Global Organic Acids Market Size, Share, And Enhanced Productivity By Form (Liquid, Granules, Powder), By Source (Biomass, Molasses, Starch), By Type (Acetic Acid, Citric Acid, Formic Acid, Lactic Acid, Propionic Acid, Fumaric Acid, Others), By Application (Food and Beverages, Feed, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171276

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

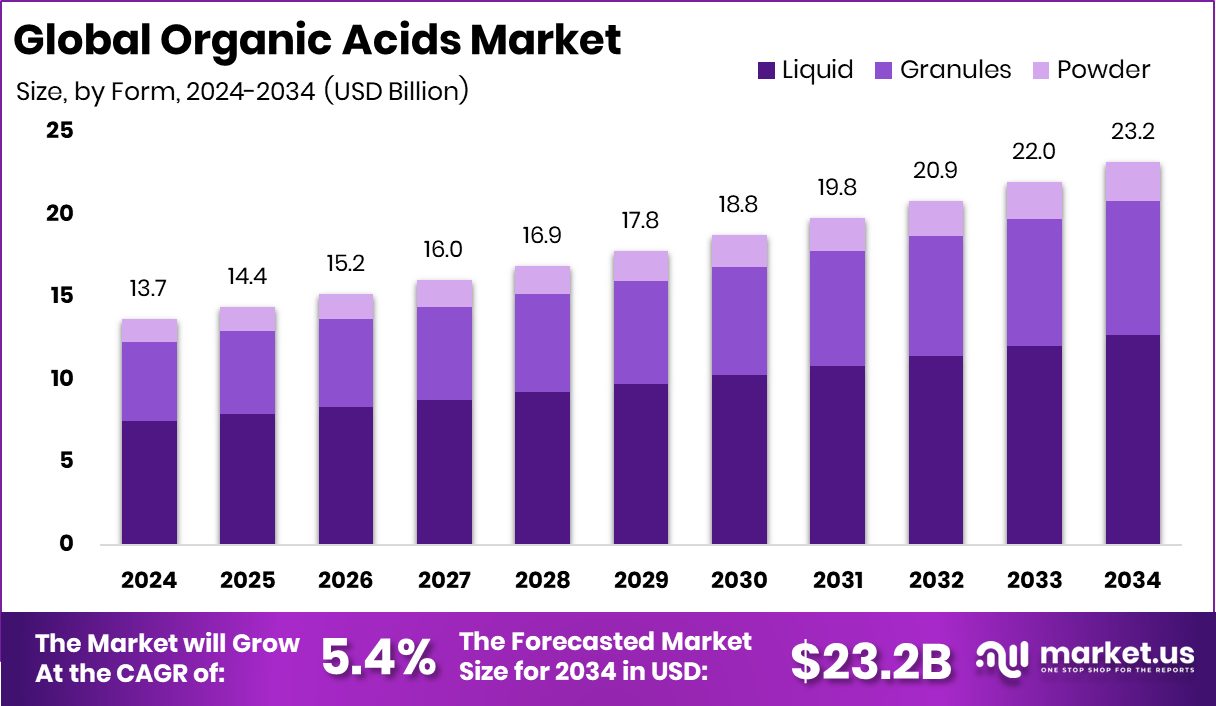

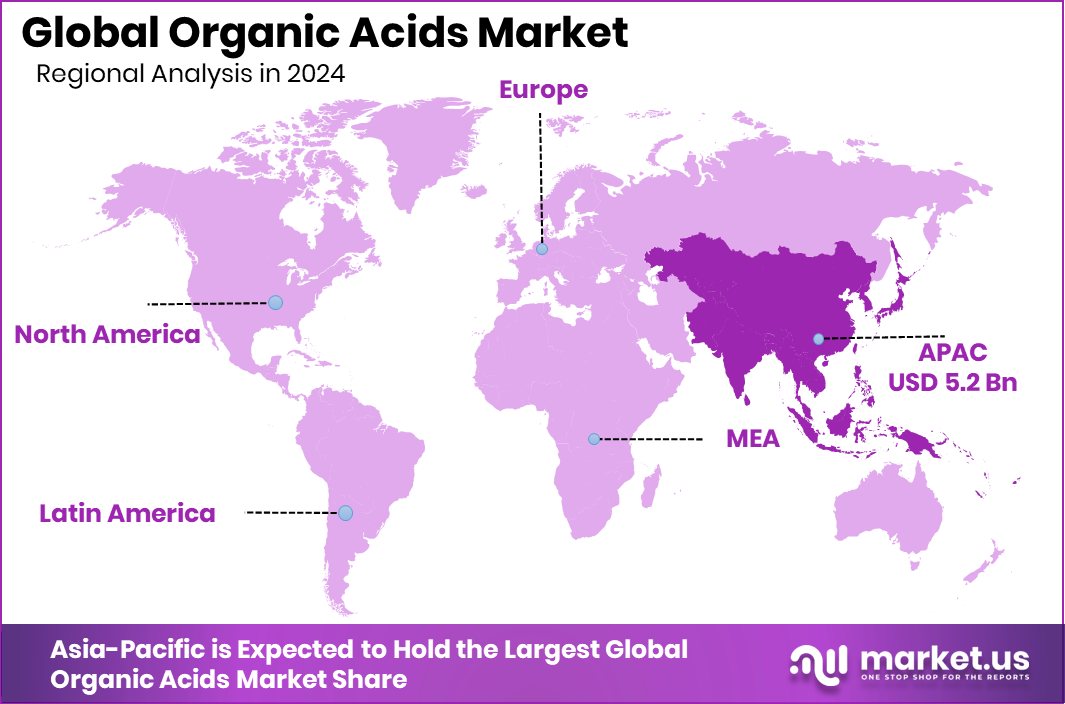

The Global Organic Acids Market is expected to be worth around USD 23.2 billion by 2034, up from USD 13.7 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034. Strong industrial demand helped Asia-Pacific capture 38.40%, valued at USD 5.2 Bn.

Organic acids are naturally occurring compounds found in plants, animals, and microbes. Common examples include lactic, citric, acetic, and succinic acids. They are widely used to preserve food, balance taste, improve digestion, support animal nutrition, and enable chemical reactions. Because many organic acids can be produced through fermentation, they fit well with today’s shift toward cleaner and more sustainable production methods.

The organic acids market covers the production, processing, and use of these acids across food and beverages, agriculture, pharmaceuticals, personal care, and industrial applications. Demand is rising as industries move away from synthetic additives toward naturally derived and bio-based ingredients. Recent investments reflect this shift, such as Afyren’s €21 million capital raise to scale industrial biobased organic acid production and TripleW’s $16.5 million Series B to make lactic acid from food waste.

Market growth is driven by advances in biotechnology and fermentation efficiency. Public and private funding is accelerating innovation, including BioMADE’s $26.9 million investment across 17 projects to strengthen the U.S. bioeconomy and Pow.bio’s $9.5 million raise to expand continuous fermentation platforms. These efforts lower production costs and improve scalability.

Rising demand comes from clean-label foods, organic farming, and sustainable agriculture. The USDA’s $1 million four-year grant supporting anaerobic soil disinfestation highlights how organic acids support eco-friendly farming systems. In food systems, reduced-sugar and natural preservation solutions are also increasing in usage.

Opportunities are strongest in bio-based foods and green manufacturing. Supportive funding ecosystems, such as Swansea’s BioHUB, receiving £4.5 million from UKRI, and India’s Two Brothers Organic Farms securing ₹14.5 crore in Pre-Series A funding, are expanding local organic acid value chains.

Key Takeaways

- The Global Organic Acids Market is expected to be worth around USD 23.2 billion by 2034, up from USD 13.7 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034.

- Liquid form dominates the Organic Acids Market with 54.8% share due to easy handling, blending, and faster industrial processing.

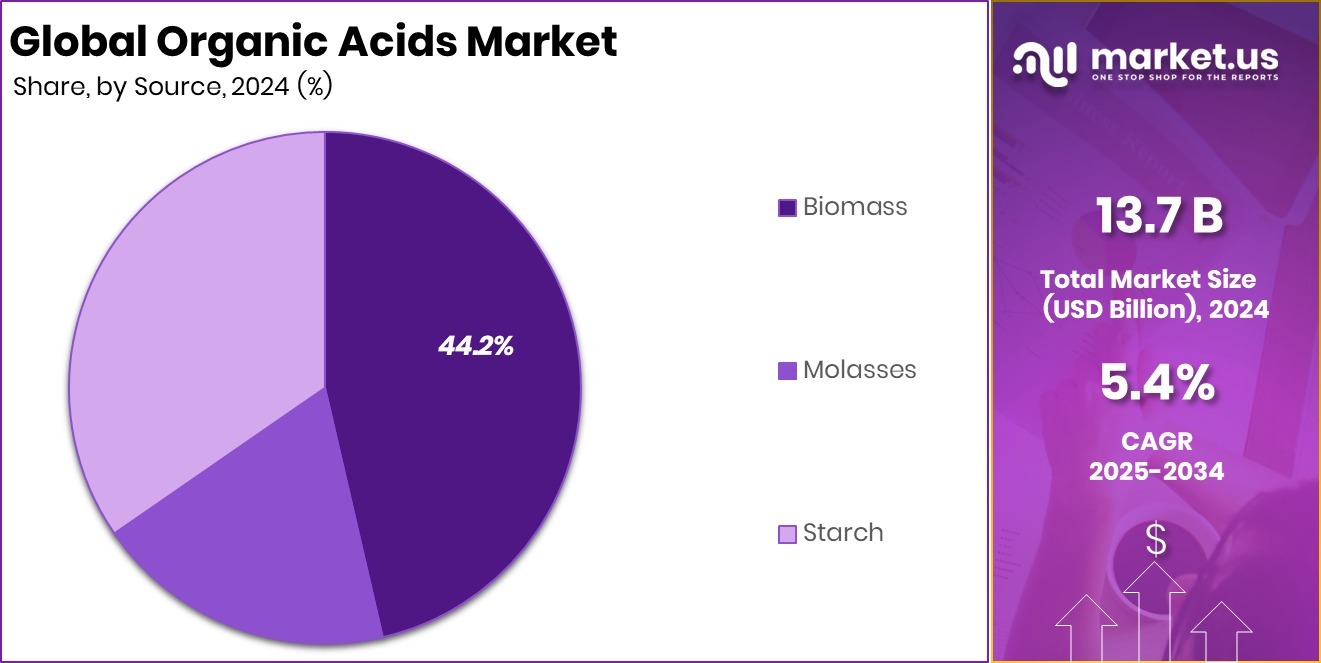

- Biomass-based sources hold 44.2% share, driven by sustainability goals and growing preference for renewable raw materials.

- Citric acid leads by type with 33.4% share, supported by wide use in food, beverages, and pharmaceutical formulations.

- Food and beverage applications account for 49.5% share, fueled by clean-label demand and natural preservation needs.

- The Asia-Pacific region’s 38.40% contribution translated into USD 5.2 Bn in Organic Acids revenue.

By Form Analysis

Liquid form dominates the Organic Acids Market due to easy handling across industries.

In 2024, Liquid held a dominant market position in the By Form segment of the Organic Acids Market, with a 54.8% share, reflecting its strong acceptance across multiple end-use processes. Liquid organic acids are preferred due to their ease of handling, accurate dosing, and uniform blending characteristics, especially in continuous production environments. Their solubility and stability make them suitable for applications that demand consistent performance and controlled reactions.

The dominance of the liquid form is also supported by efficient storage and transportation advantages, which reduce operational complexity for manufacturers and users. Liquid formats allow faster integration into existing systems without additional processing steps, helping maintain product quality and operational efficiency. These functional benefits continue to support the leading position of liquid organic acids in the market.

By Source Analysis

Biomass sources lead the Organic Acids Market as sustainability drives bio-based production growth.

In 2024, Biomass held a dominant market position in the by-source segment of the Organic Acids Market, with a 44.2% share, driven by the growing preference for renewable and naturally derived raw materials. Biomass-based production aligns well with sustainability goals, offering a lower environmental footprint compared to fossil-based alternatives while supporting circular resource use.

The strong share of biomass reflects its reliability as a feedstock and its compatibility with fermentation-based manufacturing routes. These processes allow consistent output quality while utilising agricultural and biological inputs efficiently. As industries continue to prioritise cleaner sourcing and long-term supply stability, biomass remains a key contributor to organic acid production.

By Type Analysis

Citric acid holds a major share in the Organic Acids Market, driven by food.

In 2024, Citric Acid held a dominant market position in the By Type segment of the Organic Acids Market, with a 33.4% share, supported by its wide functional versatility and strong demand across routine consumption applications. Citric acid is valued for its acidity regulation, preservation properties, and flavour enhancement capabilities, making it a staple ingredient in many formulations.

Its dominance is reinforced by consistent demand patterns and well-established production processes that ensurea reliable supply. The balance between performance, safety, and cost efficiency continues to position citric acid as a core organic acid type, sustaining its leading share within the overall market structure.

By Application Analysis

Food and beverages dominate the Organic Acids Market through preservation, flavouring, and shelf-life.

In 2024, Food and Beverages held a dominant market position in the By Application segment of Organic Acids Market, with a 49.5% share, highlighting the essential role of organic acids in everyday consumption products. Organic acids are widely used to improve taste balance, extend shelf life, and maintain product stability in food and drink formulations.

This segment’s leadership is supported by steady consumption volumes and consistent quality requirements. Organic acids meet both functional and safety expectations, making them integral to production processes. Their established use across diverse food and beverage categories continues to secure this segment’s dominant position in the market.

Key Market Segments

By Form

- Liquid

- Granules

- Powder

By Source

- Biomass

- Molasses

- Starch

By Type

- Acetic Acid

- Citric Acid

- Formic Acid

- Lactic Acid

- Propionic Acid

- Fumaric Acid

- Others

By Application

- Food and Beverages

- Feed

- Pharmaceuticals

- Others

Driving Factors

Sustainable Production Push Accelerates Organic Acids Demand

The biggest driving factor for the Organic Acids Market is the strong global push toward sustainable and low-carbon production. Industries are actively replacing petrochemical-based inputs with bio-based organic acids made through cleaner processes. This shift is supported by fresh funding into green chemistry and carbon-reuse technologies.

For example, New Iridium raised $2.65 million in seed funding to develop advanced materials that improve efficiency in chemical and energy systems. Similarly, a Danish startup secured $10 million to launch a CO₂ utilisation plant, showing how captured carbon can be converted into valuable chemicals, including organic acid intermediates.

Regulatory pressure and consumer awareness are also shaping demand. Recent legal scrutiny in the beverage space, highlighted by Celsius reaching a class-action settlement that could pay customers up to $250, is pushing brands to reformulate with safer, transparent ingredients. Organic acids benefit directly from this shift, as they are widely accepted as clean, functional, and naturally derived inputs.

Restraining Factors

High Capital Needs Slow Sustainable Scale-Up

A key restraining factor in the Organic Acids Market is the high cost and complexity of scaling sustainable production technologies. While bio-based and CO₂-derived organic acids are promising, moving from pilot plants to commercial volumes requires heavy upfront investment, advanced infrastructure, and long development timelines. This creates pressure on pricing and limits adoption among cost-sensitive buyers. Even with public support, projects take time to become economically viable.

For instance, Avantium received a €3.5 million EU grant to advance its CO₂ conversion project, highlighting that such technologies still depend on grants rather than market revenues alone. Similarly, SAF technology firm GAFT secured a €750k grant from Singapore-based Temasek Foundation, showing early-stage innovation needs continuous financial backing. Until production costs fall and processes mature, affordability and scale will remain a challenge for wider organic acid adoption.

Growth Opportunity

Food Waste Conversion Unlocks Circular Organic Acids

A major growth opportunity in the Organic Acids Market lies in converting food and agricultural waste into valuable organic acids. This approach reduces disposal costs while creating new revenue streams, making sustainability economically attractive.

Companies are increasingly using fermentation to turn discarded food into lactic acid and related bio-based materials used in packaging, food preservation, and agriculture. A clear signal of this opportunity is TripleW raising $16.5 million in Series B funding to produce lactic acid and bioplastics directly from food waste, proving commercial interest in circular models.

Public funding is also supporting waste-to-value innovation. The German Ministry awarded €2.6 million to a project focused on upcycling dairy waste into mycelium protein, strengthening infrastructure that shares feedstocks and fermentation know-how with organic acid production. As regulations tighten on waste disposal, these circular pathways are expected to drive long-term market expansion.

Latest Trends

Waste-To-Energy Integration Reshapes Organic Acids Production

A clear latest trend in the Organic Acids Market is the integration of waste-to-energy platforms with bio-based chemical production. Organic waste, landfill gas, and biomass residues are increasingly treated as valuable inputs rather than disposal problems. This trend is gaining speed as large funding rounds back infrastructure that supplies clean feedstocks and energy for fermentation-based organic acids.

BiofuelCircle’s plan to raise ₹70 crore reflects rising confidence in circular bioenergy ecosystems. At a larger scale, Waga Energy secured $180 million in senior debt over four years to expand biomethane projects at U.S. landfill sites, strengthening renewable gas availability that supports low-carbon chemical manufacturing.

Smaller but critical scale-up funding, such as CHAR Technologies receiving $2.25 million, is helping bridge pilot operations to commercial supply. Together, these developments show how energy recovery and organic acid production are converging into one circular value chain.

Regional Analysis

Asia-Pacific led the Organic Acids Market with 38.40% share, reaching USD 5.2 Bn.

Asia-Pacific emerged as the dominating region in the Organic Acids Market, holding a 38.40% share and generating USD 5.2 Bn, reflecting its strong manufacturing base and broad consumption across food processing, agriculture, and industrial applications. The region benefits from large-scale production capabilities, availability of raw materials, and consistent downstream demand, which together reinforce its leading position.

North America represents a mature regional market, supported by steady demand from food, pharmaceutical, and industrial users, where organic acids are valued for performance consistency and regulatory acceptance. Europe shows stable growth, driven by structured supply chains and a strong focus on quality standards in food and specialty applications, supporting sustained usage of organic acids across sectors.

The Middle East & Africa region remains smaller in comparison, but organic acids play an important role in food preservation and industrial processing, especially in regions with rising urban consumption. Latin America contributes through its agricultural strength and growing food processing activities, where organic acids are increasingly used to enhance product stability and shelf life. Together, these regions shape a balanced global market, with Asia-Pacific clearly leading in scale and value.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Archer Daniels Midland Company plays a strategic role in the organic acids space through its strong agricultural processing foundation and deep expertise in fermentation-based solutions. The company benefits from tight integration across grain sourcing, processing, and ingredient manufacturing, which supports cost control and supply reliability. Its focus on food, beverage, and nutrition applications positions organic acids as value-added ingredients rather than commodities, strengthening long-term demand stability.

BASF SE brings a chemistry-driven approach to the organic acids market, supported by its broad industrial footprint and process innovation capabilities. The company’s strength lies in large-scale production efficiency, consistent quality, and the ability to serve diverse end-use industries such as food, pharmaceuticals, and industrial formulations. Its emphasis on process optimization and sustainable chemistry enhances competitiveness in both mature and emerging applications.

Celanese Corporation contributes to the market through its advanced materials and chemical production expertise, with organic acids fitting into its broader specialty chemicals portfolio. The company’s focus on performance-driven applications allows organic acids to be positioned as functional inputs with clear technical value. Strong operational discipline and customer-focused product development support its role in supplying high-purity and application-specific organic acid solutions.

Top Key Players in the Market

- Archer Daniels Midland Company

- BASF SE

- Celanese Corporation

- E.i. Dupont De Nemours and Company

- Eastman Chemical Company

- Henan Jindan Lactic Acid Technology and Co.

- Tate and Lyle Plc.

- The Dow Chemical Company

Recent Developments

- In June 2025, Dow announced it signed an agreement to sell its 50% ownership in the DowAksa Advanced Composites joint venture to its partner Aksa Akrilik Kimya Sanayii A.Ş. This strategic move shifts Dow’s capital toward its core materials science businesses and supports capital allocation for high-value chemical segments across cosmetics, packaging, and industrial materials.

- In November 2024, Tate & Lyle completed the acquisition of CP Kelco, a company known for pectin, specialty gums, and other nature-based ingredients. This major deal strengthened Tate & Lyle’s portfolio in food and beverage ingredients, especially solutions that improve texture, mouthfeel, and functionality in products such as low-sugar drinks and foods. The acquisition expanded the company’s global footprint and enhanced its ability to serve customers in key markets around the world.

- In April 2024, ADM broke ground on a new biorefinery project in Minnesota in partnership with Solugen, where ADM supplies dextrose for manufacturing organic acids. This site will produce organic acids used in water treatment, energy, and home & personal care products, expanding ADM’s role in sustainable chemicals beyond basic agricultural processing. It is a key development showing ADM’s move toward bio-based chemical production.

Report Scope

Report Features Description Market Value (2024) USD 13.7 Billion Forecast Revenue (2034) USD 23.2 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Granules, Powder), By Source (Biomass, Molasses, Starch), By Type (Acetic Acid, Citric Acid, Formic Acid, Lactic Acid, Propionic Acid, Fumaric Acid, Others), By Application (Food and Beverages, Feed, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archer Daniels Midland Company, BASF SE, Celanese Corporation, E.i. Dupont De Nemours and Company, Eastman Chemical Company, Henan Jindan Lactic Acid Technology and Co., Tate and Lyle Plc., The Dow Chemical Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Archer Daniels Midland Company

- BASF SE

- Celanese Corporation

- E.i. Dupont De Nemours and Company

- Eastman Chemical Company

- Henan Jindan Lactic Acid Technology and Co.

- Tate and Lyle Plc.

- The Dow Chemical Company