Global Switchgear Market Size, Share, And Business Benefits By Voltage Type (Low Voltage, Medium Voltage, High Voltage), By Insulation (Air, Gas, Oil, Vacuum, Others), By Current (AC, DC), By Installation (Indoor, Outdoor), By End Use (T and D Utilities, Commercial and Residential, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154618

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

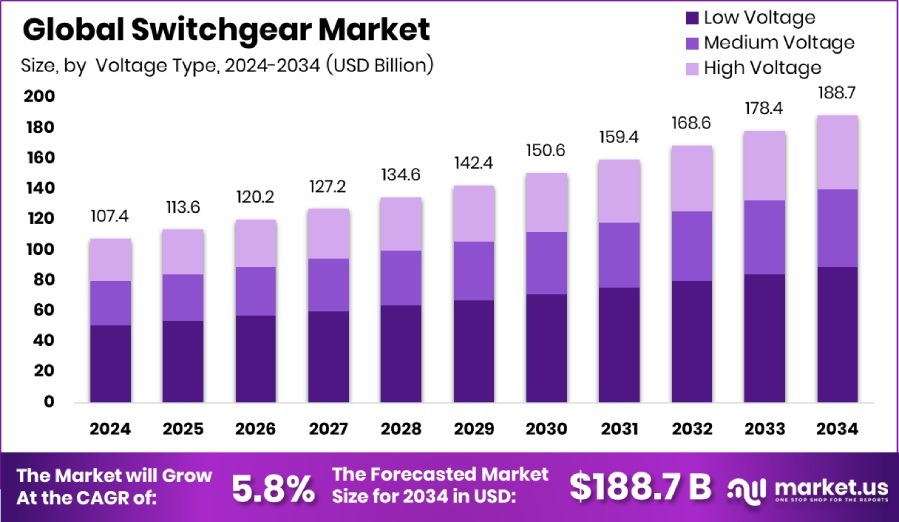

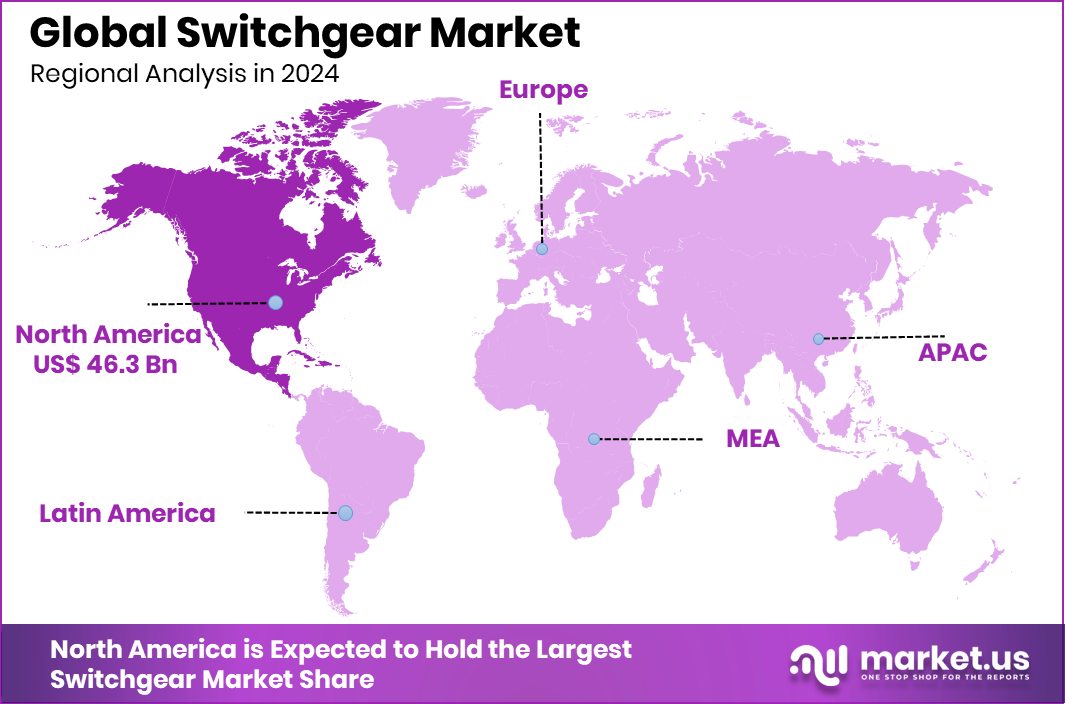

The Global Switchgear Market is expected to be worth around USD 188.7 billion by 2034, up from USD 107.4 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034. Strong utility investments supported North America’s USD 46.3 billion switchgear market growth.

Switchgear refers to a combination of electrical disconnect switches, fuses, or circuit breakers that are used to control, protect, and isolate electrical equipment. It is an essential part of power systems, used in both high-voltage and low-voltage electrical networks. Switchgear ensures safe operation of electricity by interrupting the flow in case of faults, thereby preventing damage to the system and ensuring safety for users. According to an industry report,$86 million has been committed for a new switchgear and power electronics facility in Western Pennsylvania.

The Switchgear Market includes the manufacturing, sales, and deployment of devices used to manage electrical power systems. This market spans across various voltage levels, including low, medium, and high voltage applications. It serves diverse end-users such as industrial units, residential and commercial infrastructure, and public utilities. According to an industry report, Nuventura, based in Berlin, secures €25 million in Series A funding to eliminate greenhouse gas use.

Growth in this market can be linked to rising investments in power infrastructure across developing regions. Governments and private players are expanding transmission and distribution networks, especially in urbanizing areas, which increases the demand for advanced and safe switchgear systems. Electrification projects in rural areas also continue to add steady demand for compact and reliable switchgear. According to an industry report, Power stock gains attention after Vedanta places a ₹30 Crore order.

Demand is further fueled by the rapid expansion of renewable energy installations such as solar and wind farms. These require modern switchgear for grid connectivity and operational safety. Additionally, rising concerns over power reliability, energy efficiency, and system monitoring are pushing industries to adopt digital switchgear systems. According to an industry report, Nuventura in Berlin raises €25M to develop SF6-free switchgear solutions.

Key Takeaways

- The Global Switchgear Market is expected to be worth around USD 188.7 billion by 2034, up from USD 107.4 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034.

- In the switchgear market, the low-voltage segment holds the largest share at 47.3% in 2024.

- Air insulation dominates among insulation types, accounting for 33.8% of the switchgear market’s total share.

- AC current type leads significantly in the market, representing around 87.2% of switchgear usage.

- Indoor installation is preferred by end-users, making up 57.4% of the global switchgear market share.

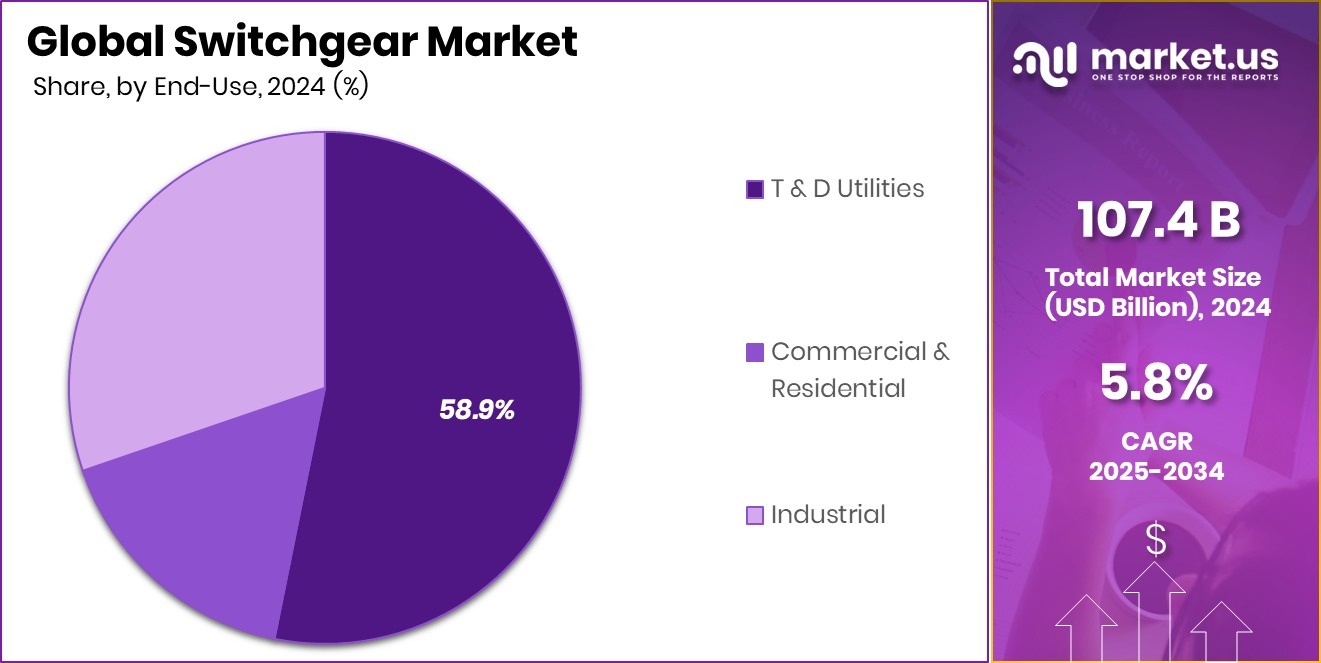

- Transmission and distribution utilities contribute the highest, capturing 58.9% of the total market demand.

- North America switchgear market reached a valuation of USD 46.3 billion in 2024.

By Voltage Type Analysis

Low-voltage switchgear holds a 47.3% share in the global market.

In 2024, Low Voltage held a dominant market position in the By Voltage Type segment of the Switchgear Market, with a 47.3% share. This leadership can be attributed to the wide-scale application of low voltage switchgear in residential, commercial, and industrial distribution networks.

As urbanization and infrastructure development projects expand across both developed and emerging economies, the demand for safe and reliable low-voltage power distribution systems continues to rise. These systems are extensively deployed for protecting electrical circuits and managing energy distribution in low-load environments, including buildings, factories, and public infrastructure.

The dominance of low voltage switchgear is also supported by increasing investments in smart city initiatives and digital infrastructure, where compact and intelligent low-voltage equipment is essential for effective energy control and fault isolation. Moreover, growing safety standards and the need for minimal power outages are prompting upgrades in existing low-voltage systems, particularly in densely populated urban regions.

Additionally, the affordability, ease of installation, and flexibility of low voltage switchgear further strengthen its adoption. The segment’s large market share in 2024 highlights its critical role in modern power management strategies, especially in decentralized grids and localized distribution networks that require efficient and scalable solutions.

By Insulation Analysis

Air-insulated switchgear contributes 33.8% to the total market revenue.

In 2024, Air held a dominant market position in the By Insulation segment of the Switchgear Market, with a 33.8% share. This leadership is primarily driven by the cost-effectiveness and wide acceptance of air-insulated switchgear (AIS) in various power distribution applications.

Air, as an insulating medium, offers a safe and environmentally friendly solution compared to other insulation types. The design simplicity and lower operational costs associated with air-insulated systems make them a preferred choice in medium and low voltage networks, especially for indoor installations in industrial facilities, commercial complexes, and utility substations.

The segment’s dominance also reflects growing adoption in grid modernization efforts, where reliability and ease of maintenance are critical. Air-insulated switchgear is valued for its proven performance, minimal risk of leakage, and long service life, which reduces operational downtime and maintenance efforts. Moreover, ongoing infrastructure upgrades and the need for sustainable and scalable electrical systems further support the strong market position of air insulation.

Its adaptability across different environments and suitability for both indoor and outdoor use enhance its appeal. The 33.8% share in 2024 underlines the trust in air insulation technology, particularly where efficiency, safety, and long-term operational cost control are top priorities.

By Current Analysis

AC switchgear dominates usage with 87.2% market share globally.

In 2024, AC held a dominant market position in the By Current segment of the Switchgear Market, with a substantial 87.2% share. This clear dominance is supported by the widespread use of alternating current (AC) in global power transmission and distribution systems.

AC switchgear is a key component in managing electrical flow across public utilities, industries, and infrastructure projects, as it enables efficient voltage regulation, fault protection, and load control. The established nature of AC power systems in both urban and rural networks reinforces the preference for AC switchgear in operational planning and system upgrades.

The high market share is also driven by the compatibility of AC switchgear with conventional grid infrastructure and generation sources. From generation plants to end-user distribution, AC-based systems continue to serve as the foundation of power delivery across multiple sectors. Moreover, its ability to support long-distance transmission and integration with transformers makes AC switchgear essential for maintaining system stability and reliability.

As utilities and industries focus on efficiency and grid resilience, the proven performance and cost-effectiveness of AC switchgear further validate its dominant position. The 87.2% share in 2024 reflects the enduring role of AC systems in powering modern economies and supporting expanding energy networks.

By Installation Analysis

Indoor installations lead, accounting for 57.4% of total demand.

In 2024, Indoor held a dominant market position in the By Installation segment of the Switchgear Market, with a 57.4% share. This dominance is mainly attributed to the increasing deployment of switchgear systems within enclosed facilities such as commercial buildings, manufacturing plants, data centers, and utility substations. Indoor switchgear is preferred for its space-saving design, enhanced safety features, and reduced exposure to environmental elements, which contribute to longer operational life and lower maintenance costs.

The 57.4% market share reflects growing demand for secure and compact power control solutions, particularly in densely populated urban areas where space constraints are critical. Indoor switchgear systems are also favored in infrastructure modernization projects, where advanced protection, automation readiness, and reliable fault-handling capabilities are required.

The market has also seen increased use of indoor installations in smart buildings and industrial automation setups, where integration with digital monitoring systems is essential for efficiency and control. As power distribution networks evolve to meet higher energy demands and stricter safety norms, indoor switchgear remains a practical and scalable choice.

By End Use Analysis

T&D utilities drive the switchgear market with a 58.9% end-use share.

In 2024, T and D Utilities held a dominant market position in the By End Use segment of the Switchgear Market, with a 58.9% share. This significant share highlights the critical role of switchgear in transmission and distribution infrastructure, where system reliability, load management, and safety are key priorities.

Utilities depend heavily on switchgear to control, protect, and isolate electrical circuits, ensuring stable delivery of electricity across long distances and through complex grid networks. The demand from T and D Utilities is further supported by continuous investments in expanding and upgrading national grid systems to meet rising electricity consumption.

The 58.9% share also reflects the increasing focus on strengthening grid resilience, reducing outage frequency, and enabling real-time monitoring across substations and power lines. As aging infrastructure is being replaced or modernized, the requirement for robust and efficient switchgear systems remains high.

Additionally, with the rise of decentralized generation and regional grid connectivity, utilities are incorporating advanced switchgear to handle varying load conditions and ensure seamless power flow. The dominant position of T and D Utilities in 2024 indicates their pivotal role in shaping the switchgear demand landscape, particularly in regions undertaking large-scale electrification and infrastructure upgrades.

Key Market Segments

By Voltage Type

- Low Voltage

- Medium Voltage

- High Voltage

By Insulation

- Air

- Gas

- Oil

- Vacuum

- Others

By Current

- AC

- DC

By Installation

- Indoor

- Outdoor

By End Use

- T and D Utilities

- Commercial and Residential

- Industrial

Driving Factors

Rising Power Infrastructure Investments Across the Globe

One of the main driving factors of the switchgear market is the rapid growth in investments related to power infrastructure development. Many countries are focusing on expanding and modernizing their electricity networks to meet the increasing demand for a stable and efficient power supply. This includes setting up new power generation plants, upgrading transmission lines, and improving distribution systems.

These projects require a large number of switchgear systems for safe and smooth operation of the electricity flow. Developing economies, in particular, are investing in rural electrification and urban infrastructure, which further increases the need for reliable and cost-effective switchgear. As a result, rising global investments in energy infrastructure are strongly pushing the growth of the switchgear market.

Restraining Factors

High Equipment Costs and Installation Challenges Globally

One key restraining factor in the switchgear market is the high cost of equipment and complex installation processes. Switchgear systems, especially those used in high-voltage applications, require significant upfront investment for purchase, testing, and setup. The costs further increase when advanced features like automation, monitoring, and protection systems are included.

In addition, installation demands skilled labor and careful handling to ensure safety and system compatibility. These challenges can delay project timelines and increase overall infrastructure costs, especially for small utilities and companies with limited budgets. As a result, high costs and technical difficulties act as barriers, slowing down adoption in some regions and impacting market growth, particularly in price-sensitive or developing areas.

Growth Opportunity

Smart Switchgear Integration with Digital Monitoring Solutions

A major growth opportunity in the switchgear market lies in integrating smart switchgear with digital monitoring solutions. As power systems evolve toward greater automation and efficiency, utilities and industries are increasingly adopting switchgear equipped with sensors, real‑time diagnostics, and remote control capabilities. This shift enables early detection of faults, predictive maintenance to reduce downtime, and enhanced safety through automated fault isolation.

With growing interest in smart grids, industrial automation, and IoT-enabled infrastructure, demand for switchgear that offers digital insights is increasing. This opens opportunities for suppliers to offer value-added solutions that support energy management, improve reliability, and reduce lifecycle costs. Smart switchgear helps end users gain greater control over power distribution, making it a prime area for market expansion.

Latest Trends

Eco-Friendly Switchgear Gaining Strong Market Attention

One of the latest trends in the switchgear market is the growing demand for eco-friendly and sustainable switchgear systems. Industries and utilities are now shifting towards alternatives that reduce environmental impact, such as using vacuum or air insulation instead of SF₆ gas, which is a potent greenhouse gas. This trend is being supported by stricter environmental regulations and the global push towards greener technologies.

Manufacturers are focusing on developing switchgear that offers the same reliability and safety without harmful emissions. As companies aim to lower their carbon footprint, eco-friendly switchgear is becoming a preferred choice. This trend is expected to continue gaining traction as sustainability becomes a key part of infrastructure development and power system planning worldwide.

Regional Analysis

In 2024, North America held 43.20% market share in the switchgear sector.

In 2024, North America emerged as the dominant region in the global switchgear market, capturing a significant 43.20% share, which translated to a market value of USD 46.3 billion. This strong position is attributed to extensive investments in grid modernization, replacement of aging infrastructure, and increased deployment of renewable energy projects across the United States and Canada.

The region’s focus on enhancing transmission and distribution networks has significantly contributed to the demand for both low and high-voltage switchgear systems. In Europe, steady growth is supported by the ongoing push for clean energy transitions and smart grid initiatives across countries such as Germany and France. Asia Pacific, while not the leading region in terms of market share, continues to see rising adoption due to rapid industrialization and urban development in emerging economies.

In the Middle East & Africa, switchgear demand is being driven by infrastructure expansion and electrification efforts in underserved areas. Meanwhile, Latin America shows a moderate growth trend, backed by utility upgrades and rising energy consumption in developing nations. Overall, North America’s dominant 43.20% market share highlights its leading role in global switchgear demand, with other regions contributing through localized expansion, policy support, and infrastructure needs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB Ltd. continued to be influential through its focus on advanced switchgear solutions for medium- and high-voltage applications. The company emphasized reliability, safety, and digital connectivity in its portfolio. Its innovations in compact and smart designs helped meet evolving utility and industrial requirements, reinforcing its position in mature and emerging markets globally.

Eaton Corporation further advanced its position by developing modular and flexible switchgear platforms geared to industrial and commercial installations. Its offerings prioritized ease of installation, integration with building automation, and efficient lifecycle maintenance. Eaton’s focus on value-added support services, such as predictive diagnostics and remote monitoring, contributed to strong customer loyalty and repeat business.

General Electric benefited from its expansive global reach and long-standing presence in the energy sector. The company’s switchgear business leveraged established utility relationships and engineering expertise, especially in transmission & distribution applications. Its emphasis on system compatibility and long-term reliability continued to attract utility-scale clients seeking scalable solutions.

Hitachi Limited demonstrated growing competitiveness through its innovation in environmentally conscious and digitized switchgear solutions. Emphasizing energy-efficient designs and seamless integration with smart grid infrastructure, Hitachi offered systems optimized for enhanced fault detection and lower environmental impact. Its efforts to combine sustainability with operational efficiency created compelling value for customers in infrastructure and industrial sectors.

Top Key Players in the Market

- ABB Ltd.

- Eaton Corporation

- General Electric

- Hitachi Limited

- Bharat Heavy Electricals Limited (BHEL)

- Crompton Greaves

- Powell Industries

- Legrand

- Atlas Electric, Inc.

- Siemens AG

Recent Developments

- In May 2024, Eaton completed the acquisition of Exertherm, a UK-based specialist in continuous thermal monitoring technology. Exertherm’s systems integrate with low-voltage and medium-voltage switchgear, enabling real‑time temperature tracking to improve safety and reliability. The deal enables Eaton to embed thermal analytics within its power distribution products.

- In January 2024, ABB introduced more than 20 new products during its Electrification Innovation Week in Xiamen. The launch included a next‑generation DC solid‑state circuit breaker, revolutionizing DC switchgear safety and performance, and milestone releases in ring main units and miniature circuit breakers for smart power systems. These innovations support ABB’s work in electrification and switchgear digitalization.

Report Scope

Report Features Description Market Value (2024) USD 107.4 Billion Forecast Revenue (2034) USD 188.7 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Voltage Type (Low Voltage, Medium Voltage, High Voltage), By Insulation (Air, Gas, Oil, Vacuum, Others), By Current (AC, DC), By Installation (Indoor, Outdoor), By End Use (T and D Utilities, Commercial and Residential, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB Ltd., Eaton Corporation, General Electric, Hitachi Limited, Bharat Heavy Electricals Limited (BHEL), Crompton Greaves, Powell Industries, Legrand, Atlas Electric, Inc., Siemens AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB Ltd.

- Eaton Corporation

- General Electric

- Hitachi Limited

- Bharat Heavy Electricals Limited (BHEL)

- Crompton Greaves

- Powell Industries

- Legrand

- Atlas Electric, Inc.

- Siemens AG