Global LNG Market Size, Share Analysis Report By Infrastructure Type (LNG Liquefaction Plants, LNG Regasification Facilities, LNG Shipping Fleet), By Scale (Large-Scale (Above 5 mtpa), Mid-Scale (1 to 5 mtpa), Small-Scale (Below 1 mtpa)), By End-Use (Power Generation, Industrial and Manufacturing, Residential and Commercial, Transportation, Others), By Location (Onshore, Offshore) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160511

- Number of Pages: 353

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

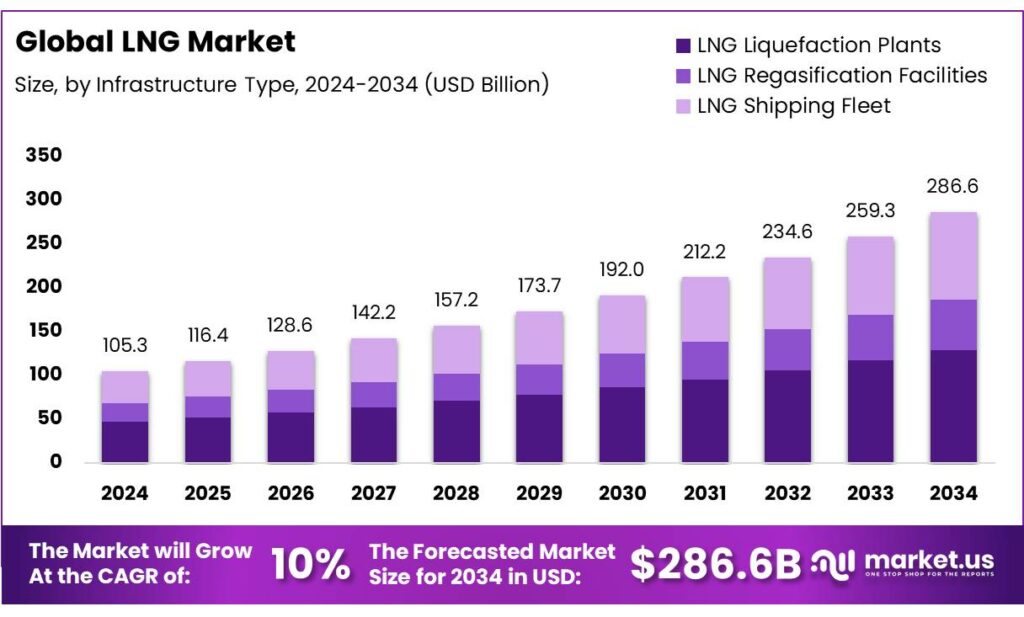

The Global LNG Market size is expected to be worth around USD 286.6 Billion by 2034, from USD 105.3 Billion in 2024, growing at a CAGR of 10.0% during the forecast period from 2025 to 2034.

The global liquefied natural gas (LNG) industry has experienced significant transformations, driven by geopolitical shifts, technological advancements, and evolving energy policies. Historically dominated by a few key exporters, the LNG market has diversified, with countries like the United States and Australia emerging as major players.

- According to the International Energy Agency (IEA), the global LNG supply capacity is projected to reach 666.5 million tonnes per annum (MTPA) by the end of 2028, surpassing demand scenarios through 2050.

The IEA anticipates that LNG demand will grow by more than 2.5% per year to 2035, outpacing the rise in overall gas demand. However, this growth trajectory may be tempered by factors such as fluctuating global gas prices, infrastructure constraints, and the increasing competitiveness of renewable energy sources. Notably, the IEA’s World Energy Outlook 2023 suggests that U.S. natural gas prices could be 67% higher under current policies compared to a net-zero scenario by 2030, highlighting the impact of LNG exports on domestic energy costs.

Conversely, emerging markets in Asia, particularly China and India, are exhibiting varying growth trajectories. China’s LNG imports experienced a 20% decline in 2022 but are projected to rebound by 9% to 14% in 2023, driven by economic recovery and increased demand for cleaner energy sources. India, while showing a resurgence in LNG imports in 2023, faces challenges in the power sector due to high LNG prices and competition from renewable energy sources. As of January 2024, only one natural gas power plant was under construction in India, despite a surge in regasified LNG demand in the previous year.

Government initiatives play a crucial role in shaping the future of the LNG industry. In the United States, the Department of Energy’s analysis indicates that increasing LNG exports could lead to higher domestic natural gas prices, potentially impacting consumers and manufacturers. The U.S. became the world’s largest LNG exporter in 2022, with exports averaging nearly 11.2 billion cubic feet per day, about 12% of the country’s dry natural gas production.

Internationally, the European Union’s REPowerEU plan has been instrumental in reducing dependency on Russian gas by accelerating LNG imports and expanding regasification capacity. Since 2022, the EU has added 50 billion cubic meters (bcm) of regasification capacity, enhancing its energy security and market flexibility.

Strategic infrastructure projects further underscore India’s commitment to enhancing LNG capabilities. The Dahej Port in Gujarat, operated by Petronet LNG, boasts a capacity of 17.5 million tonnes per year, serving as a critical hub for LNG imports. Additionally, the government’s allocation of ₹5,597 crore (approximately $640 million) in the Union Budget FY26 for the second phase of the Indian Strategic Petroleum Reserves Ltd (ISPRL) project aims to bolster energy security through enhanced storage facilities.

Key Takeaways

- LNG Market size is expected to be worth around USD 286.6 Billion by 2034, from USD 105.3 Billion in 2024, growing at a CAGR of 10.0%.

- LNG Liquefaction Plants held a dominant market position, capturing more than a 45.2% share.

- Large-scale LNG projects, defined as those with capacities above 5 mtpa, held a dominant market position, capturing more than a 59.9% share.

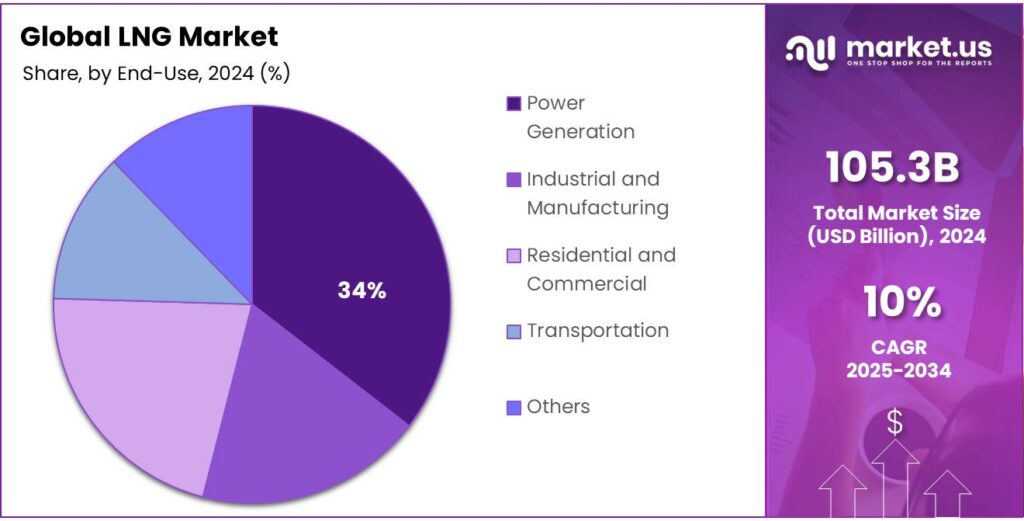

- Power generation held a dominant market position in the LNG end-user segment, capturing more than a 34.7% share.

- Onshore LNG projects held a dominant market position, capturing more than a 78.3% share.

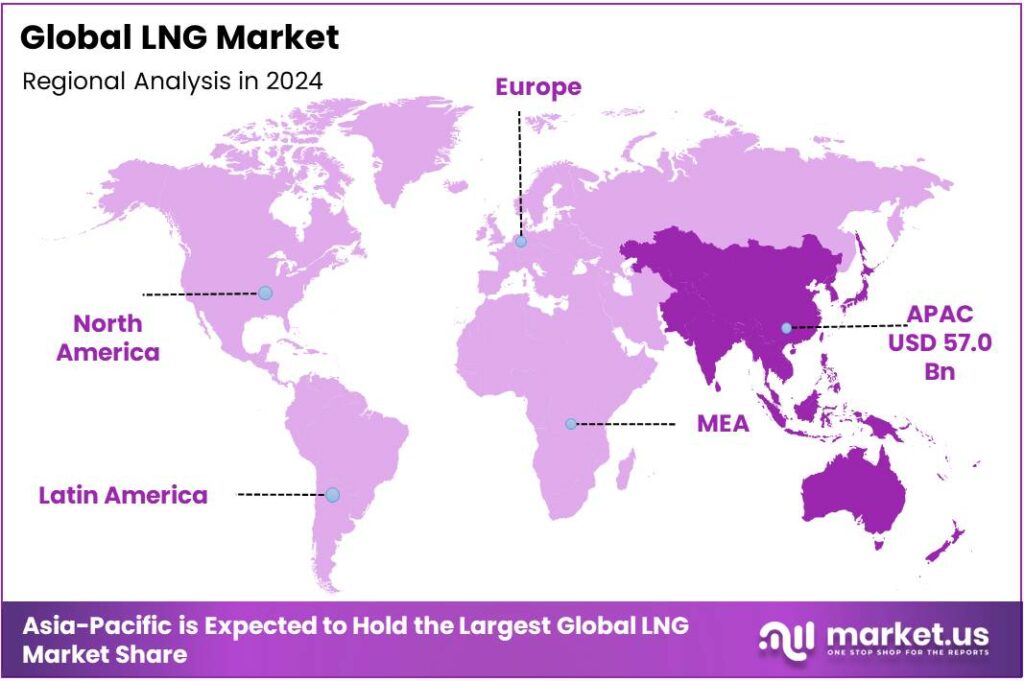

- Asia Pacific region maintained its dominant position in the global LNG market, capturing more than 54.2% of the market share, valued at approximately USD 57 billion.

By Infrastructure Type Analysis

LNG Liquefaction Plants dominate with 45.2% market share in 2024 due to strategic infrastructure expansion

In 2024, LNG Liquefaction Plants held a dominant market position, capturing more than a 45.2% share of the overall LNG infrastructure segment. This leadership can be attributed to the increasing global demand for liquefied natural gas and the ongoing development of large-scale liquefaction facilities in North America, the Middle East, and Australia. The expansion of these plants has enabled higher production efficiency and enhanced export capabilities, allowing countries to meet rising energy demands while stabilizing supply chains.

These facilities processed significant volumes of natural gas, reflecting their critical role in maintaining the LNG supply-demand balance. The focus on constructing state-of-the-art liquefaction units with advanced technology has further reinforced their market dominance, ensuring operational reliability and energy-efficient processes. Strategic government approvals and investments in new liquefaction projects have also accelerated market penetration, making these plants a cornerstone of global LNG infrastructure in 2024 and setting the stage for continued growth in 2025.

By Scale Analysis

Large-Scale LNG projects dominate with 59.9% market share in 2024 driven by high-capacity production

In 2024, large-scale LNG projects, defined as those with capacities above 5 mtpa, held a dominant market position, capturing more than a 59.9% share of the LNG market by scale. This leadership reflects the global shift toward high-capacity production facilities capable of meeting growing energy demands efficiently. Large-scale plants have been increasingly favored due to their ability to produce and export significant volumes of LNG, supporting both domestic consumption and international trade.

In 2024, these projects accounted for the majority of LNG throughput, demonstrating their strategic importance in supply chain stability and market competitiveness. Investments in advanced liquefaction technology and operational optimization have further strengthened their market share, ensuring consistent performance and reliability. Government approvals and infrastructure support have facilitated the commissioning of several new large-scale facilities, reinforcing the dominance of high-capacity LNG projects in 2024 and setting the foundation for continued growth in 2025.

By End-Use Analysis

Power Generation leads with 34.7% market share in 2024 driven by rising electricity demand

In 2024, power generation held a dominant market position in the LNG end-user segment, capturing more than a 34.7% share. This prominence is largely due to the increasing adoption of LNG as a cleaner and more efficient fuel for electricity production, replacing traditional coal and oil-based power plants in many regions. During 2024, LNG-fired power plants played a critical role in stabilizing electricity supply, particularly in countries with growing industrialization and urbanization.

The flexibility of LNG in meeting peak energy demands and its lower emissions profile compared to other fossil fuels has reinforced its preference in the power sector. Government policies promoting cleaner energy and investments in LNG-based power infrastructure have further supported this growth. Overall, the continued focus on sustainable energy and efficient power generation is expected to maintain LNG’s significant role in electricity production throughout 2025.

By Location Analysis

Onshore LNG projects dominate with 78.3% market share in 2024 due to infrastructure advantages

In 2024, onshore LNG projects held a dominant market position, capturing more than a 78.3% share of the LNG market by location. This strong position is driven by the relative ease of constructing and maintaining onshore liquefaction and storage facilities compared to offshore alternatives. During 2024, onshore plants continued to serve as the backbone of global LNG production, providing stable and high-capacity outputs that support both domestic energy needs and international exports.

The preference for onshore locations is further reinforced by lower operational risks, reduced costs, and accessibility for workforce and logistics. Government approvals and support for large-scale onshore LNG infrastructure have facilitated ongoing expansions, ensuring that these projects remain central to the LNG supply chain. Looking into 2025, onshore LNG facilities are expected to maintain their market dominance due to continued investments and strategic focus on high-volume, reliable production.

Key Market Segments

By Infrastructure Type

- LNG Liquefaction Plants

- LNG Regasification Facilities

- LNG Shipping Fleet

By Scale

- Large-Scale (Above 5 mtpa)

- Mid-Scale (1 to 5 mtpa)

- Small-Scale (Below 1 mtpa)

By End-Use

- Power Generation

- Industrial and Manufacturing

- Residential and Commercial

- Transportation

- Others

By Location

- Onshore

- Offshore

Emerging Trends

Surge in LNG Bunkering Infrastructure and Adoption in India

India is witnessing a significant shift towards adopting Liquefied Natural Gas (LNG) as a marine fuel, driven by stringent environmental regulations and the need for cleaner energy sources. The Indian government has recognized the strategic importance of LNG in enhancing the country’s energy security and reducing emissions.

It has implemented policies and initiatives aimed at expanding LNG infrastructure, including the establishment of dedicated LNG bunkering terminals and storage facilities at major ports such as Mumbai, Chennai, and Visakhapatnam. The development of these facilities is supported by investments from both public and private sectors, which are crucial for creating a reliable and efficient LNG supply chain.

Ultra Gas & Energy Ltd (UGEL), an Essar-backed venture, has emerged as India’s largest private LNG autofuel retailer. The company operates six refueling outlets located along key freight corridors in Bhilwara, Anand, Chakan-Pune, Jalna, Toranagallu, and Vallam. Each outlet has a 50-tonne scalable capacity, capable of refueling up to 600 LNG trucks monthly, contributing to a significant reduction of 1 million tonnes of CO₂ emissions annually.

UGEL plans to expand its footprint significantly with a ₹900 crore investment to establish 100 refueling outlets across various states including Gujarat, Tamil Nadu, Maharashtra, Rajasthan, Haryana, Punjab, Karnataka, Odisha. This initiative signals a commitment to a cleaner, smarter logistics system and a greener fuel transition.

The development of LNG bunkering infrastructure is not only reducing emissions but also enhancing energy security and promoting economic growth. By investing in LNG infrastructure, India is positioning itself as a leader in the transition towards cleaner and more sustainable energy sources in the maritime sector.

Drivers

Government Initiatives Driving LNG Growth in India

To achieve this target, the Indian government has set in motion several key initiatives. A significant aspect of this strategy involves the expansion of liquefied natural gas (LNG) import infrastructure. Currently, India boasts an LNG import capacity of 52.7 million metric tons per annum (MMTPA), distributed across eight terminals. The government plans to augment this capacity by 27%, reaching 66.7 MMTPA by 2030, through the addition of two new terminals

In parallel, the government is focusing on enhancing the domestic natural gas infrastructure. This includes the development of city gas distribution (CGD) networks to facilitate the supply of natural gas to households and industries, thereby promoting cleaner fuel usage. Additionally, there is a concerted effort to increase the utilization of natural gas in the transportation sector, particularly in heavy-duty vehicles, as part of the broader push towards cleaner mobility solutions.

These initiatives are underpinned by supportive policies and regulatory frameworks designed to attract investments and ensure the sustainable growth of the natural gas sector. By fostering a conducive environment for the development of LNG infrastructure and promoting the adoption of natural gas across various sectors, the Indian government is laying the groundwork for a more sustainable and resilient energy future.

The government’s proactive approach in expanding LNG infrastructure and promoting natural gas usage is expected to play a crucial role in achieving the 15% target for natural gas in the energy mix by 2030. This strategic shift not only aligns with global sustainability goals but also positions India as a leader in the transition towards a low-carbon energy future.

Restraints

Infrastructure Bottlenecks and Underutilization

This underutilization is primarily due to a combination of factors, including inadequate pipeline infrastructure, regional accessibility issues, and price volatility. For instance, the average utilization of India’s major gas pipelines is estimated to be around 41%, indicating significant unused capacity. Additionally, the expansion of LNG terminals has often been delayed due to logistical challenges and security concerns. A notable example is the delay in the expansion of the Dahej terminal, which was postponed due to cross-border tensions and related security issues.

Furthermore, the high cost of LNG compared to other energy sources has led to a preference for cheaper alternatives, such as coal and renewable energy, in power generation. In India’s power sector, which accounts for 70% of coal consumption, gas-fired generation has fallen to less than 2% of the generation mix due to high LNG costs and limited supplies of cheaper domestic gas . This economic reality poses a significant barrier to the widespread adoption of LNG as a transition fuel.

To address these challenges, the Indian government has initiated several measures, including the development of the “One Nation, One Gas Grid” policy, which aims to create a unified national gas grid to enhance connectivity and facilitate the efficient transportation of natural gas across the country. Additionally, investments are being made to expand pipeline networks and improve the infrastructure at LNG terminals to increase their capacity and efficiency. For example, GAIL (India) is working on expanding the Dabhol LNG terminal’s capacity to 12.5 MMTPA by 2031-32

Opportunity

Expansion of Small-Scale LNG (SSLNG) Infrastructure

The Indian government has recognized the potential of SSLNG and is actively promoting its adoption. According to the Petroleum and Natural Gas Regulatory Board (PNGRB), the expansion of SSLNG infrastructure is essential to meet the growing demand for natural gas in regions lacking pipeline connectivity. The government has introduced policies to facilitate the establishment of LNG retail outlets and mobile dispensing units, thereby enhancing the accessibility of LNG in underserved areas.

The demand for SSLNG is projected to increase significantly by 2030, driven by the industrial sector’s need for cleaner and more cost-effective energy sources. For instance, the Gujarat State Petroleum Corporation (GSPC) has signed a 10-year agreement with TotalEnergies to supply 400,000 metric tons of LNG annually, primarily for industrial customers. This deal underscores the industrial sector’s growing reliance on LNG as a preferred fuel.

Additionally, the expansion of the City Gas Distribution (CGD) network is expected to complement the growth of SSLNG. The government aims to increase the number of cities covered under the CGD network, thereby enhancing the reach of natural gas and creating synergies with SSLNG infrastructure.

Investments in SSLNG infrastructure are also attracting foreign interest. GAIL India Ltd, the country’s largest gas distribution company, is in discussions to secure long-term LNG supplies from the U.S., including potential investments in U.S. LNG projects. This move aligns with India’s strategy to diversify its LNG sources and ensure a stable supply for its growing energy needs.

Regional Insights

Asia Pacific leads with 54.2% market share in 2024, valued at USD 57 billion, driven by robust demand and infrastructure expansion

In 2024, the Asia Pacific region maintained its dominant position in the global LNG market, capturing more than 54.2% of the market share, valued at approximately USD 57 billion. This leadership is primarily attributed to the region’s substantial energy requirements, rapid industrialization, and strategic investments in LNG infrastructure. China and India, as the largest consumers, have significantly increased their LNG imports, with China alone importing over 281.7 million tonnes in 2024, accounting for a substantial portion of the region’s demand. The Philippines also experienced a notable shift, with a 25% rise in gas-fired electricity generation in June 2025, marking its first annual decline in coal-fired electricity generation in 17 years, due to increased LNG usage.

The region’s infrastructure expansion has been pivotal in supporting this growth. Asia Pacific accounted for the largest share of the global LNG terminals market in 2024, driven by the deployment of both onshore and floating LNG terminals. These developments are facilitated by favorable government policies and investments aimed at enhancing energy security and meeting the growing demand for cleaner fuels.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

British Petroleum (BP) is a leading global energy company actively involved in LNG production, trading, and infrastructure development. In 2024, BP continued expanding its LNG portfolio with investments in liquefaction and storage facilities, primarily in the United States and the Middle East. The company’s LNG strategy focuses on meeting global demand through reliable supply chains, operational efficiency, and low-carbon initiatives. BP also emphasizes strategic partnerships and long-term contracts to strengthen its market position, ensuring consistent growth and competitive presence in the global LNG sector.

Chevron Corporation plays a significant role in the LNG market with extensive upstream and midstream operations. In 2024, Chevron’s LNG production was supported by major projects in Australia, the U.S., and Africa, contributing to global energy security. The company focuses on optimizing liquefaction plants, expanding storage capacity, and enhancing transportation networks. Chevron’s strategic investments in LNG aim to address rising global demand while implementing sustainability initiatives and reducing emissions. Partnerships and long-term supply agreements further strengthen Chevron’s competitive advantage in the LNG industry.

Eni SpA is an Italian energy company actively engaged in LNG exploration, production, and distribution across Europe, Africa, and the Middle East. In 2024, Eni expanded its LNG portfolio by investing in liquefaction and regasification projects while enhancing supply chain efficiency. The company emphasizes low-carbon initiatives, operational excellence, and strategic partnerships to strengthen its global LNG presence. Eni’s LNG operations support industrial and power generation sectors while contributing to energy security and sustainability, positioning the company as a competitive player in the international LNG market.

Top Key Players Outlook

- British Petroleum (BP) p.l.c.

- Chevron Corporation

- China Petroleum & Chemical Corporation

- Eni SpA

- Equinor ASA

- Exxon Mobil Corporation

- Gazprom Energy

- PetroChina Company Limited

- Royal Dutch Shell PLC

- Total S.A.

Recent Industry Developments

In November 2024 China Petroleum & Chemical Corporation, Sinopec signed a 15-year agreement with TotalEnergies for the delivery of 2 million tonnes of LNG per year, commencing in 2028. This deal underscores Sinopec’s commitment to securing stable LNG supplies to meet China’s growing energy demands.

In 2024, Chevron entered into a 20-year agreement with Energy Transfer to purchase 2 million tonnes per annum (Mtpa) of LNG from the Lake Charles LNG export terminal in Louisiana, USA. This deal was later expanded by an additional 1 Mtpa, bringing the total contracted volume to 3 Mtpa.

Report Scope

Report Features Description Market Value (2024) USD {{val1}} Forecast Revenue (2034) USD {{val2}} CAGR (2025-2034) {{cagr}}% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Infrastructure Type (LNG Liquefaction Plants, LNG Regasification Facilities, LNG Shipping Fleet), By Scale (Large-Scale (Above 5 mtpa), Mid-Scale (1 to 5 mtpa), Small-Scale (Below 1 mtpa)), By End-Use (Power Generation, Industrial and Manufacturing, Residential and Commercial, Transportation, Others), By Location (Onshore, Offshore) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape British Petroleum (BP) p.l.c., Chevron Corporation, China Petroleum & Chemical Corporation, Eni SpA, Equinor ASA, Exxon Mobil Corporation, Gazprom Energy, PetroChina Company Limited, Royal Dutch Shell PLC, Total S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- British Petroleum (BP) p.l.c.

- Chevron Corporation

- China Petroleum & Chemical Corporation

- Eni SpA

- Equinor ASA

- Exxon Mobil Corporation

- Gazprom Energy

- PetroChina Company Limited

- Royal Dutch Shell PLC

- Total S.A.