Global Liquid Dietary Supplements Market Size, Share Analysis Report By Ingredient Type (Vitamins and Minerals, Proteins and Amino Acids, Omega Fatty Acids, Probiotics and Prebiotics, Others), By Type ( OTC, Prescribed), By Application (Energy and Weight Management, Sports Nutrition, Bone and Joint Health, Cardiac Health, Anti-aging, Others, By End User (Adults, Geriatric, Children, Infants), By Distribution Channel (Offline, Online) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155502

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

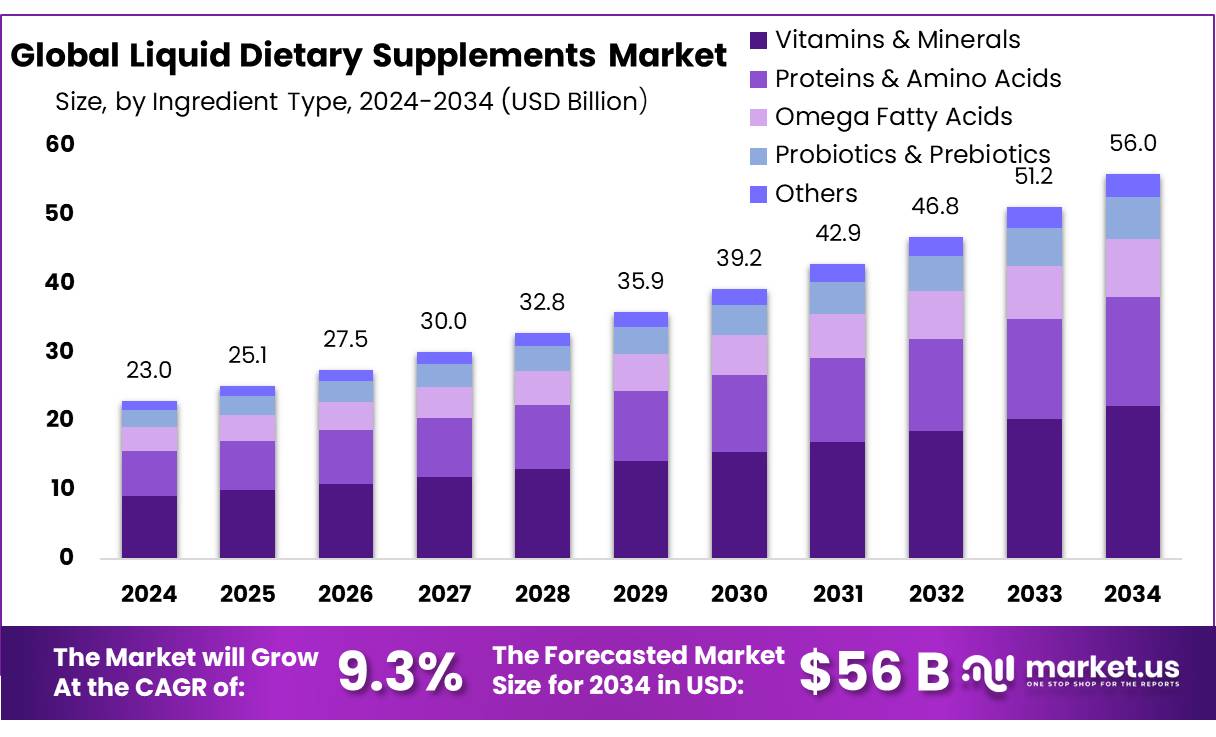

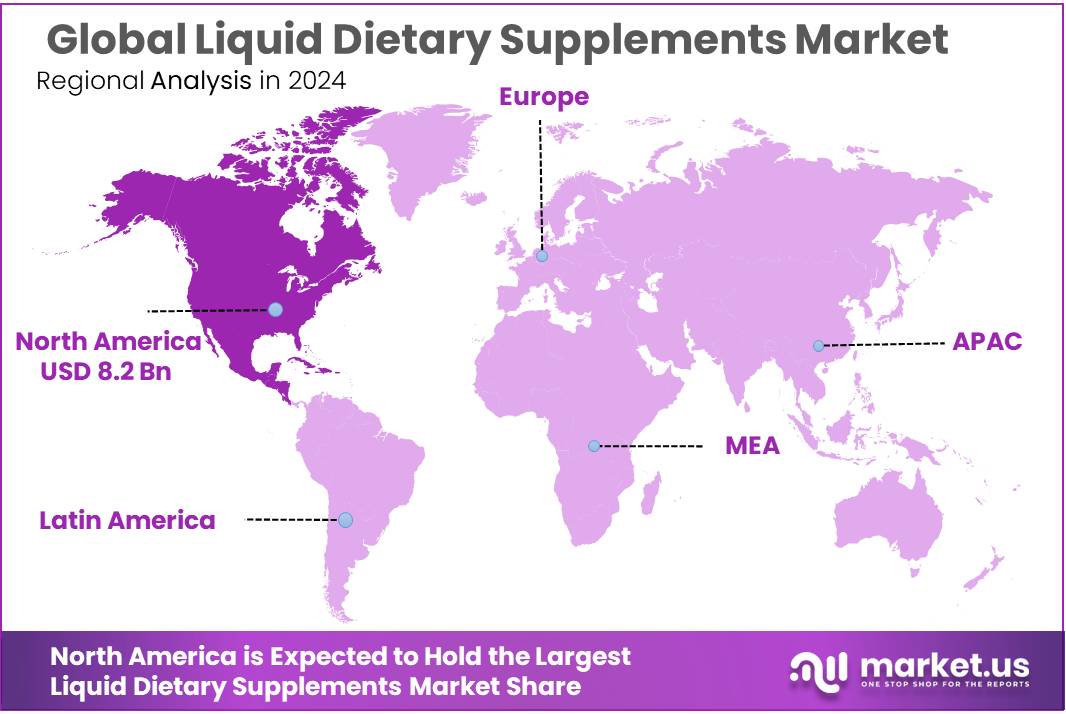

The Global Liquid Dietary Supplements Market size is expected to be worth around USD 56.0 Billion by 2034, from USD 23.0 Billion in 2024, growing at a CAGR of 9.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.8% share, holding USD 8.2 Billion revenue.

Liquid dietary supplement concentrates—formulated in fluid form to deliver nutrients such as vitamins, minerals, botanicals, and omega‑3 fatty acids—have emerged as a key segment within the broader nutritional supplements sector. Focused on ease of administration and enhanced absorption, these concentrates cater especially to populations with swallowing difficulties, busy lifestyles, or specific health‑targeted needs.

While comprehensive sector‑specific government figures are limited, we can situate their context within the overall dietary supplements industry in the United States, over half of adults consume supplements—57.6 % used any dietary supplement in the past 30 days during 2017–2018, with usage rising sharply with age and reaching 80.2% among women aged 60 and over

For instance, the ICDS provides supplementary nutrition to children under the age of six, while the PMGKAY provides free food grains to approximately 81.35 crore beneficiaries. Government initiatives play a significant role in promoting the nutraceutical sector in India. The Pradhan Mantri Bharatiya Janaushadhi Pariyojana (PMBJP) aims to provide quality generic medicines, including Ayurvedic products, at affordable prices through over 9,000 outlets across the country.

Government initiatives play a crucial role in supporting the industry. Under the National AYUSH Mission, the Government of India provides subsidies ranging from 30% to 75% for the cultivation of nearly 140 types of medicinal and herbal plants, promoting the production and use of herbal supplements. Furthermore, programs like the Community-based Management of Acute Malnutrition (CMAM) and Village Health Sanitation Nutrition Day (VHSND) aim to address nutritional deficiencies at the grassroots level, indicating a growing focus on accessible and effective nutritional solutions.

The Food Safety and Standards Authority of India (FSSAI) regulates the standards for health supplements and nutraceuticals, ensuring their safety and efficacy. The FSSAI has issued guidelines for the approval of nutraceuticals, covering various categories such as health supplements, foods for special dietary use, and foods for special medical purposes.

Key Takeaways

- Liquid Dietary Supplements Market size is expected to be worth around USD 56.0 Billion by 2034, from USD 23.0 Billion in 2024, growing at a CAGR of 9.3%.

- Vitamins & Minerals held a dominant market position, capturing more than a 39.7% share of the liquid dietary supplements.

- OTC held a dominant market position, capturing more than a 78.4% share of the liquid dietary supplements.

- Energy & Weight Management held a dominant market position, capturing more than a 36.9% share of the liquid dietary supplements.

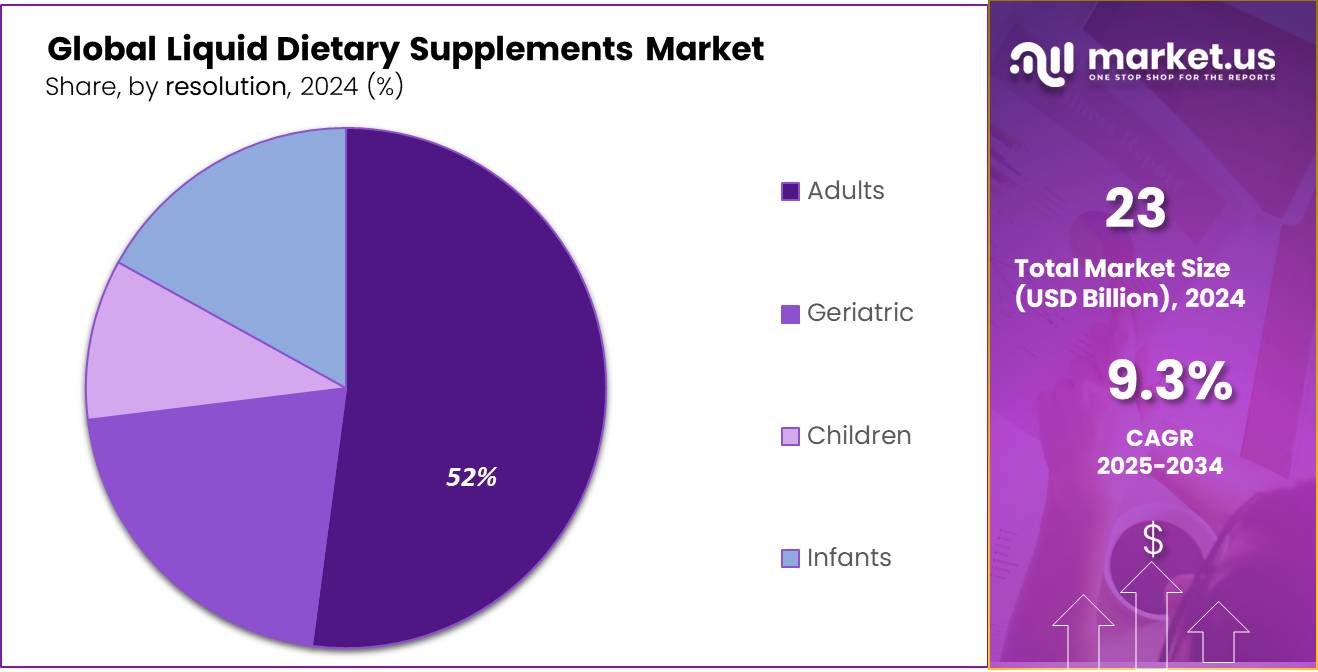

- Adults held a dominant market position, capturing more than a 52.2% share of the liquid dietary supplements.

- Offline held a dominant market position, capturing more than a 69.1% share of the liquid dietary supplements.

- North America stood out as the leading region for liquid dietary supplements, accounting for a commanding 35.8% share, which translates to a market value of approximately USD 8.2 billion.

By Ingredient Type Analysis

Vitamins & Minerals are leading the pack with 39.7% share in 2024

In 2024, Vitamins & Minerals held a dominant market position, capturing more than a 39.7% share of the liquid dietary supplements segment. This clearly shows how much consumers rely on these essential nutrients—people are choosing vitamins and minerals more than any other ingredients because they are simple, easy to understand, and trusted for daily health. The bright colours, familiar names, and long history of vitamins and minerals make them both comforting and credible for anyone trying to stay healthy, whether that’s immune support, energy, or just general well‑being.

Year by year, this ingredient segment keeps its strong footing. By the start of 2025, the demand remains steady, and there’s a steady belief among consumers that vitamins and minerals are the foundation of good nutrition. Even in a market with many new and trendy ingredient types popping up—like herbal extracts, proteins, and omega blends—vitamins and minerals continue to hold onto that leading spot firmly. It’s a go‑to for manufacturers and formulators, too, who appreciate how versatile and reliable these ingredients are in liquid concentrate formats.

By Type Analysis

OTC continues to lead the way with a 78.4% share in 2024

In 2024, OTC held a dominant market position, capturing more than a 78.4% share of the liquid dietary supplements segment. That kind of lead tells you something—it means most people are turning to over-the-counter products for their daily boost, not prescription options or niche alternatives. There’s something reassuring about picking up a well-known OTC supplement off the shelf, whether it’s vitamins, minerals, or tailored blends, and trusting it to support health without having to see a doctor.

Heading into 2025, OTC’s strong position remains rock-solid. People value how accessible, familiar, and convenient OTC products are—no hoops to jump through, no prescriptions needed, just instant availability. It’s simple: when you want a daily health aid, you head straight to the OTC section. Manufacturers like this it too, since OTC supplements are easier to design, market, and distribute compared to more regulated prescription-only lines.

By Application Analysis

Energy & Weight Management takes the lead with a strong 36.9% share in 2024

In 2024, Energy & Weight Management held a dominant market position, capturing more than a 36.9% share of the liquid dietary supplements segment. That tells us that people were really focused on two things—feeling alert and staying in shape—and those needs drove their choices in supplements. Energy and weight support—whether that’s a quick pick-me-up in the morning or something to help manage hunger after a long day—clearly resonated with consumers.

Heading into 2025, this area continues to hold consumers’ interest. The same motivation to feel fit and energized remains strong, especially as life gets busier and people juggle work, family, and health goals. Liquid supplements in this category feel like a practical solution—easy to take, fast-acting, and flexible enough to fit into a mug, smoothie, or on-the-go routine.

By End User Analysis

Adults are at the heart of the market with a strong 52.2% share in 2024

In 2024, Adults held a dominant market position, capturing more than a 52.2% share of the liquid dietary supplements segment. That’s a clear sign—most of the demand is driven by grown-ups choosing supplements to help with daily vitality, general wellness, or targeted support like immunity, digestion, or stress relief. After all, adults often juggle work, family, and fitness, making convenient forms like liquid supplements a go-to for quick and effective nutrition top-ups.

Moving into 2025, adults remain the core users of these supplements. They appreciate how simple it is to add a dose of vitamins or botanicals into their routine—whether that’s at home in the morning, at the gym, or even in the office. The practicality and fast absorption of liquid formats align well with adult lifestyles that value efficiency and immediacy.

By Distribution Channel Analysis

Offline sales still rule the scene with a solid 69.1% share in 2024

In 2024, Offline held a dominant market position, capturing more than a 69.1% share of the liquid dietary supplements segment. That says a lot—people still trust walking into a store, picking up a bottle they can see and touch, and asking store staff any last-minute questions. There’s something comforting about browsing the aisles and seeing labels up close before making a choice.

Heading into 2025, the offline channel remains the front-runner. Shoppers continue to appreciate brick-and-mortar stores for the hands-on experience and instant gratification: grab your supplement and go, no waiting for delivery. Pharmacies, health stores, and supermarkets also offer a sense of credibility—there’s a psychological ease in buying from a place you know.

Key Market Segments

By Ingredient Type

- Vitamins & Minerals

- Proteins & Amino Acids

- Omega Fatty Acids

- Probiotics & Prebiotics

- Others

By Type

- OTC

- Prescribed

By Application

- Energy & Weight Management

- Sports Nutrition

- Bone & Joint Health

- Cardiac Health

- Anti-aging

- Others

By End User

- Adults

- Geriatric

- Children

- Infants

By Distribution Channel

- Offline

- Online

Emerging Trends

Surge in Plant-Based Liquid Supplements

One of the most notable trends within this sector is the rising popularity of plant-based liquid supplements. Consumers are increasingly seeking natural, vegan-friendly alternatives to traditional supplements, leading to a surge in products featuring botanical ingredients like turmeric, ginger, and moringa. These plant-based supplements are favored for their perceived health benefits, such as anti-inflammatory properties and antioxidant effects, aligning with the growing consumer preference for clean, sustainable, and ethical products.

This shift is not only consumer-driven but is also supported by industry innovations. Companies are investing in research and development to create plant-based formulations that offer enhanced bioavailability and efficacy. For instance, advancements in extraction technologies have improved the potency and absorption rates of plant-based nutrients, making them more appealing to health-conscious consumers.

Government initiatives are also playing a role in this trend. Regulatory bodies in various countries are establishing guidelines to ensure the safety and quality of plant-based supplements. These regulations help build consumer trust and encourage the growth of the plant-based supplement market.

The convergence of consumer demand, industry innovation, and supportive regulations is propelling the plant-based liquid supplement market forward. As more individuals seek natural ways to support their health, the availability and variety of plant-based liquid supplements are expected to continue expanding, offering consumers more choices to meet their nutritional needs.

Drivers

Government Initiatives Fueling Growth in Liquid Dietary Supplements

One of the key drivers is the Pradhan Mantri Bharatiya Janaushadhi Pariyojana (PMBJP), a government scheme launched to provide quality generic medicines at affordable prices. As of 2024, over 10,000 Jan Aushadhi Kendras have been established across India, offering a wide range of medicines and supplements, including liquid formulations. This initiative has not only made healthcare products more accessible but also increased public awareness about the importance of preventive healthcare.

Additionally, the Food Safety and Standards Authority of India (FSSAI) plays a crucial role in regulating dietary supplements. In August 2024, FSSAI re-operationalized certain provisions of the Food Safety and Standards (Health Supplements, Nutraceuticals, Food for Special Dietary Use, and Food for Special Medical Purpose) Regulations, 2022. These regulations, effective from July 1, 2024, aim to ensure the safety, quality, and efficacy of dietary supplements, thereby boosting consumer confidence in liquid dietary products.

Furthermore, the government’s focus on health awareness campaigns has contributed to the rising demand for dietary supplements. For instance, the National Institute of Nutrition (NIN), in collaboration with FSSAI, has set dietary intake limits to combat lifestyle-related diseases. Such initiatives have educated the public on the importance of balanced nutrition, leading to increased consumption of supplements, including liquid forms.

These government-led efforts have created a conducive environment for the growth of the liquid dietary supplements market in India. By enhancing accessibility, ensuring product quality, and promoting health awareness, the government has significantly contributed to the market’s expansion and will likely continue to do so in the coming years.

Restraints

Regulatory Restrictions Impacting Liquid Dietary Supplements

The liquid dietary supplements market in India faces significant challenges due to stringent regulatory frameworks imposed by the Food Safety and Standards Authority of India (FSSAI). These regulations, while ensuring consumer safety, have inadvertently created barriers for manufacturers and limited product innovation.

One of the primary regulatory constraints is the prohibition of certain ingredients in dietary supplements. FSSAI has banned the use of 14 ingredients, including D-ribose, ipriflavone, and polypodium leucotomos, due to concerns over their safety and efficacy. This restriction limits the formulation options available to manufacturers and may hinder the development of innovative products that cater to evolving consumer needs.

Furthermore, the FSSAI’s stringent labeling and advertising regulations impose additional burdens on manufacturers. Products are required to display specific health claims and nutritional information, which must be substantiated by scientific evidence. This requirement can be resource-intensive and may delay product launches, affecting the competitiveness of companies in the market.

Additionally, the approval process for new ingredients and formulations is rigorous and time-consuming. Manufacturers must provide comprehensive safety and efficacy data, which can be costly and may discourage smaller companies from entering the market . This regulatory environment can stifle innovation and limit consumer access to a diverse range of dietary supplement products.

Opportunity

Government Support for Herbal Supplement Innovation

The Indian government’s initiatives are significantly boosting the growth of liquid dietary supplements, especially those derived from traditional herbs and Ayurveda. These efforts are not only enhancing market expansion but also promoting the integration of traditional knowledge with modern healthcare practices.

In 2021, the Ministry of AYUSH launched the National AYUSH Mission (NAM), a centrally sponsored scheme aimed at promoting the cultivation of medicinal plants. Under this initiative, subsidies of 30%, 50%, and 75% are provided to farmers for cultivating nearly 140 types of medicinal and herbal plants. This support is instrumental in ensuring a steady supply of high-quality raw materials for the production of herbal supplements.

Additionally, the government’s focus on research and development in the field of marine biotechnology has led to the development of innovative nutraceutical products. The Central Marine Fisheries Research Institute (CMFRI) has successfully commercialized products like Cadalmin™, derived from marine algae, which are now being used in dietary supplements.

These government-backed initiatives are creating a conducive environment for the growth of liquid dietary supplements in India, fostering innovation, and ensuring the availability of quality herbal products for consumers.

Regional Insights

North America with 35.8% Market Share (USD 8.2 Bn) in 2024

In 2024, North America stood out as the leading region for liquid dietary supplements, accounting for a commanding 35.8% share, which translates to a market value of approximately USD 8.2 billion. This dominance highlights the region’s mature consumer base, high health consciousness, and strong retail infrastructure that includes pharmacies, specialty stores, and major supermarkets.

The United States is clearly the powerhouse behind this performance, holding the lion’s share of North America’s liquid supplements market. Liquid formats—whether for vitamins, botanicals, or energy blends—are especially popular among adults and older consumers who value ease of use and rapid absorption. This partial adoption is aligned with demographic shifts and a growing emphasis on preventive nutrition among health-conscious individuals.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Amway’s flagship Nutrilite brand is one of the oldest and most trusted names in vitamins and dietary supplements. Celebrating its 90th anniversary in 2024, Nutrilite uniquely grows, harvests, and processes its own plants on organic farms across the Americas—making it the world’s number-one selling vitamin and supplement brand.

Herbalife Nutrition leverages over 40 years of experience in health and wellness. Its Formula 1 shake is a signature product, consumed daily by millions for its balanced mix of protein, fiber, vitamins, and minerals.

Abbott is a scientifically-driven healthcare company with a strong nutrition portfolio. It produces clinically developed liquid nutritional products—from infant formulas to medically tailored modular nutrition like LiquiProtein®—designed for growth, recovery, and specialized clinical needs.

Top Key Players Outlook

- Amway

- Nestlé

- Herbalife Nutrition

- Nature’s Bounty

- Abbott Laboratories

- DuoLife S.A.

- Pfizer Inc.

- BASF

- Arkopharma

- Bayer

Recent Industry Developments

In 2024, Herbalife Nutrition achieved net sales of USD 5.0 billion, a slight drop of 1.4% compared to 2023, though on a constant currency basis it still managed a modest 1.2% growth—a clear nod to underlying steady demand.

In 2024, Nestlé posted organic sales growth of 2.2% across its business, with real internal growth (RIG)—the best measure of true consumer demand—coming in at 0.8%.

Report Scope

Report Features Description Market Value (2024) USD 23.0 Bn Forecast Revenue (2034) USD 56.0 Bn CAGR (2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Ingredient Type (Vitamins and Minerals, Proteins and Amino Acids, Omega Fatty Acids, Probiotics and Prebiotics, Others), By Type ( OTC, Prescribed), By Application (Energy and Weight Management, Sports Nutrition, Bone and Joint Health, Cardiac Health, Anti-aging, Others, By End User (Adults, Geriatric, Children, Infants), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amway, Nestlé, Herbalife Nutrition, Nature’s Bounty, Abbott Laboratories, DuoLife S.A., Pfizer Inc., BASF, Arkopharma, Bayer Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Liquid Dietary Supplements MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Liquid Dietary Supplements MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amway

- Nestlé

- Herbalife Nutrition

- Nature's Bounty

- Abbott Laboratories

- DuoLife S.A.

- Pfizer Inc.

- BASF

- Arkopharma

- Bayer