Global Chlorpyrifos Market By Form (Liquid, Powder, Granular, Others), By Crop Type (Rice, Corn, Soybeans, Cotton, Fruits, Vegetables), By Target Pest (Insects, Mites, Nematodes), By Application (Soil treatment, Seed treatment, Foliar spray), By End-Use (Agriculture, Turf and ornamentals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: November 2024

- Report ID: 132744

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

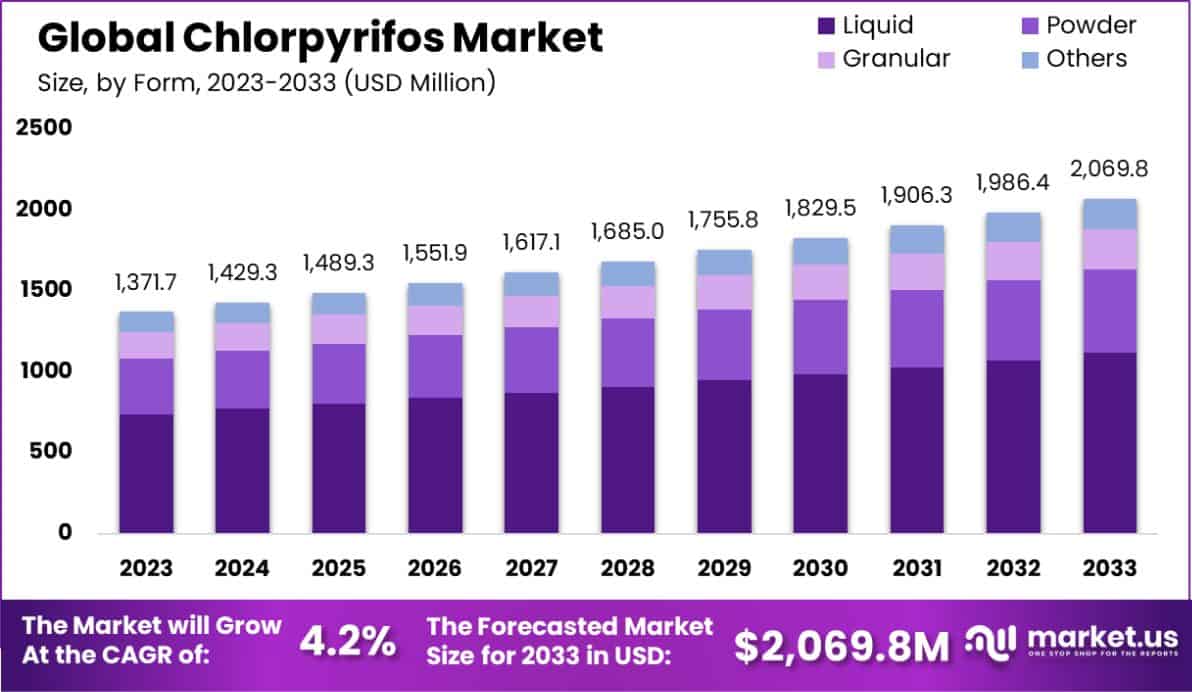

The Global Chlorpyrifos Market is expected to be worth around USD 2,069.8 Million by 2033, up from USD 1371.7 Million in 2023, and grow at a CAGR of 4.2% from 2024 to 2033.

Chlorpyrifos is a widely used organophosphate pesticide primarily applied in agriculture to control pests on crops such as corn, soybeans, and fruits. It works by inhibiting the nervous system of insects, leading to their death.

Despite its effectiveness, Chlorpyrifos has been associated with health and environmental concerns, leading to regulatory restrictions in many countries.

The Chlorpyrifos market stands at a critical juncture, influenced by escalating demands for efficient crop protection chemicals and counterbalanced by increasing regulatory scrutiny and environmental concerns.

As an organophosphate pesticide, Chlorpyrifos plays a pivotal role in managing pest infestations across a variety of crops, contributing to enhanced agricultural productivity. However, its adverse effects on human health and the environment have prompted a shift towards developing sustainable alternatives.

Significant investments are being funneled into research and development of these alternatives, exemplified by recent funding initiatives. According to dpr.ca.gov, the PR Pest Management Alliance and Research Grants have allocated $2.1 million to support projects aimed at creating sustainable pest management solutions as alternatives to Chlorpyrifos.

Additionally, the California Department of Food and Agriculture (CDFA) has injected $1.5 million through its Development of Pesticide Alternatives Grant, accelerating the registration of new pest management tools for specialty crops.

Furthermore, the Biologically Integrated Farming Systems (BIFS) program has received $2 million to foster Integrated Pest Management (IPM) demonstration projects that aim to reduce reliance on chemical insecticides.

These funding initiatives not only underscore the market’s drive towards innovation but also highlight the opportunity for growth in eco-friendly pest control solutions. As regulations tighten and consumer preferences shift towards sustainable agricultural practices, the Chlorpyrifos market is poised to evolve, presenting both challenges and opportunities for industry stakeholders.

The market for Chlorpyrifos is driven by its strong demand in agricultural pest control, especially in developing countries where large-scale farming is prevalent. Additionally, rising pest resistance to other chemicals boosts its appeal.

The increasing global population and need for high agricultural yields in pest-prone regions significantly fuel the demand for Chlorpyrifos. There is an opportunity for innovation in safer, more environmentally friendly alternatives, as well as regulatory shifts towards sustainable pest management practices.

Key Takeaways

- The Global Chlorpyrifos Market is expected to be worth around USD 2,069.8 Million by 2033, up from USD 1371.7 Million in 2023, and grow at a CAGR of 4.2% from 2024 to 2033.

- Chlorpyrifos in liquid form holds a significant market share, representing 54.4% of the product’s formulations.

- In terms of crop type usage, rice cultivation utilizes 34.3% of the market’s total Chlorpyrifos supply.

- The predominant target for Chlorpyrifos application is insect control, accounting for 64.3% of its usage.

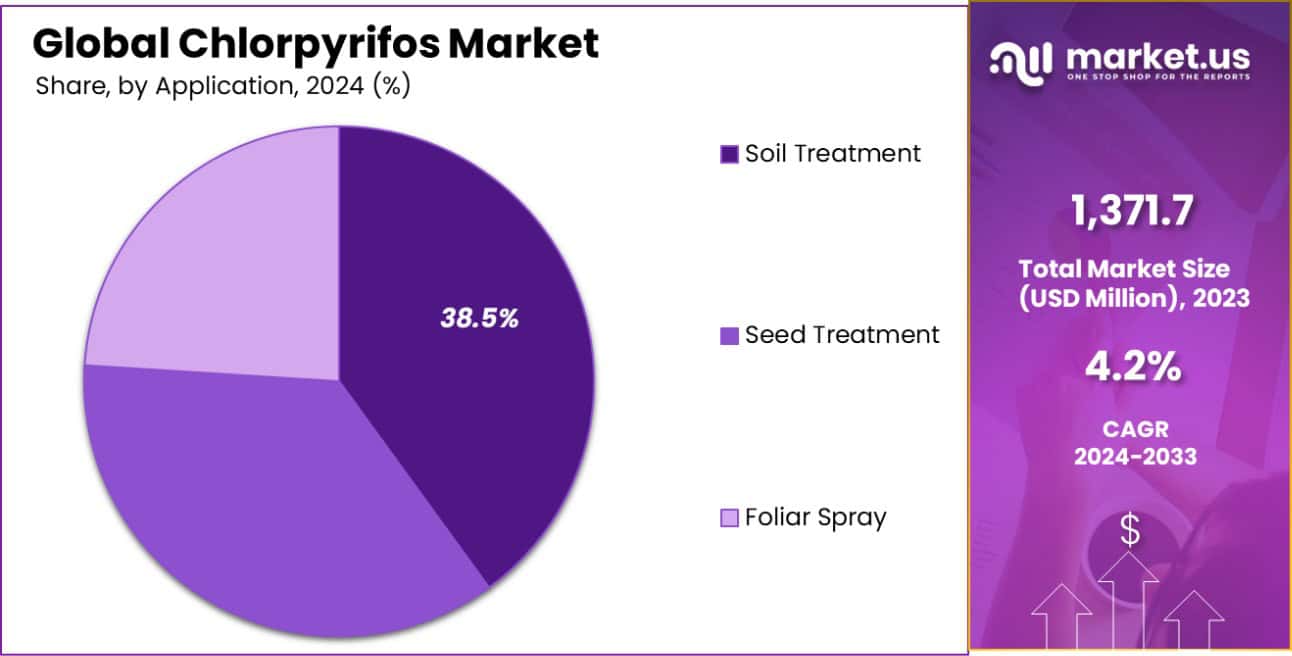

- Soil treatment applications of Chlorpyrifos comprise 38.5% of its use, emphasizing its importance in ground applications.

- The agricultural sector is the primary end-user of Chlorpyrifos, commanding an 85.3% share of the market.

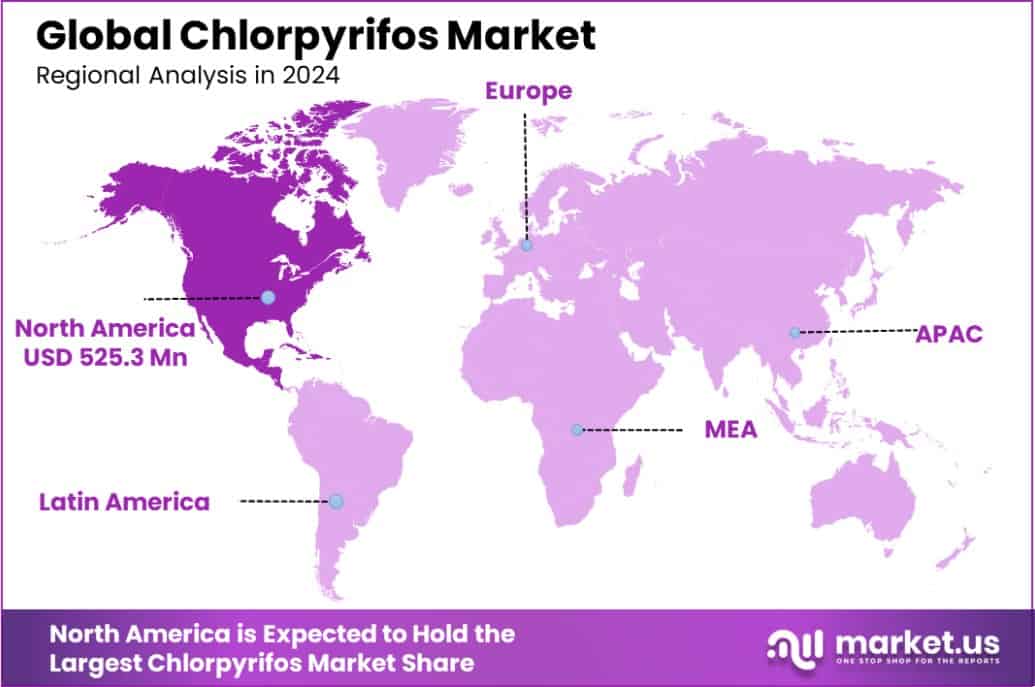

- In North America, the Chlorpyrifos market holds 42.3% with a value of USD 525.3 million.

By Form Analysis

Liquid form dominates Chlorpyrifos market with a share of 54.4%.

In 2023, the “By Form” segment of the Chlorpyrifos market was prominently led by Liquid form, capturing a 54.4% market share. This dominance is attributed to the widespread preference for liquid formulations in agricultural applications due to their ease of application and efficient absorption by plants.

Following Liquid, the Powder form held a significant portion of the market, valued for its storage stability and cost-effectiveness. Granular form also maintained a notable share, favored in settings requiring controlled release of the active ingredient. The category labeled as Others, which includes various minor forms, collectively accounted for the smallest market share.

These diverse forms cater to varying application techniques and environmental conditions, underscoring the adaptability of Chlorpyrifos across different agricultural scenarios. As market dynamics evolve, the distribution of shares among these forms may shift, reflecting changes in regulatory landscapes and technological advancements in formulation technologies.

By Crop Type Analysis

Rice crops primarily use Chlorpyrifos, constituting 34.3% of the market.

In 2023, Rice held a dominant market position in the “By Crop Type” segment of the Chlorpyrifos market, with a 34.3% share. This significant market presence is primarily due to the high susceptibility of rice crops to various pests, for which Chlorpyrifos serves as an effective pest control solution.

Following rice, Corn accounted for the next largest segment, benefiting from the broad-spectrum insecticidal properties of Chlorpyrifos that ensure crop safety and yield enhancement.

Soybeans also represented a considerable portion of the market, leveraging Chlorpyrifos to combat soil and foliar pests. Cotton, Fruits, and Vegetables segments, while smaller, collectively contribute to the market’s diversification, addressing specific pest threats unique to each crop.

These segments underscore the integral role of Chlorpyrifos in managing pest populations across a variety of agricultural settings, ensuring the protection of key staple and cash crops critical to global agricultural outputs. ‘

As environmental regulations and farming practices continue to evolve, the market dynamics of Chlorpyrifos usage across these crops are expected to shift, reflecting a balance between efficacy and ecological impact.

By Target Pest Analysis

Chlorpyrifos is primarily targeted against insects, holding a 64.3% segment share.

In 2023, Insects held a dominant market position in the “By Target Pest” segment of the Chlorpyrifos market, commanding a 64.3% share. This dominance is primarily due to the extensive range of insect pests that Chlorpyrifos effectively controls, which include beetles, moths, and various other crop-destroying species.

The efficacy of Chlorpyrifos in providing broad-spectrum insect control makes it a preferred choice for farmers seeking to safeguard their yields against diverse insect threats.

Following Insects, Mites accounted for the next significant market segment. Chlorpyrifos is valued in this segment for its ability to manage various mite species that can damage crops and reduce agricultural productivity.

Lastly, Nematodes represent a smaller, yet critical segment of the market. Chlorpyrifos is used to control these soil-borne pests, which pose a threat to a wide array of crops, including root and tuber plants.

The use of Chlorpyrifos across these target pest segments highlights its importance in integrated pest management strategies, offering robust protection to enhance crop quality and farm profitability.

However, the usage trends and market dynamics may evolve as regulatory policies and environmental considerations increasingly influence pesticide application practices.

By Application Analysis

Soil treatment is a common application, accounting for 38.5% of use.

In 2023, Soil Treatment held a dominant market position in the “By Application” segment of the Chlorpyrifos market, with a 38.5% share. This leading position can be attributed to the crucial role of soil treatment in establishing a pest-free foundation for various crops.

Soil treatment with Chlorpyrifos effectively controls subterranean pests and provides residual activity that protects germinating seeds and young plants from early pest attacks.

Following closely, Seed Treatment accounted for a substantial portion of the market. This application benefits from the use of Chlorpyrifos to coat seeds, safeguarding them from pests during critical early growth stages, thus ensuring stronger and healthier crop development.

Foliar Spray, while occupying a smaller share compared to soil and seed treatments, remains vital for addressing infestations that occur later in the crop’s lifecycle. This method allows for targeted pest control, addressing insects that emerge or persist during the growing season.

The strategic use of Chlorpyrifos across these application methods underscores its importance in integrated pest management systems, providing farmers with multiple tools to combat pest pressures effectively. As agricultural practices evolve, the adoption rates of these applications may shift, reflecting ongoing research and regulatory changes impacting pesticide use.

By End-Use Analysis

Agriculture remains the largest end-user of Chlorpyrifos, with an 85.3% share.

In 2023, Agriculture held a dominant market position in the “By End-Use” segment of the Chlorpyrifos market, with an impressive 85.3% share. This substantial market share reflects the critical role of Chlorpyrifos in agricultural pest control, where it is utilized to protect a wide array of crops from pests that threaten yield and quality.

The chemical’s effectiveness against a broad spectrum of insects makes it indispensable in integrated pest management strategies across diverse agricultural settings.

The Turf and Ornamentals segment, while significantly smaller, still plays a crucial role in the market. Chlorpyrifos is applied in these settings to manage pests in ornamental plants and turf, which are susceptible to similar pest pressures as agricultural crops.

This segment benefits from the product’s ability to provide extended protection against a range of pests, thereby maintaining the health and aesthetic value of ornamental landscapes and recreational turf.

The overwhelming dominance of Chlorpyrifos in the agriculture sector underscores its importance to global food production and security. However, the reliance on Chlorpyrifos also highlights the need for ongoing monitoring of environmental and health impacts, ensuring sustainable and safe pest management practices are upheld in the industry.

Key Market Segments

By Form

- Liquid

- Powder

- Granular

- Others

By Crop Type

- Rice

- Corn

- Soybeans

- Cotton

- Fruits

- Vegetables

By Target Pest

- Insects

- Mites

- Nematodes

By Application

- Soil treatment

- Seed treatment

- Foliar spray

By End-Use

- Agriculture

- Turf and ornamentals

Driving Factors

Increasing Demand from Expanding Agricultural Sectors Globally

The global expansion of agricultural activities is a primary driver for the Chlorpyrifos market. As worldwide food demand escalates due to growing populations, farmers increasingly rely on effective pesticides like Chlorpyrifos to enhance crop yields and quality.

This chemical is crucial in managing a broad spectrum of pests that can severely impact agricultural productivity. The dependence on such pesticides is intensified in regions experiencing rapid agricultural development and those facing significant pest threats, ensuring sustained demand for Chlorpyrifos.

Effectiveness Against a Wide Range of Crop Pests

Chlorpyrifos is renowned for its efficacy in controlling a diverse array of pests, which underpins its strong market position. Its ability to combat various insect pests across multiple crop types makes it a go-to solution in integrated pest management programs.

This versatility is particularly valuable in regions where farmers face multiple pest challenges, helping to maintain the health and viability of important staples and cash crops. The continued effectiveness of Chlorpyrifos against pests supports its ongoing use and market strength.

Regulatory Approvals in Key Markets

Regulatory endorsements in significant agricultural markets such as the United States, Brazil, and India play a crucial role in driving the Chlorpyrifos market. These approvals determine the accessibility and usage rates of Chlorpyrifos, influencing its adoption across vast agricultural landscapes.

While regulatory landscapes are subject to change, current approvals support stable market conditions for Chlorpyrifos, facilitating its continued use in farming practices globally. The future trajectory of these regulations will be key in shaping market dynamics.

Restraining Factors

Increasing Environmental Concerns and Regulatory Scrutiny

Chlorpyrifos has come under intense scrutiny due to its environmental impact, particularly its potential to harm non-target wildlife and contribute to water pollution. These environmental concerns have prompted regulatory bodies around the world to reconsider and sometimes restrict its use.

As regulations tighten, the market for Chlorpyrifos faces significant constraints, limiting its application in key agricultural regions. This shift towards more stringent environmental standards is influencing farmers and industries to seek alternative, less controversial pest control methods.

Growth of Organic Farming and Natural Pesticides

The global trend towards organic farming, which prohibits the use of synthetic pesticides like Chlorpyrifos, is a major restraining factor for its market. As consumer preference shifts towards organically grown food, driven by health and environmental considerations, the demand for chemical pesticides decreases.

This trend is supported by governmental policies and incentives that promote sustainable agricultural practices, further diminishing the market space for Chlorpyrifos and similar chemical products.

Development of Pest Resistance to Chlorpyrifos

The effectiveness of Chlorpyrifos is being undermined by the increasing development of resistance among pest populations. This resistance development compels farmers to use higher doses or switch to alternative pest control methods, which can be more environmentally friendly and sustainable.

As resistance spreads and becomes more widely recognized, the reliance on Chlorpyrifos as a primary pest control solution is expected to decline, impacting its long-term market viability.

Growth Opportunity

Expansion into Emerging Markets with High Agricultural Demand

Emerging markets with rapidly expanding agricultural sectors present significant growth opportunities for the Chlorpyrifos market. Countries in Africa, Southeast Asia, and Latin America, where agriculture forms a substantial part of the economy and where pest management is a critical concern, offer new avenues for market expansion.

The increasing need for effective pest control solutions in these regions can drive higher adoption of Chlorpyrifos, especially in areas less affected by stringent environmental regulations.

Innovations in Product Formulation and Application Techniques

There is a notable opportunity for growth in the Chlorpyrifos market through innovations in product formulations and application methods. Developing formulations that are more effective, less toxic to non-target species, and environmentally friendly can help mitigate regulatory pressures and market restrictions.

Additionally, advancements in application technology that reduce environmental impact and improve delivery efficiency can make Chlorpyrifos more attractive to markets that are increasingly sensitive to sustainable practices.

Strategic Partnerships with Agricultural Co-operatives

Forming strategic partnerships with agricultural co-operatives and large farming operations can provide a substantial growth opportunity for the Chlorpyrifos market. These partnerships can facilitate deeper market penetration and improved customer loyalty by aligning Chlorpyrifos products with the integrated pest management programs of these organizations.

Such collaborations can also enhance the market’s understanding of farmer needs and preferences, leading to better-targeted and more effective pest control solutions that align with modern agricultural practices.

Latest Trends

Increased Use of Integrated Pest Management (IPM) Practices

One of the latest trends in the Chlorpyrifos market is the integration of Chlorpyrifos into broader Integrated Pest Management (IPM) strategies. This trend involves combining chemical treatments with biological, cultural, and mechanical pest control methods to achieve more sustainable and effective outcomes.

IPM practices not only help in minimizing pest resistance but also align with environmental safety protocols, enhancing the appeal of Chlorpyrifos in markets that value ecological preservation alongside agricultural productivity.

Advancements in Precision Agriculture Technologies

The Chlorpyrifos market is benefiting from the advancements in precision agriculture technologies. These technologies enable more targeted pesticide application, reducing waste and increasing efficiency. Precision agriculture tools such as drones and GPS-guided sprayers allow for precise application of Chlorpyrifos, minimizing its environmental footprint and enhancing its efficacy.

This trend is particularly appealing in regions with stringent pesticide regulations, helping maintain market stability and growth despite potential restrictions.

Shift Towards Sustainable and Lower-Toxicity Alternatives

There is a growing trend towards developing sustainable and lower-toxicity alternatives to traditional pesticides like Chlorpyrifos. This movement is driven by increasing regulatory pressures and consumer demand for environmentally friendly farming practices.

Innovations in this area include the development of biopesticides and other non-chemical approaches that could serve as complements or substitutes to Chlorpyrifos, catering to the evolving needs of modern agriculture and potentially opening new sub-markets within the broader pesticide industry.

Regional Analysis

In 2023, North America held 42.3% of the Chlorpyrifos market, valued at USD 525.3 million.

The Chlorpyrifos market exhibits varied dynamics across global regions, with North America leading the charge, holding a dominant 42.3% market share valued at USD 525.3 million. This prominence is driven by extensive agricultural activities and the high adoption of integrated pest management practices across the United States and Canada.

Europe follows with stringent regulatory frameworks guiding the pesticide’s application, focusing on safety and environmental impacts, yet maintaining a significant market size due to its necessity in certain agronomic practices.

Asia Pacific is witnessing rapid growth in the Chlorpyrifos market, fueled by expanding agricultural sectors in countries like China and India. These regions are increasingly reliant on effective pest management solutions to boost crop yields and support their large rural populations.

Meanwhile, the Middle East & Africa, and Latin America are emerging markets where agricultural development is pacing with modernization efforts. These regions show potential for growth as they continue to increase their agricultural output and adopt more advanced farming techniques, making them important targets for expansion in the Chlorpyrifos market.

Each region’s market dynamics are shaped by local agricultural practices, pest prevalence, and regulatory landscapes, influencing the overall global market trajectory.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global chlorpyrifos market is characterized by the active participation of several key industry players, each contributing uniquely to the sector’s competitive landscape.

Companies like BASF SE, Bayer CropScience, and Syngenta are pivotal, driving innovations and sustainability initiatives amid growing regulatory scrutiny and environmental concerns. Particularly, Syngenta has been at the forefront, enhancing integrated pest management solutions that align with global sustainability goals.

Dow AgroSciences LLC and DuPont continue to leverage their robust R&D capabilities to develop safer, more effective chlorpyrifos formulations. These efforts are crucial in maintaining market share as regulatory bodies tighten environmental standards.

Meanwhile, Adama Agricultural Solutions Ltd. distinguishes itself through strategic market expansions and robust distribution networks, ensuring widespread availability of their products in key agricultural markets.

Emerging players like Jiangsu Changlong Agrochemical Co., Ltd., and Hubei Sanonda Co., Ltd., focus on cost-competitive production methods, catering to price-sensitive markets which demand high efficiency without a premium price tag.

Their growth is instrumental in maintaining competitive pressures within the market, ensuring innovation and affordability remain central to the chlorpyrifos market’s evolution.

Overall, the dynamism within the chlorpyrifos market is driven by a blend of innovation, regulatory adaptation, and strategic market expansions by these key players, reflecting a deep understanding of the complex interplay between agricultural demands and environmental health.

Top Key Players in the Market

- Adama Agricultural Solutions Ltd.

- Anhui Fengle Agrochemical

- Anhui Huaibei Pesticide Factory Co., Ltd.

- BASF SE

- Bayer CropScience

- Dow AgroSciences LLC

- DuPont

- FMC Corporation

- Hubei Sanonda Co., Ltd.

- Jiangsu Changlong Agrochemical Co., Ltd.

- Jiangsu Sanonda Co., Ltd.

- Makhteshim Agan Group

- Meghmani Organics Limited

- Nantong Jinnuo Chemical Co., Ltd.

- Nufarm Limited

- Shandong Tiancheng Biological Technology Co., Ltd.

- Shanxi Sanwei Fenghai Chemical

- Syngenta

- UPL Limited

Recent Developments

- In 2024, Nufarm reported a robust financial performance with revenues reaching $1.8 billion and a net profit of $49 million. The company emphasized its commitment to strategic growth initiatives and innovation in its product offerings, especially focusing on sustainable and eco-friendly solutions.

- In 2023, Adama made significant strides in sustainable agriculture. They launched new products based on their proprietary formulation technologies, Asorbital® and Sesgama™, which enhance the effectiveness and environmental sustainability of agricultural chemicals.

Report Scope

Report Features Description Market Value (2023) USD 1371.7 Million Forecast Revenue (2033) USD 2,069.8 Million CAGR (2024-2033) 4.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Powder, Granular, Others), By Crop Type (Rice, Corn, Soybeans, Cotton, Fruits, Vegetables), By Target Pest (Insects, Mites, Nematodes), By Application (Soil treatment, Seed treatment, Foliar spray), By End-Use (Agriculture, Turf and ornamentals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Adama Agricultural Solutions Ltd., Anhui Fengle Agrochemical, Anhui Huaibei Pesticide Factory Co., Ltd., BASF SE, Bayer CropScience, Dow AgroSciences LLC, DuPont, FMC Corporation, Hubei Sanonda Co., Ltd., Jiangsu Changlong Agrochemical Co., Ltd., Jiangsu Sanonda Co., Ltd., Makhteshim Agan Group, Meghmani Organics Limited, Nantong Jinnuo Chemical Co., Ltd., Nufarm Limited, Shandong Tiancheng Biological Technology Co., Ltd., Shanxi Sanwei Fenghai Chemical, Syngenta, UPL Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adama Agricultural Solutions Ltd.

- Anhui Fengle Agrochemical

- Anhui Huaibei Pesticide Factory Co., Ltd.

- BASF SE

- Bayer CropScience

- Dow AgroSciences LLC

- DuPont

- FMC Corporation

- Hubei Sanonda Co., Ltd.

- Jiangsu Changlong Agrochemical Co., Ltd.

- Jiangsu Sanonda Co., Ltd.

- Makhteshim Agan Group

- Meghmani Organics Limited

- Nantong Jinnuo Chemical Co., Ltd.

- Nufarm Limited

- Shandong Tiancheng Biological Technology Co., Ltd.

- Shanxi Sanwei Fenghai Chemical

- Syngenta

- UPL Limited