Global Long Chain Dicarboxylic Acid Market By Application (Nylon & Other Polyamides, Lubricants, Powder Coatings, Pharmaceuticals, Adhesives, and Corrosion Inhibitors), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 14898

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

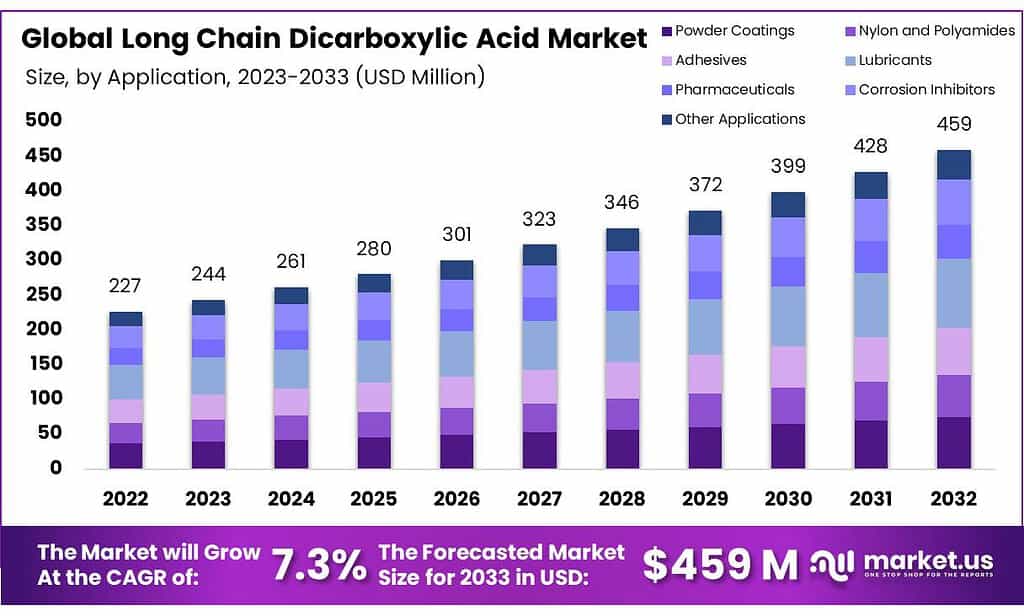

The Long Chain Dicarboxylic Acid Market size is expected to be worth around USD 459 Mn by 2033, from USD 227 Mn in 2023, growing at a CAGR of 7.3% during the forecast period from 2023 to 2033.

Long Chain Dicarboxylic Acids (LCDA) are organic compounds characterized by having a chain of carbon atoms with two carboxylic acid functional groups (-COOH) at each end. These acids are part of the larger family of dicarboxylic acids, with the distinguishing feature of having a longer carbon chain, typically containing more than ten carbon atoms.

LCDAs play a crucial role in various industrial applications, particularly in the production of polymers, resins, and coatings. The extended carbon chain in these acids contributes to their unique chemical properties, making them valuable building blocks in the synthesis of specialty materials.

These acids are often derived from natural sources or synthesized through chemical processes, providing versatility in their application across different industries. The elongated carbon backbone in LCDA imparts specific characteristics to the resulting products, such as enhanced durability, flexibility, and thermal stability.

Key Takeaways

- Market Growth Projection: Market set to reach USD 459 Mn by 2033, growing at 7.3% CAGR from 2023’s USD 227 Mn.

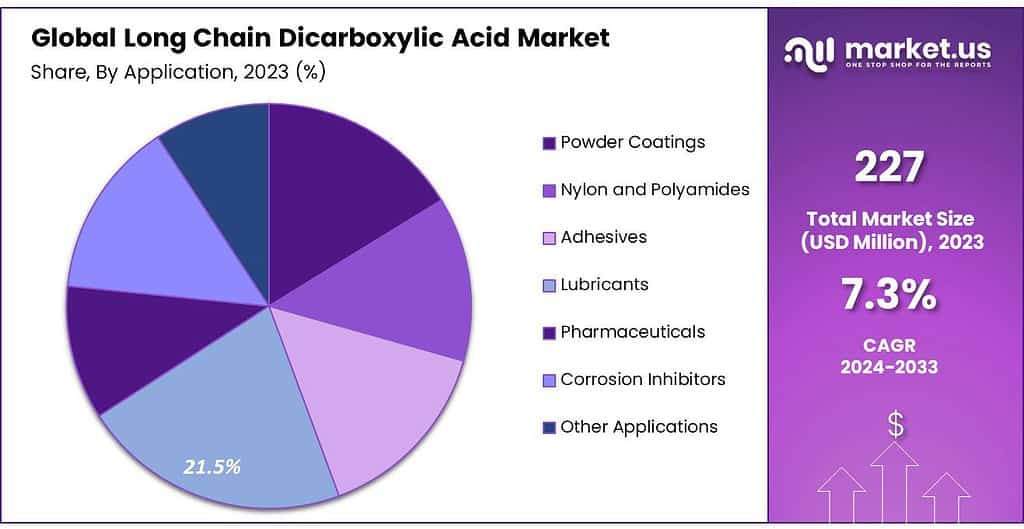

- Application Dynamics: Lubricants lead with 17.9% market share in 2023, emphasizing LCDA’s role in smooth machinery operation.

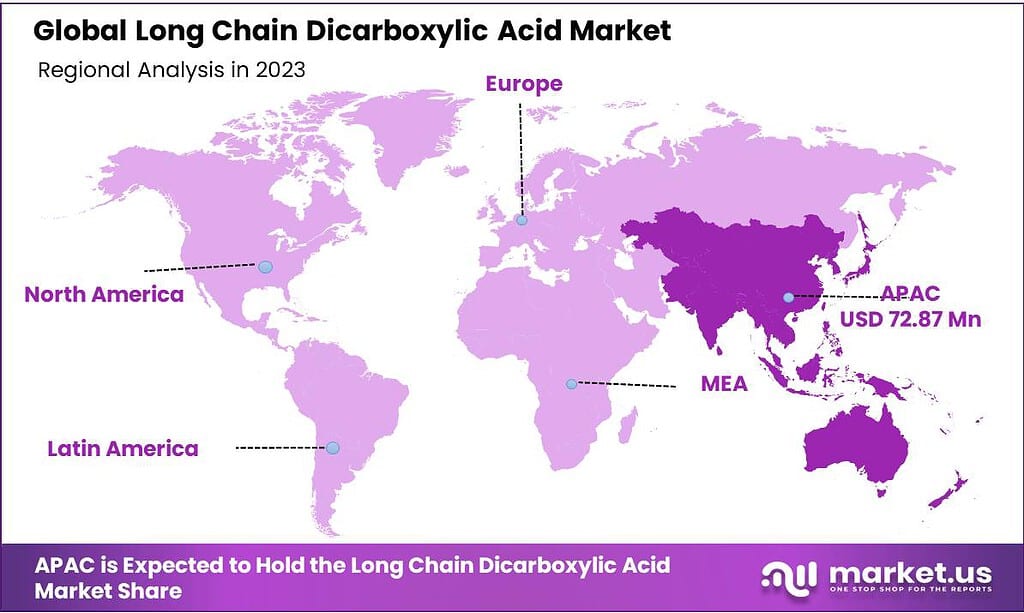

- Leading Market Region: Asia Pacific holds over 32.1% revenue share in 2023, fueled by low costs and rising demand.

- Regional Dominance – China: China dominates with 30.4% global volume, driven by large-scale production and government support.

- Regional Revenue Share – APAC: APAC leads with 32.1% revenue share in 2023, highlighting economic factors and industry demands.

Application analysis

In 2023, among the various applications of Long Chain Dicarboxylic Acid (LCDA), Lubricants stood out as the frontrunner, securing a leading market position with an impressive share of more than 17.9%. The reason why Long Chain Dicarboxylic Acid (LCDA) is leading in the market is because a lot of people need it for making lubricants.

Lubricants are important because they help machines and engines work smoothly by reducing friction and wear between moving parts. LCDA is a key ingredient in making these lubricants, and its big market share shows that many industries use it for this purpose.

Another important use of LCDA is in Powder Coatings. In 2023, this part of the market grew a lot. LCDA is in demand for making powder coatings better by improving how well they work and making them last longer. It helps these coatings resist corrosion and stick better to surfaces. The fact that LCDA has a big share in this market part tells us how crucial it is for creating high-quality powder coatings.

Nylon and Polyamides also emerged as key applications for Long Chain Dicarboxylic Acid, showcasing a considerable market share in 2023. LCDA’s role in the synthesis of nylon and polyamides, essential materials in the production of textiles, automotive parts, and various consumer goods, contributed to its significant presence in this segment.

Adhesives represented another noteworthy application segment for LCDA in 2023. The use of LCDA in adhesives is driven by its ability to enhance bonding strength and durability, catering to diverse industries such as construction, automotive, and packaging. The market share in the adhesives segment signifies the importance of LCDA in formulating effective and robust adhesive solutions.

In the Pharmaceuticals sector, Long Chain Dicarboxylic Acid (LCDA) is used because it’s versatile and works well in making medicines. Even though it doesn’t have the biggest share in the market, LCDA is important for creating pharmaceutical products.

LCDA is also used in Corrosion Inhibitors and some other applications. This shows that LCDA is useful in many different industries, making it a versatile component in various products. Its role in preventing corrosion and its diverse applications highlight its importance in different fields.

In summary, the market dynamics of Long Chain Dicarboxylic Acid in 2023 depict a diverse landscape with Lubricants leading the way, followed by substantial contributions from Powder Coatings, Nylon and Polyamides, Adhesives, Pharmaceuticals, Corrosion Inhibitors, and other applications. This segmentation emphasizes the versatility of LCDA and its pivotal role in multiple industries.

Кеу Маrkеt Ѕеgmеntѕ

By Application

- Lubricants

- Nylon & Other Polyamides

- Pharmaceuticals

- Adhesives

- Powder Coatings

- Corrosion Inhibitors

- Other Applications

Drivers

The Long Chain Dicarboxylic Acid (LCDA) market is doing really well because many people and industries need it. One big reason for its success is the growing demand from the lubricants sector. LCDA is crucial for making lubricants, which are important for making machines and engines work smoothly.

Since there’s a constant need for lubricating products in different industries, the LCDA market is growing a lot. Another important reason for the market’s success is the increased use of LCDA in powder coatings. People want coatings that perform well, last longer, and resist corrosion.

LCDA is great at making these coatings better by enhancing their performance and making them stick to surfaces more effectively. As industries look for coatings that are more efficient and durable, the demand for LCDA in powder coatings is going up. Additionally, LCDA is becoming more popular in the pharmaceutical sector because it is versatile and works well in making medicines.

The pharmaceutical industry needs different and effective ingredients for developing drugs, and LCDA is fitting this need. Even though it doesn’t have the biggest share in the market, LCDA’s role in making various pharmaceutical products is growing. Another reason LCDA is doing well is its use in preventing corrosion.

Companies in different industries are using LCDA to protect their equipment and structures from damage caused by corrosion. The special properties of LCDA make it effective in stopping corrosion, and this is helping it become more widely used and contributing to its growth in the market.

In summary, the Long Chain Dicarboxylic Acid market is flourishing due to the heightened demand for lubricants, the growing application in powder coatings, expanding roles in pharmaceutical formulations, and its effectiveness as a corrosion inhibitor. These drivers collectively contribute to the market’s positive trajectory and highlight the diverse applications and versatility of LCDA in different industries.

Restraints

While the Long Chain Dicarboxylic Acid (LCDA) market is thriving, some challenges could slow down its growth. One significant restraint is the cost associated with producing LCDA. The methods and materials used in its production can be expensive, making it less accessible for some industries or regions with budget constraints.

This cost challenge may limit the widespread adoption of LCDA, particularly in price-sensitive markets. Another restraint stems from the complexity of regulations and standards governing the use of chemicals, including LCDA.

Adhering to diverse and stringent regulations across different regions can be complicated for manufacturers. Ensuring compliance with various standards adds complexity to production processes and might pose challenges for companies operating in multiple markets.

Technical challenges related to the scalability of LCDA production can also be a hindrance. As demand increases, manufacturers need to scale up production efficiently. However, the complex nature of the production process and potential scalability issues could pose challenges, affecting the supply chain and potentially causing delays.

Moreover, LCDA faces competition from alternative products and substitutes. Industries might explore other options that offer similar properties but at a lower cost. This competitive landscape poses a restraint on the market growth for LCDA, compelling manufacturers to differentiate their products and demonstrate unique advantages.

Environmental concerns could also be a restraint. While LCDA is used for corrosion prevention and in various applications, the environmental impact of its production and disposal must be considered. Striking a balance between the benefits of LCDA and its environmental footprint is essential to address this restraint.

In summary, despite its positive trajectory, the LCDA market grapples with challenges such as production costs, regulatory complexities, scalability issues, competition from substitutes, and environmental considerations. Successfully navigating these restraints is crucial for sustained market growth and the continued adoption of LCDA in diverse industries.

Opportunities

The Long Chain Dicarboxylic Acid (LCDA) market has many chances to grow. One big opportunity is the increasing demand for products that are good for the environment. LCDA is versatile and works well with eco-friendly practices, making it a good fit for this growing trend. Companies can highlight LCDA’s eco-friendly features, aligning with the preference for sustainable solutions.

Another great opportunity is in the pharmaceutical sector. As the pharmaceutical industry keeps getting better, there’s a need for new and innovative ingredients in making medicines. LCDA’s versatility makes it useful in creating various pharmaceutical products. Companies can expand their presence in this sector by showing how LCDA fits well with the changing needs in pharmaceuticals.

The emphasis on corrosion prevention presents an opportunity for LCDA. Industries are increasingly prioritizing measures to protect their equipment and structures from corrosion-related damage. LCDA’s effectiveness as a corrosion inhibitor positions it as a valuable solution in corrosion prevention strategies. Manufacturers can capitalize on this demand by promoting LCDA’s unique properties for inhibiting corrosion across various applications.

The Long Chain Dicarboxylic Acid (LCDA) market has chances to grow by investing in research and development (R&D). If companies keep coming up with new and improved ways to use LCDA, they can create better products. By staying ahead with cutting-edge LCDA solutions, they can meet the changing needs of different industries.

There are opportunities to expand the use of LCDA in emerging economies. As these regions develop more industries, there is a demand for LCDA-based products. Companies can build a strong presence in these growing markets by forming partnerships and collaborations. In short, the LCDA market has lots of chances for growth.

This includes the demand for eco-friendly products, progress in the pharmaceutical sector, the need for solutions to prevent corrosion, continuous research and development, and expanding into emerging economies. Manufacturers can grow and reach new industries by smartly using these opportunities.

Challenges

Despite its promising potential, the Long Chain Dicarboxylic Acid (LCDA) market encounters challenges that may hinder its growth. One significant challenge is the competition from alternative products and substitutes. Industries might explore other options that offer similar properties to LCDA but at a lower cost. This competitive landscape poses a challenge for the market, compelling manufacturers to differentiate their products and demonstrate unique advantages.

Another challenge stems from environmental concerns. While LCDA is used for corrosion prevention and in various applications, the environmental impact of its production and disposal must be considered. Striking a balance between the benefits of LCDA and its environmental footprint becomes crucial to address this challenge. Manufacturers need to find ways to minimize any negative impact on the environment associated with LCDA.

Technical challenges related to the scalability of LCDA production can also be a hindrance. As demand increases, manufacturers need to scale up production efficiently. However, the complex nature of the production process and potential scalability issues could pose challenges, affecting the supply chain and potentially causing delays.

The cost associated with producing LCDA poses a significant challenge. The methods and materials used in its production can be expensive, making it less accessible for some industries or regions with budget constraints. This cost challenge may limit the widespread adoption of LCDA, particularly in price-sensitive markets.

Regulatory complexities represent another challenge. Adhering to diverse and stringent regulations across different regions can be complicated for manufacturers. Ensuring compliance with various standards adds complexity to production processes and might pose challenges for companies operating in multiple markets.

In summary, the challenges facing the LCDA market include competition from substitutes, environmental concerns, technical challenges in production scalability, high production costs, and regulatory complexities. Successfully addressing these challenges is essential for the sustained growth and widespread adoption of LCDA in various industries.

Regional Analysis

China was the dominant market for long-chain dicarboxylic acids in 2021. It accounted for more than 30.4% of global volume. This is due to its large-scale production and high consumption. China’s government has established policies to encourage investment in the construction and building sector, which is driving industry growth. High-performance nylon is used in exterior building & construction products such as glazing, expansion joints, and seals. Asia Pacific LCDA demand exceeded 24-kilo tones in 2021. This is due to a growing need from the end-use sector such as construction and automotive, and industrial equipment production.

Asia Pacific (APAC) had the largest revenue share at over 32.1% in 2023 market share for long-chain dicarboxylic acids due to its low manufacturing costs and availability of skilled workers and raw materials. In the predicted period, the market will see a significant increase in demand for nylon and other polyamides, lubricants, and adhesives that use long-chain dicarboxylic acid (LCDA).

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Shandong Hilead Biotechnology Co., Ltd, Cathay Industrial Biotech Ltd., Invista B.V, Evonik Industries AG, Zibo Guangtong Chemical Co., Ltd., are key players in this market. Cathay Industrial Biotech Ltd. announced that it would expand its capacity to meet the market demand for biobased products, including long-chain dibasic acid (LCDA), biopentane damine (DN5), and bio-polyamides (bio-PA).

Маrkеt Кеу Рlауеrѕ

- Cathay Industrial Biotech Ltd.

- Shandong Hilead Biotechnology Co. Ltd

- Invista B.V

- Zibo Guangtong Chemical Co., Ltd.

- Evonik Industries AG.

- Aecochem

- BASF

- Longhetong

- Qingjiang

- Other Key Players

Recent Developments

In June 2023, Cathay Biotech Inc. successfully secured additional funding and established a significant strategic partnership with China Merchants Group (CMG). As part of the collaboration, CMG has committed to purchasing bio-based polyamides manufactured by Cathay, with a minimum targeted volume of 10,000 tons for the year 2023. This collaboration marks a significant step forward for both companies in the bio-based materials market.

In May 2023, DuPont revealed its definitive agreement to acquire Spectrum Plastics Group from AEA Investors. This strategic move is aimed at enhancing DuPont’s current portfolio, which includes packaging, biopharma & pharma processing, and medical devices. The acquisition will play a pivotal role in fortifying DuPont’s position within the stable and reliable healthcare market.

In September 2022, INVISTA unveiled the Asia Innovation Center at the Shanghai International Chemical New Materials Innovation Center (INNOGREEN) at SCIP. This cutting-edge facility is dedicated to addressing the specific application needs of engineering polymers in critical industries like automotive and electrical & electronics

Report Scope

Report Features Description Market Value (2022) USD 227 Mn Forecast Revenue (2032) USD 459 Mn CAGR (2023-2032) 7.3% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application(Lubricants, Nylon & Other Polyamides, Pharmaceuticals, Adhesives, Powder Coatings, Corrosion Inhibitors, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Cathay Industrial Biotech Ltd., Shandong Hilead Biotechnology Co. Ltd, Invista B.V, Zibo Guangdong Chemical Co., Ltd., Evonik Industries AG., Aecochem, BASF, Longhetong, Qingjiang, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Long Chain Dicarboxylic Acid Market?Long Chain Dicarboxylic Acid Market size is expected to be worth around USD 459 Mn by 2033, from USD 227 Mn in 2023

What is the CAGR for the Long Chain Dicarboxylic Acid Market?The Long Chain Dicarboxylic Acid Market is registered to grow at a CAGR of 7.3% during 2023-2032.Who are the major players operating in the Long Chain Dicarboxylic Acid Market?Cathay Biotech Inc., Zibo Guangtong Chemical Co. Ltd, Henan Junheng Industrial Group Biotechnology Co. Ltd, AECOCHEM, Capot Chemical Co.,Ltd., INVISTA, BASF SE, Evonik Industries AG, Shandong Hilead Biotechnology Co., Ltd.

Long Chain Dicarboxylic Acid MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Long Chain Dicarboxylic Acid MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Cathay Industrial Biotech Ltd.

- Shandong Hilead Biotechnology Co. Ltd

- Invista B.V

- Zibo Guangtong Chemical Co., Ltd.

- Evonik Industries AG.

- Aecochem

- BASF

- Longhetong

- Qingjiang

- Other Key Players