Global Hydropower Generation Market Size, Share, And Business Benefits By Capacity (Mini, Micro and Pico, Small, Large and Medium), By End-User (Utility, Industrial, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154662

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

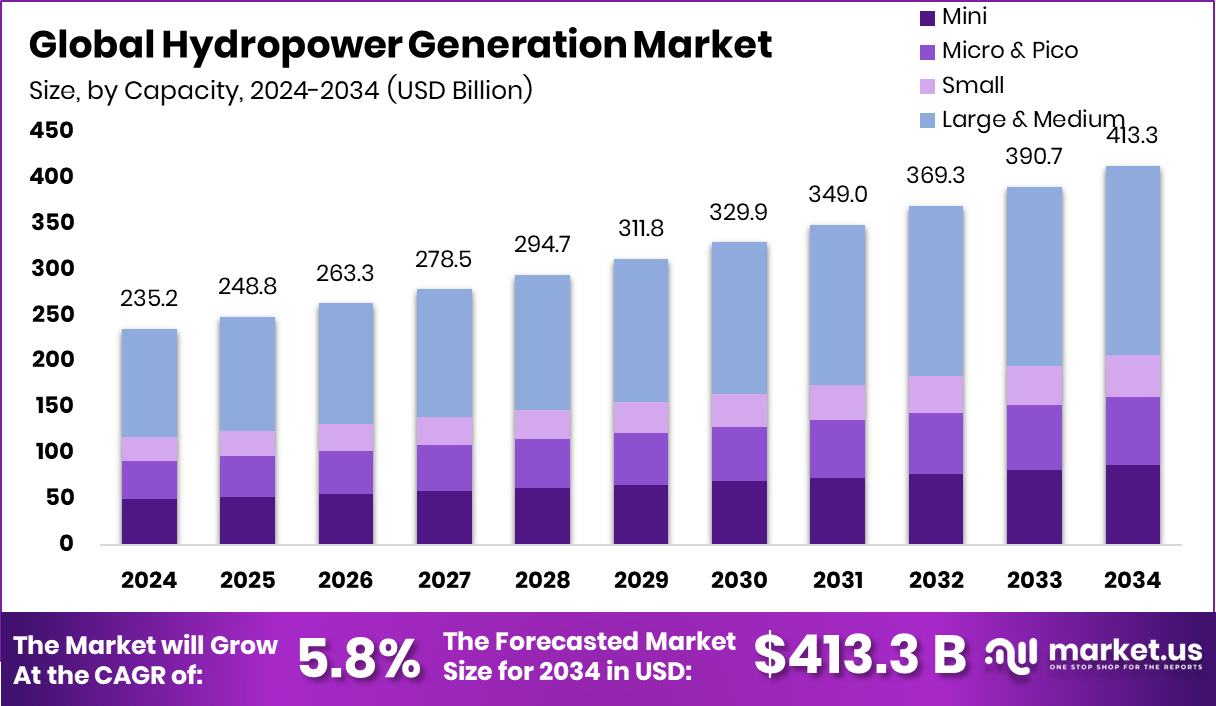

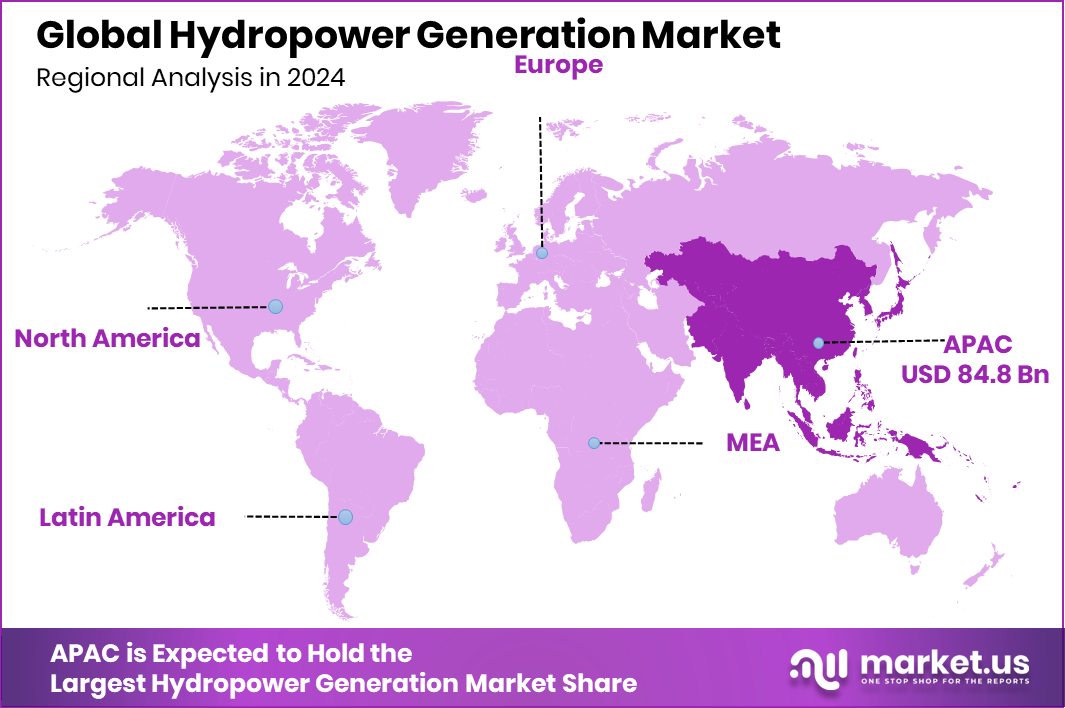

The Global Hydropower Generation Market is expected to be worth around USD 413.3 billion by 2034, up from USD 235.2 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034. Strong demand and natural water resources drove Asia-Pacific’s USD 84.8 billion growth.

Hydropower generation is the process of producing electricity by harnessing the energy of flowing or falling water. It typically involves the use of dams or river-based turbines where water spins large blades connected to generators, converting mechanical energy into electrical power. This renewable energy source is known for its reliability, low operating costs, and ability to provide both base-load and peak-load electricity supply. Hydropower is considered one of the oldest and most widely adopted forms of renewable energy across the world due to its efficiency and low carbon emissions.

The hydropower generation market includes the infrastructure, equipment, services, and technologies involved in generating electricity from water sources. It covers various types of hydropower systems, including large-scale, small-scale, and pumped storage projects. This market plays a key role in the global energy mix, especially in regions with abundant river systems and favorable topography. According to an indusry report, the World Bank approves $350 million in funding for the Mpatamanga hydropower project in Malawi.

The growth of the hydropower generation market is supported by rising global electricity demand and a shift toward cleaner energy sources. Governments are increasingly investing in renewable energy infrastructure to reduce dependence on fossil fuels. The long operational life and low cost per kilowatt-hour of hydro plants also make them attractive investments for public and private sectors alike. According to an indusry report, Alaknanda Hydro receives Rs 2,000 crore investment from Kotak funds.

Demand for hydropower is driven by the need for stable, grid-scale electricity that can support urban expansion and industrial growth. As countries phase out coal and other high-emission sources, hydropower offers a dependable alternative. The flexibility of hydropower to adjust output based on grid requirements also supports the integration of intermittent sources like wind and solar. According to an industry report, Mozambique obtained $5 billion in World Bank funding for a major hydropower project.

Key Takeaways

- The Global Hydropower Generation Market is expected to be worth around USD 413.3 billion by 2034, up from USD 235.2 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034.

- In 2024, large- and medium-capacity projects held a 56.30% share in the hydropower generation market.

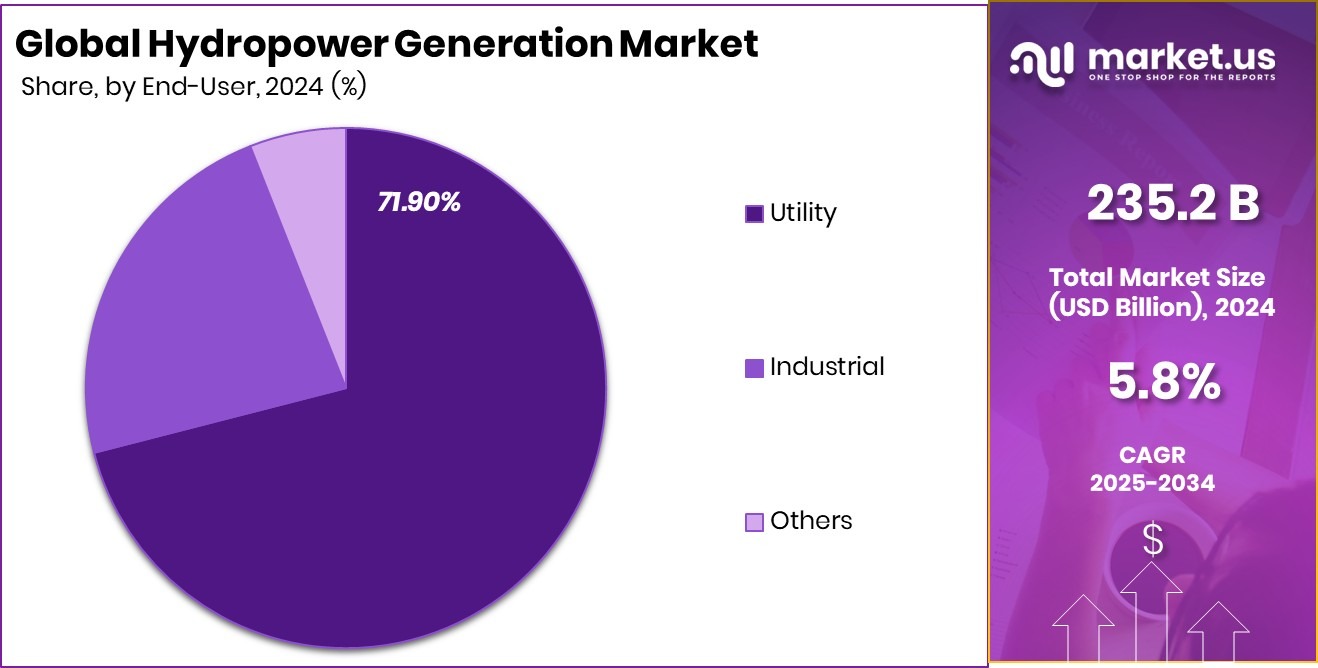

- Utilities accounted for a 71.90% share in the hydropower generation market due to large-scale energy demands.

- The hydropower generation market in Asia-Pacific reached USD 84.8 billion in 2024.

By Capacity Analysis

Large and medium hydropower dominate with 56.30% market share.

In 2024, Large and Medium held a dominant market position in the By Capacity segment of the Hydropower Generation Market, with a 56.30% share. This leading position can be attributed to the widespread deployment of high-capacity hydroelectric plants across major river systems and strategic dam locations. These installations are capable of generating substantial electricity output, making them essential components in national power grids, particularly for base-load supply and peak-load balancing.

The dominance of the Large and Medium segment reflects growing investment in infrastructure projects that support long-term energy needs and sustainability goals. These hydropower stations not only offer high energy efficiency but also operate with relatively low maintenance costs over extended lifespans, making them economically favorable.

In many regions, the demand for reliable and renewable power sources continues to rise, and large to medium hydropower facilities have proven effective in fulfilling this demand. Their ability to deliver consistent output also supports energy security and grid stability, especially in countries aiming to transition away from fossil fuels.

By End-User Analysis

Utilities lead the hydropower generation market with a 71.90% share.

In 2024, Utility held a dominant market position in the By End-User segment of the Hydropower Generation Market, with a 71.90% share. This strong dominance reflects the crucial role of utility companies in developing, operating, and maintaining large-scale hydropower infrastructure to meet national and regional electricity demands. Utilities typically possess the financial capacity, technical expertise, and regulatory approvals required to execute long-term hydropower projects that contribute significantly to grid stability.

The high market share also indicates a sustained preference for centralized power generation models, where utilities ensure a consistent electricity supply through grid-connected hydroelectric stations. Their involvement enables large-scale energy distribution, ensuring uninterrupted service across urban, industrial, and rural zones. Moreover, many utilities are expanding their renewable energy portfolios in response to government policies and sustainability commitments, with hydropower serving as a reliable and mature solution.

The operational efficiency and cost-effectiveness of hydropower further support its integration into utility-driven power generation strategies. With rising pressure to reduce carbon emissions and ensure energy security, utility companies continue to invest in new projects as well as the modernization of existing plants.

Key Market Segments

By Capacity

- Mini

- Micro and Pico

- Small

- Large and Medium

By End-User

- Utility

- Industrial

- Others

Driving Factors

Rising Global Need for Clean Energy Sources

One of the main driving factors for the hydropower generation market is the rising global need for clean and sustainable energy. Countries across the world are working to reduce pollution and cut down on harmful emissions. As a result, there is growing pressure to replace fossil fuels with renewable energy sources. Hydropower is a natural fit because it produces electricity without releasing greenhouse gases.

It is also reliable and can generate power continuously, unlike solar or wind, which depend on the weather. Governments are supporting new hydropower projects through funding and policy support, helping the market grow. This shift toward cleaner energy is making hydropower more important than ever in the global push for environmental protection and energy security.

Restraining Factors

High Initial Investment Cost Slows Growth

A major restraining factor in the hydropower generation market is the high initial investment cost required to build hydropower plants. Developing a new hydropower project involves expensive construction, land acquisition, environmental clearances, and advanced equipment. These costs are much higher compared to some other energy sources. Also, it often takes several years to complete a large-scale project and start earning returns.

This long payback period can discourage private investors and even delay government-backed projects. In some regions, limited funding or poor access to financial support make it harder to start new developments. Because of these financial barriers, many potential projects remain on hold, slowing down the overall growth of the hydropower generation market.

Growth Opportunity

Untapped Hydro Potential in Emerging Economies

A key growth opportunity in the hydropower generation market lies in the untapped water resources of emerging economies. Many countries in Asia, Africa, and Latin America have rivers and natural landscapes ideal for hydropower development, but are not yet fully used. These regions are also experiencing rapid population growth and rising electricity demand, creating a need for new, reliable energy sources.

With government support, foreign investment, and better technology, these countries can build new hydropower plants to meet future energy needs. Small and medium-sized hydropower projects are especially suitable for remote and rural areas, helping expand electricity access. This creates strong potential for market growth while supporting sustainable development goals in these fast-growing regions.

Latest Trends

Rising Focus on Modernizing Old Hydropower Plants

One of the latest trends in the hydropower generation market is the growing focus on modernizing old hydropower plants. Many existing facilities were built decades ago and are now facing wear and reduced efficiency. Instead of building new dams, governments and power operators are upgrading turbines, control systems, and safety measures in old plants. This not only improves energy output but also extends the life of the infrastructure.

Modernization helps reduce environmental impact and makes the plants more reliable. It also supports digital monitoring and automation, making operations safer and smarter. This trend is gaining momentum as it offers a cost-effective way to boost renewable power capacity without creating new environmental challenges.

Regional Analysis

In 2024, the Asia-Pacific held 36.10% market share in the hydropower generation sector.

In 2024, Asia-Pacific emerged as the dominant region in the hydropower generation market, capturing a significant 36.10% share, equivalent to a market value of USD 84.8 billion. This dominance can be attributed to the region’s abundant water resources, favorable topography, and increasing demand for reliable, low-emission power.

Countries across Asia-Pacific have continued to expand their hydroelectric infrastructure to support growing industrial activity and meet clean energy goals. North America and Europe also maintained notable positions in the market, supported by long-established hydropower infrastructure and modernization efforts in older plants.

In contrast, the Middle East & Africa and Latin America regions are gradually expanding their capacity through new small- to medium-scale hydropower projects. Although their current market shares remain comparatively lower, these regions are witnessing rising interest due to favorable government policies and increasing electricity demand in remote and underserved areas.

However, Asia-Pacific’s commanding lead reflects not only its scale of installed capacity but also ongoing project developments in fast-growing economies. The region’s contribution continues to shape global hydropower trends, with sustained investments expected to reinforce its position further. Overall, the regional dynamics indicate that Asia-Pacific will remain at the forefront of hydropower generation due to its strong resource base and strategic energy development initiatives.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Siemens continued to support hydropower infrastructure through advanced turbine and automation technologies. The company focused on digitalization of plant operations, integrating smart control systems that optimize energy output and improve reliability. Its engineering expertise in grid synchronization and power management systems strengthened the efficiency and sustainability of hydropower operations worldwide.

Statkraft Sweden—a subsidiary of the Norwegian group—remained notable for its operational excellence in renewable energy, particularly hydropower projects in Europe. Known for responsive asset management and flexible dispatch of generation capacity, the business emphasized adaptive operations across seasonal demand cycles. Its strong performance in balancing energy supply and demand contributed to regional grid stability.

ANDRITZ, a global supplier of electromechanical equipment, continued to deliver critical hardware and maintenance services to hydropower plants. With a portfolio covering turbines, generators, and automation platforms, the company enabled upgrades and rebuilds of aging facilities. Its intensive aftermarket services and refurbishment projects supported improved energy efficiency and extended plant lifecycles.

China Three Gorges Corporation maintained its position as a dominant operator and investor in large-scale hydropower infrastructure. The company focused on constructing and managing mega‑scale dams and pumped storage facilities. Its investments were fueled by national energy needs, and it emphasized integrated reservoir management, flood control, and long‑term energy supply.

Top Key Players in the Market

- Siemens

- Stakraft Sweden

- ANDRITZ

- China Three Gorges Corporation

- Voith GmbH & Co. KGaA

- ALFA LAVAL

- ABB

- ENGIE

- Tata Power

- Norsk Hydro ASA

Recent Developments

- In May 2025, Statkraft commenced construction of the Svean hydropower plant in Norway, part of its major capacity upgrade programme. This development – with an estimated investment of NOK 1.2 billion – marked the operational launch of its strategic hydropower modernisation plans .

- In October 2024, ANDRITZ was awarded a contract to upgrade one turbine-generator unit at Norway’s Vamma run-of-river plant. The work will boost unit output from 100 MW to 122 MW, including a new oil-free Kaplan runner and upgraded electrical governor and stator components.

Report Scope

Report Features Description Market Value (2024) USD 235.2 Billion Forecast Revenue (2034) USD 413.3 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Capacity (Mini, Micro, and Pico, Small, Large and Medium), By End-User (Utility, Industrial, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Siemens, Stakraft Sweden, ANDRITZ, China Three Gorges Corporation, Voith GmbH & Co. KGaA, ALFA LAVAL, ABB, ENGIE, Tata Power, Norsk Hydro ASA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hydropower Generation MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Hydropower Generation MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens

- Stakraft Sweden

- ANDRITZ

- China Three Gorges Corporation

- Voith GmbH & Co. KGaA

- ALFA LAVAL

- ABB

- ENGIE

- Tata Power

- Norsk Hydro ASA