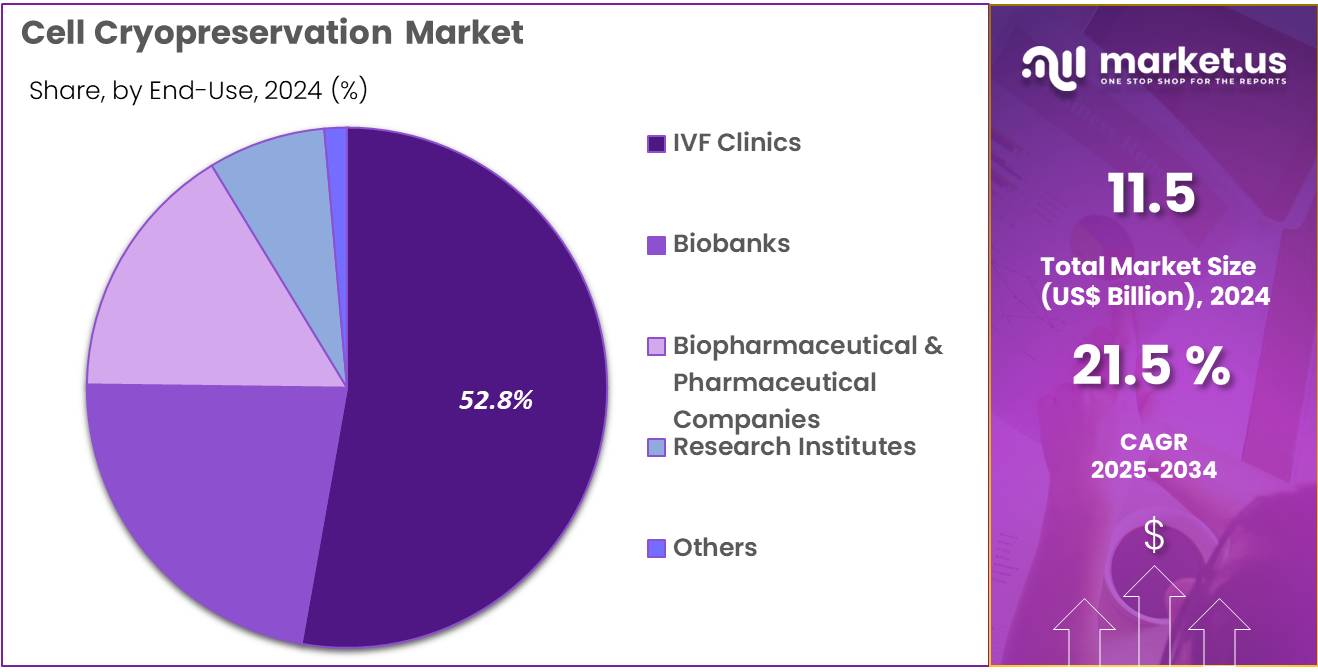

- Furthermore, concerning the end-use segment, the market is segregated into biobanks, biopharmaceutical & pharmaceutical companies, IVF clinics, research institutes, and others. The IVF clinics sector stands out as the dominant player, holding the largest revenue share of 52.8% in the cell cryopreservation market.

- North America led the market by securing a market share of 39.5% in 2024.

Product Analysis

The consumables segment led in 2024, claiming a market share of 58.7% owing to the increasing demand for reliable and effective solutions in cell storage and preservation. Consumables such as cell freezing media, cryovials, and preservation kits are projected to see growing adoption, especially as the number of regenerative medicine therapies, stem cell research, and biobanking initiatives rise. These consumables are anticipated to be essential for maintaining the viability and integrity of cells during storage, making them indispensable in clinical and research applications.

The increasing complexity of cell-based therapies and advancements in cryoprotectant solutions are likely to drive demand for high-quality consumables. Furthermore, as the focus on personalized medicine and targeted therapies expands, the need for advanced cell cryopreservation solutions that ensure long-term cell storage without compromising cell function is expected to propel the growth of the consumables segment.

Application Analysis

The stem cells held a significant share of 48.3% due to as the use of stem cells in therapeutic applications continues to expand. Stem cells, including hematopoietic, mesenchymal, and induced pluripotent stem cells, are expected to be increasingly preserved for use in regenerative medicine and cell-based therapies. The growing emphasis on personalized treatments, such as gene therapies and stem cell-based immunotherapies, is likely to drive demand for stem cell cryopreservation to ensure that viable cells are available for future use.

Additionally, advancements in stem cell technology, including improved methods for freezing and thawing, are projected to enhance the efficiency of stem cell preservation, contributing to the overall growth of this segment. As the healthcare industry increasingly embraces stem cell therapies for conditions like cardiovascular diseases, neurodegenerative disorders, and autoimmune diseases, the stem cells segment is expected to see continued expansion in the cell cryopreservation market.

End-use Analysis

The IVF clinics segment had a tremendous growth rate, with a revenue share of 52.8% owing to the increasing demand for assisted reproductive technologies (ART) worldwide. IVF clinics are expected to play a pivotal role in the growth of the market as they require advanced cryopreservation methods to store oocytes, embryos, and sperm cells for fertility treatments.

The rising prevalence of infertility and the growing adoption of IVF procedures, particularly among older age groups and couples facing fertility challenges, is likely to drive the demand for cryopreservation solutions. Additionally, as IVF clinics increasingly incorporate personalized treatment plans, the need for high-quality preservation methods to optimize patient outcomes is anticipated to further fuel market growth.

The continued development of more efficient and cost-effective cryopreservation technologies, alongside expanding IVF services, is expected to boost the demand for these solutions, making IVF clinics a key driver in the growth of the cell cryopreservation market.

Key Market Segments

By Product

- Consumables

- Cooler Boxes/Containers

- Cryogenic Tubes

- Cryogenic Vials

- Others

- Cell Freezing Media

- Dimethyl Sulfoxide

- Ethylene Glycol

- Glycerol

- Others

- Equipment

- Freezers

- Incubators

- Liquid Nitrogen Supply Tanks

By Application

- Hepatocytes

- Oocytes & Embryotic Cells

- Sperm Cells

- Stem Cells

- Others

By End-use

- Biobanks

- Biopharmaceutical & Pharmaceutical Companies

- IVF Clinics

- Research Institutes

- Others

Drivers

Rising Occurrence of Infertility Driving the Cell Cryopreservation Market

Rising occurrence of infertility is anticipated to drive the cell cryopreservation market significantly. According to the World Health Organization, 17.5% of the global adult population, or approximately 1 in 6 individuals, experience infertility. This growing prevalence creates an urgent demand for reproductive treatments that depend on cryopreservation technologies to store and preserve gametes, embryos, and other cells. Advanced fertility clinics increasingly use cryopreservation for in-vitro fertilization (IVF) procedures, ensuring effective long-term cell storage.

The technology enhances the success rates of reproductive treatments by maintaining cell viability and function. Rising awareness about fertility preservation options drives individuals to seek cryopreservation services, particularly in regions with access to advanced healthcare. Delayed family planning due to lifestyle changes and career priorities further boosts the demand for reproductive cryopreservation solutions.

Pharmaceutical and biotechnology companies integrate cryopreservation techniques into research for developing novel infertility treatments. Innovations in cryoprotectants and freezing methods reduce the risk of cell damage, improving outcomes for fertility patients. Public and private funding initiatives aimed at increasing the availability of affordable fertility services further support market expansion.

Collaboration between fertility centers and cryopreservation solution providers enhances service accessibility and quality. These trends underline the critical role of cryopreservation technologies in addressing infertility challenges globally.

Restraints

High Costs Are Restraining the Cell Cryopreservation Market

High costs of cryopreservation technologies are restraining the market. Establishing and maintaining cryopreservation infrastructure requires significant investment in advanced freezing systems, storage facilities, and energy resources. The expense of high-quality cryoprotectants and consumables further elevates the overall cost of services. Patients in low- and middle-income regions often find these services unaffordable, limiting market penetration.

Specialized training for professionals in handling cryopreservation equipment and materials increases operational costs for service providers. Regulatory compliance for cell storage facilities demands stringent quality controls, adding to financial burdens. Inconsistent insurance coverage for fertility preservation services restricts access for individuals in many parts of the world. Addressing these cost-related challenges requires innovations that enhance cost-efficiency and the development of supportive financial policies to improve accessibility.

Opportunities

Growing Funding for Stem Cell Research as an Opportunity for the Cell Cryopreservation Market

Growing funding for stem cell research presents a significant opportunity for the cell cryopreservation market. In June 2024, Acorn Biolabs, a biotechnology company based in Toronto, raised 11 million CAD ($8 million USD) in a Series A funding round to enhance its stem cell freezing services. This investment highlights the increasing focus on advancing cryopreservation technologies for regenerative medicine applications. Stem cell research relies on efficient cryopreservation methods to maintain cell viability for future therapeutic use.

Increased funding accelerates innovation in cryopreservation techniques, reducing the risks associated with freezing and thawing cells. Pharmaceutical companies and research institutions prioritize cryopreservation to support the scalability of cell-based therapies. Collaboration between biotechnology firms and funding agencies strengthens infrastructure for cryopreservation services.

Expanding public and private investments in stem cell research promotes accessibility to advanced cell storage solutions. These trends are likely to drive the cell cryopreservation market by fostering advancements in regenerative medicine and increasing the demand for long-term cell preservation.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the cell cryopreservation market. On the positive side, the increasing demand for advanced medical treatments, biotechnology innovations, and personalized medicine drives the need for cell preservation techniques, ensuring long-term cell storage for therapeutic applications. Rising healthcare investments and government initiatives to support regenerative medicine further contribute to market growth.

However, economic downturns or recessions can lead to reduced funding for research and healthcare initiatives, slowing the adoption of cutting-edge preservation technologies. Geopolitical factors, such as trade restrictions, supply chain disruptions, and varying regulatory standards across countries, can increase costs and delay the development of new products. Despite these challenges, advancements in technology and the growing need for cell-based therapies and regenerative treatments ensure a positive outlook for the market.

Latest Trends

Increase in R&D Activities Driving the Cell Cryopreservation Market:

Rising investment in research and development (R&D) activities is driving growth in the cell cryopreservation market. High levels of innovation in biotechnology, regenerative medicine, and vaccine development are expected to increase the demand for advanced cell storage solutions. As R&D expands, new techniques for preserving and thawing cells more effectively are likely to emerge, improving the overall quality and longevity of preserved cells.

In September 2024, researchers from the Universities of Manchester and Warwick developed a machine-learning application designed to enhance the freezing process for vaccines and medications. This breakthrough is anticipated to improve the efficiency of cryopreservation and support broader applications in medicine and biotechnology. As R&D activities continue to increase, the market is expected to experience continued growth and advancement in cell preservation technologies.

Regional Analysis

North America is leading the Cell Cryopreservation Market

North America dominated the market with the highest revenue share of 39.5% owing to increasing demand for cell-based therapies, advancements in regenerative medicine, and the growing focus on personalized medicine. The ability to cryopreserve cells has become increasingly essential for applications in stem cell research, immunotherapies, and tissue engineering. As biotechnology and pharmaceutical companies continue to expand their cell therapy offerings, the need for efficient and reliable cell cryopreservation techniques has grown.

A key development in this sector came in October 2024 when the CEO of Nucleus Biologics highlighted the introduction of NB-KUL DF, a transformative solution aimed at improving the cryopreservation of cells for therapeutic applications. This new product is expected to reduce patient-related negative effects, simplify processes, and lower costs, marking a significant step forward in the market.

The increasing use of cryopreserved cells in clinical trials, coupled with rising investments in biotechnology, has driven the demand for high-quality cryopreservation solutions. As a result, the cell cryopreservation market in North America is expected to continue its upward trajectory, with ongoing advancements in cell storage and recovery technologies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to advancements in healthcare infrastructure, increasing demand for regenerative medicine, and the expansion of biotechnology research. Countries such as China, India, and Japan are expected to see rising demand for cell cryopreservation solutions as they continue to focus on stem cell therapies, cancer treatments, and other cellular therapies. With the growing emphasis on personalized and cell-based therapies, there is likely to be an increased need for reliable and scalable cryopreservation techniques.

The rising prevalence of chronic diseases, along with government support for biotechnology research, is projected to drive further adoption of cryopreservation technologies. Additionally, advancements in cell storage and the increasing number of clinical trials for regenerative treatments are expected to propel the market. As Asia Pacific strengthens its role in global biotech research, the demand for high-quality cryopreservation solutions is anticipated to see robust growth in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the cell cryopreservation market focus on developing advanced cryoprotectants and freezing technologies to ensure high viability and functionality of preserved cells. Companies invest in R&D to enhance storage techniques, catering to applications in regenerative medicine, biobanking, and drug development. Collaborations with research organizations and biopharma companies drive innovation and expand their application areas.

Geographic expansion into regions with increasing investments in biotechnology strengthens market penetration. Many players also prioritize sustainability and compliance with regulatory standards to maintain product reliability.

Thermo Fisher Scientific Inc. is a key player in this market, offering cutting-edge cryopreservation solutions like CryoStar freezers and CryoSentinel systems. The company combines advanced technology with robust customer support to deliver efficient storage solutions. Thermo Fisher’s global reach and commitment to quality solidify its leadership in cell preservation technologies.

Top Key Players

- Sartorius AG

- PromoCell GmbH

- Pluristyx

- Merck KGaA

- Lonza

- LifeCell International

- HiMedia Laboratories

- Creative Biolabs

- Colder Products Company

- BioLife Solutions Inc

Recent Developments

- In April 2024, Pluristyx, a leading provider of cellular therapy technologies, equipment, and services, unveiled its in-house cryopreservation medium solution.

- In September 2024, Colder Products Company unveiled a new aseptic micro-connector, designed to seamlessly integrate into frozen cassettes used in cell and gene therapy (CGT) processing.

- In July 2022, LifeCell International, a provider of human cell and tissue-based products and services, introduced Cellutions BioStorage, a Cryopreservation Bank to support research-to-launch operations. Using advanced technologies, the initiative is designed to close the expanding supply-chain gap in the preservation and maintenance of biospecimens.

Report Scope

Report Features Description Market Value (2024) US$ 11.5 billion Forecast Revenue (2034) US$ 80.6 billion CAGR (2025-2034) 21.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Consumables (Cooler Boxes/Containers, Cryogenic Tubes, Cryogenic Vials, and Others), Cell Freezing Media (Dimethyl Sulfoxide, Ethylene Glycol, Glycerol, and Others), and Equipment (Freezers, Incubators, and Liquid Nitrogen Supply Tanks)), By Application (Hepatocytes, Oocytes & Embryotic Cells, Sperm Cells, Stem Cells, and Others), By End-use (Biobanks, Biopharmaceutical & Pharmaceutical Companies, IVF Clinics, Research Institutes, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sartorius AG, PromoCell GmbH, Pluristyx, Merck KGaA, Lonza, LifeCell International, HiMedia Laboratories, Creative Biolabs, Colder Products Company, and BioLife Solutions Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cell Cryopreservation MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Cell Cryopreservation MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sartorius AG

- PromoCell GmbH

- Pluristyx

- Merck KGaA

- Lonza

- LifeCell International

- HiMedia Laboratories

- Creative Biolabs

- Colder Products Company

- BioLife Solutions Inc