Global Hydrofluoric Acid Market By Grade (Diluted, Anhydrous), By Application (Fluorinated Derivatives, Fluorocarbon, Metal Pickling, Oil Refining, Glass Etching, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 22296

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

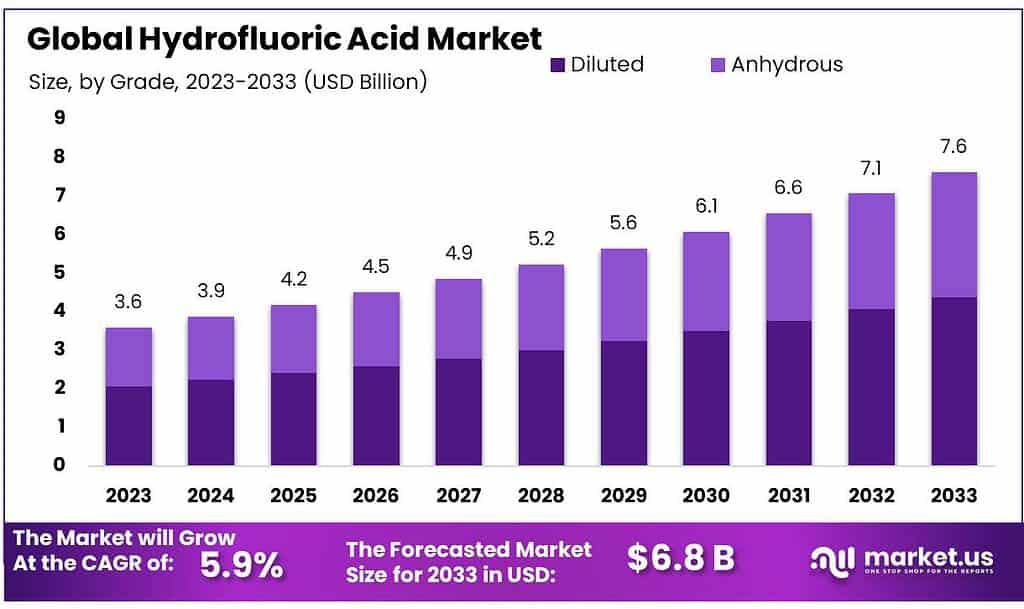

The global hydrofluoric acid market size is expected to be worth around USD 6.3 billion by 2033, from USD 3.6 billion in 2023, growing at a CAGR of 5.9% during the forecast period from 2023 to 2033.

This is due to increasing product usage in many end-use applications such as oil refining, metal, fluorocarbon, and aluminum refrigerants, metal, hydrocarbons, fluorocarbon, and aluminum. The forecast period will also see a rise in demand for hi

gh-grade acid products. The chemical industry uses hydrofluoric acid to produce various fluorine components like fluorides and fluoropolymers.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Worth by 2033: Expected to reach USD 6.3 billion, a significant increase from USD 3.6 billion in 2023. At a (CAGR) of 5.9% from 2023 to 2033.

- Grade Analysis Anhydrous Grade Dominance accounted for over 57.5% of the market share in 2023.

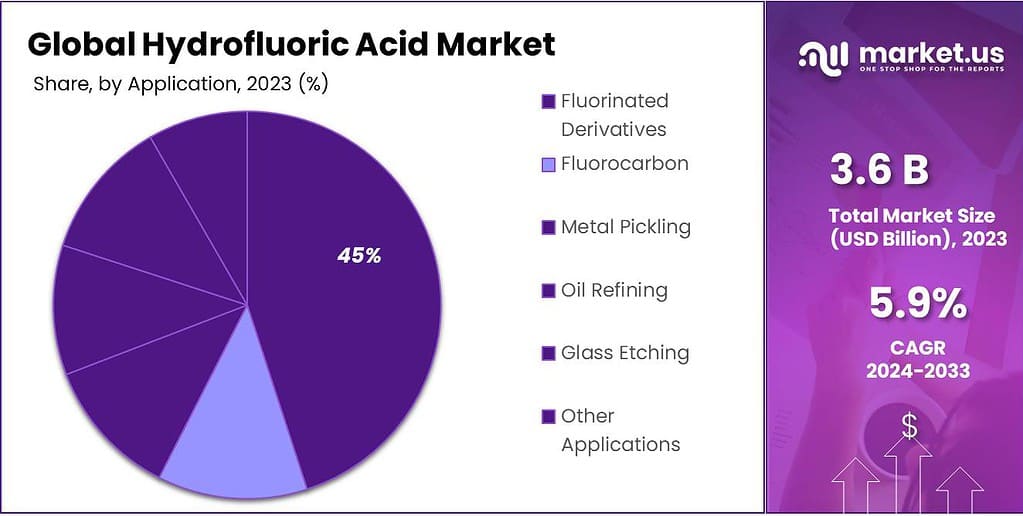

- Application Analysis Fluorocarbons Lead Usage Represented 54.5% of the market share in 2023 due to their wide use in refrigerants, air conditioning, and manufacturing.

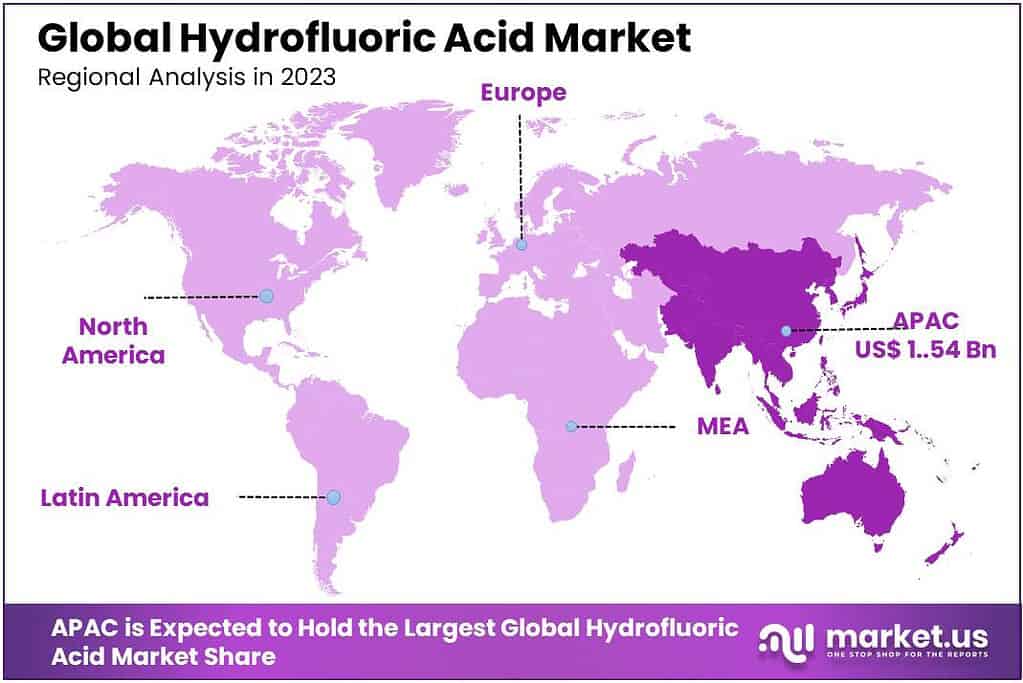

- Regional Analysis Asia Pacific Dominance: Accounted for over 43% of revenue in 2023, driven by fluorocarbon manufacturers, particularly in China, impacting electronics and metal industries.

Grade Analysis

In 2023, the hydrofluoric acid market was dominated by Anhydrous, taking up over 57.5% of the market share. Anhydrous grade signifies the absence of water, offering high purity levels, making it preferred in various industrial applications. Its effectiveness in industries like electronics, petroleum refining, and chemical manufacturing bolstered its market presence.

This can be ascribed, among other things, to an increase in product inclusion in fluorochemicals, fluoropolymers, and surfactants. It is used in petroleum alkylation as a catalyst. It can also be used in the acidolysis of cysteine-peptides’ benzyl group.

It increases production at lower temperatures which in turn has a positive effect on the demand for anhydrous grades. It is used in stainless steel pickling, glass etching, and quartz purification. It can also be used to remove native silicon dioxide (silicon dioxide) from wafers. Because it can etch silicon compounds, it is often used in research. It is extremely corrosive and toxic to the skin, making it a significant barrier to global market growth.

Inhaling a certain amount of anhydrous acid can cause serious respiratory problems. To ensure worker safety, an acid concentration of 100 mg/m3 is permissible. Domestically, anhydrous hydrofluoric acids are in high demand. It can also be used to clean metal and wheels. This will in turn lead to segment growth over the forecast period.

Application Analysis

Fluorocarbons were the undisputed winners in 2023’s hydrofluoric acid market, accounting for 54.5% market share. Fluorocarbons are widely utilized across industries such as refrigeration, air conditioning and manufacturing thanks to their heat resistance and low reactivity properties.

Fluorocarbons are in high demand from refrigerants and air conditioning systems, which has boosted production, particularly in developing countries. Because it is an alternative to ozone-depleting chlorofluorocarbons, hydrofluoric acid is seeing a rise in demand.

It can be used in many applications such as the purification and polishing of graphite, quartz, and ferrosilicon, ceramic production, and metal pickling. It is used to treat metals, removing stains from the surface. The hydrofluoric acid alkylation units are used in petroleum refining to transform alkenes or isobutane, primarily butylene and propylene, into alkylate. This is then used to make gasoline. This product can also be used in the manufacture of aluminum.

The market will grow in the future due to the increasing demand for aluminum products in different industries around the world. Hydrofluoric acid in nature is a toxic and highly corrosive substance. Hydrofluoric acid can have severe side effects on the health if inhaled or directly contacted. These restrictions can reduce the use of industrial-grade hydrofluoric acids, which can further limit product demand.

Note: Actual Numbers Might Vary In the Final Report

Кеу Маrkеt Ѕеgmеntѕ

By Grade

- Diluted

- Anhydrous

By Application

- Fluorinated Derivatives

- Fluorocarbon

- Metal Pickling

- Oil Refining

- Glass Etching

- Other Applications

Drivers

Hydrofluoric acid is essential in creating various kinds of products containing fluorine, including hydrochlorofluorocarbons (HCFCs), hydrofluorocarbons (HFCs), and hydrofluoroolefins (HFOs). HFCs, especially, are used a lot as coolants in fridges and stuff used to keep things chilly.

These coolants, HFCs and HFOs, are super important for keeping things cold in fridges all around the world. Because they’re so crucial, there’s a big need for hydrofluoric acid to make these coolants and keep things cool without using too much energy. Demand also stems from their efficient cooling solutions in diverse sectors like food storage, pharmaceutical production and electronics production – further fuelling its market.

Hydrofluoric acid has long been an integral component of the chemical industry, producing an extensive variety of fluorine compounds from fluorocarbons to fluorides and fluoropolymers. These products find applications across sectors including manufacturing, electronics and healthcare.

Hydrofluoric acid’s versatility as an ingredient of refrigeration systems and in the production of fluorine-based chemicals continues to drive its market. Furthermore, its crucial role in creating compounds used in modern industrial processes cements its place as a cornerstone in multiple industries.

Retsraints

One thing that holds back the hydrofluoric acid market is how the prices of the materials it needs keep changing a lot. These fluctuations in prices can make it tricky for companies that rely on hydrofluoric acid to plan and budget their production.

Another challenge comes from strict rules about using certain coolants, like fluorocarbons, in fridges and cooling systems. These coolants can harm the ozone layer, which is really important for protecting us from the sun’s harmful rays. So, different governments and groups have set up rules to control how much we can use these harmful coolants.

Some countries have even agreed to stop using certain types of these coolants, like HCFCs and HFCs, by making rules and protocols to limit how much we use them. These regulations make it tougher for industries that depend on hydrofluoric acid to make those coolants.

Opportunity

Hydrofluoric acid plays an essential role in the semiconductor industry, where it is employed in tasks like creating computer chips. Etching and cleaning glass play key roles in making these high-tech gadgets. As technology improves and shrinks chips further, hydrofluoric acid’s demand should increase accordingly; its role of making sure every glass used in these advanced gadgets are perfectly etched and cleaned makes it an integral component of this sector.

Hydrofluoric acid stands to benefit immensely from the expansion of the semiconductor industry, where its central function in glass etching and cleaning has created great demand. Hydrofluoric acid has proven indispensable in producing computer chips – with technology becoming ever more sophisticated gadgets requiring ever more sophisticated glass materials for semiconductor production, its importance becoming even greater as its role of meeting precise standards continues. Hydrofluoric acid therefore represents an incredible opportunity for growth within this promising sector of industry.

Challenges

Dealing with hydrofluoric acid poses some tough challenges due to its corrosive and highly toxic nature, whether it’s in liquid f

orm or as a gas. The risks involved in handling it are serious, requiring extreme caution to prevent leaks or any accidents. Its potent corrosive properties mean that even a small spill or exposure can cause significant harm. Managing its use and ensuring safety protocols are followed becomes crucial to avoid any potential dangers.

This difficulty in safely handling hydrofluoric acid poses a substantial challenge for those involved in its production, transportation, and application across various industries.

The hazardous characteristics of hydrofluoric acid present a significant hurdle for its widespread use. Its high toxicity and corrosiveness demand stringent safety measures in handling and storage. Even minor incidents with this acid can lead to severe consequences, making it essential for industries and professionals working with it to adhere strictly to safety guidelines.

Balancing its utility in various applications with the need for extreme caution in handling represents a persistent challenge in the market. Efforts to mitigate these risks and ensure safe usage remain pivotal in overcoming this challenge associated with hydrofluoric acid.

Regional Analysis

With a revenue share exceeding 43%, the Asia Pacific region dominated global markets in 2023. This is due to the numerous fluorocarbon manufacturers in the region. This industry will be the fastest-growing market during the forecast period.

China’s rising demand for electronics and metals is positively impacting product demand. Market growth will be boosted by the increasing use of metal and electronics in civil production, national defense, and industrial industries.

Due to the increased production of fluorochemicals in Europe, the market is expected to grow. North America’s industry is experiencing rapid growth due to increasing imports and R&D efforts to create a more environmentally friendly product that has the same performance.

Hydrofluoric acid manufacturing is important in Central & South America, the Middle East, and Africa areas. However, it is comparatively less popular than other developed regions around the world.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Market competition is heavily influenced by the product mix, the number of sellers, and geographic location. To produce non-toxic products, key manufacturers are involved in R&D. The popularity of online distribution is rapidly growing compared to direct sales.

However, direct sales still have a higher market value because customers can access the products more easily. To increase their presence in the value chain, key industry players are focused on mergers and acquisitions. To reduce operational costs, these players are involved in multiple activities. This includes the production and marketing of the final product.

Маrkеt Кеу Рlауеrѕ

- Daikin

- Sinochem

- Dongyue Group

- Solvay

- Koura Global

- Lanxess

- Yingpeng Chemical

- Stella Chemifa Corp.

- Honeywell International Inc.

- Other Key Players

Recent developments

In March 2021, ArcelorMittal launched XCarb, a bold initiative to cut CO2 emissions in steelmaking. They invested in projects targeting carbon reduction from blast furnaces, marking a firm step toward sustainable steel production.

Report Scope

Report Features Description Market Value (2023) USD 3.6 Billion Forecast Revenue (2033) USD 6.3 Billion CAGR (2023-2032) 5.9% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Diluted, Anhydrous), By Application (Fluorinated Derivatives, Fluorocarbon, Metal Pickling, Oil Refining, Glass Etching, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Daikin, Sinochem, Dongyue Group, Solvay, Koura Global, Lanxess, Yingpeng Chemical, Stella Chemifa Corp., Honeywell International Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is hydrofluoric acid (HF)?Hydrofluoric acid is a solution of hydrogen fluoride in water. It is a highly corrosive and toxic acid with various industrial applications due to its ability to dissolve many materials, particularly silicates and glass.

What are the primary uses of hydrofluoric acid?Hydrofluoric acid is used in various industries, including the production of fluorocarbons, fluorinated derivatives, inorganic fluorides, and for its role in the refining of certain metals like aluminum and uranium. It is also used in etching glass and in the production of electronics and chemicals.

How important is sustainability in the hydrofluoric acid industry?Sustainability is gaining importance, leading to innovations in production methods to reduce emissions and waste generation. Efforts are made to develop safer handling practices and disposal methods for hydrofluoric acid to minimize its environmental impact.

What are the main challenges faced by the hydrofluoric acid market?Challenges include safety concerns due to its highly corrosive and toxic nature, strict regulations regarding its handling and disposal, fluctuations in raw material prices, and environmental concerns regarding the production process and waste management.

-

-

- Daikin

- Sinochem

- Dongyue Group

- Solvay

- Koura Global

- Lanxess

- Yingpeng Chemical

- Stella Chemifa Corp.

- Honeywell International Inc.

- Other Key Players