Global Satellite Data Service Market Size, Share Analysis Report By Service Type (Image Data, Data Analytics), By End User (Defense and Security, Agriculture, Maritime, Environment, Energy and Power, Other End Users), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: January 2025

- Report ID: 138389

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

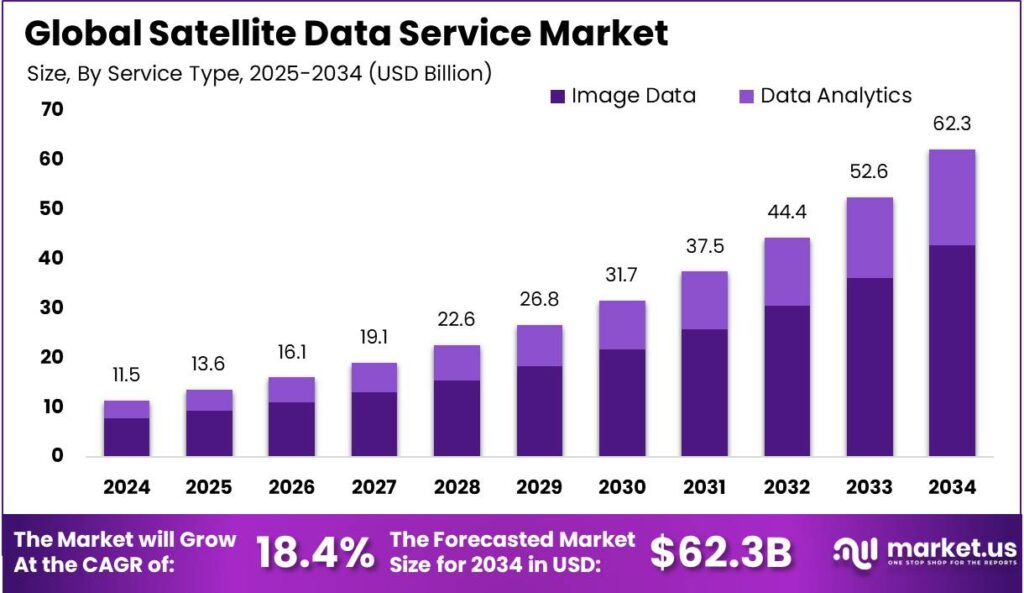

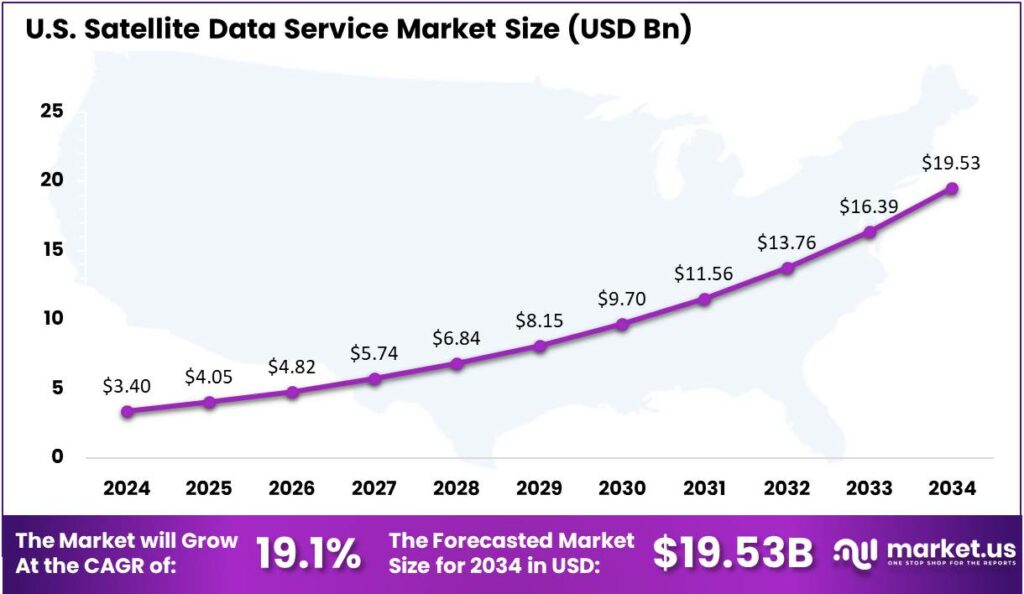

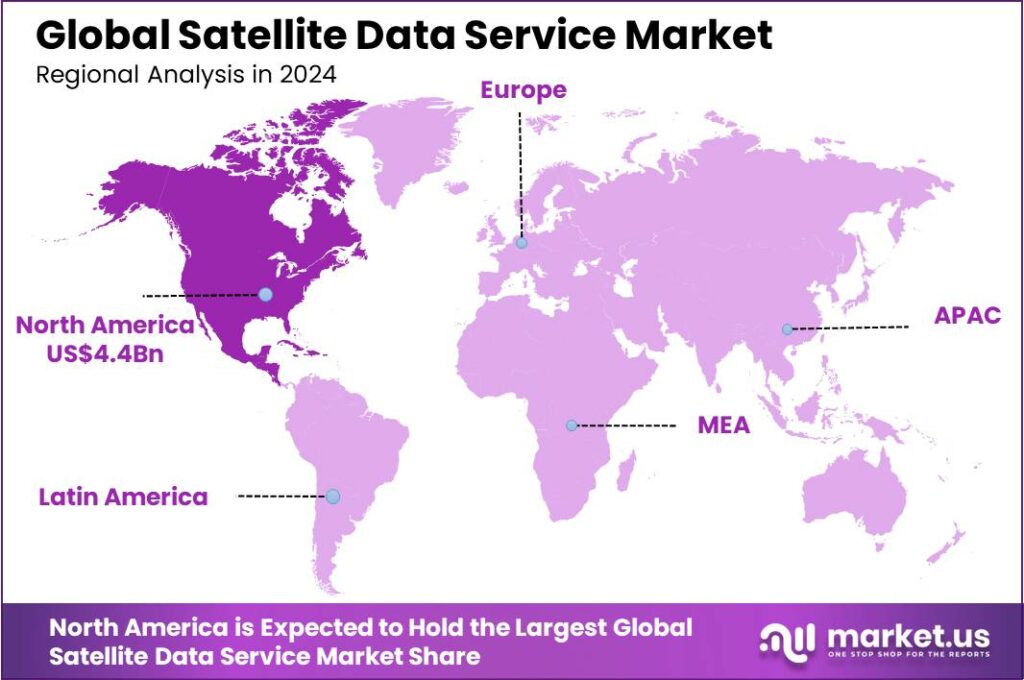

The Satellite Data Service Market size is expected to be worth around USD 62.3 Bn By 2034, from USD 11.5 Bn in 2024, growing at a CAGR of 18.40% during the forecast period from 2025 to 2034. In 2024, North America led the satellite data service market, holding over 39.0% of the share with revenues nearing USD 4.4 bn. The market in the United States alone, valued at around $3.4 billion, is expected to grow at a CAGR of 19.1%.

Satellite data services provide access to data collected by satellites orbiting the Earth, encompassing a broad spectrum of information types such as imagery, weather patterns, communication signals, and other sensor data. These services play a critical role in various applications across multiple industries, including agriculture for crop monitoring, defense for surveillance, environmental science for climate observation, and urban planning for infrastructure development.

The satellite data service market is experiencing significant growth, driven by the increasing demand for enhanced data communication across various industries including environmental monitoring, agriculture, and defense. This market comprises services such as Earth observation and telecommunications, which are essential for gathering and processing data that informs decision-making processes in both public and private sectors.

The expansion of the satellite data service market can primarily be attributed to the advancing capabilities of satellite technology, which now offers greater data accuracy and enhanced imaging resolutions. Additionally, the growing emphasis on sustainable practices and disaster management further propels the demand for real-time, reliable data accessible globally, particularly in scenarios where timely information is critical for effective response and recovery efforts.

A noticeable trend in the market is the increasing integration of machine learning and artificial intelligence with satellite data. These technologies enhance the analysis and applicability of the data collected, enabling more precise predictions and insights, particularly in environmental monitoring and urban planning. Furthermore, the development of small satellite constellations is promoting more frequent data coverage, thereby increasing the availability and timeliness of satellite-derived information.

For instance, In September 2024, Planet Labs Germany GmbH secured a three-year contract with the German Space Agency (DLR) at the German Aerospace Center. This agreement enables Planet to provide its advanced Earth observation data and analytics to DLR, empowering German researchers with high-quality insights for R&D initiatives.

The demand within the satellite data service market is bolstered by the need for high-resolution imagery and timely data across various applications. Key sectors driving this demand include agriculture for crop monitoring, urban planning for infrastructure development, and disaster management for efficient and rapid response to natural calamities.

Stakeholders in the satellite data service market, including governmental agencies, private companies, and academic institutions, benefit from enhanced decision-making capabilities provided by accurate and timely data. The availability of this data supports a wide range of applications from climate monitoring to strategic planning in resource management, ultimately leading to more informed policies and business strategies.

Key Takeaways

- The Global Satellite Data Service Market size is projected to reach USD 62.3 Billion by 2034, up from USD 11.5 Billion in 2024, growing at a CAGR of 18.40% during the forecast period from 2025 to 2034.

- In 2024, the Image Data segment dominated the satellite data service market, holding more than 68.9% of the market share.

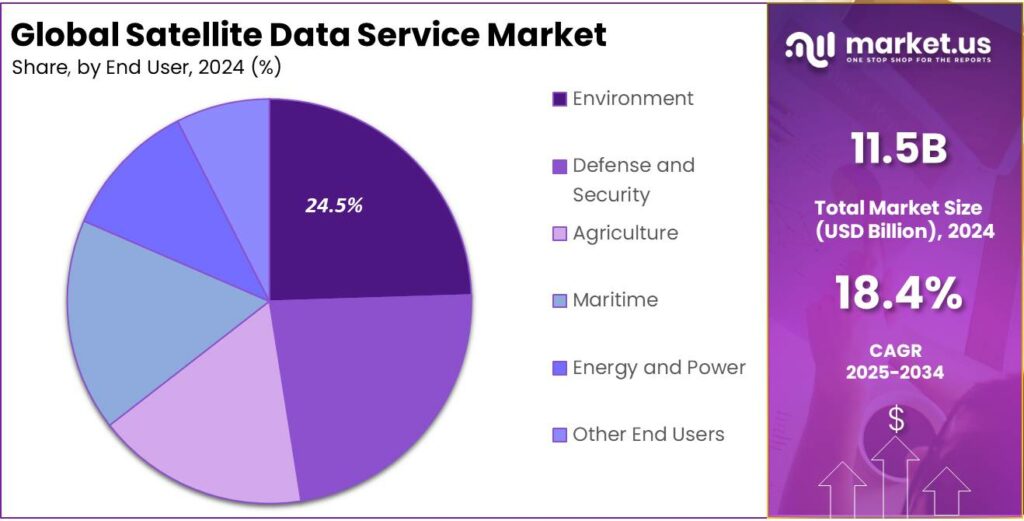

- The Environment segment also had a dominant market position in 2024, capturing over 24.5% of the market share.

- In 2024, North America held the leading position in the satellite data service market, with more than 39.0% of the market share, generating approximately USD 4.4 billion in revenue.

- The satellite data service market in the United States was valued at around USD 3.4 billion in 2024 and is expected to grow at a CAGR of 19.1%.

U.S. Satellite Data Service Market Size

The market for satellite data services in the United States, which was valued at approximately $3.4 billion in 2024, is projected to expand at a compound annual growth rate (CAGR) of 19.1%.

As businesses and government agencies adopt satellite data, the demand for real-time, accurate data drives advancements in satellite technology. These improvements enhance data quality and speed, expanding satellite data’s use in sectors like disaster management, where real-time imagery aids in prompt response, saving lives and reducing losses.

The integration of AI and machine learning with satellite data is enhancing data analysis, enabling more accurate predictions and better decision-making. This technological convergence is expected to drive the growth of the satellite data services market by providing customized solutions for industries like agriculture and urban planning.

In 2024, North America held a dominant position in the satellite data service market, capturing more than a 39.0% share with revenues reaching approximately USD 4.4 billion. This leading role can be attributed to several key factors that uniquely position North America at the forefront of the satellite services industry.

North America’s market leadership is supported by significant R&D investments from both public and private sectors, driving advancements in satellite technology and data analytics. The region’s strict regulatory frameworks ensure high data quality and security, making it a key market for industries like defense, meteorology, and agriculture.

In North America, the integration of satellite data with 5G, AI, and IoT boosts market growth by expanding its applications in urban planning, environmental monitoring, and disaster management. Strategic collaborations between governments and tech giants to launch new satellites and develop innovative solutions reinforce the region’s market leadership.

Service Type Analysis

In 2024, the Image Data segment held a dominant position in the satellite data service market, capturing more than 68.9% of the market share. This segment’s leadership is primarily attributed to the extensive application of satellite imagery across a wide range of industries including agriculture, defense, environmental monitoring, and urban planning.

High-resolution satellite images are crucial for precision agriculture where they help optimize crop yields and monitor health, and for defense applications where they provide critical intelligence. The reliance on detailed, accurate geographic information in these sectors underpins the substantial share of the Image Data segment.

Furthermore, the technological advancements in satellite imaging technologies such as multispectral and hyperspectral imaging have broadened the utility of image data. These technologies provide more detailed information about the Earth’s surface, enabling more precise analysis in environmental monitoring and resource management.

The rise of machine learning and AI in satellite image processing has fueled growth in the Image Data segment, enabling automation and better insights. This makes satellite imagery more accessible and valuable across industries like disaster management and insurance.

End User Analysis

In 2024, the Environment segment held a dominant market position within the satellite data service market, capturing more than a 24.5% share. This leadership can be attributed to heightened global awareness and regulatory pressures concerning environmental protection and climate change.

Governments and organizations globally are increasingly using satellite data to track environmental changes, assess ecosystems, and enforce regulations. This growth is driven by the pressing need for real-time, accurate data to support sustainability and disaster management efforts.

The Defense and Security segment is key in the satellite data market, using it for national security, border surveillance, and military operations. However, it lags behind the Environment segment in market share due to the latter’s wider global demand across both public and private sectors.

In Agriculture, satellite data aids in crop monitoring, soil analysis, and resource management. While advancements in satellite imagery boost this sector, its market share remains smaller than the Environment segment, due to agriculture’s more localized applications compared to the broader, global demand for environmental monitoring.

Key Market Segments

By Service Type

- Image Data

- Data Analytics

By End User

- Defense and Security

- Agriculture

- Maritime

- Environment

- Energy and Power

- Other End Users

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Need for Earth Observation in Agriculture

The agricultural sector is increasingly turning to satellite data to enhance crop monitoring, manage resources efficiently, and boost yields. Farmers utilize high-resolution imagery to assess soil health, monitor crop growth, and predict harvests.

This data-driven approach enables precise application of fertilizers and water, leading to sustainable farming practices and increased productivity. As the global population grows, the need for efficient food production becomes paramount, making satellite data indispensable in modern agriculture. The integration of satellite technology in farming not only optimizes resource use but also helps in early detection of crop diseases and pest infestations, ensuring food security.

Restraint

Expensive Satellite Deployment and Ongoing Maintenance Costs

Despite the benefits, the satellite data services market faces significant challenges due to the high costs associated with satellite deployment and maintenance. Launching satellites into orbit requires substantial investment, encompassing manufacturing, launch services, and insurance.

Additionally, maintaining and operating satellites involve ongoing expenses for ground control operations and periodic upgrades. These financial barriers can deter new entrants and limit the expansion of existing services, particularly in developing regions. Moreover, the risk of satellite malfunctions or failures adds to the financial burden, as replacements or repairs are costly and time-consuming.

Opportunity

Integration with Emerging Technologies

The integration of satellite data services with technologies like AI, IoT, and blockchain creates major growth opportunities. AI algorithms can analyze satellite imagery to detect patterns and anomalies, offering valuable insights for sectors like environmental monitoring and urban planning.

IoT devices, when integrated with satellite connectivity, enable real-time data collection from remote locations, enhancing applications in fields like wildlife tracking and asset management. Blockchain technology can ensure the security and integrity of satellite data, facilitating transparent and tamper-proof data transactions.

These integrations can lead to innovative solutions and services, expanding the market reach and creating new revenue streams for satellite data providers. As industries increasingly adopt these technologies, the demand for sophisticated satellite data services is expected to rise, offering substantial growth prospects.

Challenge

Regulatory and Spectrum Allocation Issues

Navigating the complex web of international regulations and spectrum allocation presents a formidable challenge for the satellite data services industry. Satellites operate in a highly regulated environment, with strict guidelines governing their launch, operation, and frequency usage.

Obtaining the necessary licenses and approvals can be a lengthy and intricate process, often involving multiple regulatory bodies across different countries. Spectrum allocation, in particular, is a critical issue, as the increasing number of satellite launches leads to congestion in the available frequency bands. This congestion can result in signal interference, affecting the quality and reliability of data services.

Emerging Trends

Satellite data services are evolving rapidly, bringing significant changes to various sectors. One notable trend is the deployment of small satellites in low Earth orbit (LEO). These compact satellites offer enhanced internet connectivity and faster data transmission, benefiting both businesses and consumers.

Another emerging development is in-orbit services, such as satellite refueling and debris removal. These advancements aim to extend the operational life of satellites and address the growing concern of space debris.

Artificial intelligence (AI) is also playing a crucial role in satellite operations. AI enables autonomous satellite functions and enhances data processing capabilities, leading to more efficient and responsive satellite systems.

Additionally, the integration of satellite data with Internet of Things (IoT) networks is gaining momentum. This combination improves cloud computing and provides robust backhaul support for existing terrestrial systems, facilitating better data management and connectivity.

Business Benefits

Incorporating satellite data into business operations offers numerous advantages. In the energy sector, satellite data assists in monitoring infrastructure such as pipelines and power lines, ensuring timely maintenance and reducing the risk of failures. This proactive approach enhances operational efficiency and safety.

Urban planning and infrastructure development also benefit from satellite data. High-resolution images support effective planning, monitoring of construction projects, and management of urban growth, leading to better resource allocation and sustainable development.

Furthermore, businesses can leverage satellite data for environmental monitoring, tracking deforestation, pollution levels, and natural disasters. This information is crucial for corporate social responsibility initiatives and compliance with environmental regulations.

Key Player Analysis

As the demand for real-time, Satellite Data Services increases, a few key players have emerged as leaders in this market, each offering unique capabilities and services.

- Airbus is one of the leading players in the satellite data service industry. Known for its advanced satellite technology and high-quality imagery, Airbus provides a wide range of data solutions for sectors such as defense, agriculture, and environmental monitoring.

- Ursa Space Systems Inc. stands out for its focus on radar-based satellite data. Their synthetic aperture radar (SAR) technology allows for monitoring the Earth regardless of weather conditions or time of day. This capability is especially useful in sectors like energy, mining, and disaster response.

- Planet Labs PBC is another top player in the satellite data market, offering one of the largest constellations of Earth-observing satellites. Planet Labs focuses on delivering high-frequency, high-resolution imagery, which can be used for applications ranging from agriculture and forestry to infrastructure monitoring and environmental protection.

Top Key Players in the Market

- Airbus

- Ursa Space Systems Inc.

- Planet Labs PBC

- L3Harris Technologies, Inc.

- Telstra International

- Satellite Imaging Corporation

- ICEYE

- EOS Data Analytics, Inc.

- GEOSAT

- Maxar Technologies

- Other Key Players

Top Opportunities Awaiting for Players

The satellite data service market is poised for significant growth, driven by advances in technology and increasing demands across various sectors.

- Expansion in Remote Sensing Applications: There’s a growing need for enhanced remote sensing capabilities across industries such as agriculture, defense, and energy. This demand is propelled by the increasing affordability and capabilities of satellite technologies, which allow for more detailed and frequent data collection.

- Internet of Things (IoT) Integration: Satellite IoT is emerging as a vital technology, offering extensive coverage that outstrips terrestrial network capabilities. This technology is crucial for enabling real-time asset tracking, monitoring, and management on a global scale. The integration of satellite IoT with existing networks enhances connectivity and data availability, particularly in remote areas.

- Advancements in Small Satellite Technologies: The deployment of small satellites in low-earth orbit (LEO) constellations is revolutionizing the market. These satellites are cheaper to build and launch, and they can be deployed rapidly to enhance connectivity and data throughput. This trend is facilitating new business models and services in sectors like telecommunications and earth observation.

- In-Orbit Services: As the number of satellites increases, so does the need for maintenance and management services in orbit. Companies that can offer these services will find a growing market as satellite operators look to extend the lifespan of their assets and optimize their functionality in space.

- Data Analytics Services: The ability to process and analyze the vast amounts of data collected by satellites is becoming a lucrative area. Companies that can offer advanced analytics services will enable end users to extract actionable insights from satellite data, which is increasingly critical in decision-making processes across various industries.

Recent Developments

- In April 2024, Solidium, a Finnish state-owned investment company, invested €15 million in ICEYE, a Finnish Synthetic Aperture Radar (SAR) satellite imaging company. This investment was a follow-up to a convertible debt agreement from earlier in the year.

- In November 2024, Spire Global agreed to sell its ship-tracking (Automatic Identification System) business to Kpler for $241 million. While Kpler gains exclusive rights to Spire’s maritime data, Spire retains ownership of its satellites and technology, continuing to serve U.S. government clients.

Report Scope

Report Features Description Market Value (2024) USD 11.5 Bn Forecast Revenue (2034) USD 62.3 Bn CAGR (2025-2034) 18.40% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Type (Image Data, Data Analytics), By End User (Defense and Security, Agriculture, Maritime, Environment, Energy and Power, Other End Users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Airbus, Ursa Space Systems Inc., Planet Labs PBC, L3Harris Technologies, Inc., Telstra International, Satellite Imaging Corporation, ICEYE, EOS Data Analytics, Inc., GEOSAT, Maxar Technologies, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Satellite Data Service MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

Satellite Data Service MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Airbus

- Ursa Space Systems Inc.

- Planet Labs PBC

- L3Harris Technologies, Inc.

- Telstra International

- Satellite Imaging Corporation

- ICEYE

- EOS Data Analytics, Inc.

- GEOSAT

- Maxar Technologies

- Other Key Players