Global Oat-Based Snacks Market Size, Share Analysis Report By Product Type (Snack Bars, Puffs, Cookies, Crackers and Toasties, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience stores, Specialist stores, Online stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 151915

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

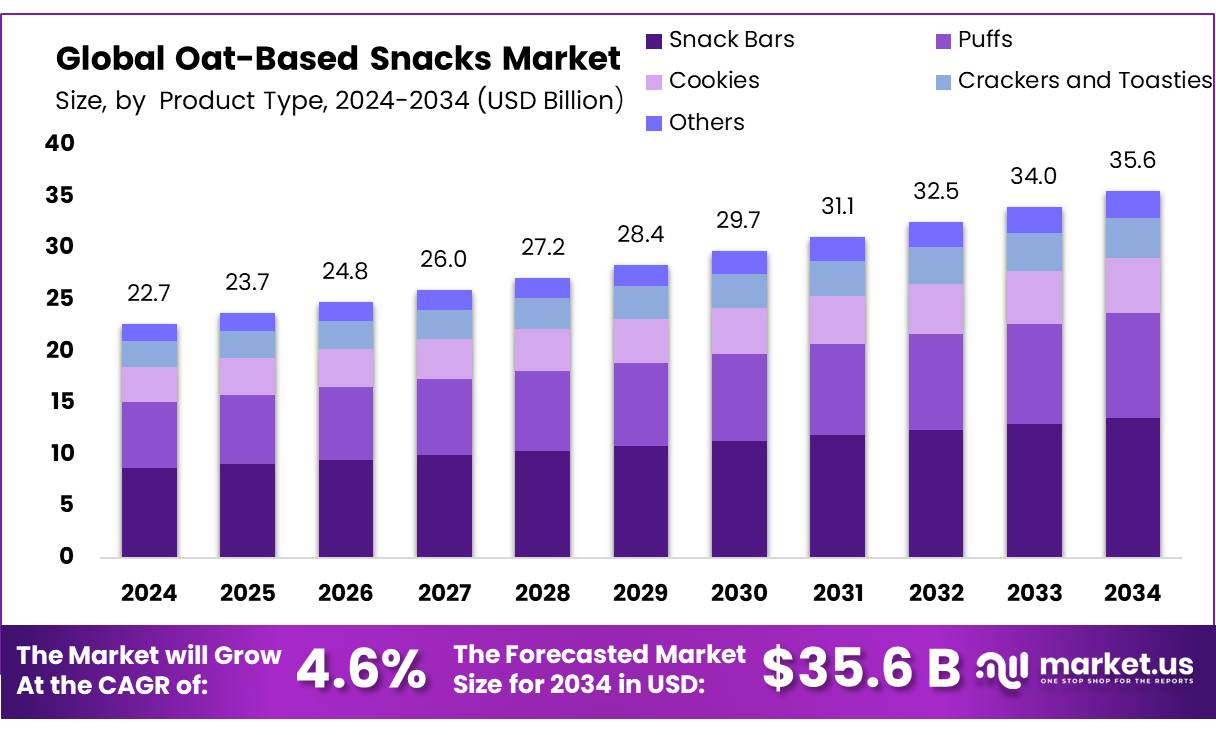

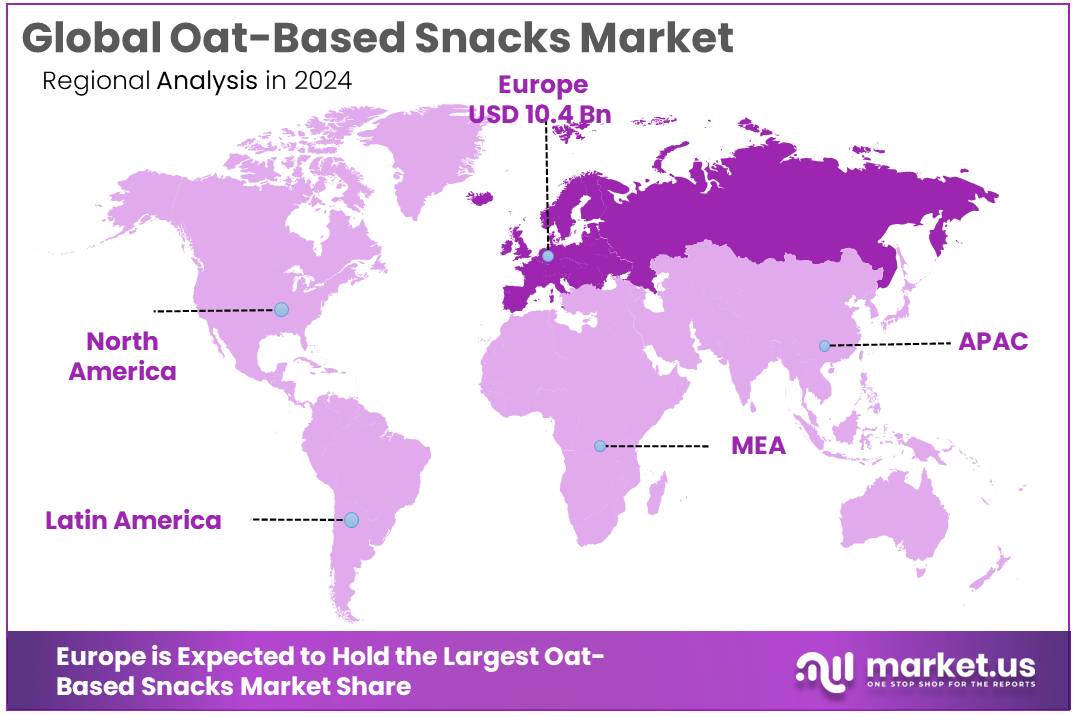

The Global Oat-Based Snacks Market size is expected to be worth around USD 35.6 Billion by 2034, from USD 22.7 Billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 45.9% share, holding USD 10.4 billion revenue.

The oat-based snacks concentrates industry has witnessed significant growth due to the rising consumer preference for healthy, plant-based, and nutrient-dense food options. Oats are recognized for their rich nutritional profile, offering an excellent source of fiber, vitamins, and minerals, which have led to their integration into a wide variety of snack products. The demand for oat-based snacks is being driven by increasing awareness regarding health, wellness, and clean-label products.

As consumers seek out functional foods that align with their dietary preferences, the oat-based snack sector has emerged as a prominent segment in the overall snack market. According to the U.S. Department of Agriculture (USDA), oats are a leading source of dietary fiber, with a serving size of 100 grams providing approximately 10.6 grams of fiber, which supports digestive health and weight management.

Several factors are driving the oat-based snack market, including the increasing demand for gluten-free, high-protein, and low-sugar alternatives. The growing prevalence of food allergies, particularly gluten intolerance, has propelled the oat-based snack industry.

For instance, the Celiac Disease Foundation reports that over 3 million Americans suffer from celiac disease, creating a large market for gluten-free products like oat-based snacks. Additionally, oat-based snacks are considered a healthy alternative to traditional snack products, as they are rich in soluble fiber, which can help lower cholesterol levels, as per the American Heart Association.

Key Takeaways

- Oat-Based Snacks Market size is expected to be worth around USD 35.6 Billion by 2034, from USD 22.7 Billion in 2024, growing at a CAGR of 4.6%.

- Snack Bars held a dominant market position, capturing more than a 38.2% share of the global oat-based snacks market.

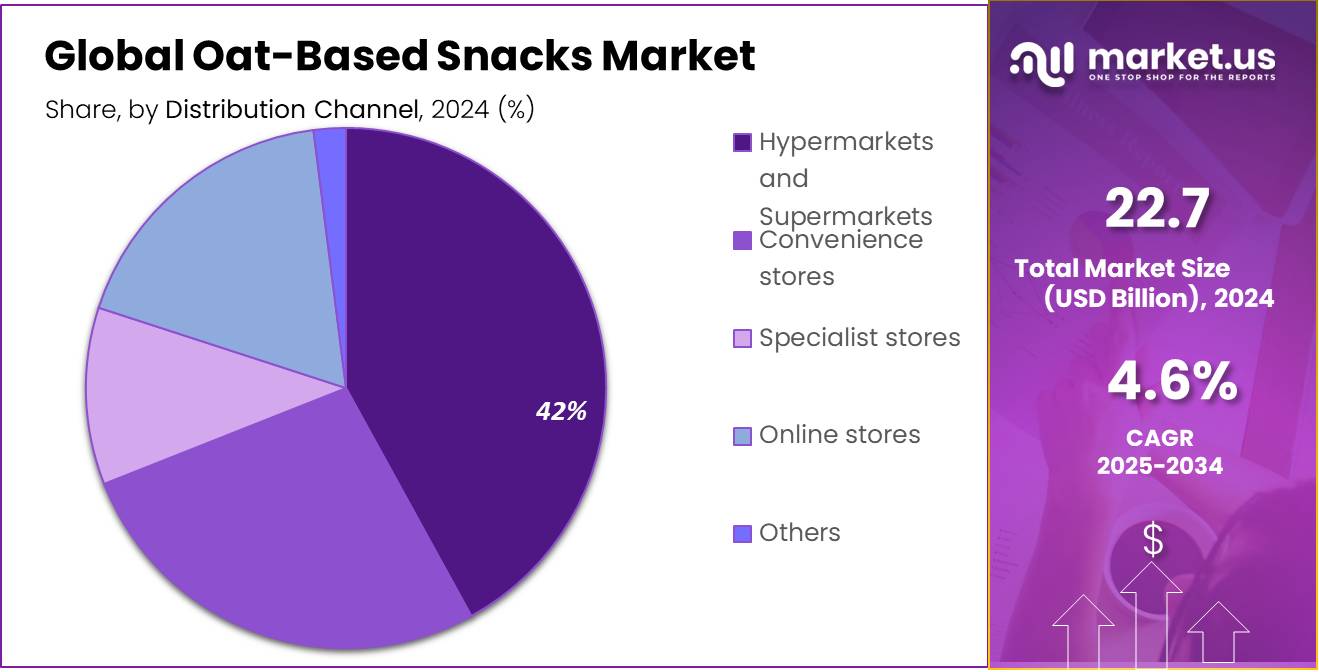

- Hypermarkets and Supermarkets held a dominant market position, capturing more than a 42.9% share of the global oat-based snacks market.

- Europe emerged as the dominant regional market for oat-based snacks, capturing 45.9% of global revenues—equating to around USD 10.4 billion.

By Product Type Analysis

Snack Bars lead the Oat-Based Snacks market with 38.2% share in 2024 due to strong health appeal and convenience.

In 2024, Snack Bars held a dominant market position, capturing more than a 38.2% share of the global oat-based snacks market. This strong performance is largely driven by growing consumer demand for quick, healthy, and nutrient-rich food options. Snack bars, often made using oat concentrates, are favored for their portability, long shelf life, and ability to include additional ingredients like dried fruits, nuts, seeds, and even protein blends—making them an ideal choice for health-conscious and on-the-go consumers.

The increasing popularity of fitness lifestyles, meal replacements, and clean-label snacking has further strengthened the snack bar category. Across urban markets in North America and Europe, oat-based snack bars have become a staple in retail shelves, while Asia-Pacific is witnessing steady adoption due to changing dietary patterns and rising disposable incomes.

By Distribution Channel Analysis

Hypermarkets and Supermarkets dominate with 42.9% in 2024, driven by easy access and diverse product availability.

In 2024, Hypermarkets and Supermarkets held a dominant market position, capturing more than a 42.9% share of the global oat-based snacks market. Their leadership in distribution is mainly due to their wide presence, large shelf space, and ability to offer consumers a broad range of oat-based snack products under one roof. These retail formats provide direct access to both premium and budget-friendly oat snacks, catering to diverse consumer groups.

Shoppers prefer hypermarkets and supermarkets because they can physically inspect new product launches, take advantage of promotional offers, and compare different brands in real time. Additionally, these stores often partner with food manufacturers to introduce private-label oat-based snack ranges, further expanding the category’s visibility.

Key Market Segments

By Product Type

- Snack Bars

- Puffs

- Cookies

- Crackers and Toasties

- Others

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience stores

- Specialist stores

- Online stores

- Others

Emerging Trends

Protein-Packed Oat Snacks Surge Ahead

Consumers are actively seeking snacks that balance convenience with functionality. According to Better Homes & Gardens, 56% of U.S. consumers now recognize protein as a vital health component—a powerful motivator behind the rise of protein-focused foods . As a result, oat snacks fortified with protein—such as high-protein bars and crisps—are gaining traction in mainstream markets.

Government support and regulation reinforce this trend. In Europe, the EFSA and FDA allow health claims for oat beta-glucan and protein, provided specific dosage levels are met. This ensures that snack brands can legally promote items as “supporting muscle health” or being “protein-rich”, giving consumers clarity and confidence.

Meanwhile, national dietary campaigns are increasingly spotlighting protein in public health guidelines. For example, Finland’s National Food Strategy emphasizes combining traditional grains with plant proteins to promote balanced everyday diets—paving the way for oats to be featured more actively in functional snacking initiatives.

Drivers

Heart-Health Benefits from Beta-Glucan (Oat Fiber)

One major driving force behind the oat-based snacks market is the scientifically backed heart-health benefit of beta-glucan, a soluble fiber found in oats. In 2024 and 2025, this functional attribute has become especially significant, as both consumers and health-conscious manufacturers seek foods that offer real physiological advantages.

Studies have consistently shown that consuming 3 grams of oat beta-glucan per day—equivalent to about one cup (70g) of cooked oats—can reduce LDL (“bad”) cholesterol by up to 10%, according to the U.S. Food and Drug Administration (FDA). Meta-analyses reinforce these figures, reporting a 5–10% reduction in LDL levels across populations consuming this amount of beta-glucan daily. Such improvements in cholesterol regulation directly target one of the leading risk factors for cardiovascular disease, making oat-based snacks with added beta-glucan especially appealing to health-minded buyers.

This health claim is recognized not only in the United States, but also in Europe. The European Food Safety Authority (EFSA) has authorized claims that 3 g/day of oat beta-glucan contributes to maintaining normal blood cholesterol. Moreover, Health Canada endorses similar statements, highlighting oat beta-glucan’s role in reducing blood cholesterol among a significant portion of the population with elevated lipid profiles.

Restraints

Rising Raw Material Costs Due to Production and Supply Pressure

One significant restraining factor for the oat-based snacks market in 2024 and early 2025 has been the rising cost of raw oat materials, largely driven by supply constraints and escalating farm-level prices. This trend has exerted pressure on manufacturers’ margins and limited the affordability of end products.

According to the U.S. Bureau of Labor Statistics, the Producer Price Index (PPI) for oats—tracking farm-gate costs—stood at 232.8 in May 2025, down slightly from 239.5 in April but remaining significantly elevated compared to earlier in the year. This persistently high PPI reflects constrained supplies and higher production expenses that are passed through to snack manufacturers. At the same time, global oat supplies remain tight. Canadian oat ending stocks were reported at just 376,000 tonnes in the 2024–25 season—near record lows—prompting concerns over availability and resulting in upward pressure on prices.

High raw material costs translate directly into increased production expense for oat-based snack manufacturers. These increased costs often force companies to either absorb tighter margins or raise retail prices. Such price increases risk turning away cost-conscious consumers, especially where competition from cheaper, conventional snacks is intense. According to the USDA Economic Research Service, food prices overall rose around 2.9% year-over-year as of May 2025, with food-at-home prices increasing 2.2% during the same period. Even moderate price hikes can deter consumers caring deeply about grocery budgets.

Opportunity

Surge in Beta-Glucan Demand Opens Growth Opportunity

One promising growth opportunity for the oat-based snacks market in 2024–2025 lies in the expanding demand for beta-glucan, a functional ingredient extracted from oats, which is increasingly recognized for its health benefits and supported by both industry trends and government-backed validations.

Government bodies have also provided strong support for beta-glucan’s health claims. The European Food Safety Authority and the U.S. Food and Drug Administration both allow health claims that 3 g of oat beta-glucan daily helps maintain normal blood cholesterol levels. This formal recognition enables manufacturers to include transparent, science-backed messages on packaging, which resonates with informed, health-conscious shoppers.

In line with public health initiatives aimed at reducing chronic disease risk, Denmark’s national whole-grain program highlights the broader context: whole-grain (including oat) consumption increased from 36g/day in 2008 to 82g/day by 2019, demonstrating that coordinated public-private partnerships and clear labeling can shift dietary habits. This model offers a blueprint for other governments to integrate oats into mainstream healthy eating campaigns—creating further market expansion for oat-based snack producers.

Regional Analysis

Europe dominates with 45.9% share, representing approximately USD 10.4 billion in 2024.

In 2024, Europe emerged as the dominant regional market for oat-based snacks, capturing 45.9% of global revenues—equating to around USD 10.4 billion. This strong position reflects the region’s well-established health-snacking culture and advanced retail infrastructure. Consumers in countries such as the UK, Germany, and France continue to favor oat-derived snacks, buoyed by growing interest in whole-grain nutrition, functional ingredients, and clean label products.

Analyses from regulatory bodies reinforce this trend—EFSA (European Food Safety Authority) has allowed health claims concerning oat beta-glucan’s cholesterol-lowering effects, underpinning product credibility and supporting marketing strategies in Europe’s most mature markets. In the UK, major supermarkets—with combined grocery market shares exceeding 60%—have expanded shelf space for oat-based snack bars and puffs, driven by consumer demand for nutritious on-the-go options.

The region’s dominance also stems from strong supply-side frameworks. EU agricultural policies have prioritized whole grain promotion and sustainable oats cultivation, improving raw-material quality and consistency. This institutional support has facilitated local manufacturers in scaling production and reducing unit costs—translating into consumer‑friendly pricing.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Abbott’s presence in the oat-based snacks market is led by its Glucerna range, including oatmeal-raisin and chocolate-caramel nut bars. Each mini bar delivers about 80 calories plus 10–11 g of protein, designed specifically for blood sugar and diabetes management. These grab-and-go snacks appeal to health-focused consumers, offering fortified nutrition with slow-release carbohydrates. The use of clinically studied formulas gives Abbott a competitive edge in the medical nutrition segment, effectively blending oat benefits with convenience needs.

Bobo’s began as a small, mother-daughter baking project in 2003 in Boulder, CO. The brand emphasizes 100% whole grain oats, producing gluten-free, vegan, non-GMO bars made with simple, clean ingredients. Their commitment to small-batch production and nostalgic flavors—like peanut butter And jelly—has attracted a loyal following. Bobo’s continuous exploration of new formats and flavors while maintaining its oat-focused roots supports a unique brand identity in the healthy snack sector.

General Mills is a major player due to its extensive U.S. pantry presence and strong brand reach. The company highlights oat-based snack innovations via its Nature Valley and Fiber One bar lines, offering fiber-rich, whole-grain options. With Nature Valley being recognized as the #1 snack bar in the world, General Mills continues to innovate, such as introducing oat-infused granolas and cereal products high in protein and whole grain. Its retailer partnerships ensure deep shelf penetration.

Top Key Players in the Market

- Abbott

- Bobo’s Oat Bars

- Britannia Industries

- General Mills Inc.

- Kellogg NA Co.

- Mondelēz International

- Nairn’s Oatcakes Limited

- Pamela’s Products

- PepsiCo, Inc.

- Seamild food Group

- Simply Delicious, Inc.

- The Quaker Oats Company

Recent Developments

In 2024, Abbott’s global nutrition segment—which includes Glucerna and Ensure—reported USD 8.41 billion in revenue, with adult nutrition accounting for USD 4.39 billion.

In 2024 General Mills, the company reported a total net sales decline of USD 19.9 billion, with the snacks and cereals segment down around 7% organically, although net sales in North America retail stood strong at USD 12.5 billion.

Report Scope

Report Features Description Market Value (2024) USD 22.7 Bn Forecast Revenue (2034) USD 35.6 Bn CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Snack Bars, Puffs, Cookies, Crackers and Toasties, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience stores, Specialist stores, Online stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Abbott, Bobo’s Oat Bars, Britannia Industries, General Mills Inc., Kellogg NA Co., Mondelēz International, Nairn’s Oatcakes Limited, Pamela’s Products, PepsiCo, Inc., Seamild food Group, Simply Delicious, Inc., The Quaker Oats Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Abbott

- Bobo's Oat Bars

- Britannia Industries

- General Mills Inc.

- Kellogg NA Co.

- Mondelēz International

- Nairn's Oatcakes Limited

- Pamela's Products

- PepsiCo, Inc.

- Seamild food Group

- Simply Delicious, Inc.

- The Quaker Oats Company