Global Surgical Booms Market By Product Type (Anesthesia Boom, Equipment Boom and Others), By Installation (Roof Mounted and Floor Mounted), By End-User (Hospitals, Ambulatory Surgical Centers, Dental Clinics and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175089

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

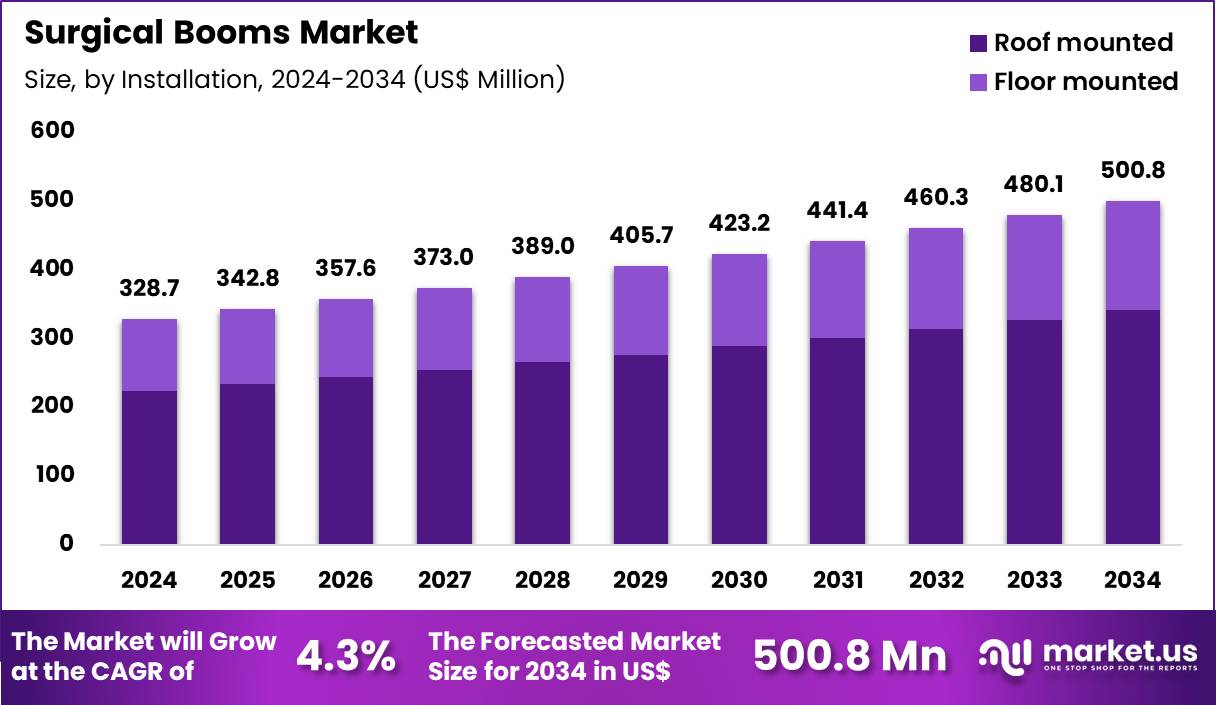

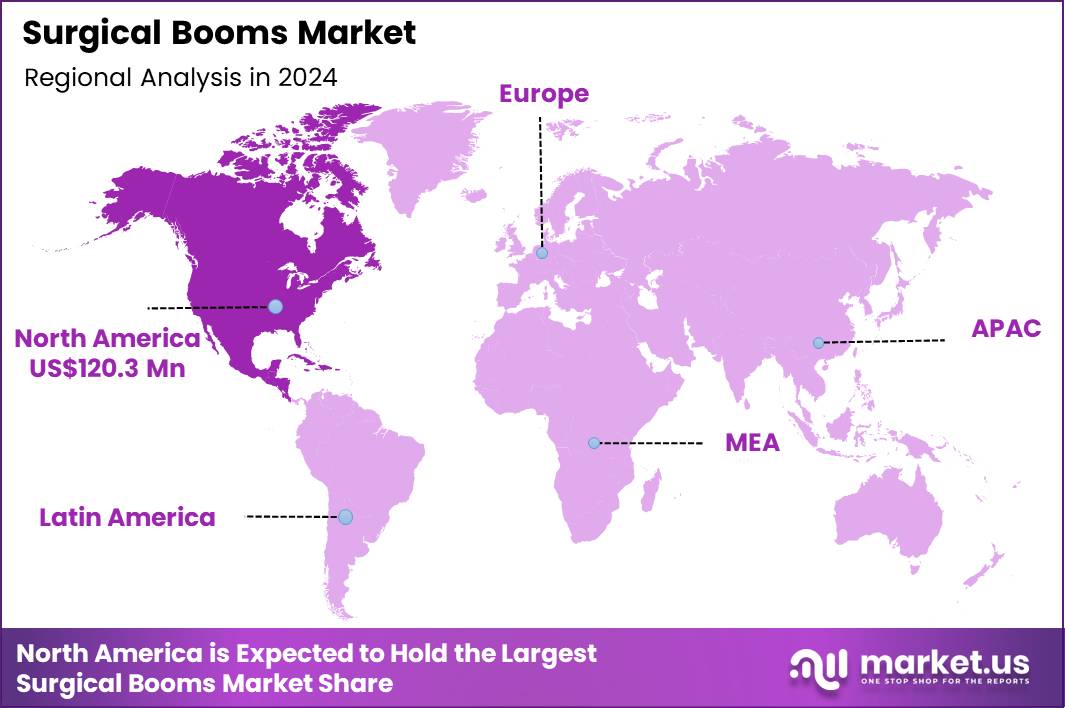

The Global Surgical Booms Market size is expected to be worth around US$ 500.8 Million by 2034 from US$ 328.7 Million in 2024, growing at a CAGR of 4.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 36.6% share with a revenue of US$ 120.3 Million.

Increasing complexity in hybrid operating rooms and minimally invasive procedures drives demand for surgical booms that centralize critical utilities and equipment, optimizing space and workflow efficiency. Surgeons utilize ceiling-mounted booms in cardiovascular interventions to suspend monitors, insufflators, and light sources directly above the sterile field, enabling unobstructed access during percutaneous valve replacements and coronary interventions.

These systems support robotic-assisted surgeries by positioning high-definition cameras and instrument arms precisely, facilitating seamless control in urologic and gynecologic procedures. Anesthesiologists rely on anesthesia booms to deliver gas lines, electrical outlets, and monitoring cables near the patient’s head, streamlining airway management and infusion delivery in neurosurgical and orthopedic cases.

Operating room teams deploy utility booms in trauma suites to organize suction, oxygen, and data ports, supporting rapid resuscitation and imaging during emergency laparotomies and thoracotomies. In multi-specialty facilities, modular booms accommodate diverse configurations, allowing quick adaptation between general surgery, endoscopy, and interventional radiology cases.

Manufacturers pursue opportunities to integrate smart features such as motorized positioning and touchless controls, expanding applications in high-throughput ambulatory surgery centers where rapid room turnover is essential. Developers advance lightweight, single-arm designs that improve maneuverability in compact hybrid suites performing combined endovascular and open procedures. These innovations facilitate incorporation of augmented reality displays and robotic interfaces, enhancing precision in spine and cranial surgeries.

Opportunities emerge in antimicrobial coatings and cable management systems that reduce infection risks and clutter in clean environments. Companies invest in energy-efficient LED integration and modular service heads that support future-proof upgrades for evolving surgical technologies. Recent trends emphasize ergonomic load-balancing mechanisms and integrated data hubs, positioning surgical booms as foundational infrastructure for value-based care models focused on procedural safety, staff efficiency, and patient outcomes.

Key Takeaways

- In 2024, the market generated a revenue of US$ 328.7 Million, with a CAGR of 4.3%, and is expected to reach US$ 500.8 Million by the year 2034.

- The product type segment is divided into anesthesia boom, equipment boom and others, with anesthesia boom taking the lead with a market share of 46.7%.

- Considering installation, the market is divided into roof mounted and floor mounted. Among these, roof mounted held a significant share of 68.2%.

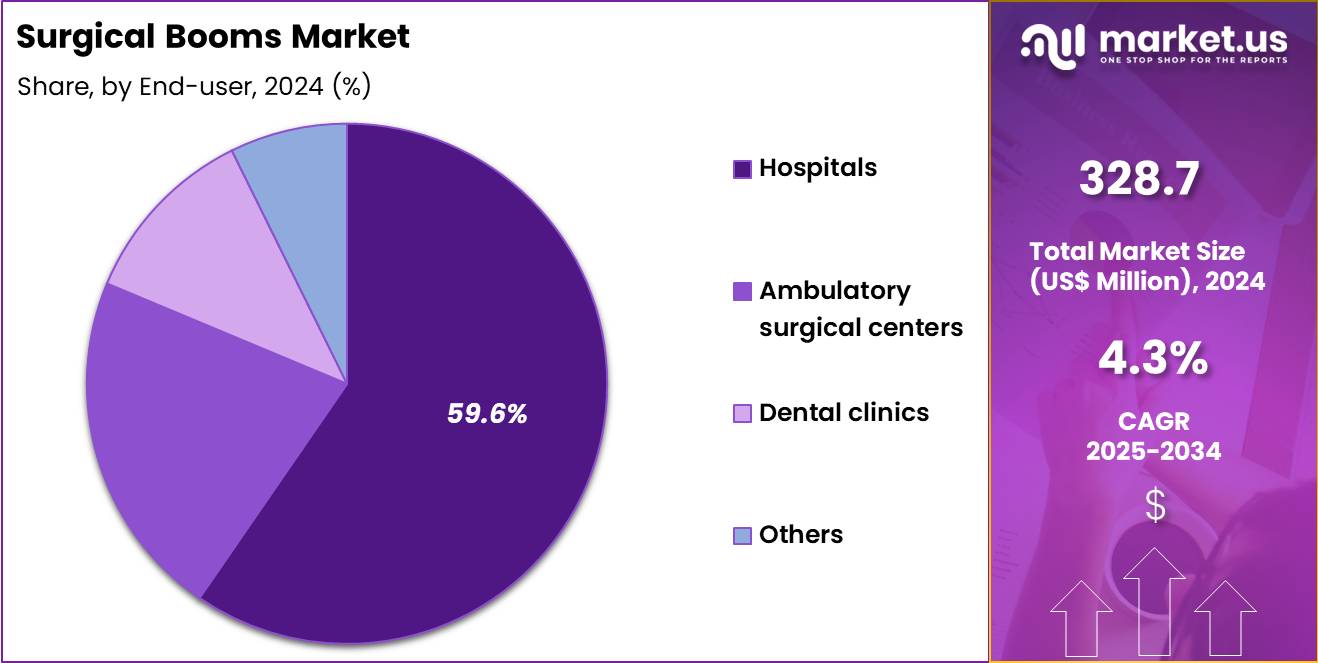

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, ambulatory surgical centers, dental clinics and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 59.6% in the market.

- North America led the market by securing a market share of 36.6%.

Product Type Analysis

Anesthesia boom contributed 46.7% of growth within product type and leads demand in the Surgical Booms market due to its direct role in safe airway and anesthetic management. Operating rooms increasingly require structured placement of gas outlets, vaporizers, ventilator connections, and monitoring cables to reduce clutter near the patient bed. Anesthesia teams prefer boom-based layouts because they keep critical equipment within reach during induction and emergence.

Hospitals also value the improved ergonomics since clinicians spend long hours adjusting lines and monitors during procedures. Rising surgical volumes in general surgery, orthopedics, and cardiovascular procedures increase daily utilization of anesthesia workstations, which strengthens demand for integrated booms.

Modern anesthesia protocols rely on multiple devices such as infusion pumps, capnography, and advanced ventilators, and booms support organized mounting and cable routing. Standardized room designs further push adoption because anesthesia booms simplify replication across multiple operating suites.

Facility planners choose booms to improve infection prevention practices by reducing floor-based equipment and limiting hard-to-clean cable tangles. Maintenance teams benefit from cleaner utility management, which supports downtime reduction and better OR availability. Increasing focus on patient safety encourages investments in equipment positioning that reduces accidental disconnections.

Training hospitals add anesthesia booms to align with modern surgical infrastructure and improve staff workflow. Vendors expand customization options, including arm length, load capacity, and gas module layouts, which supports purchasing decisions across different specialties. Renovation projects in existing hospitals also drive replacement demand as older pendant systems reach end-of-life.

Ambulatory surgery sites increasingly add anesthesia booms for complex day-care procedures requiring higher monitoring intensity. Hospitals prefer solutions that support quick room turnover, and booms reduce setup and teardown time. The segment is anticipated to maintain leadership due to procedure growth, safety emphasis, and equipment density in modern anesthesia practice.

Installation Analysis

Roof mounted systems represented 68.2% of growth within installation and dominate the Surgical Booms market because they optimize space, stability, and workflow in high-traffic operating rooms. Hospitals increasingly prioritize ceiling infrastructure to keep floors clear for staff movement, mobile imaging devices, and emergency access.

Roof mounted booms improve cable and hose management by routing utilities overhead, which reduces trip hazards and improves OR safety. This configuration also supports better cleaning routines since staff avoid equipment bases and wheels that collect dust and fluids. Engineers and planners favor roof mounted designs because they deliver strong load-bearing capability for monitors, pumps, and anesthesia modules.

Surgeons and nurses benefit from improved positioning flexibility during procedures, especially when teams adjust layouts for different case types. Growing adoption of minimally invasive and hybrid procedures raises the number of devices in the room, and ceiling-mounted solutions handle this complexity more efficiently.

Roof mounted booms also align with modern OR design standards that emphasize ergonomics and modularity. Hospitals choose ceiling systems to support faster case turnover because staff reposition equipment quickly without moving carts. Structural stability improves long-term performance, which supports better lifecycle value for capital budgets.

Advanced OR builds commonly include ceiling rails, laminar airflow management, and integrated lighting, and roof mounted booms fit easily into these designs. Vendors offer multi-arm configurations and high rotation range, which supports multi-disciplinary use. Hospitals also prefer overhead utility delivery to reduce accidental line pulling during patient transfer.

Expansion of operating room capacity in tertiary centers further pushes ceiling-mounted installations. The segment is projected to remain dominant due to space efficiency, safety improvements, and strong compatibility with modern operating room construction trends.

End-User Analysis

Hospitals accounted for 59.6% of growth within end-users and remain the main demand center for surgical booms due to their high procedure load and infrastructure investment capacity. Large hospitals perform a wide mix of surgeries that require consistent access to medical gases, power, and device mounting. OR modernization programs push hospitals to replace floor-based equipment setups with organized boom systems that improve staff efficiency.

Infection control policies also encourage hospitals to reduce clutter and maintain cleaner operating environments. Hospitals manage complex cases that require multiple pumps, monitors, and anesthesia accessories, and booms support safer placement and easier visibility. Teaching and referral hospitals expand OR suites and standardize layouts across rooms, which increases repeat purchasing volume. Hospitals invest in booms to reduce workflow interruptions during surgery, especially in time-sensitive procedures.

Biomedical teams prefer fixed utility systems because they simplify preventive maintenance and reduce damage to equipment cables. Hospitals also aim to improve ergonomics to reduce staff fatigue and handling injuries during long surgical schedules. Integration with surgical lights, imaging tools, and digital documentation systems further supports boom adoption.

Increasing demand for minimally invasive surgeries raises equipment density, which strengthens the case for boom installations. Procurement teams favor durable systems because hospitals require long service life and high uptime. Post-pandemic elective surgery backlogs increase operating room utilization, supporting continued infrastructure upgrades.

Hospitals also benefit from better patient transfer safety when floors remain unobstructed. The segment is expected to retain dominance due to procedure concentration, safety standards, and ongoing operating room expansion initiatives.

Key Market Segments

By Product Type

- Anesthesia Boom

- Equipment Boom

- Others

By Installation

- Roof Mounted

- Floor Mounted

By End-user

- Hospitals

- Ambulatory Surgical Centers

- Dental Clinics

- Others

Drivers

The rise in global surgical procedure volumes is driving the market

The escalating volume of surgical interventions globally is a primary driver for the surgical boom market as hospitals seek to manage increasing patient throughput. According to data from the American Hospital Association (AHA) and clinical registries, over 310 million major surgical procedures are performed worldwide each year, with approximately 40 million to 50 million occurring in the US alone. This surge in activity necessitates organized operating environments where surgical booms play a critical role in managing medical gases, electrical power, and audiovisual data.

Key industry players have reported financial growth linked to this demand; for instance, Steris reported that its Healthcare segment, which includes surgical infrastructure, saw a revenue increase of 14% in fiscal year 2024. Stryker also observed strong momentum in its MedSurg and Neurotechnology category, delivering US$ 11.5 billion in net sales for 2023, a significant portion of which is driven by hospital infrastructure upgrades.

The aging global population and the rising prevalence of chronic conditions, such as cardiovascular diseases, continue to fuel the need for new surgical suites equipped with ceiling-mounted arms. Furthermore, the expansion of healthcare facilities in emerging markets like India, where the government sanctioned approximately US$ 111 million for establishing modular operation theaters, further bolsters this trend.

By consolidating equipment and cables, surgical booms improve clinician ergonomics and minimize the risk of accidents during high-stakes procedures. Consequently, as surgical lists grow, the adoption of advanced equipment management systems remains a fundamental priority for modern hospitals.

Restraints

High capital expenditure and installation costs are restraining the market

The surgical boom market faces significant restraints due to the high initial investment and long-term maintenance costs associated with advanced ceiling-mounted systems. Building a modern integrated operating room can cost between US$ 3 million and US$ 4 million, with surgical booms representing a substantial portion of this capital expenditure. These systems often require specialized structural reinforcements in the ceiling and extensive electrical and gas plumbing, which can be prohibitively expensive for smaller healthcare facilities or those in low-income regions.

In the US, hospitals are facing increased financial strain; according to the American Hospital Association, total hospital expenses grew by 5.1% in 2024, significantly outpacing the general inflation rate of 2.9%. This economic pressure often leads to the deferral of large-scale equipment upgrades as administrators prioritize essential daily supplies over permanent infrastructure.

Furthermore, the ongoing maintenance and the need for specialized biomedical IT personnel to manage connected boom systems add to the total cost of ownership. Regulatory hurdles also play a role, as different jurisdictions require distinct safety certifications, slowing down global product launches and increasing R&D expenses for manufacturers.

Reimbursement cuts also impact the market; Medicare net inpatient payment rates increased by only 5.1% between 2022 and 2024, which effectively functions as a budget cut when compared to rising labor and supply costs. These financial and regulatory barriers collectively restrict the speed of market penetration, particularly in cost-sensitive healthcare environments.

Opportunities

The expansion of Ambulatory Surgical Centers (ASCs) is creating growth opportunities

The rapid growth of Ambulatory Surgical Centers (ASCs) presents a major opportunity for manufacturers to develop compact and modular surgical boom solutions. Patients and payers are increasingly shifting toward outpatient settings for procedures like orthopedic and gastrointestinal surgeries to reduce costs and recovery times.

According to the Medicare Payment Advisory Commission (MedPAC), the number of Medicare-certified ASCs in the US has continued to grow, reaching over 6,000 facilities by 2023. These centers typically require smaller, more flexible equipment management systems than traditional large-scale hospitals to maximize their limited floor space. This trend allows market players to innovate with “slim-line” or multi-specialty booms that can be easily reconfigured for different types of outpatient procedures.

Industry data shows that the ASC segment is projected to expand at a double-digit rate through the late 2020s, significantly higher than the growth rate for traditional inpatient facilities. Government initiatives to improve access to surgical care in rural areas also support the installation of modular booms in community-based clinics.

As robotic-assisted surgery becomes more common in outpatient settings, the demand for booms that can integrate robotic control units and high-definition monitors will surge. Manufacturers that offer scalable and easy-to-install boom configurations are well-positioned to capture this burgeoning market segment. Ultimately, the pivot toward value-based care and outpatient surgery ensures a steady demand for specialized, space-saving surgical infrastructure.

Impact of Macroeconomic / Geopolitical Factors

Global economic growth channels resources into advanced operating room infrastructure, strengthening the surgical booms market as hospitals prioritize integrated suspension systems to support complex procedures efficiently. Leaders capitalize on increasing surgical volumes in both developed and emerging markets, which drives consistent demand for customizable, space-efficient designs.

However, ongoing inflationary trends worldwide elevate costs for structural materials and precision engineering, requiring vendors to carefully manage budgets in competitive bidding scenarios. Geopolitical uncertainties in key industrial regions disrupt the steady flow of specialized components, leading suppliers to encounter prolonged lead times and supply variability.

Decision-makers address these challenges by developing broader vendor relationships in more stable locations, which improves procurement reliability and supports long-term planning. Current US tariffs on imported medical equipment from principal manufacturing countries add meaningful cost pressures, particularly for firms dependent on cost-advantaged foreign production.

Domestic manufacturers respond by expanding local assembly capacity, which promotes technological refinement and strengthens alignment with healthcare system requirements. Progressive incorporation of modular connectivity and ergonomic improvements continuously enhances the market’s potential, ensuring reliable advancement and increased operational value for healthcare facilities worldwide.

Latest Trends

The integration of AI-enabled digital ecosystems is a recent trend

A significant trend emerging in late 2024 and 2025 is the transformation of surgical booms from simple equipment supports into intelligent, AI-enabled digital hubs. Modern booms are now being equipped with advanced software that orchestrates data flow between imaging systems, robotic scaffolds, and electronic health records (EHRs).

In October 2024, leading players in the operating room integration space highlighted a shift toward AI-based predictive alerts and workflow guidance systems that are controlled through boom-mounted touchscreens. This movement is exemplified by recent product launches that feature 4K and 8K video routing capabilities, enabling real-time remote collaboration and surgical tele-mentoring.

Furthermore, the integration of surgical booms with smart lighting and automated table positioning—such as the Getinge Maquet Corin system released in 2024—allows for seamless synchronicity in hybrid operating rooms. These digital ecosystems aim to reduce cognitive load for surgeons by centralizing all critical patient information and device controls into a single, ergonomically positioned interface.

The use of mixed reality and mixed-reality pre-surgical planning is also being incorporated into boom-mounted displays to enhance procedural precision. This trend reflects a broader industry move toward “Software as a Medical Device” (SaMD) where the physical boom serves as the hardware foundation for a sophisticated digital platform. As hospitals move toward fully connected “Smart ORs,” the demand for these high-tech, integrated boom systems is expected to define the next era of surgical infrastructure.

Regional Analysis

North America is leading the Surgical Booms Market

North America accounted for 36.6% of the Surgical Booms market in 2024, reflecting steady expansion driven by hospital infrastructure upgrades and operating room modernization across the region. Health systems in the US and Canada increased investments in advanced ceiling-mounted equipment to improve workflow efficiency, infection control, and ergonomic safety for surgical staff. The continued shift toward minimally invasive and hybrid procedures raised demand for flexible equipment positioning and higher load-bearing capacity in operating suites.

Ambulatory surgical centers also expanded rapidly, creating incremental demand for compact and modular boom configurations that optimize limited floor space. Strong capital expenditure cycles among large hospital networks supported replacement of legacy floor-based systems with ceiling-integrated solutions. Regulatory focus on patient safety and sterility standards further accelerated adoption in high-acuity environments.

Technological integration with imaging, anesthesia delivery, and digital operating room platforms strengthened the value proposition of these systems. As supporting evidence, the American Hospital Association reported that US hospitals invested over USD 49 billion in facilities and equipment in 2023, underscoring sustained infrastructure spending that directly supports growth in advanced surgical room equipment.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to witness accelerated growth during the forecast period due to large-scale hospital expansion programs and rising surgical procedure volumes across emerging and developed economies. Governments across China, India, and Southeast Asia continue to prioritize tertiary care capacity to address growing burdens of trauma, cancer, and cardiovascular conditions. Healthcare providers increasingly favor ceiling-mounted systems to manage crowded operating rooms and support high patient throughput.

Rapid adoption of minimally invasive techniques in urban hospitals drives demand for flexible equipment layouts and integrated utilities. Private hospital chains actively invest in technologically advanced operating rooms to differentiate service quality and attract medical tourism. Local manufacturing and regional partnerships also improve product availability and cost competitiveness.

Training initiatives for surgeons and operating room staff reinforce acceptance of modern surgical infrastructure. According to India’s Ministry of Health and Family Welfare, more than 157,000 Ayushman Bharat Health Infrastructure Mission projects were approved by 2024, highlighting sustained public investment in hospital infrastructure that supports long-term demand for advanced operating room solutions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Surgical Booms market drive growth by delivering ceiling-mounted infrastructure that improves operating room space utilization, cable management, and equipment access for complex procedures. Companies expand adoption through customization capabilities that integrate medical gases, power, data ports, and imaging support to fit diverse surgical specialties.

Commercial strategies emphasize turnkey project execution with hospital construction teams, supported by installation expertise and long-term maintenance contracts. Innovation priorities focus on higher load capacities, smoother maneuverability, and modular upgrades that extend system life and protect capital investment.

Market expansion targets regions increasing surgical volumes and modernizing operating theaters to improve patient throughput and safety. Dräger operates as a leading participant with a strong surgical infrastructure portfolio, global clinical engineering support, and proven capability to deliver integrated boom solutions for advanced operating room environments.

Top Key Players

- Stryker Corporation

- STERIS plc

- Getinge AB

- Drägerwerk AG & Co. KGaA

- Skytron, LLC

- Amico Group of Companies

- Zimmer Biomet Holdings, Inc.

- Ondal Medical Systems GmbH

- TRUMPF Medical

- Brandon Medical Co Ltd

Recent Developments

- In 2024, Stryker recorded global net sales of about US$ 22.6 billion, reflecting year on year growth of just over 10%. A substantial share of this performance came from the MedSurg and Neurotechnology division, which generated roughly US$ 13.5 billion and includes advanced operating room infrastructure such as surgical boom systems. Growth in this area has been supported by Stryker’s continued rollout of its iSuite digital operating room concept, where ceiling mounted booms play a central role in improving workflow efficiency, minimizing equipment congestion, and supporting integrated surgical environments.

- In 2024, Getinge reported net sales of approximately 31.8 billion SEK, equivalent to around US$ 3.0 billion, with its Operating Room Solutions segment delivering solid organic growth across the US and European markets. This business area includes ceiling supply units and surgical lighting systems, which are increasingly adopted to enhance ergonomics and room utilization. Getinge’s focus on solutions such as Maquet PowerLED II and modular ceiling mounted units is aimed at improving procedural efficiency, enabling hospitals to increase surgical throughput without expanding physical operating room capacity.

- For the fiscal year ending March 31, 2025, Steris posted total revenue of about US$ 5.5 billion, marking a 6% increase compared with the prior year. The Healthcare segment, which covers surgical capital equipment including integrated ceiling mounted boom systems, remained a key contributor, generating roughly US$ 1.1 billion in revenue during the fourth quarter alone. Demand for these systems continues to be supported by hospital modernization projects and deferred infrastructure investments, sustaining uptake of Steris’ integrated ceiling solutions across surgical facilities.

Report Scope

Report Features Description Market Value (2024) US$ 328.7 Million Forecast Revenue (2034) US$ 500.8 Million CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Anesthesia Boom, Equipment Boom and Others), By Installation (Roof Mounted and Floor Mounted), By End-User (Hospitals, Ambulatory Surgical Centers, Dental Clinics and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Stryker Corporation, STERIS plc, Getinge AB, Drägerwerk AG & Co. KGaA, Skytron, LLC, Amico Group of Companies, Zimmer Biomet Holdings, Inc., Ondal Medical Systems GmbH, TRUMPF Medical, Brandon Medical Co Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Stryker Corporation

- STERIS plc

- Getinge AB

- Drägerwerk AG & Co. KGaA

- Skytron, LLC

- Amico Group of Companies

- Zimmer Biomet Holdings, Inc.

- Ondal Medical Systems GmbH

- TRUMPF Medical

- Brandon Medical Co Ltd