Global Freeze Dried Candy Market Size, Share, And Business Benefits By Product (Fruit-based (Strawberries, Apples, Bananas, Blueberries, Mixed Fruits), Dairy-based, Chocolate-based, Gummy Bears, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, E-commerce, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 159460

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

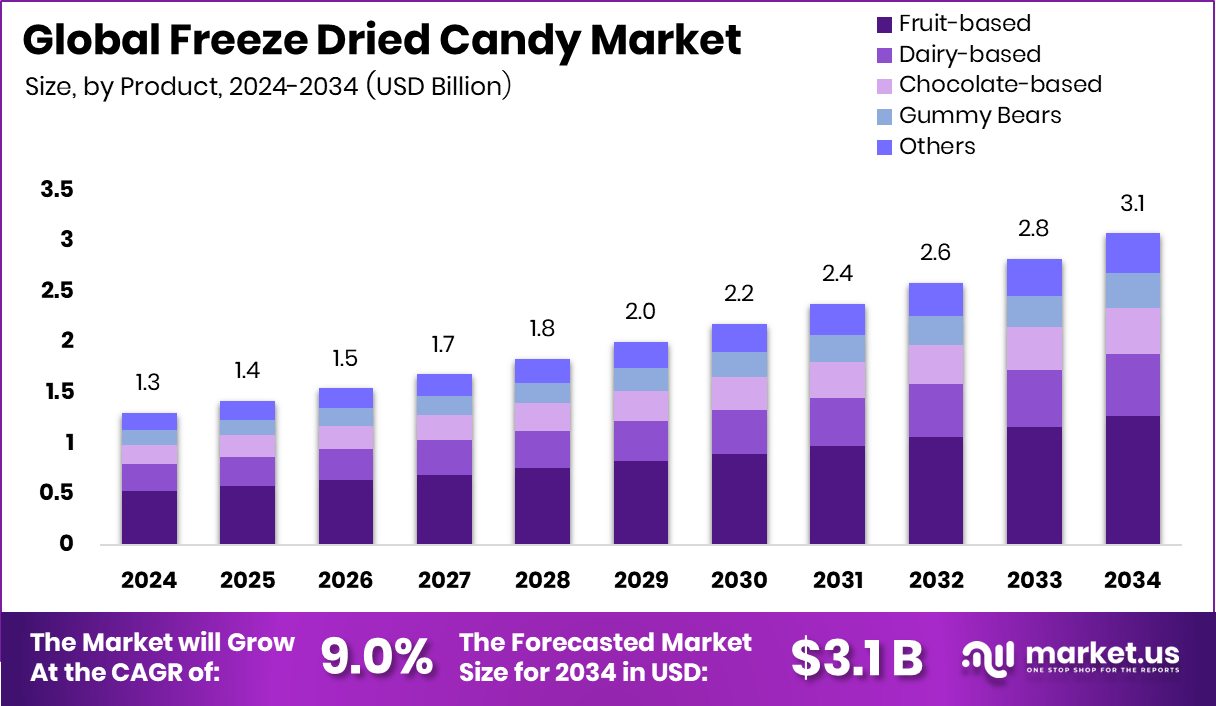

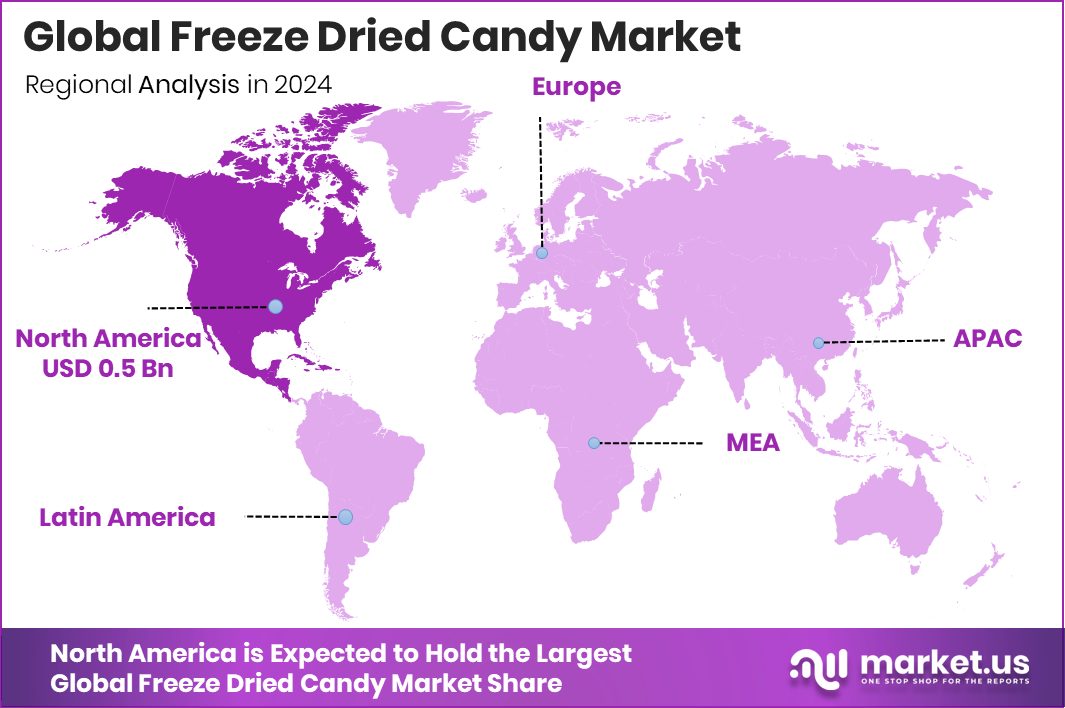

The Global Freeze Dried Candy Market is expected to be worth around USD 3.1 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 9.0% from 2025 to 2034. Strong consumer demand and retail availability supported North America’s 44.80% market contribution.

Freeze-dried candy is a new twist on traditional sweets, created by removing moisture from candies through a low-temperature, high-vacuum process. This preserves the flavor while giving the candy a crunchy texture and lighter feel. The process is becoming popular not only for its novelty but also because it helps extend shelf life without preservatives, making it appealing to consumers looking for fun, long-lasting treats.

The freeze-dried candy market is gaining traction as consumers increasingly seek unique snacking experiences and healthier alternatives to conventional sweets. With global candy consumption surpassing hundreds of billions in annual sales, this niche has carved a space within specialty and premium snacks. Investments in food technology, such as the $1M in federal funding received by the Strawberry Center and USDA ARS, highlight how government and research institutions are pushing innovation in flavor and crop development, which directly benefits candy producers experimenting with fruit-based options.

One key driver is the rising demand for innovative flavors and textures in snacks. Consumers are drawn to the distinct crunch and intensified flavor profile freeze-drying creates. Supportive investments, like USDA funding toward packaging innovations for the $143B specialty crop export industry, indicate a growing infrastructure to help manufacturers scale production efficiently while maintaining quality standards.

Demand is further fueled by younger demographics who value novelty and social media–friendly food trends. Viral interest in freeze-dried products has made them more visible, driving curiosity and repeat purchases. The surge of capital into agricultural innovation—such as the $50M Series A and $134M Series B funding for indoor fruit cultivation—also strengthens supply consistency, ensuring that fruits central to freeze-dried candy remain available year-round.

Future opportunities lie in aligning freeze-dried candy with the global trend toward premium, natural, and sustainably sourced snacks. With luxury fruit growers recently securing another $16M to expand worldwide, there is a clear path for candy makers to collaborate with specialty crop producers. Combining advanced farming practices with creative candy formulations can help position freeze-dried candy as both indulgent and innovative, bridging the gap between novelty treats and functional snacking.

Key Takeaways

- The Global Freeze Dried Candy Market is expected to be worth around USD 3.1 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 9.0% from 2025 to 2034.

- Fruit-based freeze-dried candy leads the market with 41.2%, reflecting consumer preference for natural sweetness.

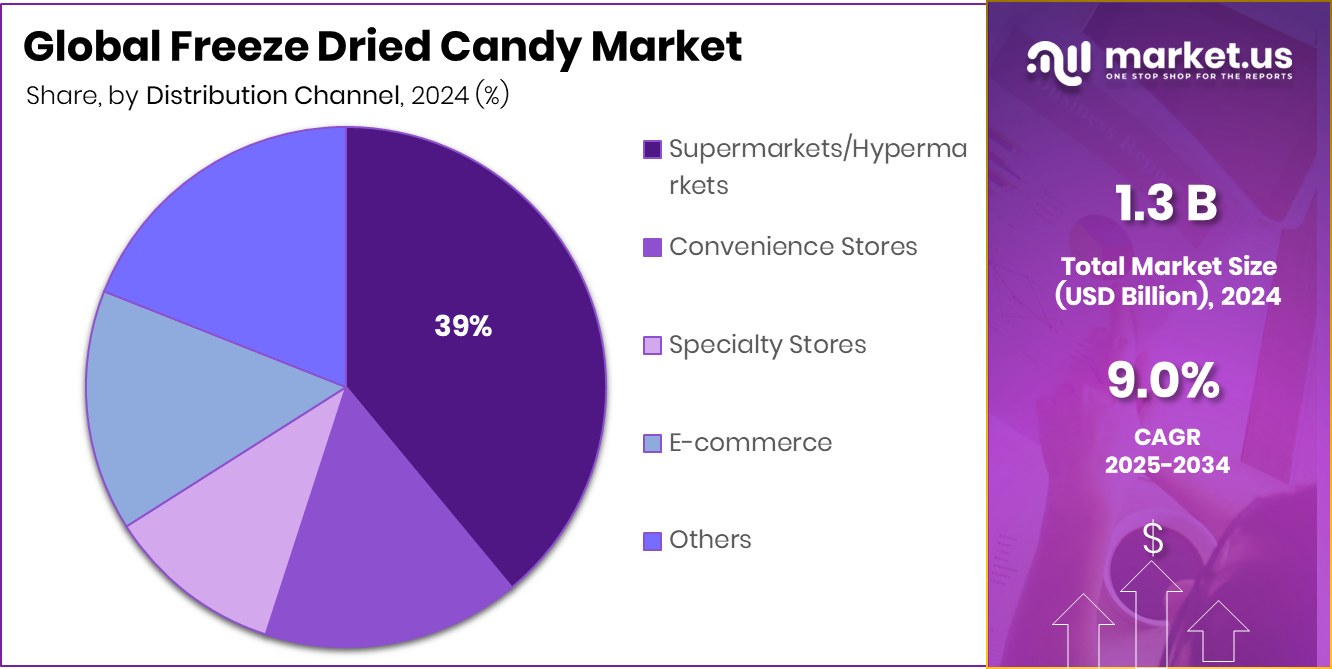

- Supermarkets and hypermarkets capture 39.6% of the distribution share, highlighting their dominance in driving freeze-dried candy sales.

- North America recorded a market value of USD 0.5 Bn overall.

By Product Analysis

Fruit-based products held 41.2%, driving the freeze-dried candy market.

In 2024, Fruit-based held a dominant market position in the By Product segment of the Freeze Dried Candy Market, with a 41.2% share. This leadership reflects the growing consumer preference for candies derived from natural fruit ingredients, offering both novelty and a perception of healthier indulgence. The fruit-based variety benefits from intensified flavors and unique textures created through freeze-drying, making it especially appealing to younger demographics seeking innovative snacking experiences.The dominance of this segment also aligns with wider food trends emphasizing natural sources, sustainability, and extended shelf stability. With fruit-based freeze-dried candies bridging the gap between indulgence and wellness, their strong share indicates continued consumer trust and a foundation for future product innovation within this category.

By Distribution Channel Analysis

Supermarkets/hypermarkets captured 39.6%, boosting the freeze-dried candy market.

In 2024, Supermarkets/Hypermarkets held a dominant market position in By Distribution Channel segment of the Freeze Dried Candy Market, with a 39.6% share. This dominance is supported by the wide availability of products, strong retail presence, and consumer trust in established store formats. Shoppers prefer these outlets for their convenience, variety, and ability to physically compare options before purchase.

Supermarkets and hypermarkets also play a key role in promoting new product lines through in-store displays and promotional campaigns, which boost consumer awareness of freeze-dried candy. Their established distribution networks ensure consistent supply and accessibility, making them the preferred choice for buyers and reinforcing their leading share in the overall market structure.

Key Market Segments

By Product

- Fruit-based

- Strawberries

- Apples

- Bananas

- Blueberries

- Mixed Fruits

- Dairy-based

- Chocolate-based

- Gummy Bears

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- E-commerce

- Others

Driving Factors

Government Support Boosting Specialty Crop Innovations

One of the biggest driving factors for the Freeze candy Market is the strong government support for specialty crop innovations. Programs like the USDA’s Specialty Crop Research Initiative (SCRI) provide millions of dollars in funding every year to improve crop quality, packaging, and sustainability. For example, in 2023, USDA allocated over $72.9 million in grants to support projects that help farmers and food processors enhance specialty crops, including fruits that are widely used in freeze-dried candy formulations.

Such funding ensures a reliable supply of high-quality raw materials, encourages innovation in food processing, and supports the expansion of freeze-dried fruit-based products. This government-driven push directly strengthens growth opportunities in the freeze-dried candy sector.

Restraining Factors

High Production Costs Despite Limited Funding Support

A key restraining factor for the freeze-dried candy market is the high cost of production. Freeze-drying technology requires specialized equipment, significant energy use, and advanced packaging to maintain product quality, which makes the final product more expensive than conventional candy. While government programs like the USDA Value-Added Producer Grants provide funding to support small and mid-sized food businesses, the amounts are often limited compared to the heavy investment required.

In 2024, the USDA announced $50 million in funding for value-added producers across the U.S., but this funding is spread across many sectors, leaving only partial support for those engaged in freeze-dried processing. These cost barriers restrict accessibility and slow down broader market adoption.

Growth Opportunity

Expanding Export Potential Through Government-Backed Programs

A major growth opportunity for the Freeze candy Market lies in expanding exports, supported by government initiatives to strengthen specialty crop trade. The USDA has been actively funding programs that improve the packaging, logistics, and global competitiveness of U.S. specialty crop products. For instance, in 2023, the USDA announced $200 million through the Regional Agricultural Promotion Program (RAPP) to help U.S. producers expand exports into new markets and build long-term demand.

Freeze-dried candies, often made from fruits like strawberries, blueberries, and apples, stand to benefit directly as these crops receive better support for reaching international markets. This creates an opportunity for producers to tap into growing global demand for innovative, shelf-stable confectionery products.

Latest Trends

Rising Focus On Sustainable Packaging Innovations Support

One of the latest trends in the Freeze candy Market is the rising focus on sustainable packaging solutions. Consumers are increasingly aware of the environmental impact of plastics, and producers are shifting toward eco-friendly, recyclable, and biodegradable materials. This trend is strongly supported by government initiatives that promote greener practices in the food sector.

The USDA has been providing funding to encourage packaging innovations within specialty crop industries, helping businesses adopt solutions that reduce waste and extend the shelf life of products. For freeze-dried candy makers, sustainable packaging not only aligns with consumer expectations but also ensures compliance with evolving regulations, positioning them well in a market that values both novelty and responsibility.

Regional Analysis

In 2024, North America dominated Freeze freeze-dried candy Market with a 44.80% share.

The Freeze Dried Candy Market shows varied regional performance across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. In 2024, North America emerged as the dominating region, accounting for 44.80% of the market share with a value of USD 0.5 billion. This leadership is supported by strong consumer adoption of novel confectionery products, coupled with the presence of established retail networks that make freeze-dried candy widely accessible.

Europe follows closely, where rising interest in premium and natural-based sweets is driving market acceptance, especially in countries emphasizing healthier snack alternatives. In the Asia Pacific, growing urban populations and increasing exposure to Western snacking trends are creating favorable conditions for market entry and expansion.

Meanwhile, the Middle East & Africa is gradually witnessing interest in freeze-dried confectionery through niche retail channels, driven by younger demographics seeking innovative products. Latin America, though smaller in scale, is showing steady potential with gradual consumer acceptance and expanding specialty retail formats.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Freeze Dried USA has positioned itself as a pioneer in delivering a wide range of candy products through advanced freeze-drying processes. By focusing on consistent quality and flavor retention, the company has built consumer trust and expanded its footprint in both domestic and export markets. Their adaptability to rising consumer demand for novel snack formats continues to drive steady growth.

SOW Goods Inc. emphasizes creativity in product lines and diversified offerings within the freeze-dried snack category. The company’s approach to targeting younger demographics and health-conscious buyers has proven effective, especially as consumers increasingly seek alternatives that balance indulgence with lighter textures and extended shelf life. Their product development strategy aligns well with shifting retail patterns, particularly online and specialty store channels, giving them strong visibility.

The Freeze Dried Candy Company, meanwhile, has carved out its niche by focusing on affordability and unique consumer experiences. By leveraging innovative flavors and consistent expansion in distribution channels, the company has broadened awareness of freeze-dried candy to mainstream buyers. Its role in making these products more accessible supports overall category expansion.

Top Key Players in the Market

- Freeze Dried USA

- SOW Goods Inc.

- The Freeze Dried Candy Company

- SweetyTreatyCo

- The Candy Space

- Mythical Candy Factory

- Ice Age Candy Company LLC

- SpaceSweets

- Happy Candy UK

- Candy Copia

Recent Developments

- In December 2024, Freeze Dried USA (started by Tim Walker) announced plans to expand its product line beyond just candies and ice creams. The company is exploring more nutritional foods and healthier freeze-dried options.

- In 2024, Happy Candy UK launched a freeze-dried “Dime Bar” candy under its product line, offering a crunchy, popped version of the classic chocolate bar.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 3.1 Billion CAGR (2025-2034) 9.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Fruit-based (Strawberries, Apples, Bananas, Blueberries, Mixed Fruits), Dairy-based, Chocolate-based, Gummy Bears, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, E-commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Freeze Dried USA, SOW Goods Inc., The Freeze Dried Candy Company, SweetyTreatyCo, The Candy Space, Mythical Candy Factory, Ice Age Candy Company LLC, SpaceSweets, Happy Candy UK, Candy Copia Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Freeze Dried Candy MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Freeze Dried Candy MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Freeze Dried USA

- SOW Goods Inc.

- The Freeze Dried Candy Company

- SweetyTreatyCo

- The Candy Space

- Mythical Candy Factory

- Ice Age Candy Company LLC

- SpaceSweets

- Happy Candy UK

- Candy Copia