Global Low and Medium-voltage Inverter Market Size, Share, And Business Benefits By Type (Single Phase Inverters, Three Phase Inverters), By Power Rating (Low Voltage Inverters (up to 1 MW), Medium Voltage Inverters (1 MW to 5 MW)), By End-User (Commercial, Residential, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154600

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

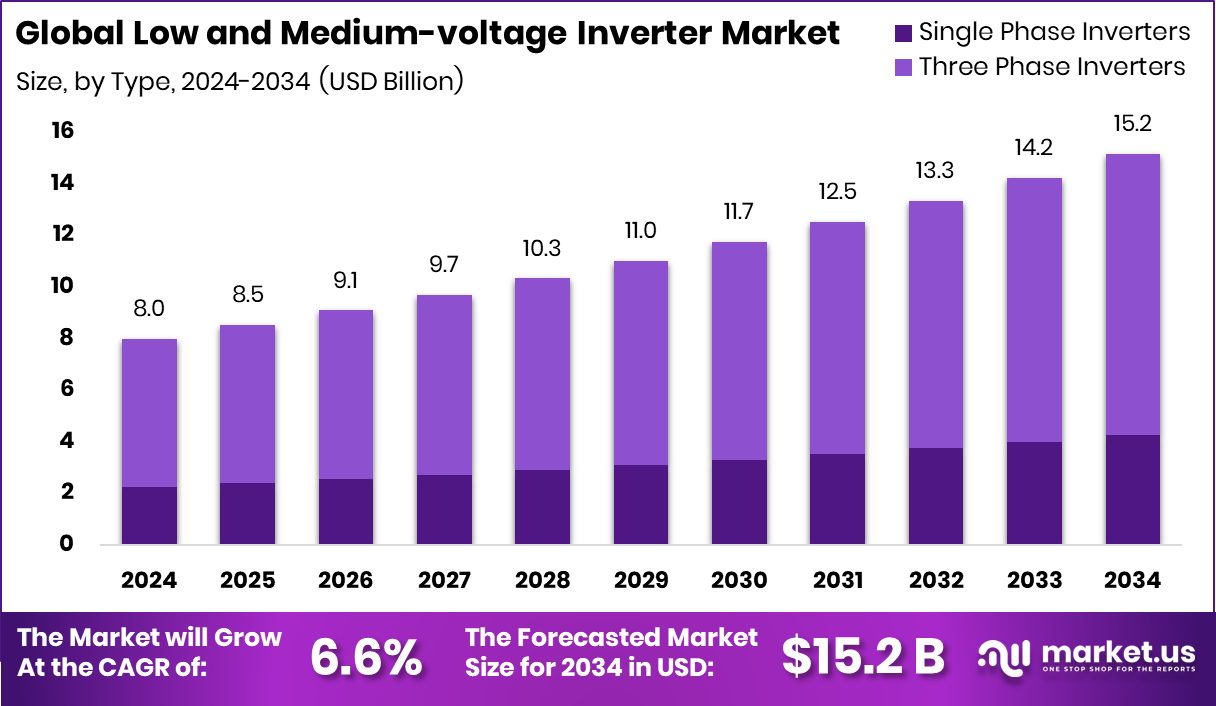

The Global Low and Medium-voltage Inverter Market is expected to be worth around USD 15.2 billion by 2034, up from USD 8.0 billion in 2024, and is projected to grow at a CAGR of 6.6% from 2025 to 2034.

A Low and Medium-voltage inverter is an electronic device used to convert direct current (DC) into alternating current (AC) within a specific voltage range. Low-voltage inverters typically operate below 1,000 volts, while medium-voltage inverters handle voltages from around 1,000 volts up to 35,000 volts. These inverters are commonly used in industrial machinery, renewable energy systems (such as solar and wind), motor drives, HVAC systems, and various utility-scale grid applications.

The Low and Medium-voltage Inverter market refers to the global demand and trade of these inverters across multiple sectors such as manufacturing, energy, infrastructure, and transportation. The market is being driven by rapid industrial automation, renewable energy adoption, and the modernization of power grids. These inverters play a key role in improving energy efficiency, reducing operational costs, and ensuring better control over electrical systems in both utility and commercial environments.

Growth in this market is being pushed by increasing investments in renewable energy and smart grid infrastructure. As solar and wind installations rise, there is a growing need for inverters that can manage higher power capacities efficiently. Government policies supporting clean energy transitions are also creating a positive impact on inverter demand.

The demand for energy efficiency in industrial operations is also rising steadily. Many industries are adopting variable frequency drives using low and medium-voltage inverters to reduce energy wastage, especially in sectors like water treatment, mining, and oil & gas. The ability of these inverters to reduce mechanical stress and improve motor performance makes them a preferred choice in heavy-duty applications.

An emerging opportunity lies in the electrification of transport and infrastructure development in developing regions. As countries expand their electric vehicle charging networks and improve rural electrification, the demand for robust and scalable inverter systems is expected to grow. Additionally, smart buildings and decentralized energy systems are opening new avenues for inverter deployment across residential and commercial segments.

Key Takeaways

- The Global Low and Medium-voltage Inverter Market is expected to be worth around USD 15.2 billion by 2034, up from USD 8.0 billion in 2024, and is projected to grow at a CAGR of 6.6% from 2025 to 2034.

- Three-phase inverters dominate the Low and Medium-voltage Inverter Market with 72.9% market share.

- Low-voltage inverters (up to 1 MW) lead the market, capturing a 65.4% share.

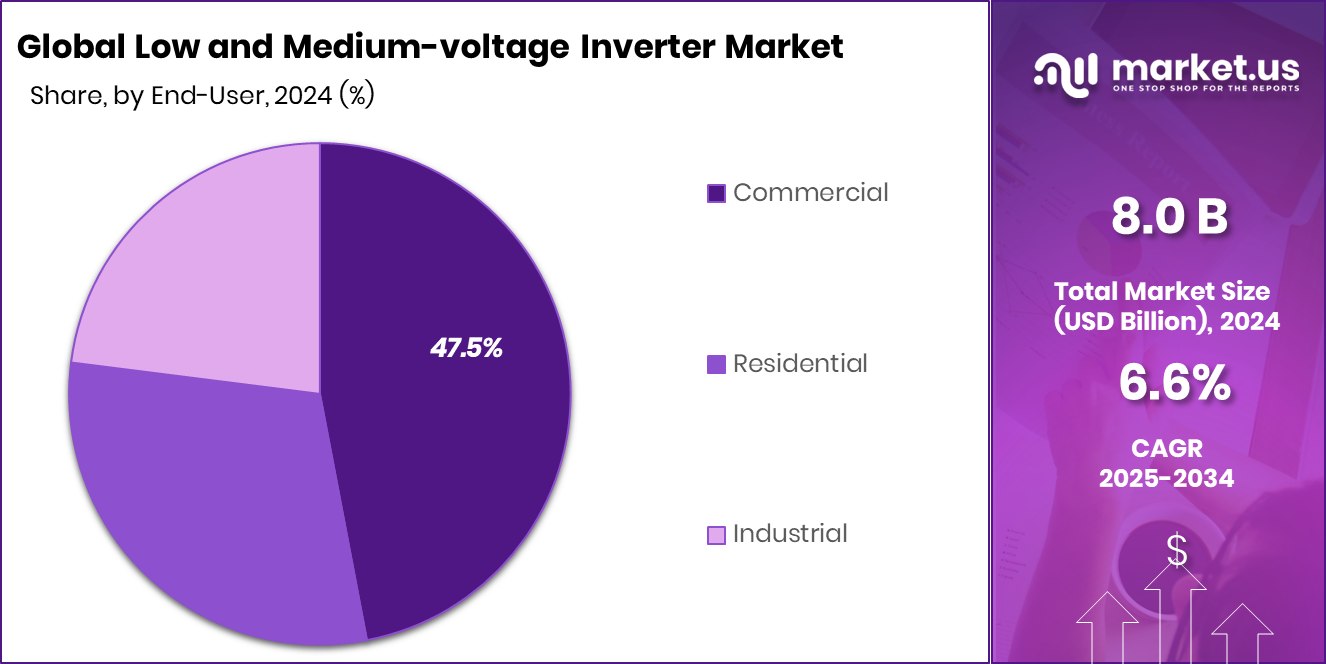

- Commercial users accounted for 47.5% of the total Low and Medium-voltage inverter market share.

By Type Analysis

Three-phase inverters dominate with 72.9% market share globally.

In 2024, Three Phase Inverters held a dominant market position in the By Type segment of the Low and Medium-voltage Inverter Market, with a 49.2% share. This dominance can be attributed to their widespread application in high-power industrial systems, large-scale motor drives, and grid-connected renewable energy installations.

Three-phase inverters are preferred in industries that require stable and efficient power conversion across medium and heavy-duty equipment. Their ability to support balanced load distribution and higher energy output has made them a critical component in modern power infrastructure, particularly in manufacturing plants, commercial buildings, and energy plants.

The demand for three-phase inverters is also increasing due to their suitability for variable frequency drive systems and their essential role in supporting energy efficiency goals across sectors. As power systems grow more complex and grid integration requirements rise, three-phase inverter technology is being adopted for its enhanced performance, reduced harmonic distortion, and reliability under continuous load.

Furthermore, in regions with expanding industrial bases and renewable energy projects, the deployment of three-phase inverters is accelerating steadily. This has reinforced their leading position in the type segment and is expected to maintain steady momentum as energy-intensive industries continue their shift toward automation and efficient energy use.

By Power Rating Analysis

Low Voltage Inverters hold 65.4% due to industrial power needs.

In 2024, Low Voltage Inverters (up to 1 MW) held a dominant market position in the By Power Rating segment of the Low and Medium-voltage inverter market, with a 49.2% share. This strong position is primarily driven by the high adoption of low-voltage systems across small to mid-sized industrial applications, commercial buildings, and decentralized renewable energy setups. These inverters are widely favored due to their compact design, cost-effectiveness, and ease of integration in existing electrical networks, making them suitable for operations where energy demand is moderate but efficiency is critical.

The growing shift toward energy-saving technologies in light industrial processes and commercial facilities has further supported the uptake of low-voltage inverters. Their role in enhancing motor control, reducing electricity usage, and ensuring smoother operation in HVAC systems, pumps, and fans has made them a go-to choice for energy optimization.

Moreover, the increasing implementation of automation in manufacturing processes has also contributed to the rising demand. With the need for scalable, efficient, and reliable power conversion systems, low-voltage inverters continue to meet key performance criteria in multiple applications. This has reinforced their leadership in the power rating category, positioning them as a preferred solution in diverse energy-conscious environments.

By End-User Analysis

The commercial sector leads the end-user segment with 47.5% market demand.

In 2024, Commercial held a dominant market position in the By End-User segment of the Low and Medium-voltage Inverter Market, with a 49.2% share. This leading share reflects the rising demand for reliable and energy-efficient power conversion solutions across commercial facilities such as shopping malls, office complexes, hospitals, educational institutions, and data centers. Commercial establishments are increasingly adopting low and medium-voltage inverters to manage power loads efficiently, reduce energy consumption, and maintain uninterrupted operations.

The adoption of inverters in commercial settings is being driven by the need to integrate renewable energy systems like rooftop solar panels, where inverters are essential for converting generated DC power into usable AC power. Moreover, building automation systems and energy management solutions in the commercial sector require robust inverter support for HVAC systems, elevators, lighting, and backup systems. The emphasis on operational efficiency and sustainability in commercial infrastructure has further fueled the demand for advanced inverter technologies that can ensure stable and optimized energy use.

With growing urbanization and expansion of commercial infrastructure worldwide, the need for reliable power solutions is only expected to grow. This has reinforced the commercial sector’s stronghold in the end-user segment of the market and is likely to sustain its leadership position moving forward.

Key Market Segments

By Type

- Single Phase Inverters

- Three Phase Inverters

By Power Rating

- Low Voltage Inverters (up to 1 MW)

- Medium Voltage Inverters (1 MW to 5 MW)

By End-User

- Commercial

- Residential

- Industrial

Driving Factors

Rising Demand for Energy-Efficient Power Conversion

One of the key factors driving the growth of the Low and Medium-voltage Inverter Market is the increasing demand for energy-efficient power conversion systems. Industries and commercial facilities are focusing on reducing their electricity consumption and operational costs. Low and medium-voltage inverters help achieve this by controlling the speed and torque of electric motors, resulting in lower energy use.

These inverters also support the smooth integration of renewable energy sources like solar and wind into the grid. With stricter energy regulations and rising electricity costs, businesses are turning to inverters as a practical solution to optimize performance and reduce wastage. This shift toward smarter energy use continues to boost the adoption of inverter technology across various sectors.

Restraining Factors

High Initial Costs Limit Wider Market Adoption

A major factor holding back the growth of the Low and Medium-voltage Inverter Market is the high initial investment required for installation. These inverters, especially those used in industrial and commercial applications, involve advanced components and technology that can be expensive. For small and mid-sized businesses, the upfront cost of purchasing and installing inverters, along with the need for skilled technicians, often becomes a financial burden.

Although long-term savings from energy efficiency are significant, the payback period may seem too long for many buyers. This cost barrier can delay decision-making or lead to the selection of cheaper, less efficient alternatives, ultimately restricting the market’s full potential in cost-sensitive regions or sectors.

Growth Opportunity

Growing Infrastructure in Developing Regions Boosts Demand

A strong growth opportunity for the Low and Medium-voltage Inverter Market lies in the rapid infrastructure development taking place across developing countries. As urbanization increases, there is a rising need for modern power systems in new commercial buildings, factories, hospitals, and public facilities. These settings require stable and efficient power supply solutions, where inverters play a critical role.

Additionally, governments in emerging economies are investing in renewable energy projects, rural electrification, and smart grid networks, all of which depend on reliable inverter systems. This expanding infrastructure creates a large market for both low and medium-voltage inverters, offering manufacturers a chance to meet growing demand and establish a strong presence in untapped, high-potential regions.

Latest Trends

Integration of Smart Features in Inverter Systems

A major trend in the Low and Medium-voltage Inverter Market is the growing integration of smart features and digital technologies. Modern inverters are now being designed with built-in communication tools, remote monitoring systems, and advanced control capabilities. These smart features allow users to track performance in real time, detect faults early, and optimize energy usage more efficiently.

In commercial and industrial setups, this helps reduce downtime and maintenance costs while improving energy management. The demand for intelligent systems is increasing, especially in sectors adopting automation and smart infrastructure. This trend reflects the shift toward digital energy solutions, where inverters are not just power converters but also play a key role in supporting smarter and connected operations.

Regional Analysis

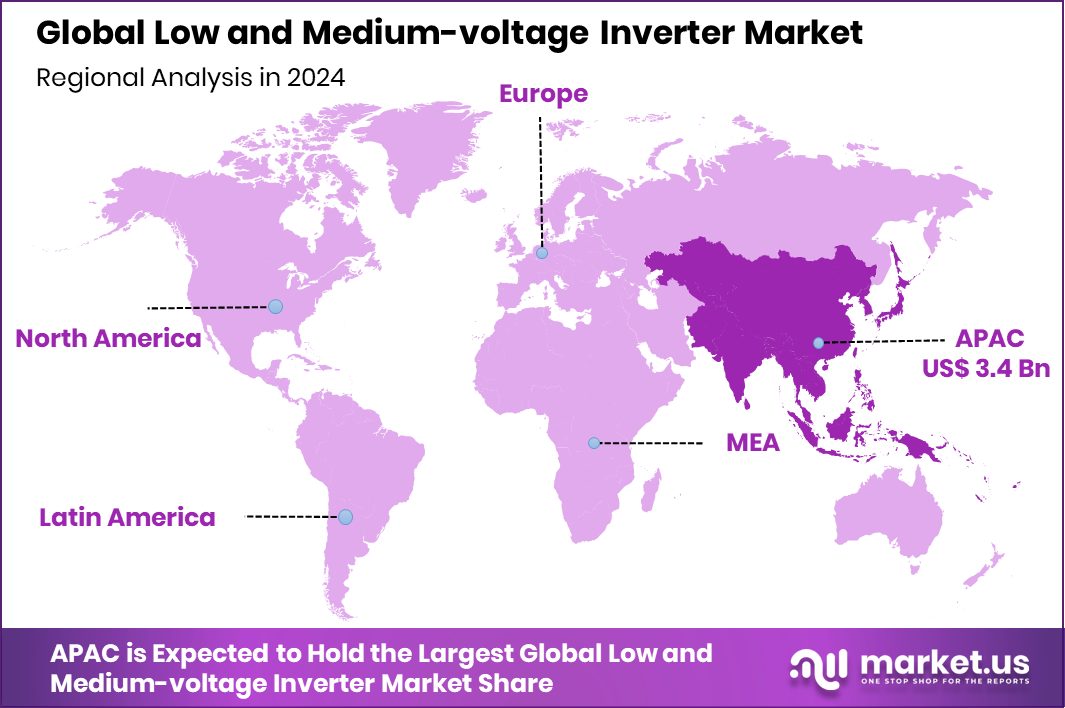

In 2024, Asia-Pacific led the market with a 43.60% share, reaching USD 3.4 Bn.

In 2024, Asia-Pacific held a dominant position in the Low and Medium-voltage Inverter Market, accounting for 43.60% of the global share and generating revenue worth USD 3.4 billion. This leadership is supported by strong industrialization, rising investments in infrastructure, and expanding renewable energy installations across countries such as China, India, and Southeast Asia. The region’s focus on energy efficiency and smart manufacturing is also contributing to the growing adoption of inverter systems in both commercial and industrial sectors.

North America continues to show steady growth due to advancements in power electronics and increased integration of smart energy systems in buildings and factories. Europe is witnessing rising demand from its push for carbon neutrality and adoption of clean energy technologies in industrial and public infrastructure. The Middle East & Africa region is gradually adopting inverter technology, particularly in utility-scale solar and infrastructure projects, driven by efforts to diversify energy sources.

Latin America is also showing progress with inverter deployment in commercial applications and solar initiatives. However, Asia-Pacific remains the most dominant regional market, driven by rapid development and large-scale implementation of power management systems across a wide range of industries, making it the central hub for future market expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB has maintained a robust presence in the low and medium‑voltage inverter sphere in 2024. Its strength is derived from deep expertise in both motor drives and converter technologies, which supports broad penetration across industrial and utility applications. ABB’s integrated solutions emphasize energy efficiency and reliability. The firm’s inverter offerings are often bundled with predictive diagnostics and support services, enhancing uptime across large-scale installations.

Fuji Electric remains a notable player, leveraging its legacy in power electronics to supply reliable inverter systems. Its modular approach facilitates flexibility and scalability in commercial and industrial applications. Emphasis on thermal management and compact design has positioned its inverters as efficient options in constrained equipment setups. Fuji Electric’s systems also emphasize seamless compatibility with battery and solar arrays.

Siemens continues to deliver advanced inverter technology focused on automation and digital integration. Its offerings include medium-voltage converters designed for grid-scale and industrial applications. Siemens leverages its broader automation ecosystem to integrate inverters with smart factory and energy management solutions. R&D expenditures in 2024 supported enhancements in reliability, harmonic mitigation, and remote monitoring.

Schneider Electric offers inverter systems that align with sustainable energy goals and building automation needs. Its portfolio supports low‑voltage applications in commercial and infrastructure projects. Schneider’s focus on user‑friendly interfaces, scalability, and integration with energy management platforms has enhanced adoption. Its inverters are often used in HVAC, UPS, and solar environments for enhanced operational visibility and improved energy control.

Top Key Players in the Market

- ABB

- Fuji Electric

- Siemens

- Schneider Electric

- Danfoss

- Yaskawa

- Delta

- Hitachi

- LENZE

- Nidec

Recent Developments

- In May 2024, Fuji Electric introduced the FRENIC‑GS series in FY2024. Designed for industrial use, it offers compact size and high energy efficiency. The product has been adopted in applications such as steel plants and harbor cranes where space and power optimization are critical.

- In May 2024, ABB introduced a new combined motor and inverter solution tailored for electric buses at Busworld Turkey 2024. The package includes the first-ever HES580 three‑level inverter paired with the AMXE250 motor. The design reduces motor harmonic losses by up to 75% (and up to 12% less motor losses compared to two‑level inverters), enabling longer motor life and improved efficiency in demanding transit applications.

Report Scope

Report Features Description Market Value (2024) USD 8.0 Billion Forecast Revenue (2034) USD 15.2 Billion CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Single Phase Inverters, Three Phase Inverters), By Power Rating (Low Voltage Inverters (up to 1 MW), Medium Voltage Inverters (1 MW to 5 MW)), By End-User (Commercial, Residential, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB, Fuji Electric, Siemens, Schneider Electric, Danfoss, Yaskawa, Delta, Hitachi, LENZE, Nidec Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Low and Medium-voltage Inverter MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Low and Medium-voltage Inverter MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Fuji Electric

- Siemens

- Schneider Electric

- Danfoss

- Yaskawa

- Delta

- Hitachi

- LENZE

- Nidec