Global Tetrakis Hydroxymethyl Phosphonium Sulfate Market Size, Share, And Business Benefits By Function (Biocide, Iron Sulfide Scavenger, Flame Retardant, Tanning Agent, Others), By Application (Oil and Gas, Agrochemicals, Water Treatment, Oilfield Chemicals, Personal Care, Textile, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161713

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

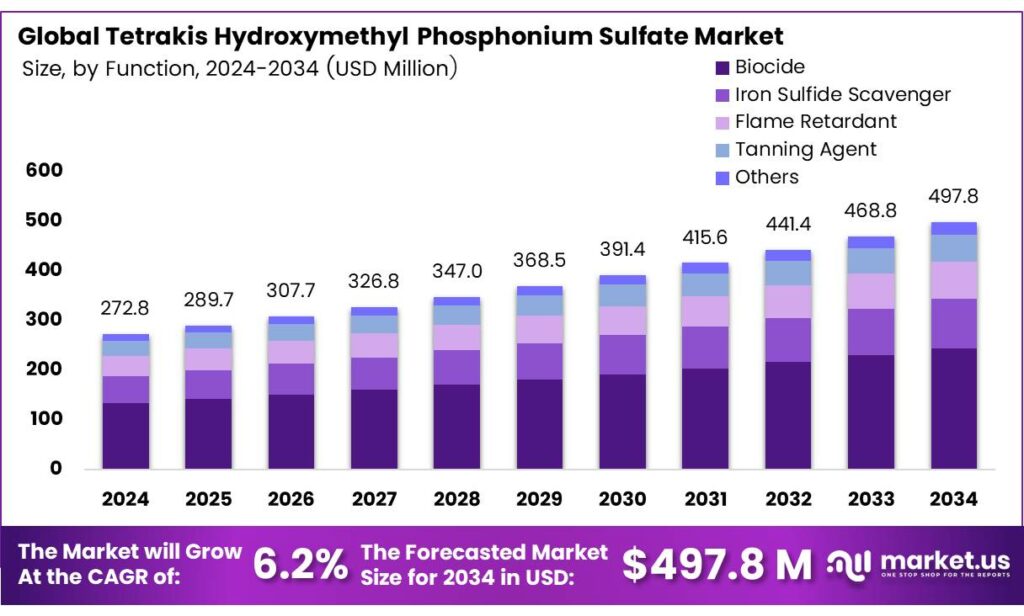

The Global Tetrakis Hydroxymethyl Phosphonium Sulfate Market size is expected to be worth around USD 497.8 Million by 2034, from USD 272.8 Million in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034.

Tetrakis(hydroxymethyl)phosphonium sulfate (THPS) is an environmentally friendly antimicrobial reagent known for its low solidification point and excellent stability. This compound can be stored for extended periods and dissolves easily in water, making it highly practical for various applications. As a new-generation environmental pesticide, THPS offers high efficacy, low toxicity, and minimal residual impact. It effectively eliminates germs and aquatic plants, making it a valuable tool in multiple industries.

In 1995, the United States Environmental Protection Agency (EPA) recognized THPS as a zero-toxicity substance and awarded it the US Green Chemical Prize for its environmentally safe properties. One of its key advantages is its rapid degradation into nontoxic substances immediately after use, ensuring minimal environmental impact. THPS is primarily used in water treatment systems, oil field operations, and the paper-making industry. Additionally, it can be applied as a flame-retardant coating for fabrics, significantly enhancing their fire-resistant properties.

- The specifications for THPS include an active content of at least 75.0%, a viscosity range of 25.0–36.0 MPa·s at 25°C, a density of 1.350–1.420 g/cm³ at 20°C, and a pH range of 2.5–5.5. These characteristics ensure its reliability and effectiveness across its various applications, making THPS a versatile and sustainable solution for both antimicrobial and flame-retardant needs. A study demonstrated that combining the biocide tetrakis(hydroxymethyl)phosphonium sulfate (THPS) with xanthan biopolymer effectively controlled microbiologically influenced corrosion (MIC) in SAE 1010 carbon steel.

The efficacy of this THPS-xanthan combination was compared against three systems: an untreated control, THPS alone, and xanthan alone. Experiments were conducted in a turbulent flow loop using seawater as the circulating medium. The study evaluated microbial group quantification, corrosion rates via mass loss, and biomass and extracellular polymeric substances (EPS) within the biofilm. Analysis of the biofilm on steel coupons was performed using scanning electron microscopy (SEM), while X-ray diffraction (XRD) identified the crystallographic phases of corrosion products.

Results revealed that the THPS-xanthan combination, even with low xanthan concentrations, significantly reduced microbial populations compared to the other systems. This combination also decreased biomass and EPS levels. SEM analysis showed that xanthan’s dispersant properties enabled the formation of a more adherent film on the steel surface, despite the presence of grooves. The lepidocrocite phase was absent in corrosion products from THPS-treated systems, while the mackinawite phase was detected. The study also found that water constituted approximately 95% of the biofilm’s total mass.

Key Takeaways

- The Global Tetrakis Hydroxymethyl Phosphonium Sulfate (THPS) market is projected to grow from USD 272.8 million in 2024 to USD 497.8 million by 2034, at a CAGR of 6.2%.

- The Biocide segment led the THPS market in 2024 with a 43.2% share due to its antibacterial efficacy and eco-friendly degradation.

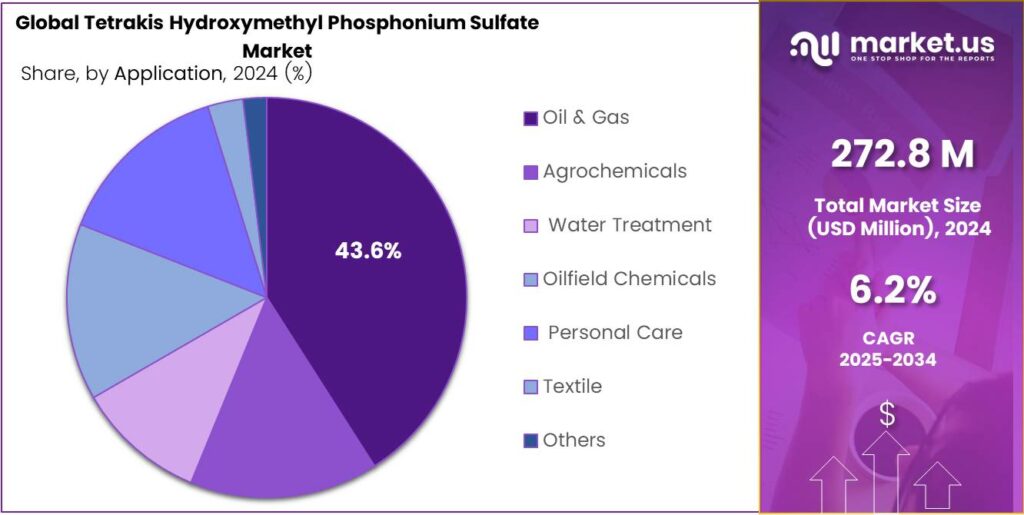

- The Oil and Gas sector dominated the THPS market in 2024, holding a 43.6% share, driven by microbial control in drilling and water systems.

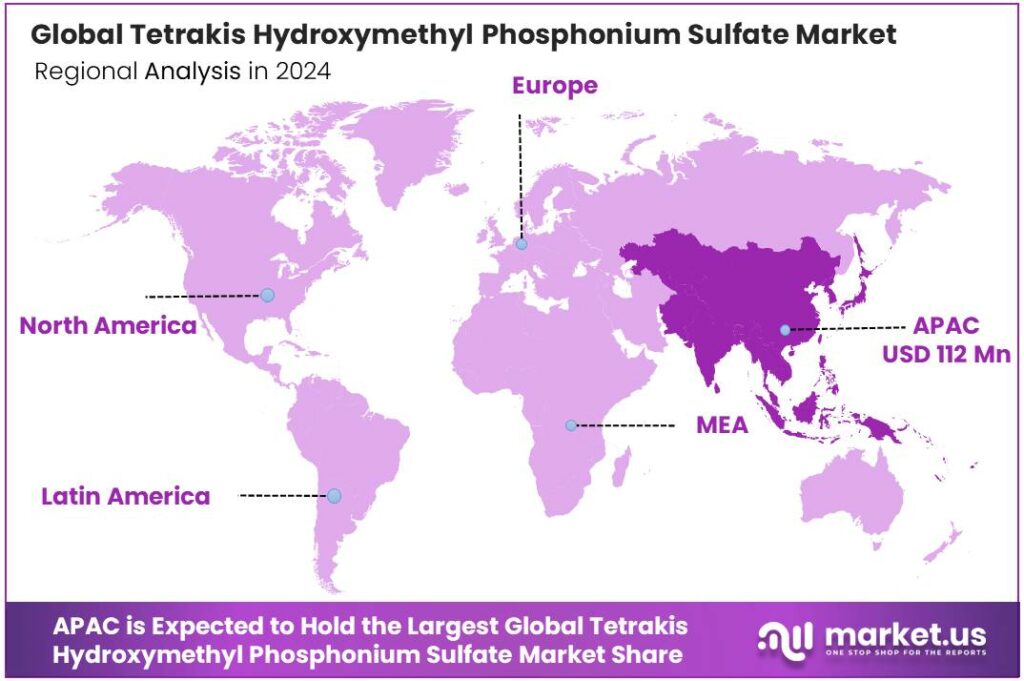

- The Asia-Pacific region held a 41.2% share of the THPS market in 2024, valued at USD 112 million, led by the oil, gas, textile, and leather industries.

By Function

Biocide Function Dominates the THPS Market with 43.2% Share

In 2024, Biocide held a dominant market position, capturing more than a 43.2% share in the global Tetrakis Hydroxymethyl Phosphonium Sulfate (THPS) market. The segment’s leadership stemmed from the compound’s strong antibacterial efficacy and its safe environmental degradation profile, which made it highly suitable for industrial water treatment, oilfield operations, and paper manufacturing.

The biocide segment continued to expand due to growing regulatory encouragement for environmentally safer antimicrobial agents. Industries across North America, Europe, and Asia-Pacific increasingly adopted THPS formulations to replace more persistent or toxic biocides. The compound’s fast biodegradation rate and minimal bioaccumulation potential also aligned well with global sustainability standards.

THPS biocides offered operators reliable microbial control without generating long-lasting residues, helping companies meet both performance and compliance goals. The steady year-on-year growth of this segment underscores the material’s expanding footprint across water-intensive sectors, where microbial balance and corrosion protection remain mission-critical.

By Application

Oil and Gas Application Leads the THPS Market with 43.6% Share

In 2024, Oil and Gas held a dominant market position, capturing more than a 43.6% share of the global Tetrakis Hydroxymethyl Phosphonium Sulfate (THPS) market. This dominance was driven by the compound’s strong effectiveness in microbial control within drilling fluids, injection waters, and produced-water systems.

THPS biocides are widely preferred in upstream and midstream operations for combating sulfate-reducing bacteria that cause corrosion, scaling, and hydrogen sulfide generation. Its rapid degradation in alkaline conditions, low bioaccumulation potential, and high solubility make it a safer and more efficient choice than many conventional aldehyde-based biocides used in the oilfield sector.

Demand from the oil and gas industry continued to rise as global energy producers increased their focus on operational efficiency, corrosion prevention, and sustainable chemical use in water management programs. THPS became an integral component of advanced produced-water treatment units, particularly in offshore and shale operations where environmental compliance and discharge regulations are tightening.

Key Market Segments

By Function

- Biocide

- Iron Sulfide Scavenger

- Flame Retardant

- Tanning Agent

- Others

By Application

- Oil and Gas

- Agrochemicals

- Water Treatment

- Oilfield Chemicals

- Personal Care

- Textile

- Others

Drivers

Growing Demand for Environmentally Safer Biocides in Industrial Water Treatment

One of the strongest drivers behind the increasing adoption of Tetrakis Hydroxymethyl Phosphonium Sulfate (THPS) is the push from industries and regulators toward biocides that are effective yet less harmful to the environment and human health. Industrial water systems (like cooling towers, oil & gas recirculation, and process water loops) often suffer from microbes, bacteria, algae, and fungi that cause corrosion, fouling, or blockages.

Traditional biocides (often oxidizing types or harsh chemical agents) carry risks: residual toxicity, by-products, higher dosages, or environmental persistence. THPS offers a compelling balance: it works at lower concentrations, degrades faster, and has a more favorable toxicology profile. The U.S. EPA notes that in many applications, THPS is used below levels harmful to fish, and that it rapidly breaks down in the environment without bioaccumulation.

- The U.S. industrial water treatment market for non-oxidizing biocides alone consumes 42 million pounds per year, growing at 6–8% annually. That is a vast scale and a big opportunity for safer biocides like THPS to displace more hazardous alternatives. Because THPS is seen as a greener option, many facilities prefer switching to it to remain compliant or reduce environmental risk.

Restraints

Strict Regulatory Hurdles and Compliance Costs

While Tetrakis Hydroxymethyl Phosphonium Sulfate (THPS) offers benefits in many industrial applications, one strong restraining factor is the burden of regulatory compliance, along with the costs and risks of meeting evolving safety standards. Because THPS is a biocide / antimicrobial chemical, it falls under strict oversight by environmental and chemical regulatory agencies.

In the U.S., for instance, biocidal chemicals must be registered under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) before they can be sold or used. In the European Union, THPS must comply with the Biocidal Products Regulation (BPR, Regulation (EU) 528/2012).

Under BPR, only biocidal active substances that are reviewed, authorised, and included in the Union list may be marketed. All uses must be assessed for risks to human health and the environment, and companies must submit detailed dossiers on toxicity, exposure, and environmental fate.

Opportunity

Escalating Volumes of Produced Water & Demand for Treatment

One powerful growth driver for Tetrakis Hydroxymethyl Phosphonium Sulfate (THPS) lies in the sheer scale and rising pressure to manage produced water in the oil & gas industry. As oil and gas fields mature, water that co-exists with hydrocarbons must be treated, re-injected, or disposed of safely. This creates sustained demand for effective biocides and treatment chemicals like THPS.

- Globally, the quantity of produced water is enormous. A peer-reviewed article reports that the current global production of produced water is on the order of 39.5 million cubic meters per day (39.5 Mm³/day). That figure underscores how much water needs microbial and chemical management. Meanwhile, industry sources (such as IOGP’s environmental indicators) note that on average 44% of produced water is discharged to the surface, while 56% is reinjected for disposal or enhanced oil recovery (EOR).

Further supporting this growth is the trend in power plants and heavy industries to reuse cooling and process water rather than fresh intake. In the U.S., of 1,655 cooling systems, 875 (53%) were recirculating systems (cooling towers or ponds), which reuse water rather than constantly drawing a new supply.

Trends

Integration with Smart Dosing & IoT for Real-Time Biocide Control

One significant emerging factor influencing the use of THPS is the move toward smart, sensor-driven dosing systems, that is, using real-time monitoring (IoT, analytics) to add biocide exactly when and where needed. This trend is becoming more relevant as chemical users demand better efficiency, lower waste, and safer operation. In many water-treatment or industrial fluid systems, microbial growth can spike unpredictably.

Operators traditionally dose biocides like THPS at fixed schedules or based on conservative safety margins. But with sensors for parameters such as pH, oxidation reduction potential (ORP), turbidity, microbial load indicators, and flow rate, dosing can become dynamic and responsive. This reduces chemical overuse, cuts costs, and lessens the environmental load of unused residuals.

Large chemical firms and industrial users are already investing in this digitization of chemical feed systems. For example, the European Coatings industry is reporting that fewer biocides are being globally approved, prompting users to optimize dosing precision. Meanwhile, biocide manufacturers are pushing products (or formulations) compatible with automated delivery systems, improving their appeal in “smart plant” environments.

Regional Analysis

Asia-Pacific leads with a 41.2% share and a USD 112 Million market value.

In 2024, Asia-Pacific held a dominant position in the global Tetrakis Hydroxymethyl Phosphonium Sulfate (THPS) market, accounting for 41.2% of the total share, valued at approximately USD 112 million. The region’s leadership is driven by the strong presence of the oil and gas, textile, and leather processing industries, key end-users of THPS as a biocide and flame retardant.

Rapid industrialization in countries such as China, India, and Indonesia continues to enhance regional demand, supported by expanding petrochemical and water treatment infrastructure. China remains the largest consumer within Asia-Pacific, propelled by growing investments in oilfield production chemicals and wastewater management projects aligned with government environmental policies.

The increasing demand for eco-friendly and low-toxicity biocides across industrial sectors has amplified the adoption of THPS, given its biodegradability and effectiveness in microbial control. Several national programs, such as India’s Clean Ganga Mission and China’s industrial wastewater treatment initiatives, are further encouraging the use of phosphorus-based compounds like THPS.

Asia-Pacific’s dominance in 2024 is expected to sustain through 2025, supported by continued infrastructure growth, favorable environmental regulations, and domestic chemical manufacturing expansion. The combination of industrial scale, regulatory emphasis, and cost advantages positions the region as the global center for THPS production and utilization.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF is a dominant force in the THPS market, leveraging its immense production scale and integrated supply chain. The company’s strength lies in its strong R&D capabilities, ensuring high-purity product quality and exploring novel applications. With a vast global distribution network, BASF serves diverse industries, including oil and gas, water treatment, and textiles.

Solvay S.A. competes strongly in the THPS market through its advanced technological expertise and specialty portfolio. The company emphasizes high-value, application-specific solutions, particularly for the oil and gas sector, where THPS is used as a superior biocide. Solvay’s strategy involves continuous innovation to improve product efficacy and environmental profile.

Lonza Group Ltd. brings its renowned expertise in microbial control to the THPS market. The company positions THPS as a key component within its comprehensive portfolio of biocidal products, especially for the oil and gas industry. Lonza’s strength is its deep understanding of industrial preservation and its ability to provide robust technical support and regulatory guidance. By focusing on proven efficacy and reliable supply.

Top Key Players in the Market

- BASF SE

- Solvay S.A.

- Lonza Group Ltd.

- Clariant AG

- Xingfa Group

- SMC

- Others

Recent Developments

- In 2024, BASF’s broader sustainability efforts, such as new certifications for its isocyanate and polyamide production sites under ISCC PLUS and REDcert schemes, indirectly benefit THPS-related downstream applications in flame retardants and textiles by enabling more sustainable supply chains.

- In 2024, Solvay remains a key producer of THPS-based biocides under its Tolcide brand, emphasizing enhanced formulations for microbial control in oil & gas and water treatment. The company highlighted ongoing advancements in its 3rd-generation THPS range (Tolcide PS A Series), which integrates THPS with biopenetrants for improved biofilm, MIC, souring, iron sulfide, and schmoo control.

Report Scope

Report Features Description Market Value (2024) USD 272.8 Million Forecast Revenue (2034) USD 497.8 Million CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Function (Biocide, Iron Sulfide Scavenger, Flame Retardant, Tanning Agent, Others), By Application (Oil and Gas, Agrochemicals, Water Treatment, Oilfield Chemicals, Personal Care, Textile, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Solvay S.A., Lonza Group Ltd., Clariant AG, Xingfa Group, SMC, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Tetrakis Hydroxymethyl Phosphonium Sulfate MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Tetrakis Hydroxymethyl Phosphonium Sulfate MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Solvay S.A.

- Lonza Group Ltd.

- Clariant AG

- Xingfa Group

- SMC

- Others