Global Indene (CAS 95-13-6) Market Size, Share, And Industry Analysis Report By Product (65 to 75 Indene, 95 Indene), By Application (Coumarone Indene Resin, Styrene Indene Resin, Pesticide, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169319

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

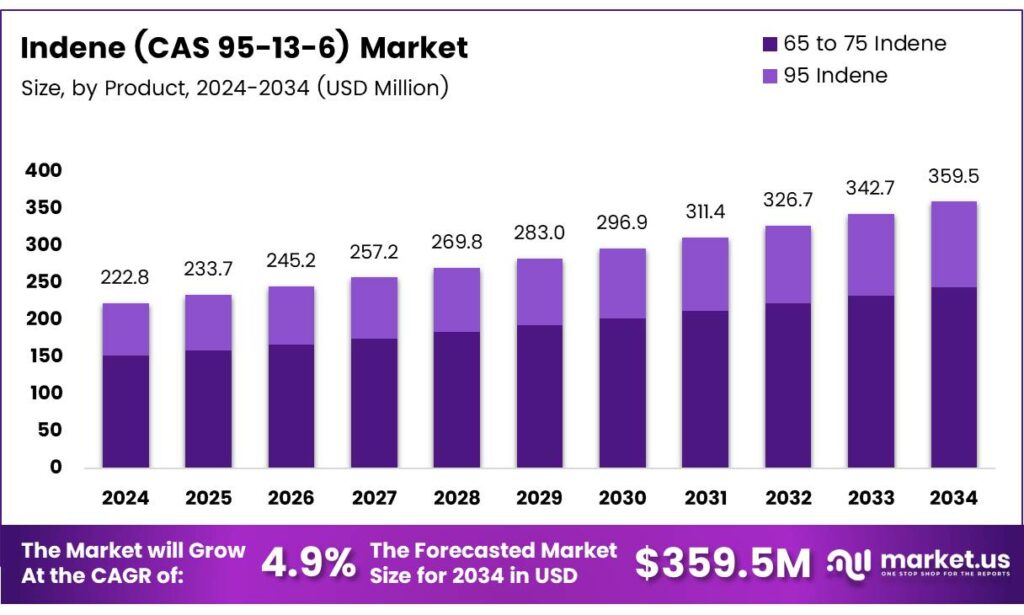

The Global Indene (CAS 95-13-6) Market size is expected to be worth around USD 359.5 million by 2034, from USD 222.8 million in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

Indene, a polycyclic aromatic hydrocarbon with the molecular formula C₉H₈ and molecular weight 116.16, is also known as benzocyclopentene. Naturally present in coal tar and crude oil, indene is also emitted during the incomplete combustion of fossil fuels. It is a colorless liquid that does not readily volatilize but turns yellow upon standing and decolorizes in sunlight, with a melting point of –1.8 °C, boiling point of 182.6 °C, flash point of 58 °C, and relative density of 0.9960 (25/4 °C).

Indene is insoluble in water but miscible with ethanol and ether. The molecule exhibits low toxicity and minimal irritation to skin and mucous membranes. Its highly reactive olefinic double bond makes it prone to polymerization and addition reactions; it polymerizes slowly at room temperature, with the rate increasing sharply upon heating or in the presence of acid catalysts, yielding secondary indene resin when treated with concentrated sulfuric acid.

- The Indene (CAS 95-13-6) is closely tied to demand for indene-coumarone resins used in coatings, rubber processing, adhesives, and inks. The key feedstock fraction distilled at 160–215°C contains approximately 40% indene, along with styrene and coumarone derivatives, forming 60–70% of total resin raw material inputs.

Indene is typically supplied as a colourless to pale yellow liquid with purity levels of ≥97% and registered under EINECS 202-393-6. Demand is further supported by its predictable physicochemical behavior, consistent polymer quality, and efficient integration into hydrocarbon resin value chains.

Indene shows low toxicity and limited skin or mucous membrane irritation, which improves its acceptability in industrial chemical formulations. ECHA data highlights its relative density of 0.9960 at 25°C, insolubility in water, and miscibility with ethanol or ether. Importantly, the molecule contains chemically active olefin bonds, enabling polymerization and addition reactions critical for resin chemistry.

Key Takeaways

- The Global Indene (CAS 95-13-6) Market is projected to grow from USD 222.8 million in 2024 to USD 359.5 million by 2034, registering a CAGR of 4.9%.

- The 65 to 75 Indene product segment dominated the market in 2024 with a share of 69.2%, driven by balanced purity and cost efficiency.

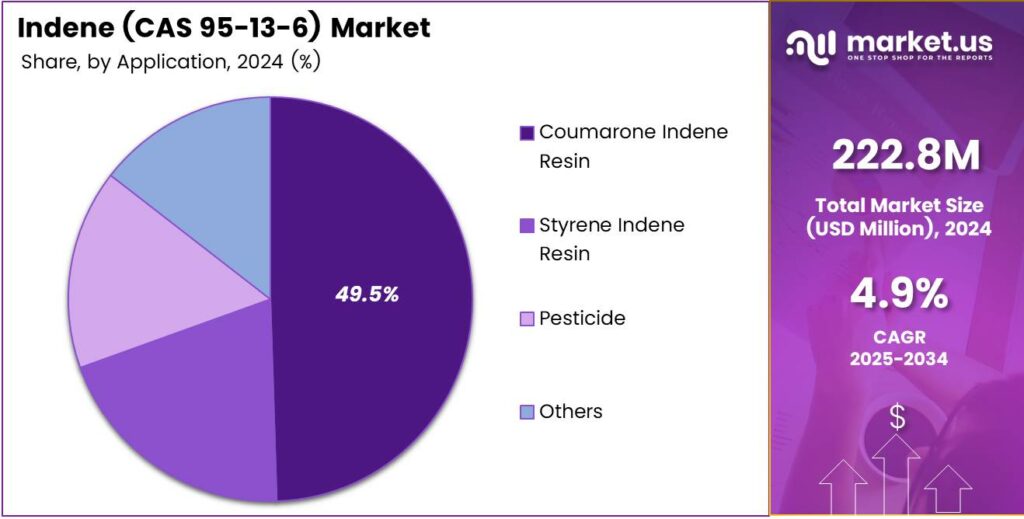

- The Coumarone Indene Resin application segment led demand in 2024, accounting for a market share of 49.5%.

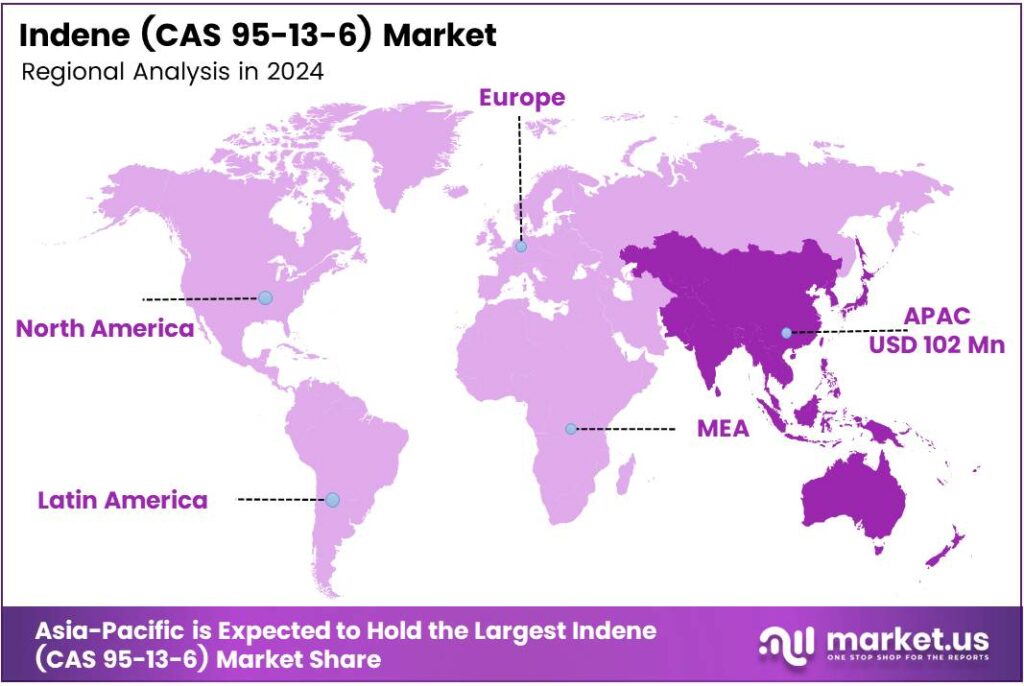

- Asia-Pacific emerged as the leading regional market in 2024 with a share of 45.8%, valued at USD 102.0 million.

By Product Analysis

65 to 75 Indene dominates with 69.2% due to its balanced purity and suitability for resin-focused industrial applications.

In 2024, 65 to 75 Indene held a dominant market position in the By Product Analysis segment of Indene (CAS 95-13-6) Market, with a 69.2% share. This grade is preferred as it offers cost efficiency and consistent performance. Consequently, manufacturers use it widely in coumarone and blended resin production.

In 2024, 95 Indene held a stable market position in the By Product Analysis segment of the Indene (CAS 95-13-6) Market. This high-purity grade is mainly selected for controlled chemical synthesis and specialty formulations. However, higher refining costs limit its adoption, although demand remains steady in quality-sensitive downstream applications.

By Application Analysis

Coumarone Indene Resin dominates with 49.5% driven by strong demand from adhesives, coatings, and rubber processing industries.

In 2024, Coumarone Indene Resin held a dominant market position in the By Application Analysis segment of the Indene (CAS 95-13-6) Market, with a 49.5% share. This dominance is supported by increasing infrastructure and construction activities that rely on durable resins. As a result, consumption remained stable across mature industrial markets.

In 2024, Styrene Indene Resin held a notable position in the By Application Analysis segment of the Indene (CAS 95-13-6) Market. This application benefits from demand in tire modification and specialty polymers. Gradually, manufacturers favor it for improving thermal stability and processing performance in engineered resin blends.

In 2024, Pesticide applications maintained a functional position in the By Application Analysis segment of the Indene (CAS 95-13-6) Market. Indene-based intermediates support selective crop protection formulations. However, usage remains regulated and application-specific, leading to controlled but necessary demand from agricultural chemical producers.

In 2024, Others held a supporting position in the By Application Analysis segment of the Indene (CAS 95-13-6) Market. This category includes niche chemical synthesis and research uses. Although volumes are smaller, steady diversification into specialty chemicals helps sustain consistent consumption across varied industrial needs.

Key Market Segments

By Product

- 65 to 75 Indene

- 95 Indene

By Application

- Coumarone Indene Resin

- Styrene Indene Resin

- Pesticide

- Others

Emerging Trends

Shift Toward High-Purity and Performance Resins Shapes Market Trends

One major trend in the indene market is the growing preference for high-purity grades. End users increasingly demand consistent quality to meet performance standards in coatings, inks, and rubber products. This pushes producers to adopt better refining and quality control practices.

- There is also a clear trend toward performance-focused resin formulations. Manufacturers are blending indene-based resins with other polymers to improve flexibility, adhesion, and thermal resistance. The International Energy Agency (IEA) reports that global refinery capacity upgrading investments exceeded USD 60 billion between 2021 and 2024, supporting better recovery of specialty aromatics such as indene.

Regional production expansion in Asia is shaping trade patterns. Countries with strong refining and chemical bases are becoming key suppliers, while others rely on imports. Overall, the market is evolving toward efficiency, better quality, and application-driven product development.

Drivers

Strong Demand for Coumarone–Indene Resins Drives Market Growth

Indene demand is strongly driven by its wide use in making coumarone–indene resins. These resins are used in paints, coatings, adhesives, rubber compounding, and printing inks. As construction and infrastructure activities increase, demand for durable coatings and adhesives rises steadily. This directly supports stable consumption of indene.

- The rubber industry is another strong driver. Indene-based resins improve tackiness, heat resistance, and flexibility in tires and industrial rubber products. The International Rubber Study Group (IRSG), global rubber consumption exceeded 29 million metric tons in 2023, driven by automotive and industrial demand.

Indene is also used as an intermediate in specialty chemicals and agrochemicals. Expanding chemical manufacturing capacity in Asia supports long-term consumption. Additionally, its availability from coal tar and petroleum streams ensures a continuous supply, which helps producers maintain steady output and pricing stability in the market.

Restraints

Dependence on Petroleum and Coal Tar Limits Market Expansion

A key restraint for the indene market is its heavy dependence on petroleum refining and coal tar processing. Any disruption in crude oil supply, refinery shutdowns, or changes in fuel demand directly affect indene availability. This makes supply planning challenging for manufacturers and downstream users.

- Environmental and safety regulations present another restraint. Indene is classified as an aromatic hydrocarbon, and its handling requires strict compliance with workplace safety and emissions norms. Digital upgrades can improve by-product yield recovery by 3–5%, making indene extraction more economically attractive without new crude inputs.

Price volatility is also a concern. Fluctuations in crude oil and coal tar prices increase raw material uncertainty, which impacts profit margins. In addition, the availability of alternative hydrocarbon resins can reduce dependence on indene in certain applications, slowing market growth.

Growth Factors

Expansion of Specialty Chemicals Creates New Growth Opportunities

Growth opportunities for the indene market are emerging from the expansion of specialty chemical manufacturing. Increasing demand for high-performance resins in electronics, industrial coatings, and infrastructure projects opens new application areas for indene-based materials.

Developing economies are investing heavily in construction, transportation, and industrial infrastructure. This creates rising demand for adhesives, sealants, and protective coatings where indene-derived resins are widely used. Local chemical production growth further supports regional indene consumption.

Another opportunity lies in process optimization and recovery technologies. Improved extraction from refinery by-products can enhance yield and cost efficiency. Producers focusing on purity improvement and customized grades can target niche applications, creating higher-value growth segments within the indene market.

Regional Analysis

Asia-Pacific Dominates the Indene (CAS 95-13-6) Market with a Market Share of 45.8%, Valued at USD 102.0 Million

Asia-Pacific leads the global Indene (CAS 95-13-6) market due to its strong petrochemical base and high downstream consumption. In this region, rapid industrialization and expanding resin, coatings, and agrochemical industries continue to support demand. In 2024, Asia-Pacific accounted for a dominant 45.8% share, with the market valued at USD 102.0 million. Growing infrastructure spending and rising manufacturing output further strengthen regional demand.

The North American indene market is driven by stable demand from specialty chemicals and construction-related applications. The region benefits from advanced refining infrastructure and consistent use in resins and binders. Demand growth remains moderate, supported by renovation activities and steady industrial production. Regulatory focus on process efficiency also encourages controlled but sustained consumption.

Europe shows steady indene demand linked to mature chemical manufacturing and strict quality standards. The market is supported by applications in performance resins and specialty formulations. Although growth is relatively modest, innovation in downstream materials supports stable consumption. Environmental regulations influence sourcing and production efficiency across the region.

The U.S. indene market benefits from consistent demand in specialty resins and industrial chemical applications. Strong domestic refining and chemical processing capabilities support supply stability. Demand growth is steady rather than aggressive, reflecting a mature end-use landscape. Ongoing maintenance and refurbishment activities sustain long-term usage.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The competitive landscape of the global Indene (CAS 95-13-6) market in 2024 is shaped by a mix of large-scale chemical producers and focused specialty suppliers, each playing a specific role in ensuring supply stability and application-driven growth.

JFE Chemical Corporation holds a strong position due to its deep integration with coal tar–based chemical operations and advanced processing capabilities. In 2024, the company benefits from operational efficiency, consistent product quality, and long-term supply relationships with resin and specialty chemical manufacturers. Its emphasis on process optimization supports stable output and cost control.

Unilong Industry Co., Ltd. is viewed as an agile supplier with a broad export-oriented portfolio of aromatic and specialty intermediates. The company’s Indene offerings align well with demand from resin and fine chemical producers seeking reliable, mid-volume sourcing. In 2024, its strengths lie in flexible packaging, customer responsiveness, and diversified end-use reach.

Longchang Chemical plays a notable role as a cost-competitive producer catering to industrial-grade Indene demand. The company focuses on serving downstream users in resins and agrochemical intermediates, where price sensitivity is high. In 2024, Longchang’s market presence is supported by steady production scaling and consistent domestic and regional supply.

Central Drug House operates primarily in high-purity and laboratory-grade chemical segments, addressing niche but essential demand. Its Indene products are valued in research, formulation development, and specialty synthesis applications. In 2024, the company’s analytical reliability and small-batch consistency strengthen its relevance in quality-driven market segments.

Top Key Players in the Market

- JFE Chemical Corporation

- Unilong Industry Co., Ltd.

- Longchang Chemical

- Central Drug House

- Richman Chemical Inc

- SimSon Pharma Limited

- Others

Recent Developments

- In 2025, JFE Chemical Corporation, a Japanese firm, is a major global supplier of indene derivatives, positioning itself as the world’s largest provider in this category. These derivatives serve as key raw materials for optical functional materials and functional polymers.

- In 2025, Unilong Industry Co., Ltd., based in China’s Shandong Province, specializes in chemical supply and lists indene (CAS 95-13-6) as a core product. It is described as a low-toxicity polycyclic aromatic hydrocarbon with applications in synthetic resins, coatings, and as an intermediate in pharmaceuticals and pesticides.

Report Scope

Report Features Description Market Value (2024) USD 222.8 million Forecast Revenue (2034) USD 359.5 million CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (65 to 75 Indene, 95 Indene), By Application (Coumarone Indene Resin, Styrene Indene Resin, Pesticide, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape JFE Chemical Corporation, Unilong Industry Co., Ltd., Longchang Chemical, Central Drug House, Richman Chemical Inc., SimSon Pharma Limited, Others Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Indene (CAS 95-13-6) MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Indene (CAS 95-13-6) MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- JFE Chemical Corporation

- Unilong Industry Co., Ltd.

- Longchang Chemical

- Central Drug House

- Richman Chemical Inc

- SimSon Pharma Limited

- Others