Global HVDC Converter Stations Market Size, Share, And Business Benefits By Type (Bi-Polar, Monopolar, Back to Back, Multi-Terminal), By Technology (Line Commutated Converter (LCC, Voltage Source Converter (VSC)), By Component (Converter, DC Equipment, Converter Transformer), By Application (Power Industry, Powering Island and Remote Loads, Interconnecting Networks, Oil and Gas), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165650

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

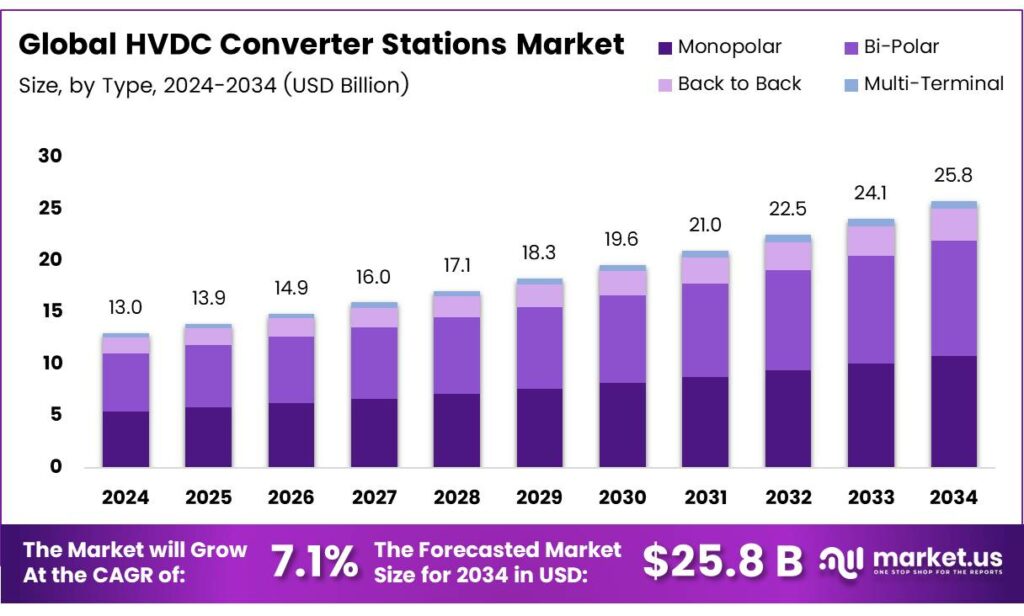

The Global HVDC Converter Stations Market size is expected to be worth around USD 25.8 Billion by 2034, from USD 13.0 Billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034.

HVDC power transmission involves sending electricity from power plants to end users via high-voltage direct current lines, enabling efficient long-distance transfer and the interconnection of networks with different frequencies. It relies on switching valves, traditionally thyristors, and increasingly insulated-gate bipolar transistors (IGBTs) to manage unidirectional DC flow.

AC prevailed due to the high cost and complexity of DC systems. Modern power electronics have since made HVDC economically viable. In a typical setup, power enters a converter station for AC-to-DC conversion, travels via HVDC cables, and is converted back to AC at the receiving end for distribution. The Office of Electricity champions HVDC research for these advantages and recently celebrated the winners of the American-Made HVDC Prize, which will address deployment barriers through innovative hardware, controls, and concepts.

The HVDC Cost Reduction (CORE) Initiative targets a 35% cost reduction in HVDC technology and long-distance transmission by 2035, with a focus on domestic manufacturing to meet all U.S. demands competitively. HVDC excels over high-voltage AC (HVAC) by eliminating capacitive charging currents, especially in subsea cables, and removing the need for frequency and phase synchronization.

- It also enables power exchange between 50 Hz and 60 Hz networks. The world’s longest HVDC link was the 2,000 km line from Xiangjiaba Dam to Shanghai, when Brazil’s 2,375 km Rio Madeira project took the title, serving São Paulo. Though a late adopter, China rapidly advanced HVDC technology. The 1987 Zhoushan project marked its start; 13 projects totaling 23,720 MW were operational, supporting west-to-east transmission and national grid integration.

Key Takeaways

- The Global HVDC Converter Stations Market is expected to grow from USD 13.0 billion in 2024 to USD 25.8 billion by 2034 at a 7.1% CAGR.

- Bi-Polar dominates By Type with a 43.2% share in 2024 for load balancing, low losses, and stability in large projects.

- Line Commutated Converter (LCC) leads By Technology with a 67.4% share in 2024 due to cost-effective bulk transmission and AC grid integration.

- Converter holds top By Component with 38.9% share in 2024 as the core for efficient AC-DC transformation with advanced semiconductors.

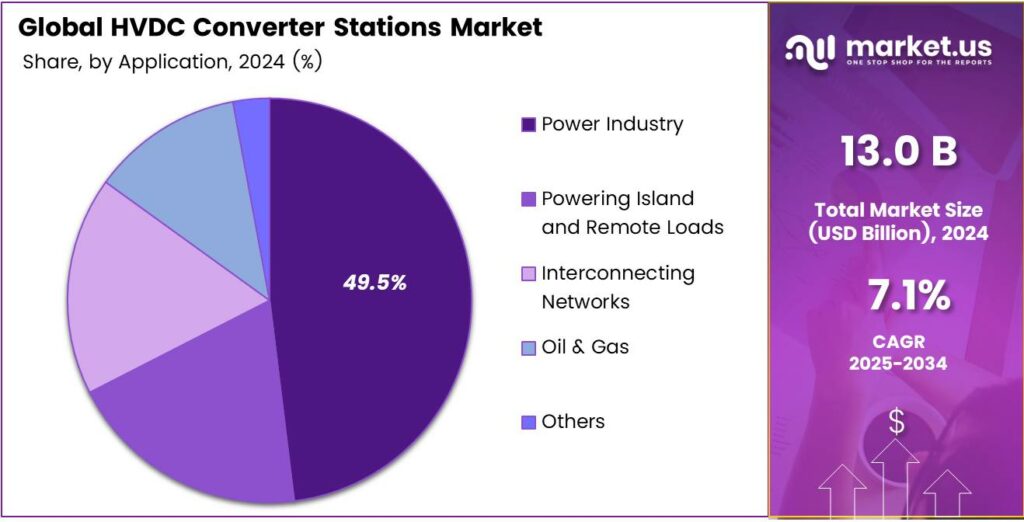

- Power Industry commands By Application with 49.5% share in 2024, driven by long-distance transmission and renewable integration.

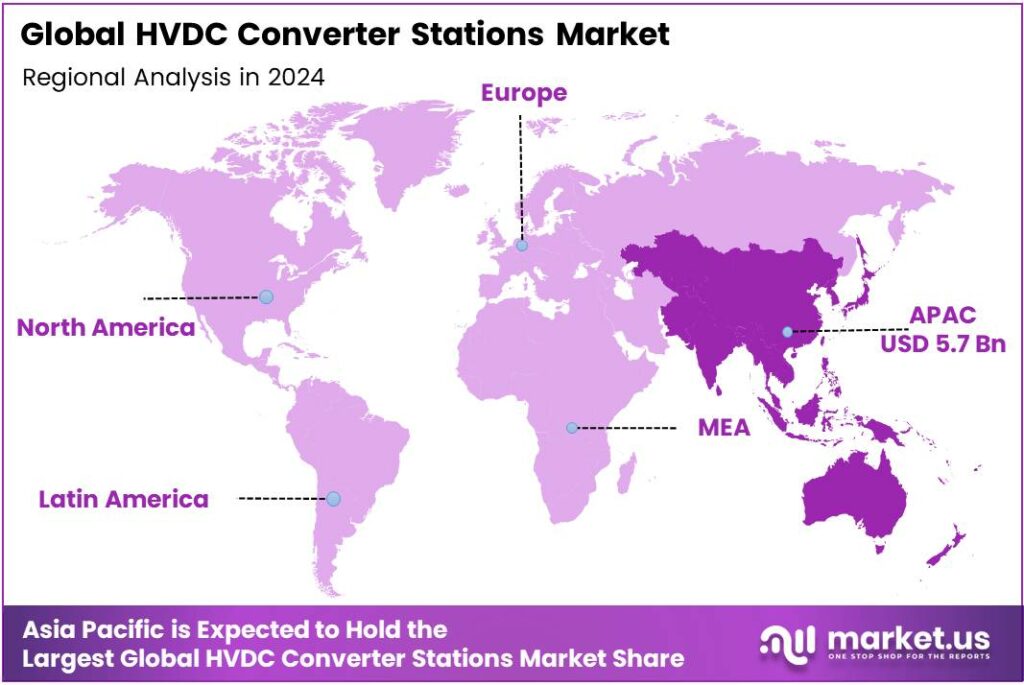

- Asia Pacific leads with 44% share of USD 5.7 billion in 2024, fueled by grid expansion, renewables, and cross-border energy trade.

By Type Analysis

Bi-Polar dominates with 43.2% due to its reliability and efficiency in long-distance power transmission.

In 2024, Bi-Polar held a dominant market position in the By Type Analysis segment of the HVDC Converter Stations Market, with a 43.2% share. This configuration excels in balancing loads and minimizing losses, making it ideal for high-voltage direct current systems. Additionally, its dual-pole design enhances operational stability. Therefore, industries prefer Bi-Polar for large-scale projects.

Monopolar systems follow as a cost-effective alternative for specific applications. They utilize a single conductor, reducing infrastructure costs significantly. Moreover, these setups suit underwater cables efficiently. Thus, Monopolar gains traction in budget-conscious installations.

Back-to-back configurations enable seamless interconnection between asynchronous grids. They facilitate immediate power exchange without long transmission lines. Furthermore, this type supports regional energy trading. Hence, Back to Back remains vital for grid synchronization.

Multi-Terminal setups expand network flexibility by connecting multiple points. They allow complex power routing and redundancy. Additionally, Multi-Terminal enhances system resilience against failures. Consequently, it emerges in advanced renewable integration projects.

By Technology Analysis

Line Commutated Converter (LCC) dominates with 67.4% due to its proven performance in high-power applications.

In 2024, Line Commutated Converter (LCC) held a dominant market position in the By Technology Analysis segment of HVDC Converter Stations Market, with a 67.4% share. LCC technology offers robust power handling and lower costs for bulk transmission. Moreover, it integrates well with existing AC grids. Thus, utilities favor LCC for ultra-high voltage projects.

Voltage Source Converter (VSC) provides superior control and black-start capabilities. It supports independent active and reactive power regulation. Additionally, VSC enables connection to weak grids. Therefore, it grows rapidly in offshore wind farms.

By Component Analysis

Converter dominates with 38.9% due to its core role in power conversion efficiency.

In 2024, Converter held a dominant market position in the By Component Analysis segment of the HVDC Converter Stations Market, with a 38.9% share. Converters form the heart of HVDC systems, ensuring efficient AC-DC transformation. Furthermore, advanced semiconductors boost their performance. Hence, demand surges for high-capacity converters.

DC Equipment includes cables and switches essential for transmission. It ensures reliable power flow over distances. Moreover, innovations reduce losses in DC Equipment. Thus, it supports expanding HVDC networks. A Converter Transformer steps up voltages for efficient transfer.

It isolates and protects the system effectively. Additionally, custom designs enhance compatibility. Consequently, Converter Transformer remains crucial in station setups. Others encompass valves, filters, and controls that fine-tune operations. They improve overall system harmony and safety. Furthermore, these components enable modular expansions. Therefore, Others contribute to versatile HVDC solutions.

By Application Analysis

Power Industry dominates with 49.5% due to its extensive use in grid stabilization and renewable integration.

In 2024, Power Industry held a dominant market position in the By Application Analysis segment of the HVDC Converter Stations Market, with a 49.5% share. This sector drives HVDC adoption for long-distance bulk power transfer. Moreover, it aids in integrating renewables seamlessly. Thus, the Power Industry leads market growth.

Powering Island and Remote Loads delivers electricity to isolated areas. It overcomes geographical barriers efficiently. Additionally, HVDC minimizes losses in such setups. Hence, it empowers off-grid communities. Interconnecting Networks links regional grids for stability. It balances supply and demand dynamically. Furthermore, this application prevents blackouts.

Oil and Gas utilize HVDC for offshore platforms. It supplies reliable power to extraction sites. Moreover, compact stations fit harsh environments. Therefore, Oil and Gas boosts sectoral efficiency. Others include transportation and industrial uses. They adapt HVDC for specialized needs. Additionally, emerging applications explore new potentials. Thus, Others diversify market opportunities.

Key Market Segments

By Type

- Bi-Polar

- Monopolar

- Back to Back

- Multi-Terminal

By Technology

- Line Commutated Converter (LCC)

- Voltage Source Converter (VSC)

By Component

- Converter

- DC Equipment

- Converter Transformer

- Others

By Application

- Power Industry

- Powering Island and Remote Loads

- Interconnecting Networks

- Oil and Gas

- Others

Emerging Trends

HVDC Converter Stations Powering Offshore Energy Hubs and Hybrid Grids

As offshore wind targets rise, the grid story is changing fast. Across the EU, countries have agreed offshore wind goals in the range of 86–89 GW by 2030, 259–261 GW by 2040, and 356–366 GW by 2050. These volumes simply cannot move efficiently without long-distance, high-capacity HVDC links and converter stations that can manage complex power flows between multiple countries.

- One clear sign of this shift is the push for energy islands and offshore hubs. The Bornholm Energy Island in the Baltic Sea, for example, will connect a 3 GW offshore wind cluster to both Denmark and Germany. The EU has approved a grant of €645 million for this project through the Connecting Europe Facility, making it a flagship for transnational HVDC-based infrastructure.

In these hubs, HVDC converter stations do more than just convert AC to DC. They allow operators to route power flexibly between several grids, stabilize asynchronous systems, and support black-start capabilities. That means fewer curtailments and better use of every megawatt produced offshore.

Drivers

Rapid Growth of Variable Renewables Demands Long-Distance HVDC Backbones

Global renewables are now expanding at a pace that makes grid planners nervous and hopeful at the same time. In 2024, the world added about 585 GW of renewable capacity, taking total installed renewables to around 4,448 GW. Solar and wind made up the vast majority of this build-out, and both depend on strong long-distance transmission.

- IRENA’s 1.5°C pathway says renewable power capacity needs to reach more than 11,000 GW by 2030 to stay on track, with solar and wind providing roughly 90% of additions. That kind of expansion scatters generation far from traditional load centers and deep into offshore zones, deserts, and high-resource regions. HVDC converter stations become the practical way to connect these new clusters to urban demand without excessive losses.

Grid experts are blunt about the consequences. IRENA notes that the goal of tripling renewable power by 2030 makes planning and investing in grid development even more urgent, precisely because wind and solar are spread across many locations and need stronger transmission backbones. AC systems alone struggle with stability, congestion, and losses over very long distances.

Restraints

Supply-Chain Bottlenecks and Long Lead Times for Critical HVDC Components

The biggest brake on HVDC converter station deployment today often sits in the factory, not the parliament. The International Energy Agency’s work on transmission grids shows how strained equipment supply has become. For cables and large power transformers, average procurement lead times have almost doubled, now reaching two to three years for cables and up to four years for big transformers.

Direct-current cable systems, which are essential for HVDC links, are under even greater stress. Industry surveys cited by the IEA highlight that waiting times for specialised DC cables can extend beyond five years, squeezing project schedules before construction even starts. Developers can win auctions, secure permits, and still sit idle because the converter transformers, valves, and cables are simply not available.

On top of timing issues, only a handful of global suppliers can deliver the most complex HVDC systems at scale. That concentration raises concerns about competition, pricing power, and resilience if one manufacturer faces technical problems or financial stress. For emerging markets, tight manufacturing capacity can mean longer queues and higher prices than wealthier regions, limiting their ability to adopt modern HVDC solutions quickly.

Opportunity

Massive Grid Investment Plans and Public Funding to Cut HVDC Costs

The financial pipeline for grids and HVDC looks increasingly strong. A coalition led by the Global Renewables Alliance has endorsed a target of around USD 700 billion per year in grid infrastructure investments, along with adding or upgrading over 80 million kilometers of transmission and distribution lines. HVDC corridors and converter stations sit at the center of those plans.

- Governments are not just talking about investment; they are putting money on the table to de-risk new HVDC technologies. In the United States, the Department of Energy’s Office of Electricity and Wind Energy Technologies Office has launched a USD 10 million funding opportunity to drive innovation in HVDC voltage-source converter systems. The aim is to lower costs, raise power capacity, and shrink substation footprints so that HVDC becomes easier to deploy across the grid.

DOE initiatives on transmission acceleration and DC-grid innovation are designed to make HVDC systems cost-comparable with traditional AC transmission and to reduce permitting friction for major corridors. Similar support schemes are being shaped in Europe and parts of Asia, where grid operators are under pressure to connect offshore wind clusters and cross-border interconnectors quickly.

Regional Analysis

Asia Pacific Dominates the HVDC Converter Stations Market with a Market Share of 44%, Valued at USD 5.7 Billion

Asia Pacific leads due to rapid grid expansion, strong renewable energy additions, and large-scale interconnection projects. Countries across the region continue investing heavily in long-distance transmission to stabilize growing energy demand. The region’s focus on cross-border energy trade and clean-power integration further strengthens its 44% share valued at USD 5.7 billion.

North America is advancing HVDC adoption through the modernization of aging grids and rising investments in offshore wind connections. The region emphasizes energy reliability and long-distance transmission upgrades to reduce congestion. Supportive regulatory frameworks and federal funding accelerate HVDC deployment for cross-state renewable integration.

Europe remains a key HVDC hub driven by inter-country electricity trading and strong decarbonization goals. The region continues to expand offshore wind corridors and subsea interconnector routes. Ongoing energy security initiatives encourage the fast deployment of HVDC technology across continental power networks.

The U.S. continues to expand HVDC capacity to support large renewable corridors, particularly wind and solar. Federal initiatives encourage cost-efficient long-distance transmission and cross-regional grid balancing. Growing decarbonization targets drive utilities to adopt HVDC for improved reliability and reduced line losses.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key HVDC Converter Stations Company Insights

In the global HVDC converter stations market, Bharat Heavy Electricals Limited is steadily strengthening its position, supported by India’s aggressive grid expansion and renewable integration plans. The company benefits from strong domestic policy backing, engineering depth, and growing participation in ±800 kV and above projects across key transmission corridors.

GE Grid Solutions LLC remains a strategic player, leveraging its portfolio of VSC and LCC technologies to address long-distance, offshore wind, and interconnection projects. Its focus on digitalized controls, protection systems, and system-level services helps utilities reduce lifecycle costs and manage increasingly complex grid conditions.

Mitsubishi Electric Corporation is well placed in Asia and globally, driven by its experience in large-scale HVDC links, including multi-terminal and back-to-back schemes. The company’s emphasis on high-efficiency power electronics, reliability, and modular design supports demand from countries upgrading aging infrastructure and integrating large renewable parks.

Siemens Energy AG plays a pivotal role by offering end-to-end HVDC solutions, from converter technology to system engineering and grid studies. Its strong reference base in Europe, the Middle East, and emerging markets allows it to capture opportunities in cross-border interconnectors and offshore wind export systems. The company’s strategy increasingly revolves around decarbonization-aligned projects, digital twins, and service contracts.

Top Key Players in the Market

- Bharat Heavy Electricals Limited

- GE Grid Solutions LLC

- Mitsubishi Electric Corporation

- Siemens Energy AG

- Hitachi Energy Ltd.

- LSIS

- Hyosung

- C-Epri Power Engineering Company

- Toshiba Corporation

- ABB

Recent Developments

- In 2025, Hitachi Energy India Limited, BHEL signed a contract with Rajasthan Part I Power Transmission Limited to design and execute bi-pole, bi-directional HVDC terminals linking Bhadla to Fatehpur. The equipment includes thyristor valves for AC-to-DC conversion, highlighting BHEL’s leadership in EHV substations and HVDC solutions.

- In 2025, the GE Vernova-led consortium was awarded to supply and construct two VSC-based HVDC converter stations for the Eastern Green Link 1 (EGL1) project, a joint venture between National Grid and SP Energy Networks. The system transmits renewable energy to power UK homes.

Report Scope

Report Features Description Market Value (2024) USD 13.0 Billion Forecast Revenue (2034) USD 25.8 Billion CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Bi-Polar, Monopolar, Back to Back, Multi-Terminal), By Technology (Line Commutated Converter (LCC), Voltage Source Converter (VSC)), By Component (Converter, DC Equipment, Converter Transformer, Others), By Application (Power Industry, Powering Island and Remote Loads, Interconnecting Networks, Oil and Gas, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Bharat Heavy Electricals Limited, GE Grid Solutions LLC, Mitsubishi Electric Corporation, Siemens Energy AG, Hitachi Energy Ltd., LSIS, Hyosung, C-Epri Power Engineering Company, Toshiba Corporation, ABB Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  HVDC Converter Stations MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

HVDC Converter Stations MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bharat Heavy Electricals Limited

- GE Grid Solutions LLC

- Mitsubishi Electric Corporation

- Siemens Energy AG

- Hitachi Energy Ltd.

- LSIS

- Hyosung

- C-Epri Power Engineering Company

- Toshiba Corporation

- ABB