Global Rapeseed Oil Market Size, Share Analysis Report By Product Type (Processed, Virgin), By Nature (Organic, Conventional), By End-use (Food Service, Food Processor, Retail, Others), By Distribution Channel (Supermarkets and Hypermarkets, Online Stores, Specialty Stores, Retail Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152293

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

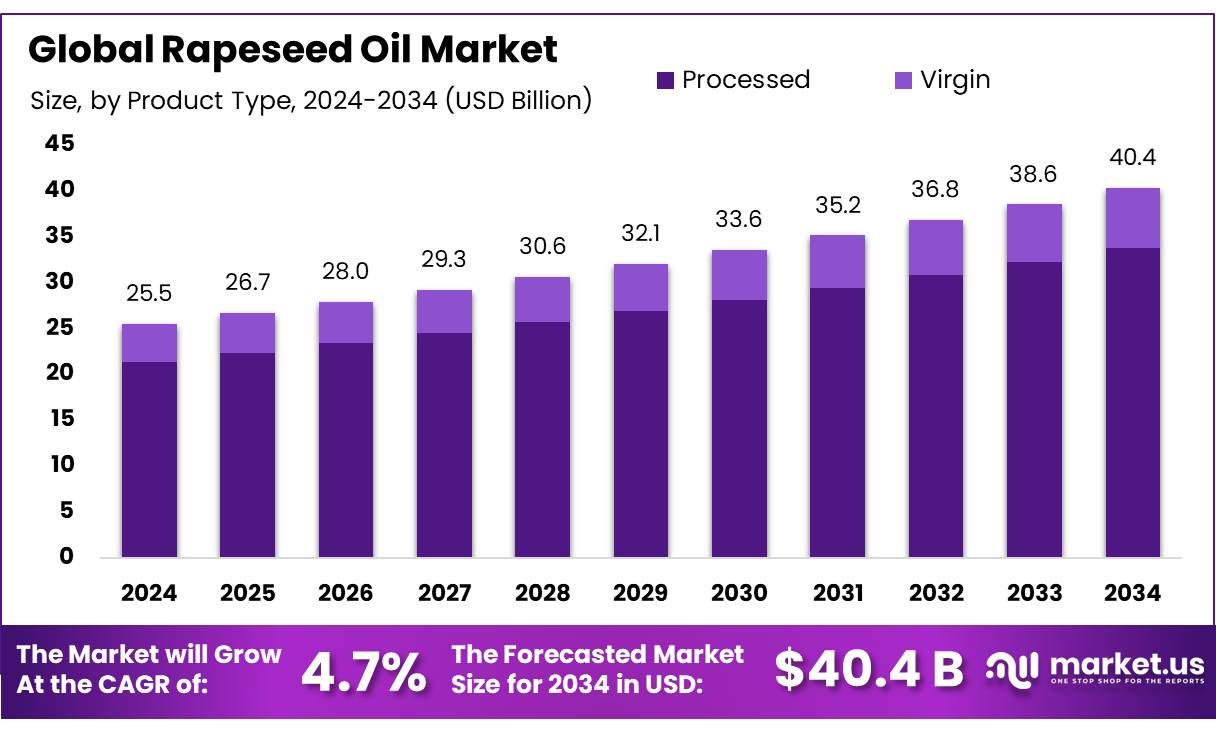

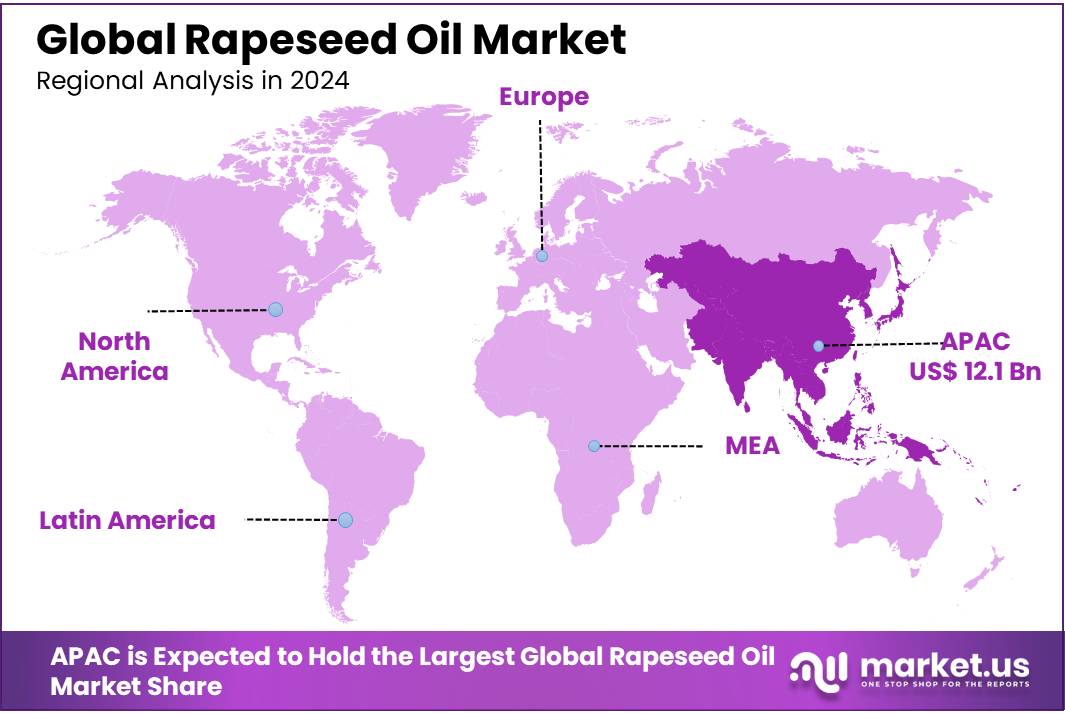

The Global Rapeseed Oil Market size is expected to be worth around USD 40.4 Billion by 2034, from USD 25.5 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 47.8% share, holding USD 12.1 billion revenue.

The global rapeseed oil concentrates industry is characterized by stable production volumes, diverse applications, and growing recognition as a multifunctional bio-resource. In 2021, worldwide rapeseed oil production reached approximately 26.6 million tonnes, with Canada, Germany, and China contributing nearly 43% of this output.

The production volume for the 2024–2025 period was estimated at around 89.8 million metric tonnes globally, with Canada alone accounting for some 22 million MT (representing over 54% of its own national production). Rapeseed occupies a significant position as the world’s third most important oilseed by volume, supplying nearly 13% of global vegetable oil output.

Several driving factors underlie this sustained growth. Firstly, health-driven consumer preferences have reinforced demand for rapeseed oil owing to its favorable profile—low saturated fat and high omega-3 and omega-6 content. Secondly, government policies and regulatory mechanisms have catalyzed biofuel production. For example, EU mandates for bio-based renewable fuels have supported the stable use of rapeseed in biodiesel applications. In India, the 2024 tariff-rate quota (TRQ) allowed importation of up to 150,000 MT of refined rapeseed oil to mitigate inflationary pressure on food prices.

Emerging challenges and risk factors also influence the sector. Adverse weather conditions, such as the record-high temperatures recorded during sowing seasons, have led Indian rapeseed cultivation areas to contract by approximately 10% in 2024 compared with the previous year. Additionally, protectionist measures, such as China’s 100% import tariff on Canadian rapeseed meal and oil implemented in March 2025, are expected to create supply constraints and potentially elevate global commodity prices.

Key Takeaways

- Rapeseed Oil Market size is expected to be worth around USD 40.4 Billion by 2034, from USD 25.5 Billion in 2024, growing at a CAGR of 4.7%

- Processed held a dominant market position, capturing more than an 83.8% share of the global rapeseed oil market.

- Conventional held a dominant market position, capturing more than an 82.9% share of the global rapeseed oil market.

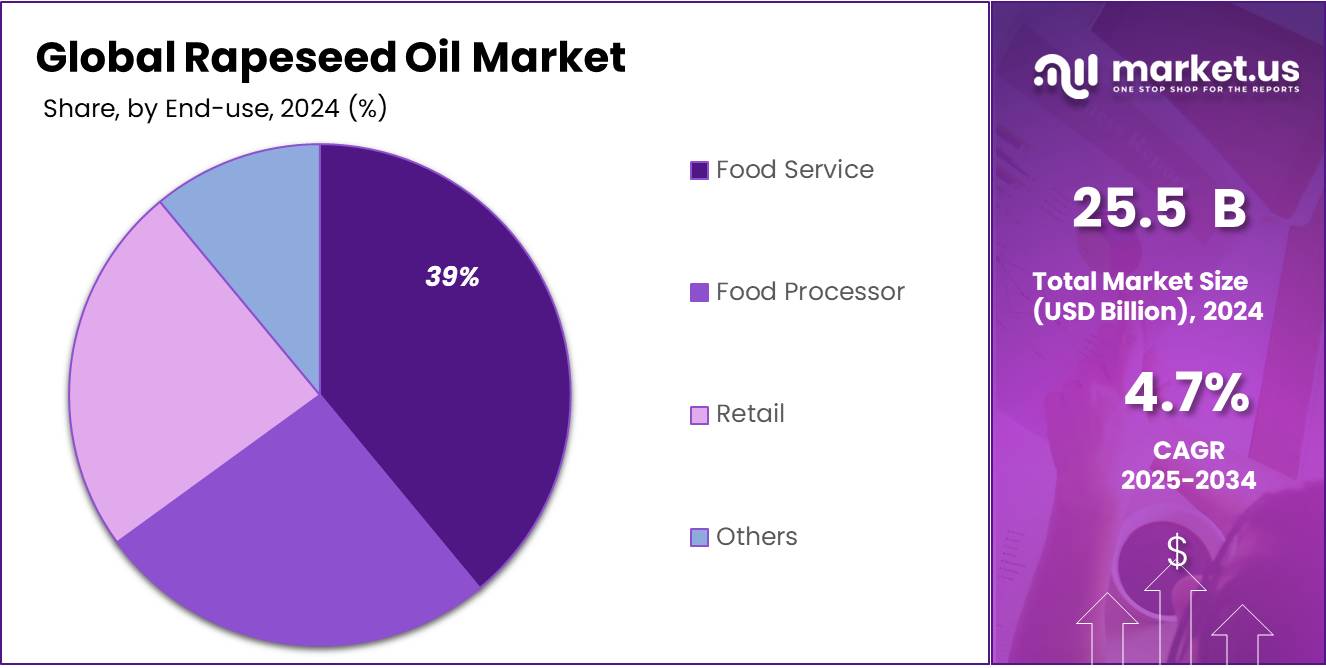

- Food Service held a dominant market position, capturing more than a 39.6% share of the global rapeseed oil market.

- Supermarkets and Hypermarkets held a dominant market position, capturing more than a 44.9% share of the global rapeseed oil market.

- Asia-Pacific region commanded a commanding 47.8% share, equivalent to around USD 12.1 billion

By Product Type Analysis

Processed Rapeseed Oil dominates with 83.8% market share in 2024 due to its widespread use across food and industrial sectors.

In 2024, Processed held a dominant market position, capturing more than an 83.8% share of the global rapeseed oil market. This strong lead is largely due to its extensive applications in both the food industry and non-food sectors such as biofuels, lubricants, and cosmetics. Processed rapeseed oil is preferred because it has a longer shelf life, neutral flavor, and refined purity, making it suitable for large-scale commercial use.

Its popularity in cooking oils, salad dressings, and margarine has driven consistent demand from food manufacturers across North America, Europe, and Asia-Pacific. Moreover, government policies supporting renewable fuel blends—particularly in the European Union and Canada—have further encouraged the uptake of processed rapeseed oil in biodiesel production.

By Nature Analysis

Conventional Rapeseed Oil leads with 82.9% market share in 2024, driven by large-scale cultivation and cost-efficiency.

In 2024, Conventional held a dominant market position, capturing more than an 82.9% share of the global rapeseed oil market. This strong presence is mainly due to its widespread farming practices, high yield efficiency, and lower production costs compared to organic alternatives. Conventional rapeseed oil is extensively used in food processing, packaged foods, and industrial applications like biodiesel and animal feed.

Farmers prefer conventional cultivation because it allows the use of chemical fertilizers and pest control, which result in better crop output and predictable harvests. This, in turn, ensures consistent supply to oil processors and food manufacturers. Most of the large-scale food producers and exporters across Europe, Canada, and India depend on conventional rapeseed oil for its volume availability and lower procurement cost.

By End-use Analysis

Food Service dominates with 39.6% share in 2024, fueled by rising demand from hotels, restaurants, and catering sectors.

In 2024, Food Service held a dominant market position, capturing more than a 39.6% share of the global rapeseed oil market. This segment’s lead is driven by the growing use of rapeseed oil in commercial kitchens across quick-service restaurants, hotels, cafeterias, and catering services. Rapeseed oil is widely favored in the food service industry due to its light flavor, high smoke point, and health benefits such as low saturated fat and high omega-3 content.

These qualities make it ideal for deep frying, sautéing, and salad dressings, especially in large-scale food operations that require consistency and volume. The rise in urban dining, food delivery services, and organized hospitality sectors—especially in regions like North America, Europe, and Asia—has significantly increased bulk purchasing of rapeseed oil by food service providers.

By Distribution Channel Analysis

Supermarkets and Hypermarkets lead with 44.9% share in 2024, driven by consumer preference for one-stop shopping and wide product variety.

In 2024, Supermarkets and Hypermarkets held a dominant market position, capturing more than a 44.9% share of the global rapeseed oil market. This dominance is largely due to their extensive retail footprint, wide product assortment, and the convenience they offer to consumers. These large-format stores often stock multiple rapeseed oil brands, including private labels and premium options, giving customers a range of price and quality choices.

The trust built by well-known retail chains also plays a key role in influencing purchase decisions, particularly in urban and semi-urban areas. Additionally, frequent promotional offers, bulk discounts, and organized shelf displays make these stores a preferred channel for households looking to purchase cooking oils in larger quantities.

Key Market Segments

By Product Type

- Processed

- Virgin

By Nature

- Organic

- Conventional

By End-use

- Food Service

- Food Processor

- Retail

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Online Stores

- Specialty Stores

- Retail Stores

- Others

Emerging Trends

Growing Shift Towards Sustainable and Clean-Label Rapeseed Oil

One of the most notable trends in the rapeseed oil market today is the rising consumer demand for sustainable production practices and clean-label products. Over the years, customers have become increasingly concerned about the environmental impact of food production and have started favouring oils produced without genetically modified seeds, excessive chemicals, or environmentally harmful farming methods.

This shift is being reinforced by both government support and industry initiative. For instance, European agricultural policies now emphasise sustainable farming, encouraging farmers to adopt crop rotation techniques, reduce pesticide use, and improve soil quality. These efforts align with industry practices such as traceability systems and quality certification standards.

Additionally, public programs in countries like Canada and France are funding pilot projects focused on reducing agrochemical footprints in rapeseed cultivation, helping these sustainable variants reach mainstream supply chains. This not only supports healthier farming but also positions rapeseed oil as an environmentally conscious choice for consumers.

From a market standpoint, sustainable rapeseed oil is becoming a premium product. Clean-label trends are driving growth in retail food, restaurant, and private-label channels. Consumers are increasingly willing to trade up for labels that indicate non-GMO, eco-certified processes, or low-impact farming methods. This trend also provides an opportunity for brands to differentiate themselves through product storytelling—highlighting responsible sourcing, reduced carbon footprints, and environmental commitments on labels.

Drivers

Cardiovascular Health Appeal Elevated by High Omega-3 and Low Saturated Fat

One of the strongest growth drivers for the rapeseed oil market is increasing consumer awareness of its positive impact on heart health. Rapeseed oil is celebrated for its nutritional profile, containing approximately 7–11g of omega3 fatty acids per 100g, positioning it as one of the richest plant-based sources of alpha-linolenic acid (ALA). The European Food Safety Authority (EFSA) recognizes that omega3 ALA helps maintain normal blood cholesterol levels under EU Regulation (EC) No1924/2006—an endorsement that encourages widespread adoption of rapeseed oil in diets across Europe.

In parallel, rapeseed oil is low in saturated fats (around 7–8g per 100g), which aligns with global dietary guidelines aimed at reducing cardiovascular disease. It is composed of roughly 63% monounsaturated fat and 28% polyunsaturated fat, with a favorable omega6 to omega3 ratio of about 2:1. These healthy fat ratios make rapeseed oil a preferred cooking medium in households and foodservice sectors alike, particularly amid rising rates of heart disease worldwide.

Government policies and public health campaigns in the EU have further reinforced this trend. For example, nutritional labeling regulations in the EU require clear disclosure of fatty acid content, helping consumers make informed choices. EFSA’s health claim approvals also allow product packaging to highlight benefits such as “high in omega3” and “contributes to normal blood cholesterol levels,” which strengthens market positioning and consumer trust.

Restraints

Price Volatility and Supply Risks Weigh on Rapeseed Oil Market

A significant restraint on the rapeseed oil industry is the persistent price volatility driven by fluctuating crop yields, shifting trade policies, and geopolitical tensions. For instance, in Q1 2025, rapeseed oil prices in the United States jumped to an average of USD 1,281 per metric tonne, rising by 3.9% from Q4 2024. Similar trends were seen in Europe and India, where prices swung in response to weather events, currency shifts, and changing demand dynamics. Such rapid price shifts complicate cost planning for food manufacturers, retailers, and producers, reducing profit margins and occasionally leading to supply chain disruptions.

China’s decisive actions in early 2025 underscore the destabilizing impact of trade policy on pricing. The country introduced a 100% tariff on Canadian rapeseed oil and meal in March, triggering futures prices to surge by over 7% in mere days. China also raised margin requirements on futures contracts from 7% to 9% to temper speculative swings. Although China had buffer stocks, analysts warned of possible shortages in Q3 2025. These sudden policy shifts can disrupt trade flows and leave downstream sectors scrambling for alternative suppliers, often at less favorable costs.

On the agricultural side, India provides another cautionary example. Unseasonably high temperatures in the 2024 sowing season resulted in a forecasted 10% decline in planting area. This reduction in rapeseed acreage forced many producers to switch to crops like wheat and potatoes, intensifying pressure on domestic edible oil supply and prompting higher import requirements. India has responded by considering increased import duties on vegetable oils—raising tariffs to 27.5–35.75% depending on the oil type—to protect local farmers.

Opportunity

Expansion of Biodiesel Demand Bolstered by EU Policy

A key growth opportunity for the rapeseed oil market lies in the expanding biodiesel sector, driven in particular by supportive European Union mandates. In 2024, rapeseed oil represented approximately 50% of bio-based diesel feedstock in Europe, reflecting its sustained dominance in the renewable fuel mix. The European Commission’s Renewable Energy Directive II (adopted June 2023) sets binding targets requiring member states to ensure that at least 14% of transport energy comes from renewables by 2030, supplemented by binding greenhouse gas reduction criteria . This EU push directly increases demand for feedstocks like rapeseed oil.

Furthermore, in the 2024/25 crop year, the EU imported around 3.4 million tonnes of rapeseed—an increase of nearly 5% over the previous year—owing to lower domestic harvest estimates and sustained processing volumes of around 23 million tonnes. Such dynamics indicate strong import dependency coupled with rising raw material needs for both edible and fuel applications.

At the same time, EU policy places emphasis on advanced sustainability standards for biofuels, excluding feedstocks linked to deforestation and carbon-rich land use. Rapeseed oil, with its established cultivation practices mostly on arable land, fits these criteria well. As regulatory frameworks evolve to prioritize lower carbon intensities and traceability, rapeseed oil aligns favorably with sustainability requirements.

Regional Insights

Asia-Pacific (APAC) dominates with 47.8% share and approximately USD 12.1 billion in 2024

In 2024, the Asia-Pacific region commanded a commanding 47.8% share, equivalent to around USD 12.1 billion, of the global rapeseed oil market. This supremacy is underpinned by two principal nations—China and India—which together contribute more than half of the region’s consumption and production volumes. China remains the largest consumer, leveraging rapeseed oil extensively in culinary applications, while India continues to expand its domestic production and processing capacity to meet mounting demand.

Government initiatives across APAC further reinforce market resilience. In China, rapeseed oil is integrated into both food security and energy diversification policies. India, on the other hand, implements import tariffs and encourages domestic cultivation to manage price stability and enhance farmer incomes. These policy frameworks support future growth, even amid global supply disruptions or weather-related yield variations.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Adani-Wilmar, a 50:50 joint venture between India’s Adani Group and Singapore’s Wilmar International, is one of the country’s leading edible oil producers. The company dominates branded cooking oils, with a strong nationwide distribution network covering urban and over 30,000 rural towns. Its competitive edge lies in its price-led offerings, wide oil portfolio, and scale, supported by Wilmar’s global intelligence systems. Despite recent shifts in shareholder structure, Adani-Wilmar remains a dominant player in rapeseed and other edible oils across India.

ADM, a top global agribusiness firm, operates over 270 processing plants and 420 procurement points worldwide. With net income of US 1.8 billion in 2024, the company processes rapeseed into tailored oils, including hydrogenated and modified variants through advanced enzymatic and blending technologies. ADM’s strength lies in its robust R&D in edible specialty oils, strong supply chain, and the ability to serve diverse food, nutraceutical, and industrial segments with consistent quality and scale.

Borges Mediterranean Group, founded in 1896 in Catalonia, is a major olive and seed oil processor, with €6700 million revenue and 1-100 employees. Its Borges Agricultural & Industrial Edible Oils division refines rapeseed alongside olive and other seed oils, serving over 60 countries. Borges leverages Mediterranean oil heritage and industrial-scale refining to position rapeseed oil within both B2B and retail channels, emphasizing quality and traceability.

Top Key Players Outlook

- Adani Wilmar Ltd.

- Archer Daniels Midland (ADM)

- Borges Mediterranean Group

- Bunge Limited

- Cargill Incorporated

- Cullise Ltd.

- Interfat SA

- Louis Dreyfus Company B.V.

- Mackintosh of Glendaveny

- Yorkshire Rapeseed Oil

Recent Industry Developments

In 2024, Bunge Limited, a global agribusiness and food company generating approximately USD 6.0 billion in revenue from its Refined & Specialty Oils segment, maintained a strong position in the rapeseed oil sector as a major processor and distributor.

In 2024, Archer Daniels Midland (ADM) processed approximately 35.7 million tonnes of oilseeds, including canola and rapeseed, through its global network of more than 270 plants and 420 crop procurement facilities, underscoring its expansive operational capacity in rapeseed oil crushing, refining, and distribution.

Report Scope

Report Features Description Market Value (2024) USD 25.5 Billion Forecast Revenue (2034) USD 40.4 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Processed, Virgin), By Nature (Organic, Conventional), By End-use (Food Service, Food Processor, Retail, Others), By Distribution Channel (Supermarkets and Hypermarkets, Online Stores, Specialty Stores, Retail Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Adani Wilmar Ltd., Archer Daniels Midland (ADM), Borges Mediterranean Group, Bunge Limited, Cargill Incorporated, Cullise Ltd., Interfat SA, Louis Dreyfus Company B.V., Mackintosh of Glendaveny, Yorkshire Rapeseed Oil Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adani Wilmar Ltd.

- Archer Daniels Midland (ADM)

- Borges Mediterranean Group

- Bunge Limited

- Cargill Incorporated

- Cullise Ltd.

- Interfat SA

- Louis Dreyfus Company B.V.

- Mackintosh of Glendaveny

- Yorkshire Rapeseed Oil