Global Ballast Water Treatment Systems Market Size, Share, Analysis Report By Technology (Physical, Mechanical, Chemical), By Capacity (Less-than 1500m3, 1500-5000m3, Greater-than 5000m3), By Ship Type (Offshore Support Vessels, Tankers/Carriers, Barges/Cargo Vessels, Tugboats, Defense Vessels, Ferries, Yachts, Cruise Ships, Others), By End-use (New Built, Retrofit) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139368

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

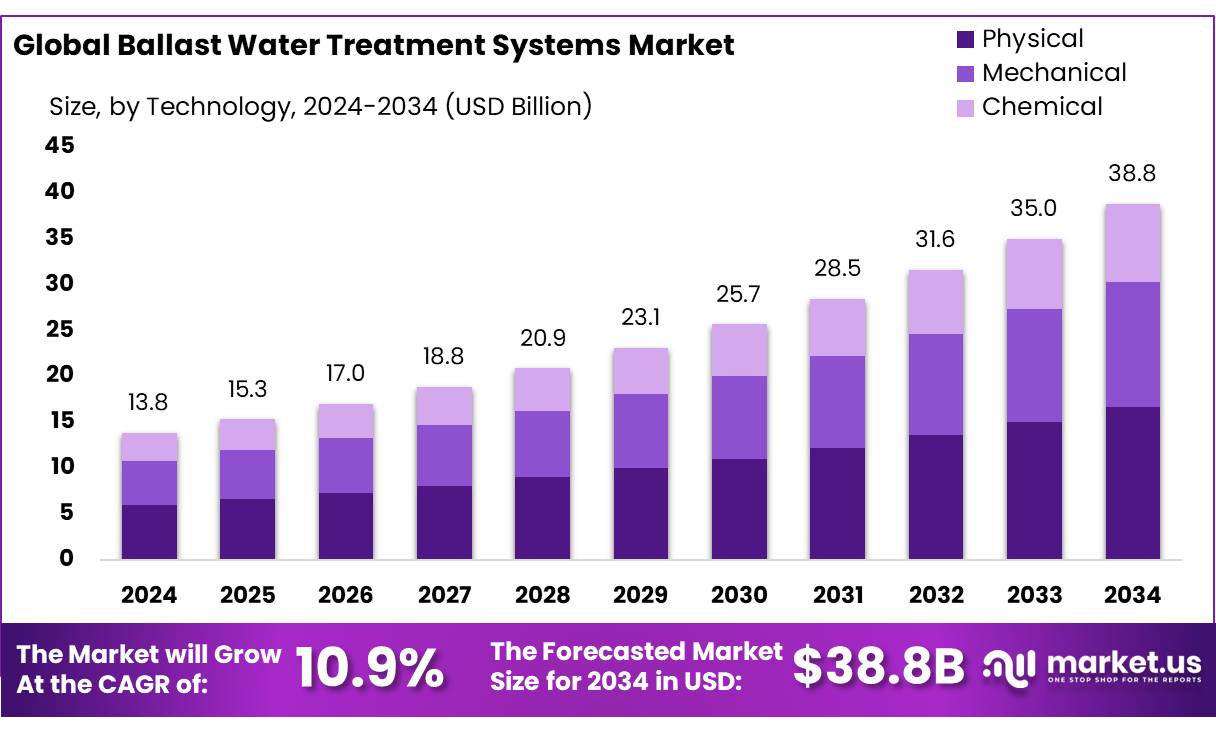

The Global Ballast Water Treatment Systems Market size is expected to be worth around USD 38.8 Bn by 2034, from USD 13.8 Bn in 2024, growing at a CAGR of 10.9% during the forecast period from 2025 to 2034.

The ballast water treatment is still a developing technology with an increasing number of manufacturers, there is little in-service experience for the systems being offered, and it is generally acknowledged that no single system is appropriate for all ship types. The Ballast Water Treatment System (BWTS) is a system designed to remove and destroy/inactive biological organisms (zooplankton, algae, and bacteria) from ballast water.

In modern technologies like UV light and electrochlorination/electrolysis provide efficient and eco-friendly solutions. Ballast water treatment systems use a variety of technologies to lower the risk of invasive species in the ballast water. Physical separation techniques, such as filtration and centrifugation, remove larger organisms and particles. Chemical treatment techniques, such as integrating chlorine or ozone disinfection, effectively remove or inactivate smaller organisms and pathogens.

The general layout of a Ballast Water Treatment (BWT) system is as follows

– The ballast water is typically physically treated by passing it through a filter to remove dirt and living organisms that are 50 microns or larger; some systems use cavitation devices for this purpose.

– The water is then sterilized to kill microbes by chemical treatment using chemicals, and the treated water is filled in ballast tanks. These methods include reducing the oxygen content of the water, adding active substances like ozone and using its sterilizing properties, sterilizing the water using chemicals, and emitting ultraviolet rays.

– The water is then released overboard, but for a system that requires re-treatment or neutralization, the water is released afterwards.

Key Takeaways

- Ballast Water Treatment Systems Market size is expected to be worth around USD 38.8 Bn by 2034, from USD 13.8 Bn in 2024, growing at a CAGR of 10.9%.

- Physical treatment technology held a dominant market position in the ballast water treatment systems market, capturing more than a 43.30% share.

- 1500-5000m³ capacity range held a dominant market position, capturing more than a 48.60% share of the ballast water treatment systems market.

- Tankers/Carriers held a dominant market position, capturing more than a 26.20% share of the ballast water treatment systems market.

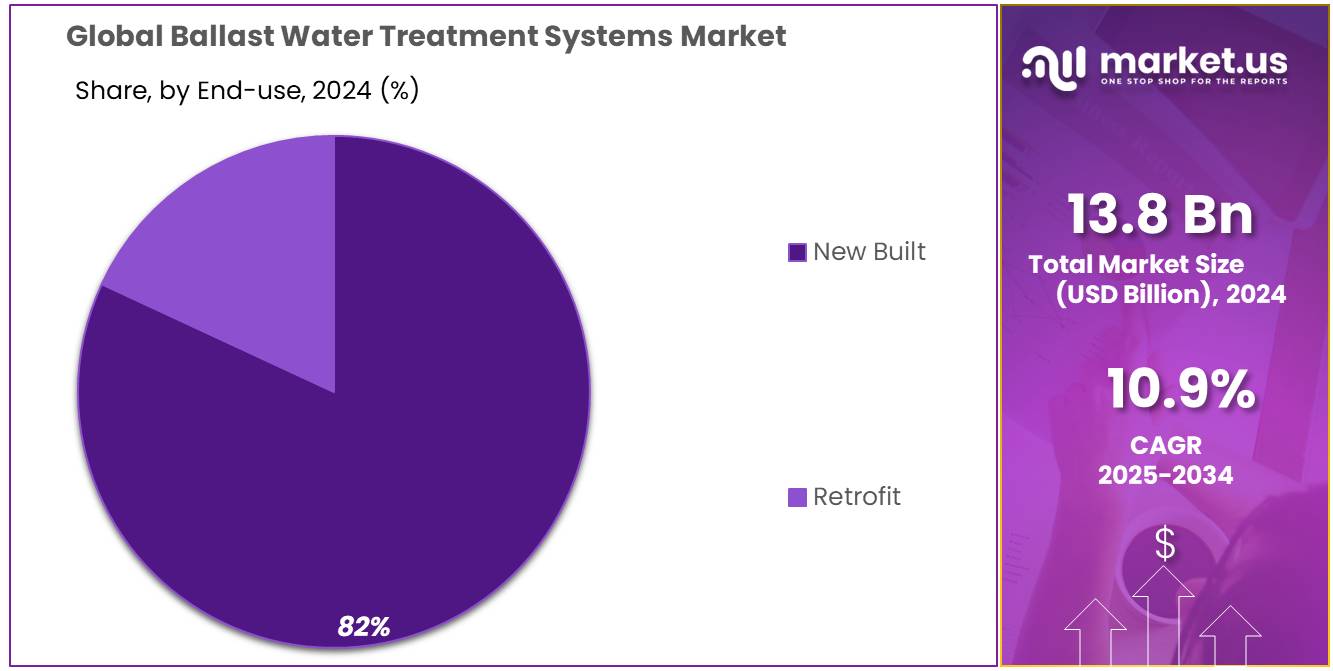

- New Built held a dominant market position, capturing more than a 82.10% share.

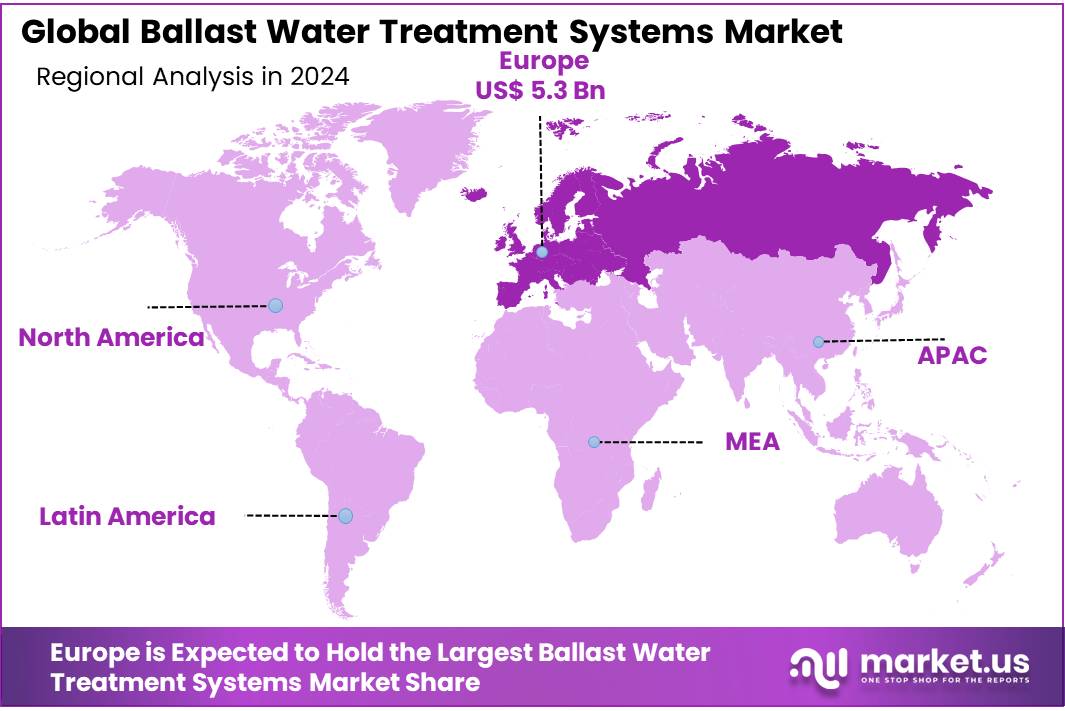

- Europe held a dominant position in the global ballast water treatment systems (BWTS) market, capturing 38.90% of the market share, valued at approximately $5.3 billion.

By Technology

In 2024, Physical treatment technology held a dominant market position in the ballast water treatment systems market, capturing more than a 43.30% share. Physical methods, such as filtration and sedimentation, have become increasingly popular due to their ability to effectively remove larger particles and organisms from ballast water.

In 2024, Ultraviolet Light (UV) technology also saw a significant rise in adoption, holding a substantial share of the market. UV treatment uses ultraviolet light to neutralize harmful microorganisms in ballast water without the need for chemicals, making it an environmentally friendly option. As ship operators increasingly look for sustainable alternatives to chemical treatments, UV technology continues to grow, with market forecasts indicating it will be a key player in the coming years.

Heat Treatment, Deoxygenation, and Cavitation/Ultrasonic, are witnessing slower adoption but are still considered critical for niche applications. These methods, though not as widely adopted as physical and UV treatments, are expected to grow steadily as technological advancements improve their efficiency and lower operational costs.

Chemical treatments, particularly oxidizing biocides and non-oxidizing biocides, are still widely used due to their effectiveness in killing a broad spectrum of organisms. However, concerns about their environmental impact may slow growth in these technologies, as ship operators increasingly prioritize sustainable and chemical-free solutions.

By Capacity

In 2024, the 1500-5000m³ capacity range held a dominant market position, capturing more than a 48.60% share of the ballast water treatment systems market. This segment’s dominance can be attributed to the fact that vessels with this capacity range make up a significant portion of the global fleet. These ships are typically medium-sized commercial vessels, such as bulk carriers, container ships, and tankers, which require effective and efficient ballast water management solutions to meet increasingly stringent environmental regulations.

In 2024, the <1500m³ segment also held a considerable share of the market, though it was smaller than the 1500-5000m³ range. Smaller vessels, such as smaller cargo ships, fishing boats, and leisure vessels, fall into this category. While this market segment has a lower total demand compared to medium-sized ships, the growth in the small vessel market, especially in regions with stricter environmental regulations, is driving adoption of ballast water treatment systems for smaller capacities.

The >5000m³ segment is projected to see steady growth, though it currently captures a smaller portion of the overall market. Larger vessels, including large tankers, LNG carriers, and container ships, fall into this category. These ships require highly efficient, scalable ballast water treatment systems to handle the massive volumes of ballast water they take on. While this segment may not dominate in volume, the high capacity of these systems results in a larger market share value in terms of revenue.

By Ship Type

In 2024, Tankers/Carriers held a dominant market position, capturing more than a 26.20% share of the ballast water treatment systems market. This significant share is primarily driven by the large number of tankers and carriers that operate globally, transporting oil, gas, chemicals, and bulk goods. These vessels are subject to stringent environmental regulations, such as the International Maritime Organization’s (IMO) Ballast Water Management Convention, which mandates the treatment of ballast water to prevent the spread of invasive species.

Following tankers, Offshore Support Vessels are also a prominent segment in the market. These vessels, which support offshore oil and gas exploration activities, have seen an increasing need for ballast water treatment systems. In 2024, offshore support vessels are expected to continue contributing significantly to market growth, driven by the increasing number of offshore projects and the need for compliance with international regulations.

Barges/Cargo Vessels also hold a notable market share. While their demand for ballast water treatment systems is lower than tankers and offshore vessels, it remains significant due to the large number of smaller commercial vessels that operate globally. These vessels, while not as large as tankers, still transport goods in coastal and inland waterways, which are heavily regulated for environmental protection.

Other vessel types, such as Tugboats, Defense Vessels, Ferries, Yachts, and Cruise Ships, also contribute to the market but in smaller proportions compared to the leading segments. Tugboats and Defense Vessels, for instance, are typically smaller but still require compliance with ballast water management laws. Cruise Ships and Yachts, with their larger passenger numbers, are also being equipped with ballast water treatment systems to meet both regulatory and environmental standards.

By End-use

In 2024, New Built held a dominant market position, capturing more than a 82.10% share of the ballast water treatment systems market. This high market share is primarily driven by the growing number of new ships being constructed worldwide. As environmental regulations become more stringent, especially with the implementation of the IMO Ballast Water Management Convention, new ships are increasingly being built with integrated ballast water treatment systems.

The Retrofit segment, while growing, captured a smaller share in 2024, but it is still an important part of the market. With thousands of existing vessels that need to comply with new environmental regulations, there is a continuous push to retrofit older ships with modern ballast water treatment systems. Although the retrofit market does not match the new build market in terms of volume, it is expected to grow steadily as older vessels come up for regulatory compliance.

Key Market Segments

By Technology

- Physical

- Ultraviolet Light

- Heat Treatment

- Deoxygenation

- Cavitation/Ultrasonic

- Mechanical

- Filtration

- Cyclonic Separation

- Electromechanical Separation

- Chemical

- Oxidizing Biocides

- Non-oxidizing Biocides

By Capacity

- <1500m3

- 1500-5000m3

- >5000m3

By Ship Type

- Offshore Support Vessels

- Tankers/Carriers

- Barges/Cargo Vessels

- Tugboats

- Defense Vessels

- Ferries

- Yachts

- Cruise Ships

- Others

By End-use

- New Built

- Retrofit

Drivers

Government Regulations Driving the Demand for Ballast Water Treatment Systems

One of the major driving factors behind the growth of the ballast water treatment systems market is the increasingly stringent government regulations concerning environmental sustainability, specifically the IMO Ballast Water Management Convention. This convention mandates that ships must manage their ballast water to prevent the spread of harmful aquatic species. By 2024, it is expected that over 90% of the global fleet will need to comply with these standards, pushing the demand for effective ballast water treatment systems significantly.

In fact, the International Maritime Organization (IMO), which is the UN body responsible for regulating shipping, has set a target to have all ships comply with the new ballast water treatment standards by 2024, thereby prompting rapid adoption of treatment systems across the shipping industry. Countries and maritime organizations worldwide are aligning with IMO regulations, which are further accelerating the demand for advanced, efficient ballast water treatment systems.

For example, the United States has its own set of regulations enforced by the Environmental Protection Agency (EPA), which is even more stringent than IMO standards. As of 2024, the EPA has mandated that all vessels operating in U.S. waters install treatment systems to meet the Vessel General Permit (VGP) for ballast water discharge, further driving demand for these systems.

This regulatory push is particularly strong in regions such as Europe, where stricter laws are being enforced, and Asia-Pacific, where countries are heavily investing in upgrading their maritime fleets to comply with environmental standards. With the global shipping industry estimated to be worth $1.5 trillion, these government regulations ensure that ballast water treatment systems will continue to play a crucial role in the shipping industry’s environmental efforts.

Restraints

High Installation and Maintenance Costs as a Major Restraining Factor

One significant challenge that is slowing the widespread adoption of ballast water treatment systems is the high installation and maintenance costs associated with these systems. Despite the growing regulatory pressure to install such systems on ships, the initial cost of purchasing and installing these advanced treatment technologies remains a major hurdle for many shipping companies.

The cost for retrofitting older ships with these systems can range from $500,000 to $2 million, depending on the size of the vessel and the type of system installed. For example, a large cargo ship may incur higher costs due to the complexity of retrofitting its ballast water management system. These hefty expenses can be difficult for smaller shipping companies to absorb, especially when they are already dealing with fluctuating fuel prices, operational costs, and regulatory compliance.

Furthermore, the maintenance costs for these systems can also add up over time. Routine maintenance, system checks, and potential repairs are necessary to ensure the system operates efficiently and remains compliant with the latest standards. This can result in ongoing operational expenses, making it an ongoing financial burden for ship owners.

A report from the International Chamber of Shipping (ICS) noted that some smaller shipping companies are struggling to meet the IMO’s Ballast Water Management regulations because of the high initial and ongoing costs. This is particularly true for companies operating in developing countries, where there is less access to financial support for such capital-intensive upgrades.

Opportunity

Expansion of Maritime Trade and Increasing Regulatory Support

A key growth opportunity for the ballast water treatment systems market lies in the expansion of global maritime trade and the increasing regulatory support to ensure environmental sustainability. As global trade continues to grow, so does the volume of ships requiring ballast water treatment. According to the United Nations Conference on Trade and Development (UNCTAD), global maritime trade is expected to grow by 4.1% per year from 2022 to 2027, which translates into a higher demand for ships, including those requiring ballast water management.

In addition, the International Maritime Organization (IMO) has been a driving force behind the implementation of stricter environmental standards. The IMO’s Ballast Water Management Convention, which came into force in 2022, requires all ships to install approved ballast water treatment systems by their first International Oil Pollution Prevention (IOPP) renewal survey after 2024.

This regulation covers over 50,000 commercial vessels globally, which creates a substantial opportunity for the ballast water treatment systems market. With more than 90% of global trade being carried by ships, the IMO’s ongoing regulations create a significant growth opportunity for companies that provide effective and efficient ballast water management solutions.

Trends

Adoption of Advanced Ballast Water Treatment Technologies

One of the most significant trends in the ballast water treatment systems (BWTS) market is the growing adoption of advanced technologies, particularly electrochemical treatment and UV-based systems. As the industry moves toward greater environmental compliance and energy efficiency, these cutting-edge solutions are becoming more popular. In 2024, the demand for UV treatment systems and electrochemical treatment is expected to grow at an accelerated rate due to their ability to treat ballast water more efficiently and with lower operating costs.

For instance, UV treatment technology uses ultraviolet light to neutralize harmful microorganisms in ballast water, providing a chemical-free and environmentally friendly solution. It is becoming a preferred option for ship operators seeking to comply with IMO regulations while minimizing environmental impact. These systems are particularly favored for their ease of use and minimal maintenance. The technology is also aligned with increasing sustainability goals within the maritime industry.

Moreover, the International Maritime Organization (IMO) has been instrumental in pushing for the adoption of cleaner technologies. By setting rigorous standards for ballast water management and imposing fines for non-compliance, IMO has made the integration of advanced BWTS a necessity. The IMO’s Ballast Water Management Convention (BWM Convention) continues to drive the uptake of more efficient systems. As of 2024, it’s estimated that more than 50,000 ships worldwide are mandated to comply with these stringent regulations, fueling further demand for state-of-the-art BWTS.

Regional Analysis

In 2024, Europe held a dominant position in the global ballast water treatment systems (BWTS) market, capturing 38.90% of the market share, valued at approximately $5.3 billion. The region’s dominance can be attributed to stringent regulatory standards set by the International Maritime Organization (IMO) and European Union (EU) directives that demand ships operating in European waters to adopt effective ballast water management solutions. These regulations have prompted both new-build ships and existing vessels to install advanced treatment systems.

North America also represents a significant market for BWTS, driven by the large fleet of commercial vessels and ongoing regulatory requirements. The U.S. and Canada are actively enhancing their ballast water management frameworks, leading to an expanding market for advanced treatment systems in the region. However, North America holds a smaller share compared to Europe, with demand continuing to rise in alignment with increasing environmental regulations and the need for compliance with the USCG (United States Coast Guard) standards.

Asia Pacific, with its rapidly growing maritime trade, follows closely as a key player in the BWTS market. The demand for BWTS is expanding in countries like China, Japan, and South Korea, primarily driven by increased shipping activity and stricter environmental regulations.

Middle East & Africa and Latin America hold relatively smaller market shares but are expected to grow steadily due to expanding shipping activities and a gradual shift toward stricter environmental regulations in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Wärtsilä, a global leader in advanced technologies and services for the marine and energy sectors, has a strong presence in the ballast water treatment systems (BWTS) market. In 2024, Wärtsilä’s BWTS offerings continue to lead with innovative solutions designed to meet the stringent International Maritime Organization (IMO) regulations for ballast water management.

The company’s Wärtsilä AQUARIUS range, which includes AQUARIUS BWTS and the AQUARIUS UV system, is widely recognized for its reliability and compliance with both IMO’s Ballast Water Management Convention and the USCG regulations. Wärtsilä’s systems use advanced ultraviolet (UV) technology and chemical-free treatment methods that ensure ships can efficiently treat ballast water without harming marine life. Wärtsilä has installed over 1,200 BWTS units globally, and it continues to see strong demand for its solutions due to increasing environmental regulations.

The company also provides comprehensive retrofit services, allowing existing vessels to comply with evolving environmental standards. In 2024, Wärtsilä expects a 5% year-over-year growth in its ballast water treatment system installations as more vessels opt for eco-friendly retrofits and new builds are fitted with its advanced solutions, contributing significantly to its overall marine solutions revenue.

Top Key Players

- Wärtsilä

- Alfa Laval AB

- Xylem

- Atlantium Technologies Ltd.

- BIO-UV Group

- Industrie De Nora S.p.A.

- Mitsubishi Kakoki Kaisha, Ltd.

- Ecochlor Inc.

- DESMI A/S

- ERMA FIRST

- GEA Group AG

- Headway Technology Group (Qingdao) Co., Ltd

- Optimarin AS

- PANASIA CO,LTD

- Other Key Players

Recent Developments

In 2024, Alfa Laval’s PureBallast 3 remains one of the most popular and trusted systems for meeting the stringent ballast water management regulations set by the IMO and the USCG.

In 2024, Xylem has reported a 6% annual growth in its ballast water treatment product line, with strong interest from commercial shipping and offshore industries.

Report Scope

Report Features Description Market Value (2024) USD 13.8 Bn Forecast Revenue (2034) USD 38.8 Bn CAGR (2025-2034) 10.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Physical, Mechanical, Chemical), By Capacity (<1500m3, 1500-5000m3, >5000m3), By Ship Type (Offshore Support Vessels, Tankers/Carriers, Barges/Cargo Vessels, Tugboats, Defense Vessels, Ferries, Yachts, Cruise Ships, Others), By End-use (New Built, Retrofit) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Wärtsilä, Alfa Laval AB, Xylem, Atlantium Technologies Ltd., BIO-UV Group, Industrie De Nora S.p.A., Mitsubishi Kakoki Kaisha, Ltd., Ecochlor Inc., DESMI A/S, ERMA FIRST, GEA Group AG, Headway Technology Group (Qingdao) Co., Ltd, Optimarin AS, PANASIA CO,LTD, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ballast Water Treatment Systems MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Ballast Water Treatment Systems MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Wärtsilä

- Alfa Laval AB

- Xylem

- Atlantium Technologies Ltd.

- BIO-UV Group

- Industrie De Nora S.p.A.

- Mitsubishi Kakoki Kaisha, Ltd.

- Ecochlor Inc.

- DESMI A/S

- ERMA FIRST

- GEA Group AG

- Headway Technology Group (Qingdao) Co., Ltd

- Optimarin AS

- PANASIA CO,LTD

- Other Key Players