Global Margarine Market Size, Share, And Business Benefits By Type (Hard, Soft, whipped, Liquid, Spreadable Stick), By Source (Plant-Based (Soybean Oil, Palm Oil, Corn Oil, Sunflower Oil, Canola Oil, Others), Animal-Based), By Nature (GMO, Non-GMO), By Application (Commercial, Household), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online Retails, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152246

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

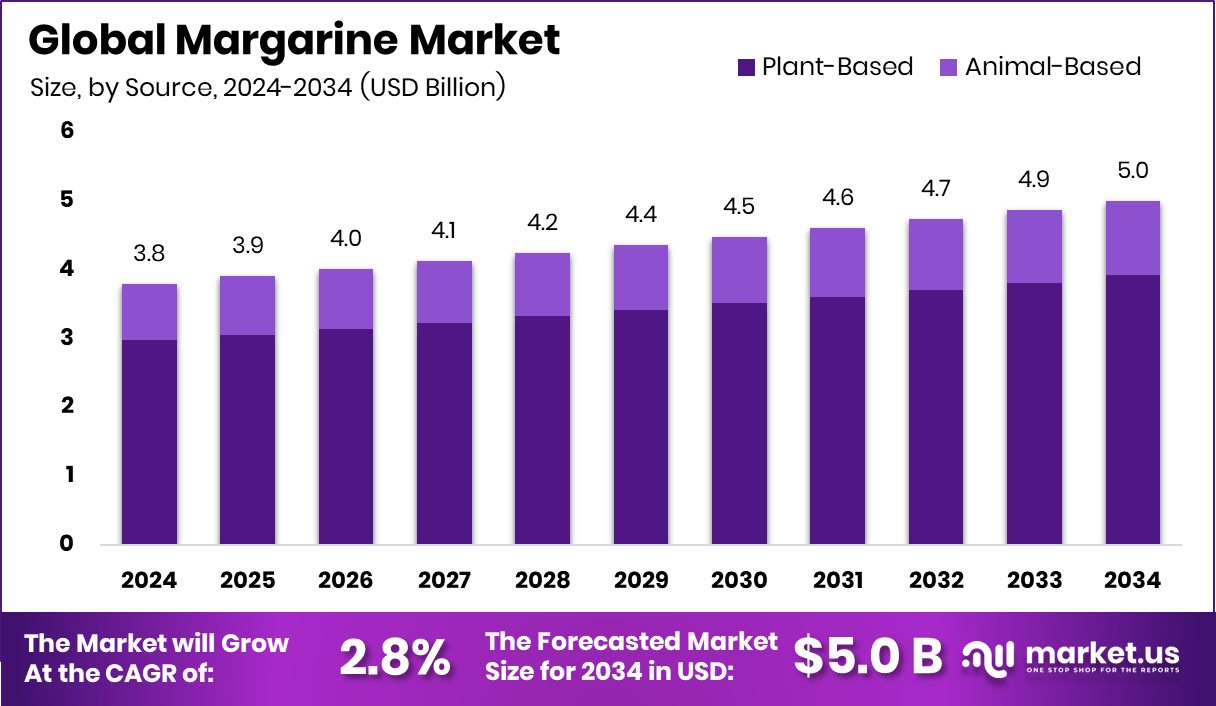

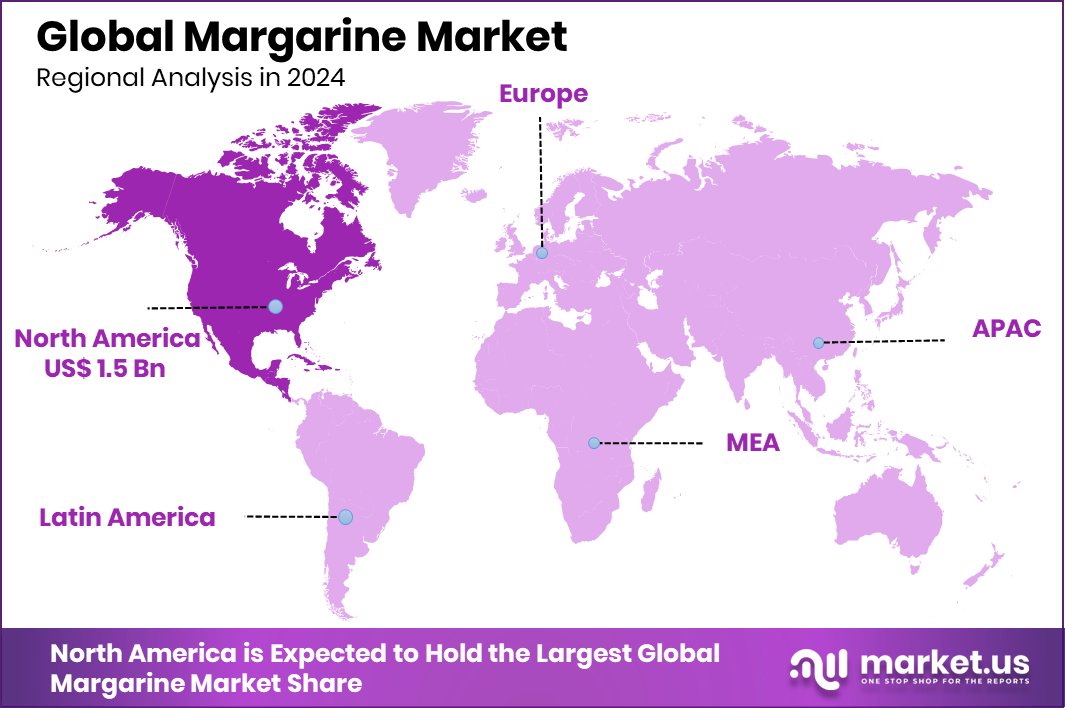

Global Margarine Market is expected to be worth around USD 5.0 billion by 2034, up from USD 3.8 billion in 2024, and grow at a CAGR of 2.8% from 2025 to 2034. With a 41.8% share, North America dominated the global margarine market landscape.

Margarine is a non-dairy spread made primarily from vegetable oils such as soybean, palm, or sunflower oil. It was originally developed as a substitute for butter and is widely used in cooking, baking, and as a table spread. Modern margarine is often fortified with vitamins A and D and contains emulsifiers, salt, and sometimes milk components to improve taste and texture. It is available in various forms—hard blocks, soft spreads, and liquid types—each catering to specific culinary uses.

The margarine market represents a significant segment within the global food industry, driven by both consumer preferences and industrial demand. It includes the production, distribution, and consumption of various margarine types across retail, bakery, and food service channels. The market caters to diverse dietary needs and culinary preferences, offering products with low trans fats, organic ingredients, and plant-based profiles.

Growth in the margarine market is largely driven by rising demand for cost-effective alternatives to butter, especially in emerging economies where price sensitivity remains high. Consumers are increasingly opting for margarine due to its affordability, longer shelf life, and suitability for a wide range of applications, including baking, frying, and sandwich spreads.

Russia’s EFKO Group, a major player in sunflower oils, margarine, milk products, and ketchup, has announced the launch of a $50 million global food tech venture fund. The initiative was revealed by the fund’s directors during Israel’s AgriFood Week, marking EFKO’s strategic entry into food innovation on a global scale.

Key Takeaways

- Global Margarine Market is expected to be worth around USD 5.0 billion by 2034, up from USD 3.8 billion in 2024, and grow at a CAGR of 2.8% from 2025 to 2034.

- In the margarine market, soft margarine dominates by type, holding a 34.8% global share.

- Plant-based margarine leads by source, accounting for 78.3% due to the growing demand for vegan alternatives.

- GMO variants dominate by nature in the margarine market, capturing a significant 67.9% overall share.

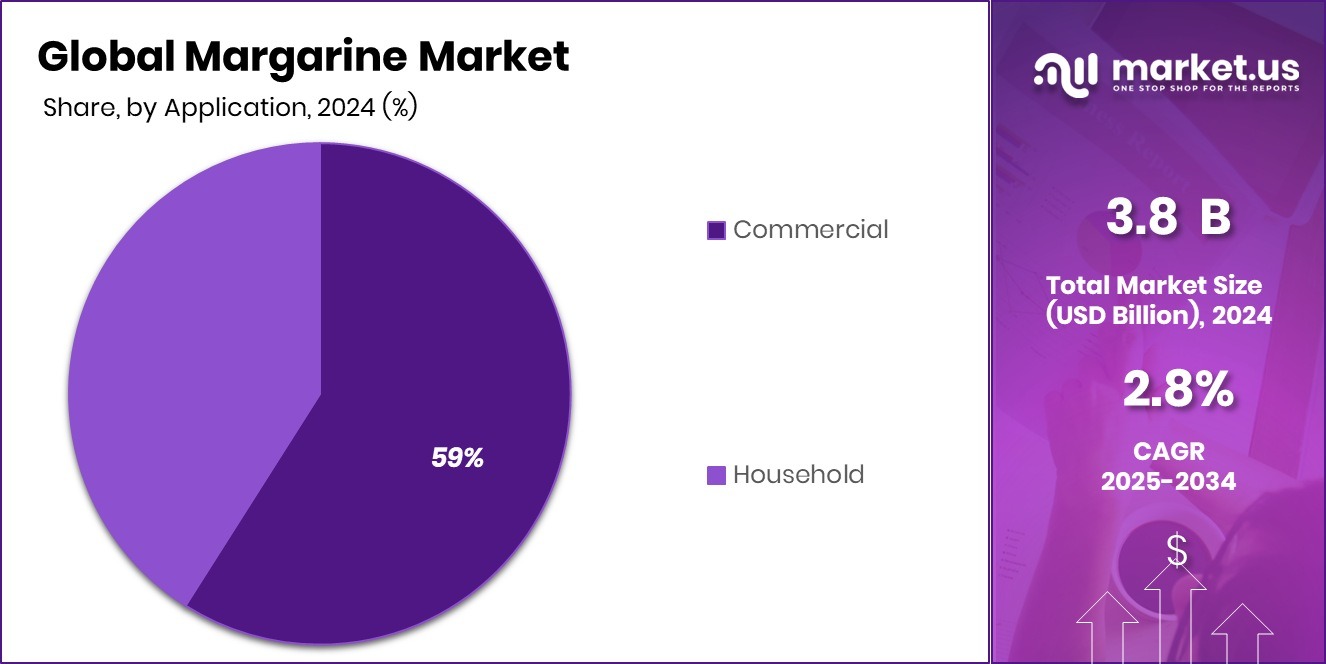

- Commercial applications represent 59.4% of margarine usage, especially in bakeries, restaurants, and food service sectors.

- Supermarkets and hypermarkets lead distribution, making up 44.1% of margarine sales across major regions.

- North America’s margarine market value stood at USD 1.5 billion in 2024.

By Type Analysis

Soft margarine holds a 34.8% share, showing a strong preference for easy spreading.

In 2024, Soft held a dominant market position in the By Type segment of the Margarine Market, with a 34.8% share. This segment’s stronghold is primarily attributed to its wide usage in household consumption, where ease of spreading and convenience are key purchasing factors.

Soft margarine, often packaged in tubs, is favored for its smooth texture and ready-to-use nature, making it an ideal choice for spreading on bread, toast, and other bakery items. Its popularity is also supported by growing health awareness among consumers, as soft margarine products are commonly formulated with reduced saturated fats and no trans fats, aligning with modern dietary preferences.

The dominance of the soft margarine segment reflects broader shifts in consumer behavior, particularly in urban settings where busy lifestyles drive demand for convenient and ready-to-consume food products. Furthermore, its versatility in culinary applications—ranging from baking to frying—adds to its market strength.

The segment’s performance also benefits from effective packaging, extended shelf life, and the incorporation of plant-based oils, making it more appealing to vegan and health-conscious consumers. As awareness of healthier eating habits continues to rise, the preference for soft margarine is expected to maintain its leading position within the margarine market.

By Source Analysis

Plant-based margarine dominates with a 78.3% share due to rising vegan food demand.

In 2024, Plant-Based held a dominant market position in the By Source segment of the Margarine Market, with a 78.3% share. This significant share reflects the growing consumer shift toward plant-derived ingredients, largely driven by increased awareness of health, sustainability, and ethical consumption.

Plant-based margarine, typically made from vegetable oils such as sunflower, soybean, or palm, has become a preferred choice for consumers seeking alternatives to animal-derived products. The segment’s dominance is reinforced by its alignment with vegan, lactose-free, and cholesterol-conscious dietary trends, which continue to gain momentum globally.

The strong performance of the plant-based segment also indicates rising adoption across both household and commercial food sectors. With evolving preferences for clean-label and environmentally responsible food items, plant-based margarine meets the demand for natural, non-dairy options without compromising on taste or functionality. Its usage spans baking, cooking, and direct consumption, further supporting its widespread appeal.

Moreover, regulatory encouragement for plant-based innovation and favorable labeling practices have added to consumer trust and transparency. As consumers increasingly prioritize health and sustainability in food choices, the plant-based source is expected to retain its leadership within the margarine market, anchoring future product developments and driving overall market expansion.

By Nature Analysis

GMO margarine accounts for 67.9%, driven by consistent industrial-scale production methods.

In 2024, GMO held a dominant market position in the by-nature segment of the Margarine Market, with a 67.9% share. This leading share highlights the continued reliance on genetically modified ingredients, particularly oils such as soybean and corn, which are commonly used in margarine production.

The dominance of the GMO segment can be attributed to its cost-effectiveness, consistent supply, and functionality in large-scale manufacturing. These factors make GMO-based margarine a preferred choice for both industrial and retail applications, especially in regions where regulatory frameworks permit its use.

The widespread acceptance of GMO margarine also stems from its role in ensuring product stability, longer shelf life, and desirable texture. For manufacturers, the availability of GMO oil crops supports efficient sourcing and production continuity, helping to meet the growing global demand. Consumers in several markets remain price-sensitive, and GMO-based margarine often provides a more affordable alternative without sacrificing product performance.

The segment’s strong position reflects ongoing consumer acceptance and industry confidence in the safety and practicality of genetically modified ingredients. As production systems continue to prioritize scalability and affordability, the GMO segment is expected to maintain its commanding position within the margarine market.

By Application Analysis

Commercial usage leads at 59.4%, reflecting heavy demand from bakeries and food services.

In 2024, Commercial held a dominant market position in the By Application segment of the Margarine Market, with a 59.4% share. This dominance underscores the strong dependence of the food service and industrial sectors on margarine as a key functional ingredient.

The commercial segment covers a wide range of applications, including bakeries, restaurants, hotels, catering services, and food processing units, where margarine is favored for its cost-efficiency, ease of handling, and consistent quality. Its role in baked goods, sauces, pastries, and prepared meals makes it an essential fat component in high-volume cooking environments.

The high share of the commercial segment also reflects the steady rise in consumption from the growing bakery and quick-service restaurant industries. Margarine offers advantages such as a stable shelf life and favorable performance in high-temperature processes, which are vital in commercial kitchens and manufacturing plants. Additionally, bulk packaging and tailored formulations suited to specific commercial needs have supported its widespread usage.

The segment’s continued dominance indicates the importance of margarine as a reliable and economical fat source in large-scale food operations. As demand from institutional buyers remains strong, the commercial application segment is expected to retain its leading role within the global margarine market.

By Distribution Channel Analysis

Supermarkets and hypermarkets drive 44.1% of sales, offering wide product availability and visibility.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Margarine Market, with a 44.1% share. This leading position reflects the strong consumer preference for purchasing margarine through organized retail outlets that offer a wide variety of products under one roof.

Supermarkets and hypermarkets provide better visibility, product variety, and promotional pricing, which attract a large volume of foot traffic. The ability to compare different brands, types, and packaging formats in-store also plays a key role in influencing purchasing decisions.

The dominance of this channel is also supported by the trust consumers place in established retail formats, where quality assurance and product freshness are more strictly maintained. These outlets typically stock both premium and value margarine offerings, allowing them to serve diverse consumer segments. Strategic shelf placement and in-store promotions further contribute to higher product turnover.

In addition, the growing trend of urbanization and the rise of organized retail networks, particularly in developing regions, have made supermarkets and hypermarkets a convenient and preferred shopping destination. As a result, this distribution channel is expected to maintain its strong presence, continuing to drive significant volume sales in the global margarine market.

Key Market Segments

By Type

- Hard

- Soft

- whipped

- Liquid

- Spreadable Stick

By Source

- Plant-Based

- Soybean Oil

- Palm Oil

- Corn Oil

- Sunflower Oil

- Canola Oil

- Others

- Animal-Based

By Nature

- GMO

- Non-GMO

By Application

- Commercial

- Household

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retails

- Others

Driving Factors

Health-Conscious Shoppers Prefer Plant-Based Spreads More

One of the main driving factors for the margarine market is the rising consumer preference for plant-based and healthier alternatives to traditional animal fats. Many people are now more aware of the health risks linked to high cholesterol and saturated fats found in butter. As a result, margarine, especially the types made from vegetable oils and free from trans fats, is becoming a popular choice.

Consumers are also reading labels more closely and looking for products with added vitamins, no dairy, and no hydrogenated oils. This shift in eating habits is not just happening in homes but also in restaurants and bakeries, where healthier ingredients are now being used to meet the growing demand for better food options.

Restraining Factors

Growing Concerns About Artificial Ingredients in Margarine

One major restraining factor for the margarine market is the increasing concern among consumers about the presence of artificial additives and processed ingredients. Despite improvements in formulation, many margarine products are still viewed as highly processed and unnatural. Some consumers worry about the use of emulsifiers, preservatives, and hydrogenated oils that may still exist in certain margarine types.

This perception often leads people to return to traditional options like butter, which they see as more natural and less altered. Health-conscious buyers are becoming more cautious, especially with growing awareness about clean-label products. As a result, negative public perception and distrust regarding the ingredient profile of margarine may limit its growth in some consumer segments.

Growth Opportunity

Expansion Potential in Gluten-Free and Specialty Products

The primary growth opportunity for the margarine market lies in developing and promoting gluten-free and specialty product lines. As dietary preferences evolve, more consumers are seeking products that cater to specific health needs, such as those with gluten intolerance or food sensitivities. By introducing margarine variants that are not only plant-based and low in saturated fat but also certified gluten-free, manufacturers can tap into a niche yet rapidly expanding consumer base.

Specialty labels—such as allergen-free, low-sodium, or region-specific flavors—could further differentiate products and drive premium pricing. This approach aligns with the growing demand for transparency and tailored nutrition, allowing margarine brands to expand beyond traditional segments. Such innovation is expected to provide a competitive edge and catalyze broader market acceptance.

Latest Trends

Rising Demand For Clean-Label Margarine Products

A key trend shaping the margarine market today is the increasing consumer shift toward clean-label products. People are becoming more cautious about what goes into their food, and many now prefer margarine that is made with simple, recognizable ingredients. This includes products that are free from artificial colors, preservatives, hydrogenated oils, and synthetic additives.

Consumers are reading labels more carefully and choosing options that reflect a healthier and more natural lifestyle. This trend is especially strong among younger and urban populations who prioritize transparency and health in their food choices.

Regional Analysis

In 2024, North America held a 41.8% market share, reaching USD 1.5 billion.

In 2024, North America emerged as the leading regional market in the global margarine industry, capturing a dominant share of 41.8%, with a market value of approximately USD 1.5 billion. This strong position is primarily supported by high consumer demand for plant-based and health-focused food products across the United States and Canada. The well-established food processing sector, combined with a strong preference for convenient and ready-to-use cooking fats, further contributes to regional growth.

Europe followed as a significant market, driven by the growing adoption of margarine in bakery and confectionery applications, supported by the region’s longstanding tradition of commercial baking. In the Asia Pacific, rising disposable incomes, changing dietary patterns, and rapid urbanization are driving demand, especially in emerging economies such as India and Southeast Asia.

The Middle East & Africa region is gradually expanding due to growing awareness of affordable butter alternatives and the increasing presence of modern retail formats. Latin America also reflects steady market development, fueled by rising demand for cost-effective spreads in daily cooking and growing population-driven consumption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, several prominent players—including BRF Global, Bunge Limited, Cargill, Incorporated, and China Mengniu Dairy Company Limited—are exerting substantial influence on the global margarine market. Each exhibits distinct strategic emphases that collectively shape industry dynamics and inform future direction.

BRF Global continues to leverage its integrated meat and food processing infrastructure to support oil-based product formulations. Its strong distribution network across Latin America has enabled the company to penetrate retail and commercial channels effectively. BRF’s focus on optimizing cost efficiencies and localizing supply chains is expected to sustain its competitiveness in emerging markets.

Bunge Limited, a vertically integrated agribusiness leader, occupies a critical position in vegetable oil sourcing and processing, serving as a primary raw-material supplier to margarine manufacturers. Its upstream integration—from oilseed crushing to oil refining—grants resilience in feedstock pricing and ensures consistent quality. Bunge’s investments in sustainable agriculture practices, including traceable non-GMO oils, align well with growing consumer demand for transparency and environmental stewardship.

Cargill, Incorporated stands out for its global reach and product innovation in tailored fat solutions. Renowned for co-developing custom blend solutions and plant-based fat profiles, Cargill supports food service and industrial customers by providing functional and texture-enhancing formulations. Its R&D-driven strategy and focus on clean-label, non-hydrogenated fats align with current trends in health-conscious consumption.

China Mengniu Dairy Company Limited is notable for its diversified dairy and non-dairy offerings within China’s expanding margarine sector. Mengniu’s strong domestic market presence and established cold-chain logistics offer a platform to extend margarine variants—especially fortified and flavored spreads—into household kitchens. Despite its dairy-centric roots, the company’s pivot into vegetable-oil-based spreads suggests strategic adaptation to local consumer preferences.

Top Key Players in the Market

- Associated British Foods PLC

- BRF Global.

- Bunge Limited.

- Cargill, Incorporated.

- China Mengniu Dairy Company Limited

- Conagra Brands Inc.

- Namchow (THAILAND) LTD.

- NMGK Group

- Puratos NV

- Richardson International Limited

- Unilever

- Vandemoortele

- Wilmar International Ltd

Recent Developments

- In March 2025, Vandemoortele signed an agreement to acquire Bunge’s margarine and spreads business in Germany, Poland, Finland, and Hungary, along with 20 consumer brands and multiple production sites. This move reinforces Vandemoortele’s position in plant-based food solutions across Central and Northern Europe and complements its existing bakery fat portfolio.

- In March 2024, Wilmar Africa introduced Fortune Spread and Fortune All‑Purpose Margarine, unveiling both new margarine products and a state‑of‑the‑art factory in Ghana. The facility, designed specifically for margarine production, enhances local supply and supports industrial and household usage.

Report Scope

Report Features Description Market Value (2024) USD 3.8 Billion Forecast Revenue (2034) USD 5.0 Billion CAGR (2025-2034) 2.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hard, Soft, whipped, Liquid, Spreadable Stick), By Source (Plant-Based (Soybean Oil, Palm Oil, Corn Oil, Sunflower Oil, Canola Oil, Others), Animal-Based), By Nature (GMO, Non-GMO), By Application (Commercial, Household), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online Retails, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Associated British Foods PLC, BRF Global., Bunge Limited., Cargill, Incorporated., China Mengniu Dairy Company Limited, Conagra Brands Inc., Namchow (THAILAND) LTD., NMGK Group, Puratos NV, Richardson International Limited, Unilever, Vandemoortele, Wilmar International Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Associated British Foods PLC

- BRF Global.

- Bunge Limited.

- Cargill, Incorporated.

- China Mengniu Dairy Company Limited

- Conagra Brands Inc.

- Namchow (THAILAND) LTD.

- NMGK Group

- Puratos NV

- Richardson International Limited

- Unilever

- Vandemoortele

- Wilmar International Ltd