Metal-air Battery Market Size, Share, And Strategic Business Review By Metal (Zinc, Lithium, Aluminum, Iron, Others), By Voltage (Low (less than 12V), Medium (12-36V), High (greater than 36V)), By Type (Primary, Secondary), By Application (Electric Vehicles, Military Electronics, Electronic Devices Stationary Power, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 136099

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Strategic Business Review of Metal-air Battery

- By Metal Analysis

- By Voltage Analysis

- By Type Analysis

- By Application Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

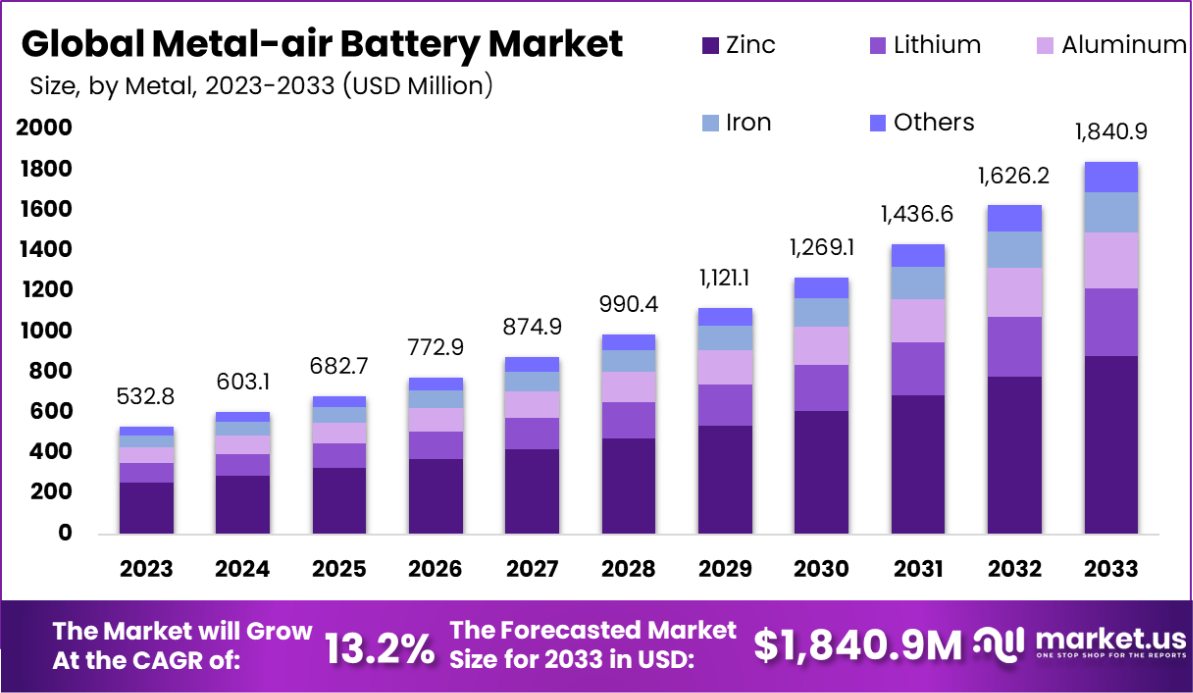

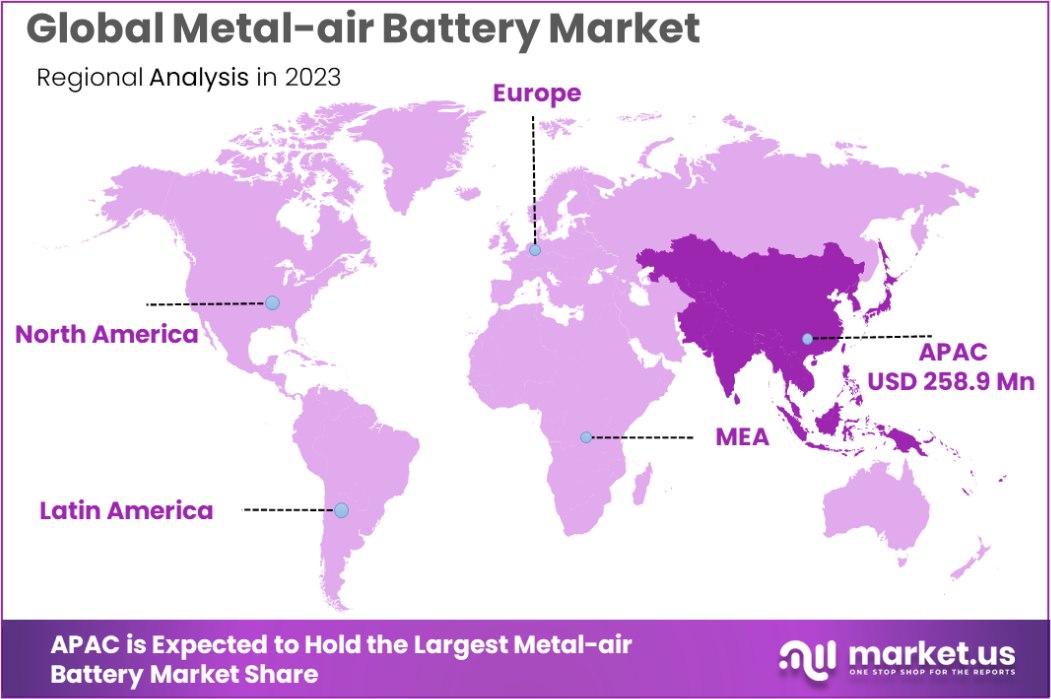

The Global Metal-air Battery Market is expected to be worth around USD 1,840.9 Million by 2033, up from USD 532.8 Million in 2023, and grow at a CAGR of 13.2% from 2024 to 2033. The Asia-Pacific metal-air battery market holds 48.6% with a valuation of USD 258.9 million.

A metal-air battery is a type of battery that uses metal as the anode and atmospheric oxygen as the cathode, with an electrolyte in between. This design allows for a high energy density because the cathode doesn’t need to be stored within the battery, making metal-air batteries lighter and potentially more compact than conventional batteries. They are particularly interesting for applications where weight and battery size are critical, such as electric vehicles and portable electronic devices.

.

.The metal-air battery market refers to the economic sector focused on the development, production, and sale of these batteries. This market is growing due to several factors including the push for more sustainable energy storage solutions, the increasing adoption of electric vehicles, and advancements in battery technologies that improve efficiency and reduce costs.

Key growth factors for this market include technological advancements that enhance battery life and energy density, as well as increasing investment in renewable energy sources that require efficient storage solutions. Demand is driven by the expanding electric vehicle market and the growing need for portable power in consumer electronics.

Opportunities within the metal-air battery market include expansion into large-scale energy storage systems and the potential for these batteries to be used in remote and off-grid power systems, where their efficiency and longevity could provide significant benefits.

The metal-air battery market is poised for substantial growth, underpinned by a convergence of technological advancements, regulatory support, and increasing demand from key sectors. As the global push for more sustainable and efficient energy storage solutions gains momentum, the metal-air battery technology stands out due to its high energy density and potential for large-scale deployment.

Estimates by CRS Reports suggest a robust outlook for electric vehicles (EVs), a key driver for the metal-air battery market, with projections of 200 million EVs sold by 2030. This surge in EV adoption amplifies the need for advanced battery technologies that can offer longer ranges and more efficient energy storage solutions. The metal-air battery, with its superior energy-to-weight ratio, is particularly well-suited to meet these demands.

Furthermore, the state of California, a leader in energy innovation, already operates 6,600 MW of battery storage and has laid out plans to dramatically scale this capacity. By 2045, over 48 GW of battery storage and 4 GW of long-duration storage are expected to be operational to support the state’s 100% clean electricity goals. This significant investment in battery infrastructure underscores the growing reliance on advanced storage solutions, where metal-air technologies could play a crucial role.

Supportive policy frameworks also bolster the market. The Biden-Harris Administration has announced over $3 billion to strengthen America’s battery supply chain, reflecting a strategic commitment to enhancing domestic manufacturing capabilities and reducing reliance on imported materials.

Additionally, the National Science Foundation’s grant of $313,194 for research on solid oxide metal-air battery systems signals ongoing support for foundational research and development, further accelerating the market’s expansion.

Key Takeaways

- The Global Metal-air Battery Market is expected to be worth around USD 1,840.9 Million by 2033, up from USD 532.8 Million in 2023, and grow at a CAGR of 13.2% from 2024 to 2033.

- Zinc-based metal-air batteries dominate the market, holding a 48.2% share by metal.

- Medium voltage batteries, ranging from 12-36V, constitute 48.1% of the market by voltage.

- Primary metal-air batteries lead the market by type, capturing a 61.5% share.

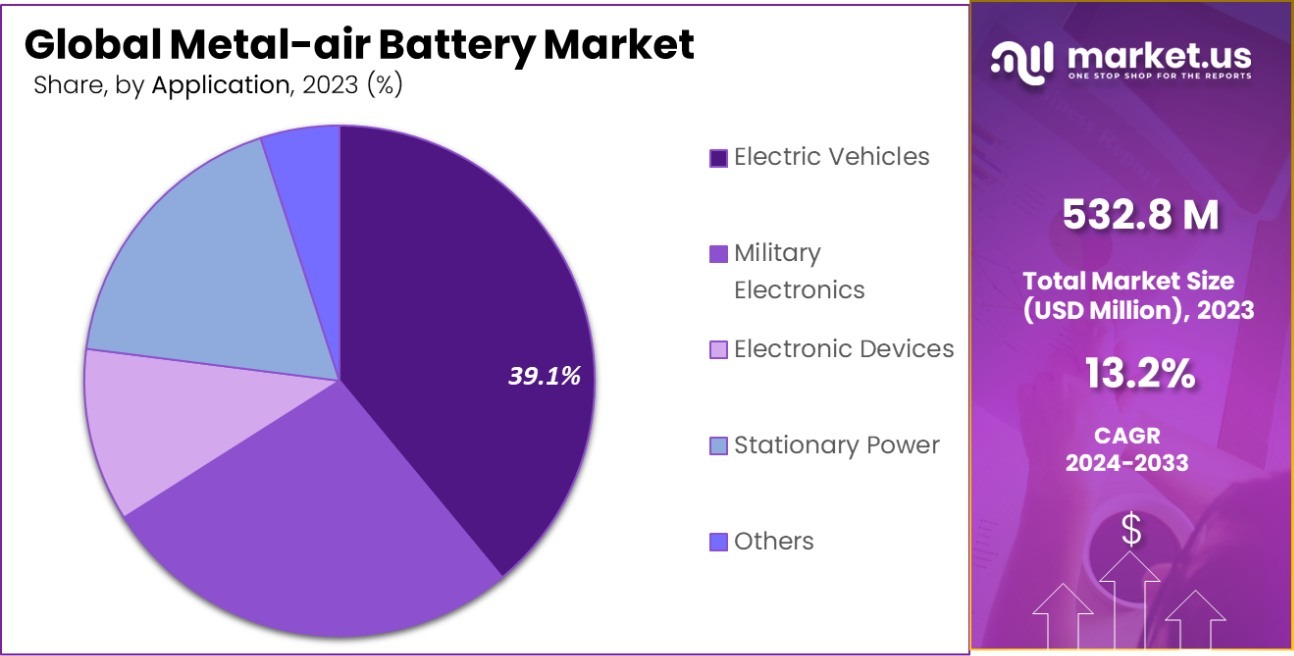

- Electric vehicles are a major application, accounting for 39.1% of the market by use.

- In Asia-Pacific, the metal-air battery market holds a 48.6% share, valued at USD 258.9 million.

Strategic Business Review of Metal-air Battery

A strategic business review of the metal-air battery market reveals its substantial growth potential, driven by the increasing demand for sustainable and efficient energy storage solutions.

Metal-air batteries, known for their high energy density and cost-effectiveness, are particularly advantageous in applications ranging from electric vehicles to grid storage. These batteries utilize metals such as zinc, lithium, or aluminum as the anode and oxygen from the air as the cathode, which can significantly reduce the battery weight and cost.

The environmental benefits of metal-air batteries, including their potential for lower carbon emissions compared to conventional batteries, align well with global sustainability goals. This has spurred investment in research and development to overcome challenges such as limited rechargeability and shorter lifespans compared to other battery technologies.

Technological advancements are focused on enhancing the electrode design and electrolyte formulations to improve the overall battery performance and lifecycle.

The application spectrum of metal-air batteries is expanding. In the electric vehicle sector, they are being explored as a means to extend vehicle range without the need for heavier battery systems. Additionally, their ability to be recycled more easily than lithium-ion batteries presents an opportunity to minimize the environmental impact of used batteries.

By Metal Analysis

Zinc-based metal-air batteries dominate the market, comprising 48.2% due to their cost-effectiveness and availability.

In 2023, Zinc held a dominant market position in the “By Metal” segment of the Metal-air Battery Market, with a 48.2% share. Zinc’s prominence in this segment is primarily due to its favorable characteristics such as high energy density, cost-effectiveness, and environmental safety. These traits make Zinc an attractive option for manufacturers looking to develop efficient and sustainable battery solutions.

Following Zinc, Lithium accounted for a significant portion of the market, capturing 29.1% of the share. Lithium’s high electrochemical potential and energy density make it ideal for high-performance applications, driving its substantial market penetration. The increasing demand for portable electronics and electric vehicles, which require reliable and long-lasting power sources, further bolsters Lithium’s strong position in the market.

Aluminum and Iron, holding shares of 13.6% and 9.1% respectively, also play crucial roles in the market. Aluminum’s lightweight properties and high-energy capacity make it suitable for specific industrial applications, while Iron’s abundance and recyclability appeal to cost-conscious sectors focusing on sustainability. Each metal’s unique properties cater to different market needs, contributing to the diverse landscape of the Metal-air Battery Market.

By Voltage Analysis

Medium voltage metal-air batteries (12-36V) hold 48.1% of the market, favored for their balance in power and size.

In 2023, the Medium (12-36V) category held a dominant market position in the By Voltage segment of the Metal-air Battery Market, capturing a 48.1% share. This segment benefited significantly from its widespread adoption in mid-range applications that require a balance of power, longevity, and cost-efficiency. Such applications typically include portable electronic devices, light electric vehicles, and backup power systems.

The medium voltage range is particularly favored for its ability to offer higher energy density and longer cycle life compared to the Low (<12V) segment, which accounted for a 31.2% market share. Low voltage batteries are primarily used in smaller consumer electronics and wearables, where compact size and low weight are prioritized over high power output.

Conversely, the High (>36V) segment held a 20.7% share of the market. This segment caters predominantly to high-demand applications such as electric buses, large-scale energy storage systems, and advanced industrial machinery. Despite its smaller market share, this segment is expected to grow rapidly, driven by the increasing demand for renewable energy solutions and large vehicles that require robust energy storage systems.

As technological advancements continue to enhance the efficiency and reduce the costs of metal-air batteries, the dynamics within these segments are likely to evolve, potentially reshaping the market landscape in the coming years.

By Type Analysis

Primary metal-air batteries, which are non-rechargeable, constitute 61.5% of the market, preferred for their high energy density.

In 2023, Primary held a dominant market position in the “By Type” segment of the Metal-air Battery Market, with a 61.5% share. This impressive market share underscores Primary’s leading role in the industry, largely driven by its robust product offerings and strong distribution networks.

Secondary, meanwhile, accounted for the remaining 38.5% of the market. This segment includes various players who are gradually expanding their market presence through innovative technologies and strategic partnerships.

The significant lead of Primary in the market is attributed to its advanced technological implementations and the reliability of its metal-air batteries, which are extensively used across various applications including electric vehicles, electronics, and energy storage systems. The company has effectively leveraged its R&D capabilities to enhance the efficiency and lifespan of its batteries, thus appealing to a broader consumer base.

Secondary’s market position, while smaller, is nonetheless crucial as it represents the combined efforts of other companies competing in this space. These competitors are focusing on niche markets and specialized applications, potentially paving the way for shifts in market dynamics in the upcoming years.

Their growth is supported by increasing investments in sustainable and renewable energy solutions, aligning with global trends towards greener technologies. This segment’s competitive landscape is expected to intensify with advancements in battery technology and the entry of new players aiming to capitalize on the growing demand for environmentally friendly energy storage solutions.

By Application Analysis

Electric vehicles are a major application, using 39.1% of metal-air batteries, driven by the demand for efficient energy solutions.

In 2023, Electric Vehicles held a dominant market position in the “By Application” segment of the Metal-air Battery Market, with a 39.1% share. This segment’s prominence is attributed to the increasing adoption of electric vehicles, driven by global initiatives to reduce carbon emissions and the improving economics of EV ownership.

Electric Vehicles are followed by Military Electronics, which accounted for a 21.4% share, highlighting its critical role in enhancing the operational capabilities of defense systems through reliable and high-energy-density power solutions. Electronic Devices captured a 19.7% market share, underscoring the growing demand for portable power sources in consumer electronics.

Lastly, Stationary Power held a 19.8% share, indicating a steady demand for metal-air batteries in emergency power systems and grid storage solutions. This distribution reflects the diverse applications of metal-air batteries, each segment benefiting from the unique attributes of the technology, such as high energy density and cost-effectiveness, catering to specific needs ranging from mobility solutions to critical power backup.

Key Market Segments

By Metal

- Zinc

- Lithium

- Aluminum

- Iron

- Others

By Voltage

- Low (<12V)

- Medium (12-36V)

- High (>36V)

By Type

- Primary

- Secondary

By Application

- Electric Vehicles

- Military Electronics

- Electronic Devices Stationary Power

- Others

Driving Factors

Increased Demand for Eco-Friendly Energy Solutions

The Metal-air Battery Market is significantly driven by the global shift towards sustainable energy solutions. As governments and corporations alike push for greener alternatives to reduce carbon footprints, metal-air batteries emerge as a prime choice due to their high energy density and reliance on abundant, non-toxic materials.

This trend is bolstered by international environmental regulations and the growing societal awareness around climate change, making metal-air batteries an attractive option for various applications including electric vehicles and renewable energy storage.

Advancements in Battery Technology

Rapid technological advancements in battery design and materials have propelled the Metal-air Battery Market forward. Innovations in electrode materials and improvements in air cathode structures enhance the overall efficiency and lifespan of these batteries.

This progress not only optimizes their performance in high-demand applications such as electric vehicles and portable electronics but also reduces production costs. As these batteries become more cost-effective and robust, their adoption rate across multiple sectors is expected to surge, further driving market growth.

Expansion in Electric Vehicle (EV) Market

The burgeoning growth of the electric vehicle (EV) market serves as a key catalyst for the expansion of the Metal-air Battery Market. Metal-air batteries, known for their high energy capacity and lighter weight compared to traditional lithium-ion batteries, are increasingly considered for EV applications.

This trend is supported by global initiatives and subsidies aimed at promoting EV adoption to combat urban air pollution and dependency on fossil fuels, directly influencing the demand for advanced battery technologies like metal-air systems.

Restraining Factors

Limited Commercial Availability of Metal-air Batteries

One of the primary restraining factors for the Metal-air Battery Market is the limited commercial availability of these batteries. Despite their potential, metal-air batteries are still predominantly in the developmental and pilot testing phase, with few models available for widespread commercial use.

This slow market rollout can be attributed to the technical challenges in scaling production and ensuring consistent performance across varied operational conditions. The current scarcity of fully developed and commercially viable products hinders the adoption rate and delays the potential market penetration of metal-air batteries.

High Costs of Initial Investment and Infrastructure

The deployment of metal-air batteries often involves high initial costs, not only in terms of the batteries themselves but also the infrastructure required for their operation and maintenance. The need for specialized charging stations and maintenance facilities can be prohibitively expensive, especially in regions lacking existing infrastructure.

This financial barrier can deter potential users and investors, particularly in emerging markets and sectors where budget constraints are significant. Consequently, the high upfront investment required can slow down the adoption and growth of the Metal-air Battery Market.

Technical Limitations and Durability Concerns

Metal-air batteries face significant technical challenges that act as a market restraint, including issues related to their durability and operational efficiency. These batteries are prone to rapid capacity loss over time and underperform in extreme weather conditions.

Furthermore, the current limitations in air cathode technology prevent these batteries from achieving their maximum potential lifespan and performance. These technical drawbacks make metal-air batteries less attractive for applications requiring long-term reliability and high power output, thus limiting their broader market acceptance.

Growth Opportunity

Expansion into Renewable Energy Storage Solutions

The Metal-air Battery Market has substantial growth opportunities in the renewable energy sector, particularly for storage solutions. As global investment in renewable energy sources like solar and wind continues to increase, the demand for efficient, high-capacity storage systems rises.

Metal-air batteries, with their high energy density and ability to scale, are well-positioned to meet these storage demands. This presents a significant opportunity for market expansion as these batteries can be integrated into renewable systems to improve energy reliability and grid stability, especially in areas with intermittent power supplies.

Development of Portable and Wearable Technology

The ongoing miniaturization and evolution of consumer electronics, including wearable and portable devices, offer a promising growth avenue for the Metal-air Battery Market. These applications require compact, lightweight, and long-lasting power sources.

Metal-air batteries are ideal due to their energy-to-weight ratio superior to many other battery technologies. This makes them especially suitable for powering devices like smartwatches, fitness trackers, and medical monitoring devices, where extended battery life is crucial to consumer satisfaction and functional viability.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations between metal-air battery developers and application manufacturers can unlock new growth opportunities. By aligning with automotive, electronics, and renewable energy companies, battery manufacturers can tailor their products to meet specific industry needs, enhancing product applications and market reach.

These partnerships can facilitate the sharing of technology and expertise, accelerating product development and commercialization. Moreover, collaborating with governments and regulatory bodies can help overcome barriers and shape policies favorable to the adoption of metal-air batteries, particularly in markets that are still in their infancy.

Latest Trends

Expansion of Electric Vehicles Drives Metal-Air Battery Adoption

The surge in electric vehicle (EV) production and sales globally is significantly bolstering the metal-air battery market. These batteries are favored for their high energy density and cost-efficiency, which are crucial for the extended range and performance of EVs.

Major automotive manufacturers are investing in this technology to overcome the limitations of conventional batteries, positioning metal-air batteries as a viable alternative. This trend is supported by government incentives for cleaner transportation options, further accelerating the market’s growth.

Innovation in Battery Technology Enhances Performance and Safety

Recent advancements in metal-air battery technology have led to notable improvements in battery lifespan, safety, and environmental impact. Researchers and companies are focusing on developing non-flammable electrolytes and biodegradable components, which promise to reduce the ecological footprint of these batteries.

Enhanced performance features, including faster charging times and higher energy output, are making these batteries increasingly attractive for both consumer electronics and industrial applications. Such innovations are pivotal in driving the widespread adoption of metal-air batteries.

Renewable Energy Storage Solutions Propel Market Growth

The integration of metal-air batteries in renewable energy systems is a rapidly growing trend, driven by the global shift towards sustainable energy sources. These batteries are being used increasingly in smart solar and wind energy installations for energy storage.

Their ability to store large amounts of energy economically makes them ideal for balancing supply and demand in grids powered by renewables. The ongoing development and scaling up of these technologies are expected to further enhance their efficiency and reduce costs, contributing significantly to the metal-air battery market expansion.

Regional Analysis

In Asia-Pacific, the metal-air battery market holds a 48.6% share, valued at USD 258.9 million.

The global metal-air battery market is segmented into key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each contributing uniquely to the market dynamics.

Asia-Pacific dominates the metal-air battery market, commanding a 48.6% share with a market valuation of USD 258.9 million. This region’s leadership is driven by rapid industrialization, extensive investment in renewable energy, and the proliferation of electric vehicles, particularly in countries like China, Japan, and South Korea. The supportive government policies and growing tech-savvy consumer base further propel the adoption of metal-air technologies in this region.

North America, particularly the United States and Canada, follows suit with significant advancements in technology and a high adoption rate of eco-friendly energy solutions contributing to market growth. Europe is also a substantial contributor, with an emphasis on sustainability initiatives and the modernization of energy grids through renewable energy sources.

The Middle East & Africa and Latin America regions, though smaller in market size, are experiencing gradual growth. Increased awareness about renewable energy and the need for sustainable energy storage solutions drive this trend. Government initiatives aimed at modernizing infrastructure and increasing energy security are boosting the adoption of metal-air batteries in these regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global metal-air battery market, key players are dynamically shaping the industry landscape through technological innovation and strategic market positioning. Arotech Corporation and Duracell Inc. continue to lead with robust research and development initiatives that focus on enhancing the energy density and lifecycle of metal-air batteries.

Energizer Holdings, Inc. leverages its vast distribution network to ensure widespread market penetration and consumer accessibility, emphasizing the reliability and efficiency of its products.

Epsilor Electric Fuel and Fuji Pigment Co. Ltd. are notable for their pioneering work in biodegradable and environmentally friendly battery components, addressing the increasing consumer demand for sustainable products.

GP Batteries International Limited and Guangdong Tiangju Electronics Technology Co., Ltd are expanding their market reach in the Asia-Pacific region, capitalizing on the rapid growth of electronic manufacturing and renewable energy sectors in the area.

Emerging players like Log 9 Materials and NantEnergy are making significant strides in the commercial application of metal-air technology, particularly in the realms of electric vehicles and smart grid storage, which are poised for exponential growth.

Panasonic Energy Co., Ltd. and Phinergy stand out for their collaborative ventures with automotive industries to develop tailored battery solutions that enhance electric vehicle performance and range.

Meanwhile, companies like Poly Plus Battery, Renata S.A., and Thunderzee are focusing on niche markets, including medical devices and military applications, providing specialized products that meet specific energy requirements.

ZAF Energy Systems Inc. (ZAFSYS) and ZeniPower (Zhuhai Zhi Li) Battery Co., Ltd., along with Zinc8 Energy Solutions, are advancing the scalability of metal-air batteries, aiming to reduce costs and improve the feasibility of large-scale energy storage systems.

Top Key Players in the Market

- Arotech Corporation

- Duracell Inc.

- Energizer Holdings, Inc.

- Epsilor Electric Fuel

- Fuji Pigment Co. Ltd.

- GP Batteries International Limited

- Guangdong Tiangju Electronics Technology Co., Ltd

- Log 9 Materials

- NantEnergy

- Panasonic Energy Co., Ltd.

- Phinergy

- Poly Plus Battery

- Renata S.A.

- Thunderzee

- ZAF Energy Systems Inc. (ZAFSYS)

- ZeniPower (Zhuhai Zhi Li) Battery Co., Ltd.

- Zinc8 Energy Solutions

Recent Developments

- In 2024, Epsilor introduced the COMBATT ELI-52526-GM, a high-energy military battery with a capacity of 4,400Wh/175Ah, designed to stringent MIL-PRF-32565C standards, enhancing tactical energy solutions for defense applications.

- In 2024, Fuji Pigment Co. Ltd. advanced their aluminium-air battery technology, making it rechargeable with normal or salty water, and enhanced by a structure reducing corrosion and byproduct buildup, thereby improving lifespan and energy efficiency.

Report Scope

Report Features Description Market Value (2023) USD 532.8 Million Forecast Revenue (2033) USD 1,840.9 Million CAGR (2024-2033) 13.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Metal (Zinc, Lithium, Aluminum, Iron, Others), By Voltage (Low (<12V), Medium (12-36V), High (>36V)), By Type (Primary, Secondary), By Application (Electric Vehicles, Military Electronics, Electronic Devices Stationary Power, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Arotech Corporation, Duracell Inc., Energizer Holdings, Inc., Epsilor Electric Fuel, Fuji Pigment Co. Ltd., GP Batteries International Limited, Guangdong Tiangju Electronics Technology Co., Ltd, Log 9 Materials, NantEnergy, Panasonic Energy Co., Ltd., Phinergy, Poly Plus Battery, Renata S.A., Thunderzee, ZAF Energy Systems Inc. (ZAFSYS), ZeniPower (Zhuhai Zhi Li) Battery Co., Ltd., Zinc8 Energy Solutions Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Metal-air Battery MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Metal-air Battery MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Arotech Corporation

- Duracell Inc.

- Energizer Holdings, Inc.

- Epsilor Electric Fuel

- Fuji Pigment Co. Ltd.

- GP Batteries International Limited

- Guangdong Tiangju Electronics Technology Co., Ltd

- Log 9 Materials

- NantEnergy

- Panasonic Energy Co., Ltd.

- Phinergy

- Poly Plus Battery

- Renata S.A.

- Thunderzee

- ZAF Energy Systems Inc. (ZAFSYS)

- ZeniPower (Zhuhai Zhi Li) Battery Co., Ltd.

- Zinc8 Energy Solutions