Global Diethanolamine Market By Grade (Industrial Grade, Pharmaceutical Grade, Cosmetic Grade), By Form (Liquid, Powder), By Application (Chemical Intermediate, Paints and Coatings, Metalworking Fluids, Textile Additives, Gas Treatment, Others), By End-user Industry (Agriculture, Personal Care, Textile, Construction, Cosmetics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 134227

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

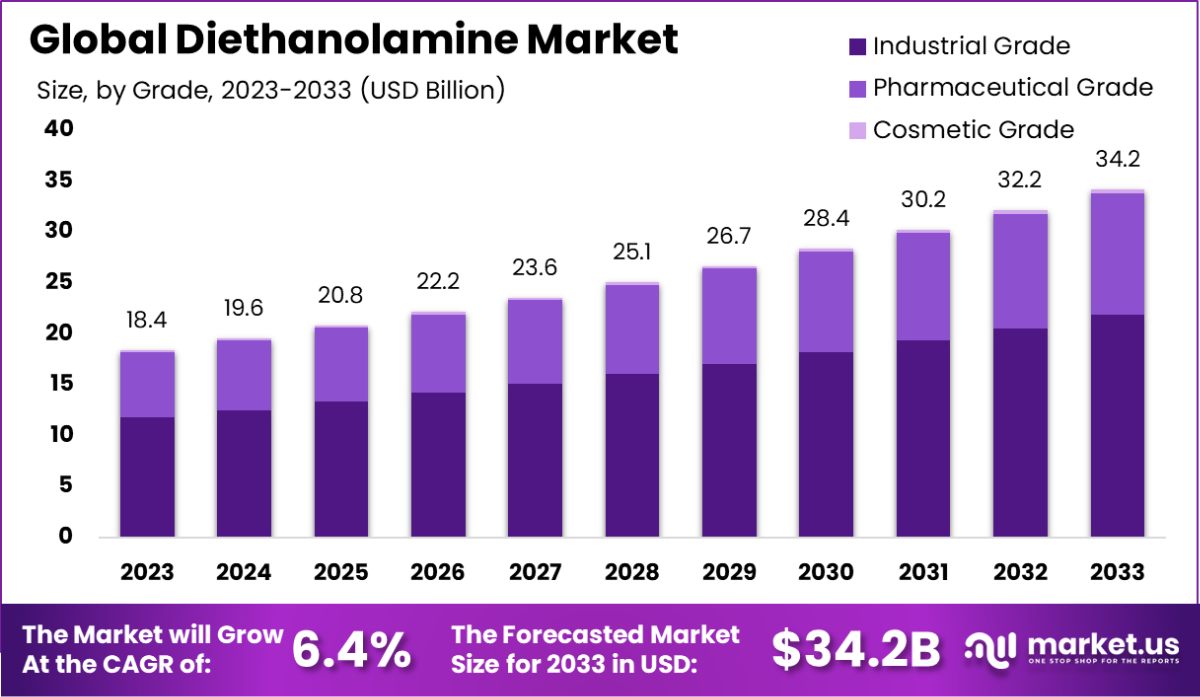

The Global Diethanolamine Market is expected to be worth around USD 34.2 Billion by 2033, up from USD 18.4 Billion in 2023, and grow at a CAGR of 6.4% from 2024 to 2033.

Diethanolamine (DEA) is a colorless, viscous liquid with a slight ammonia odor. It is a key compound used in the production of surfactants, emulsifiers, and detergents. DEA finds applications in personal care, pharmaceuticals, agricultural chemicals, and water treatment chemical industries. It is also used in the production of corrosion inhibitors, lubricants, and foaming agents.

The growth of the Diethanolamine market is driven by its increasing demand for the production of surfactants and personal care products. The expansion of the chemical manufacturing sector, particularly in emerging markets, also supports DEA consumption.

Rising demand for biodegradable surfactants in detergents and personal care products, along with DEA’s use in agricultural formulations, propels market growth. Growing awareness of sustainable and eco-friendly products presents opportunities for DEA’s use in green formulations, especially in the personal care and agriculture sectors.

The Diethanolamine (DEA) market is poised for steady growth, fueled by increasing demand across various industrial sectors such as personal care, pharmaceuticals, agriculture, and chemical manufacturing. DEA, a reactive and bifunctional compound, offers a unique combination of alcohol and amine properties, which makes it essential in the production of surfactants, emulsifiers, and detergents.

According to journals sagepub, DEA reacts with fatty acids at temperatures between 140°C and 160°C, forming ethanolamides, which are crucial in numerous formulations. The market is also benefiting from the increasing adoption of DEA in agrochemicals, particularly for pesticide production.

From a commercial standpoint, DEA is widely available with a minimum purity of 99.0%, as reported by Dow Chemical Company, with minimal impurities (0.5% maximum ethanolamine and triethanolamine). This high purity level ensures consistency in end-product performance, enhancing its appeal to industries with strict quality control standards.

The demand for biodegradable and eco-friendly surfactants in personal care products and detergents is expected to further accelerate the market’s growth. Additionally, the growing focus on sustainable agricultural practices and the need for efficient corrosion inhibitors are presenting new opportunities for DEA in these sectors.

As the chemical industry continues to innovate with green formulations, Diethanolamine’s role as a versatile intermediate compound is expected to expand, positioning it as a key player in emerging market trends. The ongoing development of cost-effective, high-purity DEA will likely further strengthen its market position, especially in the Asia-Pacific region, where demand for industrial chemicals is on the rise.

Key Takeaways

- The Global Diethanolamine Market is expected to be worth around USD 34.2 Billion by 2033, up from USD 18.4 Billion in 2023, and grow at a CAGR of 6.4% from 2024 to 2033.

- Industrial-grade Diethanolamine accounts for 64.5% of the total market share globally.

- Liquid Diethanolamine represents 76.4% of the market due to its versatile applications.

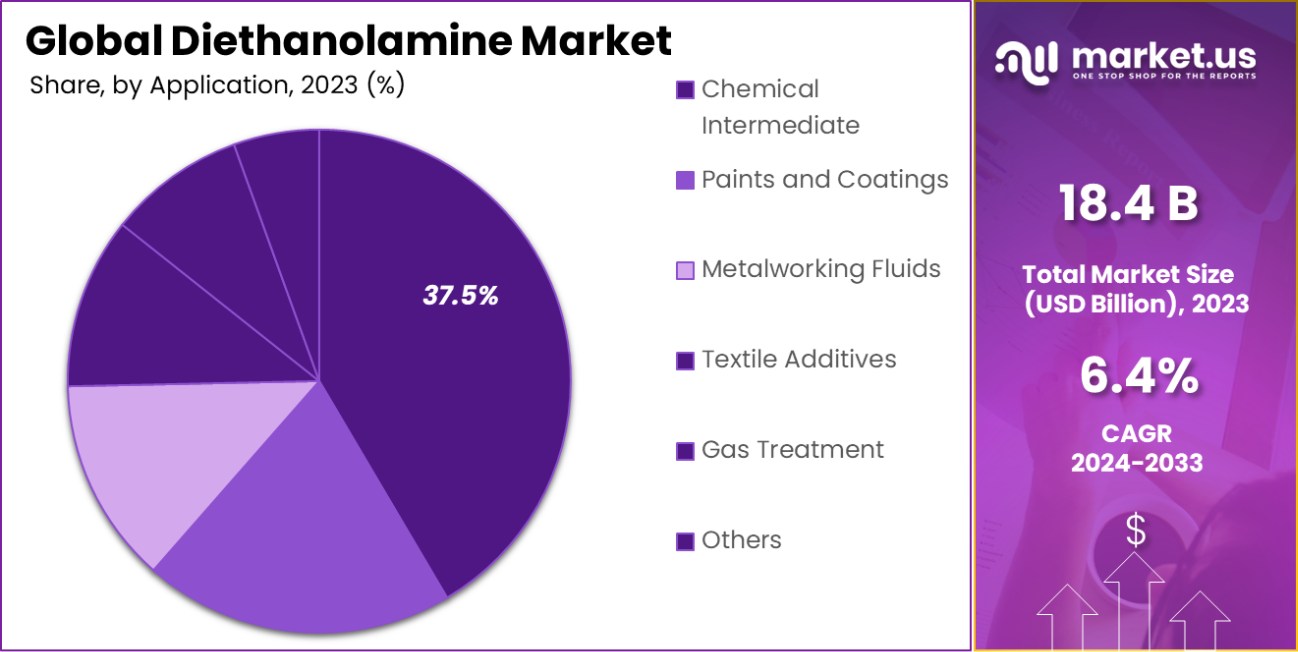

- Chemical intermediates make up 37.5% of the Diethanolamine market, driving industrial growth.

- Agriculture holds a significant 29.1% share of the Diethanolamine market, boosting demand.

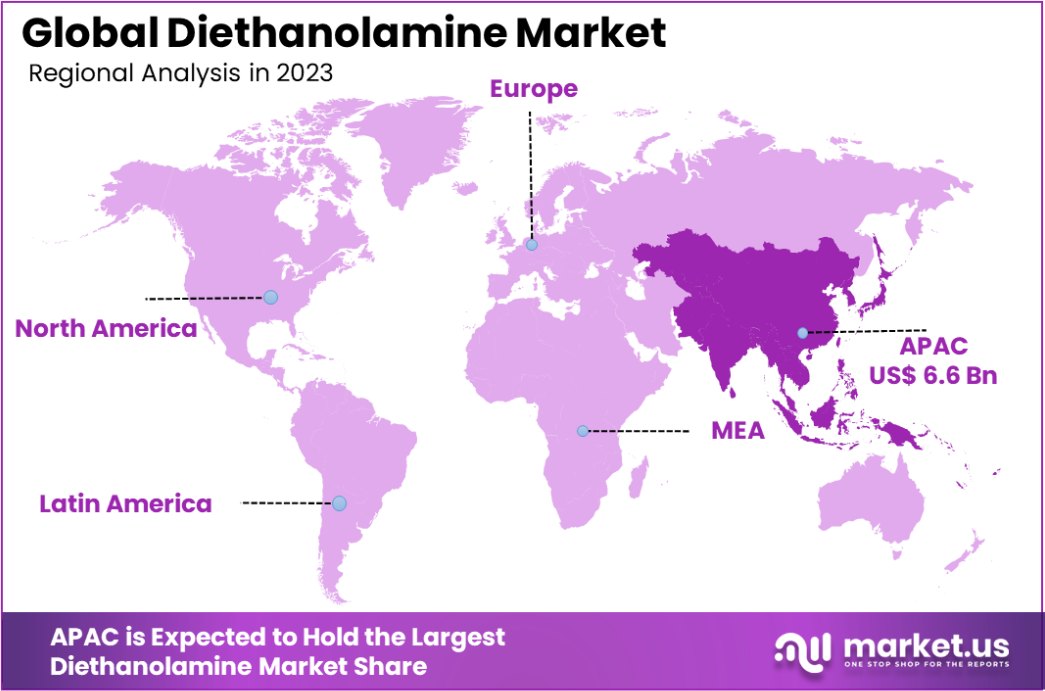

- The Asia-Pacific Diethanolamine market holds 39.6%, valued at USD 6.6 Bn.

By Grade Analysis

The Diethanolamine market is dominated by industrial grade, accounting for 64.5% of the total market share.

In 2023, Industrial Grade held a dominant market position in the By Grade segment of the Diethanolamine Market, with a 64.5% share. This segment’s growth is primarily driven by the widespread use of Diethanolamine in industrial applications, including as a chemical intermediate in the production of surfactants, detergents, and emulsifiers. Industrial-grade DEA is favored for its cost-effectiveness and sufficient purity for large-scale chemical manufacturing processes.

Pharmaceutical Grade Diethanolamine, which commands a smaller market share, is primarily used in drug formulations and other pharmaceutical applications. Its higher purity and stringent quality standards cater to the specific needs of the healthcare sector, where precision and safety are paramount.

Cosmetic Grade Diethanolamine also holds a modest share, catering to personal care products such as shampoos, skin creams, and other cosmetic formulations. The use of DEA in cosmetics is driven by its effectiveness as a stabilizing agent and emulsifier. However, the demand for cosmetic-grade DEA is relatively constrained by regulatory concerns around its use in certain regions due to potential health risks at higher concentrations.

Overall, the Industrial Grade segment’s significant market share reflects the broad applicability of Diethanolamine in various industrial processes, with continued demand expected from the chemical, agricultural, and manufacturing sectors.

By Form Analysis

The liquid form of Diethanolamine holds a significant market share, representing 76.4% of global demand.

In 2023, Liquid held a dominant market position in the By Form segment of the Diethanolamine Market, with a 76.4% share. The preference for liquid Diethanolamine is largely attributed to its superior ease of handling and effective integration into various manufacturing processes.

Liquid form DEA is widely used in chemical formulations, detergents, emulsifiers, and surfactants due to its efficient dissolving properties and versatility across multiple industrial applications. This form is especially prevalent in sectors such as agriculture, personal care, and chemical manufacturing, where consistency and ease of use are crucial.

The Powder form of Diethanolamine, though occupying a smaller share of the market, is used in specific applications where controlled handling or slow-release properties are required. Powdered DEA is often preferred in solid formulations and certain agricultural chemicals, where precise measurements and longer shelf stability are essential. However, its relatively limited share can be attributed to challenges in dissolution rates and handling compared to the more commonly used liquid form.

Overall, the dominance of liquid Diethanolamine reflects its flexibility and efficiency in industrial applications, while powder form remains a specialized choice for select applications requiring distinct formulation characteristics. The growth in the liquid segment is expected to continue as industries seek more efficient and versatile chemical intermediates.

By Application Analysis

As a chemical intermediate, Diethanolamine serves a vital role in various industries, representing 37.5% market share.

In 2023, Chemical Intermediate held a dominant market position in the By Application segment of the Diethanolamine Market, with a 37.5% share. Diethanolamine is primarily utilized as a chemical intermediate in the production of surfactants, emulsifiers, and detergents, which are vital components in various industries, including personal care, agriculture, and cleaning products.

The versatility and effectiveness of DEA as a chemical intermediate in numerous formulations drive its widespread adoption and position it as the leading application segment.

The Paints and Coatings segment holds a significant share due to Diethanolamine’s role as a dispersing agent and pH stabilizer in the production of coatings and paints. It helps improve the consistency and performance of products, especially in the automotive and industrial sectors.

In the Metalworking Fluids sector, Diethanolamine is used for lubrication and as an emulsifier in cutting fluids, aiding in smoother machining processes and extended tool life. The Textile Additives application also contributes to market growth, where DEA is employed in dyeing and finishing processes to enhance fabric performance and appearance.

Gas Treatment applications, where Diethanolamine is used in gas purification and CO2 absorption processes, continue to expand as environmental concerns and industrial regulations drive demand. The Others category includes various niche applications, contributing to the market’s overall growth trajectory.

By End-User Industry Analysis

Agriculture is the leading end-user industry for Diethanolamine, consuming 29.1% of the overall market volume.

In 2023, Agriculture held a dominant market position in the By End-User Industry segment of the Diethanolamine Market, with a 29.1% share. Diethanolamine plays a crucial role in the agricultural sector, primarily in the production of herbicides, pesticides, and fungicides.

Its ability to enhance the efficacy of chemical formulations and improve their stability makes it a key component in crop protection products, driving strong demand in this industry.

The Personal Care industry also contributes significantly to the Diethanolamine market, where it is used in the formulation of shampoos, conditioners, and other cleaning products. DEA acts as an emulsifier and stabilizing agent, helping improve the performance and texture of personal care products.

In the Textile sector, Diethanolamine is utilized in dyeing and finishing processes, where it helps improve fabric quality, color retention, and durability. This application is particularly important in the production of high-quality textiles and apparel.

The Construction industry uses Diethanolamine in the formulation of cement additives and other building materials, where it enhances product performance and longevity. Cosmetics, a growing segment for Diethanolamine, utilizes the compound for its emulsifying and stabilizing properties in skincare and beauty products.

The Others category includes niche applications in various industries such as coatings, lubricants, and metalworking fluids, which contribute to the overall demand for Diethanolamine.

Key Market Segments

By Grade

- Industrial Grade

- Pharmaceutical Grade

- Cosmetic Grade

By Form

- Liquid

- Powder

By Application

- Chemical Intermediate

- Paints and Coatings

- Metalworking Fluids

- Textile Additives

- Gas Treatment

- Others

By End-user Industry

- Agriculture

- Personal Care

- Textile

- Construction

- Cosmetics

- Others

Driving Factors

Increasing Demand for Surfactants and Emulsifiers

The growing need for surfactants and emulsifiers in various industries, including personal care, cleaning products, and detergents, is one of the key driving factors for the Diethanolamine market. As a versatile compound, Diethanolamine (DEA) acts as an essential ingredient in the formulation of these products, improving their effectiveness and stability.

With the expansion of industries focusing on environmentally friendly products, the demand for biodegradable and non-toxic surfactants further boosts the need for Diethanolamine, ensuring continued market growth in the coming years.

Growth in Agricultural Chemicals and Crop Protection

The agricultural sector remains a significant driver for the Diethanolamine market, as DEA is widely used in the production of herbicides, pesticides, and fungicides. Diethanolamine helps improve the stability and efficiency of these agricultural chemicals, ensuring better crop protection and higher yields.

With the increasing global focus on food security and sustainable farming practices, the demand for effective crop protection products continues to rise. This, in turn, is expected to drive the growth of Diethanolamine consumption in the agriculture sector.

Rising Adoption of Personal Care and Cosmetics

The growing personal care and cosmetics industries are key contributors to the demand for Diethanolamine. Used as an emulsifier, stabilizer, and pH regulator in shampoos, conditioners, skincare products, and other cosmetics, Diethanolamine plays a crucial role in enhancing the performance and quality of these products.

As consumers increasingly seek high-quality, innovative personal care solutions, the demand for Diethanolamine in these applications is expected to continue growing, particularly as the industry moves towards more natural and eco-friendly formulations.

Restraining Factors

Regulatory Concerns and Health Safety Issues

One of the primary restraining factors for the Diethanolamine market is the growing regulatory scrutiny over its safety in various consumer products. Diethanolamine, particularly in high concentrations, has been linked to potential health risks, including skin irritation and possible carcinogenic effects.

As a result, regulatory bodies in several regions have imposed stricter regulations on the use of Diethanolamine in personal care and cosmetic products. This has led to a shift towards alternative, safer ingredients, limiting the growth of Diethanolamine in certain industries.

Volatility in Raw Material Prices

The price of Diethanolamine is influenced by fluctuations in the cost of its raw materials, primarily ethanolamine and fatty acids. Price volatility in these raw materials can significantly impact the overall cost structure of Diethanolamine production, making it more difficult for manufacturers to predict costs and maintain profitability.

Additionally, sudden price hikes or supply chain disruptions due to geopolitical or environmental factors could lead to cost increases, limiting the market’s growth potential and making it less attractive to cost-sensitive industries.

Availability of Safer Alternatives

The availability of safer, more environmentally friendly alternatives to Diethanolamine poses a challenge to its market growth. As consumer awareness regarding health and sustainability rises, industries are increasingly seeking green, non-toxic alternatives for applications such as personal care, agriculture, and cleaning products.

These alternatives, such as plant-based emulsifiers and surfactants, are becoming more popular due to their lower environmental impact and safer profiles.

Growth Opportunity

Expansion in Green and Sustainable Product Lines

As industries increasingly focus on sustainability, Diethanolamine presents growth opportunities in the development of eco-friendly products. With the growing demand for biodegradable surfactants, emulsifiers, and other ingredients, Diethanolamine can be positioned as a key component in formulations that meet the rising consumer preference for environmentally conscious products.

Manufacturers can leverage this trend to develop Diethanolamine-based formulations that are safer for both consumers and the environment, driving demand in sectors like personal care, household cleaning, and agriculture.

According to ncbi.nlm.nih.gov, Diethanolamine is present in machining and grinding fluids and has been detected in workplace air in the metal manufacturing industry. It was present in bulk-cutting fluids at levels ranging from 4 to 5%.

Rising Demand in Emerging Markets

The Diethanolamine market has significant growth potential in emerging economies, where industrialization and urbanization are accelerating. Regions like Asia-Pacific, Latin America, and Africa are witnessing rapid growth in manufacturing, agriculture, and personal care sectors, which are major end-users of Diethanolamine.

Increased infrastructure development and the expanding consumer base in these regions create demand for chemical intermediates and agrochemicals, boosting the market for Diethanolamine. Companies can capitalize on this opportunity by increasing production and distribution networks in these high-growth regions.

Innovation in Agrochemicals and Crop Protection

The ongoing development of more efficient agrochemicals and crop protection products presents a substantial growth opportunity for the Diethanolamine market. Diethanolamine is used in the formulation of herbicides, pesticides, and fungicides, which are critical to enhancing crop yields and supporting food security.

With the increasing adoption of precision farming and integrated pest management techniques, the need for advanced chemical intermediates like Diethanolamine will rise.

Latest Trends

Shift Toward Bio-Based and Green Diethanolamine Alternatives

A growing trend in the Diethanolamine market is the shift towards bio-based, eco-friendly alternatives. As sustainability becomes a key focus across industries, demand for bio-based surfactants and emulsifiers is rising. Manufacturers are increasingly exploring renewable feedstocks, such as plant-derived materials, to produce Diethanolamine and its derivatives.

This shift aligns with growing consumer preferences for natural and biodegradable products, particularly in the personal care, cleaning, and agriculture sectors. The trend toward green chemistry and sustainable production methods is likely to reshape the Diethanolamine market in the coming years.

According to the manager online, BASF has opened a new production plant for alkyl ethanolamines, including dimethyl ethanolamine (DMEOA) and methyl diethanolamine (MDEOA), at its Verbund site in Antwerp, Belgium. This investment increases the company’s global annual production capacity by nearly 30% to over 140,000 tons/year.

Advancements in Agrochemical Formulations Using Diethanolamine

Advancements in agrochemical formulations are another important trend influencing the Diethanolamine market. Diethanolamine is being integrated into innovative herbicides, pesticides, and fungicides to improve agricultural productivity and sustainability. With the increasing demand for efficient crop protection solutions, there is a strong focus on enhancing the performance and environmental impact of agrochemicals.

Diethanolamine’s role in improving the efficacy and stability of agrochemical formulations ensures its continued relevance in the agricultural sector. The trend towards more sophisticated agrochemical products presents substantial growth opportunities for Diethanolamine manufacturers.

Rising Consumer Demand for Clean Beauty and Personal Care

The clean beauty trend is significantly impacting the Diethanolamine market, especially in personal care and cosmetics. Consumers are becoming more conscious about the ingredients in their personal care products, seeking those that are safer, non-toxic, and sustainably sourced.

This has led to an increase in the demand for formulations that avoid potentially harmful chemicals. As a result, Diethanolamine manufacturers are adapting by providing higher-purity, safer variants for use in cosmetics and skincare products. The shift toward clean beauty is expected to drive future demand for Diethanolamine in personal care applications.

Regional Analysis

The Asia-Pacific Diethanolamine market holds a 39.6% share, valued at USD 6.6 billion.

The global Diethanolamine market is segmented by region, with Asia-Pacific dominating the market, holding a share of 39.6%, valued at USD 6.6 billion. The region’s robust growth is primarily driven by the increasing demand for eco-friendly formulations, particularly in personal care, household cleaning, and agriculture.

The expanding industrial sectors in countries like China, India, and Japan further contribute to this dominance, supported by the rise in manufacturing activities and stringent environmental regulations.

North America follows as a significant market for Diethanolamine, with steady growth attributed to the demand from the chemical, agriculture, and personal care industries. The presence of key manufacturers in the U.S. and Canada boosts the market, with a focus on sustainable product formulations. Europe, although slightly smaller in market share, is driven by stringent environmental policies and the rising demand for biodegradable surfactants.

The Middle East & Africa and Latin America exhibit slower growth, but their markets are expected to expand gradually as industrialization and sustainable product trends gain traction.

The Middle East’s oil and gas industry presents an opportunity for Diethanolamine in drilling and refining applications. Latin America’s increasing focus on agricultural sustainability also creates demand for eco-friendly chemical formulations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Diethanolamine market continues to see strong competition and innovation from a range of established players across various industries. Companies such as BASF SE, Dow, and Huntsman Corporation maintain significant market shares due to their extensive global reach and comprehensive product portfolios.

BASF SE, in particular, leverages its strong R&D capabilities and sustainable initiatives to cater to the growing demand for eco-friendly formulations, especially in personal care, agriculture, and industrial applications.

Dow and Exxon Mobil Corporation, both leaders in the petrochemical sector, utilize their advanced manufacturing processes to ensure high-quality Diethanolamine production, which positions them as key players in the chemical supply chain. These companies are also focused on achieving regulatory compliance and sustainability, in line with increasing global environmental standards.

Formosa Plastics Corporation, INEOS, and LyondellBasell Industries Holdings B.V. are key regional players that strengthen their market positions by enhancing their production capabilities in Asia-Pacific and North America. Their expansion strategies are centered around capacity increases and partnerships to meet the growing demand for Diethanolamine in diverse sectors, including agriculture and personal care.

Meanwhile, companies like Air Liquide, Linde PLC, and Mitsubishi Chemical Corporation offer advanced technologies for gas separation and chemical production, which further solidify their positions in the Diethanolamine market.

The competitive landscape is also shaped by key players such as Reliance Industries Limited, SABIC, and Sinopec, which dominate the Middle East and Asian markets through robust supply chains, cost-effective production, and strong customer relationships.

Top Key Players in the Market

- Air Liquide

- Alfa Aesar

- BASF SE

- BeanTown Chemicals

- Chemanol

- Dow

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- HELM AG

- Huntsman Corporation

- INEOS

- LG Chem

- Linde PLC

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Corporation

- NIPPON SHOKUBAI CO., LTD.

- Reliance Industries Limited

- SABIC

- Sinopec

- Spectrum Chemical MFG Group

- The Dow Chemical Company

- VWR International LLC

Recent Developments

In 2024, Chemanol secured approval for feedstock to manufacture specialty chemicals, including methyl diethanolamine, a key component in industries such as oil and gas and pharmaceuticals. By 2024, Chemanol established a $112 million specialty chemicals facility in Jubail, aiming to enhance its production capabilities significantly.

In 2023, ExxonMobil has been expanding its low emissions initiatives and technological advancements within its chemical production processes. This aligns with their broader corporate goals of reducing greenhouse gas emissions and enhancing sustainable practices across their operations.

Report Scope

Report Features Description Market Value (2023) USD 18.4 Billion Forecast Revenue (2033) USD 34.2 Billion CAGR (2024-2033) 6.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Industrial Grade, Pharmaceutical Grade, Cosmetic Grade), By Form (Liquid, Powder), By Application (Chemical Intermediate, Paints and Coatings, Metalworking Fluids, Textile Additives, Gas Treatment, Others), By End-user Industry (Agriculture, Personal Care, Textile, Construction, Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Air Liquide, Alfa Aesar, BASF SE, BeanTown Chemicals, Chemanol, Dow, Exxon Mobil Corporation, Formosa Plastics Corporation, HELM AG, Huntsman Corporation, INEOS, LG Chem, Linde PLC, LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Corporation, NIPPON SHOKUBAI CO., LTD., Reliance Industries Limited, SABIC, Sinopec, Spectrum Chemical MFG Group, The Dow Chemical Company, VWR International LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Air Liquide

- Alfa Aesar

- BASF SE

- BeanTown Chemicals

- Chemanol

- Dow

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- HELM AG

- Huntsman Corporation

- INEOS

- LG Chem

- Linde PLC

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Corporation

- NIPPON SHOKUBAI CO., LTD.

- Reliance Industries Limited

- SABIC

- Sinopec

- Spectrum Chemical MFG Group

- The Dow Chemical Company

- VWR International LLC