Global Natural Food Flavors Market Size, Share, And Enhanced Productivity By Source (Plant Based, Animal Based), By Flavor Type (Fruit and Flavor, Vegetable Flavor, Herb and Spice Flavor, Diary Flavor, Others), By Application (Beverages, Dairy, Nutrition and Health, Savory, Bakery and Confectionery, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 172233

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

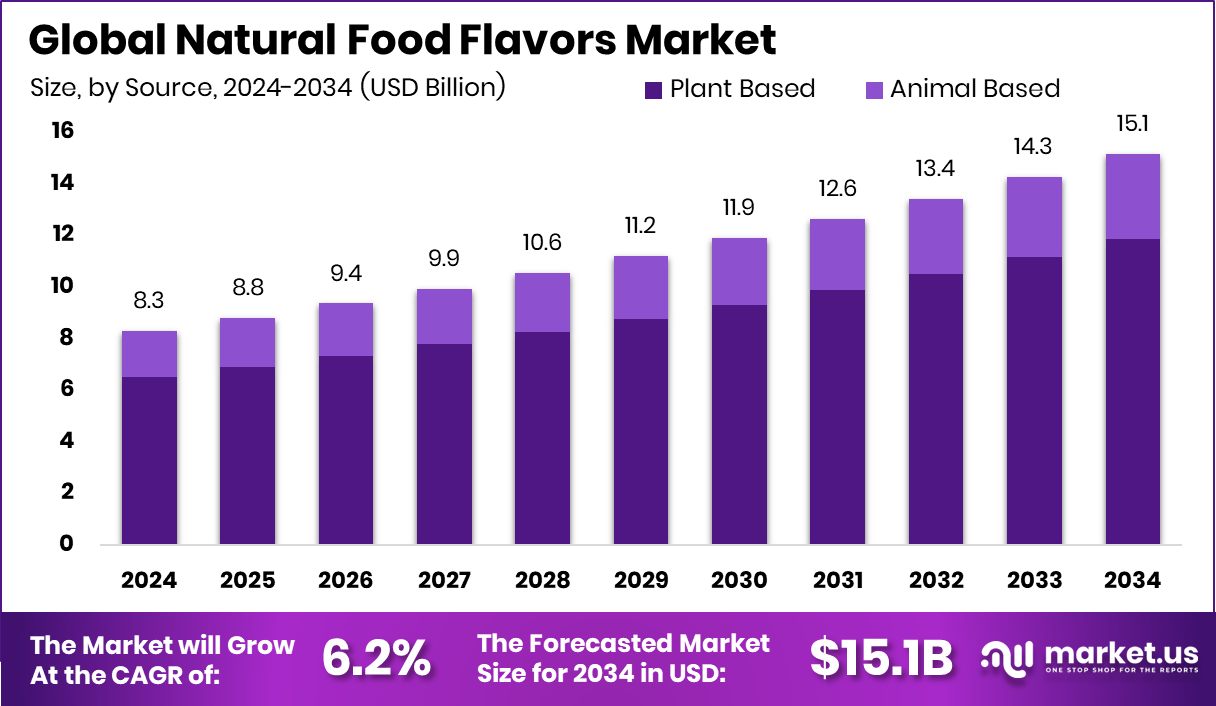

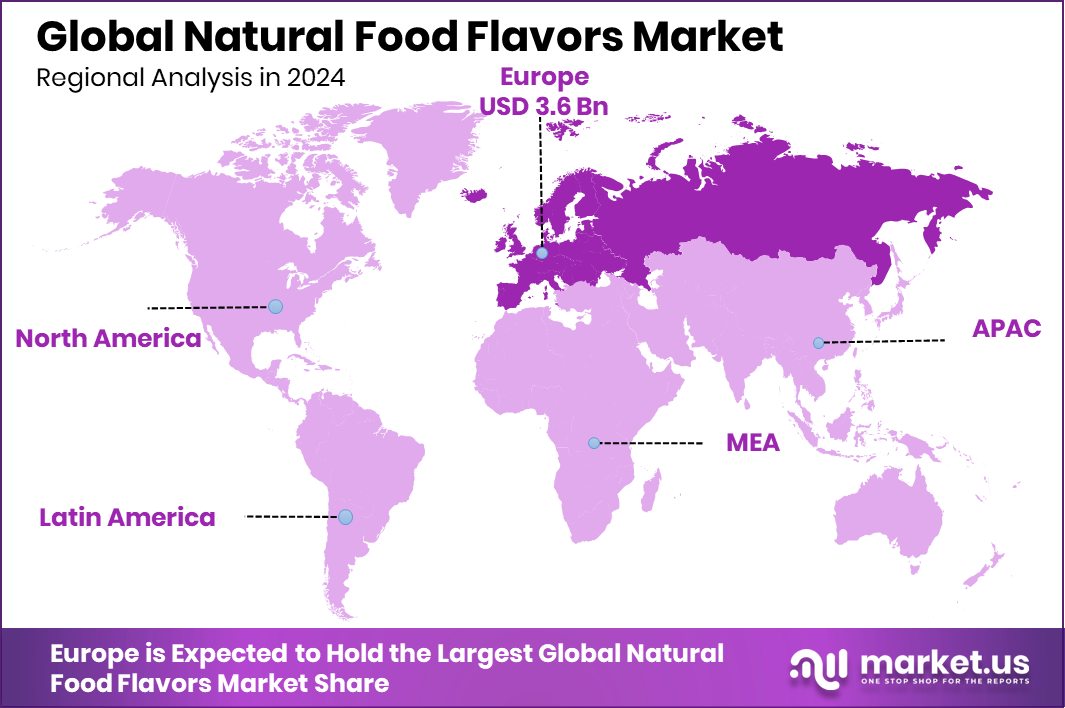

The Global Natural Food Flavors Market is expected to be worth around USD 15.1 billion by 2034, up from USD 8.3 billion in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034. Europe accounted for 43.90% of the Natural Food Flavors Market, totaling USD 3.6 Bn.

Natural food flavors are ingredients derived from plant, animal, or microbial sources that are used to enhance taste and aroma in food and beverages. These flavors are obtained through physical, enzymatic, or traditional processing methods rather than chemical synthesis. They are widely used to replace artificial flavors, helping food products meet clean-label expectations and align with consumer preferences for recognizable and natural ingredients.

The natural food flavors market refers to the global ecosystem involved in the production, formulation, and application of these naturally sourced flavoring agents across food categories such as beverages, confectionery, bakery, dairy, and snacks. The market is shaped by regulatory definitions of “natural,” evolving consumer awareness, and increasing use of minimally processed ingredients in packaged foods.

Market growth is largely driven by rising health awareness and clean-label consumption. Consumers are actively avoiding artificial additives, which is pushing food brands to reformulate products. Funding activities such as Fireside Ventures leading INR 20 Cr investment in Oroos Confectionery and Go Desi raising $5 million highlight how natural taste positioning is attracting capital.

Demand for natural food flavors is also supported by innovation in premium confectionery and snacks. Doughlicious securing $5 million funding and Canada’s Awake Chocolate reaching $8 million funding reflect the growing demand for naturally flavored indulgent products.

Opportunities are expanding as startups and food brands use funding to scale natural formulations, improve sourcing, and launch region-specific flavor profiles. These investments indicate long-term confidence in natural flavor adoption across global food systems.

Key Takeaways

- The Global Natural Food Flavors Market is expected to be worth around USD 15.1 billion by 2034, up from USD 8.3 billion in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034.

- In 2024, plant-based flavors dominated the market with 78.2% share.

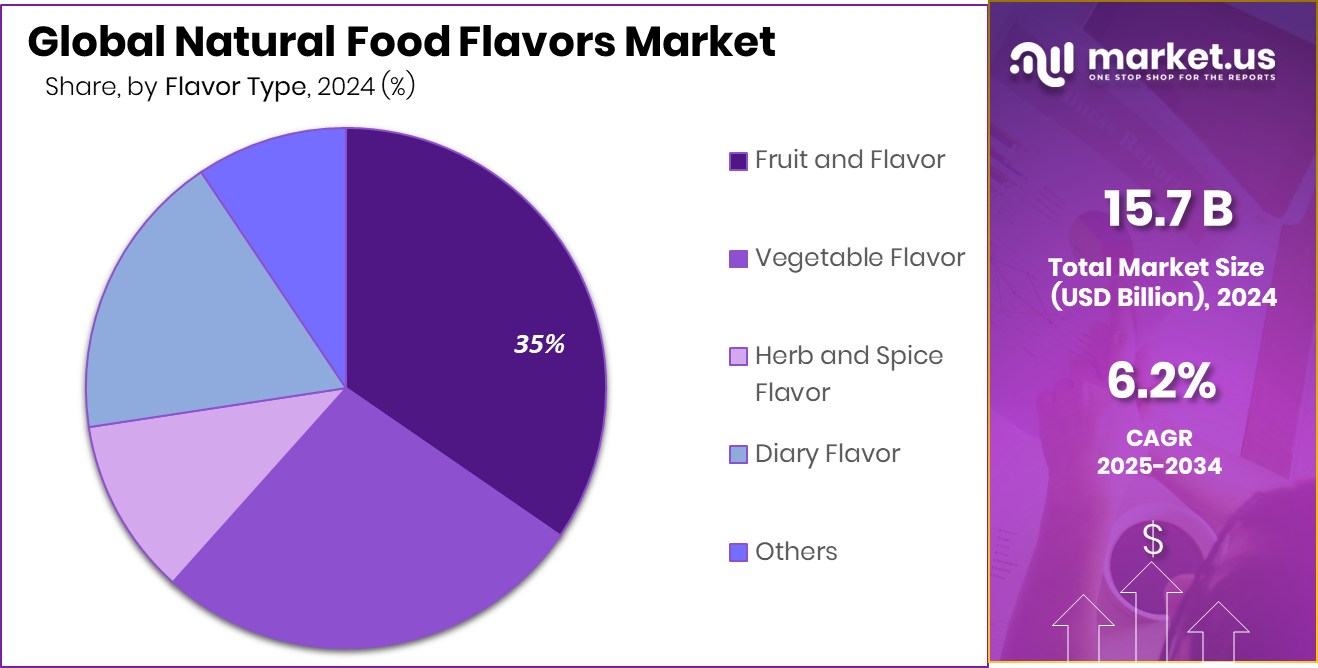

- Fruit and other natural flavors captured 34.6% in flavor type segment.

- Beverages remained the leading application, accounting for 35.% of consumption.

- Natural Food Flavors Market in Europe reached 43.90%, representing USD 3.6 Bn value.

By Source Analysis

Plant-based flavors dominate the market, accounting for 78.2%, reflecting growing consumer preference.

In 2024, the Natural Food Flavors market registered a significant trend toward plant-based sources, which accounted for 78.2% of the overall market share. This dominant adoption can be attributed to increasing consumer demand for clean-label products and heightened awareness of health and sustainability issues. Manufacturers across regions have intensified the use of plant-derived ingredients such as herbs, spices, fruits, and botanicals to align with evolving dietary preferences.

The shift toward plant-based natural flavors has been supported by advancements in extraction technologies that preserve sensory quality while ensuring regulatory compliance. This segment’s robust prevalence reflects a broader industry movement prioritizing ingredient transparency and environmental stewardship.

As end-users, including food and beverage producers, continue to reformulate products with plant-based flavor solutions, the market is positioned for further integration of botanical innovations and sustainable sourcing practices, reinforcing the strategic importance of plant-derived natural flavors in industry portfolios.

By Flavor Type Analysis

Fruit and natural flavors lead with 34.6%, driving product innovation in the industry.

In 2024, fruit and flavor types emerged as a key determinant in the Natural Food Flavors market, contributing 34.6% of total demand within the segment. This substantial share was driven by consumer preference for vibrant and familiar taste profiles, particularly those associated with citrus, berry, and tropical fruits. Product developers leveraged fruit-based natural flavors to enhance the appeal of a wide spectrum of offerings, from confectionery and dairy alternatives to snacks and nutritional bars.

The high adoption of fruit flavors also reflects broader trends in flavor innovation, where authenticity and clean sensory experiences are prioritized. Enhanced extraction and formulation techniques have enabled the retention of characteristic taste and aroma compounds, further strengthening consumer acceptance.

As flavor houses and food manufacturers intensify their focus on fruit-derived natural flavors, the segment’s contribution is expected to remain a central element of product differentiation strategies, responding to ongoing shifts in consumer taste preferences and lifestyle choices.

By Application Analysis

Beverages hold 35.7% share, showing strong demand for flavored drinks in global markets.

In 2024, beverages continued to lead application demand within the Natural Food Flavors market, capturing 35.7% of the total applications share. The beverage sector’s prominent role is driven by reformulation strategies aimed at reducing artificial additives and enhancing taste profiles in products such as soft drinks, functional waters, juices, and ready-to-drink teas.

The integration of natural flavors has been particularly pronounced in functional and health-oriented beverages, where consumer expectations for transparent ingredients intersect with flavorful experiences. Flavor developers have been working closely with beverage producers to tailor solutions that maintain stability and consistency while meeting clean-label requirements.

As beverage innovation accelerates in response to lifestyle and wellness trends, the reliance on natural flavor solutions is set to expand further. This sustained application dominance highlights the beverage segment’s strategic influence on overall market dynamics, reinforcing its central role in driving both product development and consumer engagement across global markets.

Key Market Segments

By Source

- Plant Based

- Animal Based

By Flavor Type

- Fruit and Flavor

- Vegetable Flavor

- Herb and Spice Flavor

- Diary Flavor

- Others

By Application

- Beverages

- Dairy

- Nutrition and Health

- Savory

- Bakery and Confectionery

- Others

Driving Factors

Rising Demand for Clean Label Natural Taste

The Natural Food Flavors Market is strongly driven by the growing demand for clean-label and animal-free food products. Consumers are increasingly checking ingredient lists and avoiding artificial flavors, additives, and animal-derived components. This shift is pushing food producers to adopt natural flavor solutions that support vegan, dairy-free, and sustainable product positioning. Innovation in alternative proteins and flavor-compatible ingredients is reinforcing this trend.

For example, Those Vegan Cowboys secured $7.3M in funding to launch animal-free casein by 2026, highlighting how natural flavor systems are essential for replicating traditional taste without animal inputs. In a related development, the same cow-free dairy startup also closed a €6.25 million funding round as it prepares for a crowdfunding campaign, showing strong investor confidence. These funding activities reflect how clean-label demand is reshaping flavor development priorities and accelerating the adoption of natural food flavors across next-generation food products.

Restraining Factors

High Capital Intensity And Regulatory Cost Pressures

The Natural Food Flavors Market faces restraint from high capital requirements and cost pressures linked to scaling, compliance, and modernization. Producing consistent natural flavors requires advanced processing systems, quality controls, and regulatory alignment, which increases operational costs. These financial demands can slow innovation and limit participation from smaller producers. The situation is visible in broader food and dairy segments that influence natural flavor usage.

For instance, Milky Mist Dairy Food filed for a ₹2,035 crore IPO with Sebi to support debt repayment, expansion, and modernization, highlighting how large capital deployment is required to remain competitive. Similarly, Ace International raised ₹305 cr to build a dairy nutrition hub in Andhra Pradesh, reflecting infrastructure-heavy investments needed across food value chains. Such funding activity indicates that cost and scale barriers remain a key restraint, particularly for companies aiming to adopt natural flavor systems at commercial volumes.

Growth Opportunity

Innovation In Dairy Alternatives And Natural Flavors

The Natural Food Flavors Market presents a strong growth opportunity through innovation in dairy alternatives and naturally derived taste systems. As consumers shift toward plant-based and alternative dairy products, there is a growing need for natural flavors that can deliver familiar taste and mouthfeel.

Product developers are focusing on clean and stable flavor solutions that support butter, cream, and milk-like profiles without traditional dairy inputs. This opportunity is reinforced by Time-Travelling Milkman securing $2.3M in funding to launch a dairy fat alternative, showing rising interest in next-generation dairy substitutes.

In addition, $750,000 in funding allocated to dairy farms to boost long-term success supports improvements in raw material quality and sustainable practices. Together, these funding developments highlight expanding opportunities for natural food flavors to support innovation across both alternative and traditional dairy value chains.

Latest Trends

Restaurant Sector Driving Natural Flavor Innovation

A key latest trend in the Natural Food Flavors Market is the growing influence of the restaurant and foodservice sector on flavor innovation. Independent and premium restaurants are focusing on fresh, clean, and naturally sourced flavors to differentiate menus and meet changing consumer expectations. This trend is supported by targeted investments in restaurant growth and concept development. Savory Fund launched a $1M contest to support independent restaurants, encouraging creativity and the use of high-quality natural ingredients, including flavors.

In another move, Savory Fund acquired a majority stake in The Sicilian Butcher with up to $30 million in investment, strengthening the expansion of chef-driven concepts that rely on authentic taste profiles. Additionally, Mercato Partners raised another $100M for restaurant investments, signaling continued capital flow into food businesses where natural flavors play a central role in menu quality and brand positioning.

Regional Analysis

Europe leads the Natural Food Flavors Market with 43.90% share, at USD 3.6 Bn.

The Natural Food Flavors Market shows clear regional differentiation across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, driven by consumer awareness, regulatory frameworks, and food processing maturity. Europe stands as the dominating region, accounting for 43.90% of the market with a total value of USD 3.6 Bn, supported by strong clean-label regulations, high demand for natural ingredients, and well-established food and beverage manufacturers.

North America represents a mature and quality-driven market, where demand is shaped by health-conscious consumers and a strong preference for plant-based and minimally processed food products. Asia Pacific reflects expanding consumption of packaged foods and beverages, supported by urbanization, rising disposable incomes, and changing dietary habits across major economies.

The Middle East & Africa market is progressing steadily, supported by growing food imports, expanding food processing activities, and the gradual adoption of natural ingredients. Latin America shows consistent demand growth, driven by traditional food formulations, increasing use of natural flavors in beverages, and improving retail food distribution networks. Overall, Europe remains the market anchor in value and share, while other regions contribute through volume expansion and evolving consumer preferences.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Givaudan continues to focus on natural, plant-derived flavor solutions that align with clean-label and sustainability expectations from food and beverage manufacturers. Its emphasis on sensory science and ingredient traceability positions the company as a preferred partner for premium and reformulated food products.

DSM-Firmenich benefits from its combined expertise in nutrition, taste, and wellness, enabling an integrated approach to natural food flavors. The company’s focus on health-oriented flavor systems supports applications where taste enhancement must align with reduced sugar, salt, or artificial additives. This balanced positioning strengthens its role in functional foods and beverages that require both flavor performance and nutritional credibility.

Symrise maintains a strong presence through its botanical expertise and natural ingredient sourcing capabilities. The company’s approach emphasizes authentic taste profiles and stable natural formulations suited for large-scale food applications. Across these players, innovation is centered on natural extraction methods, formulation stability, and regulatory alignment, reinforcing their leadership in shaping market standards and customer expectations globally.

Top Key Players in the Market

- Givaudan

- DSM-firmenich

- Symrise

- International Flavors & Fragrances (IFF)

- Kerry Group

- Archer Daniels Midland (ADM)

- BASF

- Sensient Technologies

- Takasago International Corporation

- Huabao International Holdings Limited

Recent Developments

- In June 2025, Givaudan announced its intention to acquire a majority stake in Vollmens Fragrances, a Brazilian fragrance house serving Latin America and beyond. By September 2025, this acquisition was completed, strengthening Givaudan’s regional presence and customer reach in high-growth markets.

- In March 2025, Huabao leaders participated in the China International Food Additives and Ingredients Exhibition (FIC 2025), highlighting the company’s focus on innovative technologies and healthier product formats. The event showcased flavour and functional product developments aligned with consumer demand for healthier, natural food solutions. This activity underlined Huabao’s ongoing commitment to research and innovation in natural and functional flavour segments.

Report Scope

Report Features Description Market Value (2024) USD 8.3 Billion Forecast Revenue (2034) USD 15.1 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Plant Based, Animal Based), By Flavor Type (Fruit and Flavor, Vegetable Flavor, Herb and Spice Flavor, Diary Flavor, Others), By Application (Beverages, Dairy, Nutrition and Health, Savory, Bakery and Confectionery, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Givaudan, DSM-firmenich, Symrise, International Flavors & Fragrances (IFF), Kerry Group, Archer Daniels Midland (ADM), BASF, Sensient Technologies, Takasago International Corporation, Huabao International Holdings Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Natural Food Flavors MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Natural Food Flavors MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Givaudan

- DSM-firmenich

- Symrise

- International Flavors & Fragrances (IFF)

- Kerry Group

- Archer Daniels Midland (ADM)

- BASF

- Sensient Technologies

- Takasago International Corporation

- Huabao International Holdings Limited