Global Beetroot Powder Market Size, Share, And Business Benefits By Product (Conventional, Organic), By Packaging (Cans, Bottle, Bags, Pouch, Others), By Application (Food and Beverage, Nutraceuticals and Dietary Supplements, Cosmetics and Personal Care, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144178

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

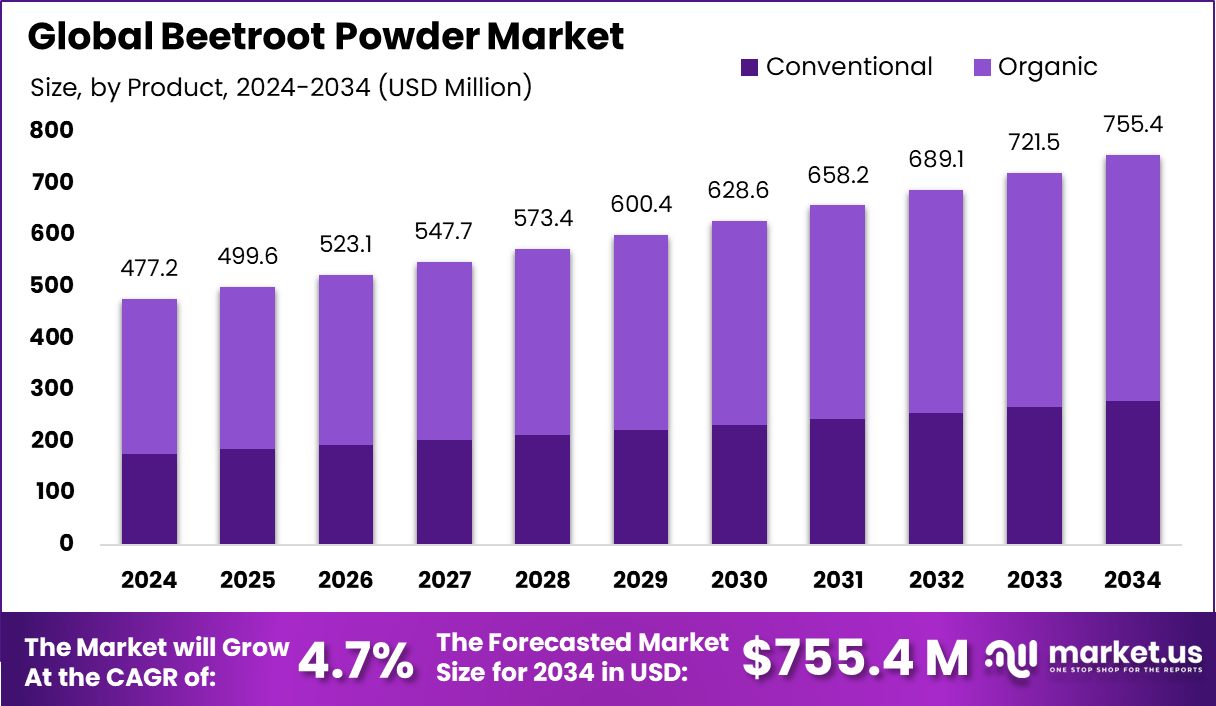

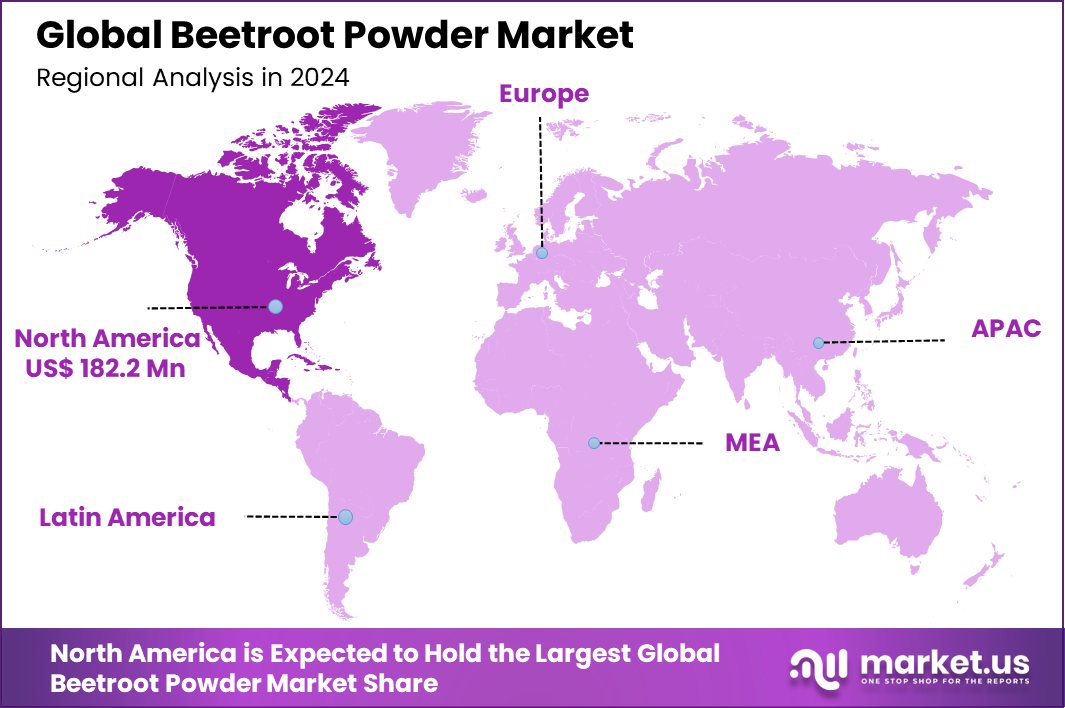

The Global Beetroot Powder Market is expected to be worth around USD 755.4 million by 2034, up from USD 477.2 million in 2024, and grow at a CAGR of 4.7% from 2025 to 2034. Strong demand for natural supplements helped North America achieve a 38.20% share, worth USD 182.2 million.

Beetroot powder is made from dried, ground beets and retains most of the nutritional value of the raw vegetable. It’s popular for its flavor, color, and health benefits, including high levels of vitamins, minerals, and antioxidants. It’s widely used in smoothies, health supplements and as a natural food coloring.

The beetroot powder market is experiencing growth due to its increasing popularity as a health supplement and a natural food additive. Its versatility and health benefits appeal to health-conscious consumers and those interested in natural products, driving its demand across various sectors.

Byroe teamed up with ingredient suppliers to craft their Beet Glow Boosting Serum, made with upcycled beet and 7% PHA. The formula offers gentle exfoliation while strengthening the skin barrier, combining sustainability with effective skincare benefits.

One significant growth factor is the rising awareness of health and wellness, especially post-pandemic. People are more conscious of what they consume, seeking out products that support overall health and immunity. Beetroot powder, with its high nutritional value, fits perfectly into this category.

Demand for beetroot powder is buoyed by its application in multiple industries. In the food and beverage sector, it’s used for its nutritional benefits and its vibrant color, serving as a natural alternative to synthetic dyes. The cosmetics industry also utilizes beetroot powder in natural and organic products, from blushes to lip colors, appealing to consumers seeking chemical-free options.

There’s a significant opportunity to expand the applications of beetroot powder in the health supplements market. As research continues to reveal more benefits, such as its impact on blood pressure and stamina, brands can innovate by incorporating beetroot powder into a variety of health products.

Key Takeaways

- The Global Beetroot Powder Market is expected to be worth around USD 755.4 million by 2034, up from USD 477.2 million in 2024, and grow at a CAGR of 4.7% from 2025 to 2034.

- Organic beetroot powder holds a significant market share, accounting for 63.30% of the total market.

- Pouch packaging is favored in the beetroot powder market, making up 32.20% of sales.

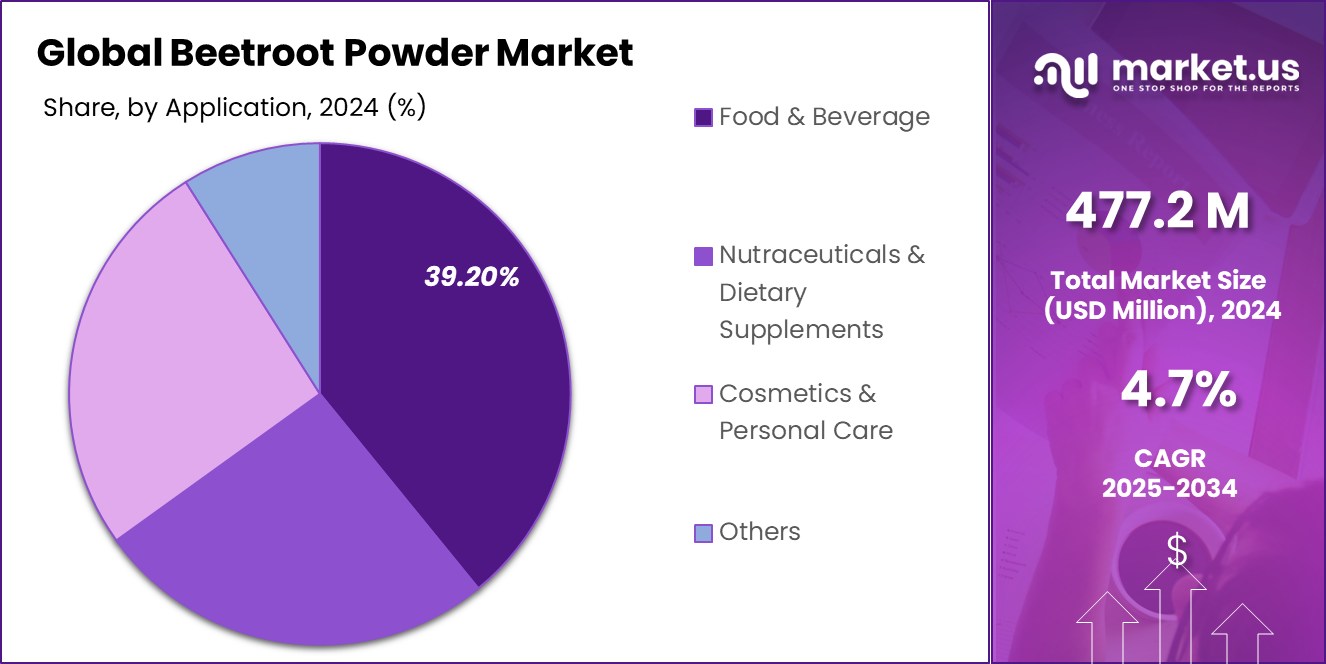

- In applications, food and beverage lead with 39.20% of the beetroot powder market share.

- Supermarkets and hypermarkets are the largest distribution channel, commanding 41.10% of the market.

- The North American beetroot powder market reached a total value of USD 182.2 million in 2024.

By Product Analysis

Organic beetroot powder dominates the market with a significant 63.30% share.

In 2024, the Organic segment held a dominant market position in the by-product category of the Beetroot Powder Market, commanding a 63.30% share. This segment’s substantial market share underscores a growing consumer preference for organic products, reflecting heightened awareness about health and environmental sustainability.

Organic beetroot powder is particularly favored for its perceived purity and higher nutritional benefits compared to non-organic variants. As consumers increasingly opt for products free from pesticides and artificial substances, organic beetroot powder has become a staple in health-conscious diets.

This trend is reinforced by the clean label movement, which prioritizes transparency in labeling, allowing consumers to easily recognize and understand the ingredients in their purchases. The dominance of the organic segment is also supported by the expanding distribution channels that make organic beetroot powder more accessible to a broader audience.

As it continues to be integrated into various dietary supplements and functional foods, the organic segment is likely to maintain its leading position in the market, driven by consumer demands for health-centric and environmentally friendly products.

By Packaging Analysis

Pouch packaging is preferred for beetroot powder, holding a 32.20% market share.

In 2024, the Pouch segment held a dominant market position in the By Packaging category of the Beetroot Powder Market, securing a 32.20% share. This segment’s prominence is largely attributed to the convenience and cost-effectiveness of pouch packaging. Pouches, being lightweight and flexible, offer significant advantages in terms of reducing shipping costs and storage space, making them a preferred choice for both manufacturers and consumers.

Additionally, the ability of pouches to preserve the freshness of beetroot powder by protecting it from moisture and air exposure has been crucial in maintaining the product’s quality and extending its shelf life. The growing consumer preference for portable and easy-to-use packaging options also plays a critical role in driving the demand for pouches in the beetroot powder market.

These factors, combined with innovations in pouch materials that enhance sustainability, such as biodegradable and recyclable options, continue to support the segment’s growth. With increasing environmental awareness among consumers, the demand for eco-friendly packaging solutions like pouches is expected to remain strong, further cementing their leading position in the market.

By Application Analysis

Beetroot powder is mainly used in food and beverage, comprising 39.20%.

In 2024, the Food and Beverage segment held a dominant market position in the By Application category of the Beetroot Powder Market, with a 39.20% share. This significant market share is indicative of beetroot powder’s widespread adoption in culinary applications, where it is prized not only for its nutritional benefits but also for its vibrant color and earthy flavor.

Within the food and beverage industry, beetroot powder is extensively used as a natural food coloring agent, offering a healthier alternative to synthetic dyes in a variety of products, such as smoothies, sauces, and baked goods. Moreover, its application in health-focused beverages, like detox drinks and protein shakes, has expanded its consumer base.

The increasing consumer interest in clean-label products, which favor natural ingredients over artificial additives, has further propelled the demand within this segment. Additionally, the rising popularity of plant-based and vegan diets has contributed to the growth of beetroot powder in food products, aligning with consumers’ dietary preferences for non-animal-derived ingredients.

As health consciousness continues to influence consumer choices, the Food and Beverage segment is expected to maintain its dominance in the beetroot powder market.

By Distribution Channel Analysis

Supermarkets and hypermarkets are the leading distribution channels, accounting for 41.10% of sales.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Beetroot Powder Market, with a 41.10% share. This leadership reflects the convenience and accessibility that these large retail formats offer to consumers seeking beetroot powder.

Supermarkets and hypermarkets are pivotal in introducing a wide range of beetroot powder products to a diverse consumer base, thanks to their extensive geographic footprint and the ability to stock a variety of brands and product types.

The visibility that these outlets provide to beetroot powder has significantly contributed to its market penetration. Consumers appreciate the ability to physically evaluate product quality, compare different brands, and make informed decisions based on packaging information and pricing, all within the convenience of their regular grocery shopping trips.

Additionally, the aggressive promotional activities and discounts often offered by these retail giants enhance the appeal of purchasing beetroot powder from supermarkets and hypermarkets. As they continue to be a primary shopping destination for health and wellness products, supermarkets and hypermarkets are expected to maintain their leading position in the distribution of beetroot powder.

Key Market Segments

By Product

- Conventional

- Organic

By Packaging

- Cans

- Bottle

- Bags

- Pouch

- Others

By Application

- Food and Beverage

- Nutraceuticals and Dietary Supplements

- Cosmetics and Personal Care

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online

- Others

Driving Factors

Increasing Demand for Natural Food Additives

One of the primary driving factors in the Beetroot Powder Market is the increasing consumer demand for natural food additives. As health awareness rises, more consumers are turning away from synthetic colors and flavor enhancers in favor of natural alternatives.

Beetroot powder, known for its vibrant color and nutritional benefits, fits perfectly into this trend. It offers an appealing, clean-label option for manufacturers looking to meet consumer preferences for wholesome, understandable ingredients.

Its application extends across various food products, enhancing both the visual appeal and nutritional profile. This shift toward cleaner eating habits ensures that beetroot powder remains a popular choice in the food and beverage industry, pushing its market growth steadily upward.

Restraining Factors

Limited Shelf Life Affects Market Growth Rate

One big challenge for the beetroot powder market is its short shelf life. Even though it’s in a dried form, beetroot powder can easily lose its color, taste, and nutrients if not stored properly. It often gets affected by moisture, heat, and light. This makes it tough for sellers and distributors to keep it fresh for a long time.

Companies have to spend more on good packaging and storage, which increases the overall cost. Customers also prefer products that last longer and stay stable on shelves. So, this issue makes it harder for beetroot powder to compete with other supplements or health foods that don’t spoil as quickly. It slows down market growth, especially in warm, humid regions.

Growth Opportunity

Rising Demand for Natural Food Color Alternatives

A major growth opportunity for the beetroot powder market is the rising demand for natural food coloring. More people now want food products without artificial additives or chemicals. Beetroot powder is a great option because of its deep red color and natural origin.

It works well in smoothies, yogurts, snacks, and even bakery items. Food and beverage companies are looking for clean-label ingredients, and beetroot powder fits that trend perfectly.

It’s not just a colorant—it also adds nutrition, like vitamins and antioxidants. As health-conscious consumers increase, especially in North America and Europe, more brands are replacing synthetic dyes with natural ones. This creates strong market opportunities for beetroot powder in the food and beverage sector.

Latest Trends

Growing Use in Sports Nutrition Health Products

One of the latest trends in the beetroot powder market is its rising use in sports nutrition. Athletes and fitness enthusiasts are turning to beetroot powder for its natural nitrate content. These nitrates help improve blood flow, increase stamina, and support better oxygen use during workouts. As a result, many sports drinks, protein shakes, and pre-workout mixes now include beetroot powder.

This trend is especially strong in North America and Europe, where the fitness industry is booming. Brands are promoting beetroot-based products as a clean, plant-based option for energy and endurance. With more people choosing natural over synthetic supplements, beetroot powder is becoming a favorite ingredient in sports health and recovery products worldwide.

Regional Analysis

North America holds the largest share in the beetroot powder market, with 38.20% regional dominance.

The global beetroot powder market shows notable regional variation, with North America emerging as the dominant player. In 2024, North America accounted for the highest market share of 38.20%, reaching a value of USD 182.2 million. The region’s strong preference for natural and plant-based health supplements, along with the rising popularity of clean-label products, continues to drive demand.

Europe follows closely, supported by a growing focus on functional foods and wellness trends across countries like Germany, France, and the U.K. Asia Pacific is another key region, with increasing consumer awareness around plant-based nutrition in countries such as China, India, and Japan.

Though currently behind North America and Europe, the region offers future growth potential due to urbanization and rising disposable incomes. The Middle East & Africa market remains in the early stages but is gradually expanding due to shifting dietary preferences and increased health awareness.

Latin America is witnessing modest growth, led by Brazil and Mexico, where the demand for organic food products is steadily climbing.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global beetroot powder market has become increasingly competitive, with key players focusing on clean-label production, supply chain enhancement, and geographic expansion. Among the notable contributors, Biofinest has maintained a strong market presence due to its premium-grade beetroot powder offerings targeted toward health-conscious consumers.

Known for its USDA Organic and Non-GMO certifications, Biofinest continues to attract a solid customer base across North America and Europe, where natural and organic products are in high demand. Its direct-to-consumer e-commerce strategy has further strengthened its footprint.

BioGin Biochemicals Co., Ltd., based in Asia, has distinguished itself by emphasizing research and innovation. The company’s product line includes standardized beetroot extracts with consistent nitrate levels, aligning with the increasing demand in sports nutrition and nutraceutical segments. BioGin’s strategic focus on ingredient purity and functional benefits has helped it secure partnerships with dietary supplement manufacturers globally.

Botanical Ingredients Ltd has positioned itself as a key B2B supplier with strong ties to the food and beverage industry. Its high-quality beetroot powders cater to large-scale production needs, including beverage blends, sauces, and natural food coloring. The company’s scalable production capabilities and global distribution channels enable it to serve diverse industries, especially in Europe and Latin America.

Top Key Players in the Market

- Biofinest

- BioGin Biochemicals Co., Ltd.

- Botanical Ingredients Ltd

- Diana Food

- Earth Notions Inc.

- Food to Live

- Go Superfood

- Nature’s Way Products LLC

- Natures Aid Ltd.

- NutriCargo LLC

- Radiance Ltd.

- Super Sprout LLC

- Terrasoul Superfoods

- Freeze

Recent Developments

- In July 2024, Beetroot powder is seeing rising use in animal nutrition, valued for boosting livestock vitality. Firms like BioNutra Ingredients LLC have launched beetroot-based feed additives aimed at improving animal health and overall performance.

- In July 2024, In pharma circles, beetroot powder is gaining attention for heart health benefits. Nature’s Way Products LLC and peers are backing studies on beetroot’s role in improving blood circulation and managing blood pressure through supplement innovation.

Report Scope

Report Features Description Market Value (2024) USD 477.2 Million Forecast Revenue (2034) USD 755.4 Million CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Conventional, Organic), By Packaging (Cans, Bottle, Bags, Pouch, Others), By Application (Food and Beverage, Nutraceuticals and Dietary Supplements, Cosmetics and Personal Care, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Biofinest, BioGin Biochemicals Co., Ltd., Botanical Ingredients Ltd, Diana Food, Earth Notions Inc., Food to Live, Go Superfood, Nature’s Way Products LLC, Natures Aid Ltd., NutriCargo LLC, Radiance Ltd., Super Sprout LLC, Terrasoul Superfoods, Freeze Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Beetroot Powder MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Global Beetroot Powder MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Biofinest

- BioGin Biochemicals Co., Ltd.

- Botanical Ingredients Ltd

- Diana Food

- Earth Notions Inc.

- Food to Live

- Go Superfood

- Nature’s Way Products LLC

- Natures Aid Ltd.

- NutriCargo LLC

- Radiance Ltd.

- Super Sprout LLC

- Terrasoul Superfoods

- Freeze