Global Fragrance Fixatives Market Size, Share and Report Analysis By Product (Sclareolide, Ambroxide, Galaxolide, Iso E Super, Sucrose Acetate Isobutyrate, and Others), By End-Use (Fine Fragrances, Personal Care And Cosmetics Products, Home Care Products, Fabric Care, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034.

- Published date: Feb 2026

- Report ID: 176515

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

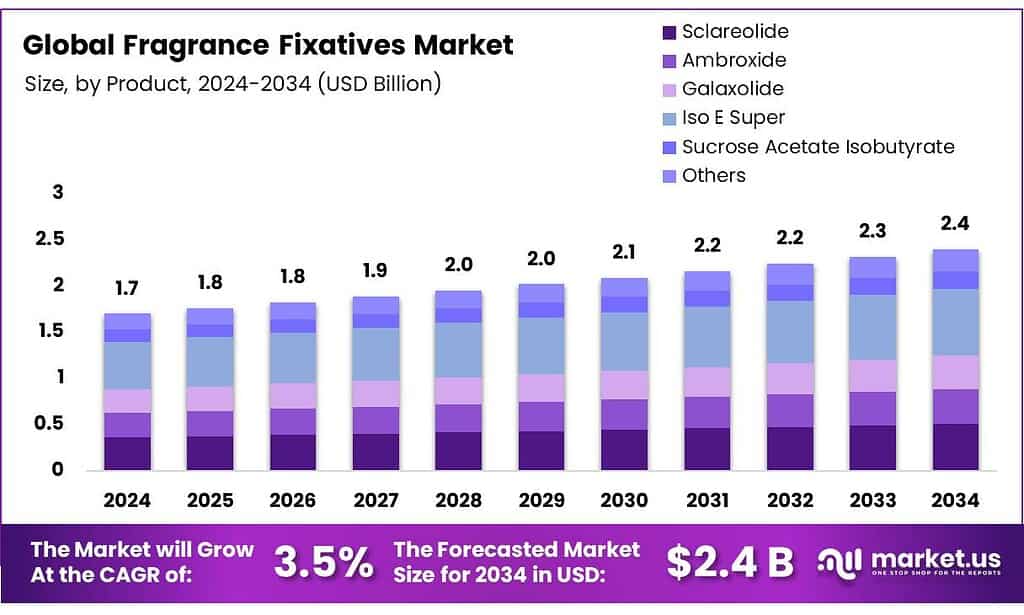

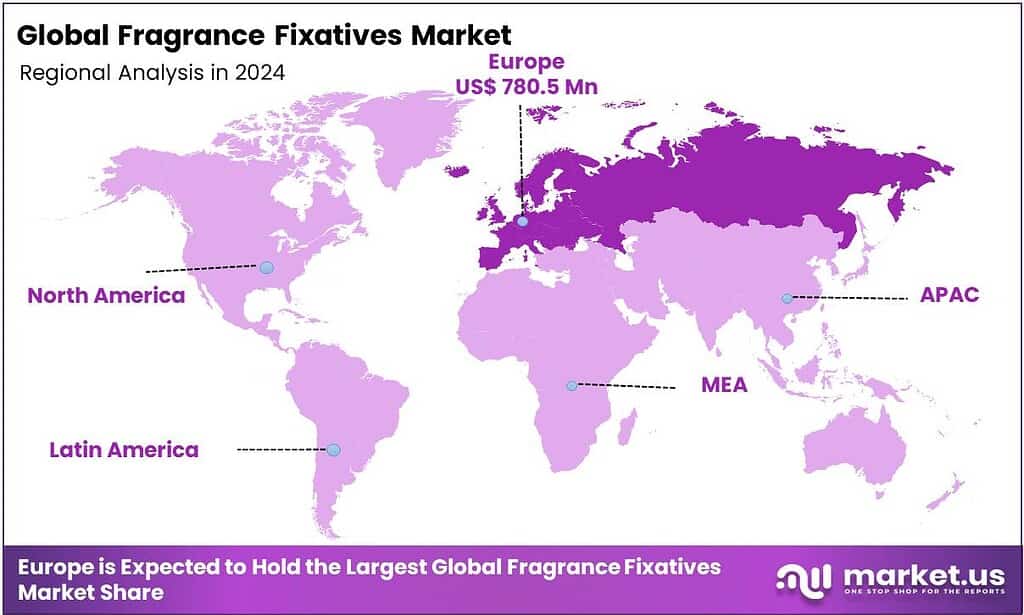

Global Fragrance Fixatives Market size is expected to be worth around USD 2.4 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 3.5% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 45.3% share, holding USD 0.7 Billion in revenue.

A fragrance fixative is a substance used in perfumery to slow the evaporation of more volatile scent molecules, extending the longevity of a fragrance on the skin or fabric. By equalizing vapor pressures, fixatives anchor lighter top notes and heart notes, ensuring the scent unfolds gradually rather than disappearing quickly. The market centers on materials that stabilize volatility, extend scent longevity, and shape diffusion across fragranced products.

The demand for the products is structurally anchored in fine fragrances, where long wear times and complex olfactory architectures require higher fixative loadings and greater material diversity than functional applications. In addition, expansion in cosmetics, personal care, fabric care, and home care further supports usage, as fragrances play both sensory and functional roles in these categories.

Similarly, the market faces technical and regulatory constraints, such as ingredient performance that must align with increasingly stringent chemical, safety, and allergen regulations, particularly in Europe. These constraints raise formulation and compliance complexity while narrowing permissible ingredient choices.

- Of the approximately 4,000 ingredients used in modern perfumery, approximately 60% are produced at a scale below one metric ton per year, facilitating the introduction of niche, sustainable fixatives.

Furthermore, a notable trend in the market is the shift toward natural and sustainable fixatives, reflected in the growing inclusion of botanically derived materials and the adoption of green chemistry frameworks. Moreover, Europe remains a central hub due to its concentration of perfumery expertise, regulatory infrastructure, and production capacity, reinforcing its influence on fixative development, selection, and application standards globally.

Key Takeaways

- The global fragrance fixatives market was valued at USD 1.7 billion in 2024.

- The global fragrance fixatives market is projected to grow at a CAGR of 3.5% and is estimated to reach USD 2.4 billion by 2034.

- On the basis of types of fragrance fixatives, iso e super dominated the market in 2024, comprising about 30.2% share of the total global market.

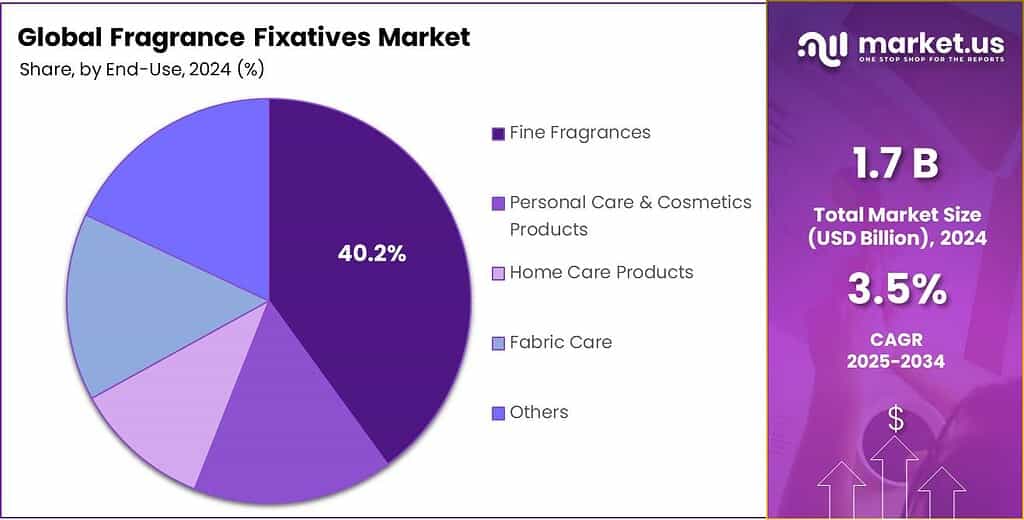

- Among the end-uses of fragrance fixatives, the fine fragrances industry dominated the market in 2024, accounting for around 40.2% of the market share.

- In 2024, Europe was at the dominant of the fragrance fixatives market, comprising 45.3% of the market share.

Product Analysis

Iso E Super Fragrance Fixatives Held the Largest Share in the Market.

On the basis of product type, the fragrance fixatives market is segmented into sclareolide, ambroxide, galaxolide, iso e super, sucrose acetate isobutyrate, and others. The iso e super fragrance fixatives dominated the market in 2024 with a market share of 30.2%, primarily due to its combination of performance versatility, regulatory robustness, and formulation efficiency. Iso E Super provides diffusion and fixation, contributing a long-lasting woody-amber character while enhancing radiance without dominating a composition, which reduces the need for multiple supporting materials.

Additionally, it exhibits high stability, broad solubility, and consistent performance across fine fragrance, personal care, and functional products. Furthermore, iso e super has fewer use restrictions and simpler allergen labeling requirements compared with materials such as galaxolide or ambroxide in certain jurisdictions. Similarly, its relatively neutral odor profile enables wide compatibility across fragrance families, whereas sclareolide and sucrose acetate isobutyrate are more niche, structurally specific fixatives with narrower application ranges.

End-Use Analysis

In 2024, the Fine Fragrances Industry Dominated the Fragrance Fixatives Market.

In 2024, the fine fragrances industry emerged as the largest end-use sector for fragrance fixatives, accounting for nearly 40.2% of the product’s global consumption, outperforming sectors such as personal care & cosmetics products, home care products, fabric care, and others. As fine fragrances require higher fixative intensity, complexity, and material loading per unit than other fragranced applications, it is the dominant sector. Fine fragrances are designed for prolonged skin wear, often exceeding 8-12 hours, which necessitates the use of multiple fixatives at relatively high concentrations to control evaporation rates and scent evolution.

In contrast, personal care, home care, and fabric care products prioritize cost efficiency, wash-off performance, or short-term scent release, leading to lower fixative dosages and simpler systems.

Moreover, fine fragrances rely heavily on high-purity, odor-active fixatives to support nuanced accords without interference, whereas functional products commonly use fewer, more utilitarian stabilizers. Additionally, fine fragrance formulations are reformulated and relaunched more frequently, sustaining continuous demand for fixatives in development and production cycles.

Key Market Segments

By Product

- Sclareolide

- Ambroxide

- Galaxolide

- Iso E Super

- Sucrose Acetate Isobutyrate

- Others

By End-Use

- Fine Fragrances

- Personal Care & Cosmetics Products

- Deodorants

- Soaps & Shower Gels

- Hair Care

- Skin Care

- Others

- Home Care Products

- Fabric Care

- Detergents

- Fabric Softeners

- Others

Drivers

Expansion of the Perfume Sector Drives the Demand for Fragrance Fixatives.

The expansion of the global perfume sector acts as a primary catalyst for the fragrance fixatives market, directly driven by consumer demand for scent longevity and olfactory complexity. In 2025, the global perfume sector demonstrated measurable expansion that correlates with increased use of fragrance fixatives.

Approximately 6,000 new perfumes were launched worldwide in 2025, about twice the pre-2019 annual average, reflecting heightened product development activity across luxury and mass-market segments. This proliferation of launches underscores greater formulation throughput and a broader variety of olfactory profiles that rely on fixatives to ensure consistency and longevity in finished products.

Furthermore, the Modernization of Cosmetics Regulation Act of 2022 (MoCRA) compels manufacturers to standardize testing and labeling, necessitating the development of fixatives that comply with stricter transparency and safety requirements. The expanding volume and diversity of perfume products directly elevate demand for and application of fragrance fixatives as essential performance enhancers in contemporary scent production.

Restraints

By-product Toxicity Might Hamper the Growth of the Fragrance Fixatives Market.

The fragrance fixatives market faces a dual challenge, which is the requirement for superior technical performance to ensure scent longevity and the increasing stringency of global regulatory frameworks. Under the EU’s REACH regulation, substances used in fragrances, including many fixatives, must be registered with the European Chemicals Agency (ECHA) and meet extensive data and safety requirements before market placement, adding complexity to technical compliance processes.

- Under Regulation (EU) 2023/1545, the number of fragrance allergens requiring disclosure has tripled from 26 to 82, which must be complied with by August 2026.

Furthermore, the EU Cosmetics Regulation legally restricted specific fragrance ingredients in finished products, with mandatory labelling thresholds, such as 0.001 % for leave-on products. This expanded allergen disclosure necessitates precise quantification of minor components in complex fixative blends, increasing analytical and documentation burdens.

Compliance with IFRA Standards, while voluntary, is often required for market acceptance. The differences between IFRA limitations and local legal requirements, bans such as Butylphenyl Methylpropional in the EU, further complicate formulation decisions across jurisdictions. These regulatory constraints demand advanced analytical characterization and risk assessment to ensure technical performance without breaching safety mandates.

Opportunity

Applications in Cosmetics and Fabric Care Industries Create Opportunities in the Fragrance Fixatives Market.

The expansion of cosmetics and fabric care industries presents a measurable opportunity for the fragrance fixatives market through increased formulation demand, where sustained scent performance is critical. The fragranced products, including cosmetics, skin care, deodorants, and household detergents, are core components of broader consumer goods sectors where fragrance systems play functional and sensory roles. The highest exposure to fragrance ingredients occurs in personal care/cosmetic products, underscoring their central role in the fixative demand cycle.

Functional fragrance oils are routinely incorporated into laundry detergents, fabric softeners, and air fresheners, underscoring multi-sector demand for fragrance delivery technologies. Leveraging the trend, several companies innovate their product offerings. For instance, in November 2025, Givaudan expanded its PlanetCap biodegradable range with a laundry serum featuring a 40% fragrance load.

Similarly, IFF launched ENVIROCAP in July 2025, a biodegradable, ECHA-compliant biopolymer delivery system intended to set new standards for fragrance retention in fabric care. This cross-segment product expansion, across personal care and fabric care formulations with fragranced functional roles, supports elevated inclusion of technical fixative solutions in finished goods requiring consistent scent persistence.

Trends

Shift Towards Natural and Sustainable Fragrance Fixatives.

The shift toward natural and sustainable fragrance fixatives reflect a documented restructuring of ingredient portfolios and industry frameworks to integrate eco-conscious chemical choices. The 2025 IFRA Transparency List, a primary inventory of fragrance and functional ingredients globally, identifies 1,021 Natural Complex Substances (NCSs) among 3,691 total materials currently in use, indicating substantial representation of botanically derived compounds within fragrance formulations that include fixatives.

Similarly, institutional efforts such as the IFRA Green Chemistry Compass framework formally guide ingredient manufacturers to apply green chemistry principles across life-cycle stages, from sourcing to production, aiming to reduce environmental and health impacts in line with sustainability objectives. While not regulatory, this tool embodies an industry-level method to evaluate and steer ingredient choices toward safer and more sustainable design.

The prevalence of NCSs in a major global ingredient inventory, coupled with structured sustainability-oriented tools, demonstrates an operational trend within the fragrance sector toward incorporating natural and environmentally mindful fixative materials and manufacturing. For instance, IFF announced the launch of its first hybrid energy system (wind and solar) in 2025, aiming to reduce CO2 emissions by 1,283 tons annually to lower the carbon footprint of its ingredient manufacturing.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Fragrance Fixatives Market.

Current geopolitical tensions have demonstrable effects on the fragrance fixatives market, primarily through supply chain disruptions, energy and feedstock volatility, and logistics challenges that ripple across chemical production networks. According to UNCTAD data from late 2025, disruptions in the Red Sea and Suez Canal forced a 35% increase in average transit distances for chemical shipments between Asia and Europe, raising operational costs for manufacturers such as Givaudan and Symrise.

Similarly, in 2025, several Asian nations implemented export quotas on essential oils and botanical derivatives to prioritize domestic value-added industries, reducing the global supply of wood-based fixatives. Furthermore, the Russia-Ukraine conflict has disrupted key transport routes and raised energy costs, affecting crude supply dynamics that underpin petrochemical feedstocks used in synthetic fixative manufacture.

Moreover, regulatory sanctions and trade restrictions have complicated access to inputs derived from affected regions, forcing firms to adapt procurement and reroute logistics. These tensions elevate operational risk, requiring strategic adjustments in sourcing, inventory management, and regional diversification of supply chains.

Regional Analysis

Europe is at the Forefront of the Global Fragrance Fixatives Market.

Europe held the major share of the global fragrance fixatives market with an estimated revenue share, of 45.3%. Europe’s position sustained by a high concentration of fragrance houses, advanced chemical manufacturing infrastructure, and a rigorous regulatory environment. European regulatory and production infrastructure further underpins this leadership. The EU market supports roughly 500 million consumers of cosmetic and personal care products, including fragranced goods, demonstrating a large and established consumer base for formulations that incorporate fragrance fixatives.

Additionally, the market in the region is characterized by the presence of the large four companies in the industry, which are Givaudan (Switzerland), dsm-firmenich (Switzerland), Symrise (Germany), and Mane (France) that collectively manage several active fixative ingredients. Furthermore, France’s Grasse region remains the primary consumer of high-grade natural fixatives.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Manufacturers of fragrance fixatives prioritize formulation innovation, regulatory compliance, and sustainability credentials to strengthen competitive positioning. They invest in research and development to create fixatives with improved volatility profiles, broader solubility, and enhanced stability across fine fragrance, cosmetics, and functional applications.

Additionally, they emphasize sustainability, with increased use of naturally derived or green-chemistry designed fixatives to meet evolving institutional and consumer expectations. Similarly, companies enhance supply chain resilience through diversified sourcing and backward integration of key intermediates to mitigate disruption risks.

The major players in the industry

- Givaudan S.A.

- DSM-Firmenich

- International Flavors & Fragrances (IFF)

- Symrise AG

- Takasago International Corporation

- Sensient Technologies Corporation

- Robertet Group

- Aroma Ingredients

- Alpha Aromatics

- Ashland Inc.

- Eastman Chemical Company

- Other Key Players

Key Developments

- In March 2025, Ashland Inc. announced the completion of the sale of its Avoca business to Mane. The Avoca business manufactures the aromatherapy fixative sclareolide and provides contract manufacturing services through two production facilities located in North Carolina and Wisconsin.

- In November 2025, Givaudan announced to launch PlanetCaps for use in personal care applications. This innovation provides a microplastic-free solution that is fully compliant with ECHA regulations and delivers long-lasting fragrance performance in hair and body care products.

Report Scope

Report Features Description Market Value (2024) US$1.7 Bn Forecast Revenue (2034) US$2.4 Bn CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Sclareolide, Ambroxide, Galaxolide, Iso E Super, Sucrose Acetate Isobutyrate, and Others), By End-Use (Fine Fragrances, Personal Care & Cosmetics Products, Home Care Products, Fabric Care, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Givaudan S.A., DSM-Firmenich, International Flavors & Fragrances (IFF), Symrise AG, Takasago International Corporation, Sensient Technologies Corporation, Robertet Group, Aroma Ingredients, Alpha Aromatics, Eastman Chemical Company, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Givaudan S.A.

- DSM-Firmenich

- International Flavors & Fragrances (IFF)

- Symrise AG

- Takasago International Corporation

- Sensient Technologies Corporation

- Robertet Group

- Aroma Ingredients

- Alpha Aromatics

- Ashland Inc.

- Eastman Chemical Company

- Other Key Players