Global Hemostat Market By Product Type (Thrombin Based, Combination, Oxidized Regenerated Cellulose Based, Gelatin Based, Collagen Based Hemostat, Tissue Sealants- Fibrin Sealants), By Formulation (Matrix and Gel Hemostats, Sheet and Pad Hemostats, Sponge Hemostats, Powder Hemostats), By Application (Orthopedic Surgery, General Surgery, Neurological Surgery, Cardiovascular Surgery, Reconstructive Surgery, Gynecological Surgery, Trauma, Plastic Surgery, Other), By Indication (Closure, Surgery), By End-User (Ambulatory Centers, Hospitals, Clinics, Community Healthcare, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 51144

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

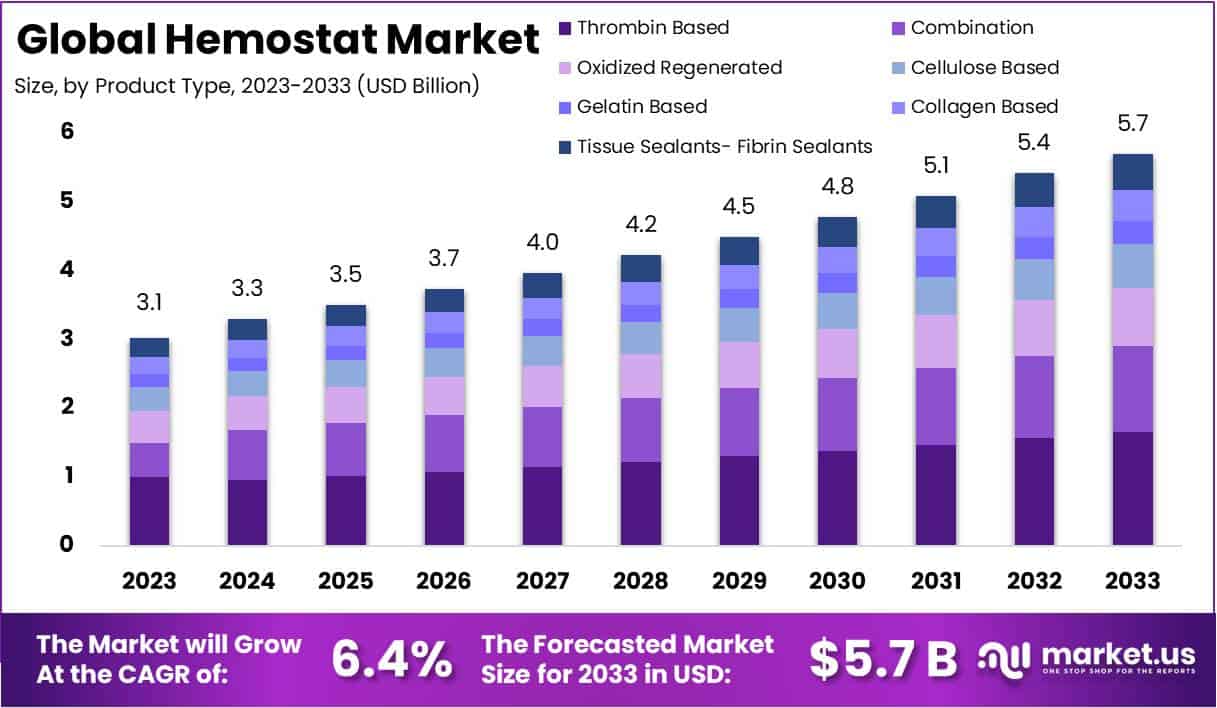

The Global Hemostat Market size is expected to be worth around USD 5.7 Billion by 2033, from USD 3.1 Billion in 2023, growing at a CAGR of 6.4% during the forecast period from 2024 to 2033.

Hemostats are surgical instruments used to control bleeding during surgical procedures or other medical interventions, commonly referred to as hemostatic forceps or arterial forceps. Hemostats clamp blood vessels or tissues either to stop bleeding or provide a stable grip during surgery – they come in various sizes and shapes with straight or curved jaws for maximum efficiency and are frequently employed across specialties including general surgery, orthopedists, and gynecology.

Key Takeaways

- Market Growth Projection: The global Hemostat Market is set to reach USD 5.7 Billion by 2033, with a notable CAGR of 6.4% during 2024-2033.

- Top Product Segment: Thrombin-based hemostats dominated the market in 2023, holding a significant 28.9% share.

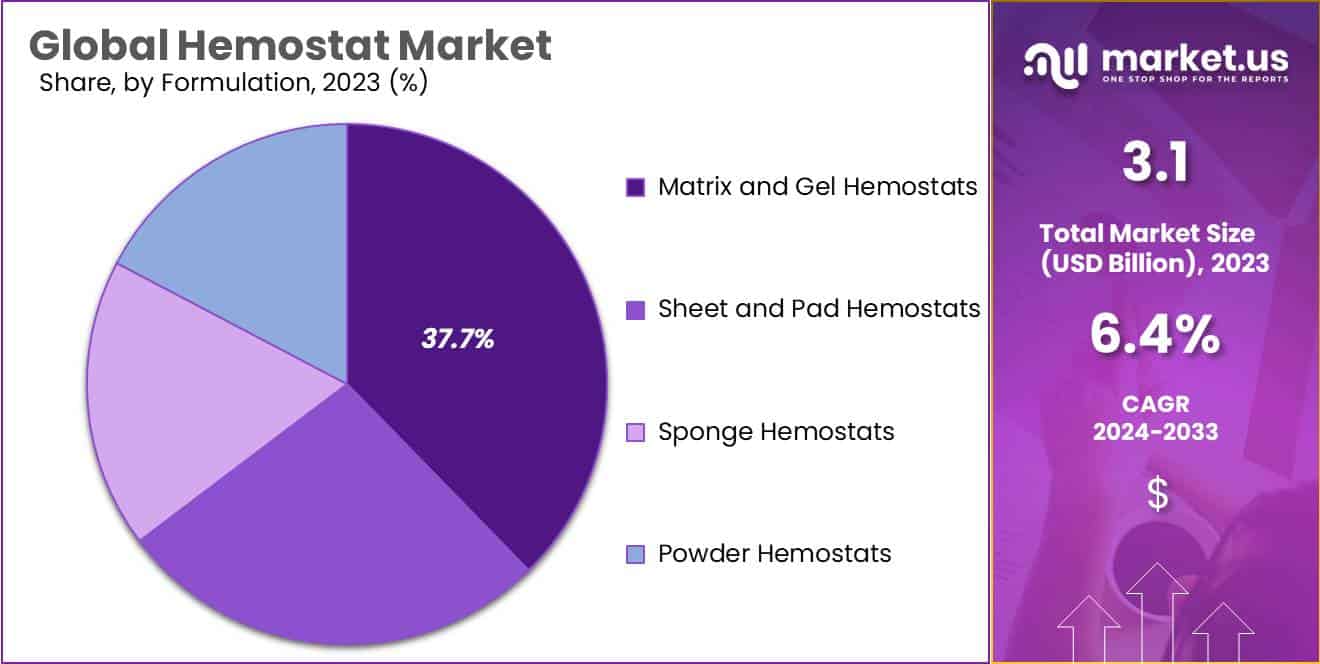

- Formulation Leadership: Matrix and Gel Hemostats led the formulation segment in 2023, securing a substantial 37.7% market share, indicating their preference for medical applications.

- Indication Dominance: The surgery segment held a dominant market position in 2023, capturing more than a 61.4% share.

- Application Focus: Orthopedic surgery emerged as the dominant application segment in 2023, capturing over 38.6% of the market share.

- End-User Dominance: Hospitals were the leading end-user segment in 2023, capturing a substantial 49.2% market share, emphasizing their pivotal role in hemostat utilization.

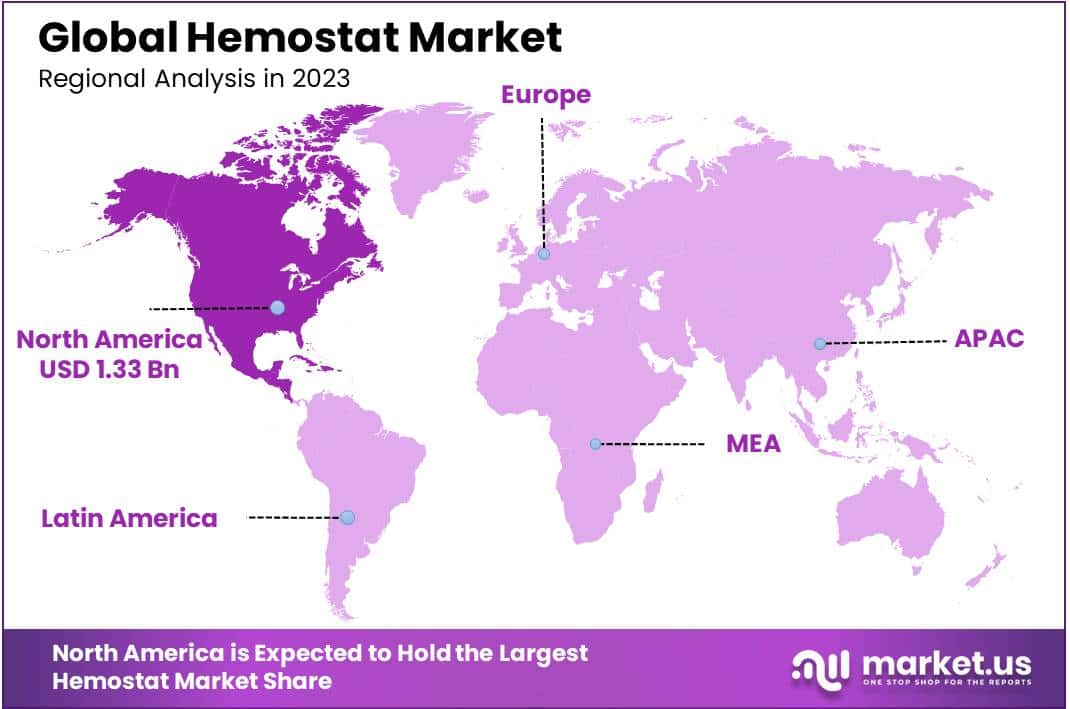

- Regional Impact: North America held a dominant position in 2023 with a 48.1% market share, driven by a robust healthcare infrastructure and high chronic disease prevalence.

Driving Factors

Rising Prevalence of Chronic Diseases: Hemostats are increasingly being used in surgical procedures to control bleeding and limit excessive blood loss, driving demand. Hemostats help surgeons minimize surgical time while simultaneously controlling bleeding to limit excessive blood loss.

Grow Geriatric Population: With increasing chronic diseases and injuries in an increasingly older population, surgical intervention becomes necessary more frequently, which has driven up demand for hemostats.

Technological Advancements: Technological advancements such as nanotechnology and biotechnology are propelling the growth of the hemostats market.

Rising Number of Surgeries: With increasing surgeries occurring across emerging economies and access to better healthcare infrastructure and an awareness of its benefits for surgical interventions increasing, hemostat demand is on the rise. This demand can be seen through its increased demand.

Restraining Factors

The global hemostat market has the following restraints:

Stringent regulatory requirements: The development and approval of new hemostatic agents are subject to strict regulatory requirements, which can delay the commercialization of new products and increase the cost of development.

Limited reimbursement options: In some countries, reimbursement for hemostatic agents may be limited or not available, which can reduce the demand for these products.

Competition from alternative therapies: Hemostatic agents may face competition from alternative therapies, such as sutures, staples, and fibrin sealants, which can limit market growth.

Growth Opportunities

An increasing number of surgical procedures: With more surgeries taking place worldwide, there has been an increasing demand for hemostatic agents to control bleeding and mitigate potential complications, creating a promising opportunity for the hemostats market.

Advancements in hemostatic technology: Advances in hemostatic technology such as nanotechnology or biologics offer enormous promise to expand the hemostats market.

Increased Demand for Minimally Invasive Surgery: As more minimally invasive surgical techniques become prevalent, so does the need for hemostatic agents suitable for use during these procedures.

Emerging Markets: With growing healthcare infrastructure in emerging markets and rising healthcare expenditures coupled with greater awareness about advanced medical technologies, emerging markets provide an ideal setting for the hemostats market to expand globally.

Aging Population: As global populations age, chronic illnesses become increasingly prevalent and demand for surgical procedures grows, driving the growth of the hemostats market.

Trending Factors

With the recent proliferation of advanced hemostatic agents, there is an emerging trend toward their adoption over traditional hemostatic products like sutures and staples. Advanced hemostatic agents provide better hemostasis, reduced risk of complications, and faster healing times than their traditional counterparts. Biologic hemostatic agents, such as fibrin and collagen-based products, have seen increased popularity due to their effectiveness and safety. These products mimic the body’s natural clotting process while helping lower the risk of adverse reactions.

As minimally invasive surgical procedures become more popular, demand for hemostatic agents that can be utilized during these procedures has also increased significantly. Hemostatic agents that can be delivered through small incisions or catheters have become particularly sought-after. Combination products, which combine hemostatic agents and sealants or adhesives, are growing increasingly popular due to their effectiveness at controlling bleeding and sealing tissue. By consolidating multiple products into one, these hybrid solutions may make surgical processes simpler for all involved.

Product Type Analysis

In 2023, Thrombin Based segment held a dominant market position, capturing more than a 28.9% share.

Based on product type, the market for hemostats is segmented into thrombin-based, combination, oxidized regenerated cellulose-based, gelatin-based, collagen-based hemostat, and tissue sealants- fibrin sealants. Among these types, the thrombin-based segment is the most lucrative in the global hemostats market.

This trend is anticipated to persist throughout the projection period due to rising R&D efforts within pharmaceutical and medical device industries, rising demand for use during surgical operations, and an upsurge in the use of surgical hemostat tools. With surgical rates rising significantly and numerous pharmaceutical players engaging in hemostat research projects underway, collagen-based hemostats should see rapid market expansion during this projection period.

Formulation Analysis

In 2023, the Matrix and Gel Hemostats segment held a dominant market position, capturing more than a 37.7% share.

By formulation, the market is further divided into matrix and gel hemostats, sheet & pad hemostats, sponge hemostats, and powder hemostats. The matrix and gel hemostats segment is estimated to be the most lucrative segment in the global hemostats market, with a market share of 35%. Also, the powder hemostats will grow considerably throughout the forecast period. This increase will be seen due to an increase in cardiovascular disorders, and an increase in use at the time of surgical procedures.

Application Analysis

In 2023, the Orthopedic Surgery segment held a dominant market position, capturing more than a 38.6% share.

By application, the market is further divided into orthopedic surgery, general surgery, neurological surgery, cardiovascular surgery, reconstructive surgery, gynecological surgery, trauma, Plastic Surgery, & other applications. Among these segments, the orthopedic surgery segment is dominant in the market. Hemostats are also used in dental and cosmetic surgeries to control bleeding.

Hemostats are used in trauma management to control bleeding in emergencies. These situations may include gunshot wounds, car accidents, & other severe injuries. Hemostats can be used to control bleeding until the patient can receive proper medical attention.

Indication Analysis

In 2023, Surgery segment held a dominant market position, capturing more than a 61.4% share.

Based on indication, the market is divided into closures and surgery. The surgery segment is dominant in the market. It is it be expected that this segment will be dominant throughout the forecast period.

End-User Analysis

In 2023, Hospitals segment held a dominant market position, capturing more than a 49.2% share.

Based on end-user, the market is segmented into ambulatory centers, hospitals, clinics, community healthcare, healthcare, and other end-users. Among these end-users, the hospital segment is estimated to be the most lucrative segment in the global hemostats market, with the largest revenue share of 47%. Hemostats are used in surgical procedures and emergencies to control bleeding and prevent excessive blood loss.

Hospitals may also use hemostats in trauma management and other medical interventions. Ambulatory surgery centers (ASCs) are medical facilities that provide same-day surgical procedures to patients. Hemostats are commonly used in ASCs to control bleeding during surgical procedures and prevent complications. Hemostats may also be used by dental clinics, academic and research institutions, and other healthcare providers.

Key Market Segments

Based on Product Type

- Thrombin Based

- Combination

- Oxidized Regenerated Cellulose Based

- Gelatin Based

- Collagen Based Hemostat

- Tissue Sealants- Fibrin Sealants

Based on Formulation

- Matrix and Gel Hemostats

- Sheet and Pad Hemostats

- Sponge Hemostats

- Powder Hemostats

Based on Application

- Orthopedic Surgery

- General Surgery

- Neurological Surgery

- Cardiovascular Surgery

- Reconstructive Surgery

- Gynecological Surgery

- Trauma

- Plastic Surgery

- Other

Based on Indication

- Closure

- Surgery

Based on End-User

- Ambulatory Centers

- Hospitals

- Clinics

- Community Healthcare

- Other End-Users

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 48.1% share and holds USD 1.33 Billion market value for the year. North America stands out due to high chronic disease prevalence rates, increasing demand for advanced medical technologies, and its established healthcare infrastructure; specifically in terms of geographical reach; it boasts the United States as its main market followed by Canada.

Europe is projected to account for a large share of the global hemostats market due to an increasing number of surgical procedures, an aging population, and rising healthcare spending. The United Kingdom, Germany, and France are the three leading markets within this continent.

Asia Pacific region is expected to grow with higher potential, due to the prevalence of chronic diseases, and advancements in healthcare infrastructure.

A significant portion of the worldwide hemostats market is expected to come from Latin America because of the region’s increased incidence of chronic diseases, rising healthcare spending, and expanding healthcare infrastructure. Two important markets in Latin America are Brazil and Mexico.

Middle East and Africa are predicted to hold a smaller market share for hemostats due to limited healthcare infrastructure and lower spending levels, but increasing healthcare investments, rising incidence of chronic diseases, and growing awareness about advanced medical technologies could spark growth here.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Emerging key players are focused on a variety of strategic policies to develop their respective businesses in foreign markets. Several hemostats market companies are concentrating on expanding their existing operations and R&D facilities. Johnson & Johnson is the leading player in the global hemostats market, with a significant market share. The company offers a range of hemostats under its subsidiary, Ethicon, Inc. Baxter International Inc. and C.R. Bard, Inc. are other key players in the market, offering hemostatic products for various surgical procedures.

Market Key Players

Listed below are some of the most prominent hemostats industry players

- CR Bard Inc

- B Braun Melsungen AG

- Baxter International Inc

- Integra Life Sciences

- Marine Polymer Technologies Inc

- Teleflex

- Ethicon Inc

- Pfizer Inc

- Z-Medica LLC

- Gelita Medical GmbH

- Anika Therapeutics Inc

- Stryker

- Integra Lifesciences Corporation

- Johnson & Johnson Services Inc

- Other Key Players

Recent Developments

- In December 2023, Baxter International Inc. made waves by announcing its acquisition of NxGen Medical, a company known for its expertise in hemostatic and wound closure technologies. This move aimed to broaden Baxter’s surgical hemostat market presence, with a particular focus on advancing minimally invasive procedures.

- In October 2023, Integra LifeSciences introduced SurgSeal+, a cutting-edge hemostatic sealant designed to enhance adhesion and control during surgical procedures. This launch underscored Integra’s commitment to innovation and expanding its offerings in the hemostat market.

- In September 2023, Ethicon Inc., a Johnson & Johnson subsidiary, achieved FDA clearance for its Hemopatch Surgical Hemostatic Patch. This collagen-based hemostat addresses bleeding control in various surgical procedures, marking Ethicon’s entry into the absorbable hemostat segment and providing surgeons with a new effective option.

- In July 2023, Marine Polymer Technologies Inc. joined forces with Medtronic in a strategic partnership to develop and bring to market a new line of hemostatic products tailored for cardiac surgery. Leveraging Marine Polymer’s expertise in bioresorbable polymers and Medtronic’s established presence in cardiac surgery, this collaboration holds the promise of delivering innovative hemostat solutions for this specific application.

Report Scope

Report Features Description Market Value (2023) USD 3.1 Bn Forecast Revenue (2033) USD 5.7 Bn CAGR (2024-2033) 6.4% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type – Thrombin Based, Combination, Oxidized Regenerated Cellulose Based, Gelatin Based, Collagen Based Hemostat, and Tissue Sealants- Fibrin Sealants; By Formulation – Matrix and Gel Hemostats, Sheet and Pad Hemostats, Sponge Hemostats, and Powder Hemostats; By Indication – Closure and Surgery; By Application – Orthopedic Surgery, General Surgery, Neurological Surgery, Cardiovascular Surgery, Reconstructive Surgery, Gynecological Surgery, Trauma, Plastic Surgery, and Other; By End-Users – Ambulatory Centers, Hospitals, Clinics, Community Healthcare, and Other End-Users Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape CR Bard Inc, B Braun Melsungen AG, Baxter International Inc, Integra LifeSciences, Marine Polymer Technologies Inc, Teleflex, Ethicon Inc, Pfizer Inc, Z-Medica LLC, Gelita Medical GmbH, Anika Therapeutics Inc, Stryker, Integra Lifesciences Corporation, Johnson & Johnson Services Inc, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Hemostat market in 2023?The Hemostat market size is USD 3.1 Billion in 2023.

What is the projected CAGR at which the Hemostat market is expected to grow at?The Hemostat market is expected to grow at a CAGR of 6.4% (2024-2033).

List the segments encompassed in this report on the Hemostat market?Market.US has segmented the Hemostat market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type the market has been segmented into Thrombin Based, Combination, Oxidized Regenerated Cellulose Based, Gelatin Based, Collagen Based Hemostat, Tissue Sealants- Fibrin Sealants. By Formulation the market has been segmented into Matrix and Gel Hemostats, Sheet and Pad Hemostats, Sponge Hemostats, Powder Hemostats. By Application the market has been segmented into Orthopedic Surgery, General Surgery, Neurological Surgery, Cardiovascular Surgery, Reconstructive Surgery, Gynecological Surgery, Trauma, Plastic Surgery, Other. By Indication the market has been segmented into Closure, Surgery. By End-User the market has been segmented into Ambulatory Centers, Hospitals, Clinics, Community Healthcare, Other End-Users.

List the key industry players of the Hemostat market?CR Bard Inc, B Braun Melsungen AG, Baxter International Inc, Integra Life Sciences, Marine Polymer Technologies Inc, Teleflex, Ethicon Inc, Pfizer Inc, Z-Medica LLC, Gelita Medical GmbH, Anika Therapeutics Inc, Stryker, Integra Lifesciences Corporation, Johnson & Johnson Services Inc, Other Key Players

Which region is more appealing for vendors employed in the Hemostat market?North America is expected to account for the highest revenue share of 48.1% and boasting an impressive market value of USD 1.33 Billion. Therefore, the Hemostat industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Hemostat?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Hemostat Market.

-

-

- CR Bard Inc

- B Braun Melsungen AG

- Baxter International Inc

- Integra Life Sciences

- Marine Polymer Technologies Inc

- Teleflex

- Ethicon Inc

- Pfizer Inc

- Z-Medica LLC

- Gelita Medical GmbH

- Anika Therapeutics Inc

- Stryker

- Integra Lifesciences Corporation

- Johnson & Johnson Services Inc

- Other Key Players