Global Lemonade Market Size, Share Analysis Report By Product Type (Cloudy Lemonade, Pink Lemonade, Clear Lemonade), By Category (Frozen Lemonade Concentrate, Fruit Lemonade Concentrate, Others), By Type (Alcoholic, Non-Alcoholic, Powder Mix), By Packaging Type (Bottles, Cans, Cartons, Pouches, Others), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Store, Convenience Stores, Online Retail, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144346

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

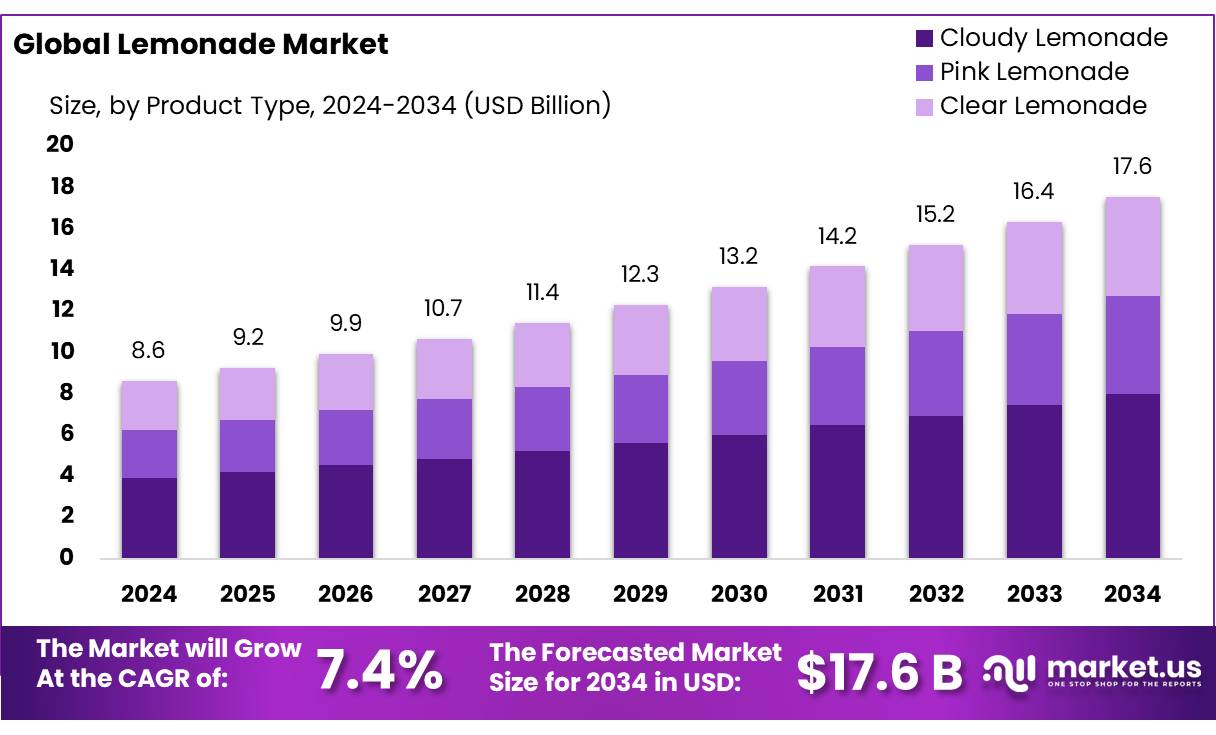

The Global Lemonade Market size is expected to be worth around USD 17.6 Bn by 2034, from USD 8.6 Bn in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034.

Lemonade, a perennial favorite among beverages, has evolved significantly from its traditional sweet and tart origins. Today’s market encompasses a wide range of variations including diet, organic, and flavored options, catering to an increasingly health-conscious consumer base. This beverage sector combines the appeal of a refreshing drink with the growing demand for healthier drink choices.

The global lemonade market has experienced steady growth, propelled by major beverage companies such as The Coca-Cola Company and PepsiCo. These industry leaders have expanded their product lines to include organic and reduced-sugar versions of lemonade, responding to consumer demands for healthier options.

For example, The Coca-Cola Company reported a 3% increase in volume growth for its non-alcoholic beverage segment, partly fueled by the popularity of healthier drink options like lemonade. Additionally, smaller niche brands are gaining market share by offering artisanal and locally-sourced varieties, which appeal to consumers looking for premium, authentic experiences.

The primary drivers of the lemonade market include health and wellness trends that emphasize low sugar and organic ingredients. The rise in consumer awareness regarding the adverse effects of artificial sweeteners and high fructose corn syrup has significantly influenced product development and marketing strategies within the industry. Furthermore, the versatility of lemonade, easily combined with other flavors and ingredients, makes it a popular base for innovation in the beverage sector.

Government regulations regarding labeling and sugar content also play a significant role in shaping the industry. For instance, the U.S. Food and Drug Administration (FDA) has implemented stricter labeling requirements that compel manufacturers to disclose the sugar content in beverages more clearly. This regulatory environment has driven companies to reformulate their products to meet both the legal standards and the preferences of health-aware consumers.

Key Takeaways

- Lemonade Market size is expected to be worth around USD 17.6 Bn by 2034, from USD 8.6 Bn in 2024, growing at a CAGR of 7.4%.

- Cloudy Lemonade held a dominant market position, capturing more than a 45.60% share of the global lemonade market.

- Fruit Lemonade Concentrate held a dominant market position, capturing more than a 38.30% share.

- Non-Alcoholic held a dominant market position, capturing more than a 47.20% share of the global lemonade market.

- Bottles held a dominant market position, capturing more than a 38.20% share in the global lemonade market.

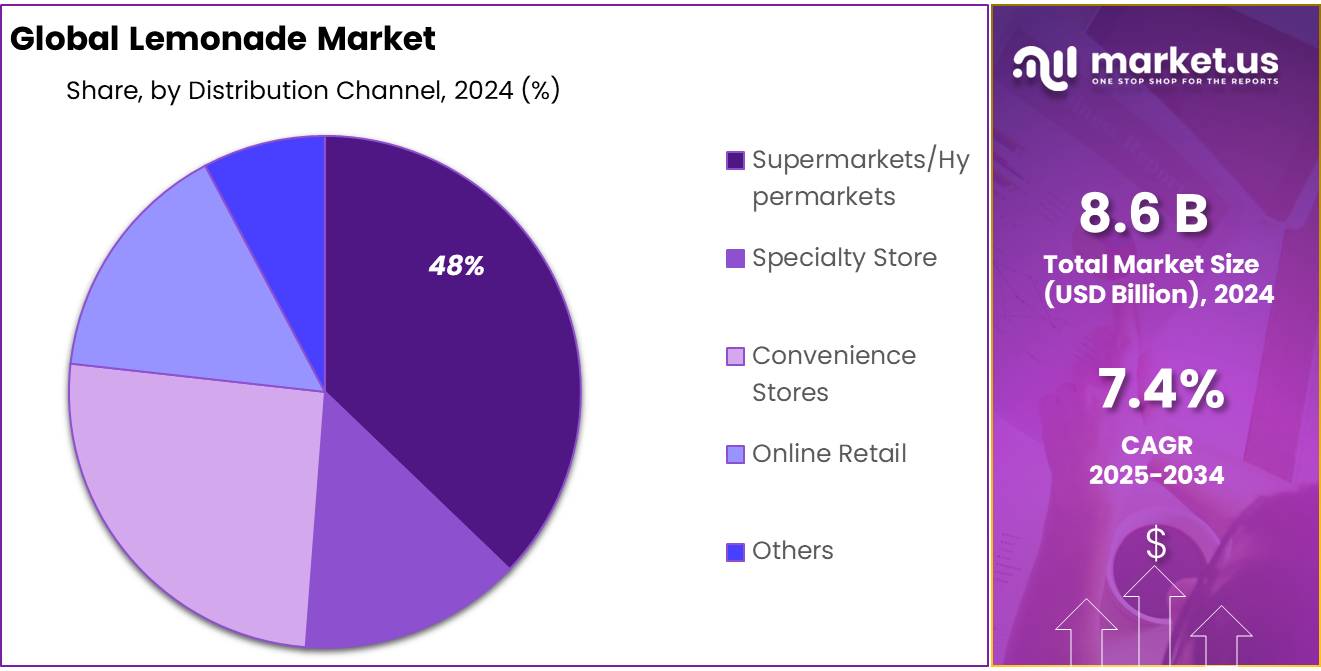

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 48.20% share.

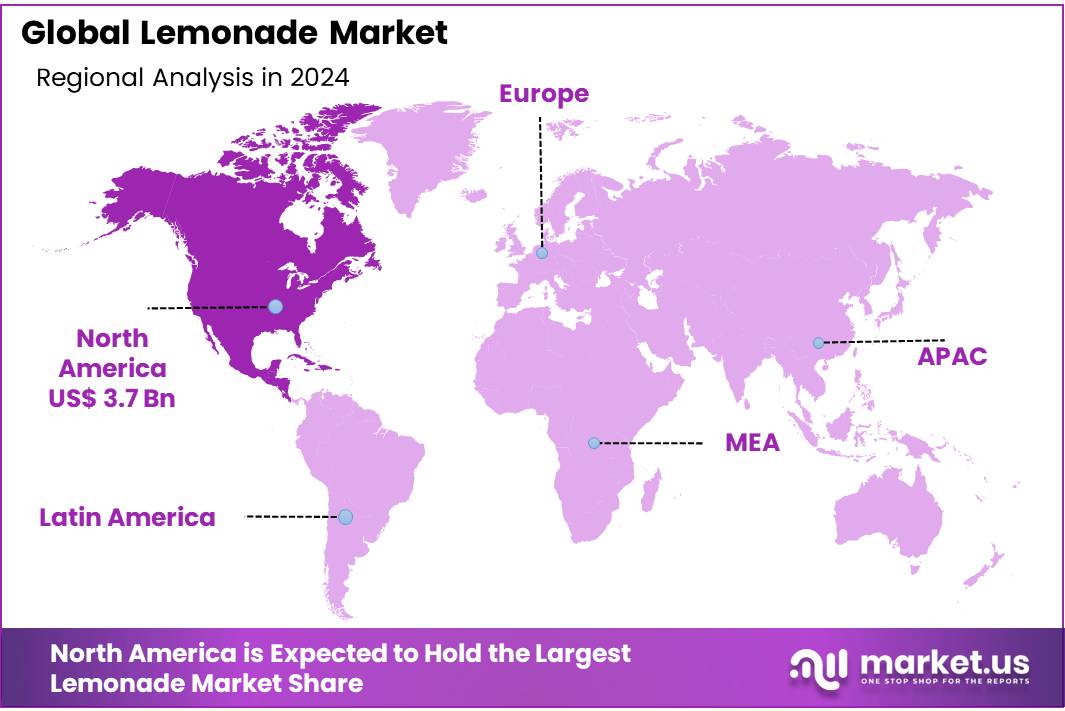

- North American lemonade market firmly held its ground as the dominating region, capturing an impressive 43.60% share, with sales reaching approximately USD 3.7 billion.

Analysts’ Viewpoint

From an investment perspective, the lemonade market offers intriguing opportunities, particularly as consumer preferences shift towards healthier beverage choices. Lemonade, known for its refreshing taste and simple ingredient list, has seen a revival with the introduction of organic and low-sugar variants, catering to health-conscious consumers. The market is also exploring innovative flavors and functional ingredients like CBD and probiotics, which align with current wellness trends. This adaptability makes lemonade a strong contender in the competitive beverage industry, potentially offering robust returns to investors aware of these evolving consumer tastes.

However, entering the lemonade market comes with its own set of risks. The beverage industry is highly competitive, and standing out requires strong branding, effective marketing, and a keen understanding of consumer preferences. Additionally, fluctuations in the cost of ingredients, particularly in regions dependent on imported lemons, can affect profit margins. The regulatory environment also presents challenges, as changes in food safety standards, labeling requirements, and health claim regulations can impact production and marketing strategies.

From a technological standpoint, advancements in production and preservation techniques have helped maintain product quality and extend shelf life, which are crucial in the beverage industry. Moreover, the increasing use of e-commerce and digital marketing offers new avenues for brand promotion and customer engagement. For investors, staying updated with technological trends, regulatory changes, and consumer insights is vital for making informed decisions and capturing market share in the evolving lemonade sector.

By Product Type

Cloudy Lemonade leads with 45.6% in 2024, driven by its refreshing appeal and traditional flavor profile

In 2024, Cloudy Lemonade held a dominant market position, capturing more than a 45.60% share of the global lemonade market. Its strong performance is largely driven by consumer preference for traditional, homemade-style beverages that feel authentic and natural. The tangy yet smooth flavor profile of cloudy lemonade, often associated with freshness and real lemon content, continues to attract health-conscious individuals who are shifting away from overly sweetened or artificial drinks.

Additionally, its popularity has surged in cafes, organic food chains, and boutique beverage brands that highlight its handcrafted essence. Moving into 2025, the demand for cloudy lemonade is expected to rise steadily, particularly in Europe and North America, where clean-label products and artisanal beverages are trending. Brands are also experimenting with variations like sparkling cloudy lemonade and low-sugar options, which are expanding its appeal among younger, trend-aware consumers.

By Category

Fruit Lemonade Concentrate leads with 38.3% in 2024, driven by ease of use and long shelf life.

In 2024, Fruit Lemonade Concentrate held a dominant market position, capturing more than a 38.30% share of the overall lemonade market. This category continues to gain traction due to its convenience, affordability, and longer shelf life compared to ready-to-drink options. Consumers, especially in households and foodservice sectors, prefer concentrates for their flexibility in mixing and ability to serve large quantities. Its wide use in quick-serve restaurants, cafes, and school canteens has further boosted its presence.

In 2025, the segment is expected to maintain steady demand as brands innovate with natural sweeteners, fortified ingredients, and tropical fruit blends like mango-lemon or berry-lemon combinations. This product’s adaptability in both home and commercial settings continues to strengthen its market hold across North America, Asia Pacific, and parts of Europe.

By Type

Non-Alcoholic Lemonade dominates with 47.2% in 2024, favored for its refreshing taste and wide appeal.

In 2024, Non-Alcoholic held a dominant market position, capturing more than a 47.20% share of the global lemonade market. This type continues to be a top choice among consumers of all age groups, mainly because it fits into both casual and health-focused lifestyles. Non-alcoholic lemonade is especially popular during warmer months and is often chosen as a natural thirst-quencher without the effects of alcohol.

It is also widely consumed in schools, offices, cafes, and family settings, making it a year-round staple. By 2025, the segment is set to grow further as new variants like low-calorie, vitamin-infused, and sparkling versions attract younger consumers and wellness seekers. The rising trend of alcohol-free socializing is also giving this segment a noticeable push, especially in North America and parts of Europe.

By Packaging Type

Bottled Lemonade leads with 38.2% in 2024, thanks to its grab-and-go convenience and brand visibility.

In 2024, Bottles held a dominant market position, capturing more than a 38.20% share in the global lemonade market. The bottled format remains a consumer favorite due to its portability, longer shelf life, and ease of storage. Whether at a supermarket, gas station, or café, bottled lemonade is readily available and visually appealing, making it a go-to option for on-the-move consumers. Its transparent packaging often highlights freshness and flavor, encouraging impulse purchases.

By 2025, bottled lemonade is expected to retain its lead as brands focus on eco-friendly bottles, premium glass variants, and innovative label designs. The format also supports small and craft lemonade producers, allowing them to market unique flavors in single-serve or family-sized packs, keeping this category strong across urban and semi-urban markets.

By Distribution Channel

Supermarkets/Hypermarkets top the charts with 48.2% in 2024, driven by bulk deals and easy availability.

In 2024, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 48.20% share in the global lemonade market. These retail outlets continue to lead the distribution scene because they offer wide product variety, attractive discounts, and convenient access under one roof. Consumers often prefer buying lemonade here due to visible shelf displays, in-store promotions, and the ability to compare multiple brands and packaging types.

Family-sized and multi-pack options also make supermarkets a preferred choice for households. Looking ahead to 2025, this channel is expected to remain strong as retailers expand chilled beverage sections, introduce local lemonade brands, and invest in private-label products. The rise in footfall across supermarkets in urban and suburban areas further supports the dominance of this distribution format.

Key Market Segments

By Product Type

- Cloudy Lemonade

- Pink Lemonade

- Clear Lemonade

By Category

- Frozen Lemonade Concentrate

- Fruit Lemonade Concentrate

- Others

By Type

- Alcoholic

- Non-Alcoholic

- Powder Mix

By Packaging Type

- Bottles

- Cans

- Cartons

- Pouches

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Store

- Convenience Stores

- Online Retail

- Others

Drivers

Increased Health Awareness Boosts Lemonade Sales

One major driving factor for the growing popularity of lemonade is the increased health awareness among consumers. As people become more conscious of the need for hydration and the risks associated with sugary drinks, lemonade, particularly those made with natural or organic ingredients, has seen a surge in demand.

According to the World Health Organization (WHO), reducing intake of free sugars helps to reduce the risk of noncommunicable diseases like heart disease and diabetes. This health guideline has encouraged consumers to seek out healthier beverage options. Lemonade, often marketed as a better alternative to soft drinks due to its lower sugar content and the presence of vitamin C, fits well within this healthier lifestyle choice. WHO suggests that individuals should reduce their sugar intake to below 10% of their total energy intake, further pushing the demand for healthier drink options like lemonade .

Additionally, government initiatives promoting healthier lifestyles have also played a significant role. For instance, the U.S. Department of Agriculture’s (USDA) guidelines recommend increasing the consumption of fruits and vegetables. These guidelines have been effectively communicated through various health campaigns, indirectly benefiting the lemonade market as lemon is a key ingredient .

Moreover, the increasing availability of lemonade varieties, such as those infused with other natural fruit juices or botanical ingredients, offers consumers a range of healthier choices that align with governmental dietary recommendations. These variants not only cater to the health-conscious market but also appeal to a broader audience looking for diversity in flavor without compromising health benefits.

Restraints

Sugar Content Concerns Dampen Lemonade Market Growth

One significant restraining factor in the lemonade market is the ongoing concern about sugar content in beverages. Despite lemonade being perceived as a healthier alternative to sodas, many commercial lemonade products still contain high levels of sugar, which can detract health-conscious consumers.

The American Heart Association (AHA) recommends that women should consume no more than 25 grams of added sugar per day, and men no more than 36 grams. However, a single serving of commercially produced lemonade can contain close to or even exceed these limits, posing a challenge for consumption among those monitoring their sugar intake. This has been highlighted in various health reports that caution against the overconsumption of sugary drinks due to their link with obesity, type 2 diabetes, and heart disease.

Governmental policies have also started to reflect these health concerns, with initiatives like sugar taxes being implemented in several countries to reduce the consumption of sugary drinks. For example, the UK introduced a Soft Drinks Industry Levy in 2018, which charges manufacturers more if their products exceed certain sugar thresholds. Such policies directly influence consumer behavior and can lead to decreased sales of traditional, sugar-rich lemonade products.

To counteract these challenges, lemonade manufacturers are increasingly innovating with low-sugar and sugar-free alternatives, using natural sweeteners like stevia to appeal to health-conscious consumers. Despite these efforts, the shadow of high sugar content continues to loom over the sector, potentially restraining market growth as consumer awareness and regulatory pressures increase.

Opportunity

Expansion into Emerging Markets Offers New Growth Avenues for Lemonade

A significant growth opportunity for the lemonade market lies in its expansion into emerging markets. As global consumer preferences shift towards healthier and more natural beverages, countries in Asia, Africa, and South America present new arenas for market penetration. The economic growth in these regions has led to an increase in disposable income and a growing middle class, which are more inclined towards experimenting with diverse food and beverage products that were previously inaccessible.

According to the United Nations Department of Economic and Social Affairs, the global middle class is expected to reach 5.3 billion by 2030, with the majority of this growth occurring in Asia. This burgeoning demographic is crucial for the lemonade market as these consumers are typically more health-conscious and open to trying new products. Moreover, the hot climates prevalent in many of these countries make lemonade, known for its refreshing qualities, an attractive drink option.

Local governments are also supporting this shift by implementing policies that promote food safety and encourage the consumption of healthier beverage alternatives. For instance, India’s Food Safety and Standards Authority has been actively promoting food safety and healthier eating practices through various initiatives and regulations, which indirectly benefits the market for beverages like lemonade that can be positioned as healthy.

To capitalize on these opportunities, lemonade manufacturers are advised to tailor their products to meet local tastes and preferences while emphasizing the natural and healthful aspects of their offerings. Establishing local partnerships and sourcing ingredients from regional suppliers can also help to optimize production costs and enhance the appeal of lemonade as a locally produced, health-oriented beverage.

Trends

Craft and Artisanal Lemonade Variants Gain Popularity

One of the latest trends in the lemonade market is the rise of craft and artisanal lemonade variants. These products, often handmade or produced in small batches with high-quality, natural ingredients, cater to the growing consumer demand for authenticity and transparency in food and beverage products. Unlike traditional lemonades, these craft versions frequently incorporate unique flavors derived from herbs, spices, and exotic fruits, differentiating them from mass-produced options.

This trend is supported by statistics from the Food and Agriculture Organization (FAO), which indicate a global increase in the consumption of natural beverages and a decline in demand for drinks containing artificial flavors and high sugar levels. The FAO has noted that consumers are increasingly prioritizing health and wellness, which includes opting for beverages that offer nutritional benefits while still satisfying taste preferences.

Moreover, government initiatives like the U.S. Department of Agriculture’s (USDA) National Organic Program have facilitated the growth of the organic beverage market by setting and enforcing consistent organic standards. This government backing helps assure consumers about the quality and origin of the ingredients used in organic craft lemonade, thereby boosting consumer confidence and driving sales.

Craft lemonade makers are leveraging these trends by marketing their beverages as not only refreshing but also as a healthier alternative that aligns with lifestyle choices centered around health and sustainability. Additionally, the visual appeal of these artisanal drinks, often served in stylish, eco-friendly packaging, enhances their allure, particularly among millennials and Generation Z consumers who value both aesthetics and ethical production practices.

Regional Analysis

In 2024, the North American lemonade market firmly held its ground as the dominating region, capturing an impressive 43.60% share, with sales reaching approximately USD 3.7 billion. This commanding presence can be attributed to a combination of factors that resonate well with consumer preferences and regional beverage consumption trends.

North America’s strong performance in the lemonade market is largely driven by the United States, where lemonade is considered a staple beverage, particularly during the warm summer months. The region’s enduring preference for lemonade is bolstered by the growing demand for healthier drink alternatives to carbonated soft drinks. In response, manufacturers have been innovating with a variety of lemonade offerings, including low-sugar and organic options, which cater to the health-conscious segment of the population.

The market is further supported by well-established distribution channels ranging from large supermarket chains to convenience stores, ensuring widespread availability of the product across urban and rural settings alike. Moreover, the trend towards premiumization of lemonade—featuring gourmet and artisanal variations—has helped in maintaining a high interest level among younger demographics who favor unique and experiential drinking options.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Arizona Beverages stands out in the lemonade market for its wide array of flavored lemonades, combining traditional recipes with new, innovative tastes. Known for its iconic big can, Arizona has successfully captured a significant market share by offering high-quality products at competitive prices. Their strategy focuses on limited-edition flavors and attractive packaging, appealing mainly to younger consumers seeking both value and variety in their beverage choices.

Britvic Soft Drinks Limited has made a strong name for itself in the lemonade market by emphasizing natural ingredients and sustainable practices. Their range of lemonades, often fortified with vitamins and offered in low-sugar variants, caters to health-conscious consumers in Europe and beyond. Britvic’s commitment to reducing environmental impact through recyclable packaging and efficient manufacturing processes further strengthens their market position and brand loyalty.

The Coca-Cola Company, through its diverse portfolio, includes a popular line of lemonade products under brands like Minute Maid and Simply Lemonade. These products are known for their quality and wide availability. Coca-Cola leverages its vast distribution network to ensure these lemonades are a common sight in supermarkets and restaurants worldwide, consistently innovating with new flavors and formulations to maintain consumer interest and market dominance.

Mike’s Hard Lemonade is synonymous with its alcoholic lemonade beverages, which have carved a niche in the flavored malt beverage market. Known for its bold flavors and fun marketing campaigns, Mike’s continues to appeal to an adult demographic looking for light alcoholic options that offer a twist on the classic lemonade. Their continuous innovation in flavors and packaging keeps the brand fresh and relevant in a competitive segment.

Top Key Players

- Arizona Beverages

- Britvic Soft Drinks Limited

- Coca-Cola Company

- Hydro One Beverages

- Mike’s Hard Lemonade

- Nestlé S.A.

- Santa Cruz Organic

- Snapple Beverage Corp.

- The Kraft Heinz Company

- PepsiCo

- Sun Orchard Inc.

- Santa Cruz Organic

- Perricone Farms

- Maribell

- Clover Farms Dairy

Recent Developments

In 2024, Arizona Beverages maintained a significant presence in the lemonade market, leveraging its reputation for producing a wide variety of flavored beverages.

In 2024, Britvic Soft Drinks Limited achieved a notable 9.5% increase in revenue, reaching £1.9 billion, driven by strong demand across its diverse beverage portfolio.

In 2024, The Coca-Cola Company expanded its presence in the lemonade market through its Minute Maid brand, introducing new flavors and healthier options to meet evolving consumer preferences.

Report Scope

Report Features Description Market Value (2024) USD 8.6 Bn Forecast Revenue (2034) USD 17.6 Bn CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Cloudy Lemonade, Pink Lemonade, Clear Lemonade), By Category (Frozen Lemonade Concentrate, Fruit Lemonade Concentrate, Others), By Type (Alcoholic, Non-Alcoholic, Powder Mix), By Packaging Type (Bottles, Cans, Cartons, Pouches, Others), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Store, Convenience Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arizona Beverages, Britvic Soft Drinks Limited, Coca-Cola Company, Hydro One Beverages, Mike’s Hard Lemonade, Nestlé S.A., Santa Cruz Organic, Snapple Beverage Corp., The Kraft Heinz Company, PepsiCo, Sun Orchard Inc., Santa Cruz Organic, Perricone Farms, Maribell, Clover Farms Dairy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Arizona Beverages

- Britvic Soft Drinks Limited

- Coca-Cola Company

- Hydro One Beverages

- Mike's Hard Lemonade

- Nestlé S.A.

- Santa Cruz Organic

- Snapple Beverage Corp.

- The Kraft Heinz Company

- PepsiCo

- Sun Orchard Inc.

- Santa Cruz Organic

- Perricone Farms

- Maribell

- Clover Farms Dairy