Global Vapor Degreasing Solvents Market By Type(Fluorinated, Chlorinated, Brominated, Others), By Application(Metal, Pharma and Biotech, Others), By End-User(Automotive, Electronics, Aerospace and Defense, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 29762

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

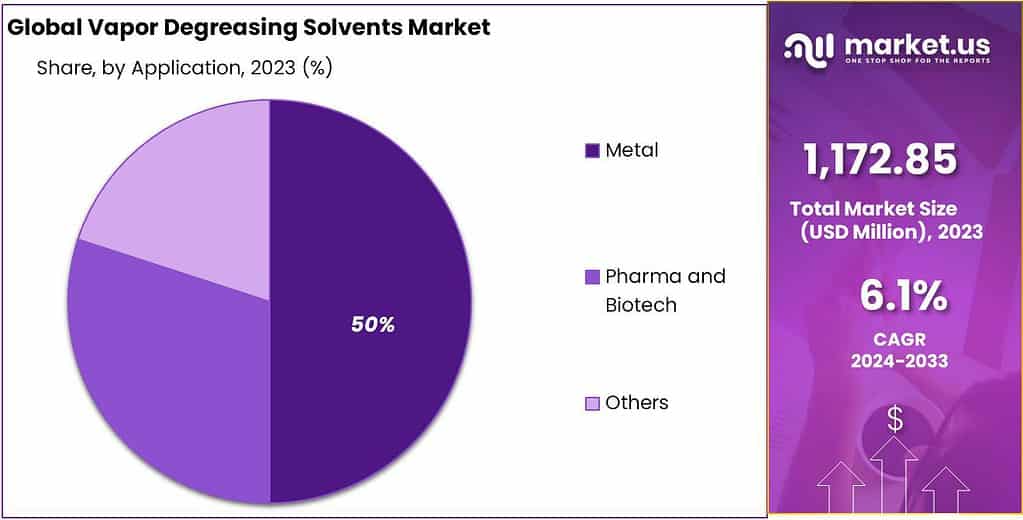

The Vapor Degreasing Solvents Market size is expected to be worth around USD 5883 Million by 2033, from USD 1173 Million in 2023, growing at a CAGR of 6.1% during the forecast period from 2023 to 2033.

The Vapor Degreasing Solvents Market refers to the segment of the industrial solvents industry that specializes in the production and distribution of solvents used specifically in vapor degreasing processes.

Vapor degreasing is a method for cleaning parts and components, primarily in manufacturing and mechanical applications, where solvents are vaporized to dissolve and remove contaminants such as oil, grease, and dirt from metal, plastic, and various other materials.

Vapor Degreasing Solvents Market encompasses the development, production, and application of specialized solvents used in the vapor degreasing process. The market is integral to various industries requiring high standards of cleanliness and is shaped by factors such as efficiency, environmental and safety regulations, and technological innovation.

Key Takeaways

- Market Growth: Vapor Degreasing Solvents Market is to grow at a 6.1% CAGR, reaching USD 5,883 Mn by 2033 from USD 1,173 Mn in 2023.

- Fluorinated Solvents: Dominant in 2023 with a 31.2% market share, valued for their cleaning efficiency.

- Metal Applications: Led the market in 2023 with a 41.4% share, vital in maintaining quality standards.

- Automotive Dependence: Automotive sector led in 2023, heavily relying on solvents for precision manufacturing.

- Environmental Challenges: Increased scrutiny on solvents due to environmental concerns, impacting manufacturers.

- Eco-friendly Alternatives: Emergence of cleaner alternatives posed competitive challenges.

- Innovation Opportunities: Focus on sustainable solvents and R&D investments for growth.

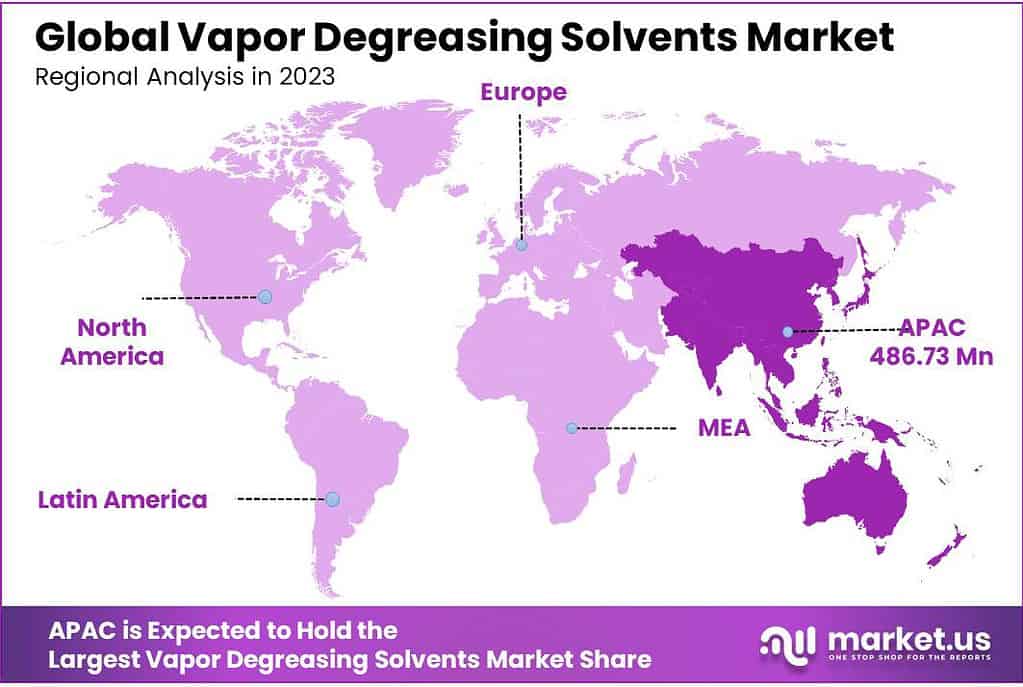

- Regional Dominance: Asia-Pacific captured 41.8% market share in 2022, driven by industrial activities in China and India.

- North America Growth: North America exhibited 8.2% CAGR due to advanced infrastructure and safe solvent adoption.

By Type

In 2023, Fluorinated vapor degreasing solvents secured a significant market share, surpassing other types with a dominant position of more than 31.2%. This indicates that, during that period, Fluorinated solvents were the preferred choice in the vapor-degreasing segment. Fluorinated solvents are good at cleaning and removing grease.

Many industries use them a lot because they work well. These solvents are on top in the market, showing that companies like using them for cleaning. Fluorinated solvents have special traits, like being good at getting rid of dirt and having a strong ability to dissolve things. These traits make them great for precise cleaning in big industries.

Other types of vapor-degreasing solvents, including Chlorinated, Brominated, and others, also play roles in addressing specific industry requirements. Each type comes with its distinct properties, influencing its suitability for different applications. Knowing that Fluorinated solvents are popular gives useful information to companies and people involved in making decisions.

It helps them choose the right solvents for cleaning based on what they need. As the market for vapor-degreasing solvents keeps changing, it’s important to stay updated on different types of solvents. This understanding helps everyone involved, like companies and users, to keep up with new trends and make smart choices in the world of industrial cleaning.

By Application

In 2023, the vapor degreasing solvents market saw metal applications taking a prominent lead, securing a significant market position with a share of 41.4%. This dominance underscores the substantial utilization of vapor-degreasing solvents in the cleaning and degreasing processes associated with metal surfaces.

Industries engaged in metalworking, manufacturing, automotive, and aerospace sectors heavily relied on these solvents to ensure precision cleaning, thereby upholding the quality standards of metal components.

Using vapor-degreasing solvents in metal-related industries is very important. These solvents help in removing oils, greases, and dirt from metal surfaces, making sure that metal products are of high quality. The understanding of this dominance in metal applications provides critical insights for manufacturers.

It guides them in formulating cleaning solutions that cater to the specific needs of industries that heavily depend on metal components. This knowledge facilitates the development of tailored solutions, ensuring the continued effectiveness of vapor-degreasing solvents in metal applications as the market evolves.

By End-User

In 2023, the Automotive sector was the leading user of Vapor Degreasing Solvents, holding a substantial market share. This suggests that the automotive industry heavily depends on these solvents for cleaning and degreasing tasks. Vapor-degreasing solvents are vital in maintaining the cleanliness and accuracy of automotive components during the manufacturing process.

The Electronics sector is a significant player in the vapor degreasing solvents market. In electronics manufacturing, these solvents are essential for cleaning electronic components, ensuring the elimination of contaminants, and meeting stringent production quality standards. Aerospace and Defense represent a crucial end-user segment for vapor-degreasing solvents.

The demanding precision and reliability standards in aerospace and defense manufacturing processes make vapor degreasing an indispensable step, and solvents play a pivotal role in meeting these stringent requirements.

Key Market Segmentation

By Type

- Fluorinated

- Chlorinated

- Brominated

- Others

By Application

- Metal

- Pharma and Biotech

- Others

By End-User

- Automotive

- Electronics

- Aerospace and Defense

- Others

Drivers

The Vapor Degreasing Solvents Market experienced substantial growth in 2023, driven by the increasing demand for efficient cleaning solutions in manufacturing processes. Key industries, including automotive, electronics, and aerospace, sought effective methods to remove oils and contaminants from metal surfaces, leading to a surge in the demand for vapor-degreasing solvents.

The automotive sector, holding a dominant market position, played a crucial role in driving this growth. With the high precision and cleanliness required in automotive manufacturing, vapor-degreasing solvents became essential for ensuring the quality and reliability of automotive components.

The electronics industry significantly contributed to the market’s expansion. The need for clean electronic components to meet stringent production standards led to an increased demand for vapor-degreasing solvents, which proved effective in removing residues and contaminants from intricate electronic parts.

In 2023, the Vapor Degreasing Solvents Market witnessed significant growth, mainly driven by the demand for efficient cleaning solutions in key industries such as automotive, electronics, and aerospace. These industries recognized the importance of maintaining high production standards, and vapor-degreasing solvents emerged as crucial contributors to achieving precision and cleanliness.

The aerospace and defense segment, known for its stringent manufacturing requirements, played a pivotal role in boosting the market. Vapor degreasing solvents proved indispensable in meeting the precision and reliability standards essential for applications in aerospace and defense manufacturing processes.

In conclusion, the Vapor Degreasing Solvents Market’s robust growth highlighted the vital role of these solvents in ensuring quality across diverse industries. The increasing reliance on vapor-degreasing solvents underscored their significance in upholding stringent production standards and ensuring the integrity of manufactured components.

Restraints

In 2023, the Vapor Degreasing Solvents Market faced notable challenges that impacted its growth trajectory. One significant restraint was the heightened environmental and regulatory scrutiny directed at specific solvents, especially fluorinated solvents. These solvents, valued for their effective degreasing properties, came under increased scrutiny due to environmental concerns and potential health risks.

Regulatory bodies responded by imposing more stringent regulations and restrictions on the use of such solvents, creating hurdles for manufacturers and users in the market. Businesses had to navigate these regulatory complexities and explore alternative solutions that align with environmental sustainability. Another restraint in the market stemmed from the evolving landscape of alternative cleaning technologies.

The emergence of eco-friendly and sustainable alternatives to traditional vapor degreasing solvents posed a competitive challenge. Industries, motivated by a growing emphasis on environmental responsibility, actively sought and adopted cleaner technologies. This shift in preference impacted the traditional market for vapor-degreasing solvents, necessitating adaptation, and innovation to remain relevant in the dynamic and changing industrial landscape.

The economic challenges associated with certain types of vapor-degreasing solvents, particularly fluorinated solvents, posed significant obstacles for businesses. The high cost of these solvents, coupled with environmental and regulatory pressures, prompted companies to reevaluate their cleaning processes and explore more cost-effective and sustainable alternatives.

This economic restraint introduced additional complexities to the decision-making processes of businesses heavily reliant on vapor-degreasing solvents. In conclusion, the Vapor Degreasing Solvents Market encountered challenges stemming from environmental regulations, the emergence of alternative cleaning technologies, and economic considerations. Successfully navigating these complexities demanded strategic planning, innovation, and a proactive approach to adapt to the evolving demands of the industry.

Opportunities

In 2023, the Vapor Degreasing Solvents Market exhibited a range of opportunities, indicating potential avenues for growth and development within the industry. One prominent opportunity was tied to the increasing focus on sustainability and environmentally friendly practices. As businesses and industries continued to prioritize green solutions, there emerged a heightened demand for vapor degreasing solvents that align with eco-friendly principles.

Manufacturers that actively pursued the development and promotion of sustainable solvents found themselves in a favorable position, catering to the preferences of environmentally conscious businesses and contributing to the broader shift toward greener practices in industrial processes. Additionally, a strategic opportunity lay in the realm of diversification and innovation within the vapor degreasing solvents sector.

Companies that invested resources in research and development, aiming to enhance the effectiveness, safety, and affordability of their solvents, discovered pathways for growth. By exploring new formulations, improving existing products, and expanding applications across various industries, these businesses positioned themselves competitively in the market.

The pursuit of innovation not only addressed current market needs but also anticipated and met the evolving demands of customers, fostering adaptability and resilience. In conclusion, the Vapor Degreasing Solvents Market in 2023 presented promising opportunities rooted in the growing demand for sustainable solutions and innovation potential. Companies that strategically embraced and capitalized on these opportunities were well-positioned for growth and success in a market that continued to evolve in response to changing environmental and industrial dynamics.

Challenges

In 2023, the Vapor Degreasing Solvents Market faced significant challenges that influenced its growth trajectory. One major hurdle was the increasing environmental and regulatory scrutiny surrounding specific solvents, particularly fluorinated solvents. These solvents, known for their effective degreasing properties, came under scrutiny due to environmental impact and potential health concerns.

Stricter regulations and restrictions were imposed, creating challenges for manufacturers and users within the market. Businesses had to navigate these regulatory complexities and find alternatives aligned with environmental sustainability. Another restraint in the market was the evolving landscape of alternative cleaning technologies.

The emergence of eco-friendly and sustainable alternatives to traditional vapor degreasing solvents posed a competitive challenge. Industries, driven by a growing emphasis on environmental responsibility, explored and adopted cleaner technologies. This shift in preference affected the traditional market for vapor-degreasing solvents, requiring adaptation and innovation to stay relevant in the changing industrial landscape.

The Vapor Degreasing Solvents Market encountered challenges due to the high cost of certain solvents, especially fluorinated ones. Businesses faced economic difficulties as they had to contend with the expensive nature of these solvents, along with environmental and regulatory pressures. This situation prompted companies to reevaluate their cleaning processes, seeking more cost-effective and sustainable alternatives.

Dealing with this economic challenge added complexity to the decision-making processes of businesses reliant on vapor-degreasing solvents. In conclusion, the Vapor Degreasing Solvents Market grappled with challenges stemming from environmental regulations, the emergence of alternative cleaning technologies, and economic considerations. Effectively navigating these complexities demanded strategic planning, innovation, and a proactive approach to adapt to the evolving demands of the industry.

Regional Analysis

In 2022, the Asia-Pacific region emerged as the leading market for Vapor Degreasing Solvents, capturing an impressive 41.8% of the global market revenue. This dominance is primarily due to the extensive and diverse industrial activities within the region, especially in countries such as China and India, where there is substantial demand for vapor-degreasing solvents.

The growing focus on sustainable manufacturing and environmental conservation has significantly influenced the expansion of the Vapor Degreasing Solvents Market in the Asia-Pacific region. This surge in demand is a response to the need for balancing industrial development with ecological considerations, leading to increased adoption of vapor degreasing solvents. Concurrently, North America has demonstrated notable growth in this market, exhibiting a Compound Annual Growth Rate (CAGR) of 8.2% during the forecast period.

This substantial growth in North America is attributed to the region’s advanced industrial infrastructure and access to state-of-the-art technologies. These factors have facilitated the widespread implementation of environmentally safer and more efficient vapor-degreasing solvents in various industrial applications.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- India

- Japan

- South Korea

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Key Players Analysis

The vapor degreasing solvents market is driven by several major players, each with its own strengths and weaknesses. Here’s an analysis of some key players

Market Key Players

- Honeywell International Inc.

- 3M Company

- Asahi Glass Co. Ltd. (AGC Inc.)

- Solvay SA

- Chemours Company

- MicroCare Corporation

- Reliance Specialty Products Inc.

- Florachem Precision Cleaning Products

- Tech Spray LP

Recent Developments

2023 3M: Launched a new line of “Novec” fluorinated solvents with improved worker safety and environmental performance.

2023 Solvay SA: Introduced a bio-based hydrocarbon solvent for vapor degreasing applications, aiming for increased sustainability.

2023 Honeywell: Partnered with a European company to distribute its Genetron hydrocarbon solvents in new markets.

Report Scope

Report Features Description Market Value (2023) US$ 1173 Mn Forecast Revenue (2033) US$ 5883 Mn CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Fluorinated, Chlorinated, Brominated, Others), By Application(Metal, Pharma and Biotech, Others), By End-User(Automotive, Electronics, Aerospace and Defense, Others) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, India, Japan, South Korea, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, and Rest of Middle East & Africa. Competitive Landscape Envirotherm GmbH, Tianhe Environmental Engineering, Shangdong Gemsky Environmental Technology, Jiangsu Fengye Tech & Environmental Group, BASF SE, Cormetech, IBIDEN Porzellanfabrick Frauenthal GmbH, Johnson Matthey Plc, Haldor Topsoe, Hitachi Zosen Corp, Seshin Electronics Co Ltd, JGC C&C, CRI Catalyst Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Vapor Degreasing Solvents MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Vapor Degreasing Solvents MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Honeywell International Inc.

- 3M Company

- Asahi Glass Co. Ltd. (AGC Inc.)

- Solvay SA

- Chemours Company

- MicroCare Corporation

- Reliance Specialty Products Inc.

- Florachem Precision Cleaning Products

- Tech Spray LP