Global Chemiluminescence Immunoassay Market By Product Type (Analyzers and Reagents), By Application (Oncology, Therapeutic Drug Monitoring, Cardiology, Endocrinology, Autoimmune Disease, Infectious Disease, and Others), By Sample Type (Blood, Saliva, Urine, and Others), By End-user (Hospitals, Pharmaceutical & Biotechnology Companies, Clinical Laboratories, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2025

- Report ID: 139624

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

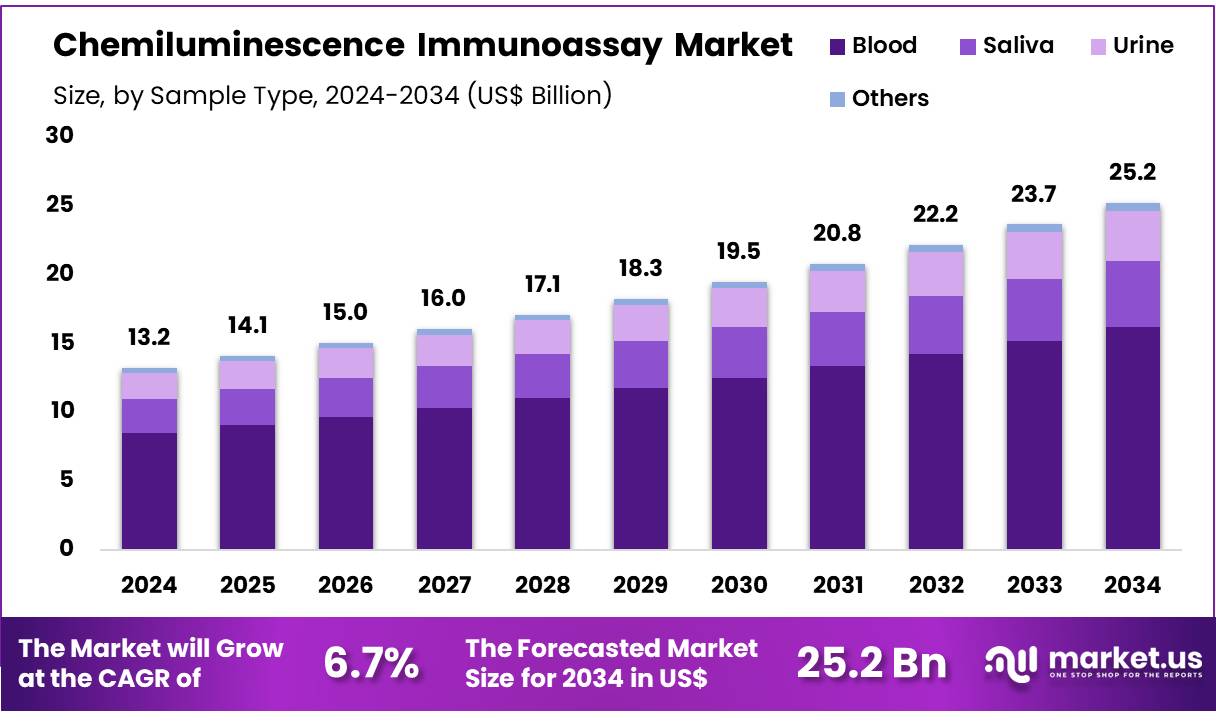

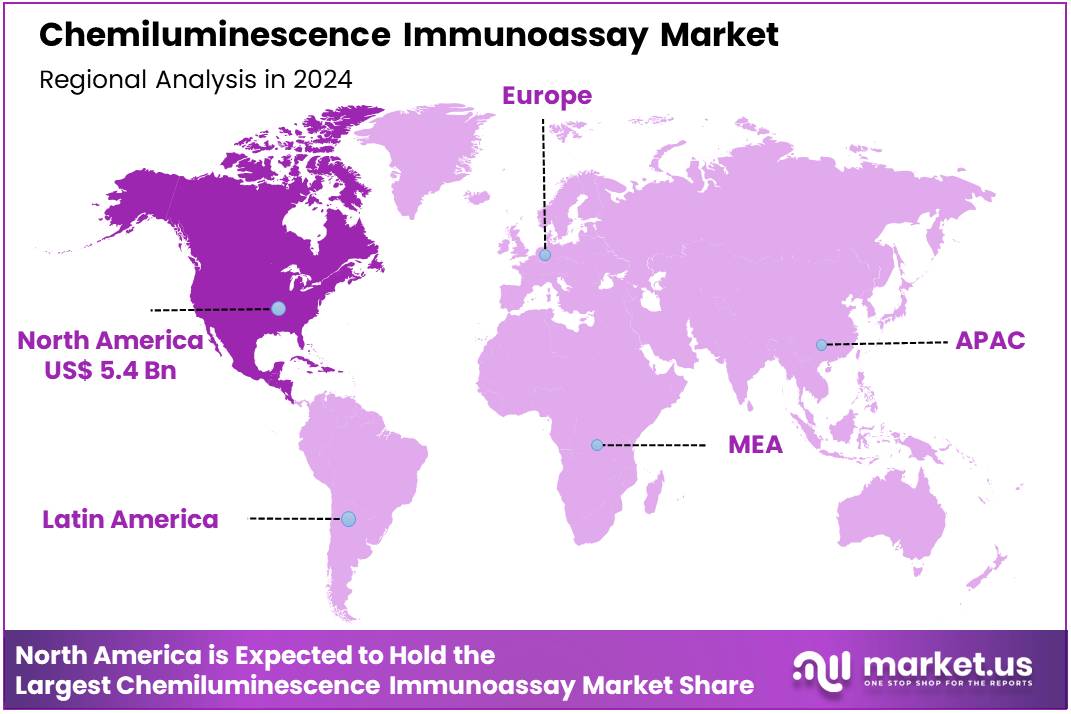

The Global Chemiluminescence Immunoassay Market size is expected to be worth around US$ 25.2 billion by 2034 from US$ 13.2 billion in 2024, growing at a CAGR of 6.7% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 41.2% share and holds US$ 5.4 Billion market value for the year.

Growing demand for accurate, rapid, and high-throughput diagnostic testing is driving the expansion of the chemiluminescence immunoassay (CLIA) market. CLIA technology is widely used for detecting a broad range of biomarkers, including hormones, proteins, and infectious agents, in applications such as clinical diagnostics, drug monitoring, oncology, and endocrinology. The increasing prevalence of chronic diseases, such as diabetes, cancer, and cardiovascular diseases, fuels the demand for advanced diagnostic methods that can provide quick and reliable results.

According to the World Health Organization’s 2022 report, DiaSorin’s Liaison CLIA analyzers are versatile tools that can conduct a wide range of tests, including those for endocrinology, therapeutic drug monitoring, oncology, and infectious diseases, using a small patient sample for a single analysis cycle. Recent trends show an increasing preference for point-of-care testing solutions, which utilize CLIA for faster results with minimal sample volumes, making them particularly useful in emergency and remote settings.

Additionally, advancements in multiplexed testing, where multiple biomarkers can be tested simultaneously, are expanding the applications of CLIA technology, allowing for more efficient patient management. Opportunities also lie in the growing focus on personalized medicine, where precise and timely biomarker testing plays a pivotal role in tailoring treatments. As the demand for non-invasive diagnostic techniques increases, the chemiluminescence immunoassay market is expected to experience significant growth, driven by innovation in test development and improved automation.

Key Takeaways

- In 2024, the market for Chemiluminescence Immunoassay generated a revenue of US$ 13.2 billion, with a CAGR of 6.7%, and is expected to reach US$ 25.2 billion by the year 2034.

- The product type segment is divided into analyzers and reagents, with reagents taking the lead in 2024 with a market share of 61.2%.

- Considering application, the market is divided into oncology, therapeutic drug monitoring, cardiology, endocrinology, autoimmune disease, infectious disease, and others. Among these, therapeutic drug monitoring held a significant share of 45.3%.

- Furthermore, concerning the sample type segment, the market is segregated into blood, saliva, urine, and others. The blood sector stands out as the dominant player, holding the largest revenue share of 64.3% in the Chemiluminescence Immunoassay market.

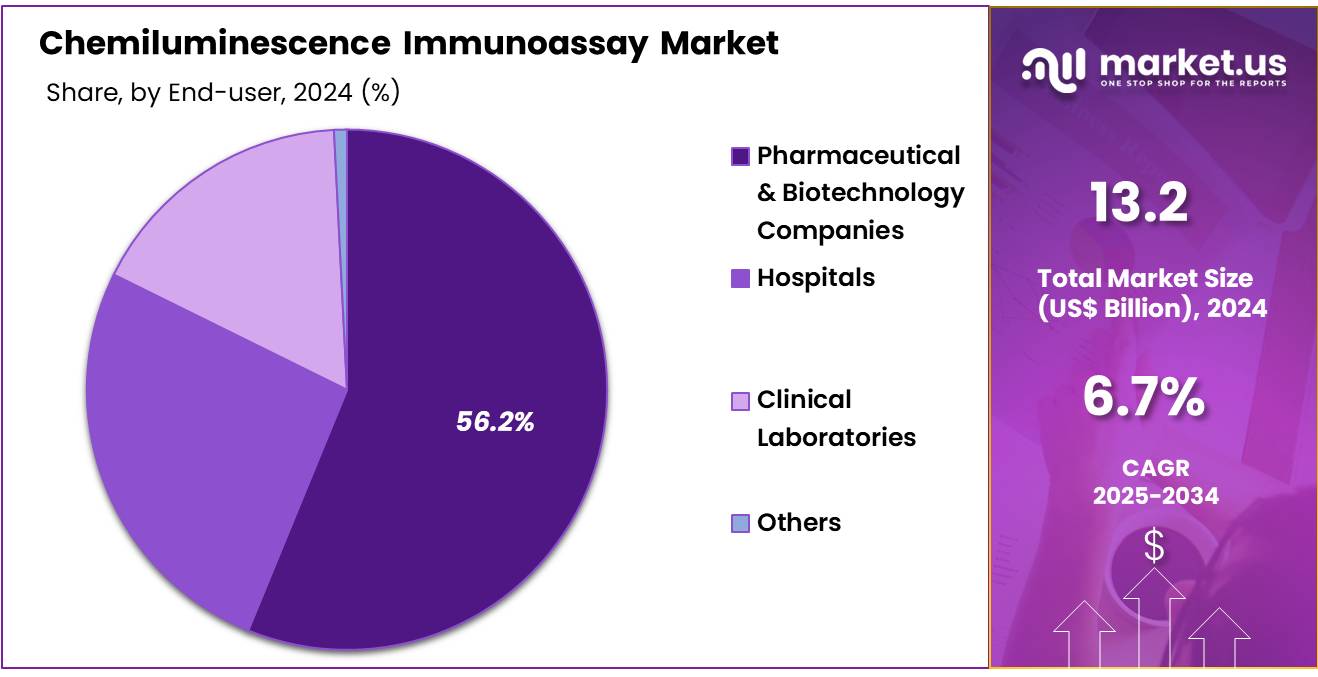

- The end-user segment is segregated into hospitals, pharmaceutical & biotechnology companies, clinical laboratories, and others, with the pharmaceutical & biotechnology companies segment leading the market, holding a revenue share of 56.2%.

- North America led the market by securing a market share of 41.2% in 2024.

Product Type Analysis

The reagents segment led in 2024, claiming a market share of 61.2% owing to the increasing demand for precise and reliable diagnostic tools. Reagents play a crucial role in the chemiluminescence immunoassay process, as they facilitate the detection of specific analytes in samples. As healthcare providers and research institutions seek more efficient, high-throughput diagnostic solutions, the demand for advanced reagents is likely to rise.

Additionally, the growing prevalence of chronic diseases, such as cardiovascular diseases and cancer, is expected to drive the need for rapid and accurate diagnostic tests, further boosting the reagents segment. Furthermore, advancements in reagent formulations, including improvements in sensitivity, stability, and specificity, are anticipated to enhance performance and fuel market growth.

Application Analysis

The therapeutic drug monitoring held a significant share of 45.3%. As personalized medicine becomes more widespread, the need for precise monitoring of therapeutic drug levels in patients is expected to increase. Chemiluminescence immunoassays are likely to play a critical role in measuring drug concentrations, ensuring optimal dosing, and improving patient outcomes.

The segment’s growth is anticipated to be driven by the increasing use of biologic drugs and chemotherapy, where monitoring drug levels can help prevent toxicity and enhance treatment effectiveness. Moreover, the rising focus on improving the safety and efficacy of drug therapies, especially in high-risk populations, will likely drive demand for reliable drug monitoring tests, further contributing to the segment’s expansion.

Sample Type Analysis

The blood segment had a tremendous growth rate, with a revenue share of 64.3% owing to the increasing use of blood-based tests in diagnostics and disease monitoring. Blood samples are anticipated to remain the most common sample type for chemiluminescence immunoassay applications, as they provide accurate and reliable results for a wide range of conditions, including infections, cancer, and cardiovascular diseases.

The growing prevalence of chronic diseases, coupled with the ongoing need for frequent and non-invasive monitoring of patient health, is likely to drive the demand for blood-based diagnostic tests. Additionally, advancements in blood collection technologies and the growing preference for point-of-care testing are projected to further accelerate the adoption of blood samples in chemiluminescence immunoassays, contributing to the growth of this segment.

End-user Analysis

The pharmaceutical & biotechnology companies segment grew at a substantial rate, generating a revenue portion of 56.2% due to the increasing adoption of advanced diagnostic tools in drug development and clinical trials. Pharmaceutical and biotechnology companies are likely to rely on chemiluminescence immunoassays to support research, identify biomarkers, and monitor the effectiveness of novel drug therapies.

The segment’s growth is expected to be driven by the need for faster, more efficient testing methods in drug discovery, particularly in the areas of oncology, immunology, and infectious diseases. As the pharmaceutical industry continues to focus on precision medicine and personalized therapies, the demand for reliable and scalable diagnostic platforms is likely to increase, further contributing to the growth of this segment.

Key Market Segments

By Product Type

- Analyzers

- Reagents

By Application

- Oncology

- Therapeutic Drug Monitoring

- Cardiology

- Endocrinology

- Autoimmune Disease

- Infectious Disease

- Others

By Sample Type

- Blood

- Saliva

- Urine

- Others

By End-user

- Hospitals

- Pharmaceutical & Biotechnology Companies

- Clinical Laboratories

- Others

Drivers

Growing Prevalence of Diabetes Driving the Chemiluminescence Immunoassay Market

Growing prevalence of diabetes is anticipated to drive the chemiluminescence immunoassay market significantly. According to the IDF Diabetes Atlas, 537 million adults worldwide currently live with diabetes, and this number is projected to rise to 643 million by 2030 and 783 million by 2045. This alarming growth increases the demand for accurate and efficient diagnostic tools, such as chemiluminescence-based assays, which offer high sensitivity and specificity.

Hospitals and diagnostic laboratories increasingly adopt these assays for routine diabetes-related tests, including monitoring insulin and HbA1c levels. The rising global burden of diabetes also drives research into biomarkers, enhancing the scope of chemiluminescence immunoassays. Pharmaceutical companies prioritize these technologies for drug development and personalized treatment plans. Expanding healthcare infrastructure in emerging economies supports the widespread adoption of advanced diagnostic solutions.

Integration of automation in chemiluminescence platforms improves throughput and reduces turnaround times, meeting the growing testing needs. Increasing public awareness about early diagnosis of diabetes fosters demand for precise and reliable testing methods. Collaboration between diagnostic companies and healthcare providers strengthens the distribution of advanced diagnostic tools. These factors underscore the critical role of chemiluminescence immunoassays in addressing the rising prevalence of diabetes globally.

Restraints

High Costs Are Restraining the Chemiluminescence Immunoassay Market

High costs of chemiluminescence immunoassay systems are restraining the market. Advanced platforms require significant investments in hardware, reagents, and maintenance, making them expensive for smaller diagnostic laboratories. Developing economies face affordability challenges due to limited healthcare budgets, reducing the accessibility of these technologies. Training requirements for handling complex systems add to operational costs, further discouraging adoption.

Expensive reagents and consumables increase the per-test cost, making routine usage less feasible in resource-constrained settings. Limited reimbursement policies for advanced diagnostic tests further restrict market growth, particularly in underfunded healthcare systems. Addressing these issues requires cost-efficient innovations and expanded government support to improve accessibility and affordability of chemiluminescence-based diagnostics.

Opportunities

Rising Technological Innovations as an Opportunity for the Chemiluminescence Immunoassay Market

Rising technological innovations are anticipated to create significant opportunities for the chemiluminescence immunoassay market. In May 2023, PerkinElmer launched Revvity, a company dedicated to delivering innovative solutions across multiple scientific domains. Advanced technologies integrated into chemiluminescence platforms enhance assay sensitivity, specificity, and automation capabilities. Miniaturization of diagnostic tools allows faster and more efficient workflows, addressing the needs of high-throughput laboratories.

Innovations in reagent formulations improve test accuracy and expand the range of detectable biomarkers. Digital connectivity and data analytics tools support real-time monitoring and advanced diagnostics. Collaborative research between industry leaders and academic institutions accelerates the development of next-generation chemiluminescence systems.

Expanding R&D funding for healthcare innovation drives technological advancements, enabling broader market penetration. These trends are likely to enhance the adoption of chemiluminescence-based diagnostics, positioning the market for substantial growth in the coming years.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the chemiluminescence immunoassay market. On the positive side, the rising demand for accurate and rapid diagnostic tests, especially in clinical and research settings, propels the market’s growth. Increased healthcare spending and government support for public health initiatives further drive adoption of advanced diagnostic technologies, including immunoassays. However, economic downturns can lead to reduced healthcare budgets and delayed investments in diagnostic tools.

Geopolitical factors, such as trade restrictions, regulatory changes, or political instability, may disrupt supply chains and affect the availability of reagents and equipment required for chemiluminescence testing. Additionally, varying regulatory standards across regions can create barriers to market access. Despite these challenges, the growing need for improved diagnostic solutions and ongoing technological advancements ensure a promising outlook for the chemiluminescence immunoassay market.

Latest Trends

Launch of New Products Driving the Chemiluminescence Immunoassay Market

Rising product launches play a key role in driving growth in the chemiluminescence immunoassay market. High levels of innovation in diagnostic technologies are expected to fuel the development of more accurate, efficient, and cost-effective testing systems. The increasing number of new product releases is likely to expand market opportunities, catering to diverse healthcare needs. In January 2022, Wondfo-Tisenc introduced their Point-of-Care (PoC) chemiluminescence immunoassay (CLIA) product through an online event that attracted more than 800 participants.

Along with the release of their new Accre system, Wondfo, a prominent Chinese medical company, aims to strengthen its position in the CLIA diagnostic market and expand its innovative platform. As more companies introduce new products, the market is anticipated to grow, offering enhanced diagnostic capabilities and increasing market penetration.

Regional Analysis

North America is leading the Chemiluminescence Immunoassay Market

North America dominated the market with the highest revenue share of 41.2% owing to advancements in diagnostic technologies, increased healthcare spending, and the rising demand for accurate and efficient testing methods. The growing prevalence of chronic diseases, including cardiovascular diseases, cancers, and autoimmune disorders, has spurred the need for reliable diagnostic tools. CLIA offers a high level of sensitivity and specificity, making it an essential technique for detecting biomarkers in various medical conditions.

In November 2023, Medical & Biological Laboratories Co., Ltd., a part of JSR Life Sciences, launched the “iStar 500,” a compact, automated CLIA analyzer designed for emergency settings and smaller to mid-sized laboratories. This device supports a broad range of tests, including cardiac, liver, reproductive health, tumor markers, and autoimmunity, offering flexibility for diverse medical needs.

The adoption of such advanced diagnostic tools, along with the increasing integration of CLIA technologies in clinical and research laboratories, has contributed to the rapid growth of the market in North America. The demand for fast, reliable, and cost-effective diagnostic solutions is expected to continue driving the expansion of the CLIA market in the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing investments in healthcare infrastructure, rising awareness of diagnostic testing, and the growing burden of chronic diseases. Countries such as China, India, and Japan are expected to witness significant growth as healthcare systems in the region modernize and expand access to advanced diagnostic technologies.

In December 2022, Sysmex obtained approval in Japan to manufacture and market the HISCL β-Amyloid 1-42 and 1-40 Assay Kits, which are designed to detect amyloid beta (Aβ) levels in blood samples, highlighting the region’s ongoing focus on innovative diagnostic solutions. The increasing incidence of conditions such as Alzheimer’s disease, cancer, and infectious diseases is expected to further drive the demand for chemiluminescence immunoassays in the region.

Additionally, government initiatives to improve healthcare access and the growing number of healthcare providers investing in diagnostic technologies will likely boost market growth. As the region’s healthcare needs continue to evolve, the demand for precise and efficient diagnostic solutions using CLIA technologies is anticipated to grow steadily.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the chemiluminescence immunoassay market focus on developing highly sensitive and specific diagnostic kits to cater to various clinical and research applications. Companies invest in R&D to enhance detection capabilities for a wide range of biomarkers, including hormones, infectious diseases, and cancer markers.

Strategic partnerships with healthcare providers and diagnostic laboratories expand market reach and foster innovation. Geographic expansion into emerging markets with growing healthcare infrastructure supports market growth. Many players also prioritize automation and integration with digital platforms to streamline testing processes and improve efficiency.

Roche Diagnostics is a leading company in this market, offering advanced chemiluminescence-based assays for diagnostics in areas like oncology, cardiology, and infectious diseases. The company focuses on innovation, combining its expertise in immunoassay technologies with a global distribution network to serve healthcare providers. Roche’s commitment to quality and precision strengthens its position as a key player in the diagnostic industry.

Top Key Players

- Siemens Healthineers

- Roche

- Ortho Clinical Diagnostics

- Fapon

- Hoffmann-La Roche AG

- DiaSorin S.p.A.

- Beckman Coulter Inc.

- Abbott Laboratories

Recent Developments

- In July 2023, Fapon, a leading name in global life sciences, introduced the Shine i8000/9000 chemiluminescence immunoassay system at the AACC 2023 exhibition. With fully automated capabilities, this high-speed analyzer can process up to 900 tests per hour, offering high throughput. It is designed to help Fapon’s partners in developing high-quality clinical diagnostic solutions.

- In June 2022, Roche launched the BenchMark ULTRA PLUS system, an advanced tissue staining platform designed to automate the staining of histological and cytological specimens on slides. The system uses specific reagents for immunohistochemistry, immunocytochemistry, and in situ hybridization for in vitro diagnostic (IVD) purposes.

Report Scope

Report Features Description Market Value (2024) US$ 13.2 billion Forecast Revenue (2034) US$ 25.2 billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Analyzers and Reagents), By Application (Oncology, Therapeutic Drug Monitoring, Cardiology, Endocrinology, Autoimmune Disease, Infectious Disease, and Others), By Sample Type (Blood, Saliva, Urine, and Others), By End-user (Hospitals, Pharmaceutical & Biotechnology Companies, Clinical Laboratories, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens Healthineers, Roche, Ortho Clinical Diagnostics, Fapon, F. Hoffmann-La Roche AG, DiaSorin S.p.A., Beckman Coulter Inc., and Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Chemiluminescence Immunoassay MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Chemiluminescence Immunoassay MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens Healthineers

- Roche

- Ortho Clinical Diagnostics

- Fapon

- Hoffmann-La Roche AG

- DiaSorin S.p.A.

- Beckman Coulter Inc.

- Abbott Laboratories