Infectious Disease Testing Market By Product Type (Kits & Reagents, Instruments, and Software & Services), By Technology (Molecular Diagnostics, Immunodiagnostics, Clinical Microbiology, and Biosensor-Based), By Application (Infectious Diseases, Nephrology, Diabetes, Cardiology, Cancer/Oncology, Autoimmune Diseases, and Others), By Sample Type (Blood, Urine, Sputum, Saliva, and Others), By Disease Type (Respiratory Infections, Vector-Borne Diseases, Sexually Transmitted Infections (STIs), Hospital-Acquired Infections (HAIs), Gastrointestinal Infections, and Others), By End-User (Diagnostic Laboratories, Hospitals & Clinics, Research Institutes, Homecare Settings, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 141827

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Technology Analysis

- Application Analysis

- Sample Type Analysis

- Disease Type Analysis

- End-user Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

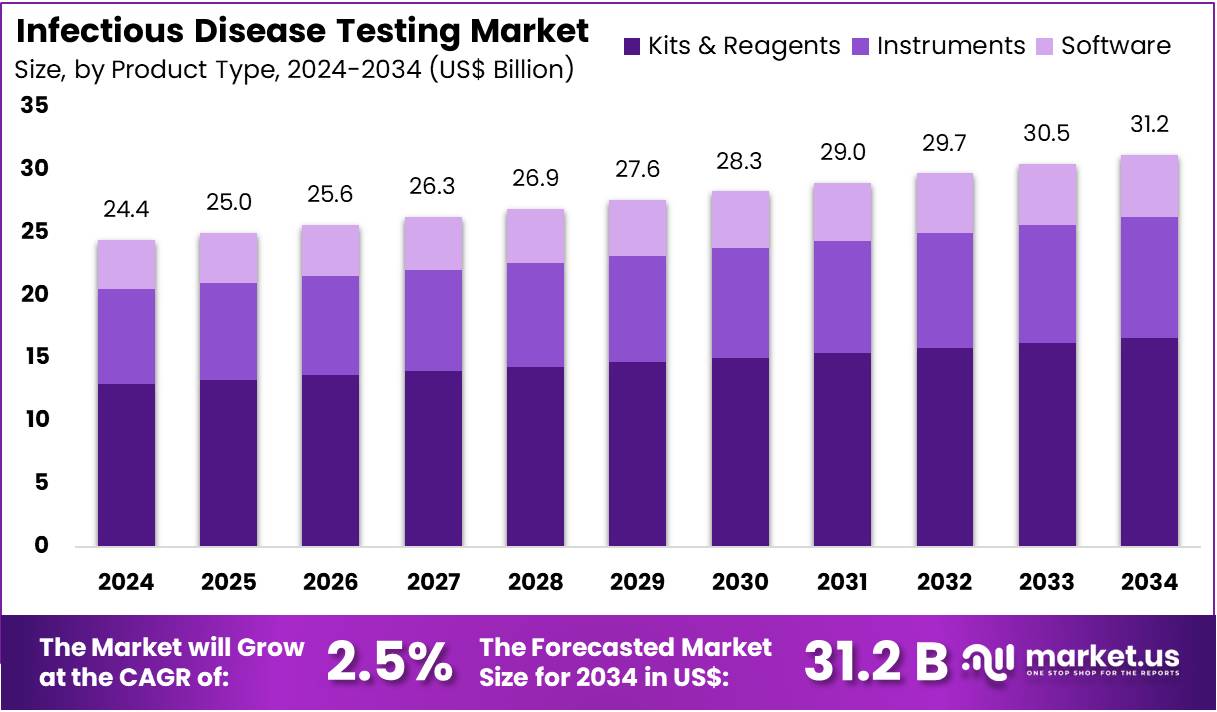

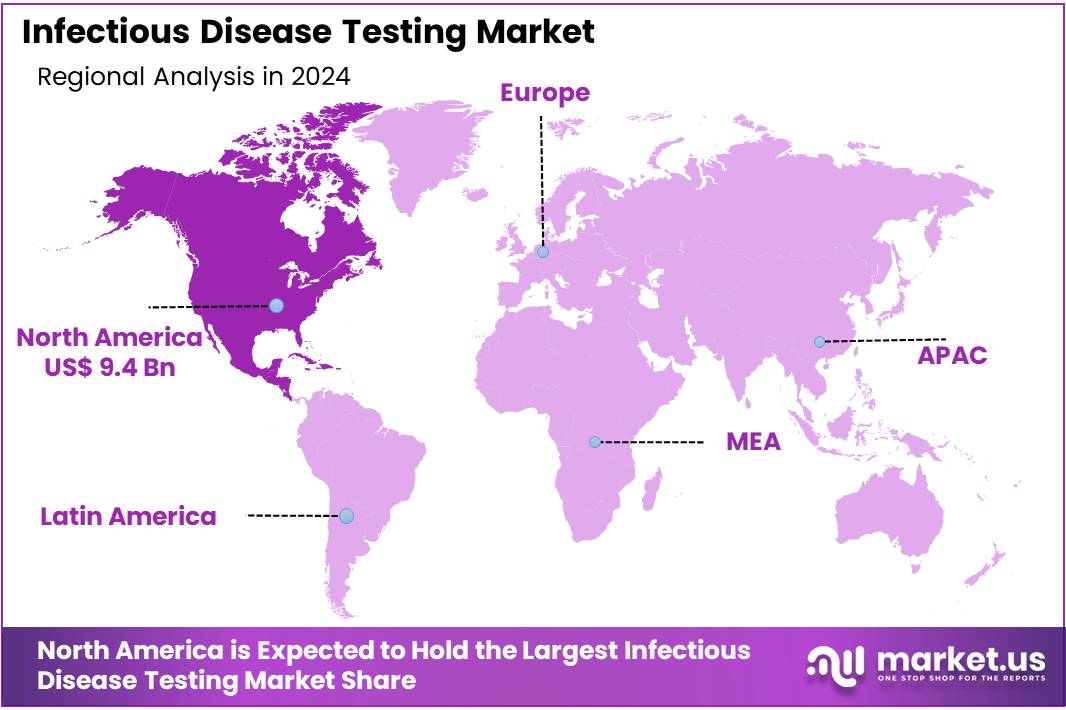

The Infectious Disease Testing Market Size is expected to be worth around US$ 31.2 billion by 2034 from US$ 24.4 billion in 2024, growing at a CAGR of 2.5% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 38.5% share and holds US$ 9.4 Billion market value for the year.

Rising prevalence of infectious diseases drives the infectious disease testing market as healthcare providers prioritize rapid, accurate diagnostics for effective patient care. Clinicians increasingly rely on point-of-care (POC) testing to swiftly identify pathogens in respiratory infections, enabling prompt treatment in outpatient settings.

The growing burden of sexually transmitted infections and vector-borne diseases amplifies demand, with software streamlining multiplex PCR assays for simultaneous pathogen detection. Hospitals deploy these solutions for sepsis screening, integrating biomarker data to guide antibiotic therapy. According to the CDC, over 2.8 million antibiotic-resistant infections occur annually in the US, underscoring the urgent need for advanced diagnostic tools. These drivers position infectious disease testing solutions as critical for enhancing clinical outcomes across diverse applications.

Growing advancements in molecular diagnostics and artificial intelligence create significant opportunities in the infectious disease testing market. Innovators develop AI-enhanced platforms that analyze genomic sequences, supporting outbreak surveillance for diseases like influenza. Research institutions utilize these systems for epidemiological studies, tracking resistance patterns in tuberculosis to inform public health strategies.

Opportunities also arise in home-based testing, where self-administered kits for HIV monitoring improve patient access and adherence. Pharmaceutical firms leverage diagnostic data for vaccine development, aligning trials with real-time pathogen trends. The WHO estimates 1.5 million new hepatitis C cases annually, highlighting the potential for scalable testing solutions to address global health challenges.

Recent trends in the infectious disease testing market emphasize rapid, decentralized diagnostics and strategic acquisitions to bolster innovation. Developers integrate isothermal amplification technologies for faster results in field settings, aiding applications like malaria testing in resource-limited environments. In December 2024, OraSure Technologies acquired Sherlock Biosciences to enhance its molecular diagnostic offerings, introducing a rapid, over-the-counter self-test for Chlamydia and Gonorrhea that delivers results in under 30 minutes using self-collected swabs.

Similarly, in April 2022, Variohm EuroSensor launched an NTC thermistor to detect subtle temperature variations, improving patient monitoring for infection-related fevers. Trends also include cloud-based platforms for real-time data sharing, enhancing collaborative responses to outbreaks like dengue. These advancements signal a dynamic shift toward accessible, precision-driven diagnostic ecosystems.

Key Takeaways

- In 2024, the infectious disease testing market generated US$ 24.4 billion in revenue, growing at a CAGR of 2.5%, and is expected to reach US$ 31.2 billion by 2034.

- The product type segment is categorized into kits & reagents, instruments, and software & services, with kits & reagents leading the market in 2024, holding a share of 55.5%.

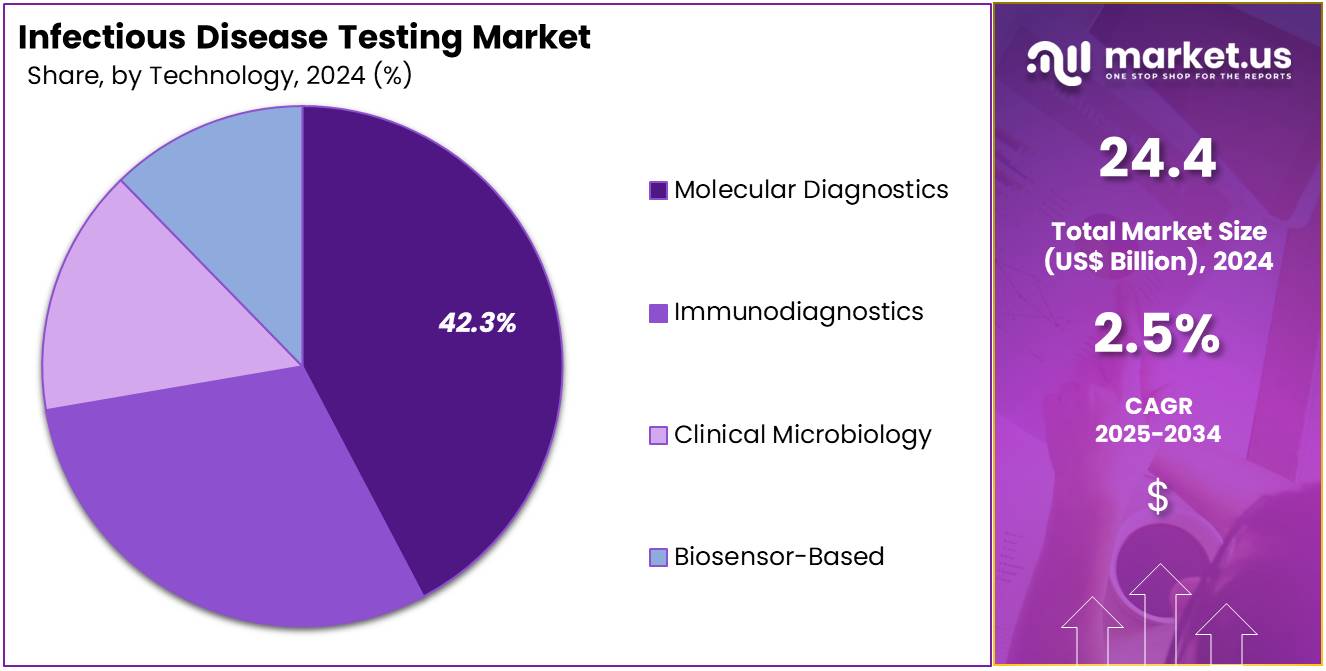

- Regarding technology, the market is divided into molecular diagnostics, immunodiagnostics, clinical microbiology, and biosensor-based solutions. Among these, molecular diagnostics held the largest share, representing 42.3% of the market.

- The application segment is broken down into infectious diseases, nephrology, diabetes, cardiology, cancer/oncology, autoimmune diseases, and other areas. Infectious diseases dominate this segment, accounting for the largest revenue share of 48.5%.

- In the sample type segment, blood, urine, sputum, saliva, and others are considered, with the blood segment leading the market, holding a revenue share of 46.2%.

- For disease types, the market is divided into respiratory infections, vector-borne diseases, sexually transmitted infections (STIs), hospital-acquired infections (HAIs), gastrointestinal infections, and others. Respiratory infections make up a significant portion of the market, holding 34.0% of the share.

- The end-user segment includes diagnostic laboratories, hospitals & clinics, research institutes, homecare settings, and others, with diagnostic laboratories leading the market, capturing a revenue share of 42.0%.

- North America maintained its leadership in the market, securing a market share of 38.5% in 2024.

Product Type Analysis

In 2024, the Kits & reagents segment held a dominant market position in the Product Type Segment of the Infectious Disease Testing Market, capturing more than a 55.5% share. This growth is driven by their widespread use in both clinical and home-based diagnostic testing. Kits and reagents are essential for a variety of diagnostic procedures, especially in infectious disease detection, where timely and accurate results are critical.

The increasing adoption of point-of-care testing, particularly in remote areas, is expected to drive further demand for these products. Instruments are expected to grow due to the integration of advanced technologies in diagnostics, such as automation and AI-driven analysis. Software & services are projected to expand as healthcare systems shift toward digitalization, increasing the demand for software solutions to manage diagnostic data and enhance accuracy.

Technology Analysis

In 2024, the Molecular Diagnostics segment held a dominant market position in the Technology Segment of the Infectious Disease Testing Market, capturing more than a 42.3% share. This driven by its precision and ability to detect infectious agents at the genetic level. The demand for accurate, fast, and sensitive diagnostic tools, particularly for infectious diseases, has been a major factor in the growth of this segment. The rise in personalized medicine, where genetic information is used for tailored treatments, is expected to boost the demand for molecular diagnostics.

Immunodiagnostics remain integral in identifying pathogens through immune responses, offering rapid results and applicability in various disease detection. Clinical Microbiology continues to be a vital technology in understanding infections, especially as global healthcare systems tackle antibiotic resistance. Biosensor-based technologies are anticipated to experience growth driven by their ability to offer real-time, on-site diagnostics with minimal patient discomfort.

Application Analysis

In 2024, the Infectious diseases segment held a dominant market position in the Application Segment of the Infectious Disease Testing Market, capturing more than a 48.5% share. The increasing global incidence of infectious diseases, such as viral outbreaks and antibiotic-resistant bacteria, is expected to propel this segment further. As the healthcare landscape increasingly embraces early detection and preventive care, the demand for rapid diagnostic testing, particularly for infections, will continue to expand.

Nephrology is expected to grow with the rising prevalence of kidney diseases and the need for early-stage diagnosis. Diabetes will continue to grow due to the increasing number of diabetes cases globally, driving demand for regular diagnostic testing. Cardiology is projected to expand due to advancements in heart disease diagnostics. Cancer/Oncology diagnostics are expected to grow as early detection becomes a critical component of effective treatment plans.

Sample Type Analysis

In 2024, the Blood segment held a dominant market position in the Sample Type Segment of the Infectious Disease Testing Market, capturing more than a 46.2% share. This owing to its crucial role in diagnosing a wide range of conditions, including infectious diseases, metabolic disorders, and cancer. Blood-based diagnostics provide comprehensive data that healthcare providers rely on to make informed decisions.

Urine remains a key sample type due to its non-invasive collection process and applicability in monitoring diseases like diabetes and kidney function. Sputum samples are essential in diagnosing respiratory infections, especially tuberculosis and pneumonia. Saliva continues to be used for non-invasive testing in viral infections and hormone monitoring. Other sample types, such as stool and tissue samples, are critical for more specific tests like gastrointestinal and cancer diagnostics.

Disease Type Analysis

In 2024, the Respiratory infections segment held a dominant market position in the Disease type Segment of the Infectious Disease Testing Market, capturing more than a 48.5% share. This driven by the ongoing global burden of diseases like influenza, pneumonia, and COVID-19. The need for fast, accurate diagnostics in these areas, particularly in emergency settings, is expected to keep this segment at the forefront. Vector-borne diseases are projected to grow due to changing climate conditions that are expanding the range of diseases such as malaria and dengue.

Sexually transmitted infections (STIs) remain a key area for diagnostics, particularly with the rise in awareness and testing programs globally. Hospital-acquired infections (HAIs) continue to pose significant risks in healthcare settings, driving the need for constant surveillance and timely diagnostics. Gastrointestinal infections are expected to grow with increasing concern about foodborne diseases and infections like norovirus.

End-user Analysis

In 2024, the Diagnostic laboratories segment held a dominant market position in the End user Segment of the Infectious Disease Testing Market, capturing more than a 42.0% share. This driven by their role in performing various diagnostic tests across a wide range of medical conditions. Laboratories provide quick, accurate results for a variety of diseases, particularly in the context of rising infectious disease threats. Hospitals & clinics continue to play a dominant role in diagnostic testing due to their integration of advanced diagnostic equipment and their proximity to a large patient population.

Research institutes are crucial in the development of new diagnostic methods and are expected to see growth with the increasing focus on personalized medicine and novel biomarkers. Homecare settings are projected to grow as more patients seek to monitor their health at home, especially for chronic conditions. Other end-users, including public health organizations and government agencies, are involved in disease surveillance and control, and they continue to contribute to the market’s growth.

Key Market Segments

By Product Type

- Kits & Reagents

- Instruments

- Software & Services

By Technology

- Molecular Diagnostics

- Immunodiagnostics

- Clinical Microbiology

- Biosensor-Based

By Application

- Infectious Diseases

- Nephrology

- Diabetes

- Cardiology

- Cancer/Oncology

- Autoimmune Diseases

- Others

By Sample Type

- Blood

- Urine

- Sputum

- Saliva

- Others

By Disease Type

- Respiratory Infections

- Vector-Borne Diseases

- Sexually Transmitted Infections (STIs)

- Hospital-Acquired Infections (HAIs)

- Gastrointestinal Infections

- Others

By End-User

- Diagnostic Laboratories

- Hospitals & Clinics

- Research Institutes

- Homecare Settings

- Others

Drivers

Rising Incidence of Infectious Diseases is Driving the Market

The increasing prevalence of infectious diseases significantly propels the infectious disease testing market by creating an urgent and growing need for advanced diagnostic solutions. This demand is particularly acute for conditions that have seen recent, alarming resurgences. For instance, the total number of syphilis cases in the United States reached 207,273 in 2022, the highest number reported since the 1950s. While provisional 2024 data shows a slight decline in overall cases compared to 2023, the rate of congenital syphilis, which is preventable, increased for the 12th consecutive year with nearly 4,000 reported cases in 2024. This alarming trend underscores the critical need for enhanced diagnostic capabilities to facilitate early detection, contact tracing, and treatment.

In direct response to this public health crisis, the National Institutes of Health (NIH) has intensified its efforts, allocating a cumulative US$2.4 million in grants in September 2024 to fund 10 projects aimed at developing innovative, rapid, and more precise diagnostic tools for adult and congenital syphilis. Such investments and the sustained high case numbers across various infections exemplify a broader trend that necessitates robust and continually improved testing solutions, thereby accelerating market growth.

Restraints

Data Privacy and Security Concerns are Restraining the Market

Despite advancements in diagnostic technologies, the risk of data breaches and the complexities of compliance with strict regulations pose a significant challenge to the infectious disease testing market. The handling and sharing of sensitive patient health information (PHI) during testing, especially with the shift to digital platforms and electronic health records, creates major security vulnerabilities. The frequency and scale of cyberattacks on healthcare systems remain substantial. The US Department of Health and Human Services (HHS) Office for Civil Rights (OCR) reported 725 data breaches of 500 or more records in 2023, with the total number of individuals affected reaching an alarming 133 million records.

Furthermore, 2024 saw an all-time record in the number of individuals affected, reaching nearly 180 million individuals. These incidents not only highlight vulnerabilities but also erode patient trust and increase hesitancy to fully engage in testing programs, particularly those involving at-home or remote data transmission. Ensuring compliance with regulations like the Health Insurance Portability and Accountability Act (HIPAA) adds significant cost and technical complexity, as organizations must continuously invest in advanced security, risk assessment, and continuous monitoring to protect this highly valuable data.

Opportunities

Integration of Artificial Intelligence (AI) is Creating Growth Opportunities

The integration of Artificial Intelligence (AI) into infectious disease diagnostics presents a major growth opportunity by enhancing the speed, accuracy, and predictive capabilities of testing solutions. AI algorithms can process and analyze vast and complex datasets from molecular sequences, lab results, and real-time surveillance systems to identify patterns, predict outbreak trajectories, and even expedite image analysis for clinical diagnosis. To accelerate this transition, the National Institutes of Health (NIH) launched the Bridge2AI program to create high-quality, ethically sourced, and AI-ready biomedical data sets that can be leveraged by the research community.

This initiative, which had key milestones and events throughout 2023 and 2024, including a Voice Symposium in May 2024, is actively working to standardize data attributes and develop best practices for machine learning across diverse data sources. By improving data standardization and accessibility, AI integration facilitates more efficient and accurate information exchange among healthcare systems, ultimately supporting better public health responses and streamlining the decision-making process for clinicians during infectious disease outbreaks.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical dynamics profoundly shape the infectious disease testing market, influencing investment levels, accessibility, and the stability of global supply chains. Robust economic expansion empowers governments and private entities to allocate greater resources toward healthcare infrastructure, thereby accelerating the creation and deployment of sophisticated diagnostic instruments tailored to emerging pathogens. In contrast, recessions impose stringent fiscal limitations on public health entities and medical facilities, curtailing the availability of costly testing protocols and impeding broader market adoption.

Geopolitical frictions exacerbate these pressures by interrupting the flow of vital components, such as reagents and diagnostic kits, through mechanisms like export controls and levies. For example, recent US tariffs on pharmaceutical imports—ranging from 10% to 54% on goods from key trading partners including China—have escalated procurement expenses and prolonged delivery timelines for molecular testing materials, as reported by industry analyses. Yet, such disruptions often catalyze ingenuity, prompting firms to innovate affordable, domestically produced point-of-care diagnostics that lessen reliance on unpredictable international suppliers.

Latest Trends

Shift Towards At-Home Testing Solutions is Driving the Market

A significant and transformative trend in the infectious disease testing market is the rapid shift towards at-home diagnostic solutions. This movement is driven by the increasing consumer demand for convenience, discretion, and patient-centered healthcare, particularly for sensitive issues like sexually transmitted infections (STIs). At-home testing kits, which include sample collection materials and easy-to-use instructions, reduce the need for clinic visits, thereby encouraging more individuals to seek timely diagnosis. This enhanced accessibility is critical given the persistent high rates of infections.

The market has seen a surge in commercially available and regulatory-cleared at-home collection tests for STIs in various regions throughout 2024. The convenience of self-testing is crucial for reducing stigma and facilitating early diagnosis, which is essential to curbing the spread of infectious diseases. As technologies like isothermal nucleic acid amplification (INAAT), a fast, cost-effective, and portable alternative to PCR, become more integrated into these home-based formats, the reliability and accuracy of self-administered testing are improving, further fueling this major market trend.

Regional Analysis

North America is leading the Infectious Disease Testing Market

North America dominated the market with the highest revenue share of 38.5% owing to several key factors. The increasing prevalence of infectious diseases, such as respiratory infections and sexually transmitted diseases, raised the demand for diagnostic testing across healthcare settings. For example, the Centers for Disease Control and Prevention (CDC) reported a 16% increase in tuberculosis cases in the US in 2023 compared to the previous year. Advancements in diagnostic technologies, including point-of-care testing and molecular diagnostics, significantly improved the speed and accuracy of disease detection, contributing to the market’s growth.

The widespread adoption of these technologies in healthcare facilities increased the accessibility of testing, especially in outpatient and emergency care settings. Additionally, increased healthcare spending and government initiatives aimed at improving disease surveillance and control further fueled market expansion. The growing reliance on faster and more accurate diagnostic tools, particularly for emerging infectious diseases, also played a critical role in strengthening the market’s growth trajectory.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to an increasing population and rising healthcare needs. The demand for diagnostic solutions is projected to grow due to the rising prevalence of infectious diseases such as malaria, influenza, and HIV in the region. The expansion of healthcare infrastructure, particularly in developing countries like India and China, will support the adoption of advanced diagnostic technologies.

Governments across Asia Pacific are focusing on improving public health systems and expanding disease surveillance programs, which will likely increase the demand for effective diagnostic testing. For example, India’s increased budget allocation for its fisheries sector to enhance aquaculture production is indicative of the region’s broader efforts to improve healthcare and disease management. The region’s growing healthcare expenditures and focus on disease prevention are expected to drive a sustained demand for advanced infectious disease testing solutions, with innovations in diagnostics expected to further support the market’s expansion over the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the infectious disease testing market focus on developing rapid, accurate, and user-friendly diagnostic solutions to meet the growing demand for early disease detection. Companies invest in advanced technologies like PCR, next-generation sequencing, and antigen tests to enhance testing accuracy and speed.

Strategic partnerships with hospitals, research institutions, and governments help expand testing capabilities and access in both clinical and point-of-care settings. Many players also prioritize the development of multiplex tests to identify multiple pathogens simultaneously, improving efficiency. Geographic expansion into regions with increasing healthcare infrastructure supports market growth.

Thermo Fisher Scientific is a leading company in this market, offering innovative diagnostic solutions such as the Applied Biosystems PCR systems for detecting infectious agents. The company focuses on continuous innovation and expanding its portfolio to address a broad range of infectious diseases. Thermo Fisher’s commitment to precision diagnostics and global accessibility positions it as a key player in the industry.

Top Key Players in the Infectious Disease Testing Market

- SEKISUI Diagnostics

- Tangen Biosciences

- Thermo Fisher Scientific

- Abbott Laboratories

- Roche Diagnostics

- Siemens Healthineers

- Bio-Rad Laboratories

- Beckman Coulter

Recent Developments

- In March 2024: SEKISUI Diagnostics secured Emergency Use Authorization (EUA) for its OSOM Flu SARS-CoV-2 Combo Test, allowing its deployment in both clinical and at-home testing environments. This approval expands access to rapid diagnostics for flu and COVID-19 detection.

- In October 2023: Tangen Biosciences and SD Biosensor gained EUA clearance from the US FDA for their rapid point-of-care SARS-CoV-2 tests. These authorizations enable broader use of their diagnostic tools in healthcare settings, enhancing early detection and response efforts.

Report Scope

Report Features Description Market Value (2024) US$ 24.4 billion Forecast Revenue (2034) US$ 31.2 billion CAGR (2025-2034) 2.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Kits & Reagents, Instruments, and Software & Services), By Technology (Molecular Diagnostics, Immunodiagnostics, Clinical Microbiology, and Biosensor-Based), By Application (Infectious Diseases, Nephrology, Diabetes, Cardiology, Cancer/Oncology, Autoimmune Diseases, and Others), By Sample Type (Blood, Urine, Sputum, Saliva, and Others), By Disease Type (Respiratory Infections, Vector-Borne Diseases, Sexually Transmitted Infections (STIs), Hospital-Acquired Infections (HAIs), Gastrointestinal Infections, and Others), By End-User (Diagnostic Laboratories, Hospitals & Clinics, Research Institutes, Homecare Settings, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SEKISUI Diagnostics, Tangen Biosciences, Thermo Fisher Scientific, Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Bio-Rad Laboratories, and Beckman Coulter. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Infectious Disease Testing MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Infectious Disease Testing MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SEKISUI Diagnostics

- Tangen Biosciences

- Thermo Fisher Scientific

- Abbott Laboratories

- Roche Diagnostics

- Siemens Healthineers

- Bio-Rad Laboratories

- Beckman Coulter