Global Release Agents Market Size, Share, And Business Benefits By Ingredients (Emulsifiers, Vegetable Oils, Wax and Wax Esters, Antioxidants, Others), By Form (Liquid, Solid), By Application (Bakery, Confectionery, Processed Meat, Convenience Food, Others), By Sales Channel (Independent Grocery Retailer, Direct Sales and Wholesalers, Non-Store Retailers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157465

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

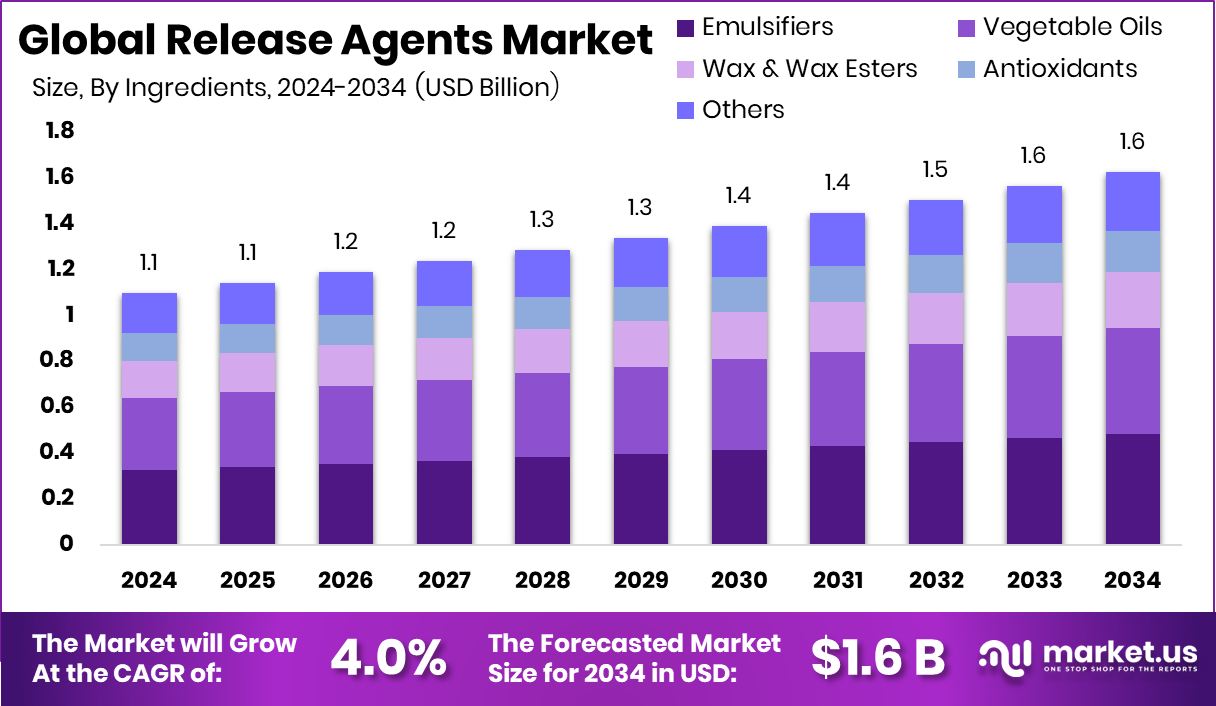

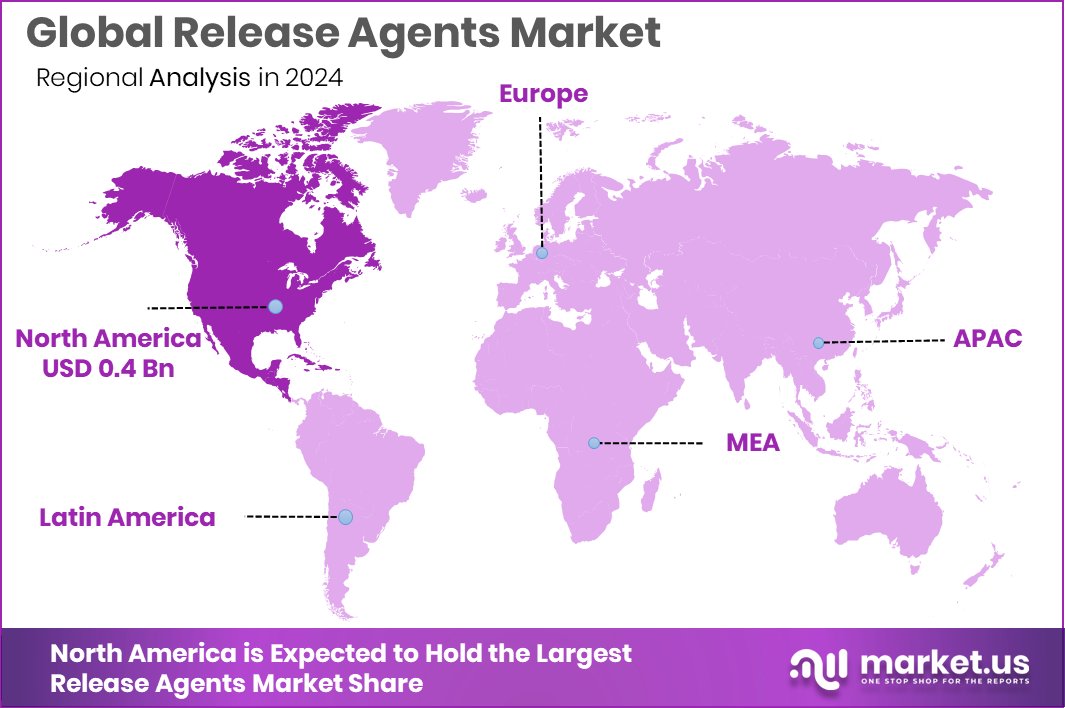

The Global Release Agents Market is expected to be worth around USD 1.6 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 4.0% from 2025 to 2034. With a USD 0.4 Bn value, North America leads the Release Agents Market, capturing 43.90% share.

Release agents are substances used in manufacturing and food processing to prevent materials from sticking to surfaces such as molds, pans, or machinery. They create a thin protective layer that makes it easier to separate finished products without damaging their shape or quality. These agents are widely applied in industries like food, bakery, plastics, rubber, and pharmaceuticals to ensure smooth operations and consistent product quality.

The release agents market refers to the global business segment that produces and supplies these non-stick solutions for various industries. With applications ranging from food processing and confectionery to automotive and construction materials, the market is driven by rising demand for efficiency, waste reduction, and high-quality finished goods. It includes both edible and non-edible release agents, serving diverse industrial requirements.

A key growth factor is the expanding food processing industry worldwide. The increasing demand for packaged and ready-to-eat products is boosting the need for release agents that ensure uniform texture, reduce waste, and maintain hygiene in food production lines.

The market demand is strongly driven by industrial automation and large-scale manufacturing. As industries adopt faster and more complex machinery, the reliance on effective release agents to prevent downtime and reduce cleaning efforts is growing rapidly.

Key Takeaways

- The Global Release Agents Market is expected to be worth around USD 1.6 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 4.0% from 2025 to 2034.

- In the Release Agents Market, emulsifiers account for 29.7%, showing their vital role in production efficiency.

- Liquid form dominates the Release Agents Market with 65.9%, reflecting widespread preference for easy application solutions.

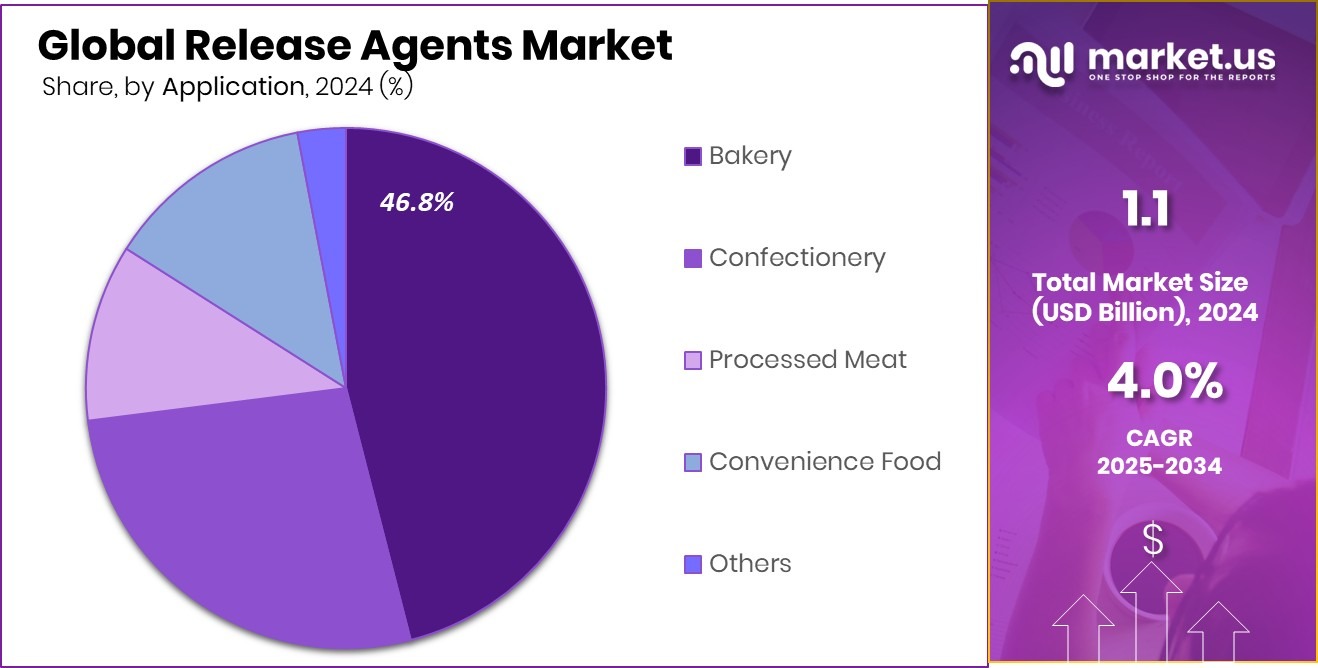

- The bakery sector leads the Release Agents Market applications at 46.8%, driven by high demand for baked goods.

- Independent grocery retailers capture 34.4% sales channel share in the Release Agents Market, emphasizing localized consumer reach.

- The 43.90% market share in North America, worth USD 0.4 Bn, highlights strong demand.

By Ingredients Analysis

Emulsifiers hold a 29.7% share, driving strong growth in the Release Agents Market.

In 2024, Emulsifiers held a dominant market position in the Ingredients segment of the Release Agents Market, with a 29.7% share. Emulsifiers play a vital role in ensuring non-stick performance, smooth product release, and improved consistency in both food and industrial applications.

Their ability to create a uniform film between surfaces and finished products reduces waste, enhances efficiency, and maintains product quality. In the food industry, emulsifiers are widely used in bakery and confectionery processes, where they prevent dough, chocolate, or other sticky formulations from clinging to machinery and molds.

Beyond food, their functional benefits extend to rubber, plastics, and other manufacturing lines, where precision and smooth separation are essential.

The growing demand for packaged and ready-to-eat foods has further strengthened the need for reliable emulsifier-based release agents, as producers seek clean, efficient, and cost-effective solutions. Additionally, their compatibility with natural and plant-based formulations makes them increasingly relevant in an industry moving toward sustainability and regulatory compliance.

With their versatility and proven performance, emulsifiers continue to secure a strong foothold, accounting for nearly one-third of the segment share. This dominance highlights their critical role in supporting efficiency and innovation within the global release agents market.

By Form Analysis

Liquid form dominates the Release Agents Market with a 65.9% share, ensuring efficient applications.

In 2024, Liquid held a dominant market position in the By Form segment of the Release Agents Market, with a 65.9% share. Liquid release agents are highly preferred due to their ease of application, superior coverage, and ability to form an even layer across different surfaces.

This ensures smooth product release in industries such as food processing, bakery, confectionery, plastics, and rubber manufacturing. Their adaptability to both manual and automated spraying systems makes them suitable for large-scale industrial operations, reducing downtime and minimizing waste.

In the food sector, liquid release agents help maintain hygiene standards by creating a clean separation between products and equipment, preventing sticking while preserving the texture and appearance of baked or molded goods. Industrial manufacturers also value liquid forms for their ability to withstand varying temperatures and provide consistent performance in high-speed production environments. The cost-effectiveness of liquid agents, combined with their high efficiency, makes them a preferred choice for manufacturers aiming to improve productivity.

By Application Analysis

Bakery applications lead the Release Agents Market, capturing 46.8% overall share.

In 2024, Bakery held a dominant market position in the By Application segment of the Release Agents Market, with a 46.8% share. The bakery industry has long been a key consumer of release agents, as these solutions are essential for ensuring consistent product quality and smooth operations in high-volume production.

From bread, cakes, and pastries to biscuits and confectionery, release agents prevent dough and batter from sticking to pans, molds, and baking trays. This not only enhances efficiency but also reduces product waste and equipment cleaning time, allowing bakeries to maintain higher productivity and lower operational costs.

The dominance of the bakery segment is strongly supported by rising global consumption of baked goods, driven by urban lifestyles, increasing demand for convenience foods, and expanding retail bakery chains.

Additionally, the growing popularity of ready-to-eat and packaged bakery items has amplified the need for reliable release solutions that preserve product texture, shape, and appearance. Health-conscious consumers are also driving interest in natural and plant-based release agents, pushing manufacturers to innovate in cleaner formulations.

By Sales Channel Analysis

Independent grocery retailers account for 34.4% sales in the Release Agents Market.

In 2024, Independent Grocery Retailer held a dominant market position in the By Sales Channel segment of the Release Agents Market, with a 34.4% share. Independent grocery retailers play a critical role in connecting manufacturers with end consumers, especially in local and community-based markets.

Their ability to cater to regional tastes, maintain strong customer relationships, and offer specialized product assortments has made them a key distribution channel for release agents used in food-related applications.

Smaller retailers often prioritize quality and customer trust, which aligns with the growing demand for safe, reliable, and clean-label release solutions in bakery and confectionery products.

The dominance of independent grocery retailers is also driven by their adaptability in stocking innovative and niche products faster than large retail chains.

With consumers increasingly seeking fresh-baked goods and ready-to-eat items, these retailers ensure a consistent supply, boosting the visibility and reach of release agents in the food segment.

Furthermore, their importance has grown with the expansion of urbanization and rising disposable incomes, where local grocery outlets remain the primary source for daily essentials.

Key Market Segments

By Ingredients

- Emulsifiers

- Vegetable Oils

- Wax and Wax Esters

- Antioxidants

- Others

By Form

- Liquid

- Solid

By Application

- Bakery

- Confectionery

- Processed Meat

- Convenience Food

- Others

By Sales Channel

- Independent Grocery Retailer

- Direct Sales and Wholesalers

- Non-Store Retailers

- Others

Driving Factors

Rising Food Processing Industry Boosts Release Agents

One of the strongest driving factors for the release agents market is the rapid growth of the global food processing industry. As more people demand packaged, ready-to-eat, and bakery products, food manufacturers rely heavily on release agents to maintain product quality and reduce waste.

These agents ensure smooth separation of baked goods, chocolates, and confectionery items from molds and machinery, keeping both efficiency and hygiene intact. Governments in many regions are also supporting food safety standards, which increases the need for reliable release solutions.

With urban lifestyles and busy schedules, processed food consumption is climbing, directly fueling the expansion of the release agents market across multiple regions. This trend will remain a key driver for years.

Restraining Factors

Health and Safety Concerns Limit Market Growth

A major restraining factor for the release agents market is the growing concern about health and safety. In food applications, some chemical-based release agents are criticized for leaving residues that may affect taste, texture, or even raise health risks if not properly regulated.

Governments and food safety authorities have become stricter about the use of additives, pushing companies to reformulate or limit certain products. This creates higher compliance costs and slows down product approvals.

In non-food industries like plastics or rubber, environmental safety is also a challenge, as synthetic release agents may contribute to pollution. These concerns make buyers cautious, reducing widespread adoption and creating a hurdle for consistent growth of the market.

Growth Opportunity

Growing Demand for Eco-Friendly Release Agent Solutions

A key growth opportunity in the release agents market is the rising shift toward eco-friendly and sustainable products. With increasing awareness about health, safety, and the environment, both consumers and industries are seeking plant-based, biodegradable, and non-toxic release agents.

These alternatives not only meet strict government regulations but also align with global sustainability goals, making them more attractive to manufacturers. Food producers, in particular, are showing strong interest in natural solutions that ensure safety while maintaining efficiency.

Companies investing in clean-label and green technologies can gain a competitive edge, as demand for safer and environmentally responsible products is expanding worldwide. This trend opens up significant room for innovation and long-term market growth.

Latest Trends

Innovation in Plant-Based and Bio-Derived Release Agents

One of the latest trends in the release agents market is the growing adoption of plant-based and bio-derived solutions. Industries are moving away from synthetic and chemical-heavy products to meet rising consumer expectations for clean-label and natural ingredients, especially in the food sector.

These bio-based release agents are designed to deliver the same performance while being safer, biodegradable, and compliant with strict environmental regulations. In addition, companies are investing in research to improve the efficiency, shelf life, and cost-effectiveness of these natural alternatives.

This trend reflects a broader industry shift toward sustainability and transparency, making plant-based release agents not just a preference but a long-term strategy shaping the future of the market.

Regional Analysis

North America holds a 43.90% share of the Release Agents Market, valued at USD 0.4 Bn.

The Release Agents Market shows varied growth patterns across regions such as North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Among these, North America dominates the market with a 43.90% share valued at USD 0.4 billion, reflecting its strong position in the global industry.

The region benefits from a highly developed food processing sector, rising demand for bakery and confectionery products, and advanced manufacturing practices that emphasize efficiency and product quality. Supportive regulatory standards on food safety and hygiene also drive higher adoption of premium release agents across the United States and Canada.

Europe follows closely, supported by a mature industrial base and a strong focus on sustainable solutions. Asia Pacific is emerging as a high-growth region due to its expanding processed food industry and increasing urban consumption.

Meanwhile, Latin America and the Middle East & Africa contribute steadily, driven by growing food demand and industrial applications. Overall, while developing regions are fueling growth opportunities, North America remains the key revenue hub, supported by strong consumer demand, advanced technology adoption, and stringent quality standards, making it the leading region in the global release agents market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Archer Daniels Midland Company (ADM) remains a key player, leveraging its extensive agricultural and food processing expertise. ADM focuses on delivering safe, reliable, and high-performance release agents tailored for the bakery and confectionery sectors. With its strong supply chain and global presence, ADM emphasizes natural and plant-based ingredients, aligning with consumer demand for clean-label products and sustainability.

AAK Foods plays a crucial role with its specialty oils and fats portfolio, which are widely used in edible release agents. The company’s strength lies in offering customizable solutions that enhance product quality while supporting healthier and more sustainable production processes. AAK’s innovation in plant-based formulations supports the market’s transition away from chemical-based solutions, making it a frontrunner in eco-conscious offerings.

DuPont, known for its scientific and technological leadership, focuses on high-performance release agents with applications beyond food, including industrial and pharmaceutical use. Its emphasis on advanced materials and regulatory compliance provides an edge in highly controlled markets. DuPont’s investment in research ensures products that meet both efficiency and safety standards.

Top Key Players in the Market

- Archer Daniels Midland Company

- AAK Foods

- Dupont

- IFC Solutions, Inc.

- Sonneveld Group BV

- Puratos Group NV

- Lecico GmbH

Recent Developments

- In October 2024, AAK announced the divestment of its foodservice facility in Hillside, New Jersey, as part of a strategic portfolio optimization. A binding agreement was signed with Stratas Foods to complete the sale, expected before the end of the year.

- In July 2024, DuPont finalized the acquisition of Donatelle Plastics, LLC, a company specializing in medical device components. The deal brings injection molding, liquid silicone rubber processing, and precision machining capabilities into DuPont’s Industrial Solutions division.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Billion Forecast Revenue (2034) USD 1.6 Billion CAGR (2025-2034) 4.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Ingredients (Emulsifiers, Vegetable Oils, Wax and Wax Esters, Antioxidants, Others), By Form (Liquid, Solid), By Application (Bakery, Confectionery, Processed Meat, Convenience Food, Others), By Sales Channel (Independent Grocery Retailer, Direct Sales and Wholesalers, Non-Store Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archer Daniels Midland Company, AAK Foods, Dupont, IFC Solutions, Inc., Sonneveld Group BV, Puratos Group NV, Lecico GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Release Agents MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Release Agents MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Archer Daniels Midland Company

- AAK Foods

- Dupont

- IFC Solutions, Inc.

- Sonneveld Group BV

- Puratos Group NV

- Lecico GmbH