Global Medicated Confectionery Market Size, Share, And Business Benefits By Confectionery Type (Chocolate, Snack Bars, Candy and Sugar Confectionery, Gum and Mint), By Application (Nutritional Supplements, Cough Drops, Pain Relief, Digestive Health, Cold Relief, Others), By End User (Children, Adults, Elderly), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Pharmaceuticals, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151881

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

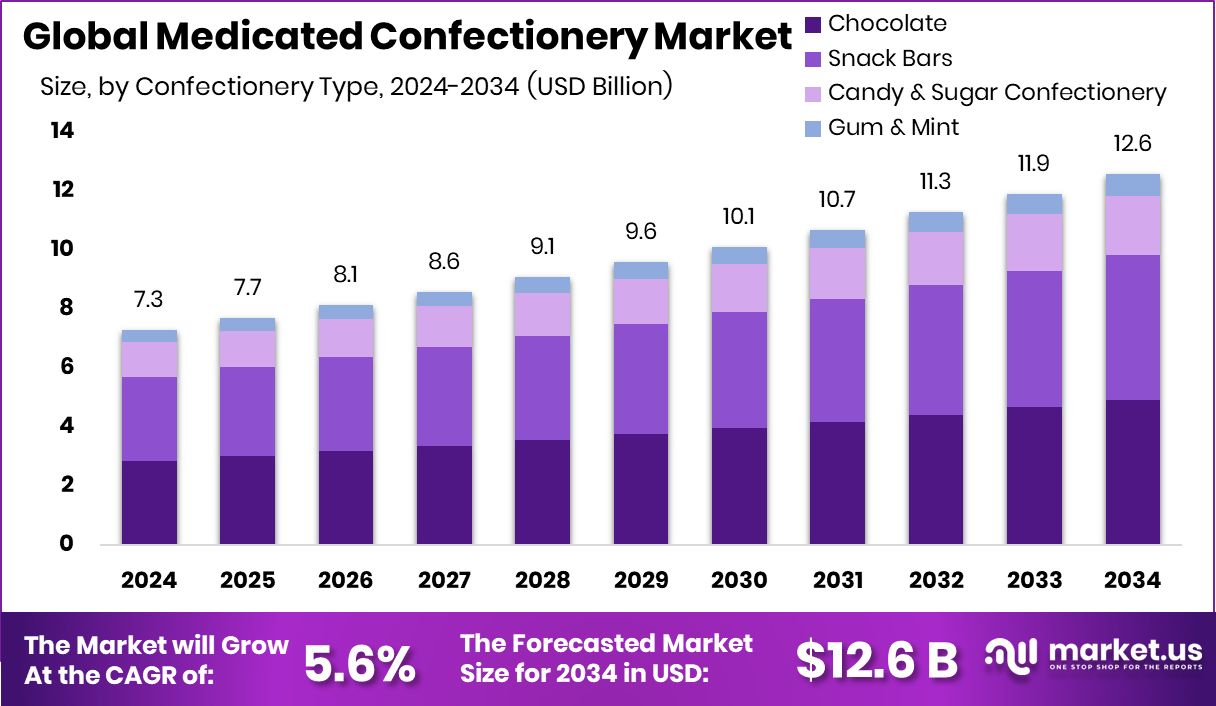

Global Medicated Confectionery Market is expected to be worth around USD 12.6 billion by 2034, up from USD 7.3 billion in 2024, and grow at a CAGR of 5.6% from 2025 to 2034. High consumer awareness in North America supports its strong 44.9% market dominance.

Medicated confectionery refers to edible products such as lozenges, gums, pastilles, and chewy candies that are infused with active medicinal ingredients. These products are designed not only for taste and convenience but also to deliver therapeutic benefits, commonly targeting sore throats, cough relief, nasal congestion, or oral health. Unlike traditional candy, these formulations are regulated as over-the-counter (OTC) medications or nutraceuticals in many regions.

The medicated confectionery market involves the production, distribution, and sale of these therapeutic edibles across pharmacies, supermarkets, and online platforms. It operates at the intersection of the food and pharmaceutical sectors, addressing both health and wellness needs. The market is shaped by regulatory standards, consumer health awareness, and changing preferences toward non-invasive treatment formats.

The market is primarily driven by rising health consciousness and the growing preference for easy-to-use medicinal formats. Urban lifestyles, coupled with increasing cases of common colds, throat irritation, and mild respiratory issues, have created a consistent demand for medicated confectionery. In particular, sugar-free and herbal variants have seen growing interest. According to an industry report, Munich-based Planet A Foods has raised €14.2 million to expand its reach with sustainable, cocoa-free chocolate.

Consumers are increasingly leaning toward functional products that combine taste with health benefits. As people adopt proactive health routines, the demand for over-the-counter remedies that are portable, easy to consume, and offer quick relief continues to climb. Seasonal flu waves and shifting climate conditions further fuel year-round consumption. According to an industry report, Tony’s Chocolonely has secured an additional €20 million in funding.

Key Takeaways

- Global Medicated Confectionery Market is expected to be worth around USD 12.6 billion by 2034, up from USD 7.3 billion in 2024, and grow at a CAGR of 5.6% from 2025 to 2034.

- In 2024, chocolate-based medicated confectionery accounted for 39.1% due to its wide consumer appeal.

- Nutritional supplements held a 34.7% share, driven by growing health awareness and preventive care focus.

- Adults dominated the end-user segment with 49.2%, reflecting higher consumption of OTC wellness-based confectionery products.

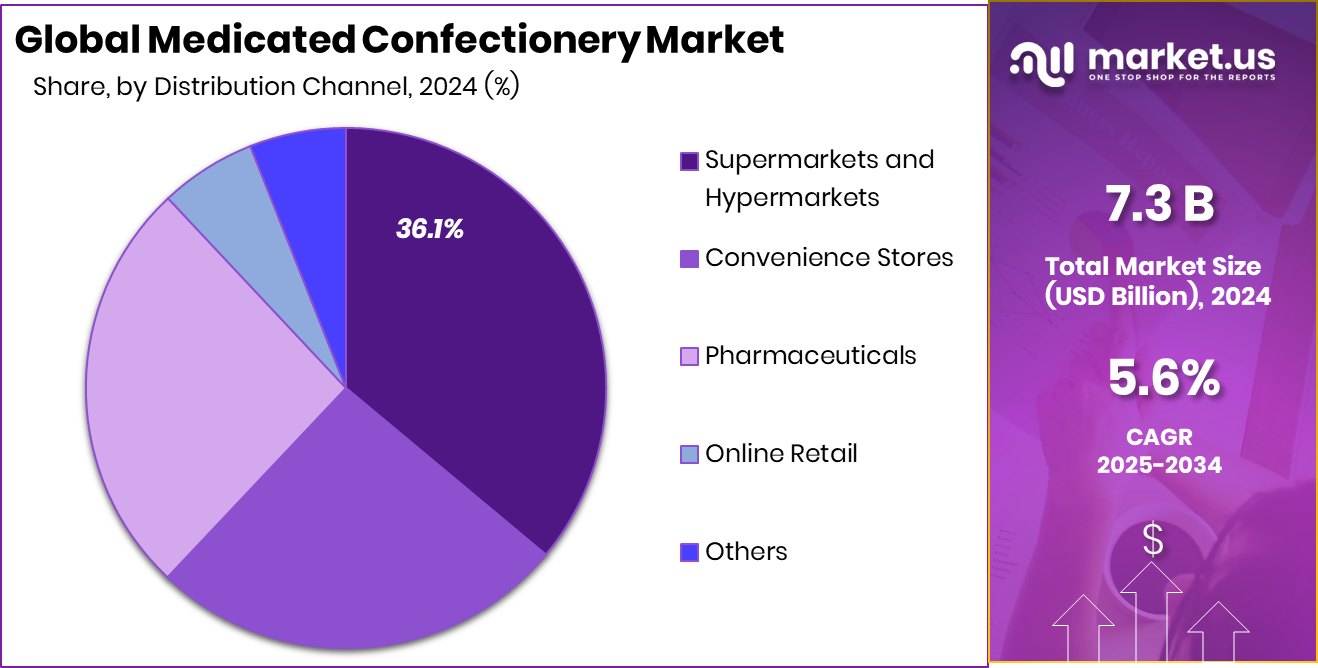

- Supermarkets and hypermarkets led distribution with 36.1%, offering convenient access to medicated confectionery across age groups.

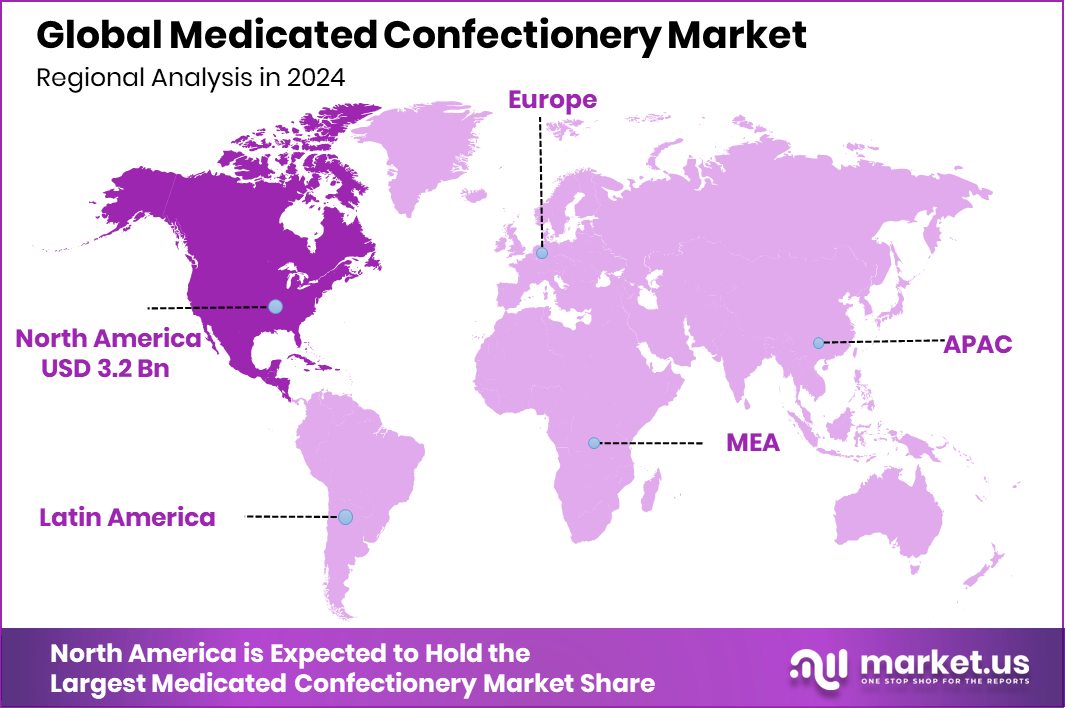

- The market value in North America reached approximately USD 3.2 billion in 2024.

By Confectionery Type Analysis

Chocolate holds a 39.1% share in the medicated confectionery market, leading preferences globally.

In 2024, Chocolate held a dominant market position in the By Confectionery Type segment of the Medicated Confectionery Market, with a 39.1% share. This leadership can be attributed to chocolate’s widespread consumer acceptance and its ability to effectively mask the taste of active medicinal ingredients.

The familiar flavor and indulgent profile of chocolate make it an appealing delivery format for therapeutic compounds, particularly among consumers who prefer convenient and palatable alternatives to traditional tablets or syrups. The blend of medicinal function with a comforting confectionery experience has contributed to sustained demand for chocolate-based medicated products across adult demographics.

Moreover, the inclusion of cocoa’s natural antioxidants and the growing popularity of functional chocolate have further supported its use in health-related applications. The segment has benefited from innovations in formulation that allow for the infusion of vitamins, herbal extracts, and other wellness ingredients without compromising taste or texture. As a result, chocolate continues to be a preferred choice for consumers seeking symptom relief in a familiar and enjoyable format.

By Application Analysis

Nutritional supplements drive 34.7% of demand in medicated confectionery product applications.

In 2024, Nutritional Supplements held a dominant market position in the By Application segment of the Medicated Confectionery Market, with a 34.7% share. This significant share reflects the growing consumer interest in maintaining everyday health and wellness through convenient and enjoyable formats.

Medicated confectionery products formulated as nutritional supplements are widely accepted for their dual function—providing essential nutrients while offering a pleasant consumption experience. These products often include vitamins, minerals, and botanical extracts aimed at supporting immunity, energy, and general well-being.

The popularity of nutritional supplements in this category is further reinforced by the increasing awareness of preventive healthcare among consumers. Instead of opting for conventional supplement forms like capsules or powders, many adults prefer medicated confectionery that fits easily into daily routines. The segment benefits from consistent demand across age groups, particularly among working individuals who seek easy-to-use health boosters.

Moreover, the absence of medical complexity in nutritional supplement-based confectionery positions it as an accessible option for health maintenance without the perception of illness. With its 34.7% market share, this application type is expected to remain central to the ongoing evolution of medicated confectionery, especially as consumer behavior continues to prioritize wellness through convenience and taste.

By End User Analysis

Adults account for 49.2% market share, showing strong usage of medicated confectionery.

In 2024, Adults held a dominant market position in the By End User segment of the Medicated Confectionery Market, with a 49.2% share. This leading position is primarily driven by the adult population’s increasing focus on personal health and preventive care. Adults are more likely to actively seek convenient formats for symptom relief and daily wellness, making medicated confectionery an attractive option due to its ease of use and palatability.

The 49.2% share also reflects the acceptance of these products among adults looking for on-the-go health solutions that fit into busy lifestyles. Products targeting issues such as throat irritation, vitamin deficiencies, or minor digestive discomforts have gained traction in this demographic, especially when offered in familiar and tasteful confectionery forms.

This segment’s strong presence in the market demonstrates a clear shift toward non-invasive, user-friendly wellness formats preferred by adult consumers. As health awareness and self-medication trends continue to grow, the adult end-user group is expected to maintain its influence and remain a major contributor to the overall performance of the medicated confectionery market.

By Distribution Channel Analysis

Supermarkets and hypermarkets dominate with a 36.1% share in product distribution channels.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the Medicated Confectionery Market, with a 36.1% share. This dominance is largely attributed to the wide accessibility, extensive shelf space, and high footfall these retail outlets offer. Consumers prefer purchasing medicated confectionery through supermarkets and hypermarkets due to the convenience of combining health-related purchases with routine grocery shopping, making these channels a primary point of sale.

The 36.1% share also reflects the advantage of in-store visibility and immediate product availability, which encourages impulse buying and brand discovery. Supermarkets and hypermarkets often stock a diverse range of medicated confectionery products, enabling consumers to compare options based on flavor, function, and price.

Moreover, promotional activities such as discounts, in-store displays, and bundled offers in these settings contribute to increased product movement and customer retention. With their strong retail infrastructure and broad consumer reach, supermarkets and hypermarkets continue to play a critical role in the market performance of medicated confectionery, maintaining a solid 36.1% share within the distribution channel segment.

Key Market Segments

By Confectionery Type

- Chocolate

- Snack Bars

- Candy and Sugar Confectionery

- Gum and Mint

By Application

- Nutritional Supplements

- Cough Drops

- Pain Relief

- Digestive Health

- Cold Relief

- Others

By End User

- Children

- Adults

- Elderly

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceuticals

- Online Retail

- Others

Driving Factors

Rising Demand for Convenient Health Solutions

One of the key factors driving the growth of the medicated confectionery market is the rising demand for convenient health solutions. Consumers today are looking for easier and more enjoyable ways to manage minor health concerns, such as sore throats, coughs, or vitamin deficiencies. Medicated confectionery products—like lozenges, gummies, or chews—offer a user-friendly option that fits well into busy lifestyles.

Unlike traditional pills or syrups, these products are pleasant to consume, portable, and often do not require water or preparation. This convenience has especially appealed to working adults and travelers. The shift toward self-care and over-the-counter remedies continues to support the popularity of these products, making convenience one of the most powerful drivers in this market.

Restraining Factors

Strict Regulations on Medicinal Ingredient Usage Limits

A major restraining factor in the medicated confectionery market is the strict regulation on the use of medicinal ingredients. These products often contain active compounds meant to offer health benefits, such as herbal extracts, vitamins, or mild therapeutic agents. However, health authorities in many countries closely monitor the amount and type of these ingredients to ensure consumer safety.

Manufacturers must comply with detailed rules on labeling, dosage limits, and product classification—whether it’s considered food, supplement, or medicine. These rules can differ from country to country, making global product distribution more complex. This regulatory pressure often slows down innovation and increases development costs, making it challenging for companies to bring new medicated confectionery products to the market quickly.

Growth Opportunity

Growing Popularity of Herbal and Natural Ingredients

A key growth opportunity in the medicated confectionery market is the increasing popularity of herbal and natural ingredients. Consumers are becoming more health-conscious and are actively choosing products that contain fewer synthetic chemicals. This shift has created strong demand for confectionery items made with natural components such as ginger, honey, menthol, turmeric, or elderberry.

These ingredients are often associated with traditional healing benefits and are seen as safer, especially for daily or long-term use. By developing products that feature these natural elements, companies can attract a wider audience, including people who prefer plant-based or holistic wellness options.

Latest Trends

Rise of Sugar‑Free and Immunity‑Boosting Gummies

A notable recent trend in the medicated confectionery market is the rise of sugar‑free and immunity‑boosting gummies. These products combine health benefits with reduced sugar content, meeting consumer demands for both wellness and better nutrition. By removing sugar, manufacturers make their products suitable for people with dietary restrictions, such as diabetics or those following low‑sugar diets.

Many of these gummies are fortified with vitamin C, zinc, or herbal extracts known to support the immune system. The dual advantage of appealing taste and functional health benefits has made them highly attractive to health‑aware adults. As consumers continue to seek effective and enjoyable self‑care options, this trend is expected to strengthen, further expanding the medicated confectionery market.

Regional Analysis

In 2024, North America led the medicated confectionery market with a 44.9% share.

In 2024, North America held a dominant position in the global medicated confectionery market, accounting for 44.9% of the total share, with a market value of USD 3.2 billion. This leadership is driven by high consumer awareness, strong retail infrastructure, and growing demand for convenient over-the-counter health products. The region’s mature healthcare systems and proactive approach to preventive wellness continue to support sustained consumption of medicated confectionery, particularly among adults.

Europe remains a well-established market, benefiting from regulatory clarity and consumer trust in functional confectionery products, while Asia Pacific is emerging as a promising region due to increasing urbanization and changing health habits.

The Middle East & Africa and Latin America represent smaller but gradually expanding markets, where improving healthcare access and retail modernization are encouraging uptake. Although these regions are at earlier stages of market development compared to North America, they present growth potential in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ricola Group has maintained its reputation as a leader in herbal-based lozenges, leveraging its long-standing Swiss heritage. The company’s focus on natural ingredients and traditional recipes continues to resonate with consumers seeking trusted, plant-derived relief for throat and respiratory symptoms. Its strong brand recognition and focused distribution support its steady performance in this health-oriented market.

Mondelez International, Inc. (Ernest Jackson), known primarily for confectionery excellence, has actively diversified its portfolio by integrating functional and therapeutic elements. Through its Ernest Jackson line, the company has been able to combine classic confectionery flavors with medicated benefits, appealing to consumers who prefer everyday wellness products that deliver both taste and function. The backing of Mondelez’s global distribution network further enhances its ability to penetrate new markets.

Baker Perkins Limited plays a strategic role as an equipment and process solutions provider for manufacturers in the medicated confectionery segment. By offering specialized machinery and production technology, Baker Perkins enables efficient, scalable manufacturing with consistent quality control. Their expertise in process automation supports industry players in meeting regulatory standards and consumer expectations for uniformity and safety.

Mastix LLC, though smaller in scale compared to other market participants, excels in niche innovation, particularly in herbal or niche ingredient formulations. Their agility allows rapid product development, tailored to evolving consumer preferences regarding natural and clean-label ingredients. This strategic flexibility grants Mastix a competitive edge in emerging sub-segments of the medicated confectionery category.

Top Key Players in the Market

- Ricola Group

- Mondelez International, Inc (Ernest Jackson)

- Baker Perkins Limited

- Mastix LLC

- Bartek Ingredients Inc.

- Reckitt Benckiser Group Plc

- Perfetti Van Melle Group

- General Mills

Recent Developments

- In November 2024, the Canadian federal government confirmed a C$27 million investment into Bartek, supporting its $192.5 million project to build a new world‑class manufacturing facility in Stoney Creek, Ontario.

- In November 2024, Bartek received C$27 million from the Government of Canada’s Strategic Innovation Fund. The investment supports their build-out of the Stoney Creek facility (~C$192.5 million project) and will introduce new production technologies, energy management systems, and a centre for novel acid development.

Report Scope

Report Features Description Market Value (2024) USD 7.3 Billion Forecast Revenue (2034) USD 12.6 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Confectionery Type (Chocolate, Snack Bars, Candy and Sugar Confectionery, Gum and Mint), By Application (Nutritional Supplements, Cough Drops, Pain Relief, Digestive Health, Cold Relief, Others), By End User (Children, Adults, Elderly), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Pharmaceuticals, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ricola Group, Mondelez International, Inc (Ernest Jackson), Baker Perkins Limited, Mastix LLC, Bartek Ingredients Inc., Reckitt Benckiser Group Plc, Perfetti Van Melle Group, General Mills Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Medicated Confectionery MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Medicated Confectionery MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ricola Group

- Mondelez International, Inc (Ernest Jackson)

- Baker Perkins Limited

- Mastix LLC

- Bartek Ingredients Inc.

- Reckitt Benckiser Group Plc

- Perfetti Van Melle Group

- General Mills