Global In Vivo Imaging Systems Market By Product Type (Magnetic Resonance Imaging (MRI), Digital Angiography, Ultrasound, Nuclear Imaging, Positron Emission Tomography (PET), Single Photon Emission Computerized Tomography (SPECT), Optical Imaging (OI), Bioluminescence Imaging, Cerenkov Luminescence Imaging, and Others), By Application (Monitoring Drug Treatment Response, Bio Distribution Studies, Cancer Cell Detection, Biomarkers, Longitudinal Studies, and Epigenetics), By End-user (Hospitals, Clinics, Pharmaceutical Research Institutes, Diagnostic Laboratories, Forensic Laboratories, and Educational Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162183

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

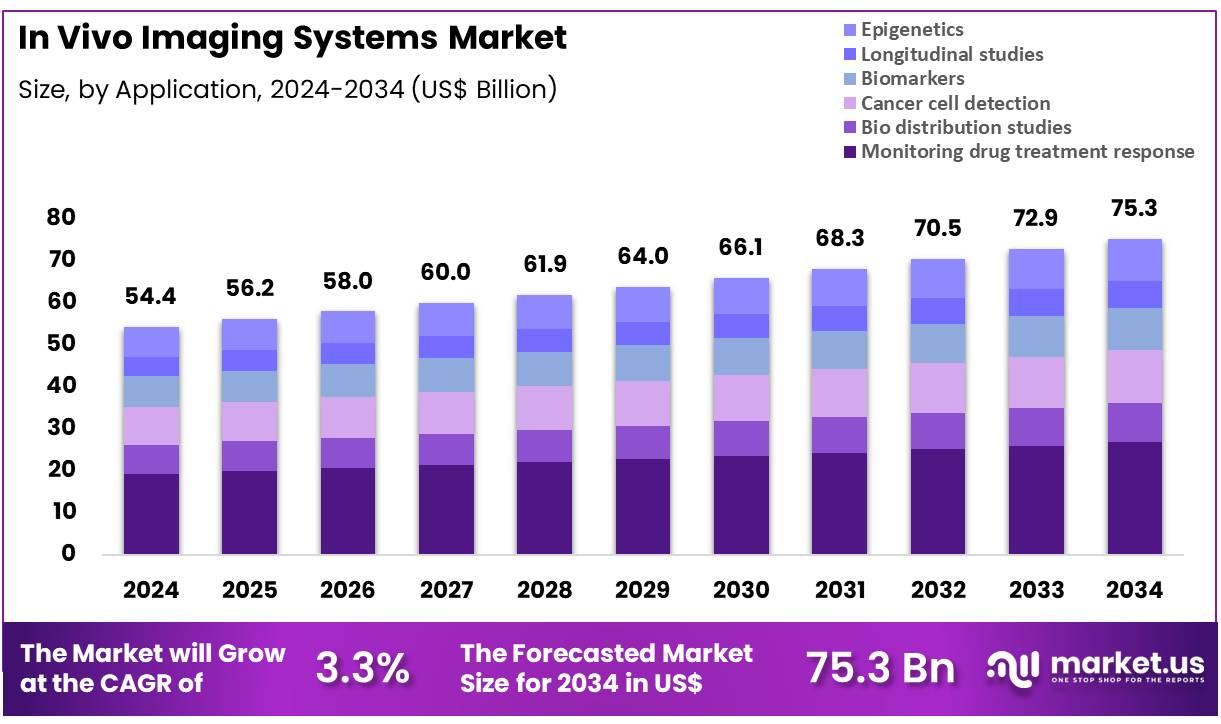

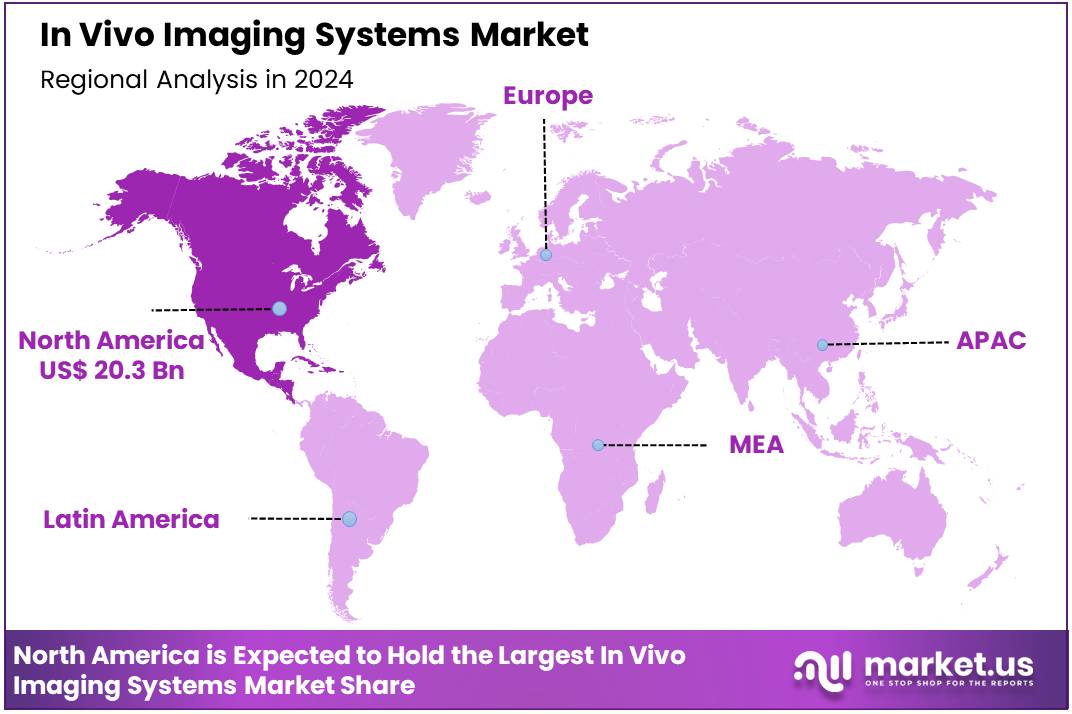

Global In Vivo Imaging Systems Market size is expected to be worth around US$ 75.3 Billion by 2034 from US$ 54.4 Billion in 2024, growing at a CAGR of 3.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.4% share with a revenue of US$ 20.3 Billion.

Rising demand for precision diagnostics drives the In Vivo Imaging Systems market as researchers and clinicians prioritize advanced visualization for accurate disease detection. Scientists increasingly utilize these systems in oncology research, imaging tumor microenvironments to evaluate therapeutic responses in real-time. This driver intensifies with the need for non-invasive monitoring, where MRI systems track disease progression in neurodegenerative disorders like Alzheimer’s.

Hospitals employ in vivo imaging for cardiovascular studies, assessing arterial plaque buildup to guide stent placements. In April 2022, PerkinElmer introduced the Vega imaging system, an automated ultrasound platform enhancing preclinical research efficiency. The National Institute of Biomedical Imaging and Bioengineering allocated US$440.6 million to imaging and bioengineering research in 2022, underscoring the critical role of these systems in advancing medical discoveries across diverse applications.

Growing investment in translational research creates substantial opportunities in the In Vivo Imaging Systems market. Innovators develop multimodal imaging platforms for musculoskeletal applications, combining CT and PET to optimize joint injury assessments in orthopedics. Academic institutions leverage these systems for drug development, visualizing biodistribution in pharmacokinetic studies for novel biologics.

Opportunities also emerge in infectious disease research, where fluorescence imaging tracks pathogen spread in animal models. In March 2021, FUJIFILM acquired Hitachi’s Diagnostic Imaging business, integrating AI-powered X-ray solutions to expand diagnostic capabilities. The FDA cleared 89 imaging devices in 2023, highlighting the potential for in vivo systems to bridge preclinical and clinical advancements.

Recent trends in the In Vivo Imaging Systems market emphasize AI integration and automated workflows to enhance diagnostic precision. Developers incorporate AI algorithms for neurology applications, improving detection of subtle brain lesions in epilepsy patients. Trends also include high-resolution optical imaging for ophthalmology, aiding retinal disease diagnosis with minimal patient discomfort.

In November 2024, GE HealthCare partnered with RadNet to advance AI-enhanced in vivo imaging, accelerating diagnostic accuracy in clinical settings. The WHO reported 8.2 million new cancer cases requiring imaging diagnostics in 2022, reflecting the push toward intelligent, scalable solutions. These advancements signal a dynamic shift toward integrated, AI-driven imaging ecosystems for diverse medical applications.

Key Takeaways

- In 2024, the market generated a revenue of US$ 54.4 Billion, with a CAGR of 3.3%, and is expected to reach US$ 75.3 Billion by the year 2034.

- The product type segment is divided into magnetic resonance imaging (MRI), digital angiography, ultrasound, nuclear imaging, positron emission tomography (PET), single photon emission computerized tomography (SPECT), optical imaging (OI), bioluminescence imaging, cerenkov luminescence imaging, and others, with magnetic resonance imaging (MRI) taking the lead in 2023 with a market share of 30.5%.

- Considering application, the market is divided into monitoring drug treatment response, bio distribution studies, cancer cell detection, biomarkers, longitudinal studies, and epigenetics. Among these, monitoring drug treatment response held a significant share of 35.6%.

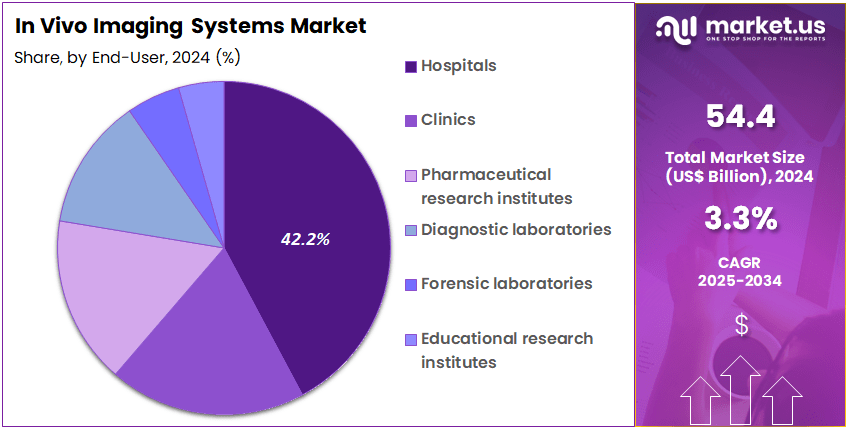

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, clinics, pharmaceutical research institutes, diagnostic laboratories, forensic laboratories, and educational research institutes. The hospitals sector stands out as the dominant player, holding the largest revenue share of 42.2% in the market.

- North America led the market by securing a market share of 37.4% in 2023.

Product Type Analysis

Magnetic resonance imaging (MRI) holds the largest share of 30.5% in the In Vivo Imaging Systems market and is expected to remain the dominant technology due to its unmatched ability to provide detailed, non-invasive imaging of soft tissues, making it crucial in a variety of diagnostic and research applications. MRI systems are increasingly used in hospitals, research institutes, and pharmaceutical companies for both clinical and preclinical imaging, especially in oncology, neurology, and musculoskeletal research.

The increasing demand for precise imaging in the early detection of diseases, coupled with advancements in MRI technology such as functional MRI (fMRI) and higher resolution imaging are projected to drive market growth. The development of portable MRI machines and the integration of artificial intelligence (AI) to enhance image analysis are expected to further boost the adoption of MRI systems.

As healthcare providers prioritize non-invasive and high-accuracy diagnostic tools, MRI is anticipated to continue playing a critical role in the market, particularly with the growing demand for advanced imaging in chronic disease management and personalized medicine.

Application Analysis

Monitoring drug treatment response is expected to maintain its dominance in the application segment, accounting for 35.6% of the market share. This segment is growing due to the increasing emphasis on personalized medicine, where real-time tracking of how a patient’s body responds to therapy is crucial for optimizing treatment regimens. In vivo imaging systems allow for the non-invasive monitoring of drug efficacy and the assessment of treatment outcomes, particularly in cancer and cardiovascular diseases.

The adoption of these systems is projected to increase as pharmaceutical companies and clinical research organizations continue to prioritize patient-centric treatments and outcomes. Moreover, the integration of imaging technologies with biomarkers and AI-driven analytics will likely enhance the precision of drug monitoring, enabling faster and more accurate decision-making.

As healthcare providers move toward evidence-based treatments, the demand for monitoring drug treatment responses using advanced imaging solutions is expected to rise, driving market expansion in this application.

End-User Analysis

Hospitals represent the largest end-user segment, holding 42.2% of the market share, and are expected to continue leading the adoption of in vivo imaging systems due to their central role in patient diagnosis, monitoring, and treatment. Hospitals rely heavily on imaging technologies such as MRI, PET, and SPECT to provide detailed, accurate, and real-time insights into patient conditions, which are essential for guiding clinical decisions.

The increasing incidence of chronic diseases, such as cancer, cardiovascular disorders, and neurological conditions, is expected to drive the demand for advanced imaging systems in hospitals. Additionally, hospitals are adopting new imaging modalities and integrating them into their electronic health record (EHR) systems to improve workflow efficiency and enhance diagnostic accuracy.

The rising demand for minimally invasive procedures and the need for better patient outcomes are anticipated to further accelerate the adoption of in vivo imaging systems in hospital settings. As healthcare systems focus more on early disease detection and personalized care, hospitals are likely to remain a dominant end-user segment, supporting the growth of the in vivo imaging systems market.

Key Market Segments

By Product Type

- Magnetic Resonance Imaging (MRI)

- Digital Angiography

- Ultrasound

- Nuclear Imaging

- Positron Emission Tomography (PET)

- Single Photon Emission Computerized Tomography (SPECT)

- Optical Imaging (OI)

- Bioluminescence Imaging

- Cerenkov Luminescence Imaging

- Others

By Application

- Monitoring Drug Treatment Response

- Bio Distribution Studies

- Cancer Cell Detection

- Biomarkers

- Longitudinal Studies

- Epigenetics

By End-user

- Hospitals

- Clinics

- Pharmaceutical Research Institutes

- Diagnostic Laboratories

- Forensic Laboratories

- Educational research institutes

Drivers

Surging NIH Funding for Cancer Research is Driving the Market

The augmentation of federal investments in cancer research has markedly advanced the in vivo imaging systems market by facilitating longitudinal studies of tumor dynamics and therapeutic responses in preclinical models. These systems, encompassing modalities like optical and nuclear imaging, enable non-invasive visualization of molecular events, accelerating the validation of biomarkers and targeted interventions.

As oncology remains a priority in biomedical agendas, enhanced funding supports the procurement of high-resolution platforms essential for dissecting heterogeneous tumor microenvironments. This influx not only bolsters academic and industry collaborations but also refines imaging protocols to align with translational goals, minimizing the gap between bench and bedside.

The emphasis on precision oncology further amplifies demand, as in vivo tools provide quantifiable data on drug penetration and efficacy endpoints. Government allocations underscore the strategic imperative to counter rising cancer burdens through innovative diagnostics. The National Cancer Institute allocated $7.0 billion for cancer research in fiscal year 2022, representing a cornerstone of support for imaging-integrated studies. This commitment extended to $7.2 billion in fiscal year 2024, sustaining momentum for advanced preclinical platforms amid escalating caseloads.

Key developers are channeling these resources into hybrid systems that fuse anatomical and functional imaging for superior spatiotemporal resolution. Economically, such funding mitigates development risks, fostering scalable solutions that enhance grant competitiveness. Moreover, it promotes ethical refinements in animal modeling, prioritizing welfare through reduced invasiveness. In summary, this fiscal propulsion not only elevates technical capabilities but also positions the market as integral to oncology’s forward trajectory.

Restraints

High Costs of Advanced Imaging Systems is Restraining the Market

The prohibitive expenses linked to acquiring and maintaining sophisticated in vivo imaging systems continue to hinder broader adoption, particularly among smaller research entities and emerging economies. Capital outlays for integrated multimodal setups often exceed seven figures, encompassing hardware, software licenses, and ancillary consumables like contrast agents.

Operational demands, including specialized training and facility retrofits, compound these financial strains, deterring routine integration into workflows. This barrier disproportionately impacts nonprofit institutes reliant on sporadic grants, limiting experimental throughput and innovation velocity.

Manufacturers grapple with pricing pressures, balancing profitability against accessibility to avoid market contraction. The complexity of customization for specific research niches further escalates bespoke development fees, prolonging return-on-investment timelines. The U.S. Food and Drug Administration cleared 139 artificial intelligence-enabled medical imaging devices in 2022, yet high implementation costs curbed penetration in resource-limited settings.

Such figures reveal a regulatory throughput unaccompanied by equitable deployment, as annual maintenance alone can approach 10-15% of initial investments. Payers and funders scrutinize cost-benefit ratios, favoring established modalities over nascent in vivo innovations. This fiscal constriction fosters dependency on shared core facilities, queuing delays that impede timely data generation.

Efforts to modularize components offer partial relief, but systemic affordability remains elusive. Ultimately, these economic impediments not only constrain market expansion but also perpetuate disparities in research equity.

Opportunities

Advancements in Multimodal Imaging Integration is Creating Growth Opportunities

The convergence of diverse imaging modalities into unified platforms has engendered substantial growth prospects for the in vivo imaging systems market, particularly in streamlining drug efficacy assessments across preclinical pipelines. Multimodal systems synergize optical, magnetic resonance, and computed tomography inputs, yielding comprehensive datasets that elucidate biodistribution and pharmacodynamics with unprecedented fidelity. This integration mitigates limitations of singular techniques, such as optical’s depth constraints or MRI’s temporal lags, fostering holistic evaluations of therapeutic interventions.

Opportunities proliferate in oncology and neurology, where hybrid visualizations track metastasis or neurodegeneration noninvasively over extended durations. Pharmaceutical giants are leveraging these for high-throughput screening, curtailing animal usage while amplifying translational relevance. Regulatory endorsements accelerate commercialization, as fused outputs align with evidentiary standards for investigational new drugs. Collaborations between device firms and biotech innovators are unlocking niche applications, like real-time immunotherapy monitoring.

As data analytics mature, these systems promise predictive modeling, optimizing trial designs and reducing attrition rates. Emerging markets, too, beckon with localized adaptations for infectious disease surveillance. Collectively, this modality fusion not only diversifies revenue avenues but also cements the sector’s role in accelerated discovery paradigms.

Impact of Macroeconomic / Geopolitical Factors

Rising inflation and limited access to capital are pressuring developers in the in vivo imaging systems market, leading them to delay hybrid modality prototypes while prioritizing maintenance for existing scanners amid tight research budgets. U.S.-China export restrictions and Red Sea shipping disruptions are hindering supplies of rare earth scintillators, extending calibration timelines and raising validation costs for international research collaborations.

To address these challenges, some developers are partnering with Pacific Northwest crystal manufacturers, incorporating supply diversification that streamlines grant approvals and attracts therapeutics-focused investors. Increasing neurodegenerative research demands are channeling BARDA funds into longitudinal tracer platforms, boosting adoptions in academic consortia.

U.S. tariffs of 25% on imported medical devices and components are elevating costs for Asian-sourced detectors, squeezing capital expenditures for preclinical suites and occasionally stalling multi-site enrollments. In response, developers are leveraging NDAA incentives to establish Idaho fabrication hubs, advancing quantum-dot enhancements and building expertise in spectral unmixing.

Latest Trends

Acquisition of Spectral Instruments Imaging by Bruker is a Recent Trend

The strategic consolidation exemplified by Bruker’s acquisition of Spectral Instruments Imaging has epitomized a burgeoning trend toward portfolio diversification in the in vivo imaging systems arena during 2024. This transaction augmented Bruker’s preclinical offerings with cutting-edge optical bioluminescence and fluorescence capabilities, enabling seamless integration into existing MRI and CT workflows. Such mergers reflect a broader industry pivot toward comprehensive solutions that expedite multimodal experimentation, reducing interoperability hurdles for end-users.

The move addresses demands for versatile platforms amid surging preclinical demands, particularly in oncology where longitudinal tracking is paramount. It also underscores investor confidence in scalable imaging ecosystems, fostering synergies in software and probe development. This trend catalyzes innovation velocity, as amalgamated entities pool R&D to pioneer next-generation hybrids.

In February 2024, Bruker completed the acquisition, fortifying its BioSpin Preclinical Imaging division with advanced in vivo optical systems for enhanced disease modeling. This enhancement broadens applicability across therapeutic areas, from cardiovascular to immunology assays. Observers note accelerated product roadmaps post-merger, with emphasis on user-centric interfaces for novice operators.

Regulatory landscapes favor such consolidations, viewing them as efficiency boosters without compromising safety. Forward-looking, this pattern anticipates further alliances, potentially incorporating AI for automated quantitation. This evolutionary consolidation not only refines market competitiveness but also democratizes access to sophisticated imaging armaments.

Regional Analysis

North America is leading the In Vivo Imaging Systems Market

In 2024, North America maintained a 37.4% share of the global in vivo imaging systems market, sustained by escalating investments in preclinical modalities to accelerate drug efficacy evaluations for neurodegenerative and oncology indications, amid a surge in federally sponsored translational initiatives. Research consortia utilized optical and MRI systems to track longitudinal tumor responses in rodent models, informing adaptive dosing strategies that shorten development cycles for immunotherapies.

The FDA’s expedited reviews for hybrid imaging platforms enhanced adoption, allowing seamless fusion of functional and anatomical data for precise lesion quantification in arthritis studies. University labs expanded hybrid PET-CT installations through grant synergies, optimizing biodistribution assessments for radiotracers in cardiovascular trials.

Heightened emphasis on non-invasive endpoints aligned with ethical guidelines, reducing reliance on terminal procedures while upholding data robustness. These alignments exemplified the area’s preeminence in bridging bench-to-bedside visualization paradigms.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Health ministries across Asia Pacific anticipate the in vivo imaging systems sector to proliferate during the forecast period, as governmental endowments fortify preclinical capacities to address endemic metabolic and infectious pathologies in burgeoning research landscapes. Authorities in South Korea and Australia disburse allocations for luminescence scanners, outfitting national institutes to delineate viral dissemination in primate surrogates for vaccine refinement.

Biopharma alliances with public entities calibrate micro-CT arrays, projecting refined pharmacokinetics for anti-malarials in vector-challenged simulations. Oversight agencies in India and Taiwan pioneer luminescence tomography suites, positioning collaborative hubs to monitor graft viability in xenotransplant evaluations. Governments project subsidizing multimodal upgrades in peripheral centers, countering logistical hurdles in archipelago terrains through portable configurations.

Regional scholars integrate cryogenic enhancements, coordinating with pharmacodynamic archives to validate neuroprotective agents in stroke analogs. These synergies engender a dynamic conduit for indigenous biomedical visualization. Japan’s Agency for Medical Research and Development funded eight joint international projects from 2020 to 2022, extending into 2024 with emphasis on advanced imaging for complex living systems.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major firms in the In Vivo Imaging Systems Market drive growth by launching hybrid scanners blending optical and nuclear technologies for precise preclinical research in oncology and neurology. They partner with academic labs to develop advanced imaging agents, speeding up therapeutic validation. Companies invest in AI-enhanced systems for automated data analysis, improving trial efficiency.

Leaders acquire niche tech firms to expand imaging modalities and strengthen portfolios. They target Latin America and the Middle East, aligning with research grants to access new markets. Additionally, they offer flexible leasing models tied to study outcomes, ensuring steady revenue.

Bruker Corporation, founded in 1960 in Billerica, Massachusetts, specializes in precision instruments for molecular research, offering multimodal imaging solutions for live animal studies. Its In-Vivo Xtreme platform integrates bioluminescence and X-ray for accurate tumor tracking.

Bruker focuses on R&D to enhance optical and cryogenic capabilities. CEO Frank H. Laukien leads global operations, emphasizing sustainable innovation. The firm collaborates with pharma to refine preclinical protocols. Bruker maintains leadership through advanced hardware and analytical tools.

Top Key Players

- Siemens

- SCANCO Medical AG

- PerkinElmer Inc.

- MR Solutions

- Mittenyl Boitec

- MILabs B.V

- Mediso Ltd.

- LI-COR Inc.

- Bruker

- Bioscan AG

Recent Developments

- In February 2024, Bruker Corporation acquired Spectral Instruments Imaging LLC and Neurescence Inc., significantly expanding its preclinical imaging solutions, especially in optical imaging and neuroscience research. This strategic move enhances Bruker’s position in the In Vivo Imaging Systems market by providing more advanced tools for preclinical studies, particularly in the growing fields of optical and neuroscience imaging, where precision and detailed visualization are essential for breakthroughs in disease research.

- In April 2024, Miltenyi Biotec entered a partnership with MiLaboratories to advance next-generation therapies through RNA immune sequencing technology. This collaboration drives the In Vivo Imaging Systems market by combining cutting-edge sequencing technologies with in vivo imaging systems, enabling more comprehensive, real-time monitoring of immune responses and accelerating the development of personalized treatments in the clinical and research sectors.

Report Scope

Report Features Description Market Value (2024) US$ 54.4 Billion Forecast Revenue (2034) US$ 75.3 Billion CAGR (2025-2034) 3.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Magnetic Resonance Imaging (MRI), Digital Angiography, Ultrasound, Nuclear Imaging, Positron Emission Tomography (PET), Single Photon Emission Computerized Tomography (SPECT), Optical Imaging (OI), Bioluminescence Imaging, Cerenkov Luminescence Imaging, and Others), By Application (Monitoring Drug Treatment Response, Bio Distribution Studies, Cancer Cell Detection, Biomarkers, Longitudinal Studies, and Epigenetics), By End-user (Hospitals, Clinics, Pharmaceutical Research Institutes, Diagnostic Laboratories, Forensic Laboratories, and Educational Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens, SCANCO Medical AG, PerkinElmer Inc., MR Solutions, Mittenyl Boitec, MILabs B.V, Mediso Ltd., LI-COR Inc., Bruker, Bioscan AG. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  In Vivo Imaging Systems MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

In Vivo Imaging Systems MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens

- SCANCO Medical AG

- PerkinElmer Inc.

- MR Solutions

- Mittenyl Boitec

- MILabs B.V

- Mediso Ltd.

- LI-COR Inc.

- Bruker

- Bioscan AG