Global Fluorochemicals Market By Product (Fluorocarbons, HCFC, HFC and Others, Inorganic Fluorochemicals, Fluoropolymers and Fluoroelastomers), By Application (Surfactants, Propellants, Aluminum Production, Refrigerant, Automobile, Agrochemicals, Others), By End Use (Electrical and Electronics, Petrochemicals, Chemicals, Aerospace, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: November 2024

- Report ID: 132666

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

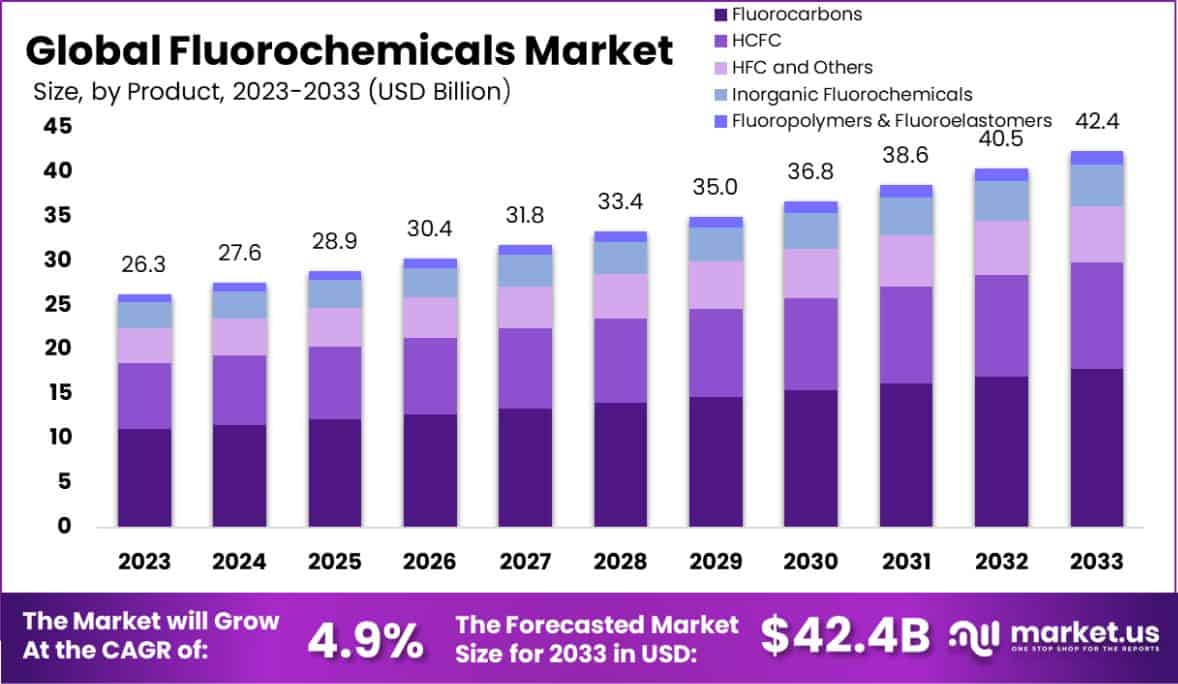

The Global Fluorochemicals Market is expected to be worth around USD 42.4 billion by 2033, up from USD 26.3 billion in 2023, and grow at a CAGR of 4.9% from 2024 to 2033.

Fluorochemicals are chemical compounds that contain fluorine, utilized primarily for their unique performance properties such as high thermal stability, resistance to chemicals, and electrical insulation.

These characteristics make fluorochemicals essential in various applications including refrigeration, air conditioning, aluminum production, and the manufacture of pharmaceuticals and agrichemicals.

The fluorochemicals market is driven by the expanding demand in industries such as automotive, electronics, and pharmaceuticals, where the unique properties of fluorochemicals are indispensable. This market is further influenced by the growing requirement for cooling systems in developing regions and advancements in refrigeration technologies.

The fluorochemicals market is poised for significant expansion, underscored by strategic investments and governmental fiscal support, positioning it favorably for sustained growth.

Notably, GFL’s subsidiary GFCL EV Products has recently secured ₹1,000 crore to expand its electric vehicle battery materials operations, a move indicative of the sector’s pivotal role in supporting advanced manufacturing capabilities for burgeoning industries like electric vehicles.

This investment highlights the evolving application spectrum of fluorochemicals, extending beyond traditional domains into critical, technology-driven sectors.

Further buoying the market, the Interim Union Budget 2024-25 has earmarked ₹192.21 crore (approximately USD 23.13 million) specifically for the chemical sector, which encompasses fluorochemicals.

This allocation is expected to facilitate advancements in production technologies and enhance the quality of domestically produced chemicals, reinforcing the industry’s foundation within a broader economic framework.

Moreover, the refrigeration and air conditioning sector, which consumes approximately 80% of hydrofluoric acid (HF) primarily for the production of refrigerant gases, continues to be a major demand driver. The global market for fluorinated refrigerants is substantial and constitutes a significant segment of the fluorochemical industry.

This sector’s robust demand underpins the stable growth trajectory of fluorochemicals, supported by both industry-specific trends and macroeconomic factors, ensuring a dynamic market environment ripe with opportunities for innovation and expansion.

The market growth can be attributed to the increased applications in industrial and domestic refrigeration and the ongoing innovations in energy-efficient and environmentally safer fluorochemicals.

The demand for fluorochemicals is bolstered by their critical role in air conditioning systems in the automotive and construction sectors, coupled with their usage in pharmaceutical and agricultural chemical formulations.

Significant opportunities in the fluorochemicals market arise from the development of alternatives to hydrochlorofluorocarbons and hydrofluorocarbons, driven by environmental regulations, which promote the use of less harmful fluorochemicals in industrial applications.

Key Takeaways

- The Global Fluorochemicals Market is expected to be worth around USD 42.4 billion by 2033, up from USD 26.3 billion in 2023, and grow at a CAGR of 4.9% from 2024 to 2033.

- Fluorocarbons dominate the market with a 42.3% share, driving major product segment growth.

- Refrigerants account for 34.4% of fluorochemical applications, essential in cooling technologies.

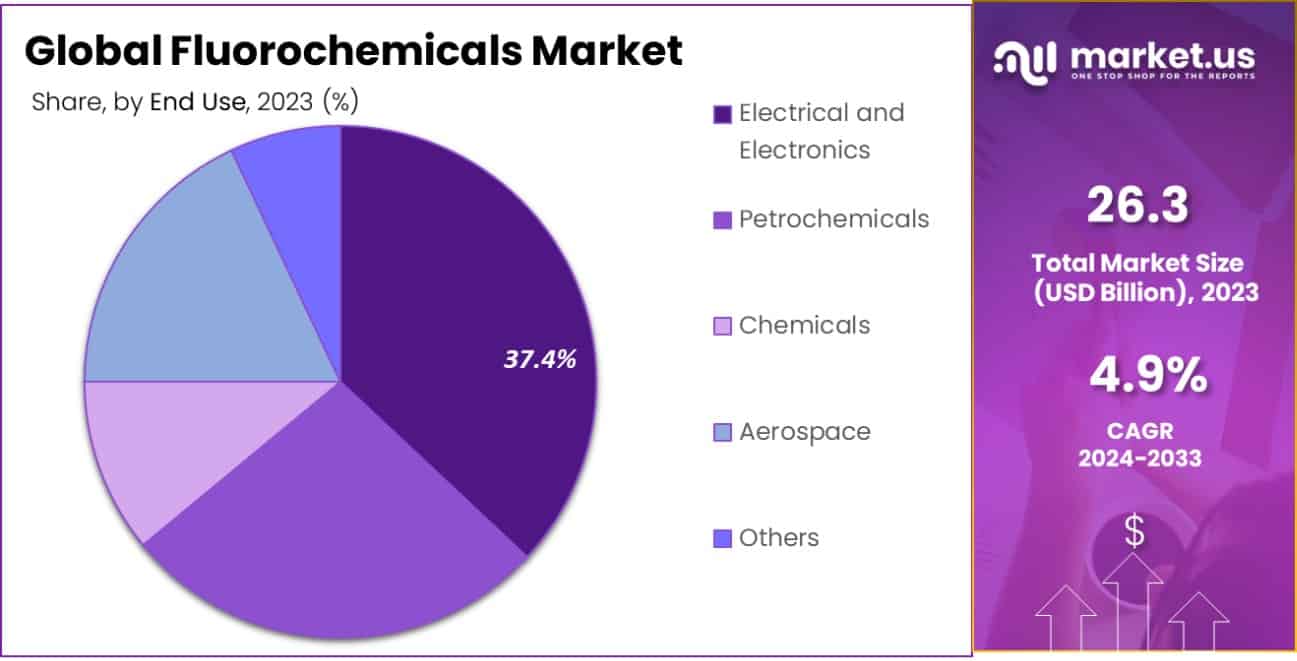

- Electrical and electronics lead end-use segments, holding a 37.4% market share.

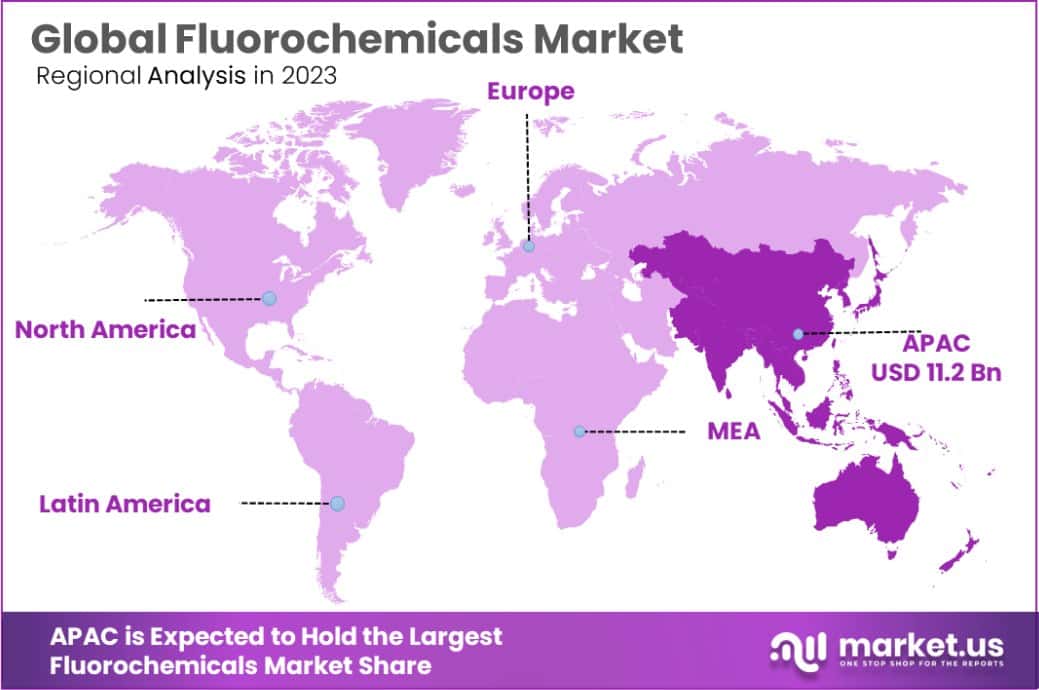

- Asia Pacific leads the fluorochemicals market with a 42.9% share, valued at USD 11.2 billion.

By Product Analysis

Fluorocarbons dominate with a 42.3% market share in fluorochemicals.

In 2023, Fluorocarbons held a dominant market position in the “By Product” segment of the Fluorochemicals Market, with a 42.3% share. This category includes various types such as HCFC, HFC, and others, which are primarily utilized for their properties as refrigerants in air conditioning and refrigeration systems.

The ongoing phase-out of HCFCs, under global environmental agreements, has spurred the adoption of HFCs, which, while still covered under phase-down plans, are less harmful to the ozone layer.

Further diversifying the fluorochemicals market are Inorganic Fluorochemicals, which are critical in applications ranging from aluminum smelting to uranium enrichment. Their unique reactive properties make them indispensable in several industrial processes.

Meanwhile, the market for Fluoropolymers and Fluoroelastomers is expanding due to their exceptional resistance to high temperatures and chemicals, making them ideal for use in the automotive, aerospace, and electronics industries.

These segments underscore the versatility and essential nature of fluorochemicals across a broad spectrum of industrial applications, driving continuous growth and innovation within the sector. This segmentation highlights not only the diversity within the fluorochemicals market but also the specialized applications that define its demand and growth trajectory.

By Application Analysis

Refrigerants hold a substantial 34.4% share as a primary application.

In 2023, Refrigerant held a dominant market position in the “By Application” segment of the Fluorochemicals Market, with a 34.4% share. This significant portion underscores the crucial role of fluorochemicals, particularly fluorocarbons like HCFCs and HFCs, in cooling systems across various industries, including automotive and residential HVAC systems.

The stringent environmental regulations and the ongoing shift towards more sustainable alternatives are driving innovations in this segment, focusing on lower global warming potential (GWP) products.

Adjacent to refrigerants, other applications such as Surfactants, Propellants, and Aluminum Production also leverage the unique properties of fluorochemicals.

Surfactants, for instance, are critical in reducing surface tension in products ranging from detergents to firefighting foams, while Propellants are widely used in medical inhalers and food aerosols.

Aluminum Production relies on the use of inorganic fluorochemicals for the smelting process, highlighting their importance in metallurgical applications.

Furthermore, the Automobile and Agrochemical sectors are increasingly dependent on fluorochemicals for applications such as fuel additives and pest control agents, respectively.

These diverse applications not only demonstrate the broad utility of fluorochemicals but also contribute to the steady demand and growth within the global market, reflecting a robust and dynamic industry landscape.

By End Use Analysis

Electrical and electronics lead, comprising 37.4% of market end-use.

In 2023, Electrical and Electronics held a dominant market position in the “By End Use” segment of the Fluorochemicals Market, with a 37.4% share. This segment’s robust performance is driven by the essential role of fluorochemicals in the production of high-performance wiring, semiconductor fabrication, and protective coatings, which are critical for the rapidly evolving electronics industry.

The unique properties of fluorochemicals, such as their excellent electrical insulation and thermal stability, make them indispensable in meeting the demanding specifications of advanced electronic devices.

Beyond electrical and electronics, fluorochemicals find extensive applications in the Petrochemicals, Chemicals, and Aerospace sectors. In petrochemical processes, fluorochemicals are utilized for their ability to withstand corrosive environments, enhancing the longevity and safety of equipment.

The chemicals industry relies on fluorochemicals for specialized applications such as catalysts and solvents, which are crucial for manufacturing a wide range of consumer and industrial products.

The aerospace sector also benefits significantly from fluorochemicals, especially in the development of lightweight, durable materials for aircraft construction and maintenance solutions.

These industries collectively underscore the pivotal role of fluorochemicals in driving technological advancements and operational efficiencies across diverse industrial landscapes, cementing their value in the global market.

Key Market Segments

By Product

- Fluorocarbons

- HCFC

- HFC and Others

- Inorganic Fluorochemicals

- Fluoropolymers and Fluoroelastomers

By Application

- Surfactants

- Propellants

- Aluminum Production

- Refrigerant

- Automobile

- Agrochemicals

- Others

By End Use

- Electrical and Electronics

- Petrochemicals

- Chemicals

- Aerospace

- Others

Driving Factors

Advancements in Refrigeration Technology and Demand

The ongoing advancements in refrigeration technology serve as a primary driving factor for the fluorochemicals market. As global temperatures rise and urbanization increases, the demand for efficient cooling solutions in residential, commercial, and industrial settings is escalating.

Fluorochemicals, particularly in the form of refrigerants, are crucial for these technologies. The shift towards more environmentally friendly refrigerants due to regulatory changes further stimulates innovations and adaptations in the market, ensuring continuous demand for new fluorochemical formulations.

Expansion in Electronics and Automotive Industries

Fluorochemicals are essential in the electronics and automotive industries due to their unique properties such as resistance to high temperatures and chemical stability. As these industries continue to grow, driven by consumer demand for more advanced electronic devices and more efficient vehicles, the need for fluorochemicals increases.

This demand is particularly strong for applications in electrical insulation, fuel systems, and gaskets, where their performance characteristics are unmatched, thereby pushing the market towards broader application scopes and technological integrations.

Increased Use in Environmental and Safety Applications

Environmental sustainability and safety regulations are significantly influencing the fluorochemicals market. As industries and governments worldwide push for reduced environmental impact, fluorochemicals are being adapted to meet these new standards.

This includes the development of alternatives to traditional harmful fluorochemicals used in refrigerants and propellants. The focus on creating products that are less detrimental to the ozone layer and lower in global warming potential is driving research and adoption of novel fluorochemicals, supporting market growth in compliance-driven sectors.

Restraining Factors

Stringent Environmental Regulations Impacting Fluorochemical Use

Environmental regulations are intensifying globally, targeting the reduction of harmful substances, including certain fluorochemicals like HCFCs and HFCs known for their ozone-depleting characteristics.

These regulations, aimed at mitigating climate change, directly affect the production and use of traditional fluorochemicals, compelling industries to seek alternative solutions.

This shift necessitates significant research and development expenditure to innovate compliant products, potentially slowing market growth as manufacturers adjust to new legal standards.

Volatility in Raw Material Prices Affecting Production Costs

The fluorochemicals market is susceptible to fluctuations in the cost of raw materials, primarily influenced by political, economic, and environmental factors. Such volatility can lead to unpredictable production costs, impacting profitability for manufacturers.

This uncertainty may deter investment in fluorochemical production and limit market growth, as companies might hesitate to commit capital towards expanding facilities or developing new products under such unstable cost conditions.

Development of Alternative Technologies Reducing Demand

The advancement of alternative technologies that do not require fluorochemicals is a significant restraining factor for the market. As industries innovate and adopt newer technologies like natural refrigerants or solid-state electronics that bypass the need for fluorochemicals, demand for traditional fluorochemical-based applications declines.

This shift not only reduces the market size for fluorochemicals but also pushes companies to innovate or diversify away from sectors where alternatives are gaining dominance, challenging the market’s long-term sustainability.

Growth Opportunity

Emerging Markets Demand Increasing for Cooling Solutions

As developing nations continue to industrialize and urbanize, the demand for air conditioning and refrigeration systems is surging, presenting a significant growth opportunity for the fluorochemicals market.

These regions are experiencing rapid economic growth, leading to increased investments in infrastructure and consumer goods, which in turn drives the need for effective cooling technologies that rely on fluorochemicals.

By focusing on these emerging markets, manufacturers can tap into new customer bases, expanding their global reach and increasing market share.

Innovations in Fluorochemicals for Eco-friendly Solutions

There is a growing market opportunity in the development and commercialization of new, environmentally friendly fluorochemicals.

As regulations tighten around the world to phase out substances harmful to the environment, the industry is compelled to innovate alternative fluorochemicals that meet these stringent standards yet maintain high performance.

This shift not only helps comply with global environmental policies but also positions companies as leaders in sustainable practices, potentially capturing a larger share of the market focused on green technologies.

Expansion in Healthcare and Pharmaceutical Applications

Fluorochemicals are increasingly used in the healthcare and pharmaceutical sectors, where their unique properties, such as chemical and biological resistance, are essential.

The growth in these industries, particularly with the expansion of biologics and the increasing need for more advanced sterilization and refrigeration solutions in medical facilities, opens up new avenues for fluorochemical applications.

Tapping into this area offers a lucrative growth opportunity for fluorochemical manufacturers to diversify their applications and benefit from the robust expansion of the global healthcare market.

Latest Trends

Adoption of Next-Generation Refrigerants for Climate Control

The fluorochemicals market is witnessing a significant trend towards the adoption of next-generation refrigerants that have lower global warming potential and are less harmful to the ozone layer. This shift is driven by international environmental agreements and national regulations aiming to mitigate climate change impacts.

Manufacturers are rapidly developing and commercializing these new refrigerants to meet the evolving demands of the automotive and HVAC industries, ensuring compliance with global standards while maintaining efficiency in climate control technologies.

Increased Focus on Fluorochemical Recycling Practices

There is a growing trend towards implementing recycling practices for fluorochemicals, particularly in the refrigeration and air conditioning sectors. As environmental awareness and sustainability initiatives gain traction, industries are increasingly adopting methods to reclaim and reuse fluorochemicals to reduce waste and environmental impact.

This trend not only helps companies comply with stringent environmental regulations but also reduces operational costs by maximizing resource efficiency, offering a dual benefit of sustainability and economic advantage.

Expansion of Fluorochemicals in Electric Vehicle Batteries

The expansion of fluorochemical applications into the electric vehicle (EV) sector marks a significant trend, driven by the global shift towards electric mobility. Fluorochemicals are utilized in various components of EV batteries, enhancing performance by improving energy density and thermal management.

As the EV market continues to grow, the demand for high-performance materials that ensure safety and efficiency in battery operation is also increasing, positioning fluorochemicals as critical components in the burgeoning sustainable transportation industry.

Regional Analysis

In 2023, the Asia Pacific fluorochemicals market reached USD 11.2 billion, accounting for 42.9% of the global market.

The fluorochemicals market showcases distinct regional dynamics, with Asia Pacific leading as the dominant region, accounting for 42.9% of the global market and valued at USD 11.2 billion.

This substantial market share is driven by rapid industrialization, expanding automotive and electronics manufacturing sectors, and increasing investments in infrastructure developments across countries like China, India, and Japan.

In North America, the market is characterized by stringent regulatory standards and a shift towards environmentally friendly fluorochemicals, particularly in the United States and Canada. This region focuses on innovative, sustainable solutions that comply with regulations aimed at reducing the environmental impact of traditional fluorochemicals.

Europe also demonstrates a strong emphasis on regulatory compliance, with the EU’s aggressive environmental policies pushing for advancements in green chemistry and sustainable practices in fluorochemical uses. European manufacturers are leading in the development of next-generation products that minimize global warming potential.

The Middle East & Africa, and Latin America regions, though smaller in market size compared to Asia Pacific, North America, and Europe, are experiencing growth due to increasing urbanization and industrial activities.

These regions present untapped opportunities for market expansion, particularly in areas like refrigeration applications and the chemical industry, driven by climatic needs and economic development.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global fluorochemicals market is significantly shaped by the strategic actions and innovations of key players such as 3M, DuPont, DAIKIN INDUSTRIES, Ltd., Solvay, and others. These companies play pivotal roles in driving the industry forward through advanced research and development initiatives, expansion into new geographical markets, and enhancements in fluorochemical applications across diverse sectors.

3M and DuPont, with their extensive portfolios and investment in technology, are leading the way in developing next-generation fluorochemicals that align with stringent global environmental standards.

These innovations focus on reducing the ozone-depleting potential and global warming impact of fluorochemical products, which is crucial for maintaining regulatory compliance and meeting the market’s demand for more sustainable options.

DAIKIN INDUSTRIES stands out in the market with its specialized focus on refrigeration and air conditioning solutions. The company’s commitment to energy-efficient and lower GWP products helps it capture a substantial share of the market in regions heavily impacted by regulatory changes, such as Europe and North America.

Solvay and Arkema are advancing in the sector by leveraging their expertise in high-performance fluorochemicals for niche applications like pharmaceuticals, specialty polymers, and agrochemicals. Their focus on tailored solutions allows them to meet specific customer needs and differentiate themselves in a competitive market.

Emerging players like Asahi India Glass Limited and Mitsui Chemicals India Pvt. Ltd. underscore the growth potential in the Asia Pacific region, capitalizing on the expanding automotive and construction industries.

Meanwhile, companies like Honeywell International Inc. and Air Products and Chemicals, Inc. continue to expand their global footprint by fostering partnerships and increasing production capacities to serve growing markets such as the Middle East, Africa, and Latin America.

Collectively, these key players are essential to the fluorochemicals market’s dynamics, offering innovations that address both current and future industry challenges while navigating complex regulatory landscapes and shifting consumer preferences toward sustainability.

Top Key Players in the Market

- 3M

- DuPont

- DAIKIN INDUSTRIES, Ltd.

- Solvay

- Asahi India Glass Limited

- Arkema

- Honeywell International Inc.

- DONGYUE GROUP

- Pelchem SOC Ltd

- Air Products and Chemicals, Inc.

- Mitsui Chemicals India Pvt. Ltd.

- Halocarbon, LLC

- Koura

Recent Developments

- In 2024, DuPont continued to strengthen its market position through strategic leadership changes and maintaining its focus on key industries like electronics and healthcare, which rely heavily on fluorochemicals for various applications.

- In 2023, Air Products highlighted its role in accelerating the energy transition with significant projects like the world’s largest green hydrogen complex in NEOM, Saudi Arabia, aiming to decarbonize heavy-duty transportation and other industrial sectors.

Report Scope

Report Features Description Market Value (2023) USD 26.3 Billion Forecast Revenue (2033) USD 42.4 Billion CAGR (2024-2033) 4.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Fluorocarbons, HCFC, HFC and Others, Inorganic Fluorochemicals, Fluoropolymers and Fluoroelastomers), By Application (Surfactants, Propellants, Aluminum Production, Refrigerant, Automobile, Agrochemicals, Others), By End Use (Electrical and Electronics, Petrochemicals, Chemicals, Aerospace, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3M, DuPont, DAIKIN INDUSTRIES, Ltd., Solvay, Asahi India Glass Limited, Arkema, Honeywell International Inc., DONGYUE GROUP, Pelchem SOC Ltd, Air Products and Chemicals, Inc., Mitsui Chemicals India Pvt. Ltd., Halocarbon, LLC, Koura Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fluorochemicals MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Fluorochemicals MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M

- DuPont

- DAIKIN INDUSTRIES, Ltd.

- Solvay

- Asahi India Glass Limited

- Arkema

- Honeywell International Inc.

- DONGYUE GROUP

- Pelchem SOC Ltd

- Air Products and Chemicals, Inc.

- Mitsui Chemicals India Pvt. Ltd.

- Halocarbon, LLC

- Koura