Global Sectionalizer Market Size, Share Analysis Report By Phase Type (Single Phase, Three Phase), By Voltage Rating (Up to 15 kV, 16-27 Kv, 28-38kV), By Control Type (Resettable Electronic, Programmable Resettable), By Mounting Type (Pole Mounted, Pad Mounted), By End-Use (Industrial, Residential, Commercial, Utilities) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153741

- Number of Pages: 248

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

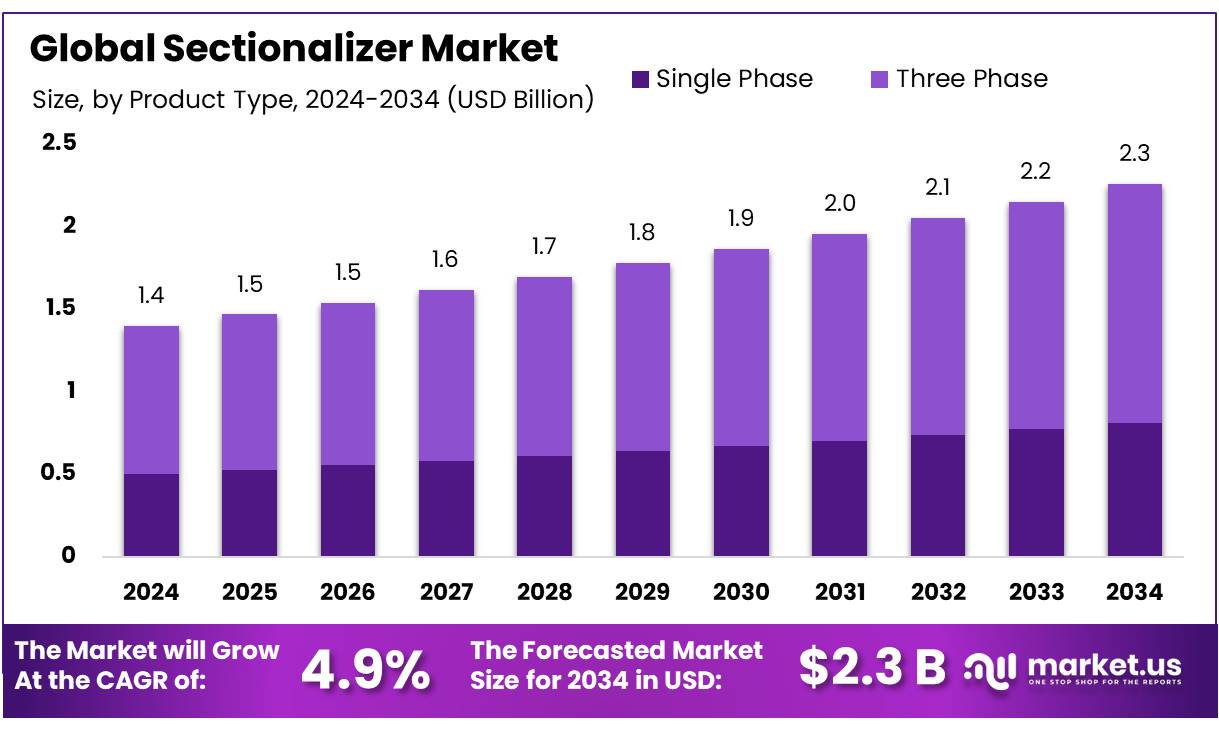

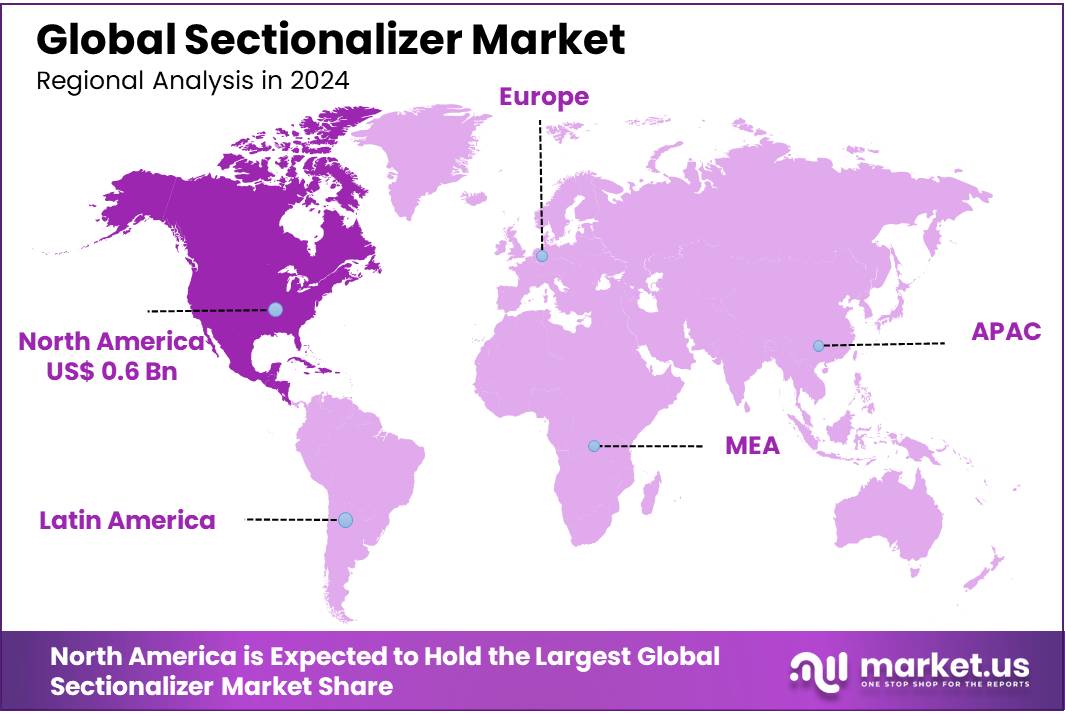

The Global Sectionalizer Market size is expected to be worth around USD 2.3 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 45.9% share, holding USD 0.6 Billion revenue.

The introduction of sectionalizer devices—sometimes referred to loosely as sectionalizer “concentrates” when bundled in system procurement—marks a critical evolution in power distribution systems. A sectionalizer is an automatic protective device installed in overhead or underground distribution feeders to isolate sections during fault conditions, preventing widespread outages and enhancing grid resilience. In modern smart grid environments, sectionalizers are paired with reclosers and remote monitoring systems to ensure coordination and continuity of supply.

Key drivers of industry growth include rapid urbanization, aging grid infrastructure, and an accelerating shift to smart distribution automation. Sectionalizers are widely adopted for their ability to automate fault isolation and limit outage impact, minimizing service interruptions.

In emerging economies such as India and China, grid modernization and rural electrification are major contributors; according to the Indian Ministry of Power, per capita electricity consumption rose to 1,395 kWh in 2023–2024, up 45.8% (438kWh) from 957 kWh a decade earlier, underscoring growing electricity demand and the need for resilient distribution networks.

Government and regulatory support in India has accelerated deployment of automated distribution devices, including sectionalizers. Up to 100% foreign direct investment (FDI) is allowed in the chemical and electrical manufacturing segments under the automatic route (with few hazardous chemical exceptions).

India received INR 73.9 billion in FDI in the chemical sector in FY 2023 24, reinforcing capital inflow into allied industries. NITI Aayog reports that approximately 95% of propylene in India is converted into polypropylene (PP), far exceeding the global average of 70%, indicating high domestic value addition—an indicator of local supply base maturity which also supports technologies like sectionalizers that depend on polypropylene and related feedstocks.

Key Takeaways

- Sectionalizer Market size is expected to be worth around USD 2.3 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 4.9%.

- Three Phase held a dominant market position, capturing more than a 64.8% share in the global sectionalizer market.

- Up to 15 kV held a dominant market position, capturing more than a 51.7% share in the sectionalizer market.

- Resettable Electronic held a dominant market position, capturing more than a 76.2% share in the sectionalizer market.

- Pole Mounted held a dominant market position, capturing more than a 67.9% share in the sectionalizer market.

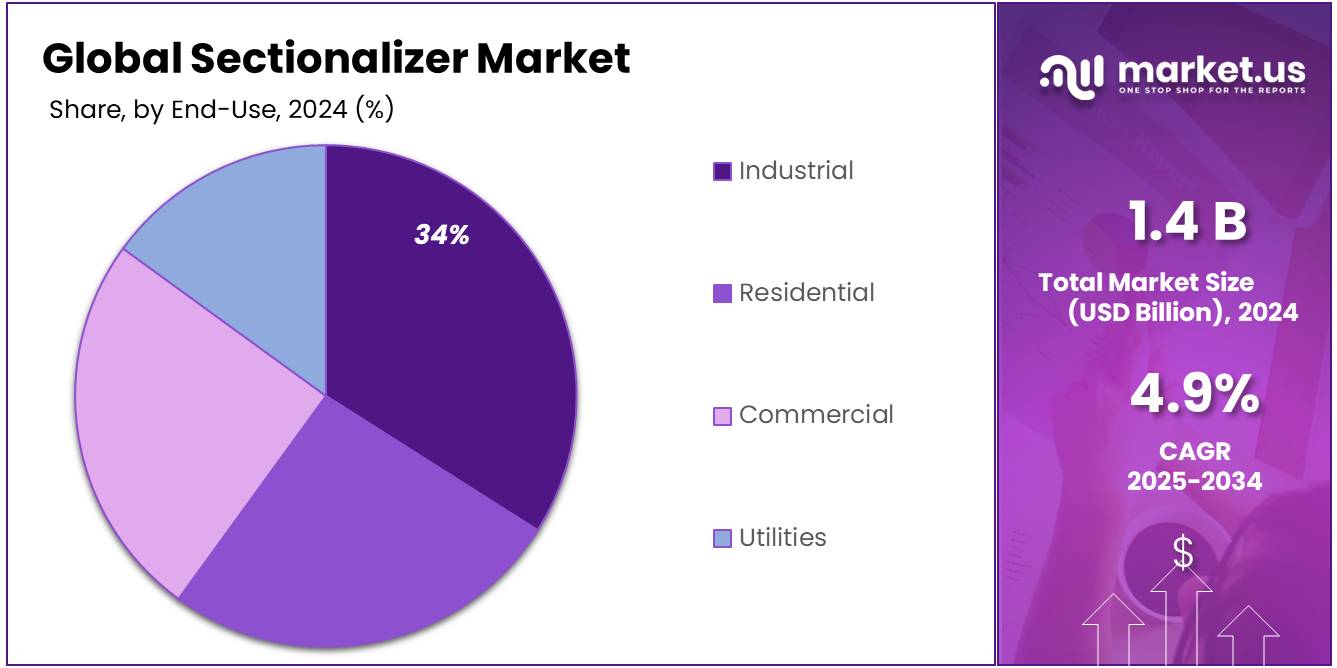

- Industrial held a dominant market position, capturing more than a 34.2% share in the sectionalizer market.

- North America held a dominant position in the global sectionalizer market, accounting for 45.9% of the total market share, which equates to a valuation of approximately USD 0.6 billion.

By Phase Type Analysis

Three Phase Sectionalizers dominate with 64.8% due to grid-wide compatibility and reliability.

In 2024, Three Phase held a dominant market position, capturing more than a 64.8% share in the global sectionalizer market by phase type. This leading share is primarily due to the widespread use of three-phase distribution systems in industrial, commercial, and large-scale utility applications. Three-phase sectionalizers are preferred for their ability to handle higher loads, support longer feeder lines, and maintain voltage stability across diverse electrical infrastructures. Their design ensures better fault isolation and improved power reliability, especially in regions with frequent service interruptions or dense energy consumption patterns.

With increasing grid modernization projects and expanding renewable energy integration, utilities continue to favor three-phase sectionalizers to enhance operational efficiency and reduce downtime. Moreover, the rising investments in rural and semi-urban electrification—especially in emerging economies—have further contributed to their deployment. By 2025, the three-phase segment is expected to maintain its dominance, supported by ongoing infrastructure upgrades, government support for distribution automation, and the growing need for fault-tolerant electrical networks. This steady demand outlook indicates the continued relevance of three-phase systems in meeting modern distribution requirements.

By Voltage Rating Analysis

Up to 15 kV dominates with 51.7% due to widespread use in distribution networks.

In 2024, Up to 15 kV held a dominant market position, capturing more than a 51.7% share in the sectionalizer market by voltage rating. This segment leads primarily because most urban and rural power distribution systems operate within this voltage range. Devices rated up to 15 kV are widely used across secondary distribution networks, making them suitable for residential areas, commercial buildings, and small industrial facilities. Their compatibility with low- to medium-voltage grids and ease of integration into existing infrastructure have supported their high adoption rate.

The increasing demand for reliable and efficient distribution systems in growing cities, along with rural electrification projects, has further driven the installation of sectionalizers in this voltage class. Utilities prefer sectionalizers up to 15 kV due to their cost-effectiveness, simplified maintenance, and proven performance in isolating faults in low-voltage zones. By 2025, the segment is expected to retain its lead, with consistent deployment across grid expansion and modernization programs. The emphasis on minimizing power outages and improving service continuity in utility networks continues to make this segment the preferred choice for distribution network operators worldwide.

By Control Type Analysis

Resettable Electronic dominates with 76.2% due to automation and easy remote control features.

In 2024, Resettable Electronic held a dominant market position, capturing more than a 76.2% share in the sectionalizer market by control type. This strong preference is driven by growing demand for automated power distribution and quick fault restoration. Resettable electronic sectionalizers are designed to automatically reset after operation, reducing manual intervention and improving system reliability. Their ability to detect and respond to faults in real-time helps utilities minimize outage durations and optimize grid performance.

With the rising adoption of smart grid technologies, these devices are increasingly favored for their remote programmability, data logging capabilities, and seamless integration into advanced control systems. Their use is particularly common in areas where operational efficiency, cost reduction, and quick service restoration are critical. In 2025, this segment is expected to continue its dominance as grid operators invest further in digital infrastructure, particularly in regions with ageing power networks and rising electricity demand. The focus on building resilient, automated distribution systems is set to keep resettable electronic sectionalizers at the forefront of control solutions.

By Mounting Type Analysis

Pole Mounted dominates with 67.9% due to easy installation and wide utility use.

In 2024, Pole Mounted held a dominant market position, capturing more than a 67.9% share in the sectionalizer market by mounting type. This strong lead is mainly due to the widespread use of pole-mounted sectionalizers in overhead distribution systems across urban and rural areas. These devices are easy to install, require minimal ground space, and offer better visibility and access for maintenance crews. Their suitability for medium-voltage networks and adaptability to existing infrastructure make them the preferred choice for utilities seeking efficient fault management.

The increasing focus on modernizing grid infrastructure, especially in regions with ageing power lines, continues to boost demand for pole-mounted sectionalizers. Their compatibility with automated reclosers and smart grid technologies further strengthens their relevance. In 2025, this segment is expected to maintain its top position, driven by ongoing rural electrification, infrastructure upgrades, and expanding renewable energy networks. The ease of deployment and cost-efficiency associated with pole-mounted units ensure their continued preference among distribution network operators globally.

By End-Use Analysis

Industrial end-use dominates with 34.2% due to high energy demand and fault protection needs.

In 2024, Industrial held a dominant market position, capturing more than a 34.2% share in the sectionalizer market by end-use. This dominance is largely due to the critical requirement for uninterrupted power supply and fault isolation in industrial facilities. Manufacturing plants, refineries, and heavy engineering operations depend on continuous electricity to avoid costly downtimes and equipment damage. Sectionalizers help safeguard these operations by quickly isolating faulted sections, thereby ensuring operational stability and worker safety.

The rising number of industrial zones, especially in developing economies, has increased the demand for reliable power distribution infrastructure. Industries are also increasingly adopting automation and digitization, which further amplifies the need for efficient electrical protection systems like sectionalizers. In 2025, this segment is expected to maintain its lead, supported by ongoing expansion in sectors such as automotive, metal processing, oil and gas, and chemicals. As industrial electricity consumption continues to grow, so does the importance of dependable grid components like sectionalizers for maintaining system integrity.

Key Market Segments

By Phase Type

- Single Phase

- Three Phase

By Voltage Rating

- Up to 15 kV

- 16-27 Kv

- 28-38kV

By Control Type

- Resettable Electronic

- Programmable Resettable

By Mounting Type

- Pole Mounted

- Pad Mounted

By End-Use

- Industrial

- Residential

- Commercial

- Utilities

Emerging Trends

Smart Grid Integration and Renewable Energy Driving Sectionalizer Use

A key trend in the sectionalizer market today is the rise of smart grid systems integrated with renewable energy sources. Power networks are becoming more complex as solar and wind farms feed into local grids, especially around food processing zones. This renewables expansion demands smarter fault isolation and faster response time—areas where sectionalizers really shine.

Governments are supporting smart grids through initiatives like the U.S. Department of Energy’s Grid Resilience Innovation Partnerships, and India’s R-APDRP (Restructured Accelerated Power Development and Reform Programme) which fund automation upgrades in local distribution networks. These actions encourage utilities to deploy smart sectionalizers that can isolate and restore power to unaffected zones instantly.

Food companies that invest in reliable, automated electrical switches are less likely to suffer spoilage or downtime—and that means sturdier supply chains, lower waste, and savings. As cooling systems and processing lines grow ever more sensitive, suppliers of sectionalizers who can speak to smart‑grid benefits find big opportunity. The trend is simple, but powerful: smarter grids and renewables demand smarter fault isolation, and sectionalizers are the tool making that happen.

Drivers

Rising Demand for Reliable Power Distribution in Food & Beverage Processing Drives Sectionalizer Adoption

One of the major driving forces behind the growth of the sectionalizer market is the increasing demand for uninterrupted and reliable power distribution across food and beverage processing units. These industries are extremely sensitive to power quality and downtime. A brief outage during processing or packaging can result in massive product losses, equipment damage, or spoilage—especially in temperature-controlled environments.

- According to the Food and Agriculture Organization (FAO), global food losses during processing and distribution amount to nearly 14% of total food produced, and equipment failure is a contributing factor in many developing and developed markets. This makes modernizing electrical infrastructure not just a convenience, but a necessity for food companies aiming to reduce waste and improve operational continuity.

Sectionalizers play a vital role in maintaining system reliability by isolating faults and preventing wide-area outages in power lines. Their deployment in food processing zones allows for localized power restoration, minimizing disruption. For example, in dairy or meat processing plants—where systems run 24/7—power disturbances of even 10 minutes can lead to batch discards, spoiled materials, and cleaning cycles that must be restarted. Such losses can reach thousands of dollars per hour for medium-scale facilities.

Restraints

High Upfront Costs Limit Sectionalizer Adoption in Small and Medium Food Processing Units

One major factor holding back the widespread use of sectionalizers in the food and beverage processing sector is their high initial cost. For small and medium-scale enterprises (SMEs), especially in developing countries, investing in sectionalizers and the necessary automation infrastructure can be financially overwhelming. These businesses often operate on tight budgets and prioritize essential production equipment over modern power distribution technologies.

The Food and Agriculture Organization (FAO) reports that in many low- and middle-income economies, around 30–40% of food processing businesses lack access to reliable power, and power-related losses contribute to nearly 15% of their production inefficiencies. Despite recognizing the benefits of automation, the cost of installing sectionalizers, protective relays, and compatible control systems often leads to postponement or cancellation of upgrades.

Moreover, power infrastructure financing for SMEs in the food industry remains limited. While some government programs exist—such as the Indian government’s SIDBI schemes for energy-efficient technologies—funding is mostly directed toward large-scale industries or urban clusters. Smaller units in rural zones often miss out due to lack of awareness, limited technical guidance, or burdensome application processes.

This cost barrier is especially problematic for processors of perishable goods, such as fruits, dairy, and meat. These businesses need consistent power but struggle to justify the upfront investment for a solution like a sectionalizer when compared with their immediate needs like cold storage or packaging machinery. Without subsidies or financing support, most of them end up relying on manual interventions or backup generators, which are inefficient and prone to human error.

Opportunity

Surge in Cold Chain Expansion Creates Opportunity for Sectionalizer Deployment

A major growth opportunity for sectionalizers is coming from the rapid expansion of cold chain infrastructure in the global food industry. As more countries focus on reducing food waste and improving the quality of perishable food products, they are investing in cold storage, refrigerated transport, and temperature-controlled processing units—all of which require reliable, uninterrupted power to function.

- According to the Food and Agriculture Organization (FAO), nearly 1.3 billion tonnes of food is lost or wasted globally each year, with a large portion occurring in the post-harvest and processing stages due to power failures and inadequate storage conditions.

In response, countries like India, China, and Brazil are significantly ramping up investments in cold chain logistics to curb such losses. In India, the Ministry of Food Processing Industries launched the PMKSY (Pradhan Mantri Kisan SAMPADA Yojana) scheme, under which over 100 cold chain projects have been approved to reduce food spoilage and increase farmer returns.

These cold storage units cannot afford even a few minutes of power outage without risking inventory spoilage. Sectionalizers offer an automated solution by isolating faulted areas in the power network and restoring power faster than manual systems, which ensures that critical equipment like blast freezers, chillers, and refrigeration compressors keep running.

Regional Insights

North America leads with 45.9% share valued at USD 0.6 billion in 2024

In 2024, North America held a dominant position in the global sectionalizer market, accounting for 45.9% of the total market share, which equates to a valuation of approximately USD 0.6 billion. This regional leadership is primarily driven by the widespread presence of advanced power distribution infrastructure, robust utility networks, and early adoption of grid automation technologies. The United States and Canada have long invested in upgrading their ageing electrical systems, with a focus on enhancing fault detection, minimizing downtime, and improving service reliability—objectives well-aligned with the use of sectionalizers.

The integration of renewable energy sources such as wind and solar into the grid has further contributed to the demand for sectionalizers, particularly those capable of operating in dynamic, two-way current environments. Utilities across North America are prioritizing fault isolation and distribution automation to support smart grid development. In the U.S. alone, the Department of Energy has allocated substantial funding for grid modernization projects under initiatives such as the Grid Resilience and Innovation Partnerships (GRIP) Program, which supports technologies including automated reclosers and sectionalizers.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB Ltd. is a global leader in electrification and automation technologies, offering advanced sectionalizers designed for efficient fault isolation and power distribution. The company leverages its strong R&D capabilities to develop smart grid-compatible solutions, including resettable electronic sectionalizers. ABB’s presence in over 100 countries and its focus on digitalization and grid automation make it a dominant force in the market. The company continues to expand its utility product portfolio through technological innovation and strategic partnerships in energy infrastructure development.

Bevins Co., based in the United States, specializes in power line monitoring and protection equipment, including sectionalizers and fault indicators. Known for its durable and field-tested designs, Bevins provides resettable and programmable sectionalizers tailored for overhead distribution networks. Its expertise in real-time line status monitoring and lightweight control systems makes it a trusted supplier for utility companies. Bevins Co. focuses on delivering high-performance, user-friendly devices that meet the evolving requirements of smart grid and distribution automation applications.

Elektrolites (Power) Pvt. Ltd is an India-based company offering high-quality electrical distribution and protection equipment, including sectionalizers. Known for its robust engineering and compliance with IEC and IS standards, the firm provides solutions for both urban and rural electrification programs. Its product portfolio includes manually operated and electronically resettable sectionalizers, suitable for diverse voltage ranges. The company actively supports domestic manufacturing under India’s “Make in India” initiative, supplying products to utilities and public-sector infrastructure projects across the country.

Top Key Players Outlook

- ABB Ltd.

- Bevins Co.

- Eaton Corporation plc

- Elektrolites (Power) Pvt. Ltd

- Entec Electric & Electronic Co., Ltd.

- G&W Electric Company

- Hubbell Incorporated

- Hughes Power System AB

- NOJA Power Switchgear Pty Ltd.

- S&C Electric Company

- Schneider Electric SE

- Siemens AG

- Tavrida Electric

Recent Industry Developments

In 2024, Elektrolites (Power) Pvt. Ltd achieved a notable role in the sectionalizer sector in India, with its VCB-type sectionalizer models (voltage range 6 kV–38 kV) approved for utilities and infrastructure projects across multiple states, including Jaipur, Rajasthan.

In 2024, Elektrolites (Power) Pvt. Ltd., based in Jaipur, India, continued to strengthen its position in the sectionalizer market as a domestic manufacturer of vacuum circuit breaker (VCB) sectionalizers and other medium-voltage protection devices. The company’s product range, certified under IEC-standards, includes sectionalizers handling voltages from 6 kV to 38 kV with continuous current ratings up to 800-A and fault-making capacity up to 16 kA.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Bn Forecast Revenue (2034) USD 2.3 Bn CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Phase Type (Single Phase, Three Phase), By Voltage Rating (Up to 15 kV, 16-27 Kv, 28-38kV), By Control Type (Resettable Electronic, Programmable Resettable), By Mounting Type (Pole Mounted, Pad Mounted), By End-Use (Industrial, Residential, Commercial, Utilities) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB Ltd, Bevins Co., Eaton Corporation plc, Elektrolites (Power) Pvt. Ltd, Entec Electric & Electronic Co., Ltd., G&W Electric Company, Hubbell Incorporated, Hughes Power System AB, NOJA Power Switchgear Pty Ltd., S&C Electric Company, Schneider Electric SE, Siemens AG, Tavrida Electric Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB Ltd.

- Bevins Co.

- Eaton Corporation plc

- Elektrolites (Power) Pvt. Ltd

- Entec Electric & Electronic Co., Ltd.

- G&W Electric Company

- Hubbell Incorporated

- Hughes Power System AB

- NOJA Power Switchgear Pty Ltd.

- S&C Electric Company

- Schneider Electric SE

- Siemens AG

- Tavrida Electric