Global Grid Connected PV Systems Market Size, Share Report By Components (Power Conditioning Unit, Grid Connection Equipment, Inverters, Others), By Technology (Thin Film, Crystalline Silicon, Others), By Grid Type (Centralized, Decentralized), By Application (Utility, Residential, Commercial, Industrial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154526

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

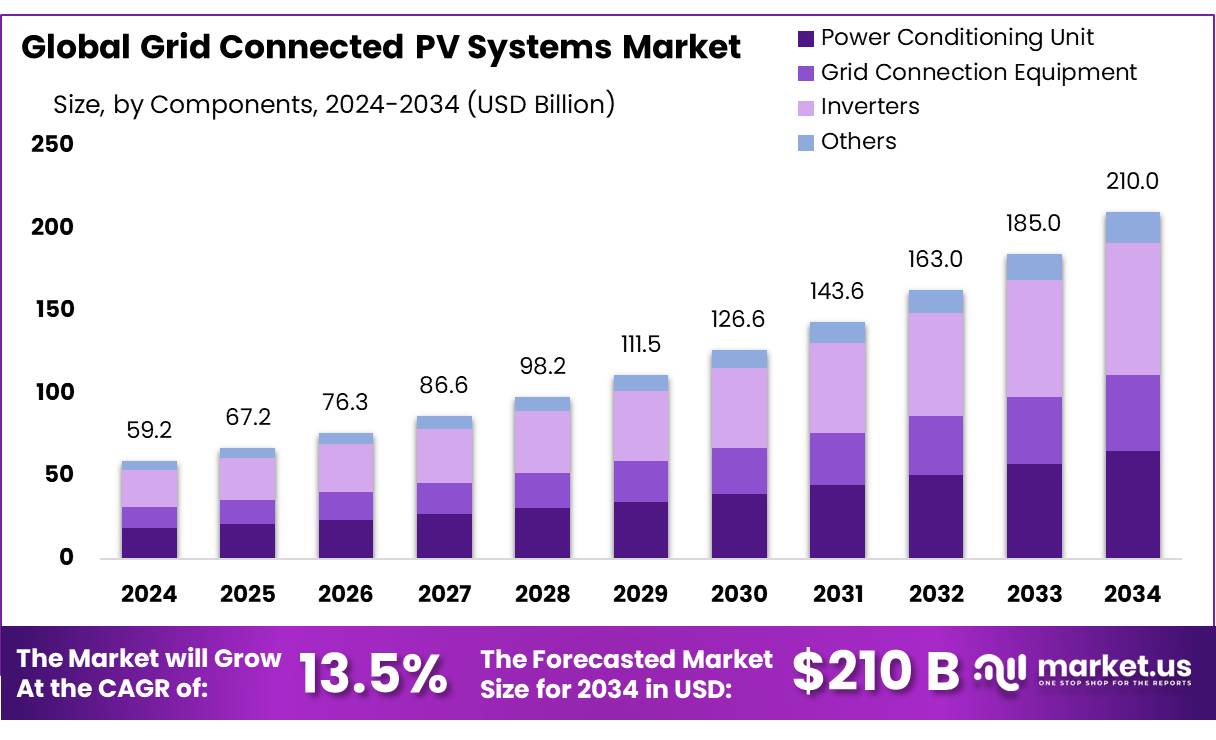

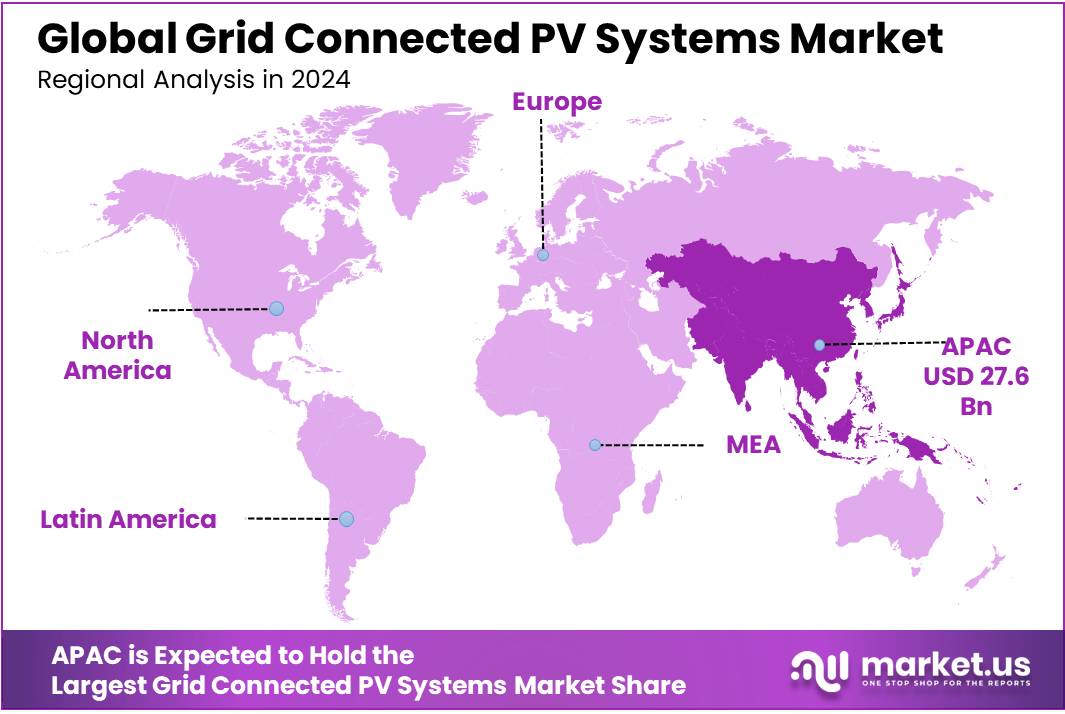

The Global Grid Connected PV Systems Market size is expected to be worth around USD 210.0 Billion by 2034, from USD 59.2 Billion in 2024, growing at a CAGR of 13.5% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific (APAC) held a dominant market position, capturing more than a 46.7% share, holding USD 27.6 Billion in revenue.

Grid-connected photovoltaic (PV) systems have emerged as a cornerstone of India’s renewable energy strategy, reflecting the nation’s commitment to sustainable development and energy security. As of January 31, 2025, India’s total solar capacity installed stands at 100.33 GW, with 84.10 GW under implementation and an additional 47.49 GW under tendering, marking a significant leap from 2.82 GW in 2014.

The driving factors behind the growth of grid-connected PV systems include favorable climatic conditions, declining costs of solar panels, and supportive government policies. India’s geographical advantage, with abundant sunlight, enhances the efficiency and viability of solar power generation. Additionally, the reduction in the cost of solar technology has made it more accessible to a broader segment of the population.

Government schemes such as the PM Surya Ghar Muft Bijli Yojana, launched in 2024, aim to install rooftop solar systems on 10 million homes, each with a capacity of up to 3 kW, providing free electricity to households. Furthermore, the government’s commitment to achieving 500 GW of non-fossil fuel-based energy capacity by 2030 underscores the strategic importance of solar power in the national energy mix.

Government strategies and policy frameworks have strongly driven growth. The Jawaharlal Nehru National Solar Mission (renamed National Solar Mission) was launched in January 2010 with an initial target of 20 GW by 2022, subsequently upscaled to 100 GW in July 2015. The national utility solar generation capacity rose from 2,650 MW in May 2014 to 12,288.83 MW by March 2017, and to 21,651.48 MW by 2018—surpassing initial targets four years ahead of schedule. In 2015–16, the grid‑connected rooftop scheme aimed to add 4,800 MW in 2016–17, progressing towards a rooftop target of 40 GW and large‑scale solar of 60 GW by 2022.

The Indian government has launched several schemes to promote solar energy adoption. The PM Surya Ghar: Muft Bijli Yojana, launched in February 2024, aims to provide rooftop solar systems to 1 crore (10 million) households, offering subsidies up to ₹75,021 crore. Additionally, the PM-KUSUM scheme supports farmers in installing solar pumps and grid-connected solar power systems. These initiatives are complemented by state-level policies, such as Delhi’s solar energy policy, which provides financial incentives for rooftop solar installations.

Key Takeaways

- Grid Connected PV Systems Market size is expected to be worth around USD 210.0 Billion by 2034, from USD 59.2 Billion in 2024, growing at a CAGR of 13.5%.

- Inverters held a dominant market position, capturing more than a 38.2% share in the Grid Connected PV Systems market.

- Crystalline Silicon held a dominant market position, capturing more than a 78.4% share in the Grid Connected PV Systems market.

- Centralized held a dominant market position, capturing more than a 66.3% share in the Grid Connected PV Systems market.

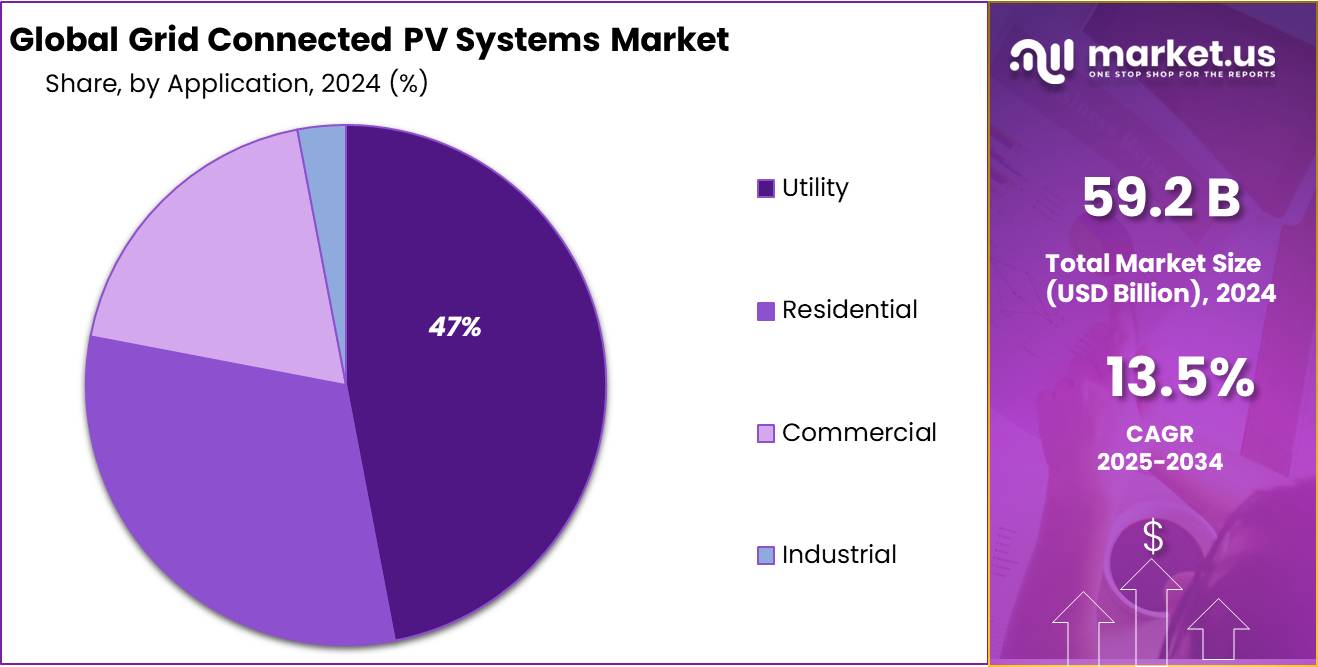

- Utility held a dominant market position, capturing more than a 47.7% share in the Grid Connected PV Systems market.

- Asia-Pacific (APAC) emerged as the dominant region in the global Grid Connected PV Systems market, capturing a significant share of 46.7%, valued at approximately USD 27.6 billion.

By Components Analysis

Inverters dominate with 38.2% due to their critical role in energy conversion.

In 2024, Inverters held a dominant market position, capturing more than a 38.2% share in the Grid Connected PV Systems market. Their crucial function—converting direct current (DC) from solar panels into usable alternating current (AC)—has made them indispensable in both residential and utility-scale solar setups. The rise in solar PV installations across urban and rural areas has further increased the demand for high-efficiency inverters.

In 2025, this segment is expected to maintain steady growth, driven by advancements in smart inverter technologies that support grid stability, remote monitoring, and compliance with updated grid codes. Moreover, government-backed initiatives supporting rooftop and utility solar adoption have further cemented the importance of inverters, ensuring their continued dominance in the component landscape of grid-connected PV systems.

By Technology Analysis

Crystalline Silicon leads with 78.4% owing to its high efficiency and durability.

In 2024, Crystalline Silicon held a dominant market position, capturing more than a 78.4% share in the Grid Connected PV Systems market. This strong lead can be credited to its proven performance, long lifespan, and better efficiency in converting sunlight into electricity compared to other solar technologies. Crystalline silicon panels, including both monocrystalline and polycrystalline types, have become the most widely used choice in residential, commercial, and utility-scale installations due to their reliability and falling production costs.

By 2025, the segment is expected to continue its growth path, supported by ongoing improvements in cell architecture, increased module output, and strong adoption across government-led solar programs and private sector investments. The dominance of crystalline silicon clearly reflects its established place in the global solar energy transition.

By Grid Type Analysis

Centralized Grid dominates with 66.3% due to large-scale utility solar installations.

In 2024, Centralized held a dominant market position, capturing more than a 66.3% share in the Grid Connected PV Systems market. This dominance was largely driven by the widespread development of utility-scale solar farms, which are designed to feed electricity directly into central power grids. Centralized systems benefit from economies of scale, making them cost-effective for power producers and governments aiming to meet renewable energy targets.

These systems are typically installed in open land areas, enabling the deployment of high-capacity photovoltaic modules and centralized inverters for efficient power management. By 2025, the segment is expected to retain its leading share, supported by ongoing investments in solar parks, favorable government schemes, and expanding grid infrastructure aimed at supporting large-scale renewable power integration. Centralized grid PV remains a backbone for national solar strategies across many regions.

By Application Analysis

Utility segment dominates with 47.7% as large solar farms power national grids efficiently.

In 2024, Utility held a dominant market position, capturing more than a 47.7% share in the Grid Connected PV Systems market. This leadership is mainly due to the increasing number of large-scale solar power plants developed to meet the rising demand for clean electricity at national and regional levels. These utility projects supply power directly to the grid and play a key role in supporting energy security and climate goals.

Governments and power producers continue to invest in high-capacity solar parks, backed by favorable policies and long-term power purchase agreements. By 2025, the Utility segment is expected to hold its strong position, supported by expanding project pipelines, improved grid infrastructure, and technological upgrades that make large solar farms more efficient and cost-effective. The segment’s growth reflects a strong shift toward centralized, high-output renewable energy solutions.

Key Market Segments

By Components

- Power Conditioning Unit

- Grid Connection Equipment

- Inverters

- Others

By Technology

- Thin Film

- Crystalline Silicon

- Others

By Grid Type

- Centralized

- Decentralized

By Application

- Utility

- Residential

- Commercial

- Industrial

Emerging Trends

Vertical Solar Installations: Maximizing Space in Urban Areas

In 2025, India is witnessing a significant shift in the adoption of grid-connected photovoltaic (PV) systems, particularly in urban areas where space is limited. The Karnataka Electricity Regulatory Commission (KERC) has recently approved the installation of solar panels on vertical surfaces such as building walls and elevated structures like carports. This move aims to optimize available space in densely populated regions and encourage broader adoption of solar energy solutions.

This policy change is part of a broader trend where urban centers are increasingly integrating renewable energy solutions into their infrastructure. For instance, Chandigarh has experienced an 18-fold increase in its renewable energy capacity over the past decade, primarily driven by government initiatives. The city has successfully installed solar photovoltaic (SPV) systems on all its government buildings and is now exploring innovative projects like SPV installations over cycle tracks.

These developments reflect a growing recognition of the importance of renewable energy in urban planning. By utilizing vertical spaces for solar installations, cities can reduce their carbon footprint, lower electricity costs, and promote sustainable development. The integration of solar energy into urban infrastructure not only contributes to environmental goals but also enhances energy security and resilience in the face of climate change.

Drivers

A Catalyst for Grid-Connected Solar Growth

One of the cornerstone initiatives is the Pradhan Mantri Surya Ghar Muft Bijli Yojana, launched in 2024. This ambitious scheme aims to empower 1 crore (10 million) residential households by providing them with rooftop solar installations, ensuring they receive up to 300 units of free electricity every month. With an investment of ₹75,021 crore, the program offers direct subsidies and concessional bank loans to beneficiaries, facilitating easy access to solar energy.

Complementing this, the Grid Connected Rooftop Solar Programme targets the installation of 40,000 MW by 2026, focusing on residential sectors. Under this program, the government provides Central Financial Assistance (CFA), covering 40% of costs for systems up to 3 kW and 20% for systems between 3 kW and 10 kW, along with incentives for communal facilities in housing societies.

These initiatives are part of India’s broader strategy to achieve 500 GW of non-fossil fuel capacity by 2030, with a significant portion derived from solar energy. The government’s commitment is further evidenced by the allocation of ₹1,500 crore for the development of solar power grid infrastructure, aiming to strengthen renewable energy infrastructure and reduce dependence on fossil fuels.

The impact of these programs is evident in the increasing adoption of solar energy across the nation. For instance, Rajasthan has installed over 1,000 MW of solar power capacity under the PM-Kusum schemes, benefiting 1.7 lakh (170,000) farmers by providing them with daytime electricity for irrigation, thereby enhancing agricultural productivity.

Restraints

Land Acquisition Challenges Hindering Grid-Connected Solar PV Expansion

One of the significant barriers to the widespread adoption of grid-connected photovoltaic (PV) systems in India is the challenge of acquiring suitable land for large-scale solar projects. As the country aims to achieve 500 GW of non-fossil fuel capacity by 2030, securing adequate land has become a critical issue.

The amount of land required for utility-scale solar power plants is approximately 1 km² for every 40–60 MW generated. Given India’s population density and competing land uses, finding and acquiring large tracts of land for solar installations is increasingly difficult. This issue is compounded by the fact that about 60% of India’s land is used for agriculture, with the average size of agricultural holdings shrinking to approximately 0.74 hectares in recent years. These factors make it challenging to secure land for solar projects without displacing existing agricultural activities.

Land acquisition processes in India are often complex and time-consuming, involving multiple stakeholders and regulatory approvals. This complexity can lead to delays in project implementation and increased costs. For instance, disputes over land ownership and usage rights can stall projects, as seen in cases where farmers have contested the use of land for solar installations.

To address these challenges, the government has been exploring alternative solutions such as agrivoltaics, which involves integrating solar panels with agricultural activities. This approach allows for dual land use, enabling farmers to continue cultivating crops while generating solar energy. However, the adoption of agrivoltaics faces its own set of challenges, including regulatory hurdles and the need for specialized infrastructure.

Opportunity

A Dual-Benefit Solution for India’s Energy and Agricultural Sectors

One of the most promising growth opportunities for grid-connected photovoltaic (PV) systems in India lies in the integration of solar energy with agriculture—a concept known as agrivoltaics. This innovative approach not only addresses the country’s energy needs but also supports its agricultural sector, offering a sustainable path forward.

A recent study has estimated that India has the potential to generate up to 3,200 gigawatt peak (GWp) of solar energy through agrivoltaic systems. States like Punjab, Haryana, and Rajasthan are identified as having the highest potential, with capacities of approximately 871 GWp, 700 GWp, and 592 GWp, respectively . This vast potential underscores the significant role agrivoltaics can play in India’s renewable energy landscape.

The benefits of agrivoltaics extend beyond energy generation. By installing solar panels above agricultural fields, farmers can continue their cultivation activities while producing electricity. This dual-use of land can lead to increased land productivity and additional income streams for farmers. Moreover, the shade provided by the solar panels can reduce water evaporation, leading to improved water use efficiency and potentially higher crop yields .

From an economic perspective, the implementation of agrivoltaic systems is also promising. Under a moderate scenario, a cumulative agrivoltaic capacity of 20 GW by 2040 is projected, requiring an investment of approximately ₹81,424 crore. This development is expected to create around 1.1 lakh full-time equivalent jobs, contributing to employment and economic growth.

Regional Insights

In 2024, Asia-Pacific (APAC) emerged as the dominant region in the global Grid Connected PV Systems market, capturing a significant share of 46.7%, valued at approximately USD 27.6 billion. This leadership position can be attributed to strong policy support, rapid urbanization, and a rising focus on renewable energy development across key economies such as China, India, Japan, South Korea, and Australia.

China alone continues to lead the global solar industry, accounting for over 50% of the world’s total solar PV installations. The Chinese government’s push for decarbonization and the deployment of ultra-high voltage transmission networks have significantly boosted investments in grid-connected solar projects. In 2024, China added over 216.9 GW of new solar capacity, reinforcing its dominance and contributing heavily to APAC’s overall market size.

India also plays a vital role in APAC’s growth trajectory. As of June 2025, India’s cumulative installed solar capacity reached 116.25 GW, with over 89 GW from grid-connected ground-mounted systems, showing the country’s aggressive solar expansion under government missions like the National Solar Mission and the Pradhan Mantri Surya Ghar Muft Bijli Yojana. Japan and South Korea are further supporting the region’s growth through modernization of grid infrastructure and subsidies for residential and commercial rooftop solar.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Zytech Solar is recognized for delivering turnkey grid-connected PV solutions, particularly in developing solar markets. The Spanish company provides modules, inverters, and complete project engineering, with installations spanning rooftop and utility-scale applications. While detailed 2025 figures are limited, Zytech’s role as a vertically integrated provider is well established across Europe, Latin America, and parts of Asia. Its modular, cost-effective approach continues to draw developers seeking scalable and region-specific solar infrastructure solutions.

Canadian Solar remains a key player in grid-connected PV systems with broad engagement in module manufacturing, project development, and energy storage. As of March 2025, the company’s cumulative shipments and contracted pipeline exceeded 157 GW globally. At SNEC 2025, Canadian Solar unveiled its new self-developed hybrid inverters (ranging from 15 kW to 350 kW), along with its high-efficiency 630–660 W TOPCon modules achieving up to 24.4% conversion efficiency.

Huawei plays a major role in grid-connected solar inverter technology and smart PV+ESS integration. Its Grid‑Forming Smart Renewable Energy Generator Solution has been verified in projects such as the 50 MW/100 MWh plant in Qinghai, China, where PCS installations demonstrated fast reactive support, grid resilience, and short-circuit endurance under harsh conditions. Huawei ranks among the top global solar inverter providers, offering digital, intelligent systems that enhance grid stability and renewable penetration.

Top Key Players Outlook

- Industrial Sunpower Corporation

- Zytech Solar

- KYOCERA Corporation

- Canadian Solar Inc

- Huawei Technologies

- JinkoSolar Holding Co. Ltd

- Trina Solar

- Panasonic Corporation

- Suntech Power Holding Co. Ltd.

- Kaneka Corporation

- TRIENERGY Schweiz AG

Recent Industry Developments

In 2024, Kyocera switched its global headquarters in Kyoto to 100% renewable electricity, cutting roughly 2,000 tons of CO₂ emissions per year.

In 2024, Huawei delivered an impressive 176 GWₐc of PV inverters globally, securing its position as the world’s largest supplier and covering an estimated 29% of the total inverter market.

Report Scope

Report Features Description Market Value (2024) USD 59.2 Bn Forecast Revenue (2034) USD 210.0 Bn CAGR (2025-2034) 13.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Components (Power Conditioning Unit, Grid Connection Equipment, Inverters, Others), By Technology (Thin Film, Crystalline Silicon, Others), By Grid Type (Centralized, Decentralized), By Application (Utility, Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Industrial Sunpower Corporation, Zytech Solar, KYOCERA Corporation, Canadian Solar Inc, Huawei Technologies, JinkoSolar Holding Co. Ltd, Trina Solar, Panasonic Corporation, Suntech Power Holding Co. Ltd., Kaneka Corporation, TRIENERGY Schweiz AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Grid Connected PV Systems MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Grid Connected PV Systems MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Industrial Sunpower Corporation

- Zytech Solar

- KYOCERA Corporation

- Canadian Solar Inc

- Huawei Technologies

- JinkoSolar Holding Co. Ltd

- Trina Solar

- Panasonic Corporation

- Suntech Power Holding Co. Ltd.

- Kaneka Corporation

- TRIENERGY Schweiz AG